Next Generation Implants Market Report

Published Date: 31 January 2026 | Report Code: next-generation-implants

Next Generation Implants Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Next Generation Implants market, exploring market dynamics, size, segmentation, regional insights, and future trends over the forecast period from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

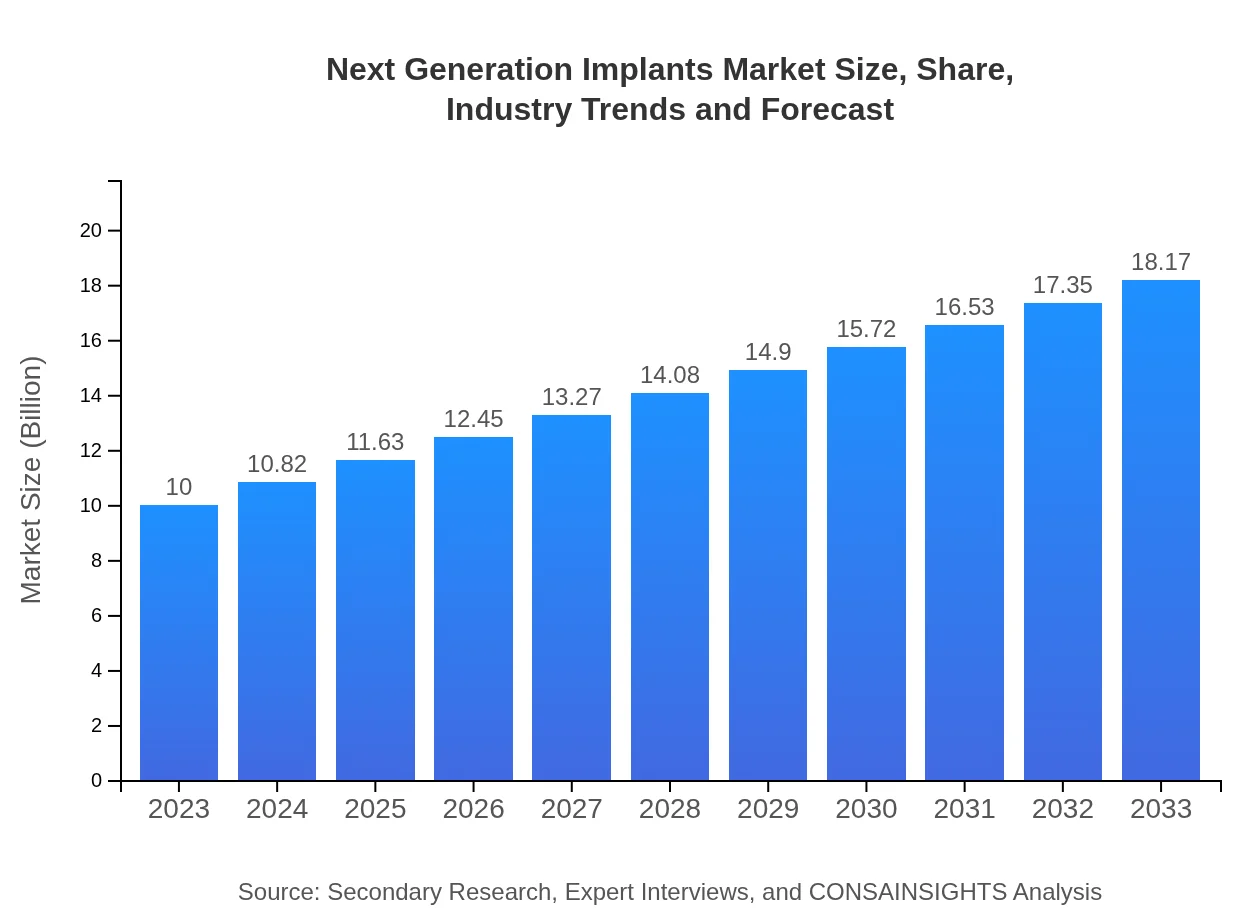

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 6% |

| 2033 Market Size | $18.17 Billion |

| Top Companies | Zimmer Biomet, Stryker Corporation, Johnson & Johnson, Medtronic , Dentsply Sirona |

| Last Modified Date | 31 January 2026 |

Next Generation Implants Market Overview

Customize Next Generation Implants Market Report market research report

- ✔ Get in-depth analysis of Next Generation Implants market size, growth, and forecasts.

- ✔ Understand Next Generation Implants's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Next Generation Implants

What is the Market Size & CAGR of Next Generation Implants market in 2023?

Next Generation Implants Industry Analysis

Next Generation Implants Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Next Generation Implants Market Analysis Report by Region

Europe Next Generation Implants Market Report:

Europe's market is estimated at $2.68 billion in 2023, with significant growth expected to $4.87 billion by 2033, driven by strong regulatory frameworks supporting innovation and a growing elderly population requiring implants.Asia Pacific Next Generation Implants Market Report:

In the Asia-Pacific region, the market size reached approximately $1.97 billion in 2023 and is projected to grow to $3.58 billion by 2033, reflecting a significant CAGR driven by increasing disposable income, healthcare expenditure, and rising awareness of advanced medical technologies.North America Next Generation Implants Market Report:

North America dominates the market, with a size of $3.81 billion in 2023 slated to expand to $6.92 billion by 2033. This growth is influenced by the region's technological advancements, high adoption rates of innovative implant technologies, and increasing healthcare investment.South America Next Generation Implants Market Report:

The South American market is smaller, with a size of $0.77 billion in 2023, projected to reach $1.39 billion by 2033, supported by improving healthcare infrastructure and an increase in procedural volumes.Middle East & Africa Next Generation Implants Market Report:

In the Middle East and Africa, the market size is projected to increase from $0.77 billion in 2023 to $1.40 billion by 2033. Continuous investments in healthcare and rising demand for advanced medical solutions are major contributing factors.Tell us your focus area and get a customized research report.

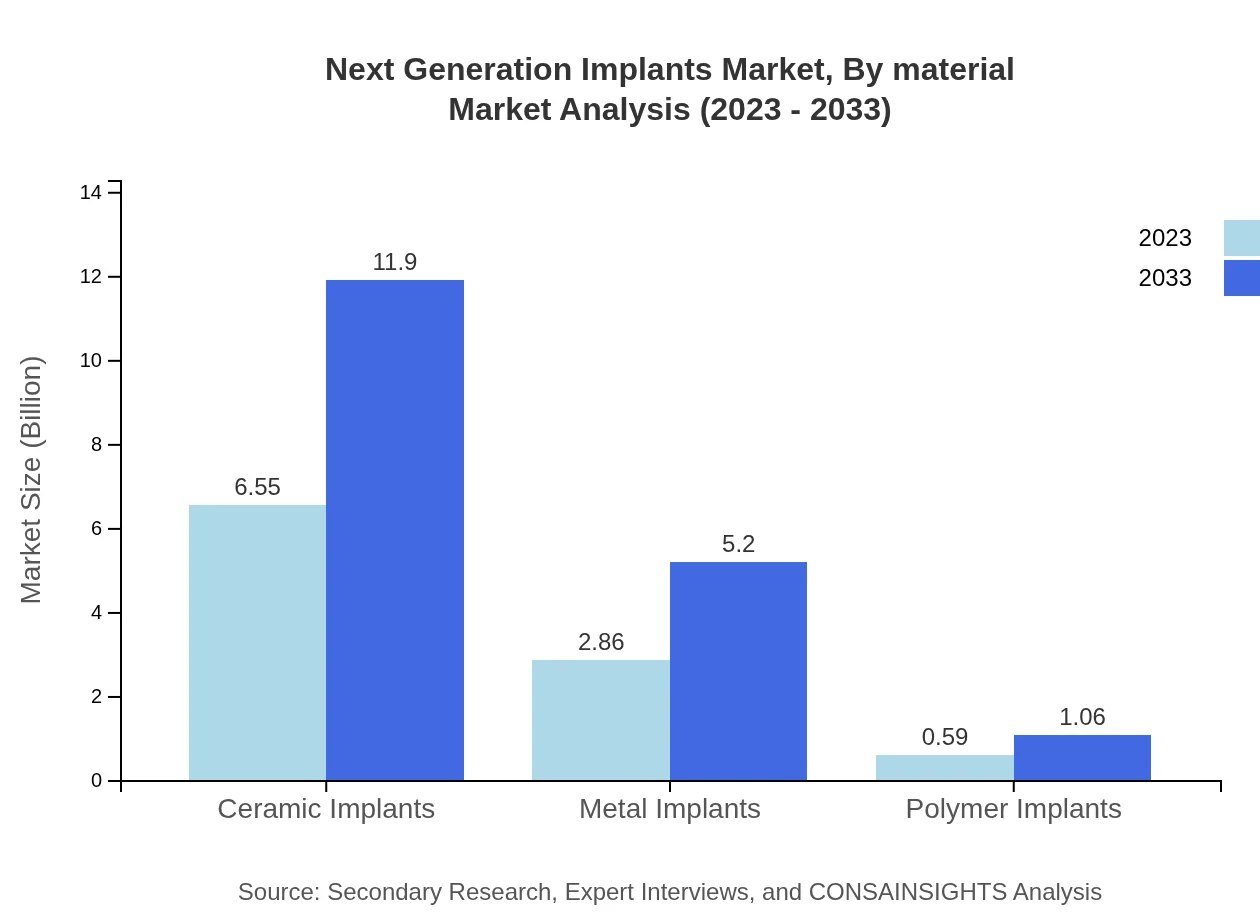

Next Generation Implants Market Analysis By Material

The material segment is dominated by Ceramic Implants, which represent the largest share with a market size of $6.55 billion in 2023, projected to grow to $11.90 billion by 2033. Metal Implants, crucial for their strength and versatility, are forecasted to grow from $2.86 billion to $5.20 billion, while Polymer Implants remain essential but smaller in size at $0.59 billion growing to $1.06 billion.

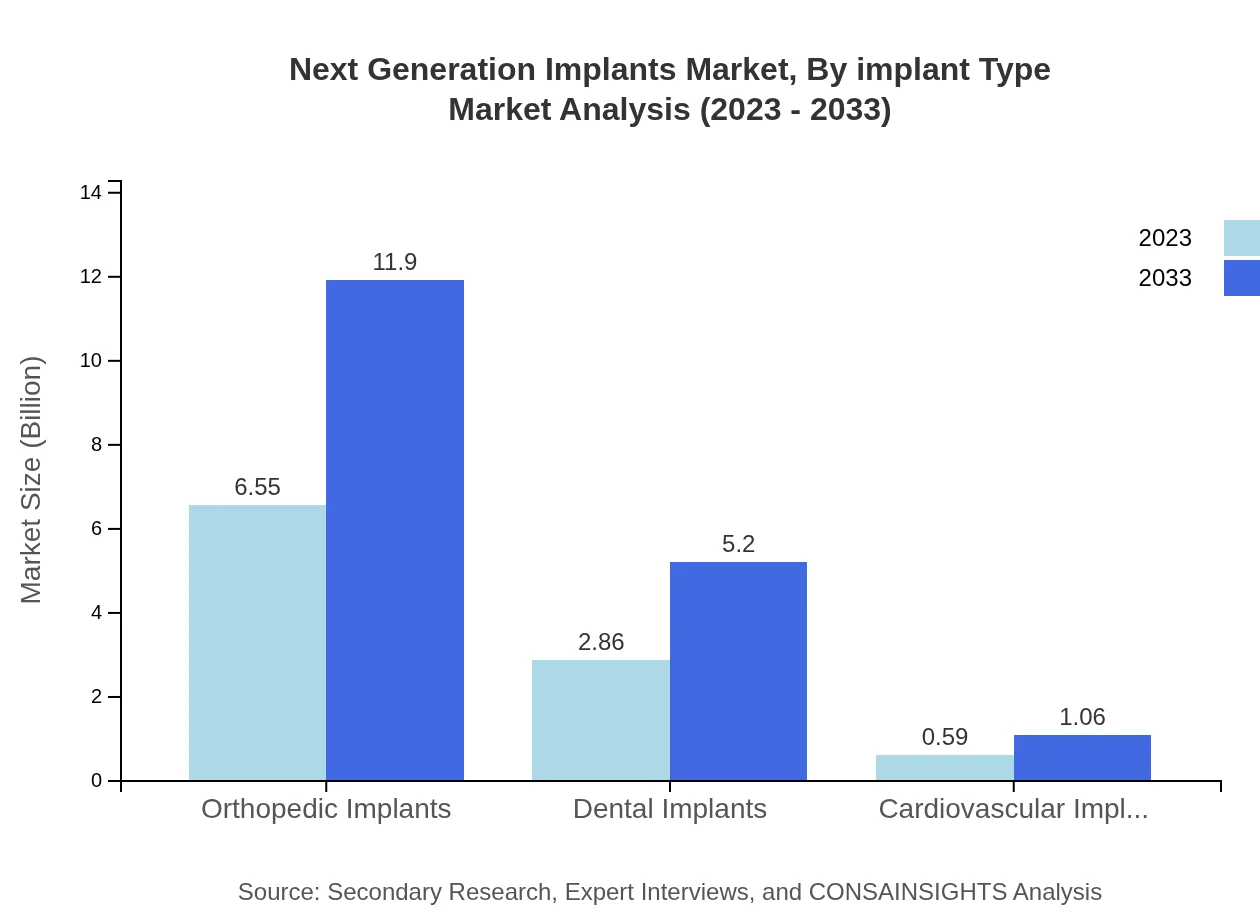

Next Generation Implants Market Analysis By Implant Type

Orthopedic Implants dominate the segment with a substantial market share and will reach $6.55 billion by 2033 from $11.90 billion in 2023. Dental Implants will also see notable growth from $2.86 billion to $5.20 billion, driven by the rising need for dental solutions. Cardiovascular Implants, although smaller, will experience growth reaching $0.59 billion by 2033.

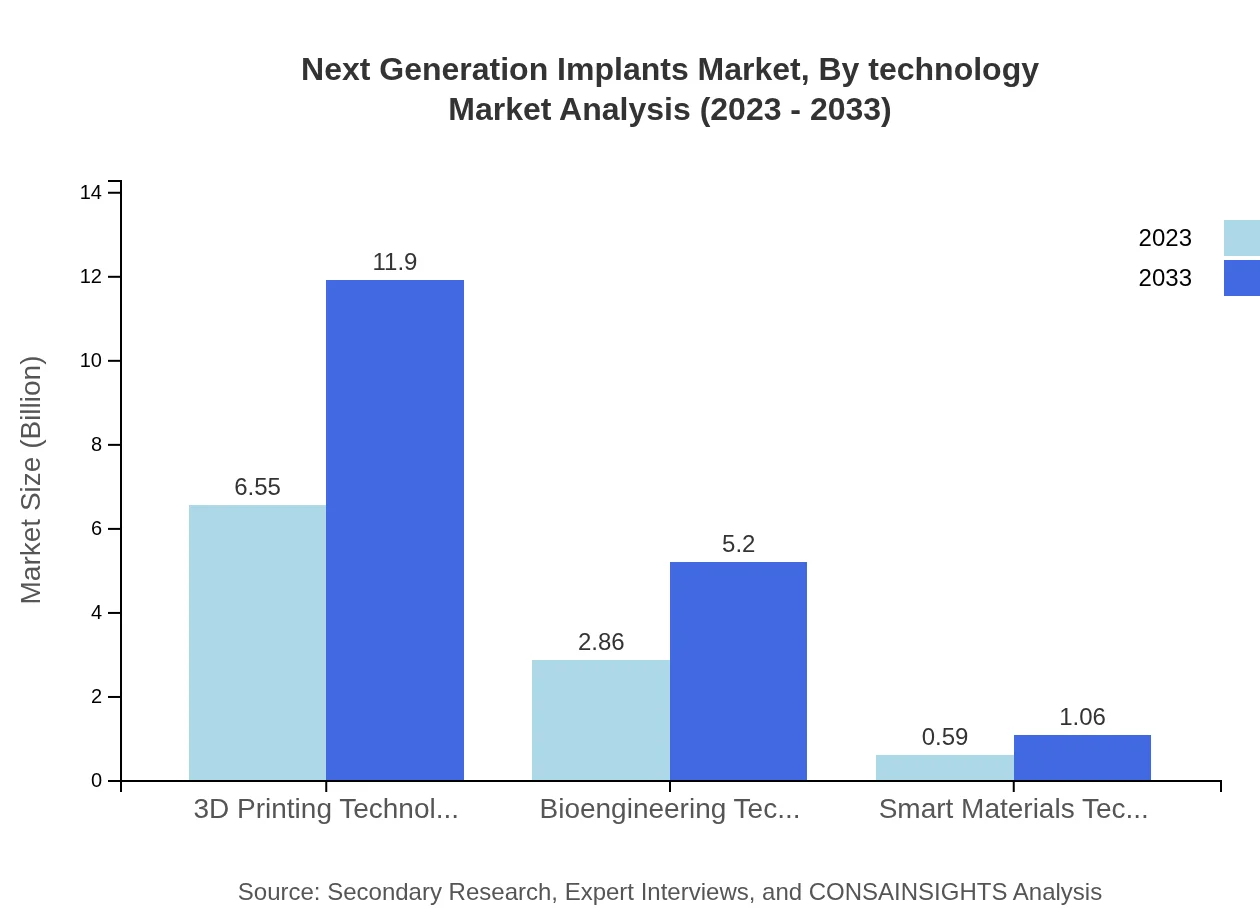

Next Generation Implants Market Analysis By Technology

The technological landscape is evolving with 3D Printing Technology holding a significant market share, growing to $11.90 billion by 2033 from $6.55 billion in 2023. Bioengineering Technology also plays a pivotal role, anticipated to expand from $2.86 billion to $5.20 billion due to innovative modeling and materials science applications. Smart Materials Technology is expected to grow similarly from $0.59 billion to $1.06 billion.

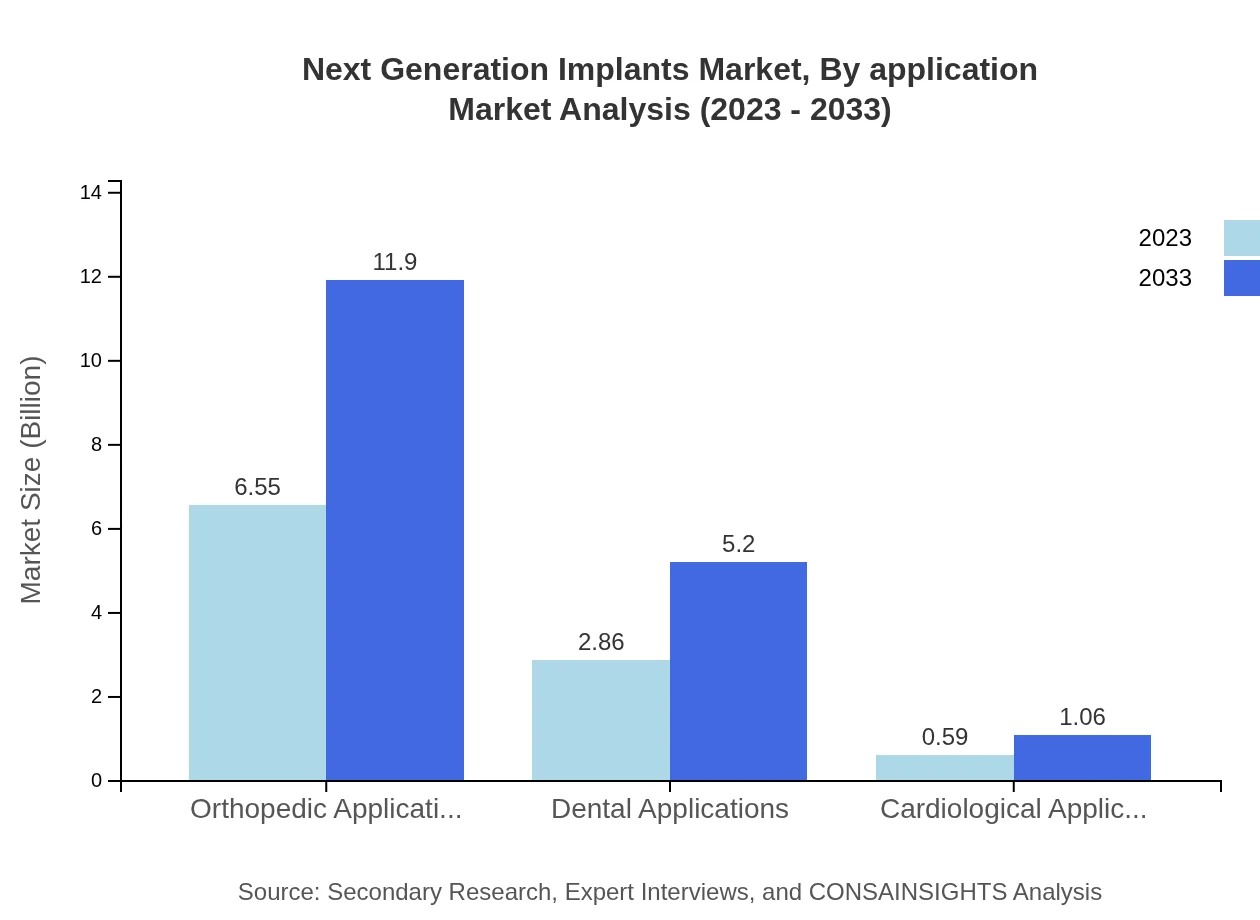

Next Generation Implants Market Analysis By Application

Orthopedic Applications will lead this segment, with a size reaching $11.90 billion by 2033. Dental applications are expected to grow to $5.20 billion, while Cardiological Applications will reach $1.06 billion. This diversification illustrates the increasing reliance on specialized surgical solutions across medical disciplines.

Next Generation Implants Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Next Generation Implants Industry

Zimmer Biomet:

A global leader in musculoskeletal healthcare, Zimmer Biomet is known for its innovative solutions in orthopedic implants, focusing on transforming patient care through advanced technologies.Stryker Corporation:

Stryker specializes in innovative medical technologies, including minimally invasive surgical implants and advanced robotics, setting industry standards in implant design and manufacturing.Johnson & Johnson:

Through its operating companies, Johnson & Johnson develops a wide range of medical devices, including cutting-edge implants for orthopedic and surgical applications, catering to various patient needs.Medtronic :

Medtronic leads in medical technology innovation, providing advanced implantable devices focused on therapeutic outcomes in cardiology and pain management.Dentsply Sirona:

Dentsply Sirona is a leader in dental products, specializing in implant technology and solutions that enhance oral health and patient experiences.We're grateful to work with incredible clients.

FAQs

What is the market size of next Generation implants?

The global market size for next-generation implants is projected to reach $10 billion by 2033, growing at a CAGR of 6% from its current valuation. This growth reflects increased technological advances and greater demand for innovative healthcare solutions.

What are the key market players or companies in the next Generation implants industry?

Key players in the next-generation implants market include major medical device manufacturers such as Zimmer Biomet, Stryker Corporation, and Medtronic. These companies are at the forefront of developing advanced implant technologies and are instrumental in shaping market trends.

What are the primary factors driving the growth in the next Generation implants industry?

Driving factors for the next-generation implants market include advancements in materials technology, increasing prevalence of chronic diseases, a growing aging population, and heightened focus on minimally invasive surgical procedures that require advanced implant solutions.

Which region is the fastest Growing in the next Generation implants?

North America is the fastest-growing region in the next-generation implants market, projected to grow from $3.81 billion in 2023 to $6.92 billion by 2033, supported by technological advancements and strong healthcare infrastructure in the region.

Does ConsaInsights provide customized market report data for the next Generation implants industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the next-generation implants industry. This includes in-depth analyses, targeted region-specific data, and insights into market dynamics relevant to individual business objectives.

What deliverables can I expect from this next Generation implants market research project?

Deliverables from the next-generation implants market research include comprehensive market analysis, segmentation insights, regional trends, competitive landscape overview, and forecasts indicating growth trajectories over the next decade.

What are the market trends of next Generation implants?

Current trends include the increasing adoption of 3D printing technology for custom implants, a shift towards bioengineered materials in implant design, and an emphasis on smart materials that offer enhanced compatibility and performance in clinical applications.