Ndt Inspection Services Market Report

Published Date: 31 January 2026 | Report Code: ndt-inspection-services

Ndt Inspection Services Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the NDT Inspection Services market, covering market dynamics, segmentation, regional insights, and forecasts for 2023 to 2033. It aims to equip stakeholders with valuable insights into market trends and growth opportunities.

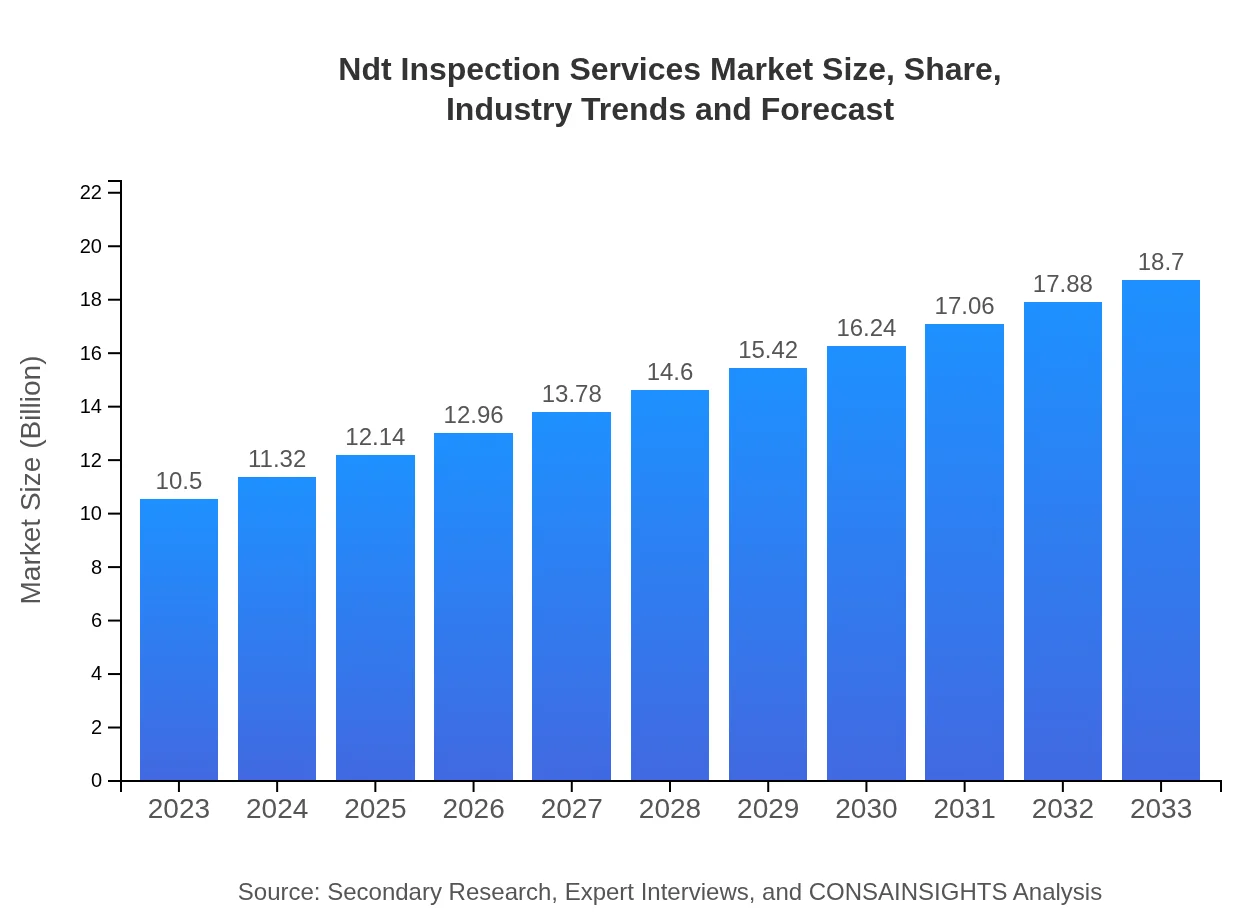

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $18.70 Billion |

| Top Companies | Baker Hughes, General Electric, Siemens , Olympus Corporation, Mistras Group |

| Last Modified Date | 31 January 2026 |

Ndt Inspection Services Market Overview

Customize Ndt Inspection Services Market Report market research report

- ✔ Get in-depth analysis of Ndt Inspection Services market size, growth, and forecasts.

- ✔ Understand Ndt Inspection Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ndt Inspection Services

What is the Market Size & CAGR of Ndt Inspection Services market in 2023?

Ndt Inspection Services Industry Analysis

Ndt Inspection Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ndt Inspection Services Market Analysis Report by Region

Europe Ndt Inspection Services Market Report:

In Europe, the market is expected to grow from $2.58 billion in 2023 to $4.60 billion by 2033. Demand for NDT services is strong in aerospace and automotive industries, driven by safety standards and technological innovations that promote efficient manufacturing processes.Asia Pacific Ndt Inspection Services Market Report:

In the Asia Pacific region, the NDT Inspection Services market is projected to grow from $2.16 billion in 2023 to $3.85 billion by 2033. Growth is driven by rapid industrialization, infrastructure development, and increasing safety regulations, particularly in countries like China and India, which are focusing heavily on modernizing their infrastructure.North America Ndt Inspection Services Market Report:

North America commands a significant share of the NDT Inspection Services market, projected to increase from $4.00 billion in 2023 to $7.13 billion by 2033. This expansion is fueled by stringent safety regulations, a robust manufacturing sector, and continuous technological advancements in testing methods.South America Ndt Inspection Services Market Report:

The South American market for NDT Inspection Services is expected to see growth from $0.36 billion in 2023 to $0.64 billion by 2033. The rising energy sector, particularly in oil and gas exploration and production, is a significant contributor to this growth, alongside improved safety standards across industries.Middle East & Africa Ndt Inspection Services Market Report:

The Middle East and Africa region sees a promising rise in NDT Inspection Services, with market size projected to grow from $1.39 billion in 2023 to $2.47 billion by 2033. This growth is largely attributed to the oil and gas sector, which emphasizes risk management and preventive maintenance to sustain operations.Tell us your focus area and get a customized research report.

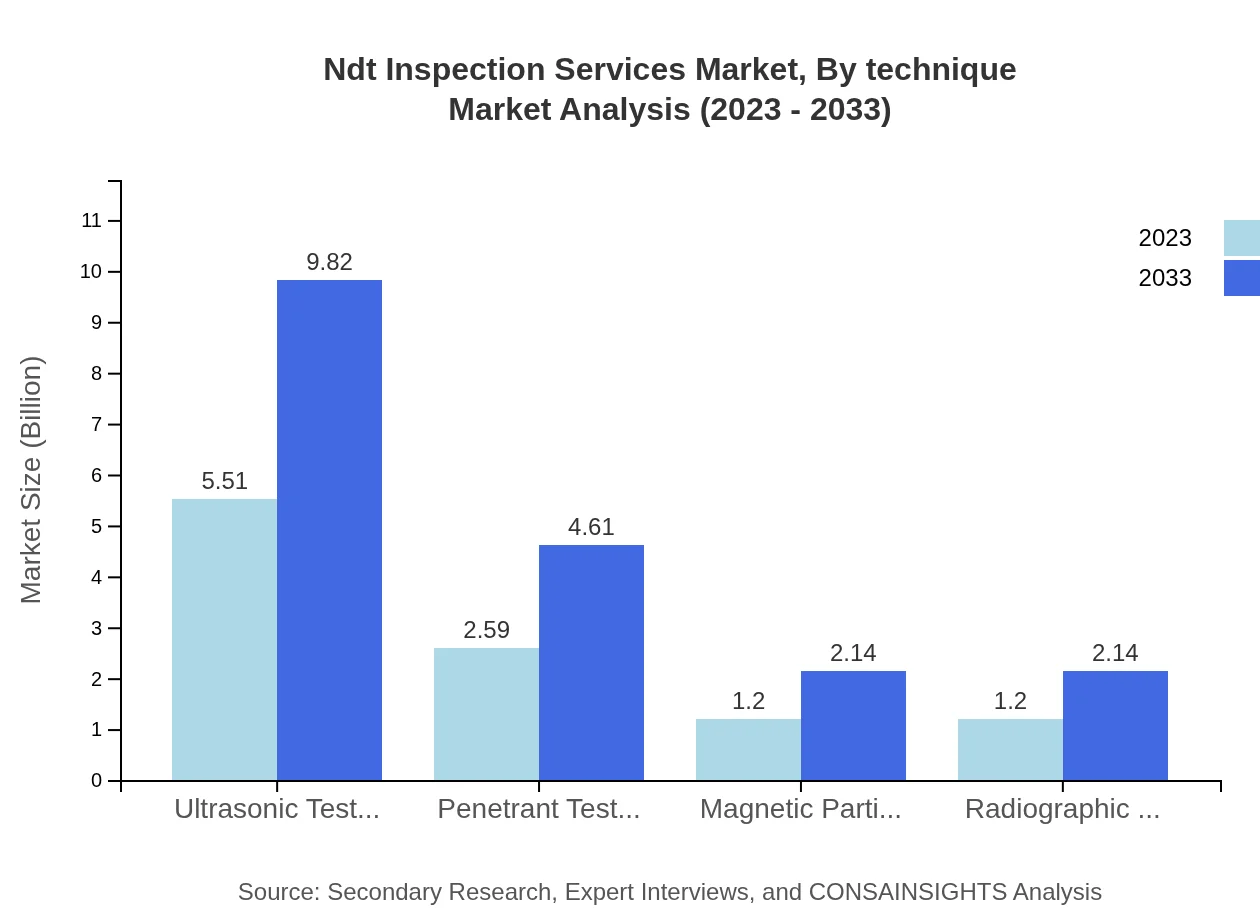

Ndt Inspection Services Market Analysis By Technique

The market for NDT Inspection Services, categorized by technique, exhibited significant trends in both market size and share. Ultrasonic Testing (UT), for example, is projected to grow from $5.51 billion in 2023 to $9.82 billion in 2033, holding approximately 52.49% market share throughout the forecast period. Other techniques such as Penetrant Testing (PT) and Magnetic Particle Testing (MT) reflect steady growth due to their applications in critical sectors. Each technique is tailored to specific materials and requirements, influencing their market demand uniquely.

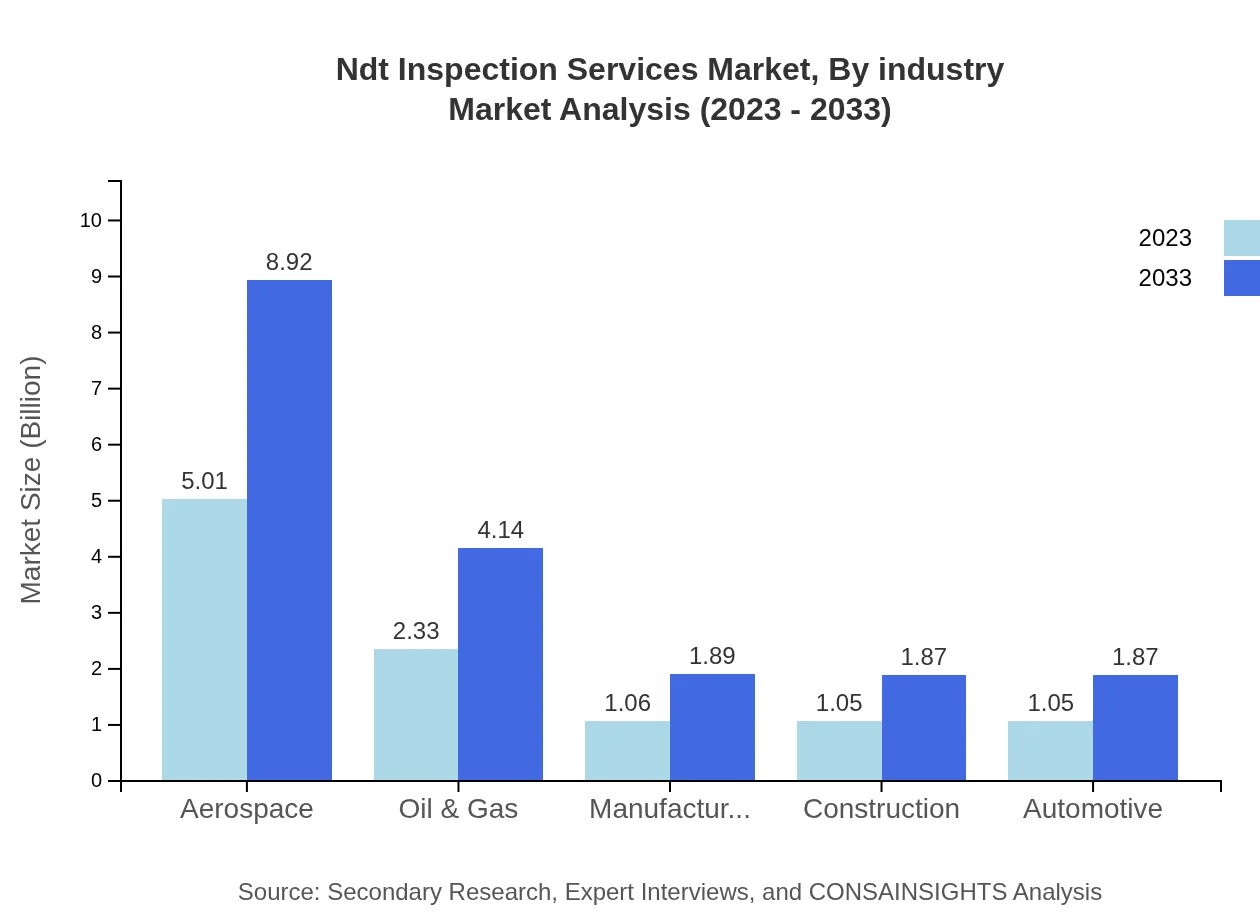

Ndt Inspection Services Market Analysis By Industry

Analysis of NDT Inspection Services by industry reveals that the Aerospace sector leads with a market size increasing from $5.01 billion in 2023 to $8.92 billion by 2033, with a constant share of 47.71%. The Oil & Gas sector is also prominent, growing from $2.33 billion to $4.14 billion, demonstrating the critical need for inspection services to ensure safety and operational effectiveness in hazardous environments.

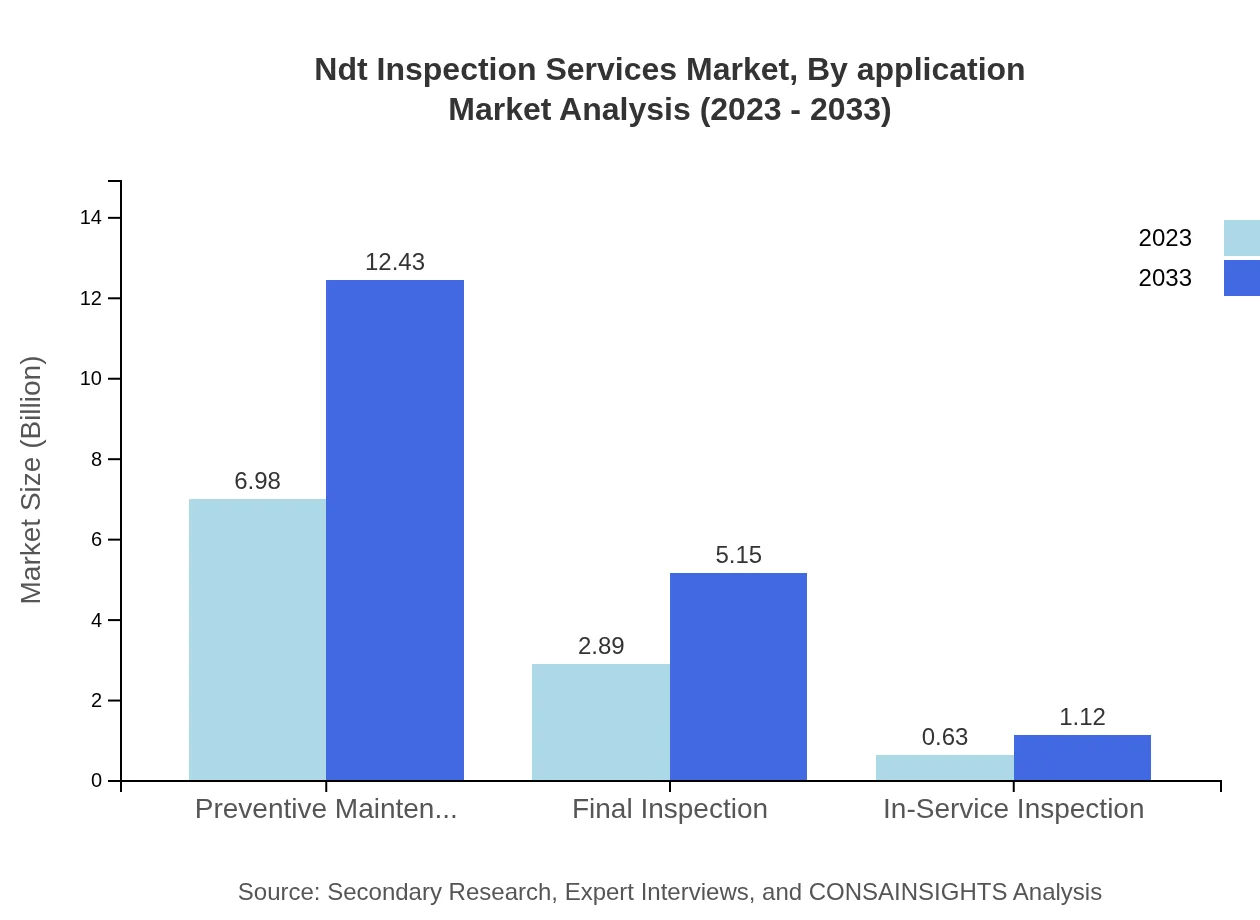

Ndt Inspection Services Market Analysis By Application

The application of NDT Inspection Services spans various usages, including Preventive Maintenance, In-Service Inspection, and Final Inspection. Preventive Maintenance leads in market size, projected to rise from $6.98 billion to $12.43 billion, maintaining a market share of 66.48%. This underscores the importance of preventative measures to ensure operational integrity across industries.

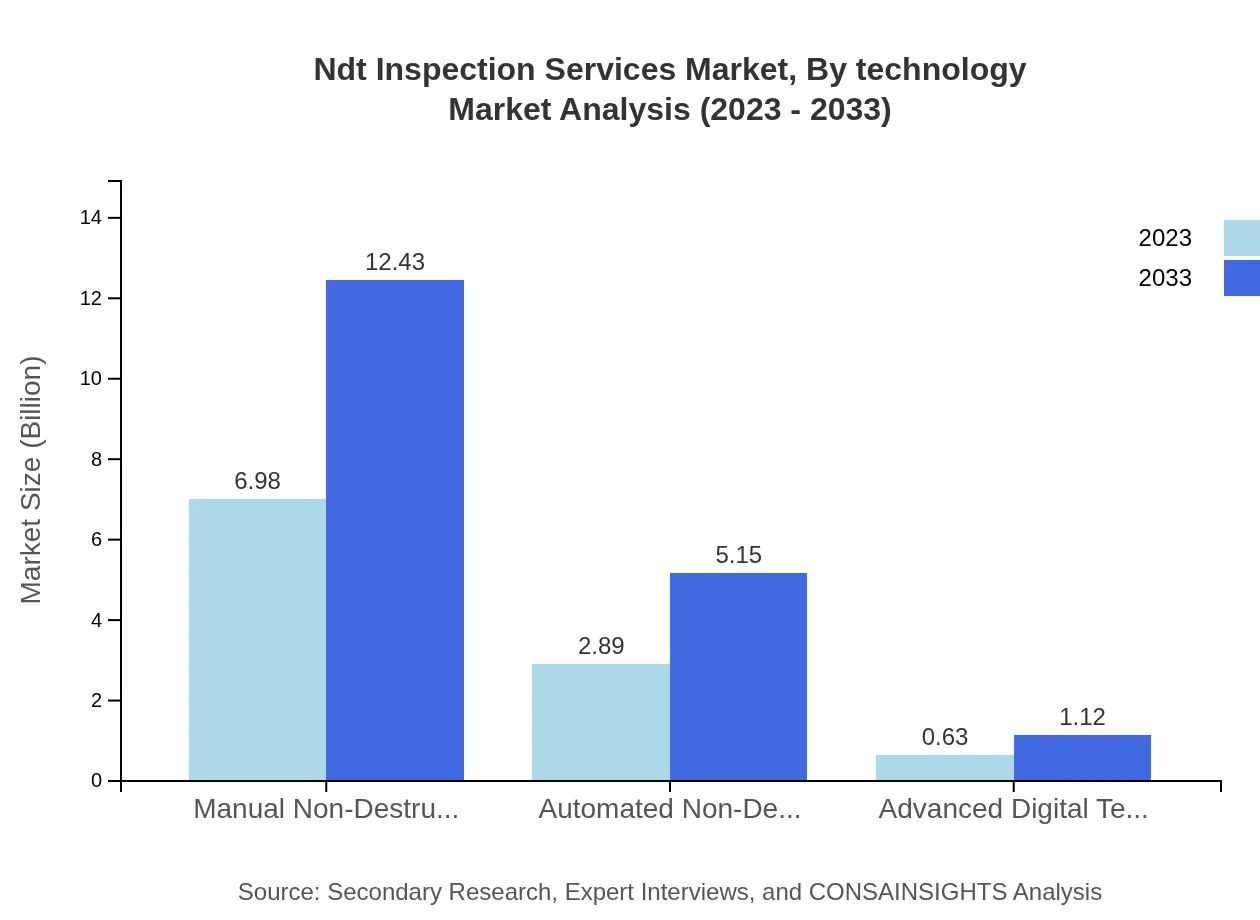

Ndt Inspection Services Market Analysis By Technology

The technological segment of the NDT Inspection Services market showcases substantial advancements, particularly with Automated Non-Destructive Testing, expected to grow substantially from $2.89 billion in 2023 to $5.15 billion by 2033. Advanced Digital Techniques also represent a growing niche, with increasing adoption rates as industries seek efficiency and accuracy in their inspection processes.

Ndt Inspection Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ndt Inspection Services Industry

Baker Hughes:

A leading provider of technology and services for oil and gas, including NDT services that enhance safety and efficiency.General Electric:

GE offers advanced instrumentation and inspection technologies that aid in the quality assurance processes across various industries.Siemens :

Siemens specializes in industrial inspection and controls, leveraging automation to enhance NDT accuracy and efficiency.Olympus Corporation:

A prominent player in the imaging and instrumentation market, Olympus enhances NDT methods through innovative ultrasonic testing solutions.Mistras Group:

Offers a wide range of NDT services and solutions enhancing safety and operational reliability for diverse industrial applications.We're grateful to work with incredible clients.

FAQs

What is the market size of NDT Inspection Services?

The global market size for NDT Inspection Services is estimated at $10.5 billion in 2023, with a projected growth rate of 5.8% CAGR through 2033, reflecting significant demand across various sectors.

What are the key market players or companies in the NDT inspection services industry?

Key players in the NDT inspection services industry include major companies like Germann, SGS, and Applus, along with various regional service providers that enhance market competition and innovation.

What are the primary factors driving the growth in the NDT inspection services industry?

The growth in the NDT inspection services industry is driven by increasing safety regulations, advancements in technology, and rising demand for quality assurance across industries such as manufacturing and aerospace.

Which region is the fastest Growing in the NDT inspection services market?

The fastest-growing region in the NDT inspection services market is projected to be North America, expanding from $4.00 billion in 2023 to $7.13 billion in 2033, driven by technological advancements and high market demand.

Does ConsaInsights provide customized market report data for the NDT inspection services industry?

Yes, ConsaInsights offers customized market report data for the NDT inspection services industry, tailored to specific client requirements, ensuring relevant insights and strategic guidance.

What deliverables can I expect from this NDT inspection services market research project?

Expect deliverables such as comprehensive market analysis, segmentation data, competitive landscape assessment, and insights into industry trends, along with strategic recommendations specific to NDT inspection services.

What are the market trends of NDT inspection services?

Current trends in the NDT inspection services market include the adoption of automated testing techniques, increasing reliance on data analytics, and a shift toward environmentally sustainable practices across sectors.