Navigation System Market Report

Published Date: 31 January 2026 | Report Code: navigation-system

Navigation System Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive overview of the Navigation System market, including insights into market size, growth trends, and forecasts from 2023 to 2033. Analysis includes segmentations by technology, application, and region, along with key player profiles and future market trends.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

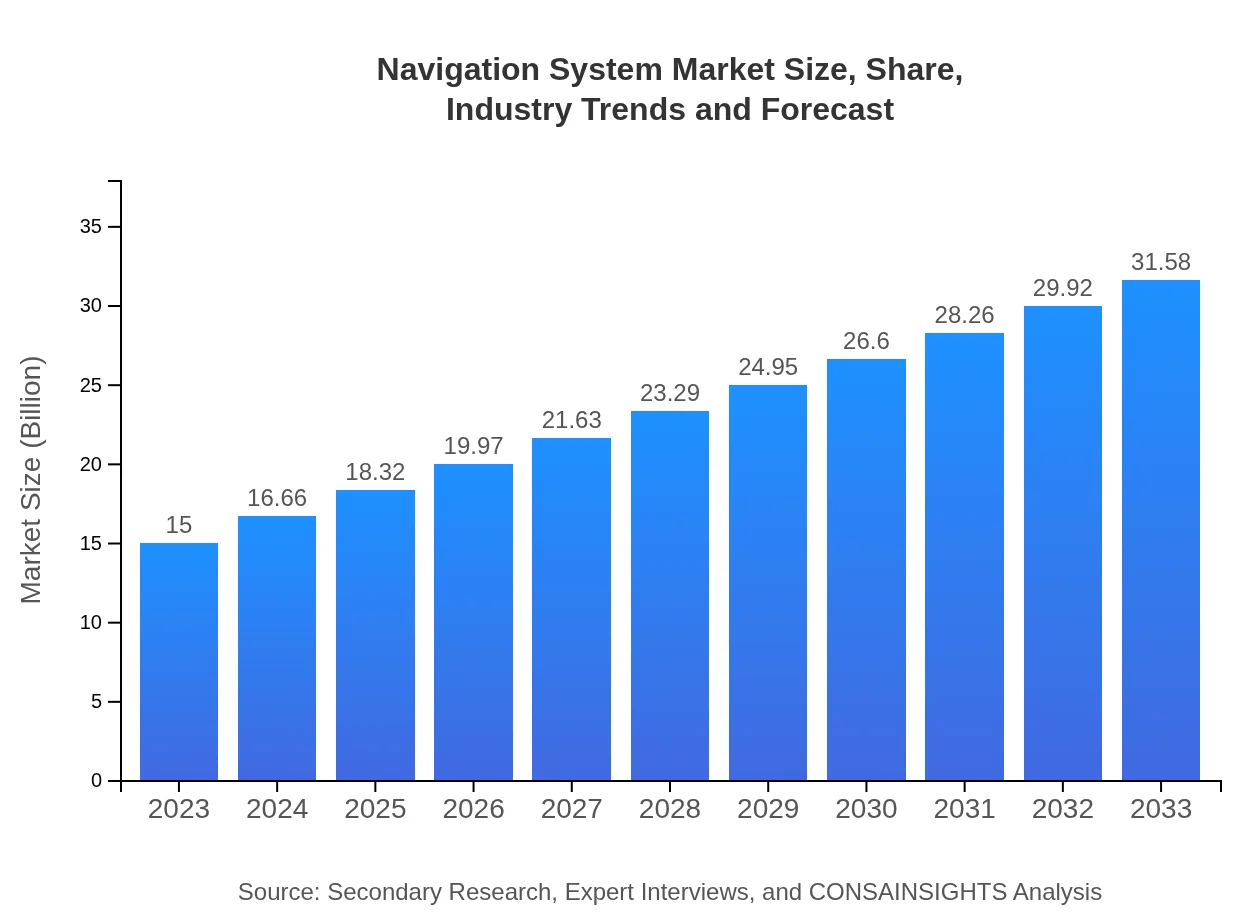

| 2023 Market Size | $15.00 Billion |

| CAGR (2023-2033) | 7.5% |

| 2033 Market Size | $31.58 Billion |

| Top Companies | Garmin Ltd., Trimble Inc., TomTom N.V., Honeywell International Inc., Alpine Electronics, Inc. |

| Last Modified Date | 31 January 2026 |

Navigation System Market Overview

Customize Navigation System Market Report market research report

- ✔ Get in-depth analysis of Navigation System market size, growth, and forecasts.

- ✔ Understand Navigation System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Navigation System

What is the Market Size & CAGR of Navigation System market in 2023?

Navigation System Industry Analysis

Navigation System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Navigation System Market Analysis Report by Region

Europe Navigation System Market Report:

The European Navigation System market, valued at $4.97 billion in 2023, is projected to grow to about $10.46 billion by 2033. Factors facilitating this growth include stringent safety regulations in the aviation sector, increasing passenger traffic, and the emphasis on reducing carbon footprints through optimally designed navigation solutions.Asia Pacific Navigation System Market Report:

In the Asia Pacific region, the Navigation System market was valued at approximately $2.85 billion in 2023 and is projected to reach $6.00 billion by 2033. The growth in this region is driven by increasing automation in transportation, the rise of smart cities, and the burgeoning automotive market, particularly in countries like China and India, which are investing heavily in GPS technology and ITS.North America Navigation System Market Report:

In North America, the market was valued at $4.92 billion in 2023, anticipated to reach approximately $10.37 billion by 2033. Strong demand stems from the burgeoning automotive industry, heavy investment in aviation navigation technologies, and a significant increase in last-mile delivery solutions leveraging navigation systems.South America Navigation System Market Report:

The South American market for Navigation Systems was valued at $0.48 billion in 2023, with expectations to grow to $1.01 billion by 2033. This growth reflects a gradual yet steady adoption of navigation solutions across the logistics and public transport sectors, aided by government initiatives aimed at modernizing transportation infrastructure.Middle East & Africa Navigation System Market Report:

The market in the Middle East and Africa stood at $1.77 billion in 2023, with predictions of reaching $3.73 billion by 2033. This region's growth is attributed to rising investment in infrastructure, coupled with an increasing demand for advanced navigation technologies across both civilian and military applications.Tell us your focus area and get a customized research report.

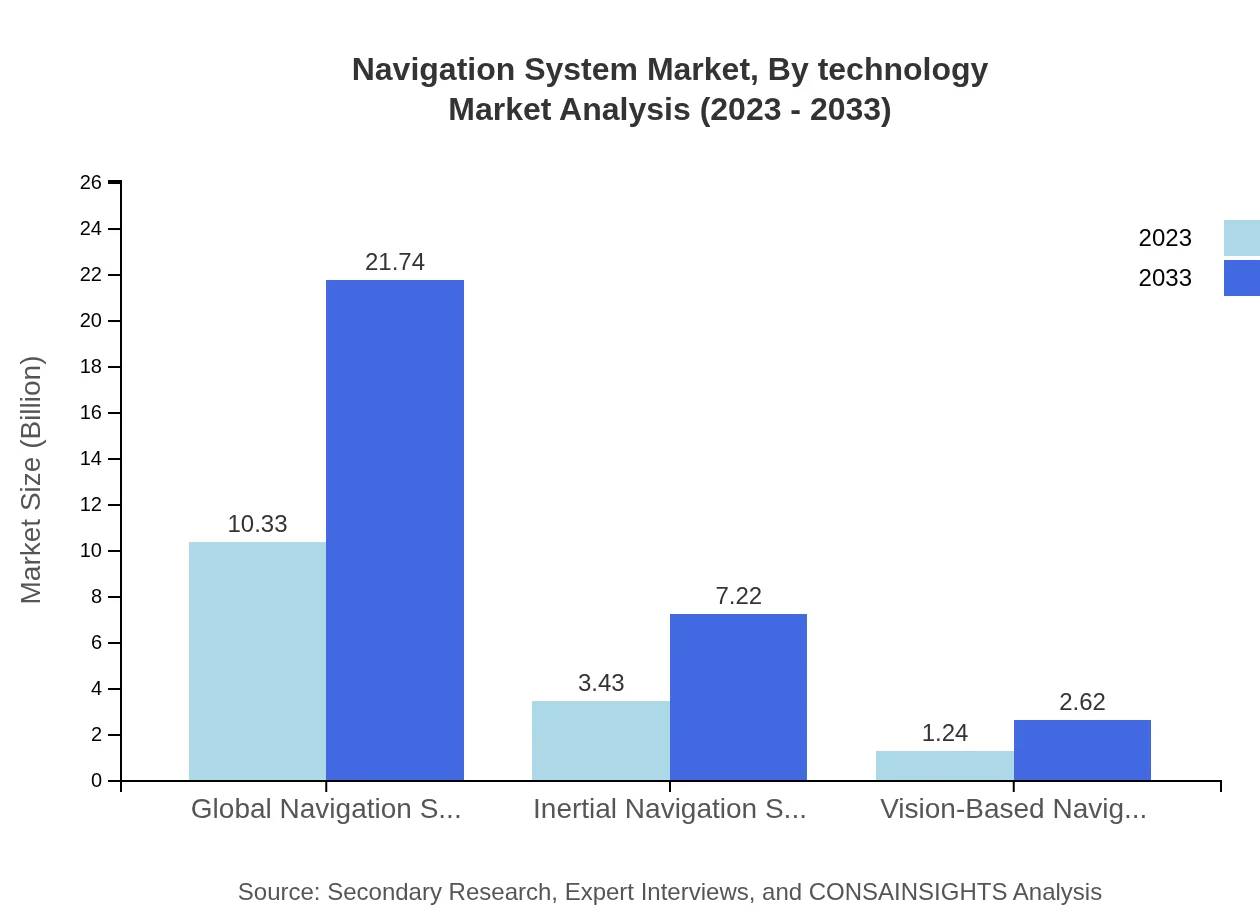

Navigation System Market Analysis By Technology

The market for Navigation Systems by technology is led by Global Navigation Satellite Systems (GNSS), accounting for 68.85% of the market share in 2023 and expected to maintain this dominance through 2033. Additionally, Inertial Navigation Systems and Vision-Based Navigation Systems follow, offering specialized capabilities that cater to specific navigation requirements across diverse applications.

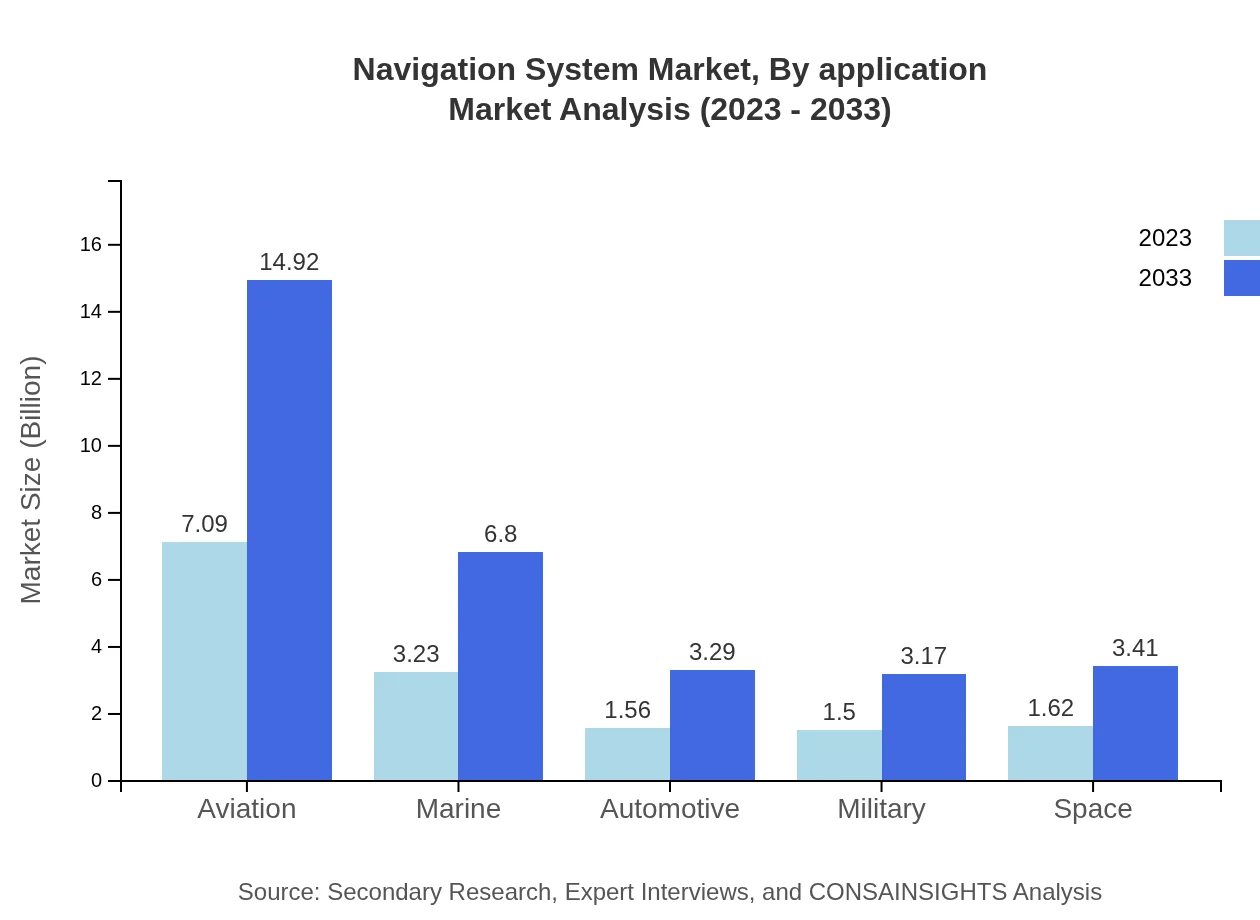

Navigation System Market Analysis By Application

The Navigation System market by application showcases dominance in aviation, contributing significantly to overall revenue with a market share of 47.24% in 2023. The automotive and marine sectors also demonstrate strong growth, driven by the need for improved navigation solutions in personal and commercial transportation.

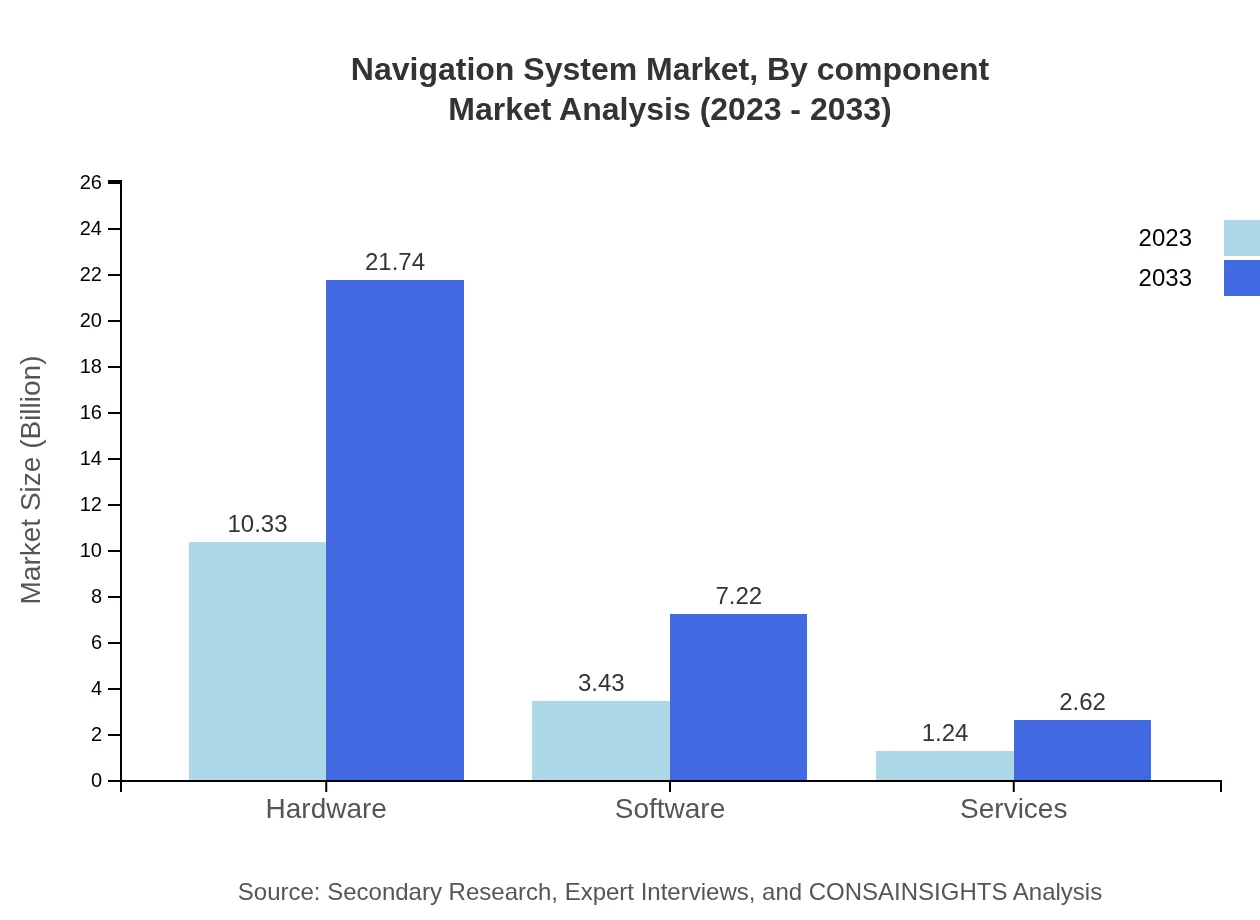

Navigation System Market Analysis By Component

Components of navigation systems include hardware, software, and services. Hardware, making up approximately 68.85% of the market in 2023, indicates robust demand for GPS receivers and related technologies, while software and services grow steadily, reflecting increasing reliance on integrated navigation solutions.

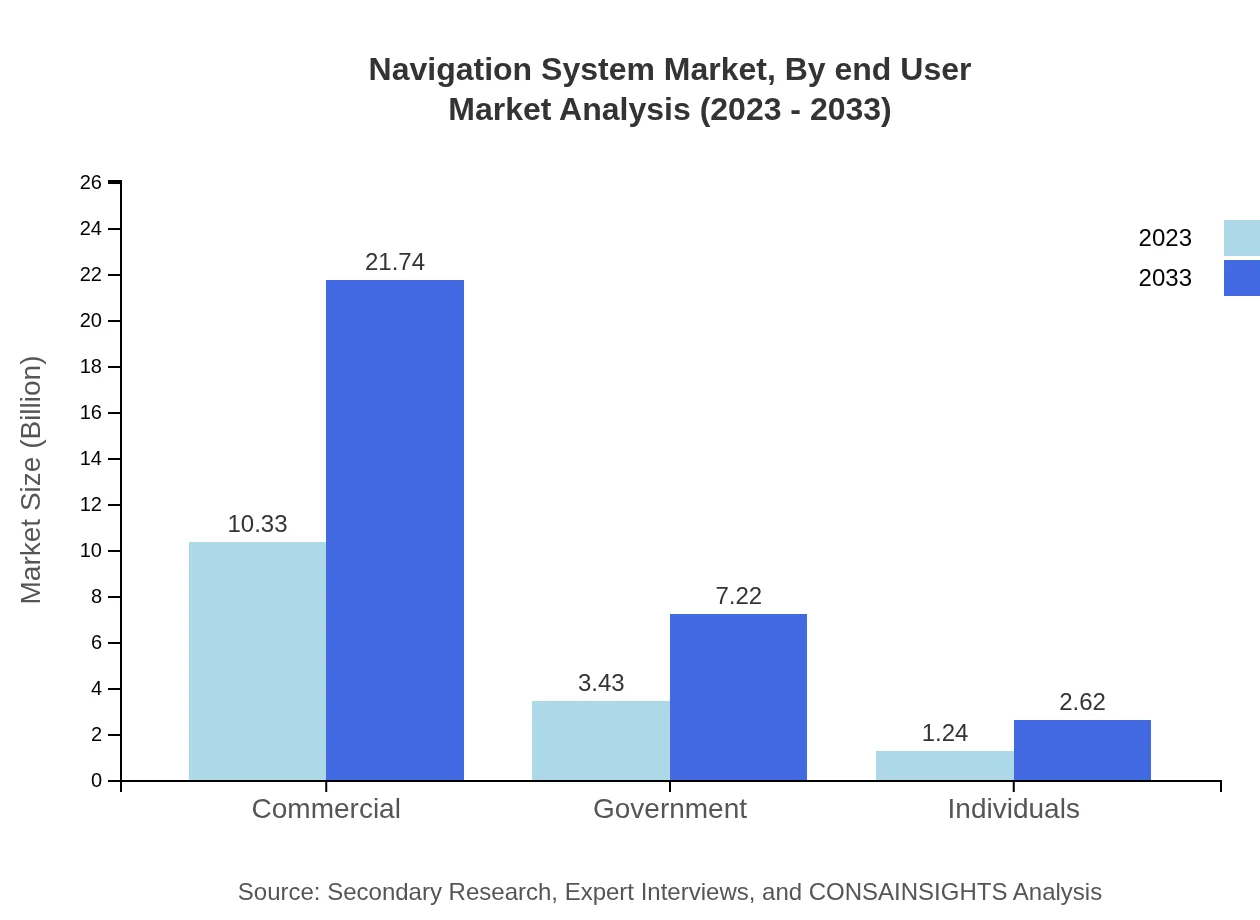

Navigation System Market Analysis By End User

The primary end-users in the Navigation System market segment include individuals, commercial entities, and government organizations. Commercial users dominate with a 68.85% share, leveraging navigation solutions for fleet management, logistics, and public transportation, while government and individual segments show significant potential for growth.

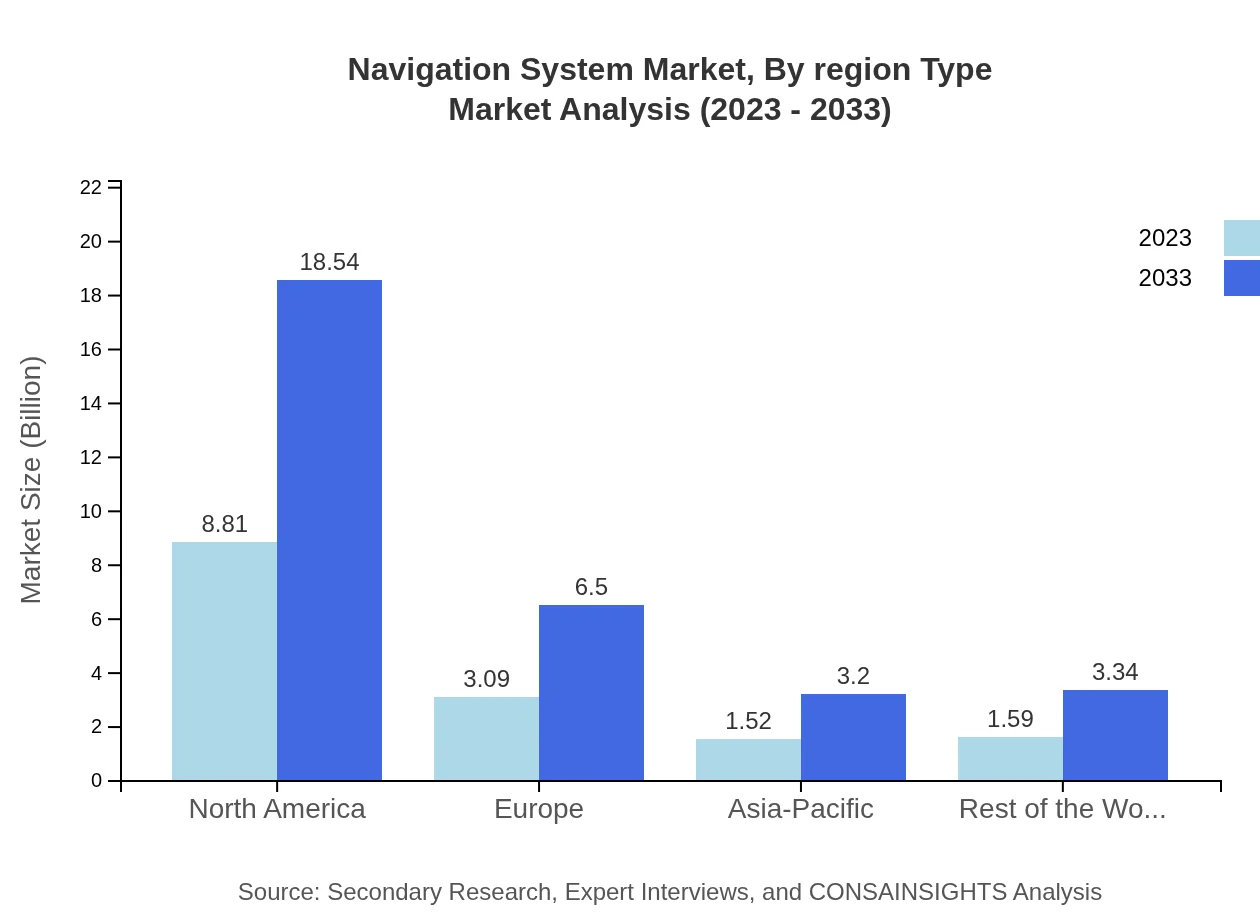

Navigation System Market Analysis By Region Type

Geographically, North America holds a substantial share of 58.72% in the Navigation System market in 2023, influenced by heavy investments in technology and favorable regulations. Europe and Asia Pacific follow, showing steady growth owing to increasing demand in both consumer and industrial navigation applications.

Navigation System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Navigation System Industry

Garmin Ltd.:

Garmin is a world-leading provider of satellite navigation solutions across automotive, aviation, and marine sectors, renowned for its innovative products and commitment to superior technology.Trimble Inc.:

Trimble specializes in advanced positioning technologies, offering integrated solutions for agriculture, construction, and transportation, leveraging their extensive experience in GNSS.TomTom N.V.:

TomTom is a market leader in navigation technologies and mapping, providing innovative software and applications for various navigation uses globally.Honeywell International Inc.:

Honeywell leads in providing aerospace navigational tools and systems, emphasizing advanced technologies designed to enhance flight safety and efficiency.Alpine Electronics, Inc.:

Alpine Electronics focuses on automotive navigation systems, delivering high-quality audio-visual solutions that enhance the in-car navigation experience.We're grateful to work with incredible clients.

FAQs

What is the market size of Navigation System?

The global navigation system market is projected to grow from $15 billion in 2023, with a CAGR of 7.5%, reaching significant milestones in 2033. This growth reflects increasing demand for advanced navigational technology across various sectors.

What are the key market players or companies in the Navigation System industry?

Key players in the navigation system industry include companies specializing in GPS technology, software development, and hardware manufacturing. Leading firms often dominate both the commercial and government sectors, indicating a competitive landscape driven by innovation.

What are the primary factors driving the growth in the Navigation System industry?

The navigation system market's growth is primarily driven by factors such as increasing demand for advanced navigation solutions in transportation and logistics, rising smartphone penetration, and enhanced navigation accuracy requirements in various industries, providing continuous opportunities for advancement.

Which region is the fastest Growing in the Navigation System?

The Asia-Pacific region is the fastest-growing market for navigation systems, projected to expand from $2.85 billion in 2023 to $6 billion by 2033, highlighting a robust increasing demand in transportation and logistics applications alongside technological advancements.

Does ConsaInsights provide customized market report data for the Navigation System industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the navigation system industry, ensuring relevance and accuracy in insights based on market demands and emerging trends.

What deliverables can I expect from this Navigation System market research project?

Upon completing the navigation system market research project, clients can expect comprehensive reports including market size analysis, growth trends, competitive landscape insights, and strategic recommendations tailored to business objectives and market opportunities.

What are the market trends of Navigation System?

Key trends in the navigation system market include increasing adoption of GNSS technologies, rise in autonomous vehicle navigation systems, and a shift towards integrated software and hardware solutions, driving innovation and enhancing operational efficiencies in various sectors.