Next Generation Sequencing Market Report

Published Date: 31 January 2026 | Report Code: next-generation-sequencing

Next Generation Sequencing Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Next Generation Sequencing (NGS) market, covering market size, growth trends, segmentation, regional insights, and forecasts from 2023 to 2033.

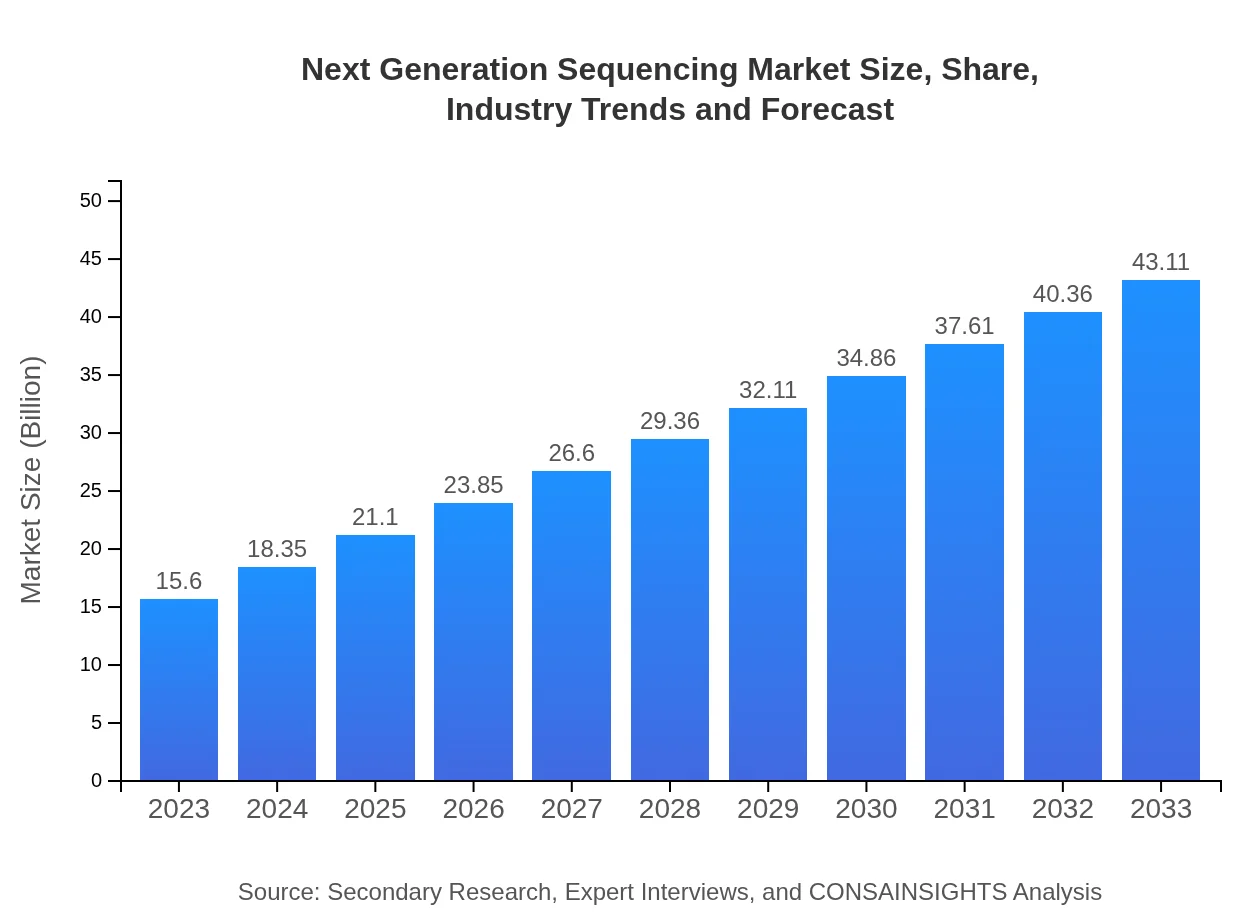

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 10.3% |

| 2033 Market Size | $43.11 Billion |

| Top Companies | Illumina, Inc., Thermo Fisher Scientific, Inc., QIAGEN N.V. |

| Last Modified Date | 31 January 2026 |

Next Generation Sequencing Market Overview

Customize Next Generation Sequencing Market Report market research report

- ✔ Get in-depth analysis of Next Generation Sequencing market size, growth, and forecasts.

- ✔ Understand Next Generation Sequencing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Next Generation Sequencing

What is the Market Size & CAGR of Next Generation Sequencing market in 2023?

Next Generation Sequencing Industry Analysis

Next Generation Sequencing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Next Generation Sequencing Market Analysis Report by Region

Europe Next Generation Sequencing Market Report:

Europe's market is projected to expand from $5.56 billion in 2023 to $15.37 billion by 2033, benefitting from strong investments in research and development, a focus on health and precision medicine, and collaborations between academia and industry.Asia Pacific Next Generation Sequencing Market Report:

The Asia Pacific region, with a market size of $2.93 billion in 2023, is projected to grow to $8.09 billion by 2033, driven by increasing government initiatives in genomics research, advancements in healthcare infrastructure, and rising demand for personalized medicine. Japan and China are pivotal players in driving this growth, with significant investments in biotechnology.North America Next Generation Sequencing Market Report:

North America remains one of the largest markets for NGS, valued at $5.16 billion in 2023, estimated to grow to $14.27 billion by 2033. This is fueled by extensive research funding, the presence of leading technology companies, and increasing applications of NGS in personalized medicine and oncology.South America Next Generation Sequencing Market Report:

In South America, the NGS market starts at $1.50 billion in 2023 and is expected to reach $4.14 billion by 2033. Growth in this region is supported by expanding research initiatives, improving healthcare policies, and rising awareness of genomic technologies among healthcare providers.Middle East & Africa Next Generation Sequencing Market Report:

In MEA, the NGS market is relatively nascent, valued at $0.45 billion in 2023, with projected growth to $1.24 billion by 2033. Emerging demand for genetic testing, growth in research capacities, and healthcare improvement initiatives contribute to this growth potential.Tell us your focus area and get a customized research report.

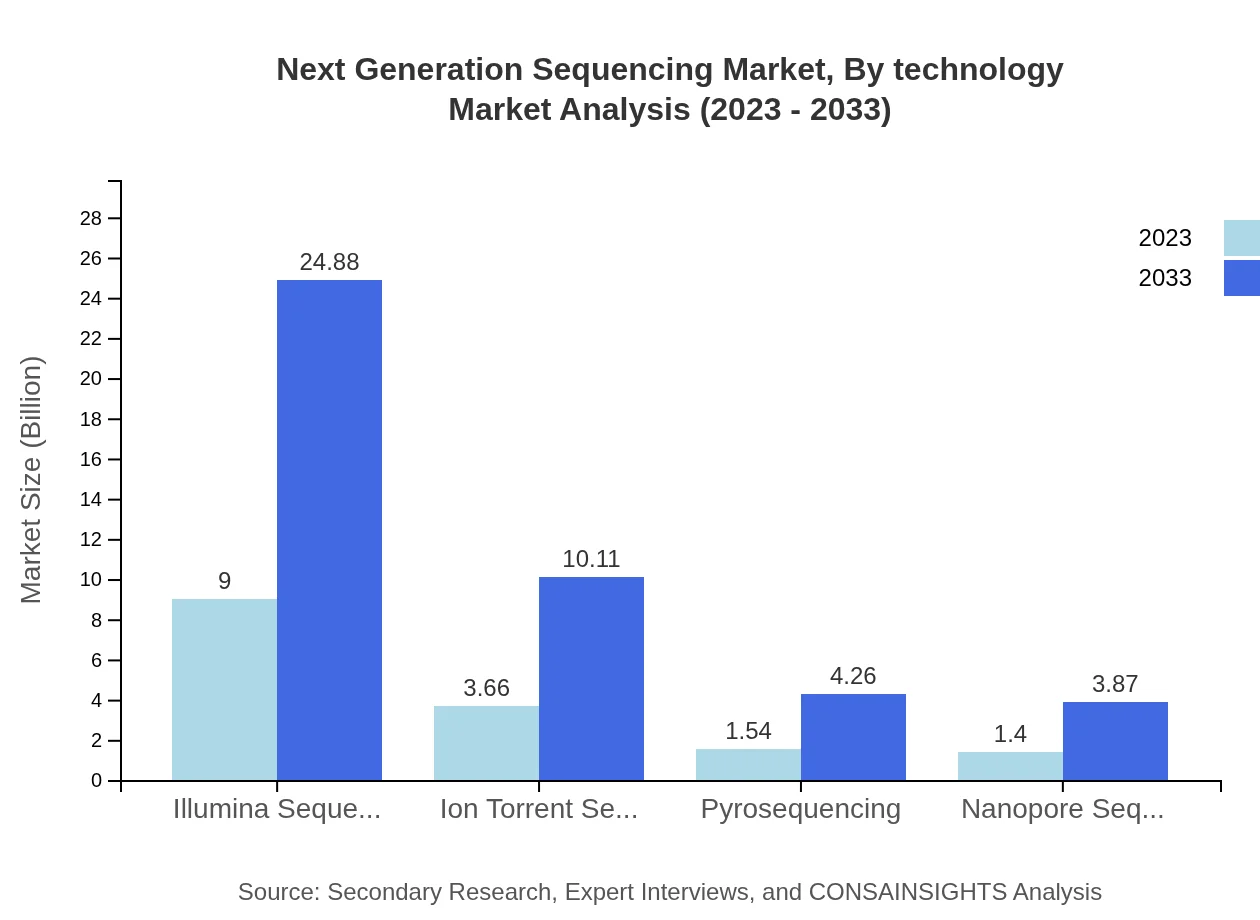

Next Generation Sequencing Market Analysis By Technology

Key technologies contributing to the NGS market include Illumina Sequencing, with a significant market size of $9.00 billion in 2023 expected to expand to $24.88 billion by 2033, holding a share of 57.72%. Ion Torrent Sequencing, valued at $3.66 billion in 2023, anticipated to grow to $10.11 billion, comprises a significant 23.44% market share. Emerging technologies like Nanopore sequencing and Pyrosequencing are slowly gaining traction and are pivotal for specific applications.

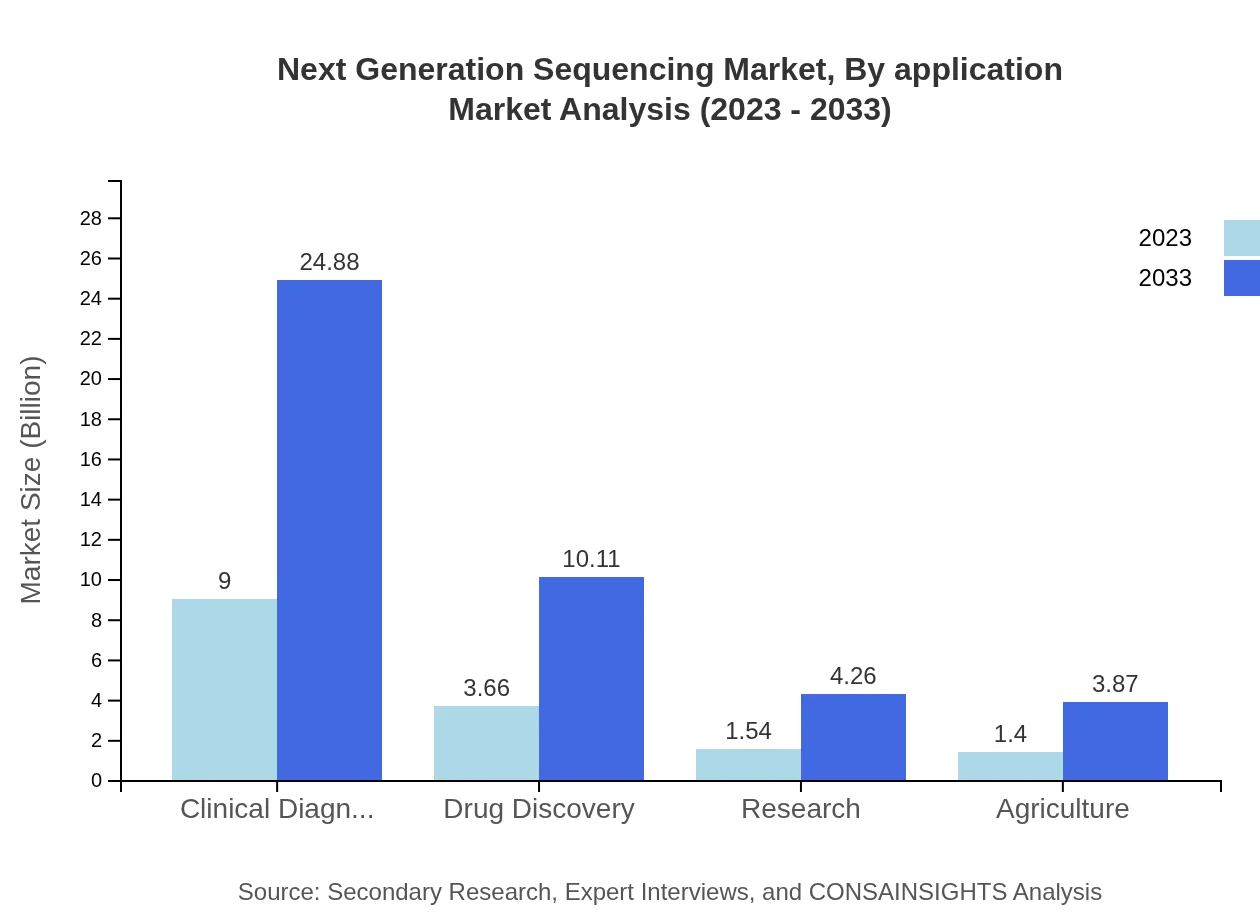

Next Generation Sequencing Market Analysis By Application

The application segments reveal the importance of NGS in various fields, such as Clinical Diagnostics (size of $9.00 billion in 2023, expected to reach $24.88 billion by 2033, with a 57.72% share), and Drug Discovery (size growth from $3.66 billion in 2023 to $10.11 billion by 2033, with a 23.44% share). The integration of NGS in research and agriculture reflects its versatility in developing sustainable practices.

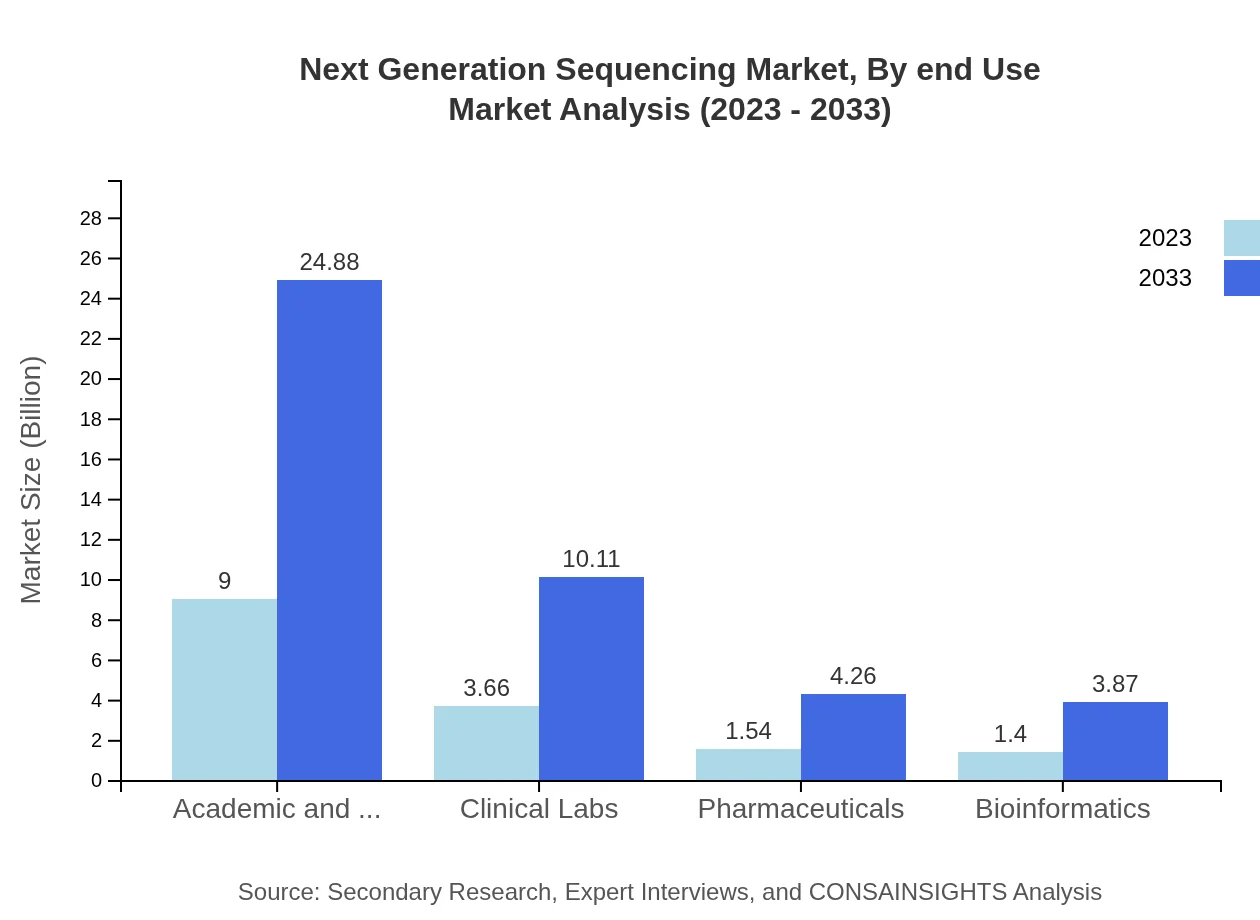

Next Generation Sequencing Market Analysis By End Use

End-use segments emphasize the diverse applications of NGS across sectors. Academic and Research Institutes account for the largest share with a size of $9.00 billion in 2023, increasing to $24.88 billion by 2033 (57.72% share). Clinical Labs exhibit robust growth from $3.66 billion to $10.11 billion, representing 23.44% share.

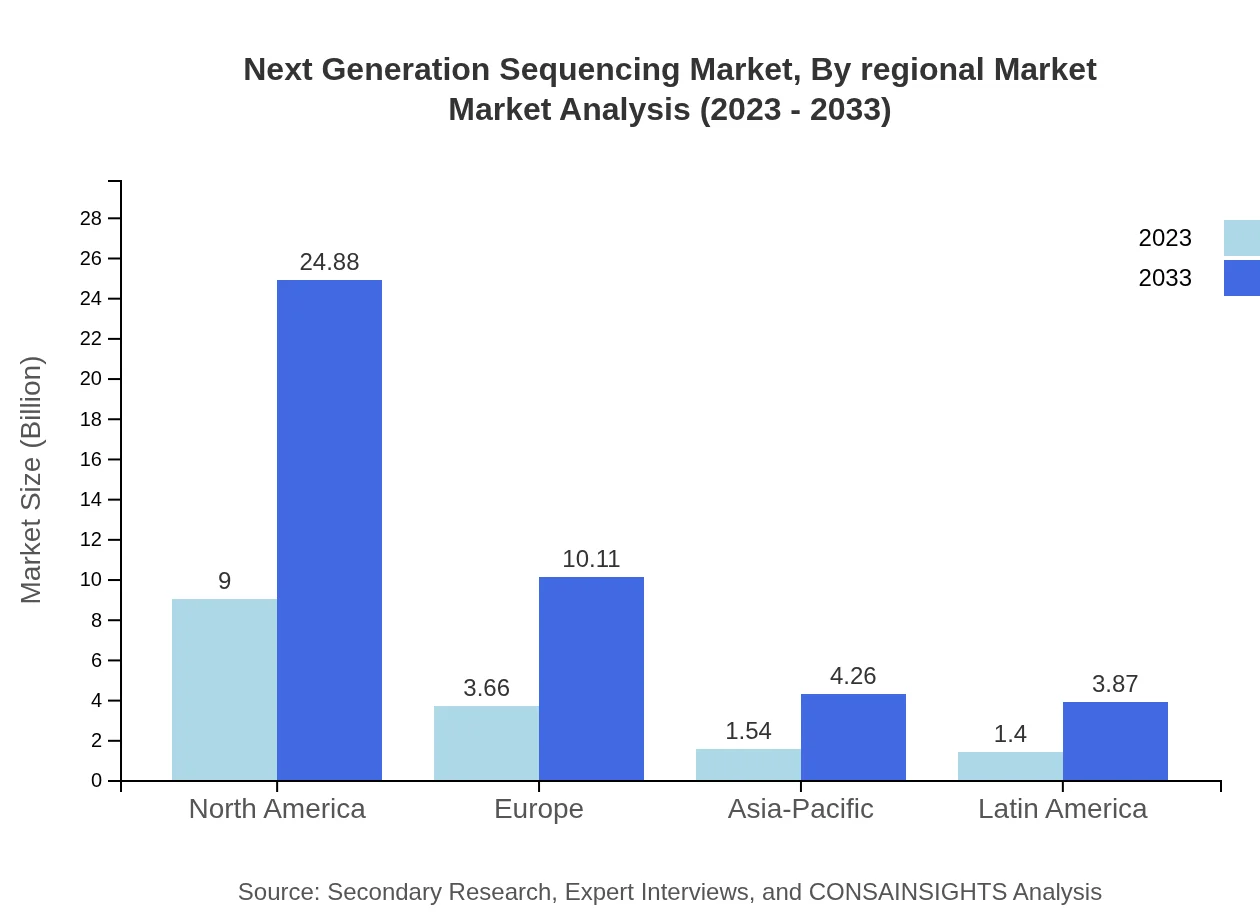

Next Generation Sequencing Market Analysis By Regional Market

Regional segments highlight the variances in market potential, with North America leading while Asia-Pacific rapidly advances. Europe exhibits steady growth, while South America and MEA present opportunities for expansion as investments in genomics increase.

Next Generation Sequencing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Next Generation Sequencing Industry

Illumina, Inc.:

Illumina is a pioneering leader in DNA sequencing technology, renowned for its innovative platforms and solutions that empower genomic research and clinical applications worldwide.Thermo Fisher Scientific, Inc.:

Thermo Fisher Scientific provides a broad range of diagnostic and genetic sequencing products, playing an integral role in advancing proteomic and genomic studies through advanced NGS technology.QIAGEN N.V.:

QIAGEN specializes in the development of sample and assay technologies, including NGS-based solutions aimed at accelerating research and diagnostics for personalized medicine.We're grateful to work with incredible clients.

FAQs

What is the market size of next Generation Sequencing?

The next-generation sequencing market is projected to reach approximately $15.6 billion by 2033, expanding at a compound annual growth rate (CAGR) of 10.3%. This growth reflects the increasing demand for sequencing technologies across various sectors including healthcare and research.

What are the key market players in the next Generation Sequencing industry?

Key players in the next-generation sequencing industry include Illumina, Thermo Fisher Scientific, BGI Genomics, Roche, and Pacific Biosciences. These companies play crucial roles in innovating sequencing technologies and expanding their applications in genomics.

What are the primary factors driving the growth in the next Generation sequencing industry?

Primary growth drivers in the next-generation sequencing industry include advancements in sequencing technologies, increased applications in personalized medicine, rising investments in genomics research, and heightened awareness about the role of genetic information in health outcomes.

Which region is the fastest Growing in the next Generation sequencing?

The Asia-Pacific region is the fastest-growing area for next-generation sequencing, projected to grow from $2.93 billion in 2023 to $8.09 billion by 2033. Its growth is attributable to increasing healthcare investments and a booming research sector.

Does ConsaInsights provide customized market report data for the next Generation sequencing industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the next-generation sequencing industry. This enables clients to gain targeted insights, facilitating better strategic decision-making.

What deliverables can I expect from this next Generation sequencing market research project?

Expected deliverables from the next-generation sequencing market research project include comprehensive market analysis reports, data on market trends, competitive landscape evaluations, and insights into technology advancements and consumer needs.

What are the market trends of next Generation sequencing?

Current market trends in next-generation sequencing highlight the focus on cost-effective sequencing solutions, integration of cloud computing for data management, and exploration of novel applications in agriculture and clinical diagnostics.