Network As A Service Market Report

Published Date: 31 January 2026 | Report Code: network-as-a-service

Network As A Service Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Network As A Service (NaaS) market from 2023 to 2033, covering key insights, market trends, growth forecasts, and critical factors influencing the industry.

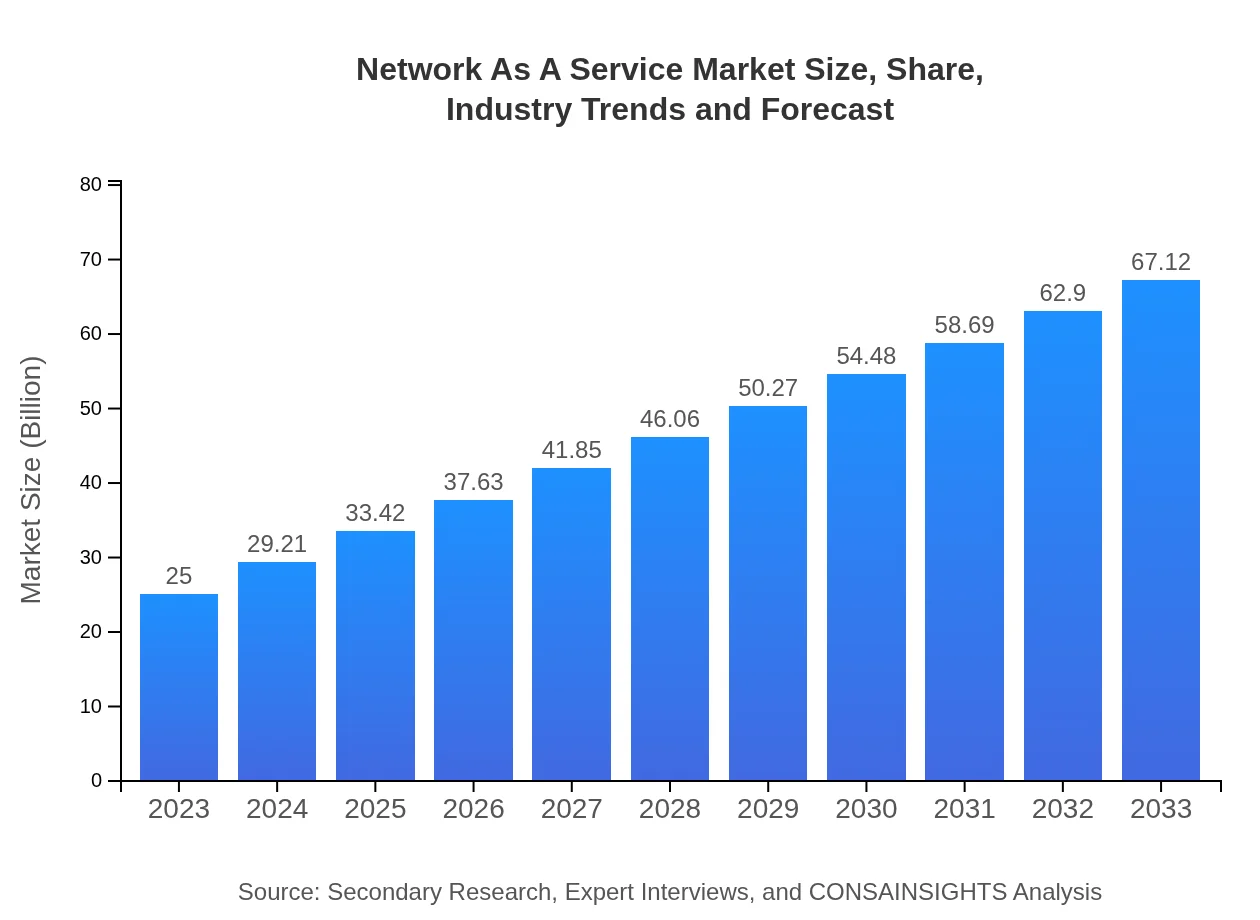

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.00 Billion |

| CAGR (2023-2033) | 10% |

| 2033 Market Size | $67.12 Billion |

| Top Companies | Cisco Systems, Inc., IBM Corporation, VMware, Inc., Microsoft Azure, Amazon Web Services (AWS) |

| Last Modified Date | 31 January 2026 |

Network As A Service Market Overview

Customize Network As A Service Market Report market research report

- ✔ Get in-depth analysis of Network As A Service market size, growth, and forecasts.

- ✔ Understand Network As A Service's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Network As A Service

What is the Market Size & CAGR of Network As A Service market in 2023?

Network As A Service Industry Analysis

Network As A Service Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Network As A Service Market Analysis Report by Region

Europe Network As A Service Market Report:

Europe's NaaS market is expected to evolve from $6.09 billion in 2023 to $16.36 billion by 2033, achieving a CAGR of approximately 10.26%. The regional market is spurred by stringent regulations on data privacy and security, driving companies to adopt NaaS solutions to enhance compliance and operational efficiency.Asia Pacific Network As A Service Market Report:

The Asia Pacific region is experiencing significant growth in the NaaS market, driven by the rapid digital transformation of enterprises and increasing Internet penetration. The market value is projected to rise from $5.23 billion in 2023 to $14.04 billion by 2033, reflecting a robust CAGR of approximately 10.62%. Countries like India, China, and Japan are at the forefront of this growth, leveraging advanced networking technologies to enhance business agility.North America Network As A Service Market Report:

North America remains the leading region for the NaaS market, with a projected value increase from $8.69 billion in 2023 to $23.34 billion in 2033 and a CAGR of around 10.66%. The dominance of technologically advanced companies and a high rate of cloud adoption fuel the demand for innovative services that provide greater networking flexibility and security.South America Network As A Service Market Report:

In South America, the NaaS market is characterized by emerging opportunities and challenges. The market is expected to increase from $1.94 billion in 2023 to $5.21 billion by 2033, showcasing a CAGR of about 10.25%. Regional players are focusing on expanding their offerings to cater to local demand, while enterprises are increasingly shifting toward NaaS on account of its cost-effectiveness.Middle East & Africa Network As A Service Market Report:

The Middle East and Africa region is witnessing a transformative phase in NaaS adoption, with the market expected to grow from $3.04 billion in 2023 to $8.17 billion by 2033, reflecting a CAGR of around 10.32%. Investments in digital infrastructure and increasing demand for scalable networking solutions are pivotal to the region's growth trajectory.Tell us your focus area and get a customized research report.

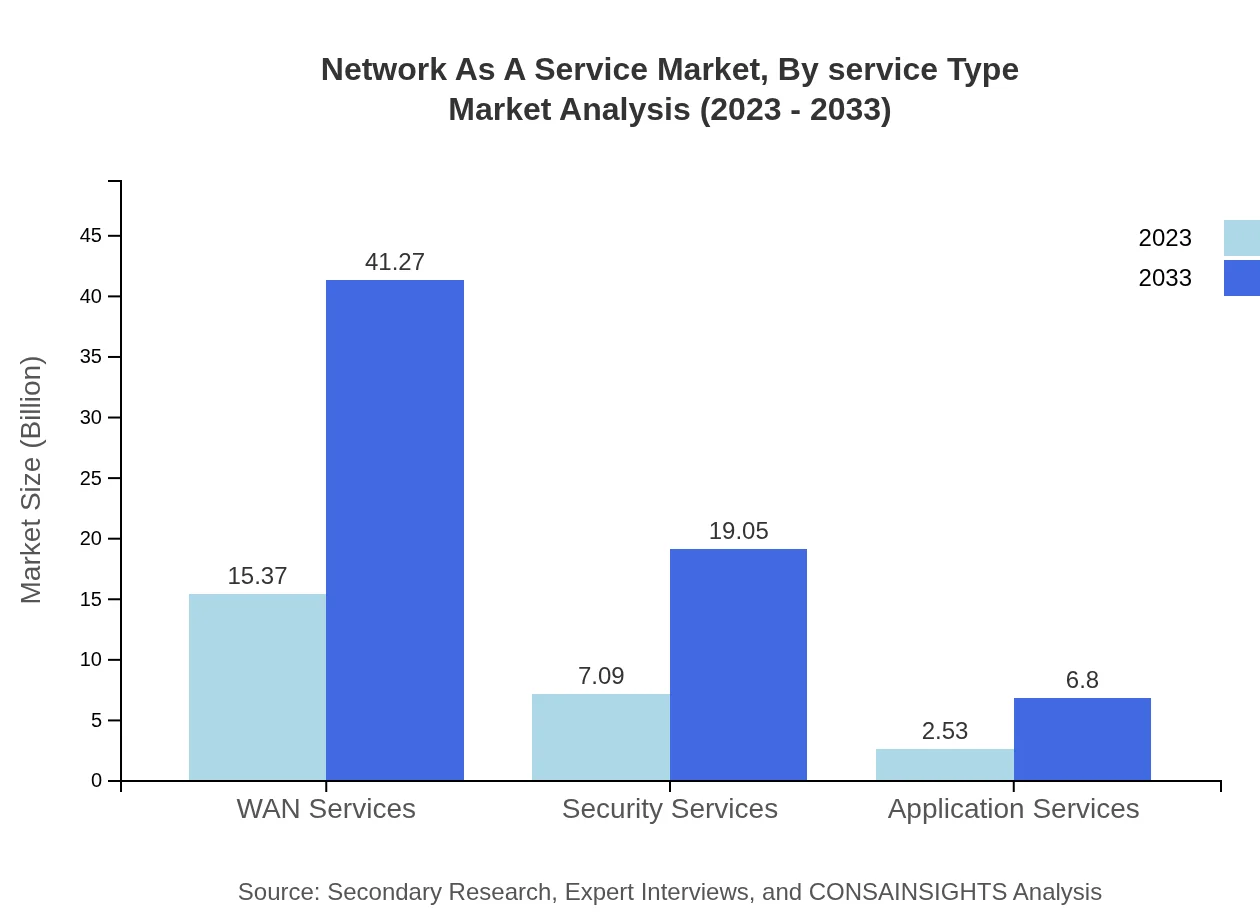

Network As A Service Market Analysis By Service Type

In 2023, WAN services will dominate the NaaS market with a size of $15.37 billion, expected to grow to $41.27 billion by 2033, retaining a market share of 61.49%. Security services are projected to expand from $7.09 billion to $19.05 billion during the same period, holding 28.38% of the market. Application services will also see notable growth from $2.53 billion to $6.80 billion, maintaining a share of 10.13%.

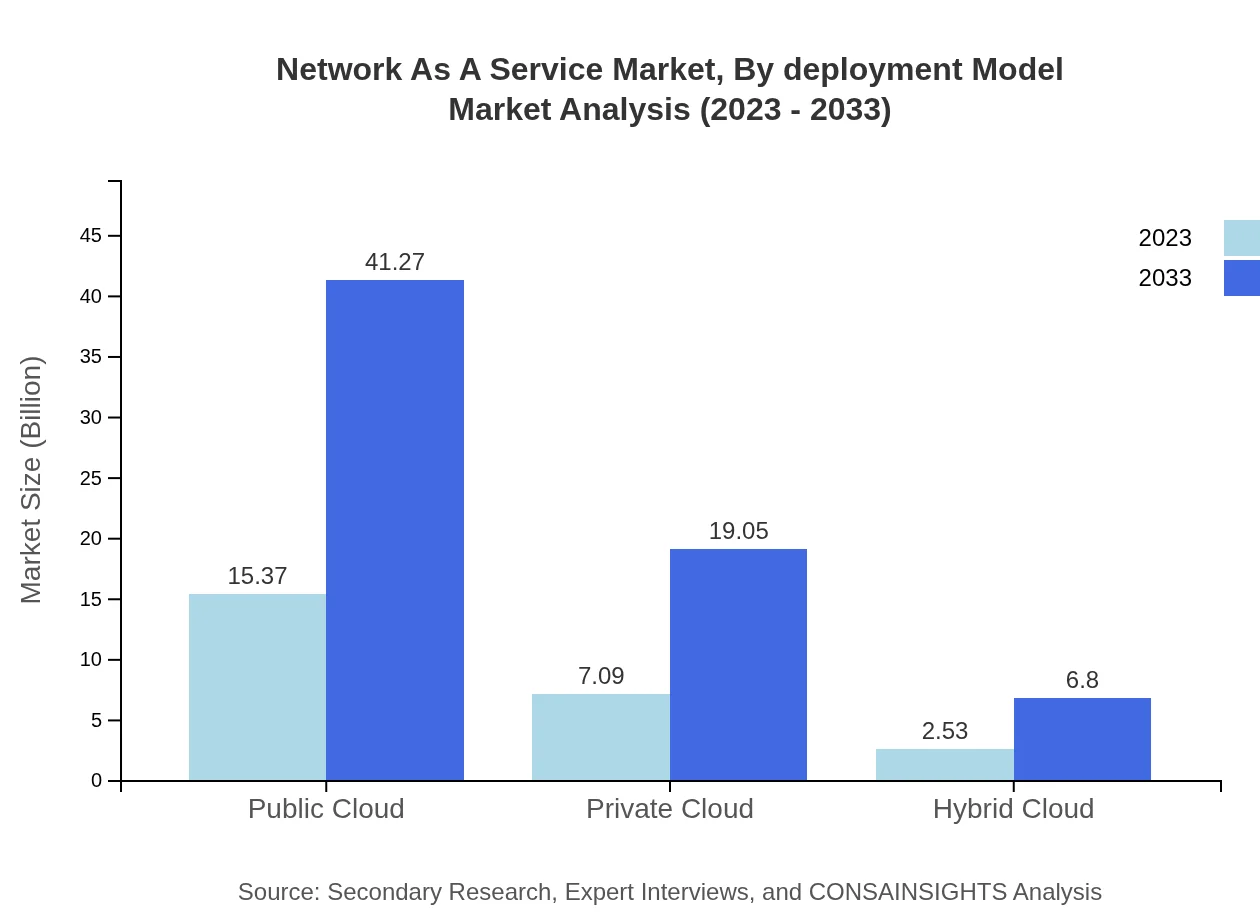

Network As A Service Market Analysis By Deployment Model

The analysis reveals growing adoption of public cloud solutions, projected to grow from $15.37 billion in 2023 to $41.27 billion by 2033, capturing 61.49% of the market. Private cloud offerings are also attracting attention, increasing from $7.09 billion to $19.05 billion, while hybrid cloud models will develop from $2.53 billion to $6.80 billion.

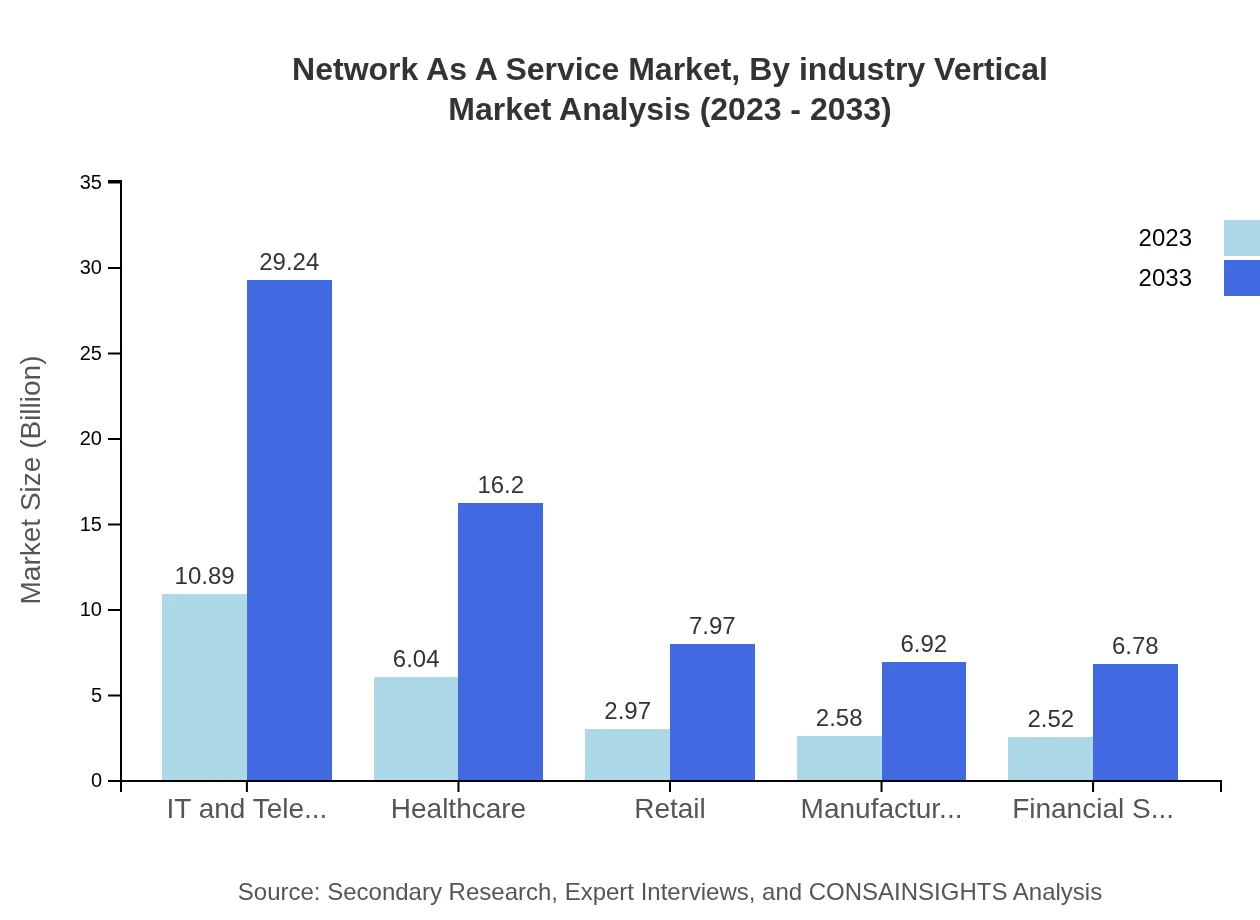

Network As A Service Market Analysis By Industry Vertical

NaaS is gaining traction across numerous industry verticals. The IT and telecom industry will lead with a market size growing from $10.89 billion to $29.24 billion, constituting 43.57% of the share. Healthcare will follow, expanding from $6.04 billion to $16.20 billion, and retail from $2.97 billion to $7.97 billion.

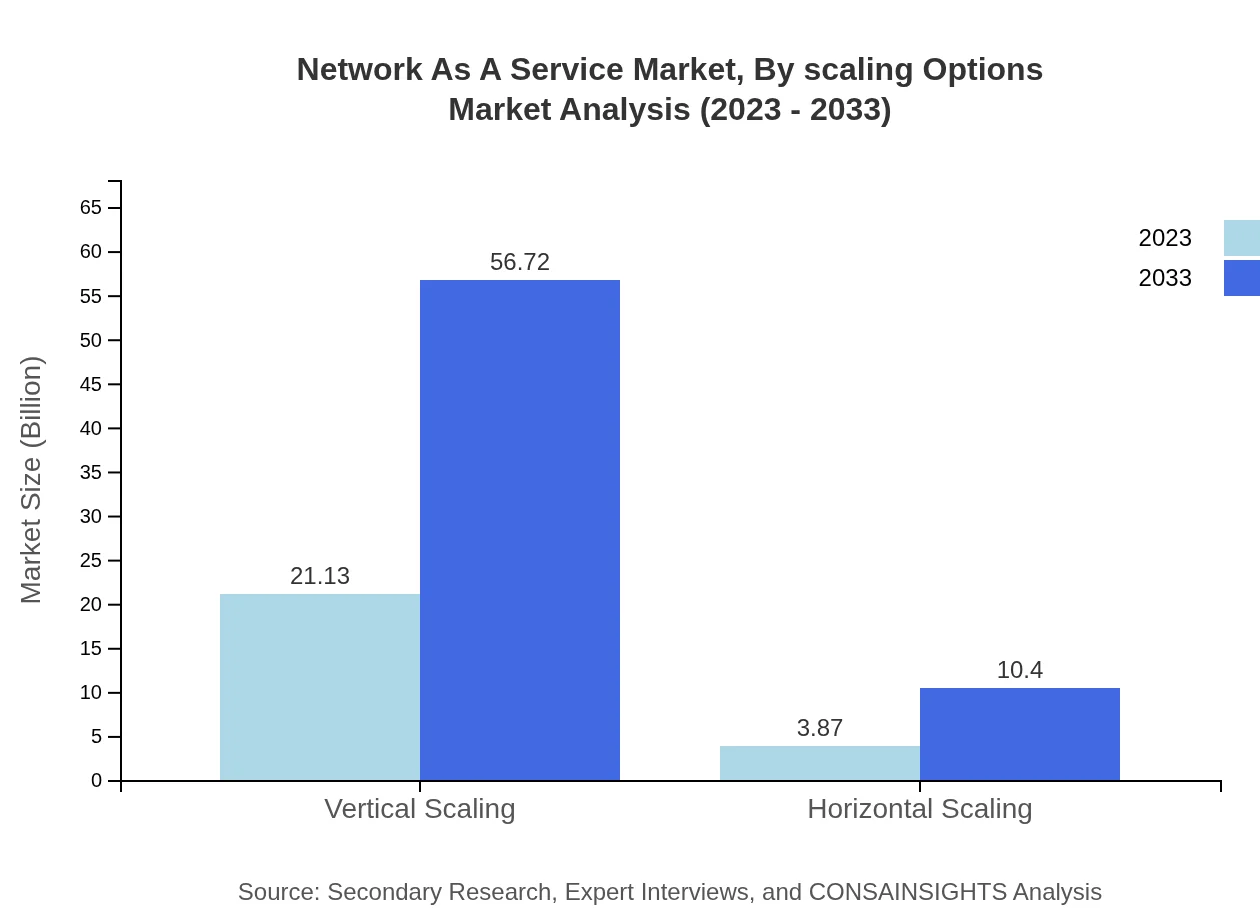

Network As A Service Market Analysis By Scaling Options

In terms of scaling options, vertical scaling will be the predominant strategy, with values expected to soar from $21.13 billion to $56.72 billion, holding 84.51% of the market by 2033. Horizontal scaling will also increase, from $3.87 billion to $10.40 billion, maintaining a 15.49% share.

Network As A Service Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Network As A Service Industry

Cisco Systems, Inc.:

A leader in networking solutions, Cisco offers a robust NaaS framework supporting flexible, scalable network services tailored to diverse business needs.IBM Corporation:

Known for its innovative cloud solutions, IBM integrates advanced technologies into its NaaS offerings, leveraging AI and machine learning to optimize performance.VMware, Inc.:

A pioneer in virtualization technologies, VMware's NaaS approach enhances network management and agility across cloud infrastructures.Microsoft Azure:

Microsoft's Azure platform provides comprehensive network services, enabling organizations to seamlessly transition to cloud solutions.Amazon Web Services (AWS):

AWS leads with its extensive portfolio of cloud services and innovative NaaS features, empowering enterprises to enhance networking capabilities.We're grateful to work with incredible clients.

FAQs

What is the market size of Network As A-Service?

The global Network-as-a-Service market is estimated to reach approximately $25 billion by 2033, growing at a CAGR of 10%. This significant growth indicates a robust demand for network solutions during the forecast period, reflecting an increasing shift towards cloud-based networking solutions.

What are the key market players or companies in the Network As A-Service industry?

Key players in the NaaS market include leading technology firms that provide robust networking solutions. Companies such as Cisco, VMware, and AT&T are pivotal, continuously innovating to meet the demands of their customers in various sectors.

What are the primary factors driving the growth in the Network As A-Service industry?

The growth of the NaaS industry is primarily driven by the increasing need for flexible connectivity solutions, the rise of remote work, and the demand for cost-effective network infrastructure. Moreover, advancements in cloud technology play a crucial role.

Which region is the fastest Growing in the Network As A-Service market?

North America is the fastest-growing region in the NaaS market, anticipated to increase from $8.69 billion in 2023 to $23.34 billion by 2033. This growth is attributed to the region's technological advancements and increasing enterprise digitization.

Does ConsaInsights provide customized market report data for the Network As A-Service industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the NaaS industry. This allows organizations to access insights relevant to their unique market position and strategic goals.

What deliverables can I expect from this Network As A-Service market research project?

Clients can expect comprehensive deliverables including detailed reports, segment analysis, regional growth insights, competitive landscape assessments, and forecasts showing market trends and growth potential in the Network-as-a-Service domain.

What are the market trends of Network As A-Service?

Current trends in the NaaS market include the rising adoption of WAN services, an increasing focus on security services, and the shift toward hybrid cloud solutions. These trends highlight the industry's evolving landscape and need for scalable network solutions.