Next Generation Firewall Market Report

Published Date: 31 January 2026 | Report Code: next-generation-firewall

Next Generation Firewall Market Size, Share, Industry Trends and Forecast to 2033

This market report provides a comprehensive analysis of the Next Generation Firewall market, detailing forecasts, insights, and regional segmentation from 2023 to 2033. Key statistics on market size, growth rates, industry trends, and major players are discussed to inform strategic decisions.

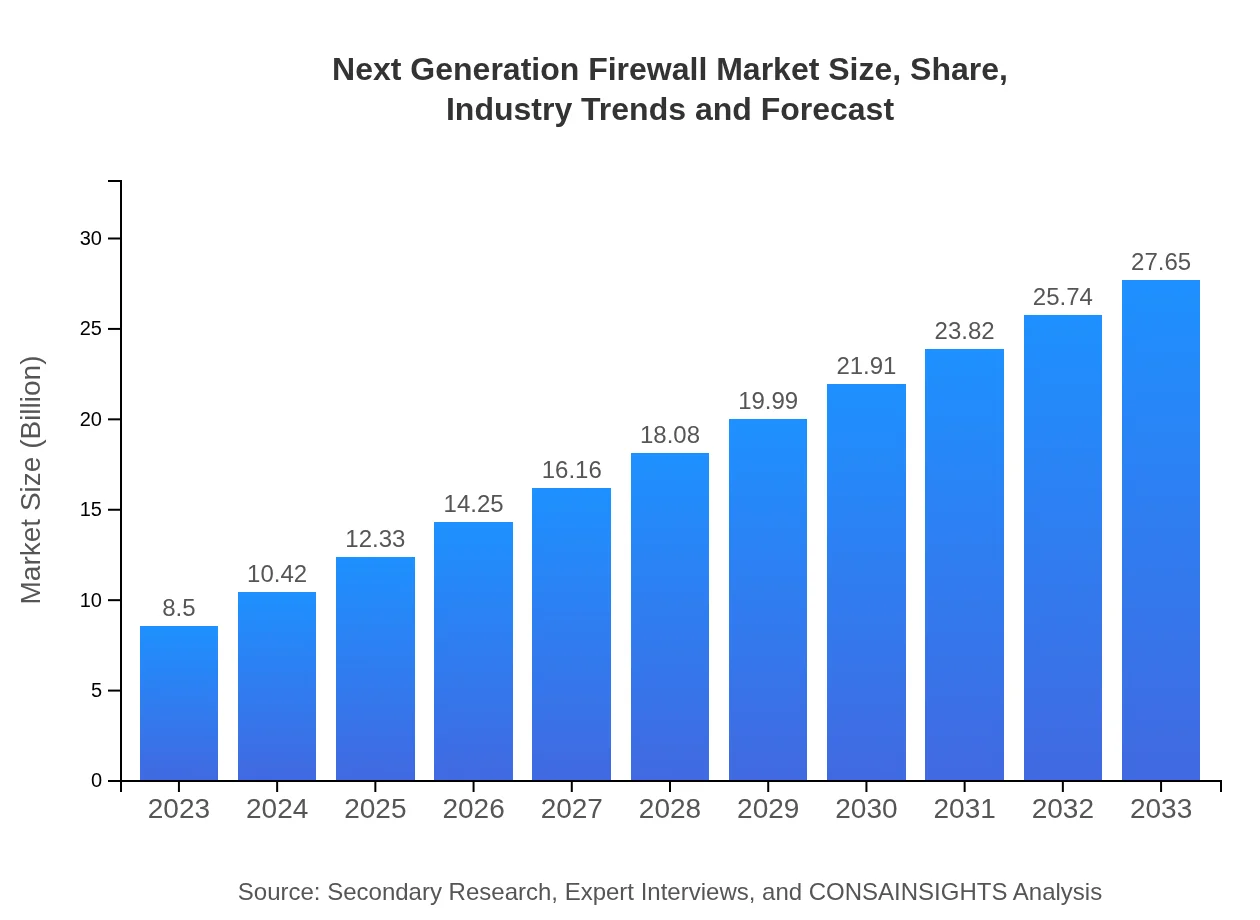

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.50 Billion |

| CAGR (2023-2033) | 12% |

| 2033 Market Size | $27.65 Billion |

| Top Companies | Palo Alto Networks, Fortinet, Cisco Systems, Check Point Software Technologies, SonicWall |

| Last Modified Date | 31 January 2026 |

Next Generation Firewall Market Overview

Customize Next Generation Firewall Market Report market research report

- ✔ Get in-depth analysis of Next Generation Firewall market size, growth, and forecasts.

- ✔ Understand Next Generation Firewall's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Next Generation Firewall

What is the Market Size & CAGR of Next Generation Firewall market in 2023?

Next Generation Firewall Industry Analysis

Next Generation Firewall Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Next Generation Firewall Market Analysis Report by Region

Europe Next Generation Firewall Market Report:

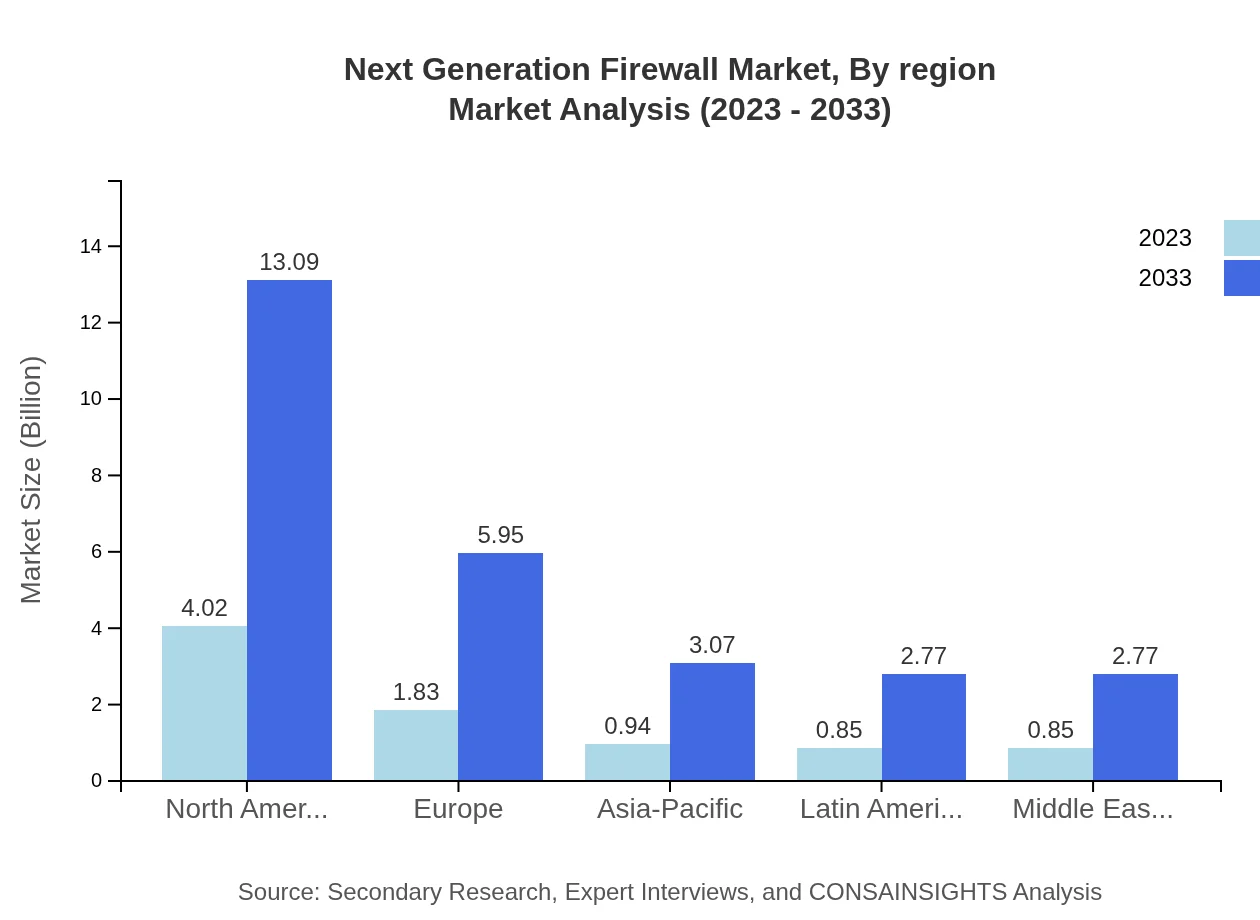

The European Next Generation Firewall market, valued at $3.12 billion in 2023, is set to reach $10.13 billion by 2033. Growing concerns over data protection and privacy regulations such as GDPR are propelling market growth.Asia Pacific Next Generation Firewall Market Report:

In the Asia Pacific region, the NGFW market is projected to grow from $1.38 billion in 2023 to $4.50 billion by 2033, driven by the rapid digitalization of economies and increasing cyber threats. Businesses are investing heavily in advanced security measures to protect sensitive data.North America Next Generation Firewall Market Report:

North America remains the largest market for NGFWs, with a value of $2.74 billion in 2023 expected to climb to $8.93 billion by 2033. The region benefits from the presence of major technology firms and increasing regulatory requirements driving enterprises to enhance their cybersecurity posture.South America Next Generation Firewall Market Report:

The South American NGFW market is estimated to increase from $0.27 billion in 2023 to $0.87 billion in 2033. Factors such as growing internet penetration and the emergence of e-commerce are driving demand for enhanced security solutions.Middle East & Africa Next Generation Firewall Market Report:

In the Middle East and Africa, the NGFW market is projected to rise from $0.99 billion in 2023 to $3.23 billion by 2033. The region's digital transformation initiatives and investments in smart city projects are expected to drive the demand for advanced cybersecurity solutions.Tell us your focus area and get a customized research report.

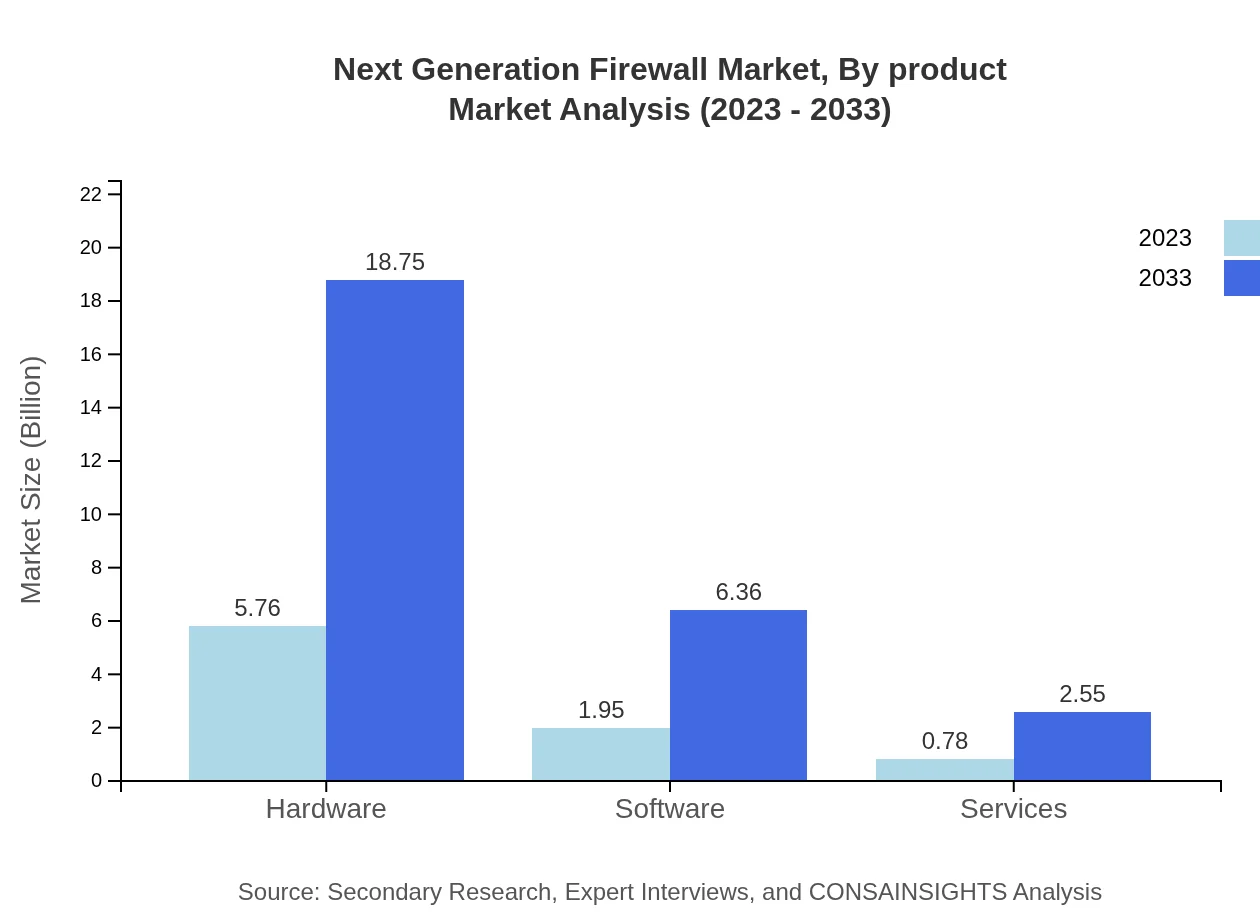

Next Generation Firewall Market Analysis By Product

The product segmentation includes hardware firewalls, software firewalls, and managed firewall services, contributing significantly to the NGFW sector's overall performance. Hardware firewalls dominate the market due to their robust security capabilities.

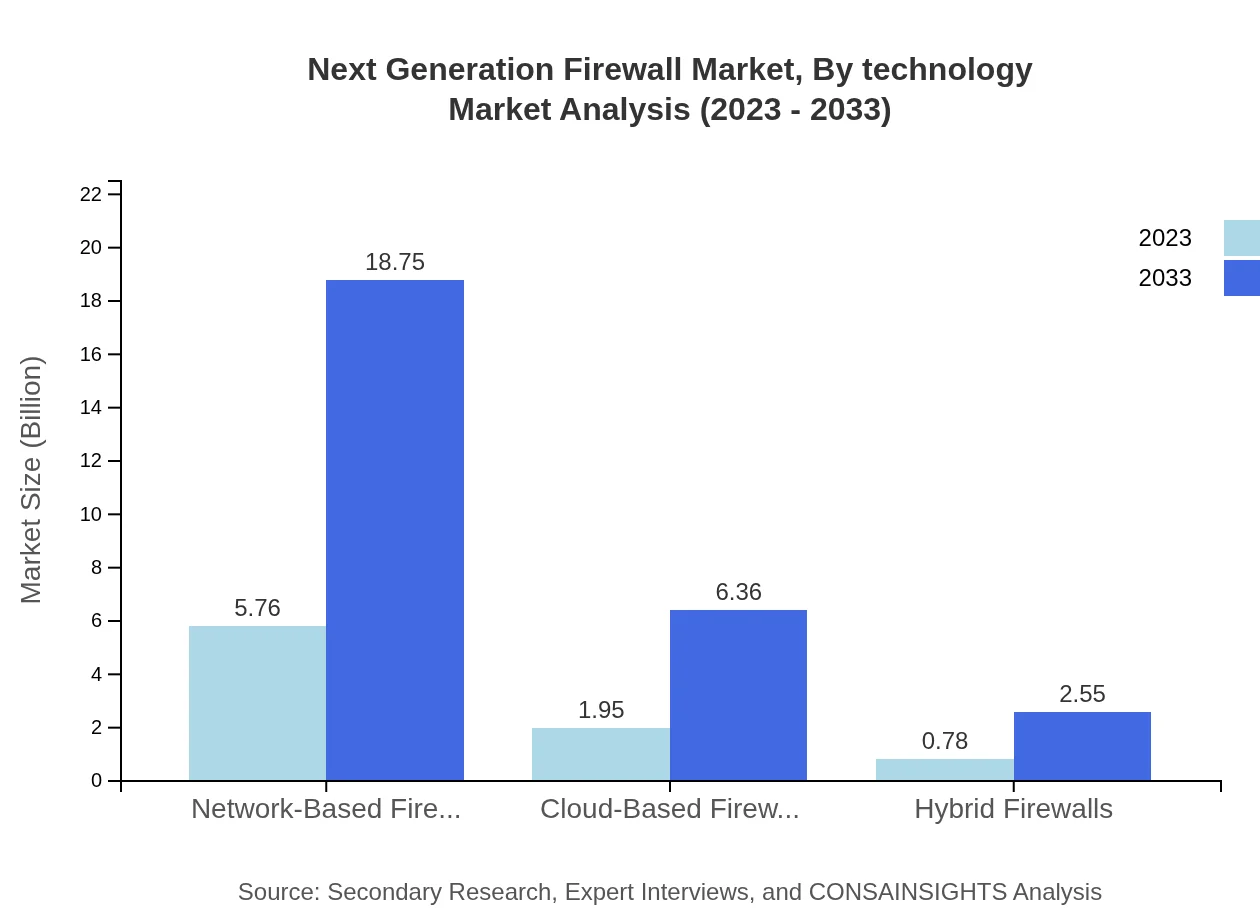

Next Generation Firewall Market Analysis By Technology

Emerging technologies like AI, ML, and cloud computing are transforming NGFW capabilities, enhancing threat detection response times and adaptability to new threats.

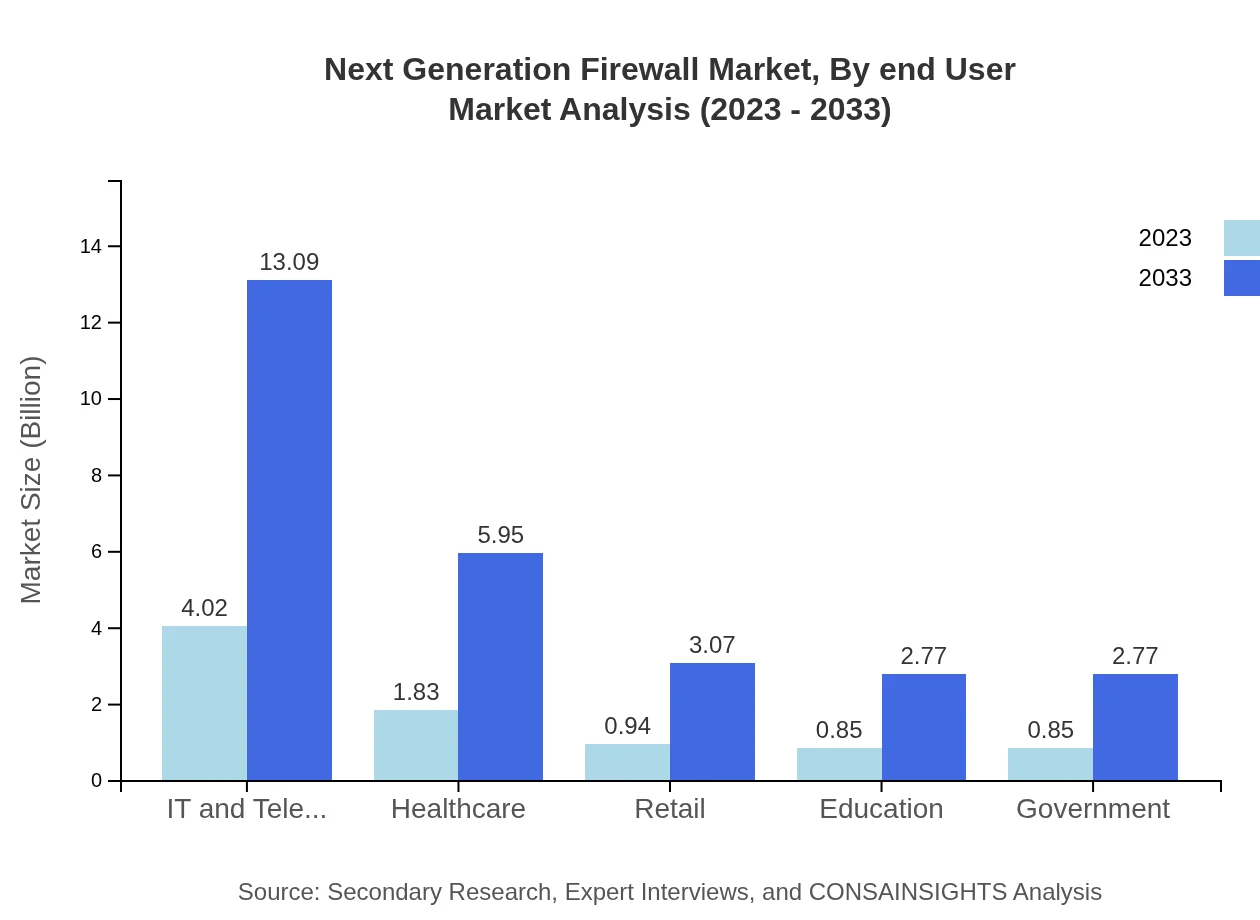

Next Generation Firewall Market Analysis By End User

Key end-user industries include IT and telecom, healthcare, government, finance, and retail. The IT and telecom sector is the largest contributor, attributed to high regulatory compliance and security needs.

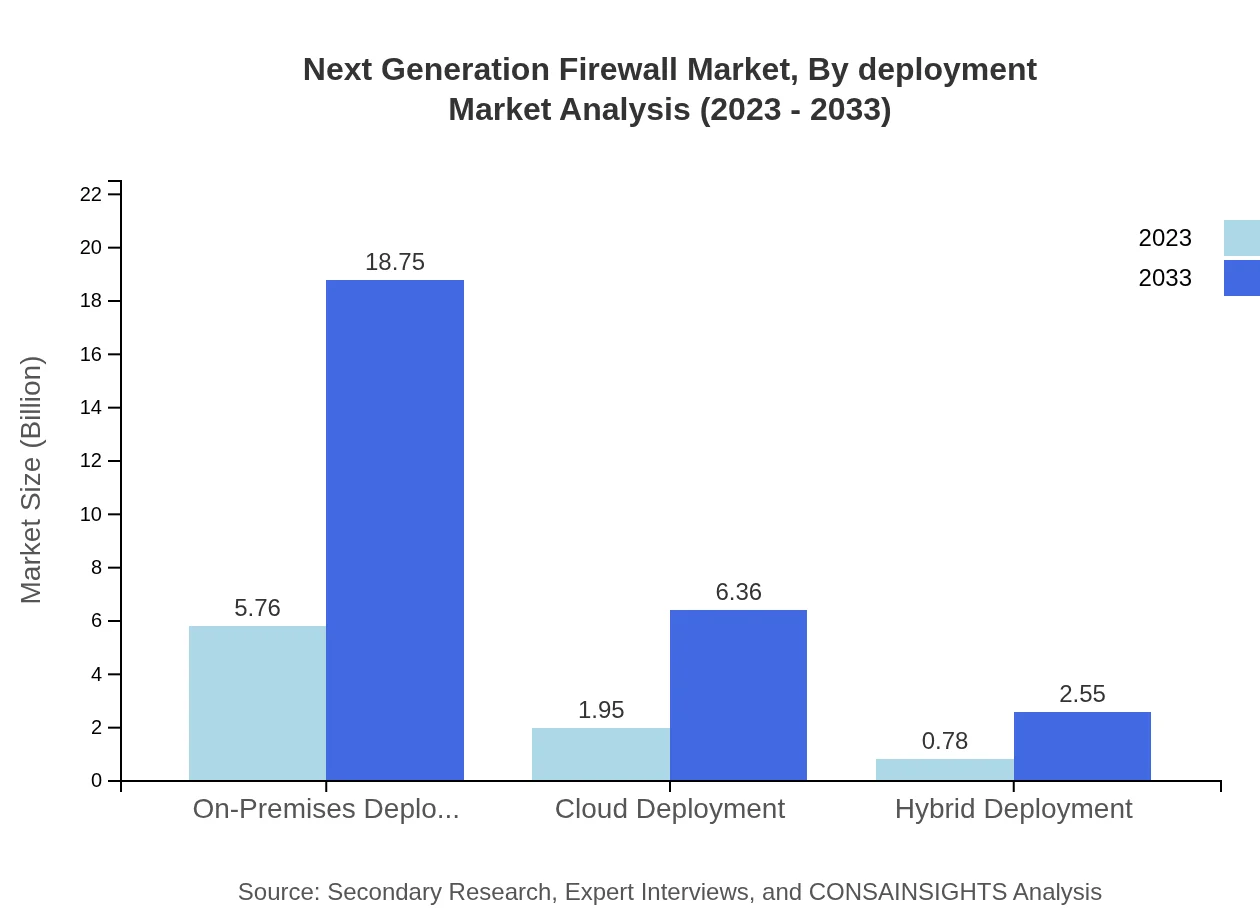

Next Generation Firewall Market Analysis By Deployment

Deployment types include on-premises, cloud, and hybrid solutions. The on-premises segment is predominant due to existing infrastructure in many organizations, while cloud-based solutions are gaining traction as businesses transition to agile operations.

Next Generation Firewall Market Analysis By Region

Regional analysis reveals strong performance in North America and Europe, with emerging markets in Asia Pacific and the Middle East driving future growth.

Next Generation Firewall Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Next Generation Firewall Industry

Palo Alto Networks:

Leading the market with innovative NGFW solutions that utilize AI and integrated security features.Fortinet:

Known for high-performance firewalls and cybersecurity solutions tailored for enterprises.Cisco Systems:

Offers a comprehensive suite of cybersecurity solutions, including robust NGFW products.Check Point Software Technologies:

Provides advanced threat prevention solutions with cutting-edge firewall technology.SonicWall:

Delivers smart security solutions with a focus on SMBs and local enterprises.We're grateful to work with incredible clients.

FAQs

What is the market size of Next Generation Firewall?

The Next Generation Firewall market size is projected to grow from $8.5 billion in 2023 to significant values by 2033, reflecting a strong CAGR of 12%, driven by increasing cybersecurity threats and advanced network security needs.

What are the key market players or companies in this Next Generation Firewall industry?

Key players in the Next Generation Firewall industry include Cisco, Palo Alto Networks, Fortinet, Check Point Software Technologies, and Juniper Networks, among others, driving innovation and competition within this dynamic market.

What are the primary factors driving the growth in the Next Generation Firewall industry?

Growth drivers for the Next Generation Firewall industry include increasing cyber threats, compliance regulations, the move to cloud services, and the demand for scalable and flexible security solutions to protect enterprise networks.

Which region is the fastest Growing in the Next Generation Firewall?

The fastest-growing region in the Next Generation Firewall market is Europe, expected to expand from $3.12 billion in 2023 to $10.13 billion by 2033, indicating robust growth as organizations prioritize security investments.

Does ConsaInsights provide customized market report data for the Next Generation Firewall industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the Next Generation Firewall industry, allowing for a more detailed analysis aligned with business objectives and market conditions.

What deliverables can I expect from this Next Generation Firewall market research project?

Deliverables from the Next Generation Firewall market research project typically include comprehensive market analysis reports, competitive landscape assessments, growth projections, and detailed segmentation insights, ensuring informed decision-making.

What are the market trends of Next Generation Firewall?

Market trends for Next Generation Firewall include the rise of cloud-based solutions, growing emphasis on integrated security measures, increasing automation in threat detection, and a shift towards subscription-based models for flexibility and cost savings.