Network Function Virtualization Nfv Market Report

Published Date: 31 January 2026 | Report Code: network-function-virtualization-nfv

Network Function Virtualization Nfv Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Network Function Virtualization (NFV) market, covering insights into market size, segments, industry trends, and forecasts from 2023 to 2033.

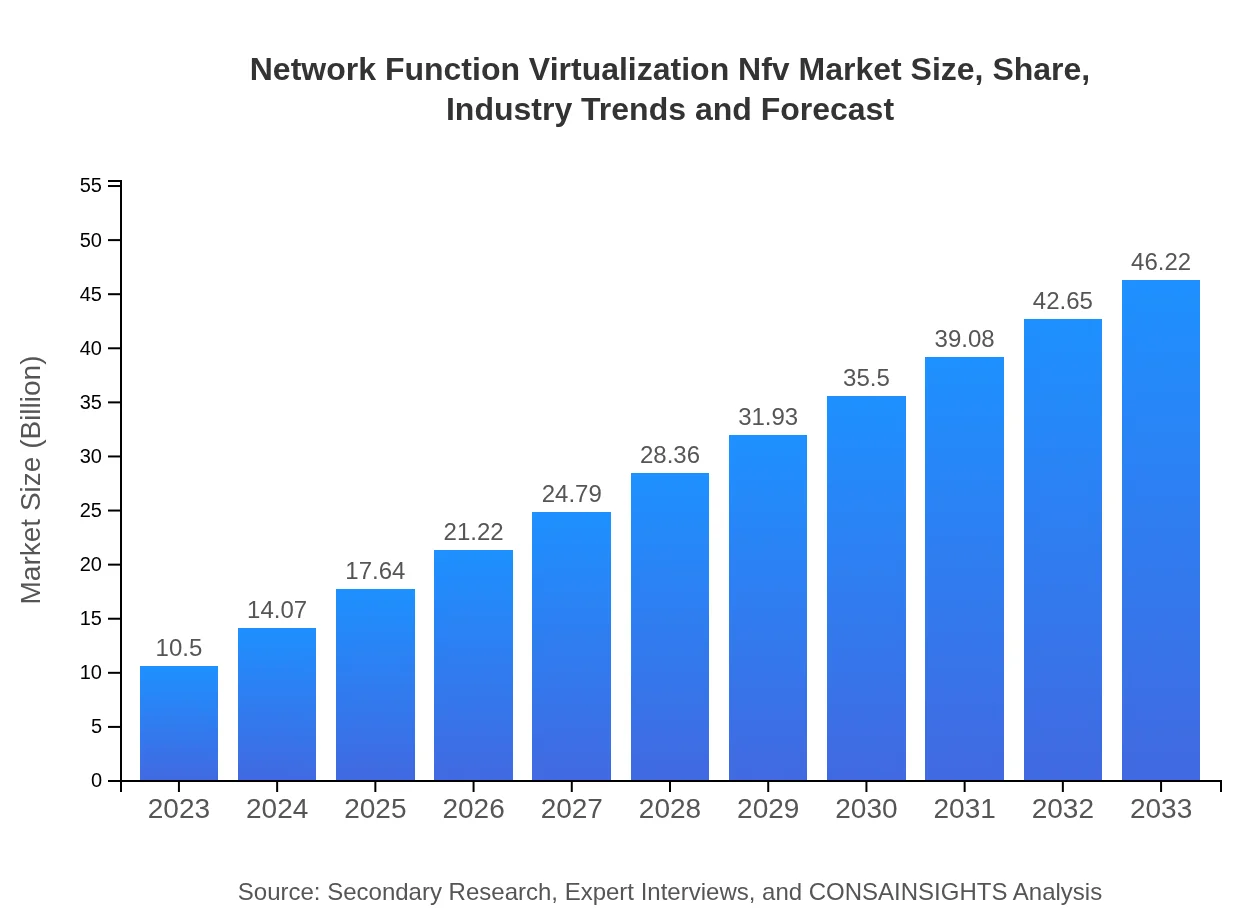

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 15.2% |

| 2033 Market Size | $46.22 Billion |

| Top Companies | VMware, Cisco, Nokia , Huawei , Red Hat |

| Last Modified Date | 31 January 2026 |

Network Function Virtualization NFV Market Overview

Customize Network Function Virtualization Nfv Market Report market research report

- ✔ Get in-depth analysis of Network Function Virtualization Nfv market size, growth, and forecasts.

- ✔ Understand Network Function Virtualization Nfv's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Network Function Virtualization Nfv

What is the Market Size & CAGR of Network Function Virtualization NFV market in 2023?

Network Function Virtualization NFV Industry Analysis

Network Function Virtualization NFV Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Network Function Virtualization NFV Market Analysis Report by Region

Europe Network Function Virtualization Nfv Market Report:

The European NFV market is forecasted to grow from $2.98 billion in 2023 to $13.12 billion by 2033. This growth is propelled by stringent regulatory advancements surrounding network security and the EU's push towards digital transformation within telecommunications.Asia Pacific Network Function Virtualization Nfv Market Report:

The Asia Pacific NFV market is anticipated to grow from $2.14 billion in 2023 to $9.42 billion by 2033, fueled by increasing cloud adoption and advancements in telecommunications infrastructure across emerging economies. Key players in this region are also leveraging NFV to meet the demands of high mobile data usage.North America Network Function Virtualization Nfv Market Report:

The North American NFV market is the largest globally, projected to escalate from $3.71 billion in 2023 to approximately $16.34 billion by 2033. The region's strong focus on technology innovation, particularly among telecom giants, will drive substantial investment into NFV technologies.South America Network Function Virtualization Nfv Market Report:

In South America, the NFV market is set to expand from $0.62 billion in 2023 to $2.72 billion by 2033. This growth will be supported by the increasing penetration of mobile and broadband services and government initiatives aimed at enhancing digital connectivity.Middle East & Africa Network Function Virtualization Nfv Market Report:

In the Middle East and Africa, the market is expected to rise from $1.05 billion in 2023 to $4.62 billion by 2033, driven by rising internet penetration and demand for mobile services. Investments in 5G networks are further anticipated to enhance the NFV market landscape.Tell us your focus area and get a customized research report.

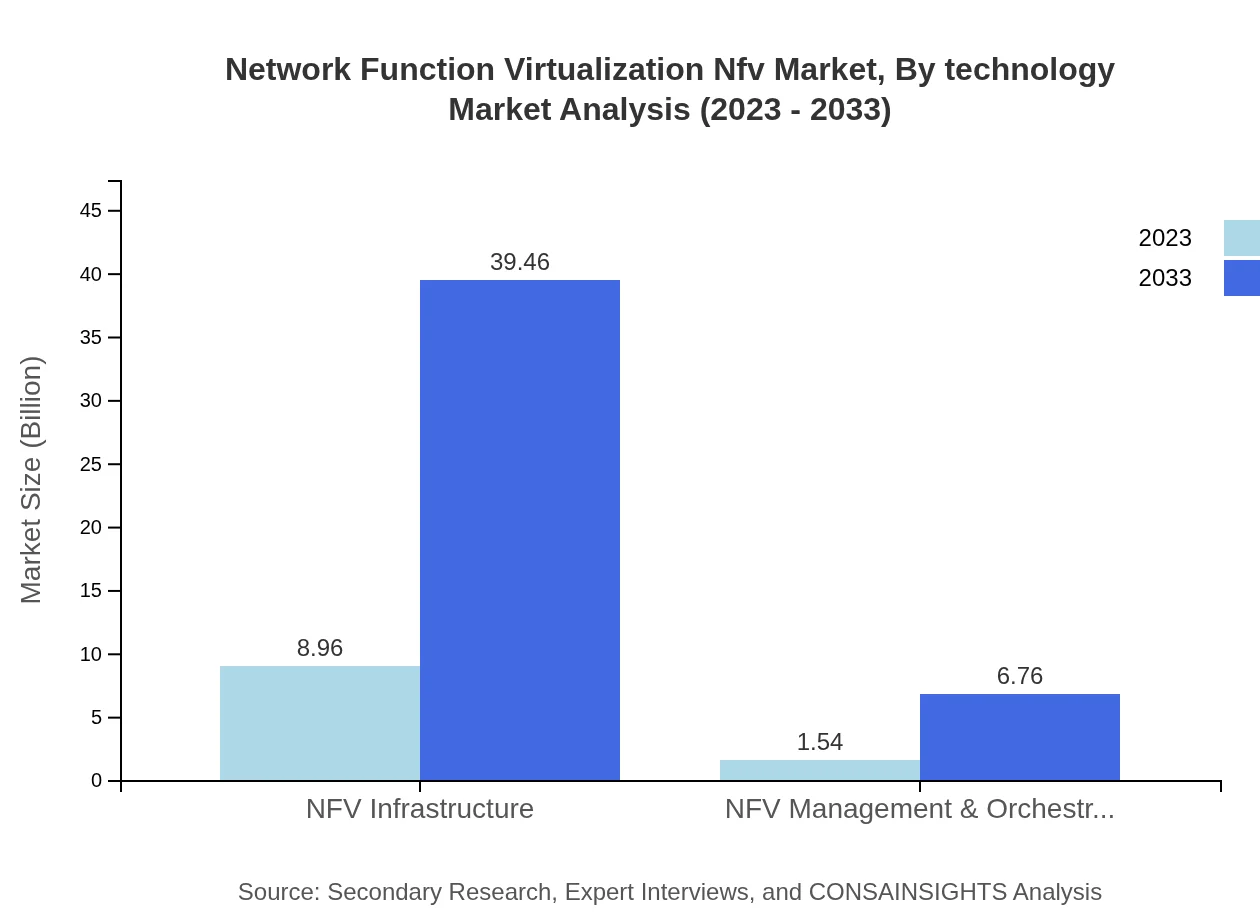

Network Function Virtualization Nfv Market Analysis By Technology

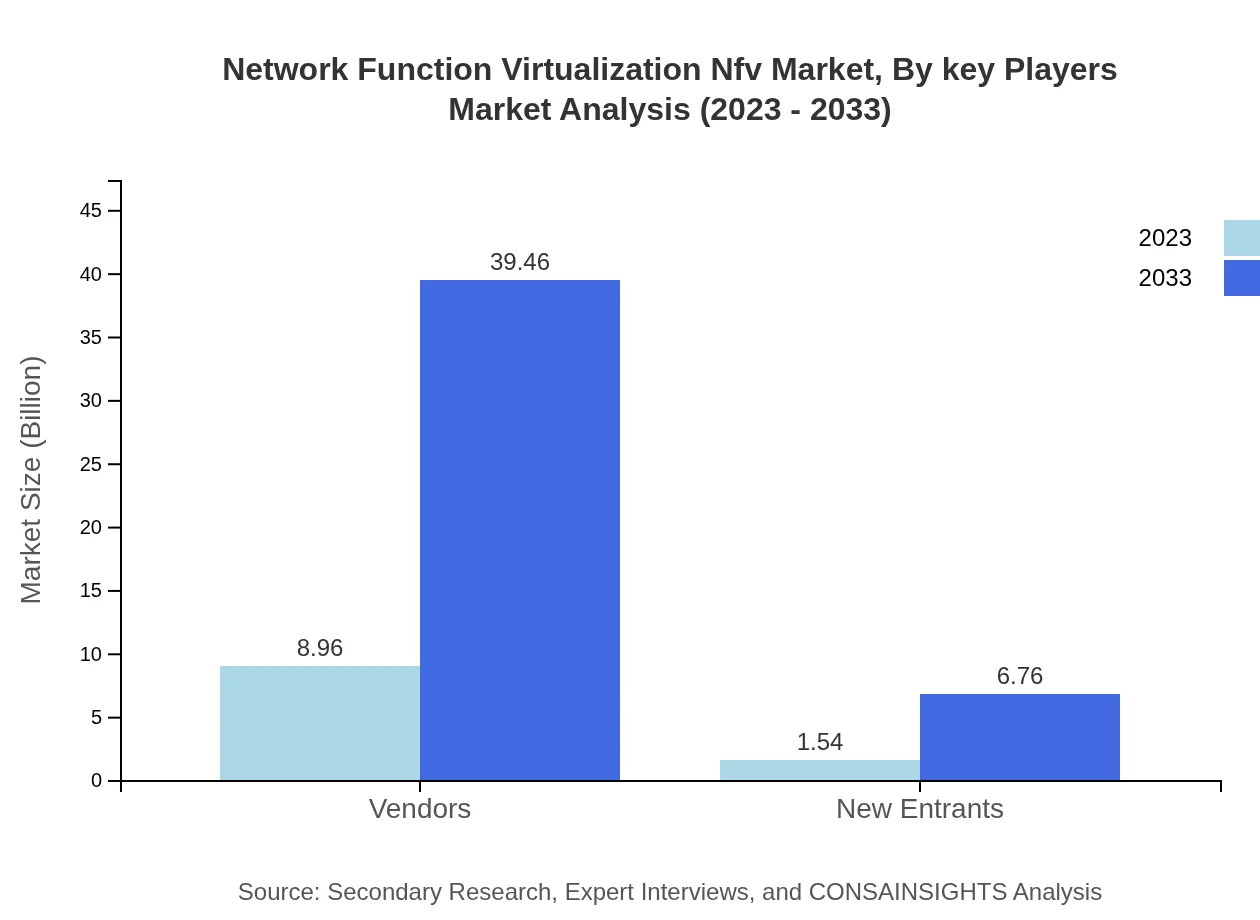

The NFV market is characterized by diverse technological offerings, which include NFV infrastructure, management and orchestration platforms, and virtualized network functions. As of 2023, NFV infrastructure accounts for the majority share with a market size of $8.96 billion, projected to amplify to $39.46 billion by 2033. Additionally, MANO solutions are crucial for the efficient deployment and management of NFV, contributing expected growth from $1.54 billion to $6.76 billion over the forecast period.

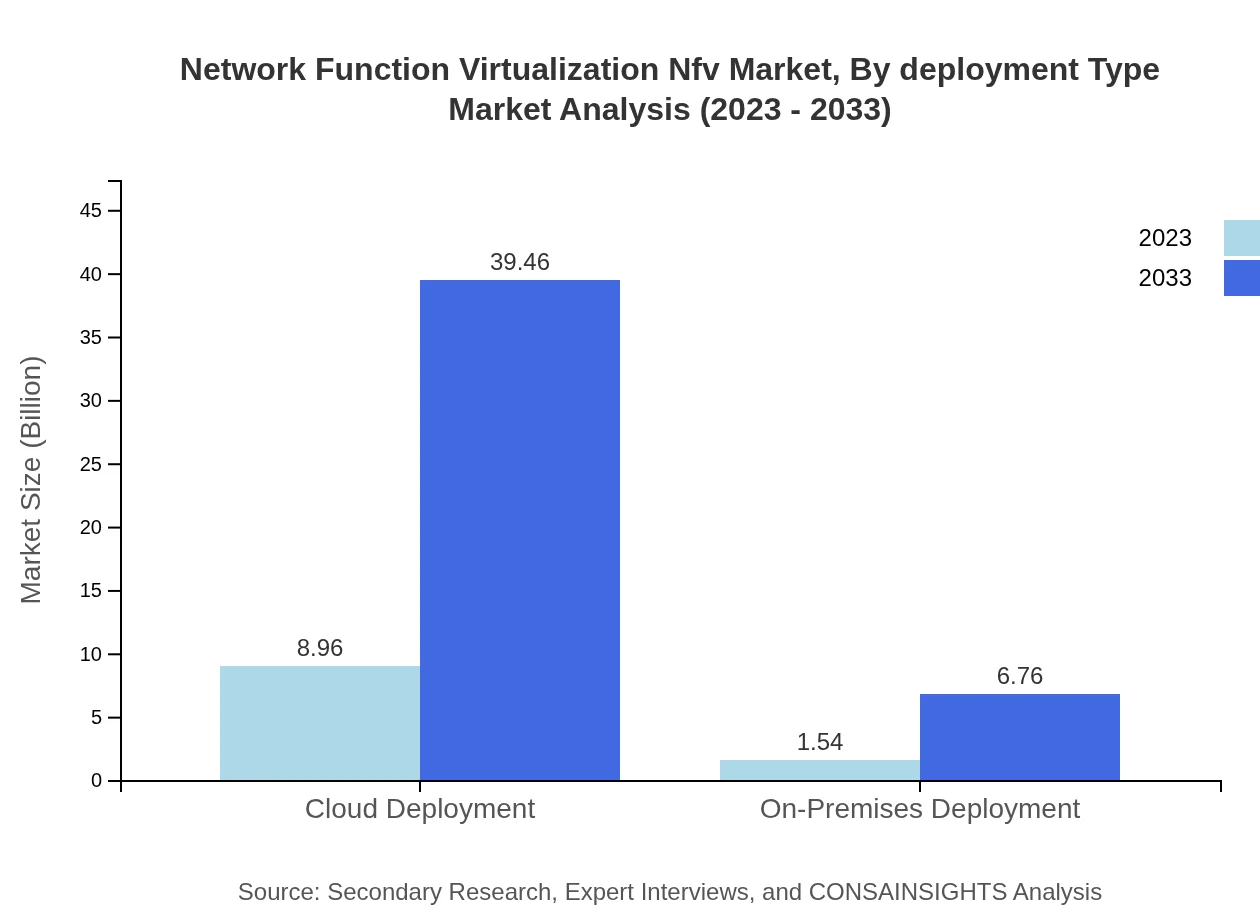

Network Function Virtualization Nfv Market Analysis By Deployment Type

Deployment types in the NFV market primarily comprise cloud deployment and on-premises deployment. Cloud deployment leads the sector with a market size of $8.96 billion in 2023, foreseen to grow to $39.46 billion by 2033, driven by its scalability and flexibility for enterprises. On-premises solutions, while smaller, are expected to grow from $1.54 billion to $6.76 billion in the same timeframe as they cater to businesses requiring direct control over their network infrastructures.

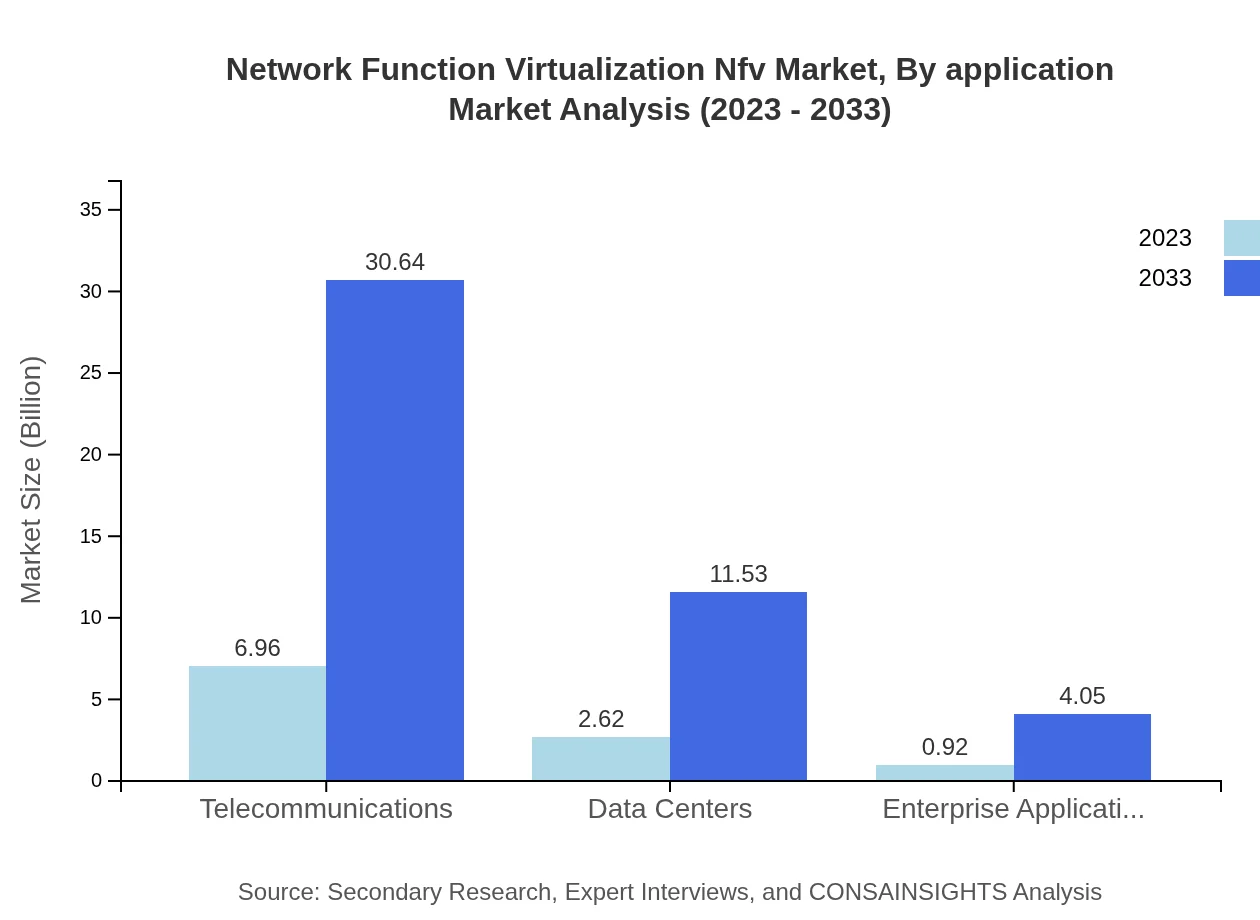

Network Function Virtualization Nfv Market Analysis By Application

The application segment of the NFV market includes telecommunications, data centers, and enterprise applications. The telecommunications sector holds the largest share at $6.96 billion in 2023, poised to rise to $30.64 billion by 2033, as NFV continues to enhance service delivery. Data centers and enterprise applications follow, with expected growth trajectories due to rising efficiency needs and operational flexibility.

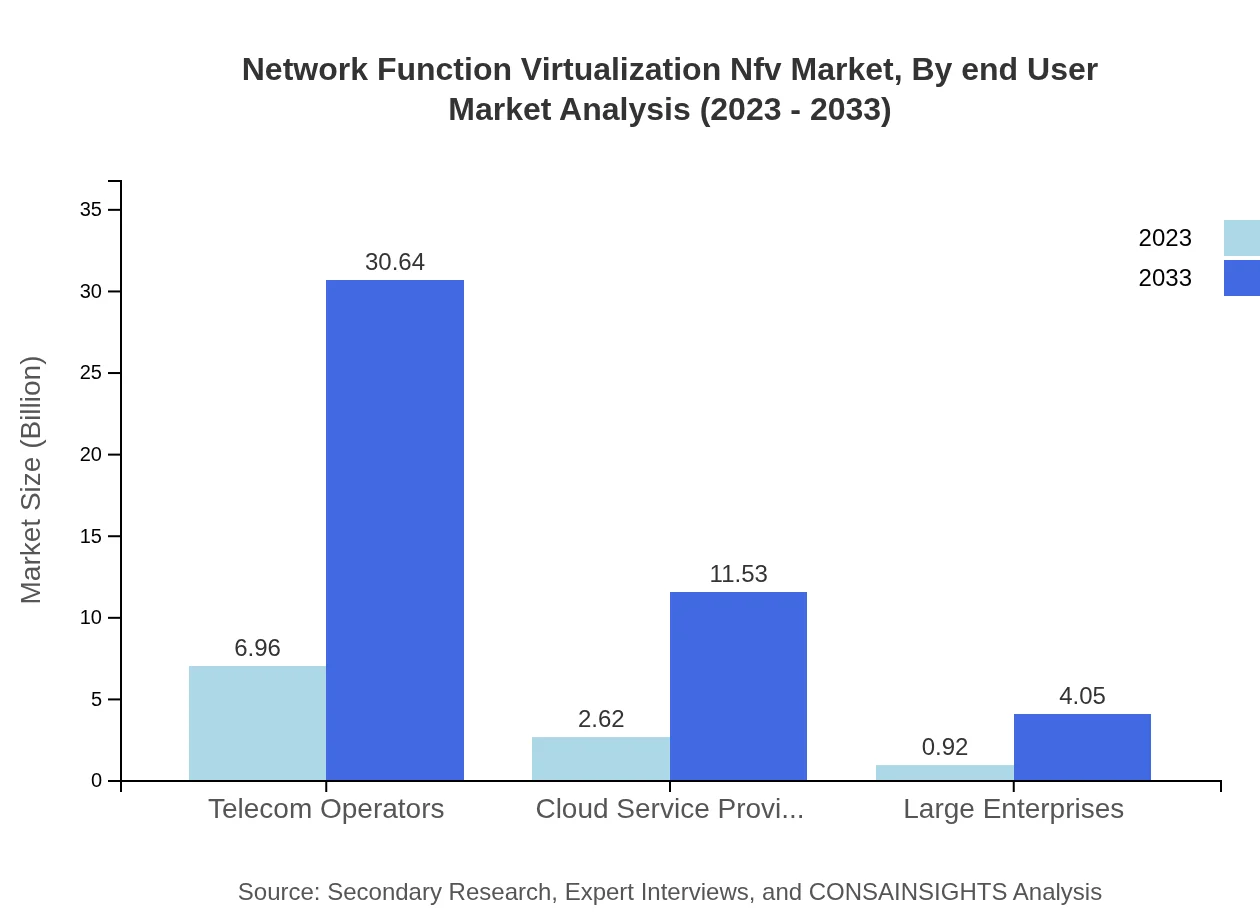

Network Function Virtualization Nfv Market Analysis By End User

End-user industries utilize NFV in various capacities. Telecom operators dominate with a sizable share, followed by cloud service providers and large enterprises. The telecom sector’s engagement stands at $6.96 billion in 2023, projected to surge significantly. Growth in large enterprises stemming from increased digitization further illustrates the expanding application of NFV across sectors.

Network Function Virtualization Nfv Market Analysis By Key Players

The NFV market features several key players including VMware, Red Hat, and Cisco, who lead advancements in virtualization technologies. Their strategies emphasize innovation in scalable network solutions to cater to the growing demand for agile networks.

Network Function Virtualization NFV Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Network Function Virtualization NFV Industry

VMware:

VMware is a leader in cloud infrastructure and digital workspace technology, providing extensive NFV solutions that optimize network resources for service providers and enterprises.Cisco:

Cisco specializes in networking hardware and software, and their NFV platforms enable telecom operators to enhance the efficiency of their network services through virtualization.Nokia :

Nokia provides advanced NFV technology solutions and has a significant role in driving telecommunications networks and 5G rollouts globally.Huawei :

Huawei is a global leader in telecommunications equipment and services, offering NFV products that support robust and scalable network infrastructures.Red Hat:

Red Hat delivers an open-source platform for NFV solutions, allowing flexibility and reducing operational costs for service providers.We're grateful to work with incredible clients.

FAQs

What is the market size of Network Function Virtualization (NFV)?

As of 2023, the Network Function Virtualization (NFV) market is valued at approximately $10.5 billion. It is expected to grow at a CAGR of 15.2%, indicating strong potential for expansion in the coming years.

What are the key market players or companies in the NFV industry?

Key players in the NFV industry include telecommunications giants, cloud service providers, and technology vendors. Prominent companies are likely to include Cisco, VMware, and Red Hat, all contributing significantly to NFV innovations.

What are the primary factors driving the growth in the NFV industry?

Growth in the NFV industry is driven by increasing demand for cloud services, cost reduction for telecom operations, and the need for advanced network management. Additionally, evolving consumer behaviors and innovations in 5G technology enhance market expansion.

Which region is the fastest Growing in the NFV industry?

Currently, North America is the fastest-growing region for NFV, projected to increase from $3.71 billion in 2023 to $16.34 billion by 2033. Europe and Asia Pacific also show substantial growth rates, indicating a strong global trend.

Does ConsaInsights provide customized market report data for the NFV industry?

Yes, ConsaInsights offers customized market reports tailored to the NFV industry. Clients can request specific analyses that meet their unique business needs, including detailed segmentations and regional insights.

What deliverables can I expect from this NFV market research project?

Deliverables from the NFV market research project typically include comprehensive market analysis, forecasts, segment data, regional insights, and strategic recommendations that can assist in decision-making and business strategy.

What are the market trends of NFV?

Market trends in NFV include a shift toward cloud-native architectures, heightened deployment in telecom environments, and the growing importance of automation in management and orchestration processes, reflecting the evolution of networking technology.