New Crop Protection Generics Market Report

Published Date: 02 February 2026 | Report Code: new-crop-protection-generics

New Crop Protection Generics Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the New Crop Protection Generics market, including insights on market size, growth forecasts, technological trends, and a regional analysis for the period 2023 to 2033.

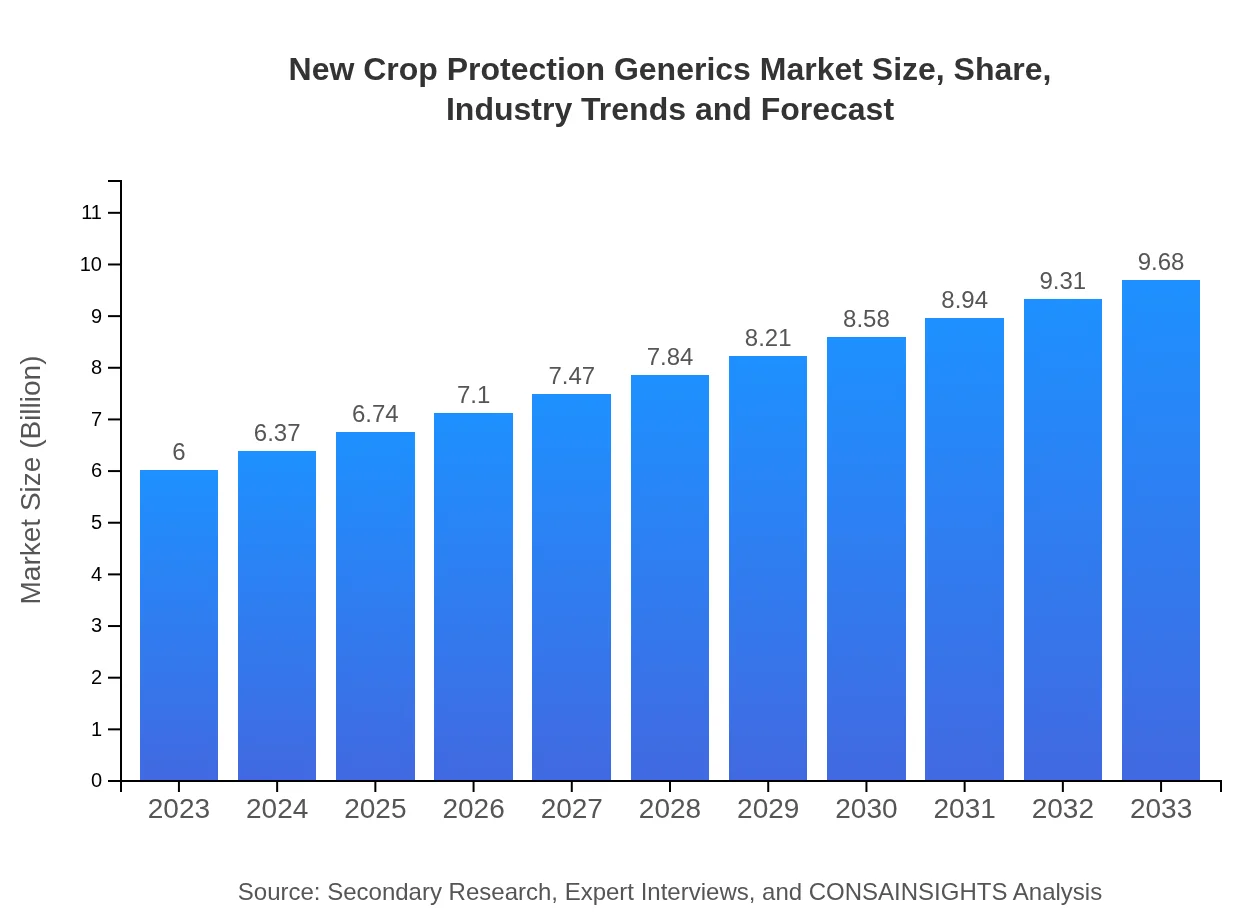

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.00 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $9.68 Billion |

| Top Companies | BASF SE, Syngenta AG, Dow AgroSciences |

| Last Modified Date | 02 February 2026 |

New Crop Protection Generics Market Overview

Customize New Crop Protection Generics Market Report market research report

- ✔ Get in-depth analysis of New Crop Protection Generics market size, growth, and forecasts.

- ✔ Understand New Crop Protection Generics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in New Crop Protection Generics

What is the Market Size & CAGR of New Crop Protection Generics market in 2023?

New Crop Protection Generics Industry Analysis

New Crop Protection Generics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

New Crop Protection Generics Market Analysis Report by Region

Europe New Crop Protection Generics Market Report:

In Europe, the market size is expected to expand from USD 1.50 billion in 2023 to USD 2.43 billion by 2033. Increasing pressure from regulatory bodies for sustainable practices and the adoption of generics is changing the crop protection landscape significantly.Asia Pacific New Crop Protection Generics Market Report:

In the Asia Pacific region, the market is expected to grow from USD 1.15 billion in 2023 to USD 1.86 billion by 2033, driven by the rising population and subsequent food demand. Countries like China and India are adopting crop protection solutions at an accelerated pace to maximize yield and ensure food security.North America New Crop Protection Generics Market Report:

The North American market is poised to grow from USD 2.34 billion in 2023 to USD 3.77 billion by 2033, driven by advanced farming practices and high demand for environmentally friendly solutions. The United States remains a key player in adopting crop protection technologies.South America New Crop Protection Generics Market Report:

South America forecasts a market increase from USD 0.55 billion in 2023 to USD 0.89 billion by 2033, with Brazil and Argentina leading in agricultural exports. The region's focus on pesticide use for crops like soybeans is propelling growth in the crop protection generics sector.Middle East & Africa New Crop Protection Generics Market Report:

The Middle East and Africa will see growth from USD 0.45 billion in 2023 to USD 0.72 billion by 2033. The emergence of new agricultural initiatives aimed at improving yield will be crucial in promoting the use of crop protection generics in this region.Tell us your focus area and get a customized research report.

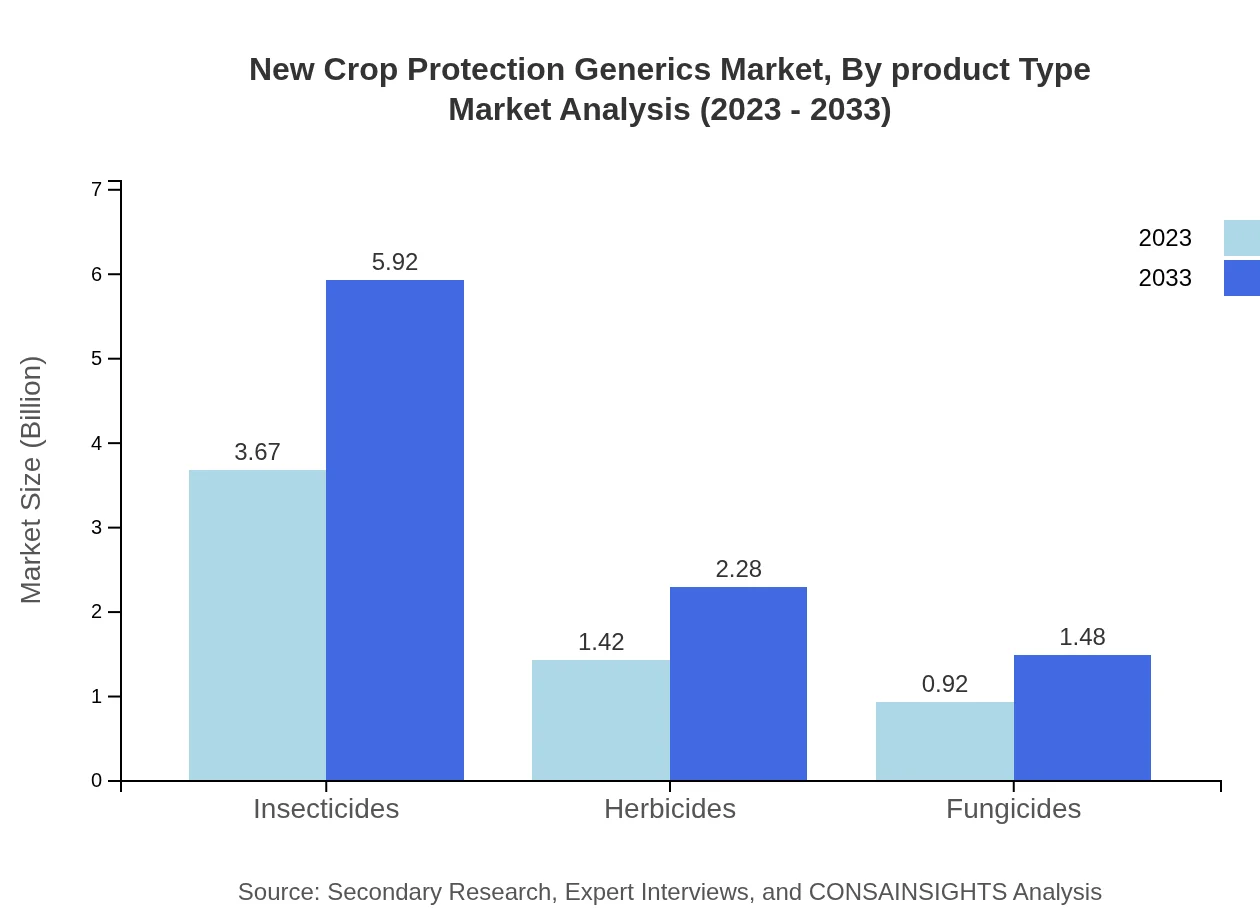

New Crop Protection Generics Market Analysis By Product Type

The New Crop Protection Generics market by product type is dominated by insecticides, which command a market share of 61.12% in 2023, translating to a size of USD 3.67 billion. By 2033, this segment is expected to reach USD 5.92 billion. Following insecticides, herbicides and fungicides account for 23.6% and 15.28% respectively, indicating strong competition and price sensitivity in these segments.

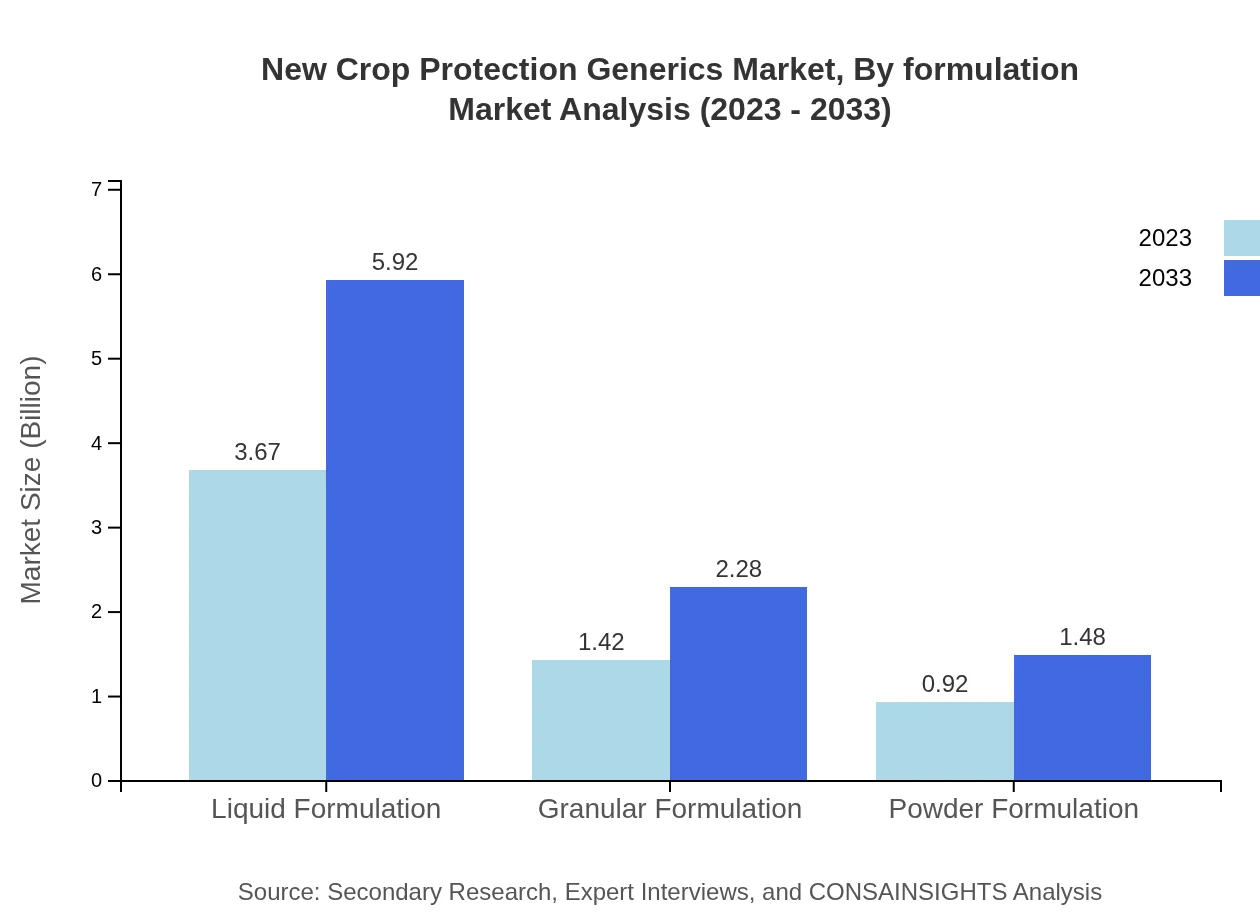

New Crop Protection Generics Market Analysis By Formulation

Liquid formulations lead the New Crop Protection Generics market, constituting 61.12% of the overall market size in 2023. This segment is anticipated to grow from USD 3.67 billion in 2023 to USD 5.92 billion by 2033. Granular formulations also offer significant presence, while powder formulations are emerging as viable alternatives in specific crop protection scenarios.

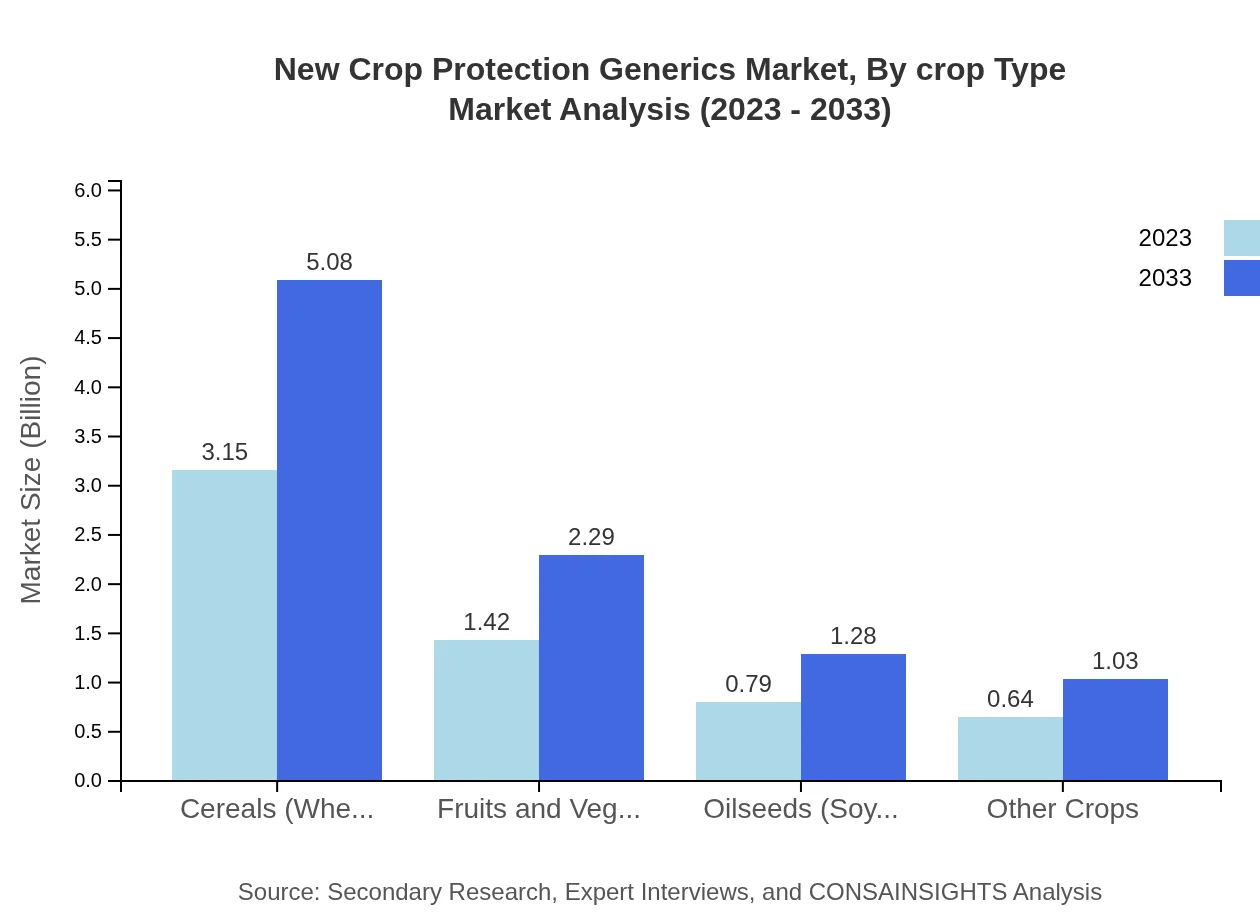

New Crop Protection Generics Market Analysis By Crop Type

Cereals, including wheat, rice, and corn, hold a substantial market share at 52.48%, with size estimates of USD 3.15 billion in 2023, expected to increase to USD 5.08 billion by 2033. Other crops such as fruits and vegetables follow with a share of 23.67%, highlighting the diverse agricultural applications for crop protection generics.

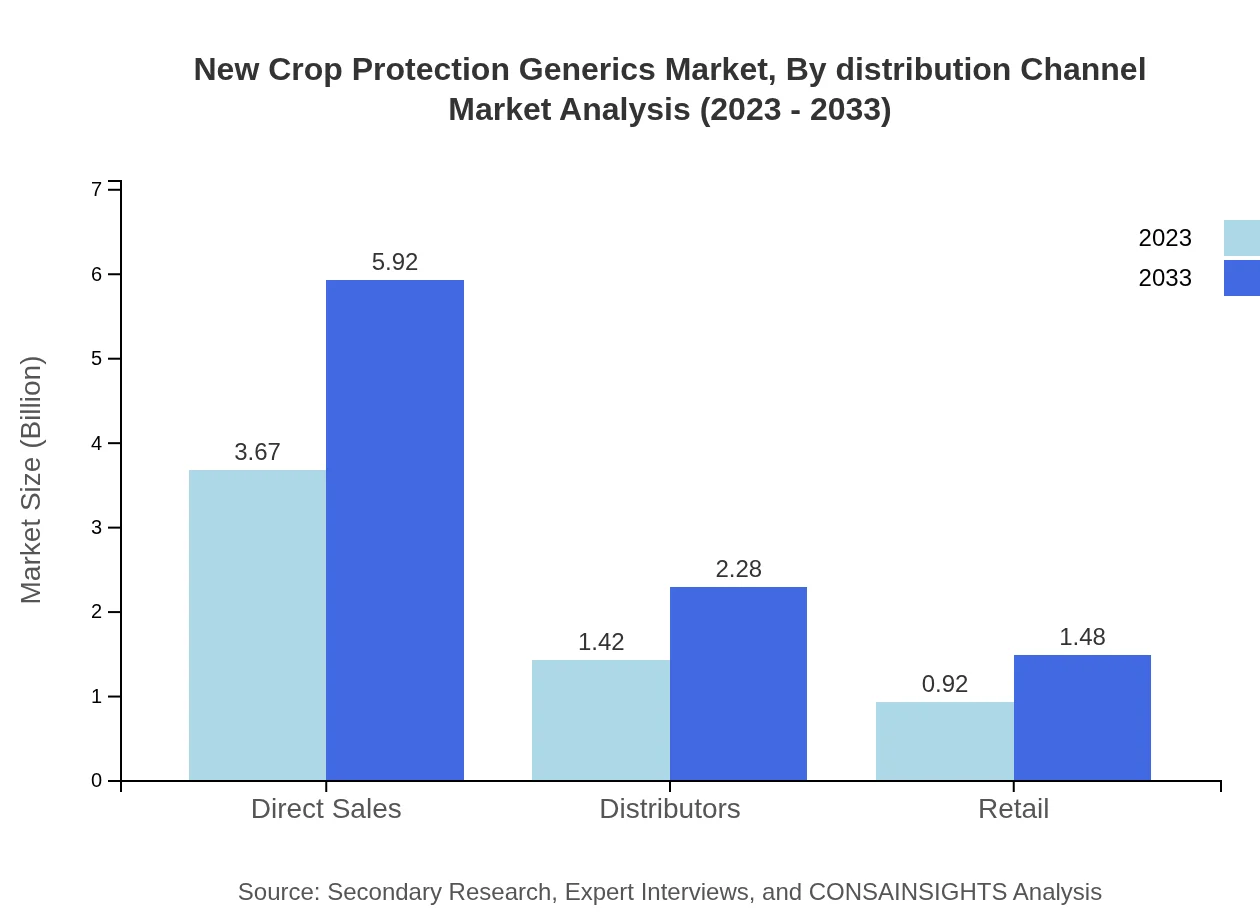

New Crop Protection Generics Market Analysis By Distribution Channel

Direct sales remain the dominant distribution channel, holding a 61.12% share in 2023 with a market size of USD 3.67 billion, expected to rise to USD 5.92 billion by 2033. Distributors account for 23.6% of the market, indicating a structured approach to product delivery.

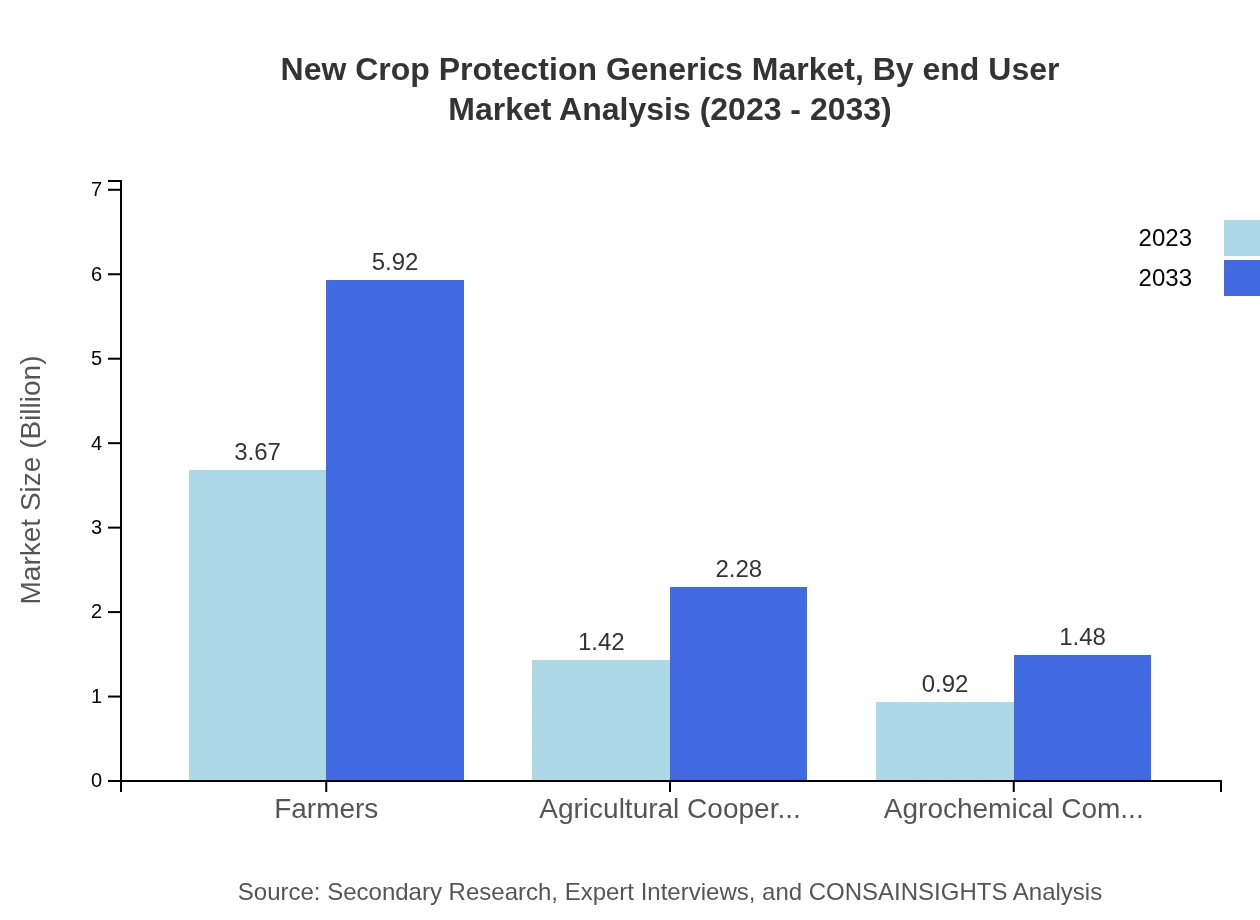

New Crop Protection Generics Market Analysis By End User

Farmers are the principal end-users of crop protection generics, representing 61.12% of the market share and growing from USD 3.67 billion in 2023 to an expected USD 5.92 billion by 2033. Agricultural cooperatives and agrochemical companies are also vital players in this segment.

New Crop Protection Generics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in New Crop Protection Generics Industry

BASF SE:

A global leader in agriculture, BASF offers innovative crop protection solutions, including generics that focus on sustainability and effectiveness in crop yield enhancement.Syngenta AG:

Syngenta provides a comprehensive range of agricultural products, including a strong portfolio of crop protection generics that address diverse agricultural challenges.Dow AgroSciences:

Dow AgroSciences is known for its extensive research and development in crop protection products, offering generics that are pivotal for enhancing agricultural productivity.We're grateful to work with incredible clients.

FAQs

What is the market size of new Crop Protection Generics?

The global market size for new crop protection generics is projected to reach approximately $6 billion by 2033, growing at a CAGR of 4.8% from its current valuation in 2023. This growth reflects increasing demand for cost-effective and environmentally-friendly agricultural solutions.

What are the key market players or companies in this new Crop Protection Generics industry?

The new crop protection generics industry features several key players including major agrochemical companies, agricultural cooperatives, and ecommerce distributors specializing in crop protection products. Their competitive strategies focus on innovation and sustainability to meet market needs.

What are the primary factors driving the growth in the new Crop Protection Generics industry?

Growth drivers include the rising demand for organic farming, regulatory changes favoring generics, and advancements in agricultural technology. These factors stimulate investment and development in cost-effective crop protection solutions, making products more accessible to farmers.

Which region is the fastest Growing in the new Crop Protection Generics?

The North American region is expected to experience the fastest growth within the new crop protection generics market, with market size projected to increase from $2.34 billion in 2023 to $3.77 billion by 2033, driven by innovation and farming practices.

Does ConsaInsights provide customized market report data for the new Crop Protection Generics industry?

Yes, ConsaInsights offers tailored market reports for the new crop protection generics industry, catering to specific client requirements. These reports provide detailed insights, including market projections, regional data, and segmentation analysis.

What deliverables can I expect from this new Crop Protection Generics market research project?

Deliverables include a comprehensive report containing market size estimations, competitive landscape, growth forecasts, and segment analyses. Clients can expect actionable insights to inform strategic business decisions tailored to their specific needs.

What are the market trends of new Crop Protection Generics?

Current market trends indicate an uptick in the adoption of generics in agriculture, driven by cost-effectiveness and sustainability concerns. Innovations in formulations and the emergence of decentralized sales models reflect ongoing shifts to meet farmer demands.