Next Generation Biometrics Market Report

Published Date: 31 January 2026 | Report Code: next-generation-biometrics

Next Generation Biometrics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive overview of the Next Generation Biometrics market, detailing its current status, forecast for 2023-2033, industry trends, regional breakdown, technological advancements, and key players shaping the market landscape.

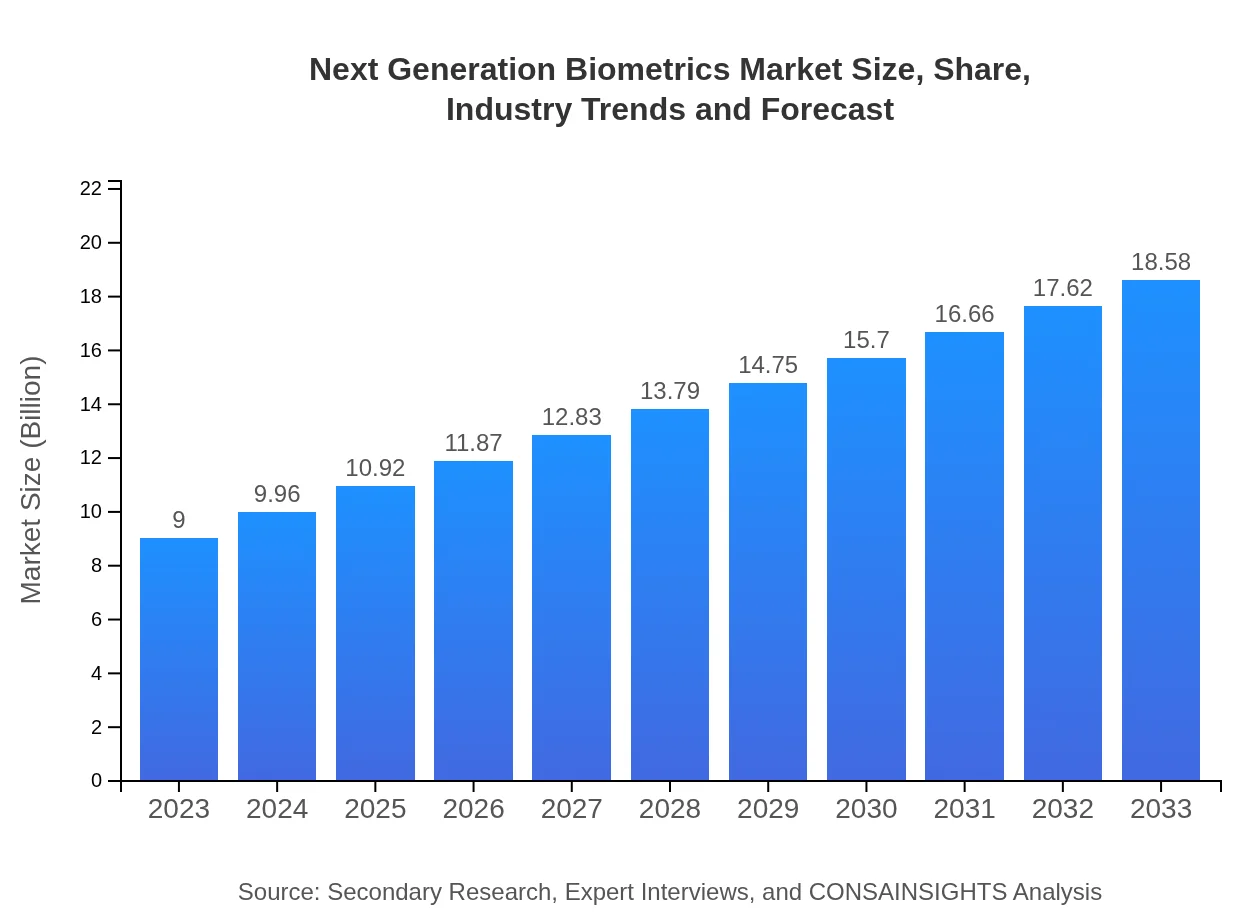

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $9.00 Billion |

| CAGR (2023-2033) | 7.3% |

| 2033 Market Size | $18.58 Billion |

| Top Companies | NEC Corporation, Thales Group, Gemalto (Thales), IDEMIA, FaceTec |

| Last Modified Date | 31 January 2026 |

Next Generation Biometrics Market Overview

Customize Next Generation Biometrics Market Report market research report

- ✔ Get in-depth analysis of Next Generation Biometrics market size, growth, and forecasts.

- ✔ Understand Next Generation Biometrics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Next Generation Biometrics

What is the Market Size & CAGR of Next Generation Biometrics market in 2023?

Next Generation Biometrics Industry Analysis

Next Generation Biometrics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Next Generation Biometrics Market Analysis Report by Region

Europe Next Generation Biometrics Market Report:

Europe's Next Generation Biometrics market will grow from $2.42 billion in 2023 to $5.00 billion by 2033. The market is seeing increased adoption in government sectors, fueled by stringent data protection regulations and the need for improved security protocols.Asia Pacific Next Generation Biometrics Market Report:

In the Asia Pacific region, the Next Generation Biometrics market is poised to reach $3.71 billion by 2033, growing rapidly from $1.80 billion in 2023. The surge is driven by increasing investments in security infrastructure and widespread adoption of digital payment systems.North America Next Generation Biometrics Market Report:

North America remains one of the largest markets, with an expected market size of $6.83 billion by 2033, up from $3.31 billion in 2023. The region's mature technology landscape and high prevalence of biometric applications in banking and security sectors are key growth drivers.South America Next Generation Biometrics Market Report:

The South American market for Next Generation Biometrics is expected to grow from $0.80 billion in 2023 to $1.65 billion by 2033. This growth is supported by rising concerns over identity theft and government initiatives aimed at enhancing security measures.Middle East & Africa Next Generation Biometrics Market Report:

The Middle East and Africa region is witnessing a gradual increase in the Next Generation Biometrics market, expected to rise from $0.68 billion in 2023 to $1.40 billion by 2033. Rising investment in smart city initiatives and security infrastructure development is expected to boost market growth.Tell us your focus area and get a customized research report.

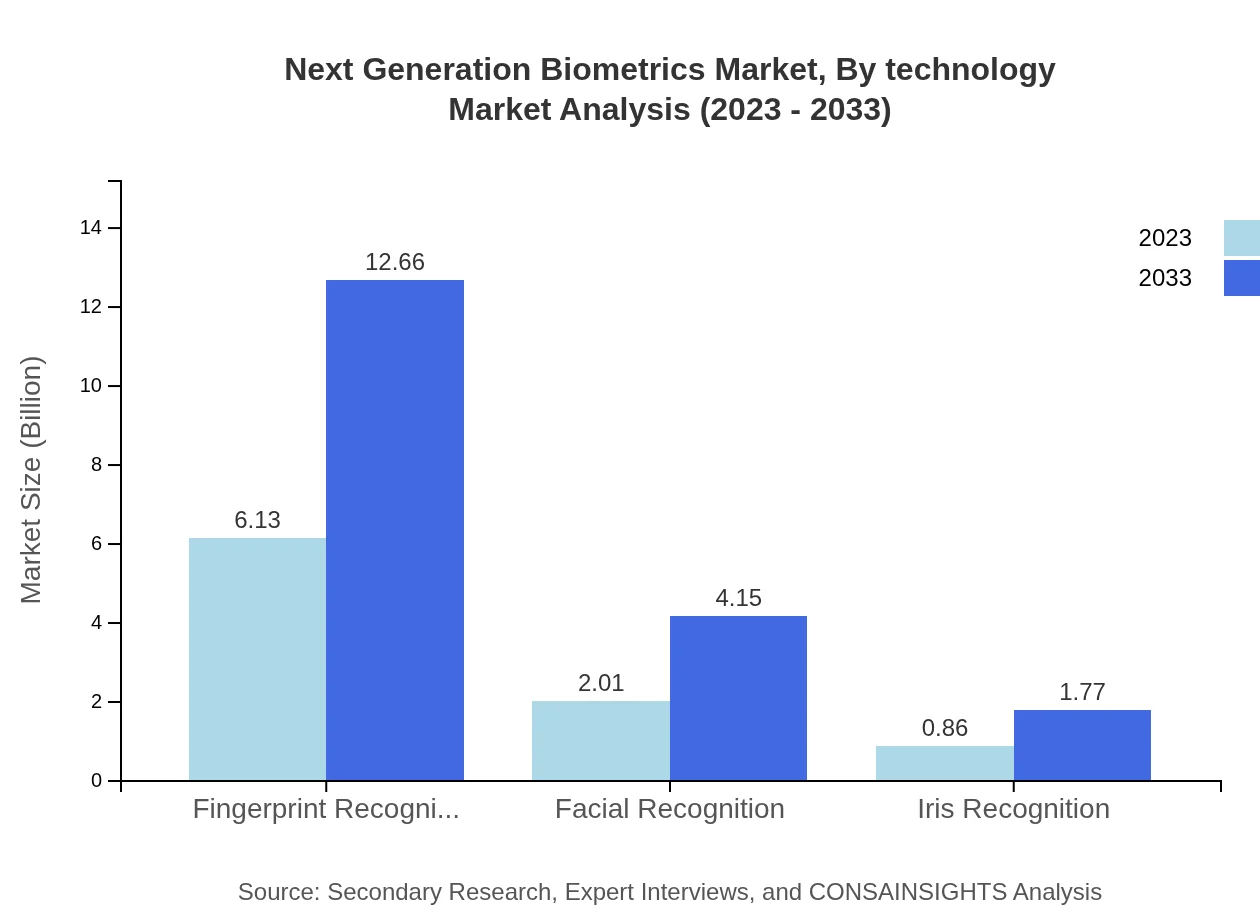

Next Generation Biometrics Market Analysis By Technology

The technology segment includes fingerprint recognition, facial recognition, and iris recognition. As of 2023, fingerprint recognition holds a substantial market share of 68.16%, with a projected size of $6.13 billion and expected growth to $12.66 billion by 2033. Facial recognition follows with a 22.33% market share, estimated at $2.01 billion in 2023, climbing to $4.15 billion by 2033. Iris recognition, while smaller, also shows promising growth from $0.86 billion to $1.77 billion.

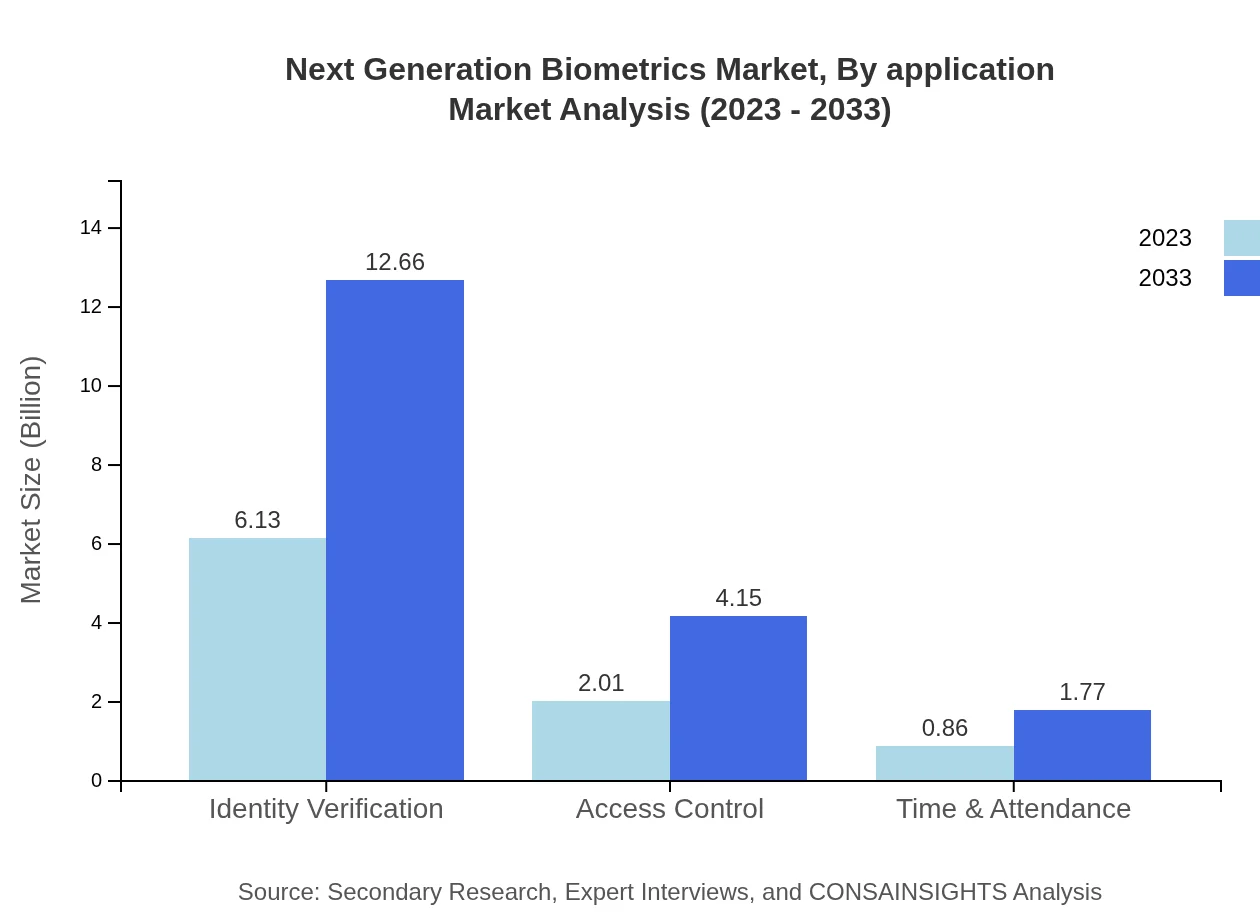

Next Generation Biometrics Market Analysis By Application

Applications primarily include identity verification, access control, and time & attendance. Identity verification is leading the market, valued at $6.13 billion in 2023 with equal share growth. Access control is projected to grow from $2.01 billion to $4.15 billion, maintaining a stable share. Time & attendance solutions are also gaining traction, expanding from $0.86 billion to $1.77 billion.

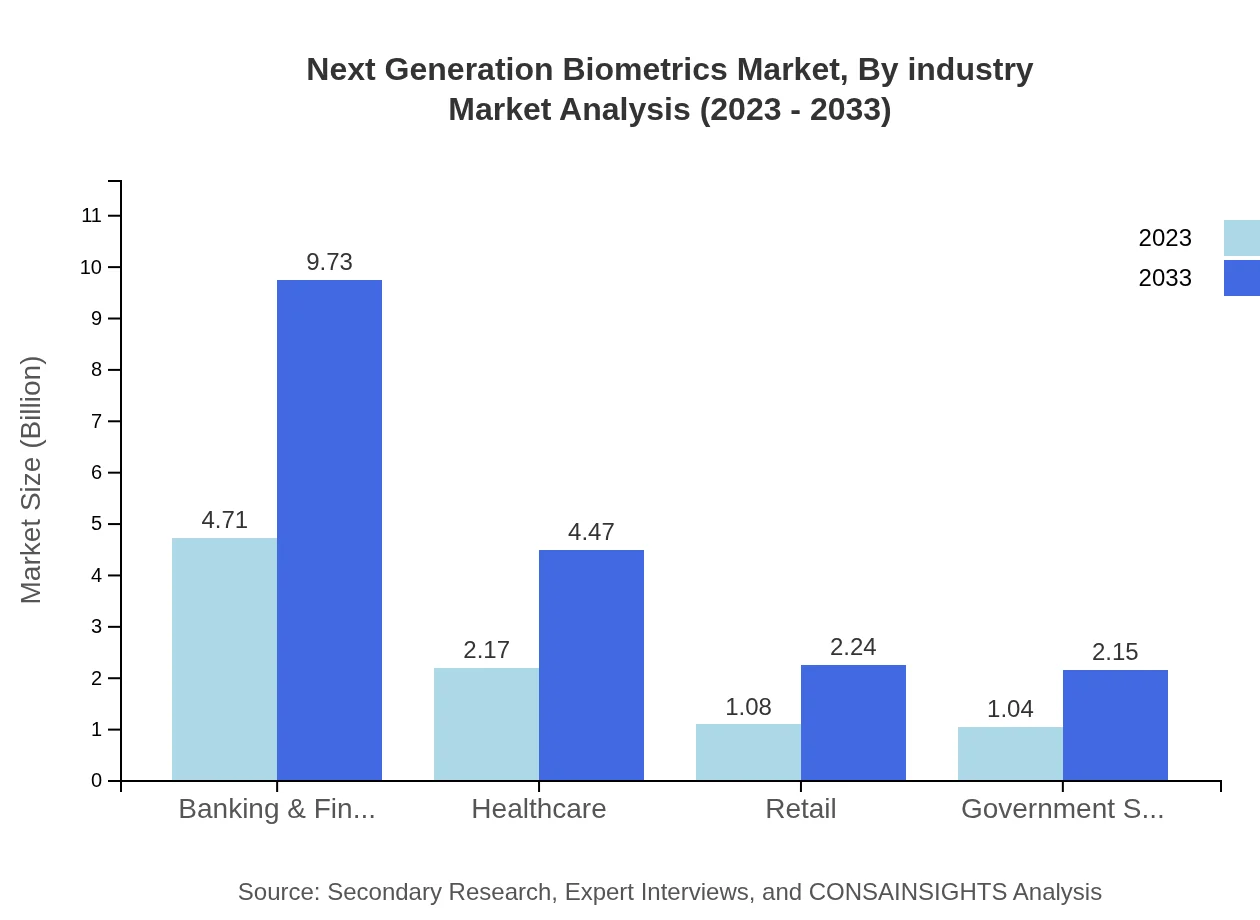

Next Generation Biometrics Market Analysis By Industry

The banking & financial services sector is the largest segment, projected to grow from $4.71 billion in 2023 to $9.73 billion by 2033, maintaining a share of 52.35%. Healthcare is another critical sector with significant growth potential, rising from $2.17 billion to $4.47 billion, accounting for 24.06% of the market share. Other industries, such as retail and government, are also growing steadily.

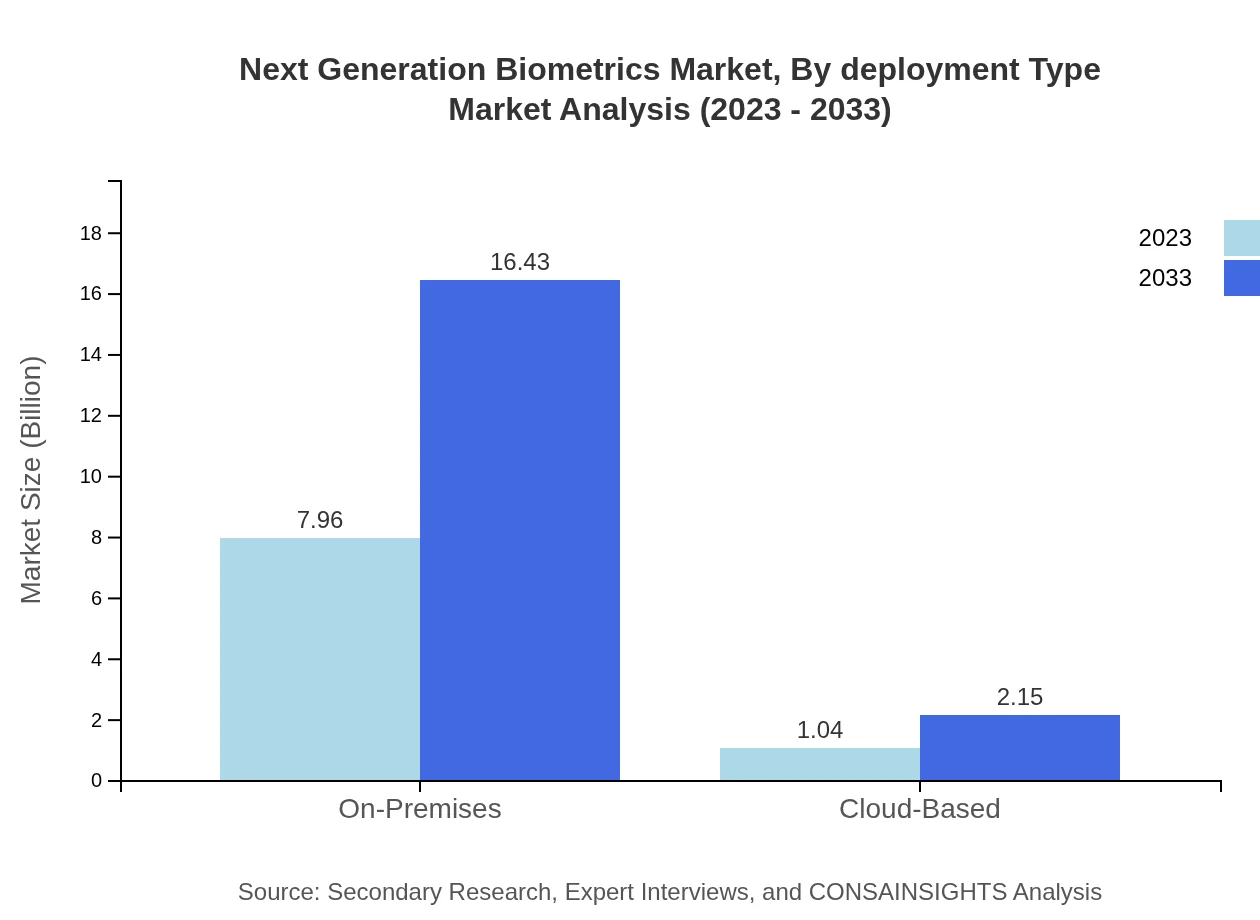

Next Generation Biometrics Market Analysis By Deployment Type

The market is analyzed based on deployment type, with on-premises solutions holding 88.43% of the market share in 2023. This segment is anticipated to grow significantly from $7.96 billion to $16.43 billion. Cloud-based solutions, while smaller with a share of 11.57%, are growing from $1.04 billion to $2.15 billion, driven by increasing demand for scalable and flexible security solutions.

Next Generation Biometrics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Next Generation Biometrics Industry

NEC Corporation:

NEC specializes in biometric solutions and is widely recognized for its facial recognition technology, enabling efficient identification and verification systems across sectors.Thales Group:

Thales offers comprehensive biometric security solutions, enhancing government and enterprise-level security measures worldwide through innovative technology.Gemalto (Thales):

A leader in the digital security space, Gemalto delivers advanced biometric authentication services, particularly in identity management applications.IDEMIA:

IDEMIA holds a significant market presence, focusing on augmented identity solutions, including biometric technology for secure and verifiable transactions.FaceTec:

FaceTec specializes in 3D facial recognition technology, providing high security in various applications, particularly in financial services and online identification.We're grateful to work with incredible clients.

FAQs

What is the market size of next Generation biometrics?

The next-generation biometrics market is valued at approximately $9 billion in 2023, with a projected CAGR of 7.3% from 2023 to 2033, indicating significant growth and expansion in the biometrics sector.

What are the key market players or companies in the next Generation biometrics industry?

Key players in the next-generation biometrics market include major tech firms such as NEC Corporation, Thales Group, HID Global, and Gemalto, which are leaders in biometric technologies and security solutions.

What are the primary factors driving the growth in the next Generation biometrics industry?

Growth in the next-generation biometrics industry is driven by increasing security concerns, technological advancements in identity verification, demand for biometric systems in mobile devices, and the rise of contactless authentication methods.

Which region is the fastest Growing in the next Generation biometrics?

The fastest-growing region in the next-generation biometrics market is North America, projected to grow from $3.31 billion in 2023 to $6.83 billion by 2033, reflecting a robust demand for advanced security solutions.

Does ConsaInsights provide customized market report data for the next Generation biometrics industry?

Yes, ConsaInsights offers customized market report data tailored specifically for businesses within the next-generation biometrics industry, catering to individual research needs and market analyses.

What deliverables can I expect from this next Generation biometrics market research project?

Deliverables from the next-generation biometrics market research project include comprehensive market analysis reports, segmentation data, trends, forecasts, regional insights, and profiles of leading companies.

What are the market trends of next Generation biometrics?

Market trends in next-generation biometrics include increased adoption of fingerprint and facial recognition technologies, a shift towards cloud-based solutions, and heightened focus on integrating biometric systems in various sectors like banking and healthcare.