Next Generation Diabetes Therapy And Drug Delivery Market Report

Published Date: 31 January 2026 | Report Code: next-generation-diabetes-therapy-and-drug-delivery

Next Generation Diabetes Therapy And Drug Delivery Market Size, Share, Industry Trends and Forecast to 2033

This report comprehensively covers the Next Generation Diabetes Therapy and Drug Delivery market, providing insights into market trends, size, regional analysis, and forecasts from 2023 to 2033.

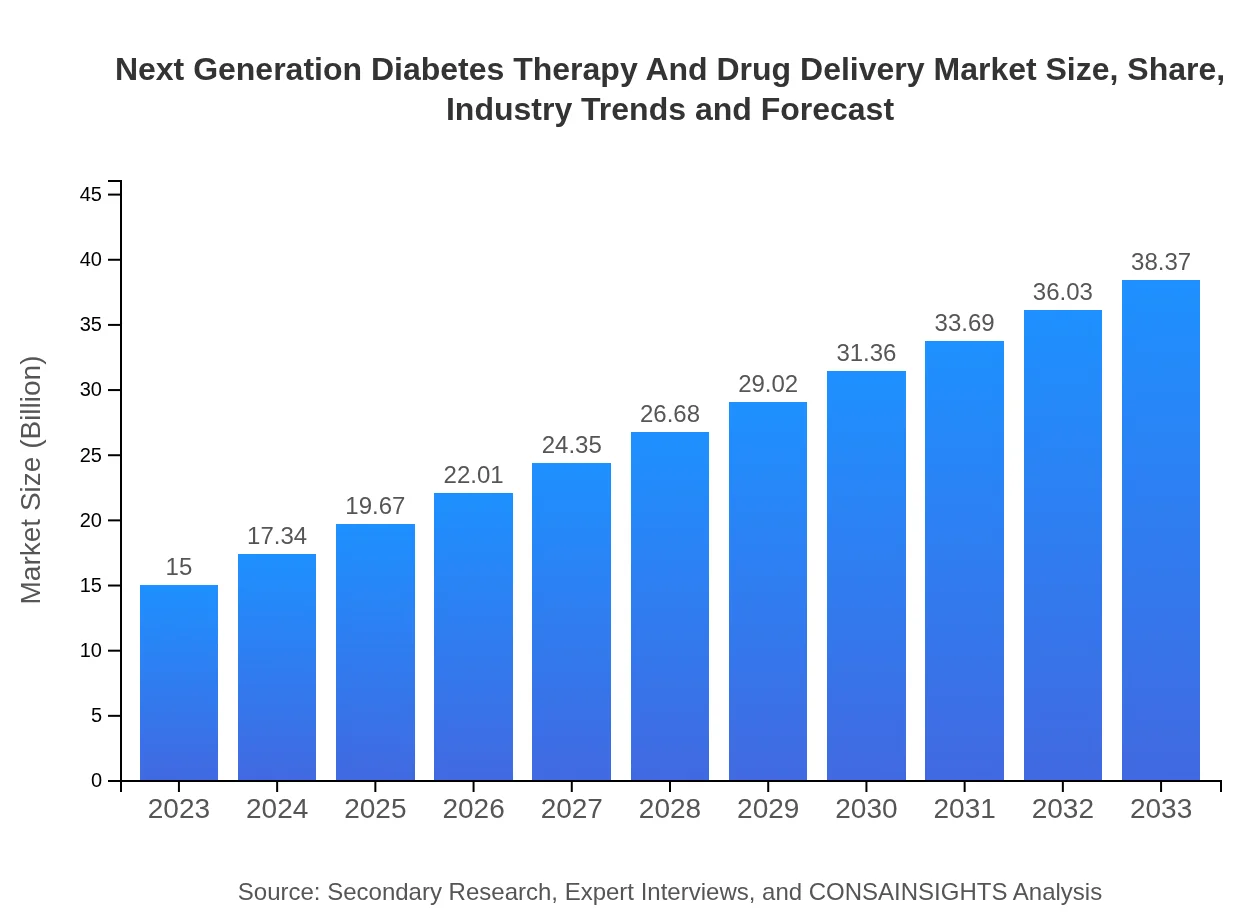

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.00 Billion |

| CAGR (2023-2033) | 9.5% |

| 2033 Market Size | $38.37 Billion |

| Top Companies | Medtronic , Abbott Laboratories, Tandem Diabetes Care, Dexcom, Sanofi |

| Last Modified Date | 31 January 2026 |

Next Generation Diabetes Therapy And Drug Delivery Market Overview

Customize Next Generation Diabetes Therapy And Drug Delivery Market Report market research report

- ✔ Get in-depth analysis of Next Generation Diabetes Therapy And Drug Delivery market size, growth, and forecasts.

- ✔ Understand Next Generation Diabetes Therapy And Drug Delivery's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Next Generation Diabetes Therapy And Drug Delivery

What is the Market Size & CAGR of Next Generation Diabetes Therapy And Drug Delivery market in 2033?

Next Generation Diabetes Therapy And Drug Delivery Industry Analysis

Next Generation Diabetes Therapy And Drug Delivery Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Next Generation Diabetes Therapy And Drug Delivery Market Analysis Report by Region

Europe Next Generation Diabetes Therapy And Drug Delivery Market Report:

Europe's market is anticipated to grow from $3.70 billion in 2023 to $9.46 billion by 2033. Strong health policies and innovative therapies contribute to this growth, supported by active R&D in diabetes care.Asia Pacific Next Generation Diabetes Therapy And Drug Delivery Market Report:

The Asia Pacific region is projected to grow significantly, reaching $7.54 billion by 2033 from $2.95 billion in 2023, driven by increasing diabetes prevalence, rising healthcare expenditure, and government initiatives promoting awareness.North America Next Generation Diabetes Therapy And Drug Delivery Market Report:

North America remains a leading market with an expected size of $13.97 billion by 2033, up from $5.46 billion in 2023, thanks to advanced healthcare infrastructure and a strong pipeline of innovative solutions.South America Next Generation Diabetes Therapy And Drug Delivery Market Report:

In South America, the market is expected to move from $0.98 billion in 2023 to $2.52 billion by 2033, fueled by improving access to healthcare and growing diabetes care programs.Middle East & Africa Next Generation Diabetes Therapy And Drug Delivery Market Report:

In the Middle East and Africa, the market is likely to grow from $1.91 billion in 2023 to $4.88 billion by 2033, driven by increasing awareness of diabetes management and the rising number of diabetic patients.Tell us your focus area and get a customized research report.

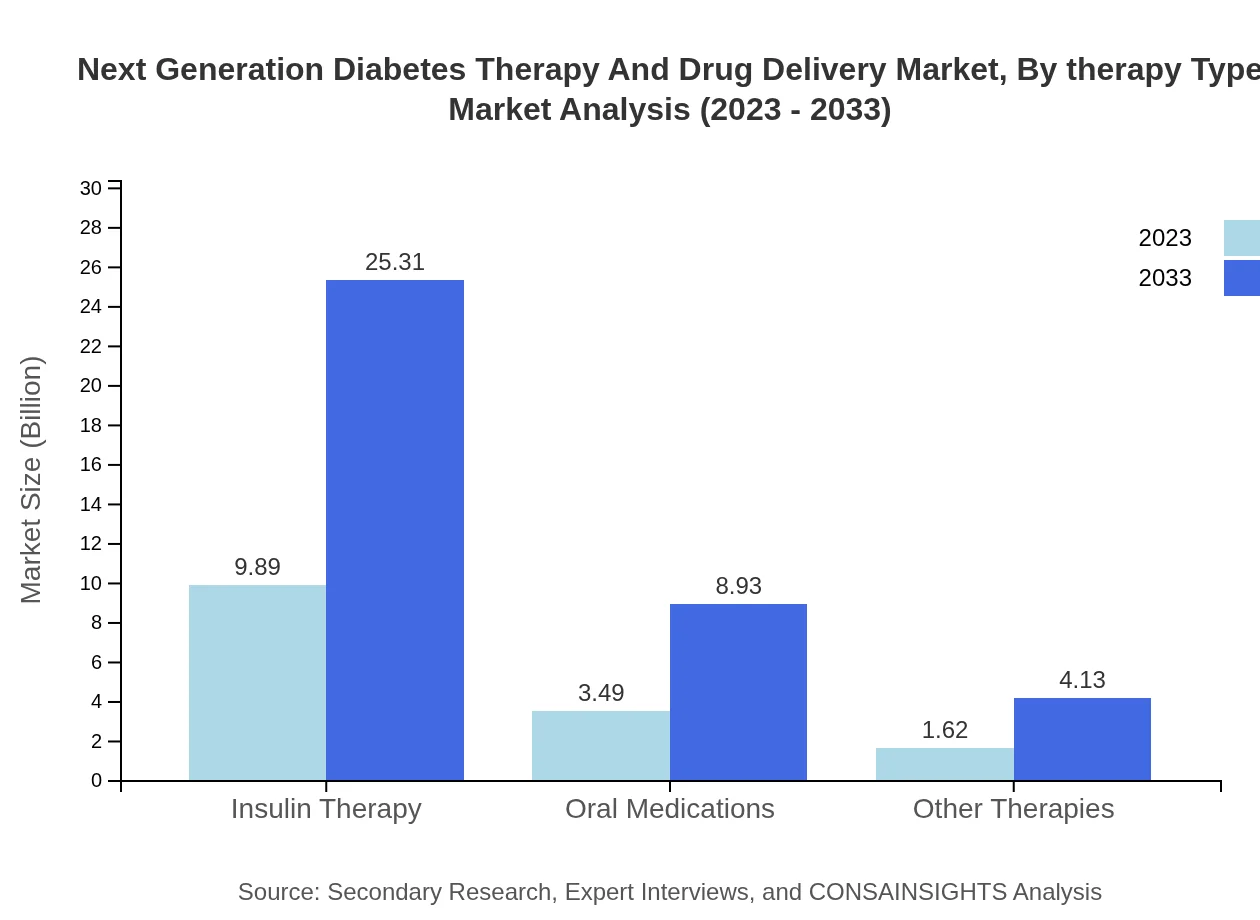

Next Generation Diabetes Therapy And Drug Delivery Market Analysis By Therapy Type

In 2023, the insulin therapy segment leads the market with a size of $9.89 billion, expected to grow to $25.31 billion by 2033. Oral medications and other therapies are also significant, contributing to the total market share of therapy types.

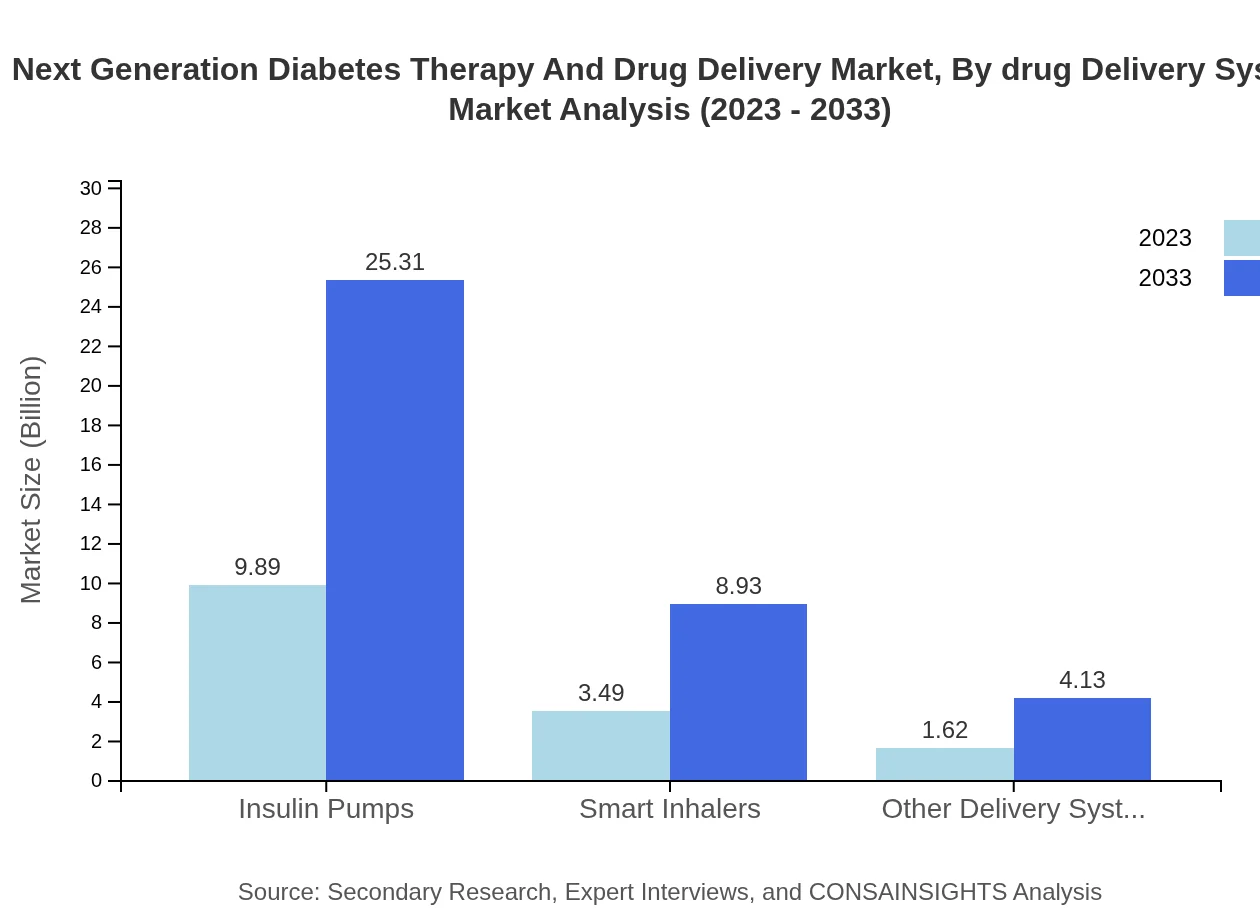

Next Generation Diabetes Therapy And Drug Delivery Market Analysis By Drug Delivery System

Delivery systems are evolving, with insulin pumps holding a market size of $9.89 billion and predicted to reach $25.31 billion by 2033. Mobile apps and wearable devices are emerging as vital components in treatment adherence and monitoring.

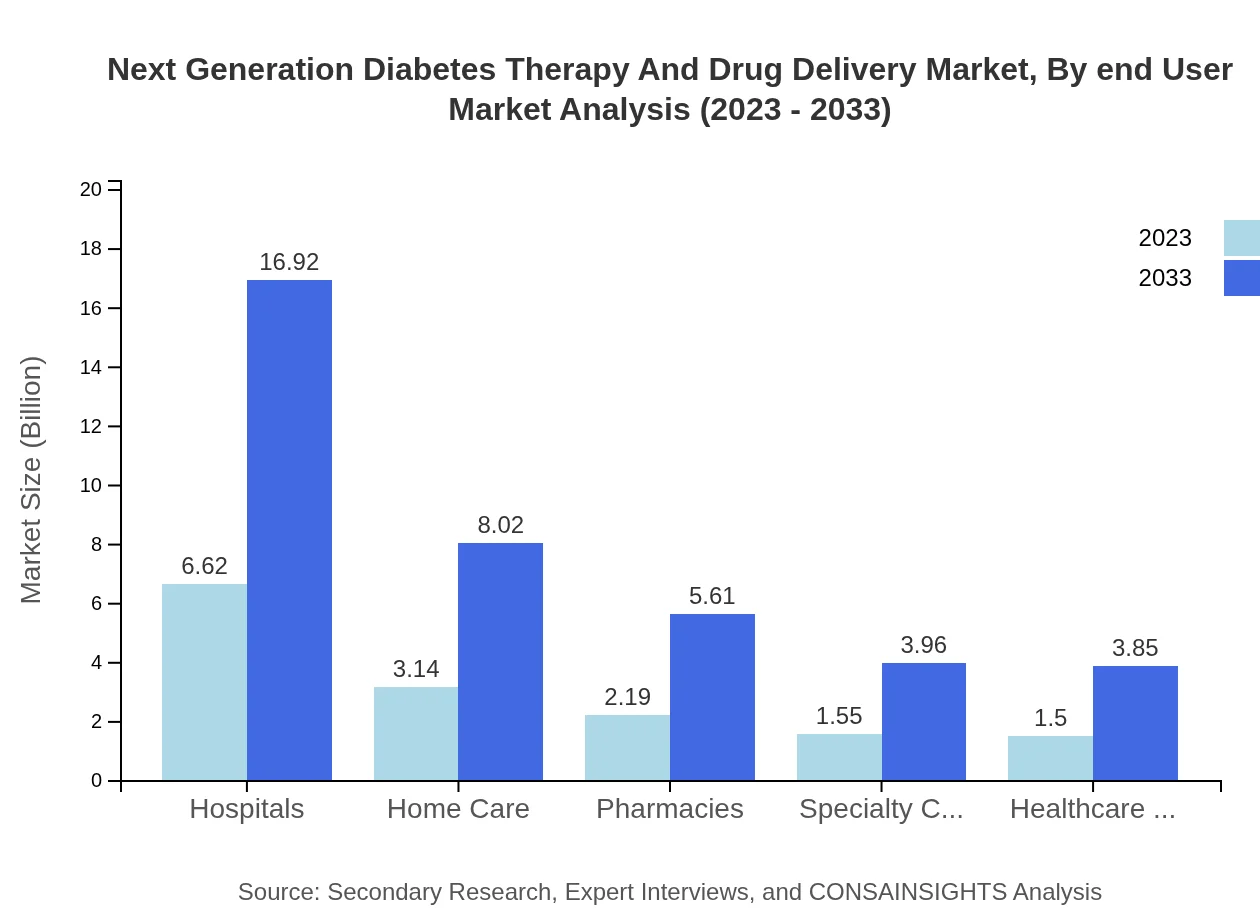

Next Generation Diabetes Therapy And Drug Delivery Market Analysis By End User

Hospitals lead the sector with a market size of $6.62 billion in 2023, projected to grow to $16.92 billion by 2033. Home care and pharmacies also play important roles, contributing significantly to overall market shares.

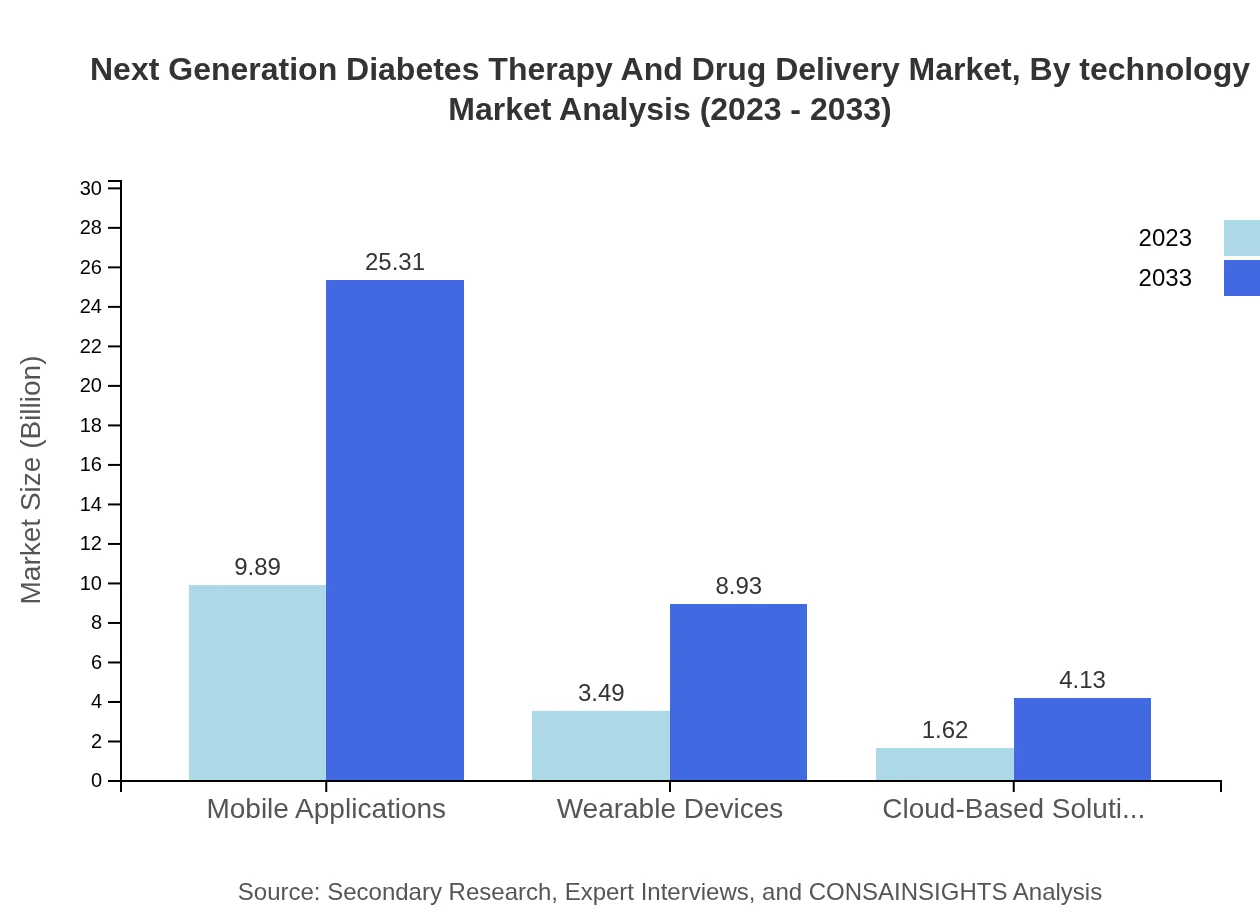

Next Generation Diabetes Therapy And Drug Delivery Market Analysis By Technology

Technological advancements in mobile applications and cloud-based solutions shape the market. Mobile applications are dominating with a share of 65.96% in 2023, reflecting the transition to digital health solutions in diabetes management.

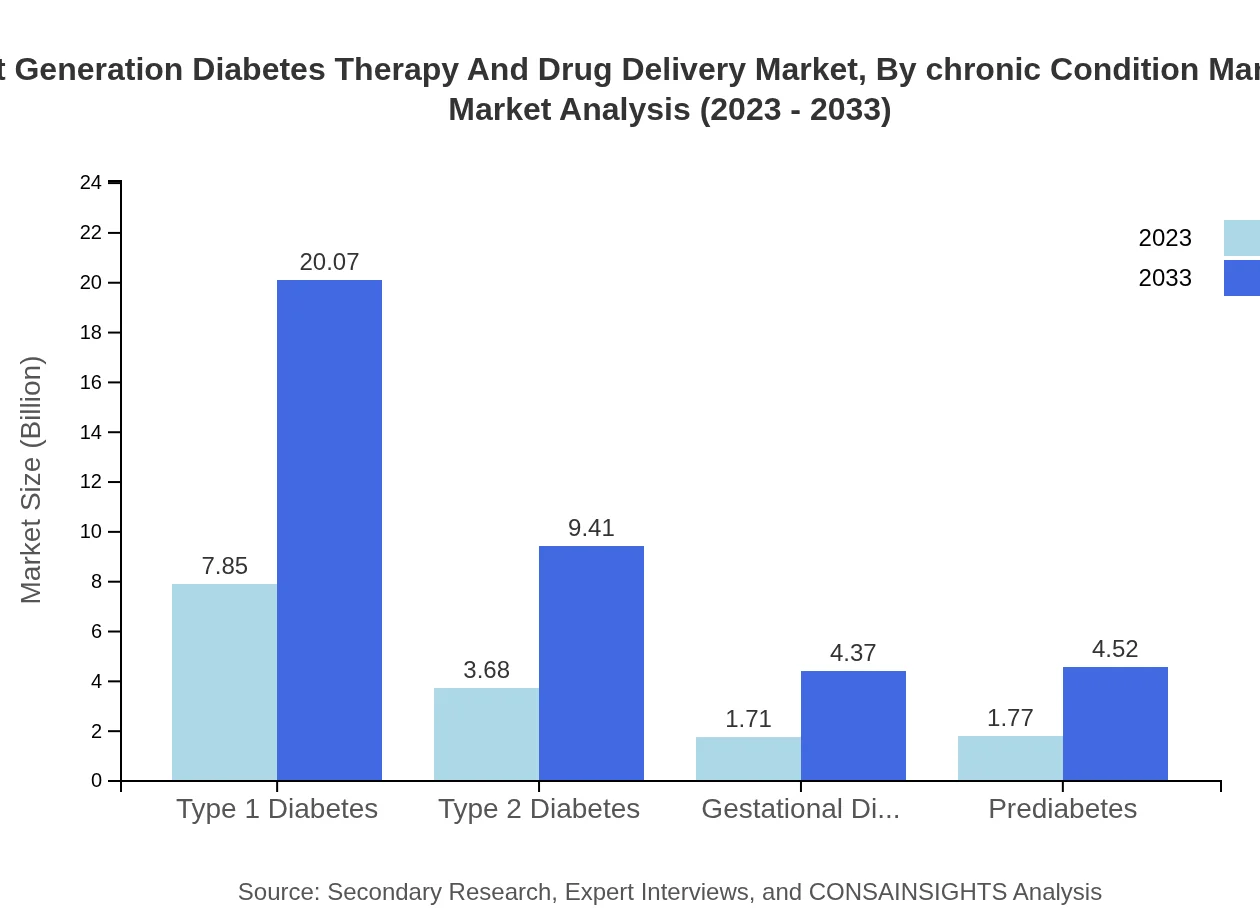

Next Generation Diabetes Therapy And Drug Delivery Market Analysis By Chronic Condition Management

The integration of chronic condition management approaches has made diabetes treatment more effective. Personalized therapies yield better patient compliance and health outcomes, contributing to market growth.

Next Generation Diabetes Therapy And Drug Delivery Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Next Generation Diabetes Therapy And Drug Delivery Industry

Medtronic :

A leading innovator in diabetes management technologies, known for its insulin pumps and continuous glucose monitoring systems.Abbott Laboratories:

Recognized for advanced diabetes care products, including Freestyle Libre, which revolutionized glucose monitoring.Tandem Diabetes Care:

Provides cutting-edge insulin delivery and management solutions, enhancing the quality of life for patients.Dexcom:

A pioneer in continuous glucose monitoring technology, helping patients manage diabetes effectively.Sanofi:

A global healthcare leader, offering a portfolio of diabetes care products, including insulin therapies and related devices.We're grateful to work with incredible clients.

FAQs

What is the market size of Next Generation Diabetes Therapy and Drug Delivery?

The Next Generation Diabetes Therapy and Drug Delivery market is projected to reach a size of approximately $15 billion by 2033, with a robust CAGR of 9.5% during the forecast period.

What are the key market players or companies in this industry?

Key players in the Next Generation Diabetes Therapy and Drug Delivery market include major pharmaceutical companies, biotech firms, and tech startups specializing in diabetes management solutions, though specific companies require further investigation.

What are the primary factors driving growth in this industry?

The growth drivers in the Next Generation Diabetes Therapy and Drug Delivery market include increasing diabetes prevalence, technological advancements in drug delivery systems, and a growing focus on personalized medicine tailored to patient needs.

Which region is the fastest Growing in this market?

Asia Pacific is anticipated to be the fastest-growing region in the Next Generation Diabetes Therapy and Drug Delivery market, with the market size projected to expand from $2.95 billion in 2023 to $7.54 billion by 2033.

Does ConsaInsights provide customized market report data for this industry?

Yes, ConsaInsights offers tailored market report data that can be customized to meet specific industry needs, ensuring clients receive relevant insights for informed decision-making.

What deliverables can I expect from this market research project?

Deliverables from the market research project include comprehensive reports, detailed analytics, and actionable insights on market trends, growth opportunities, and competitive landscapes tailored for the Next Generation Diabetes Therapy and Drug Delivery market.

What are the market trends of Next Generation Diabetes Therapy and Drug Delivery?

Current market trends include increased adoption of digital health tools, advancement in wearable technology for diabetes management, and the rise of insulin delivery systems designed for enhanced patient compliance.