Neurothrombectomy Devices Market Report

Published Date: 31 January 2026 | Report Code: neurothrombectomy-devices

Neurothrombectomy Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Neurothrombectomy Devices market, encompassing insights on market size, trends, regional performance, and forecasts for the period 2023 to 2033. It offers a thorough examination of key players and market dynamics to aid stakeholders in strategic decision-making.

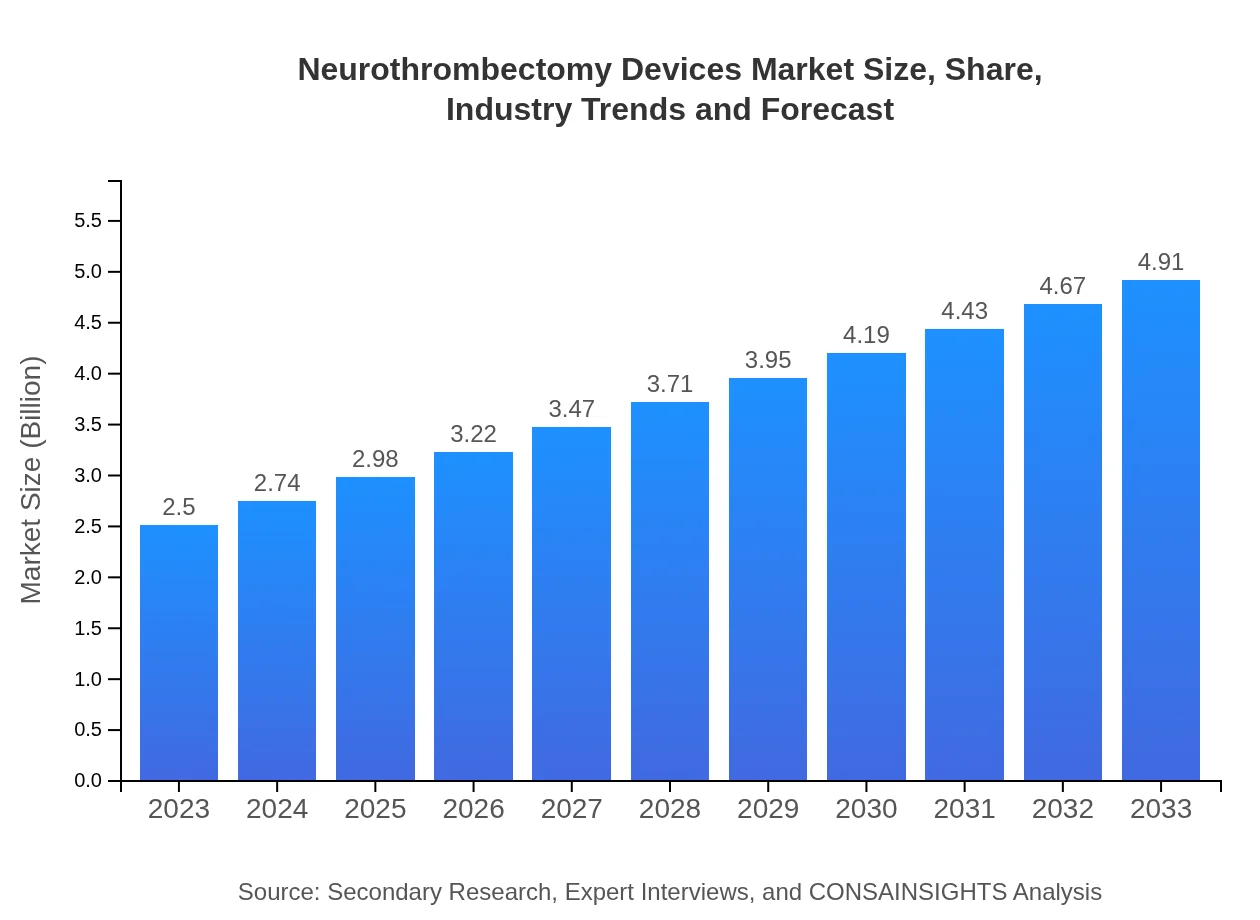

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | Medtronic , Stryker Corporation, Penumbra, Inc., Embolx |

| Last Modified Date | 31 January 2026 |

Neurothrombectomy Devices Market Overview

Customize Neurothrombectomy Devices Market Report market research report

- ✔ Get in-depth analysis of Neurothrombectomy Devices market size, growth, and forecasts.

- ✔ Understand Neurothrombectomy Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Neurothrombectomy Devices

What is the Market Size & CAGR of Neurothrombectomy Devices market in 2023?

Neurothrombectomy Devices Industry Analysis

Neurothrombectomy Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Neurothrombectomy Devices Market Analysis Report by Region

Europe Neurothrombectomy Devices Market Report:

The European Neurothrombectomy Devices market is projected to grow from $0.74 billion in 2023 to $1.45 billion by 2033. The growth dynamics in Europe are influenced by favorable reimbursement policies, an aging population, and increasing investments in healthcare technology.Asia Pacific Neurothrombectomy Devices Market Report:

In the Asia Pacific region, the Neurothrombectomy Devices market is poised to grow from approximately $0.47 billion in 2023 to $0.92 billion by 2033. This growth is attributed to increasing healthcare expenditure, rising awareness of stroke management, and improving access to advanced medical technologies.North America Neurothrombectomy Devices Market Report:

North America stands as the largest market, anticipated to grow from $0.93 billion in 2023 to $1.83 billion by 2033. The surge is driven by the high prevalence of ischemic strokes, advanced healthcare infrastructure, and continuous innovations in medical devices.South America Neurothrombectomy Devices Market Report:

The market in South America is expected to witness growth from $0.23 billion in 2023 to $0.46 billion by 2033. Factors such as increasing incidences of neurological disorders and improvements in healthcare facilities drive this growth, supported by government initiatives for better healthcare access.Middle East & Africa Neurothrombectomy Devices Market Report:

The Middle East and Africa market is expected to see growth from $0.13 billion in 2023 to $0.26 billion by 2033. Although smaller in comparison to other regions, the market benefits from growing healthcare initiatives and increasing investment in medical technologies.Tell us your focus area and get a customized research report.

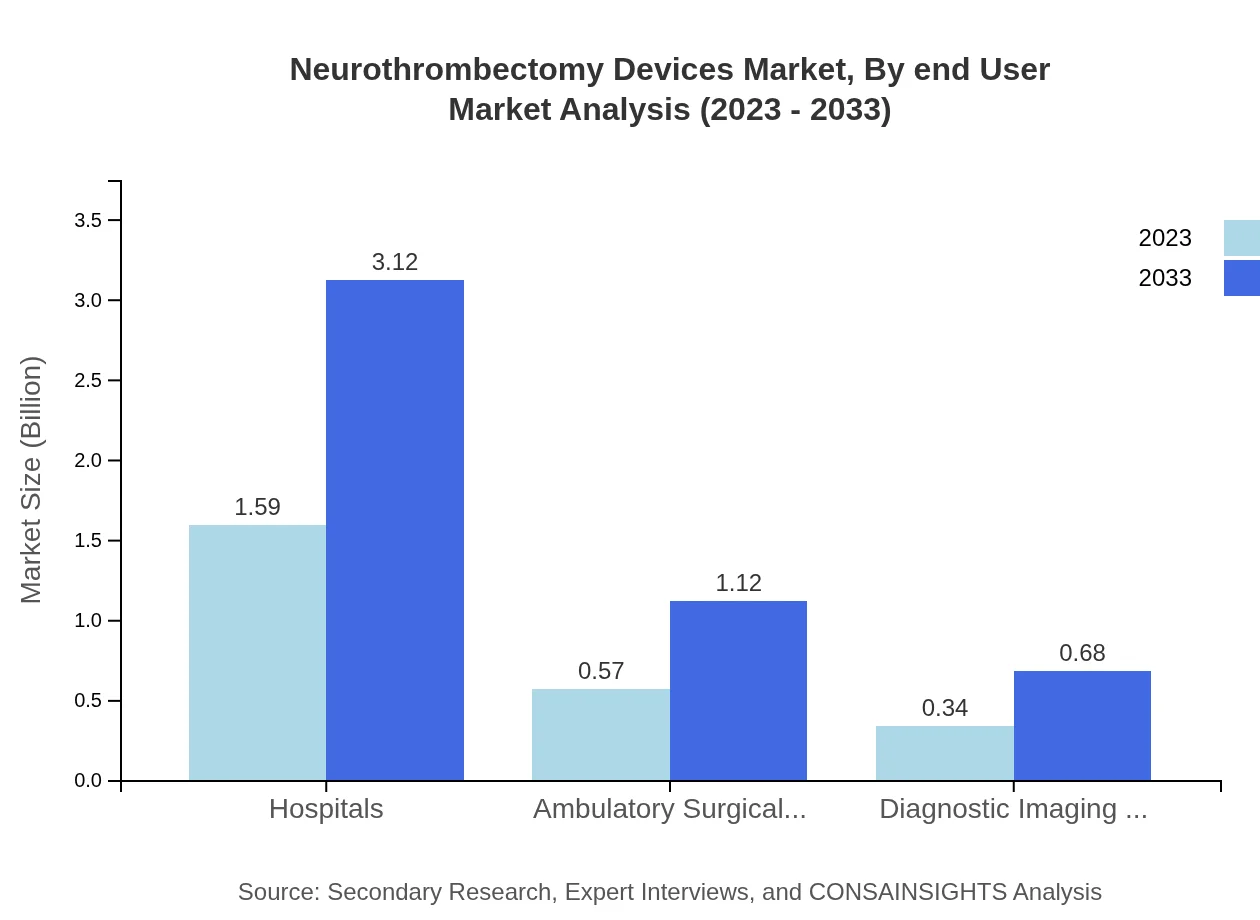

Neurothrombectomy Devices Market Analysis By End User

In 2023, hospitals dominate the Neurothrombectomy Devices market with a size of approximately $1.59 billion and a market share of 63.54%. By 2033, this segment will grow significantly to $3.12 billion. Ambulatory surgical centers follow, with a current size of $0.57 billion (22.71% market share) growing to $1.12 billion. Diagnostic imaging centers, while smaller, contribute a current size of $0.34 billion, projected to reach $0.68 billion by 2033.

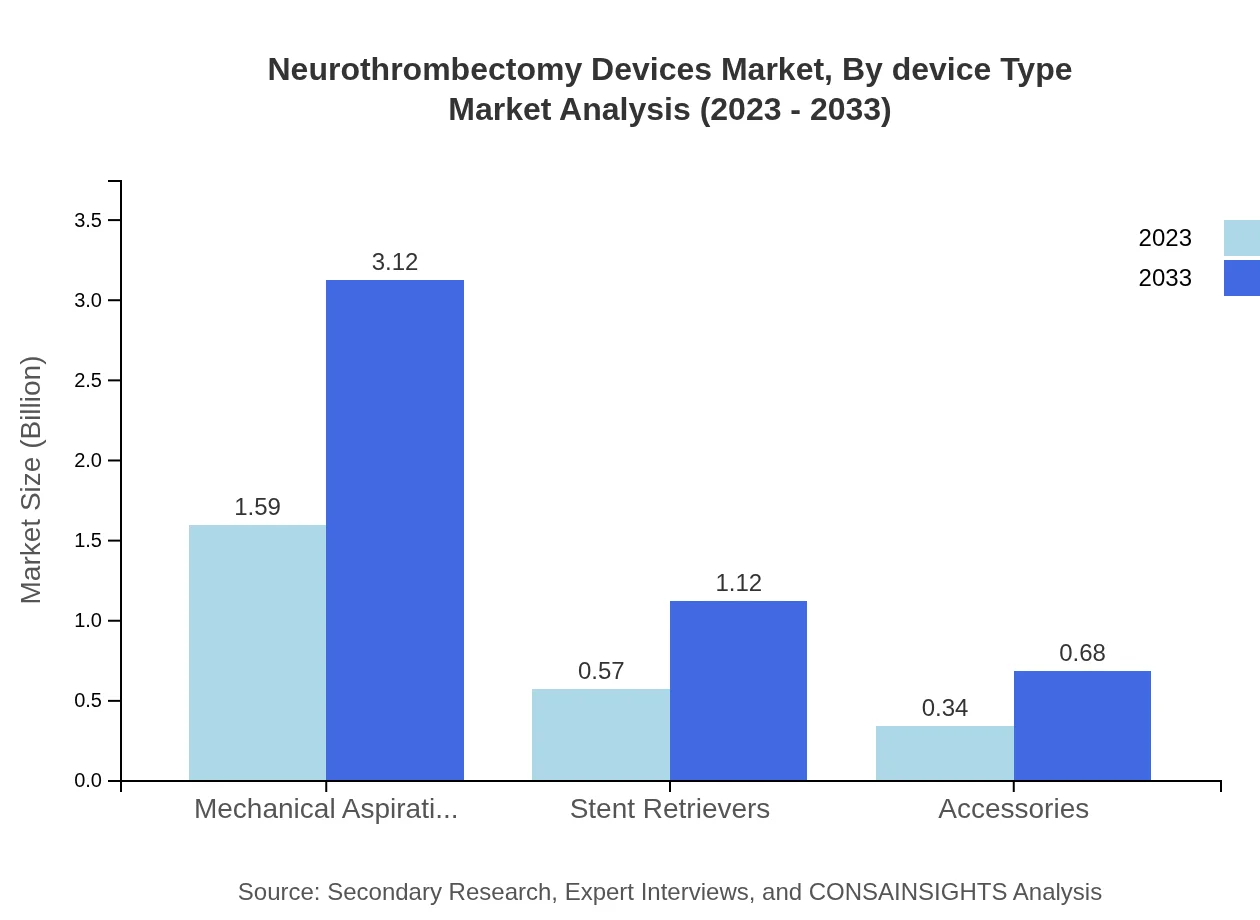

Neurothrombectomy Devices Market Analysis By Device Type

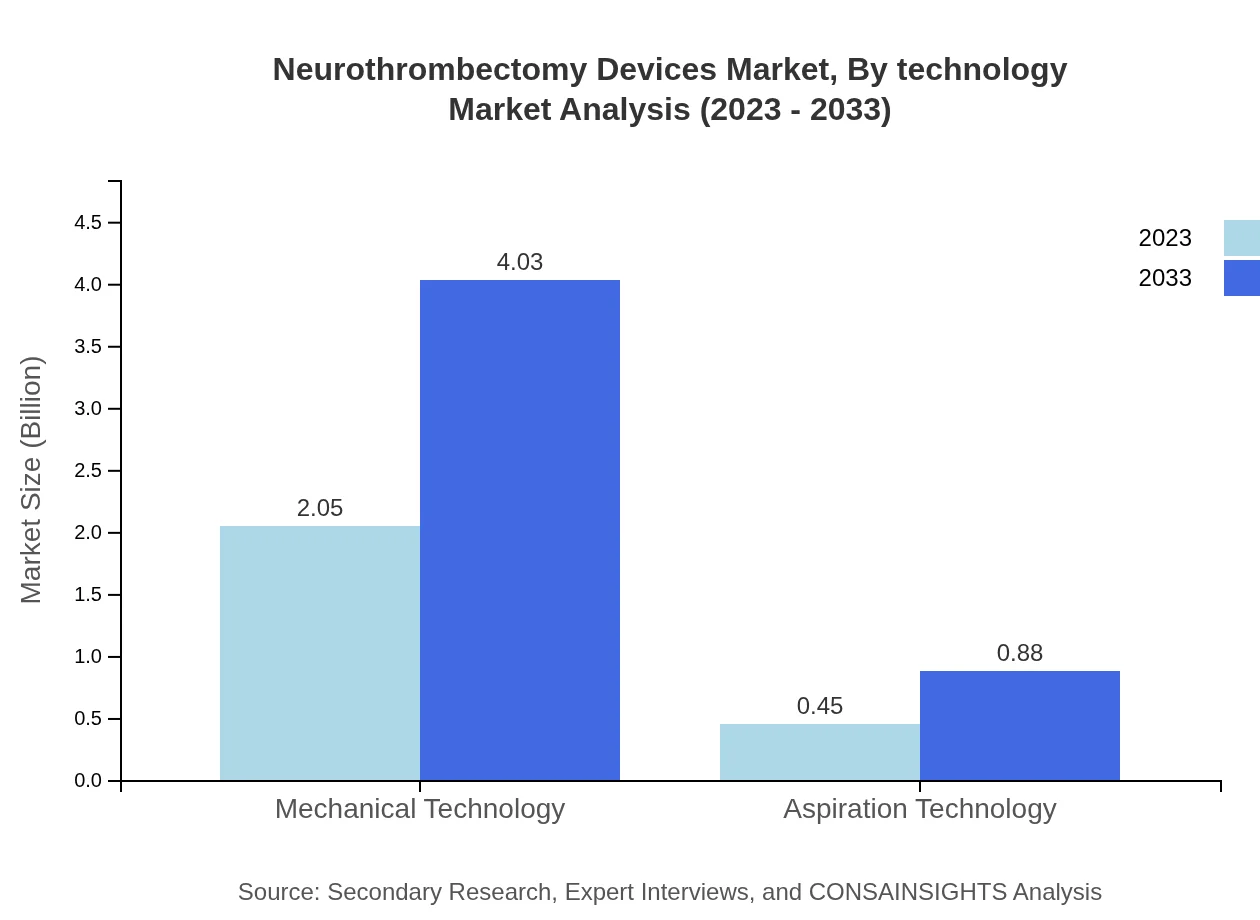

In terms of device types, mechanical technology leads the market with a size of $2.05 billion and a share of 82.08% in 2023, expected to grow to $4.03 billion by 2033. Aspiration technology, while accounting for a smaller market share at 17.92%, is projected to grow from $0.45 billion to $0.88 billion.

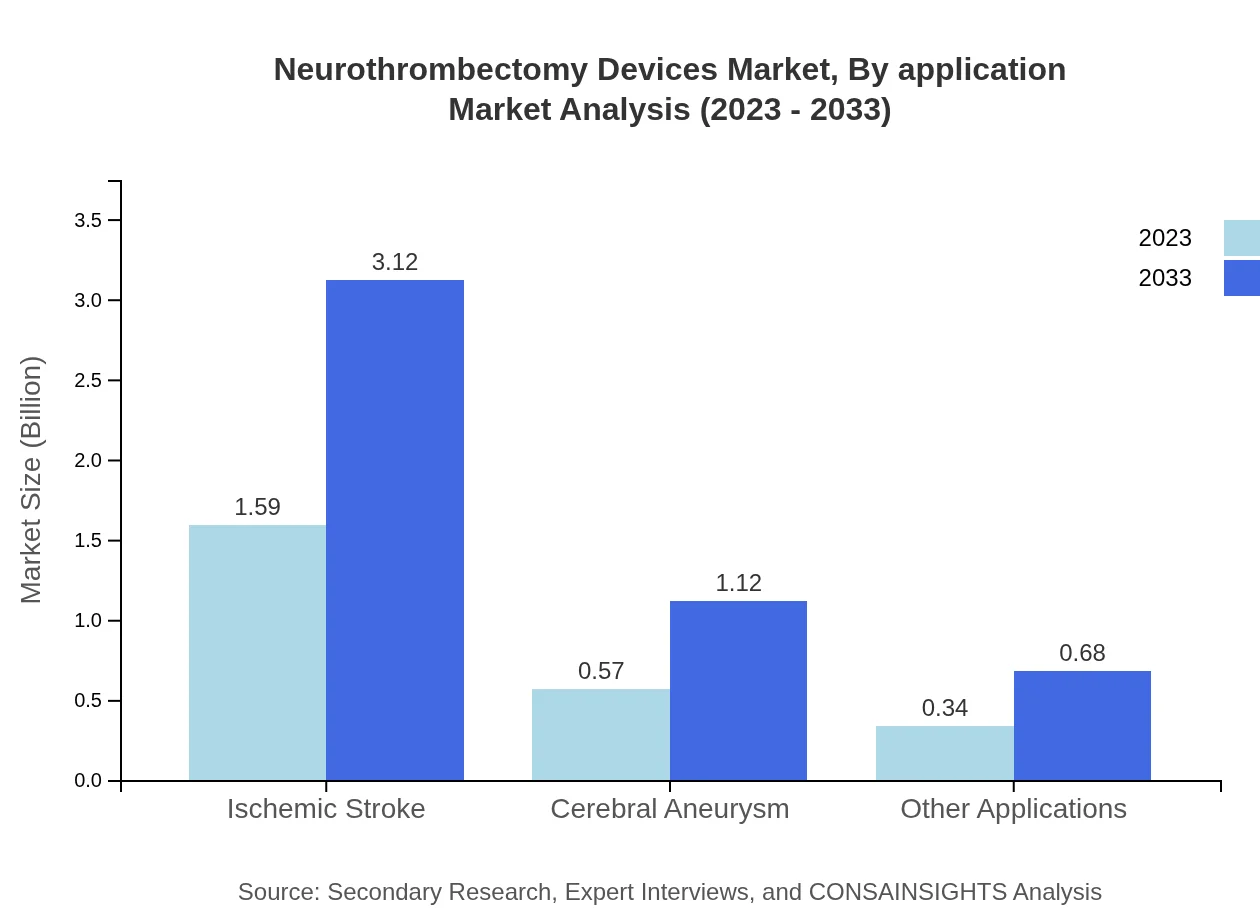

Neurothrombectomy Devices Market Analysis By Application

The ischemic stroke application currently holds a major market size of $1.59 billion with a 63.54% share in 2023, and is expected to grow to $3.12 billion by 2033. The cerebral aneurysm application is valued at $0.57 billion, expected to reach $1.12 billion by 2033, while 'other applications' show potential with a market growth from $0.34 billion to $0.68 billion.

Neurothrombectomy Devices Market Analysis By Technology

Mechanical aspiration devices maintain a strong position with a 2023 market size of $1.59 billion, maintaining a 63.54% market share, projected to grow to $3.12 billion. Stent retrievers follow, with a market size of $0.57 billion, expected to double by 2033, reinforcing their critical role in neurothrombectomy procedures.

Neurothrombectomy Devices Market Analysis By Region

Global Neurothrombectomy Devices Market, By Region Market Analysis (2023 - 2033)

Regionally, North America leads with a size of $0.93 billion, growing to $1.83 billion; Europe follows with substantial growth projections from $0.74 billion to $1.45 billion. In contrast, Asia Pacific is making significant strides, anticipated to grow from $0.47 billion to $0.92 billion by 2033.

Neurothrombectomy Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Neurothrombectomy Devices Industry

Medtronic :

A leading medical device company, Medtronic offers comprehensive stroke management solutions, including advanced neurothrombectomy devices and technologies for ischemic stroke intervention.Stryker Corporation:

Stryker provides innovative solutions for neurovascular care, specializing in neurothrombectomy devices that enhance outcomes for patients suffering from strokes.Penumbra, Inc.:

Penumbra is known for its commitment to advancing stroke intervention technologies, particularly its innovative aspiration and mechanical thrombectomy devices.Embolx:

Embolx focuses on developing minimally invasive endovascular devices, including thrombectomy systems for various neurovascular applications.We're grateful to work with incredible clients.

FAQs

What is the market size of neurothrombectomy Devices?

The global neurothrombectomy devices market is valued at approximately $2.5 billion in 2023, with a compound annual growth rate (CAGR) of 6.8% projected until 2033, indicating substantial growth opportunities within this medical device sector.

What are the key market players or companies in this neurothrombectomy Devices industry?

Key players in the neurothrombectomy devices market include prominent medical technology companies like Medtronic, Penumbra, Stryker Corporation, and Boston Scientific, known for their innovative solutions in neurovascular interventions.

What are the primary factors driving the growth in the neurothrombectomy Devices industry?

Growth in the neurothrombectomy device sector is primarily supported by an increase in ischemic stroke incidents, advancements in medical technology, a rising aging population, and a growing demand for minimally invasive surgical procedures.

Which region is the fastest Growing in the neurothrombectomy Devices?

North America is the fastest-growing region in the neurothrombectomy devices market, with its market projected to grow from $0.93 billion in 2023 to $1.83 billion by 2033, driven by advanced healthcare infrastructures and increasing investments.

Does ConsaInsights provide customized market report data for the neurothrombectomy Devices industry?

Yes, ConsaInsights offers customized market report data tailored to client specifications, providing detailed insights and analyses of the neurothrombectomy devices market to meet individual business needs.

What deliverables can I expect from this neurothrombectomy Devices market research project?

Deliverables from the neurothrombectomy devices market research project typically include comprehensive market analysis reports, segmentation insights, growth forecasts, competitive landscape assessments, and actionable strategic recommendations for stakeholders.

What are the market trends of neurothrombectomy Devices?

Current market trends include increasing adoption of advanced technologies like mechanical aspiration devices, a surge in stent retriever applications, and growing emphasis on research and development for innovative neuromedical solutions to enhance patient outcomes.