Next Generation Sequencing Services Market Report

Published Date: 31 January 2026 | Report Code: next-generation-sequencing-services

Next Generation Sequencing Services Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Next Generation Sequencing Services market, exploring trends, size, growth forecasts, and competitive landscapes from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

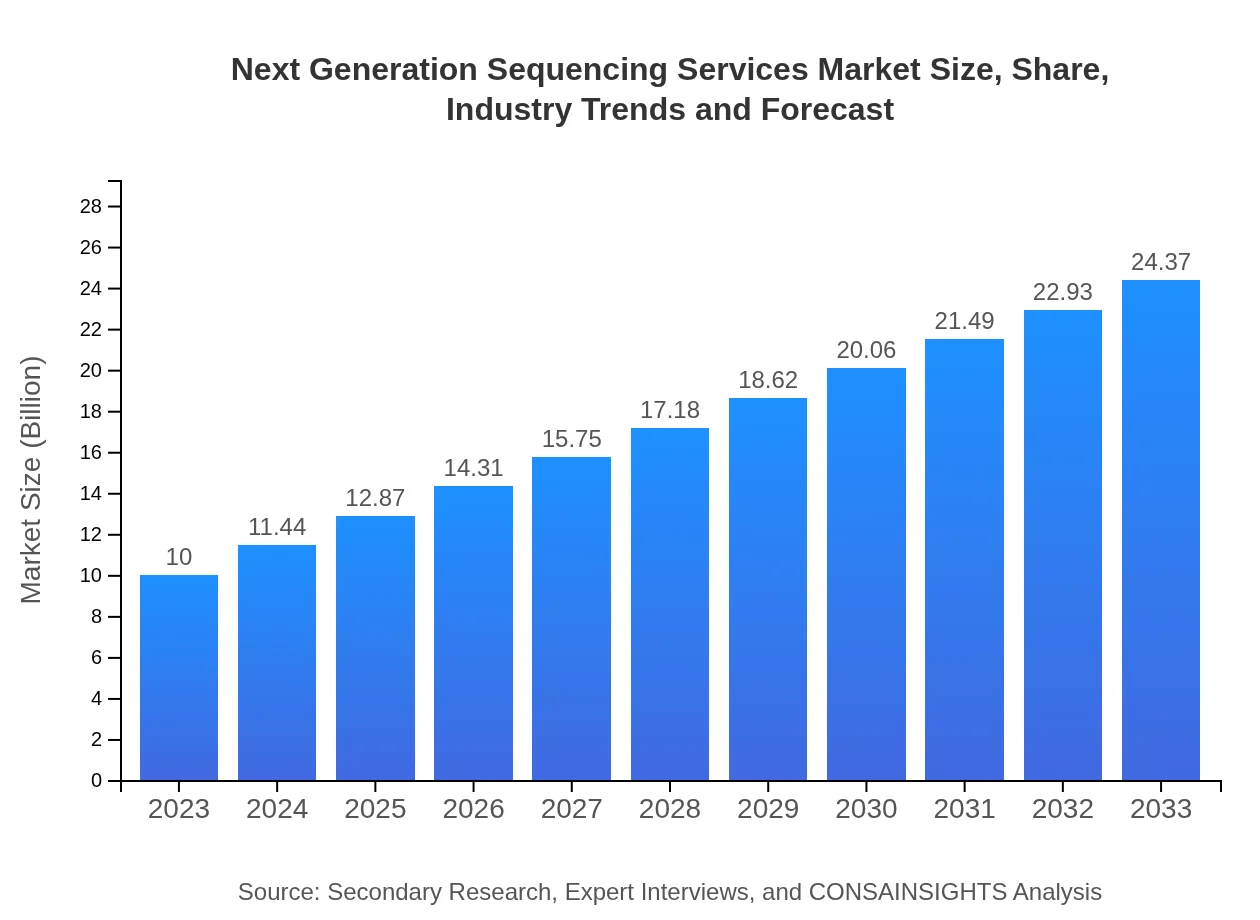

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 9% |

| 2033 Market Size | $24.37 Billion |

| Top Companies | Illumina, Inc., Thermo Fisher Scientific Inc., PacBio, Oxford Nanopore Technologies Ltd. |

| Last Modified Date | 31 January 2026 |

Next Generation Sequencing Services Market Overview

Customize Next Generation Sequencing Services Market Report market research report

- ✔ Get in-depth analysis of Next Generation Sequencing Services market size, growth, and forecasts.

- ✔ Understand Next Generation Sequencing Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Next Generation Sequencing Services

What is the Market Size & CAGR of Next Generation Sequencing Services market in 2023?

Next Generation Sequencing Services Industry Analysis

Next Generation Sequencing Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Next Generation Sequencing Services Market Analysis Report by Region

Europe Next Generation Sequencing Services Market Report:

In Europe, the market is expected to scale from $3.13 billion in 2023 to $7.64 billion by 2033. Factors such as collaborative research initiatives, supportive regulatory frameworks, and advancements in sequencing technologies contribute to market expansion.Asia Pacific Next Generation Sequencing Services Market Report:

The Asia Pacific region is anticipated to witness significant growth, with the market size reaching approximately $1.91 billion in 2023 and projected to grow to $4.67 billion by 2033. Increased funding for genomic research, advancements in healthcare infrastructure, and a rising prevalence of genetic disorders are driving the demand for NGS services in this region.North America Next Generation Sequencing Services Market Report:

The North American market is the largest for NGS services, valued at approximately $3.42 billion in 2023 and projected to grow to $8.34 billion by 2033. Key drivers include technological advancements, high investment in genomics research, and a strong demand for NGS in clinical diagnostics.South America Next Generation Sequencing Services Market Report:

In South America, the NGS services market is expected to grow from $0.51 billion in 2023 to $1.25 billion by 2033. Growing interest in genomics research and the development of personalized medicine initiatives are key factors fueling this growth.Middle East & Africa Next Generation Sequencing Services Market Report:

The Middle East and Africa market for NGS services is projected to grow from $1.02 billion in 2023 to $2.48 billion by 2033. Increasing investments in healthcare technology and research facilities are pivotal in shaping market trends in this region.Tell us your focus area and get a customized research report.

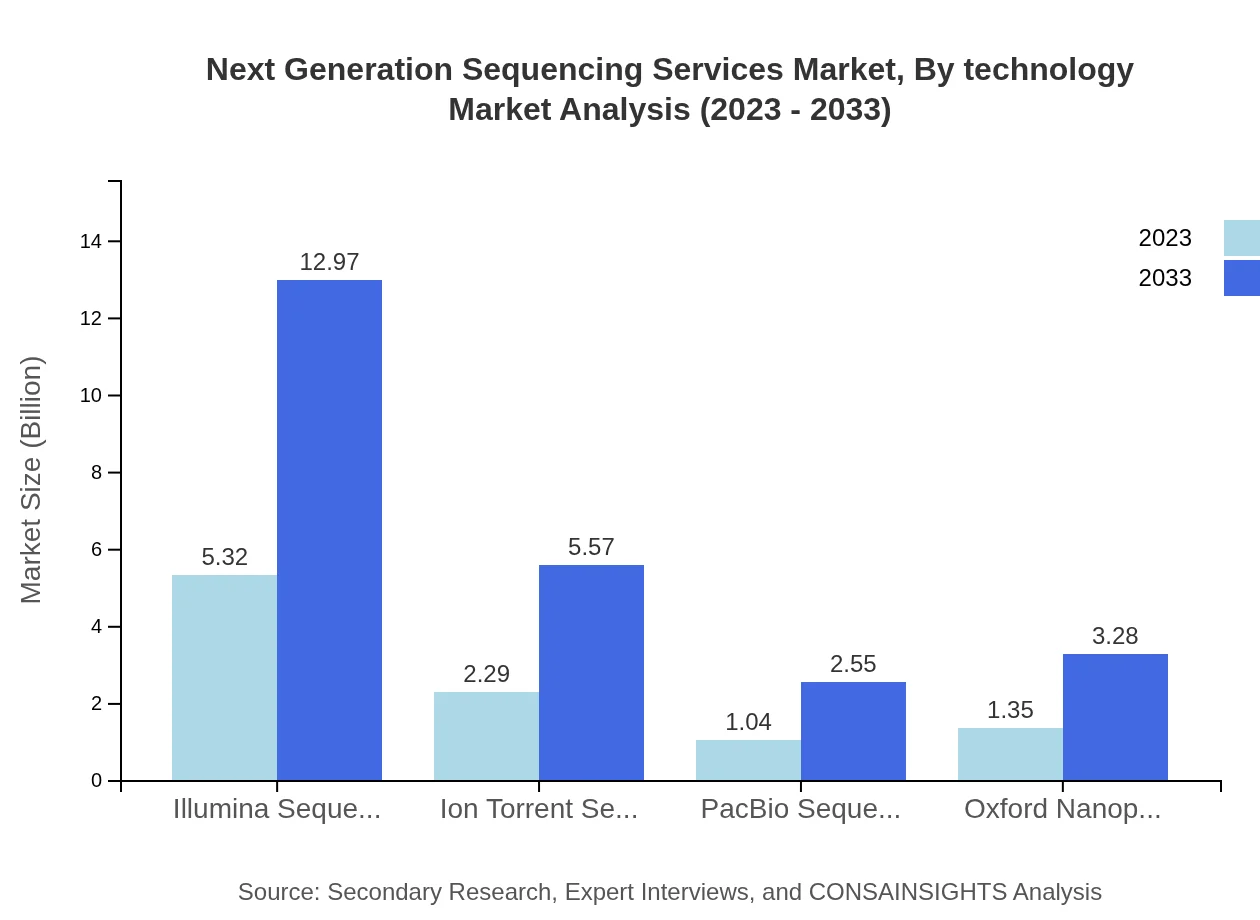

Next Generation Sequencing Services Market Analysis By Technology

Market analysis by technology reveals that Illumina Sequencing dominates the segment with a market share of 53.22% in 2023, growing from $5.32 billion to approximately $12.97 billion by 2033. Ion Torrent contributes to 22.86% market share, growing from $2.29 billion to $5.57 billion. Other technologies such as PacBio and Oxford Nanopore Technologies are also gaining traction due to their unique advantages in specific research areas.

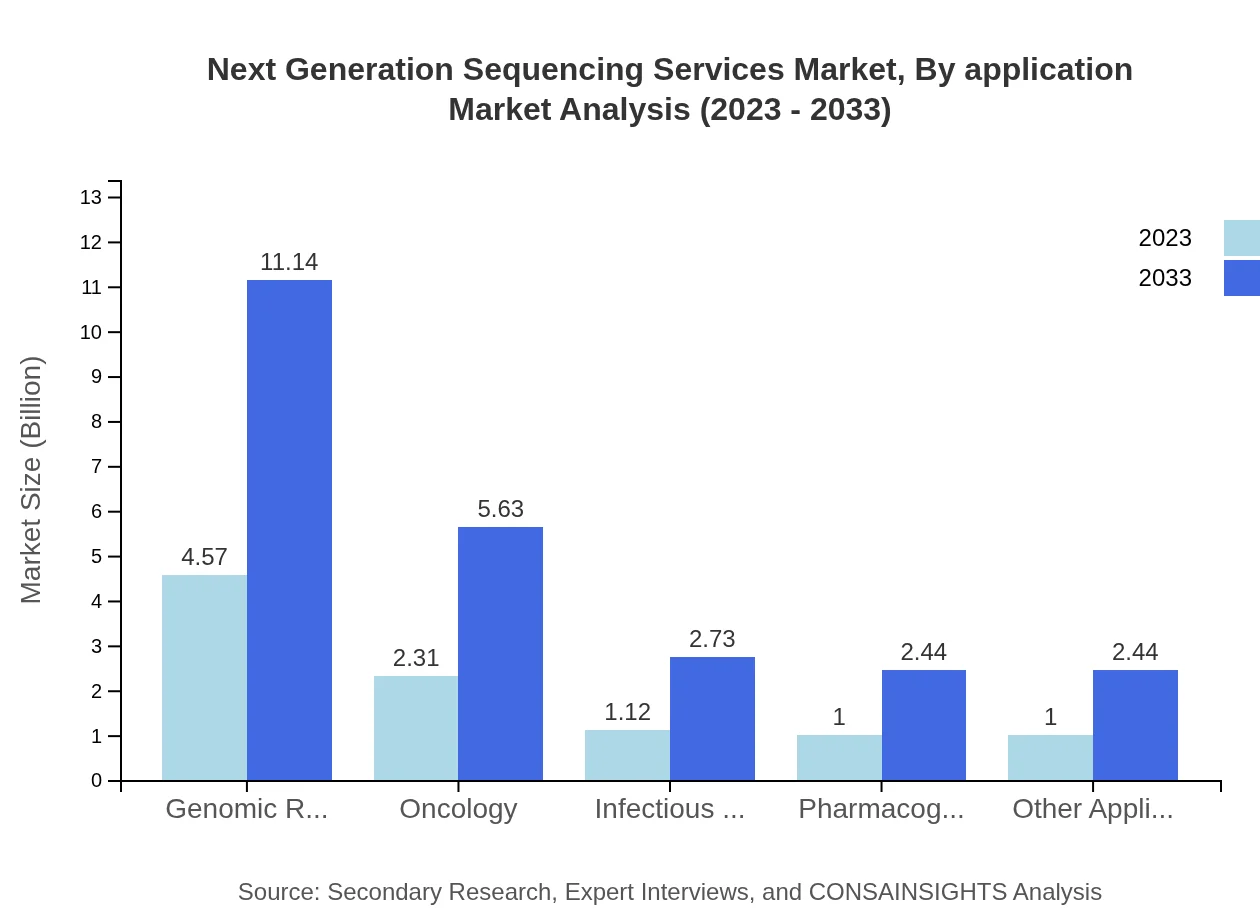

Next Generation Sequencing Services Market Analysis By Application

In the application segment, Genomic Research holds a significant market share of 45.71% in 2023, projected to increase from $4.57 billion to $11.14 billion by 2033. Oncology applications follow closely with a share of 23.1%, growing from $2.31 billion to $5.63 billion. Infectious diseases and pharmacogenomics are also crucial segments, witnessing notable growth as personalized medicine continues to evolve.

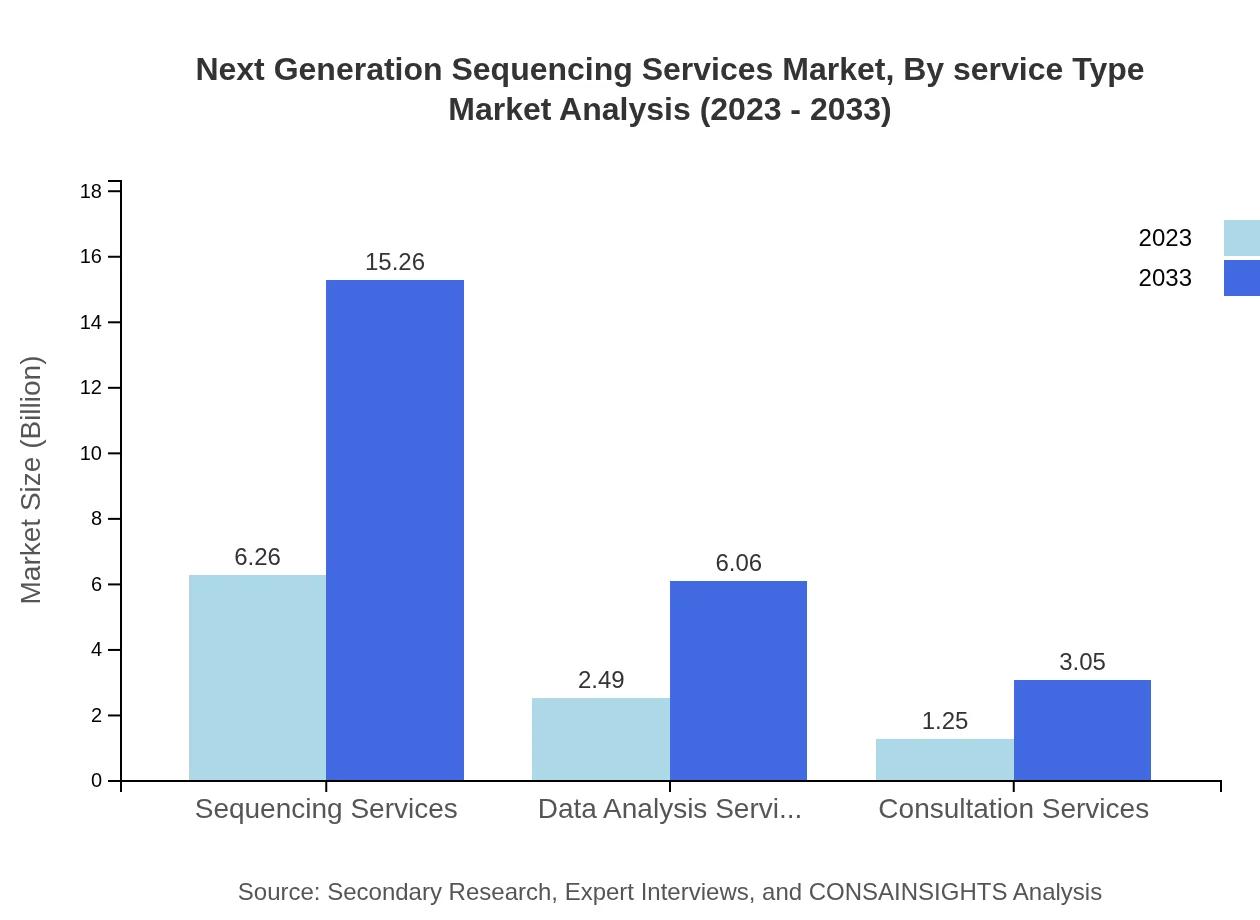

Next Generation Sequencing Services Market Analysis By Service Type

The service type segment is primarily led by Sequencing Services which accounts for 62.64% market share, projected to rise from $6.26 billion in 2023 to $15.26 billion by 2033. Following this, Data Analysis Services and Consultation Services are also significant, with shares of 24.86% and 12.5% respectively, highlighting the importance of integrated service offerings in the NGS market.

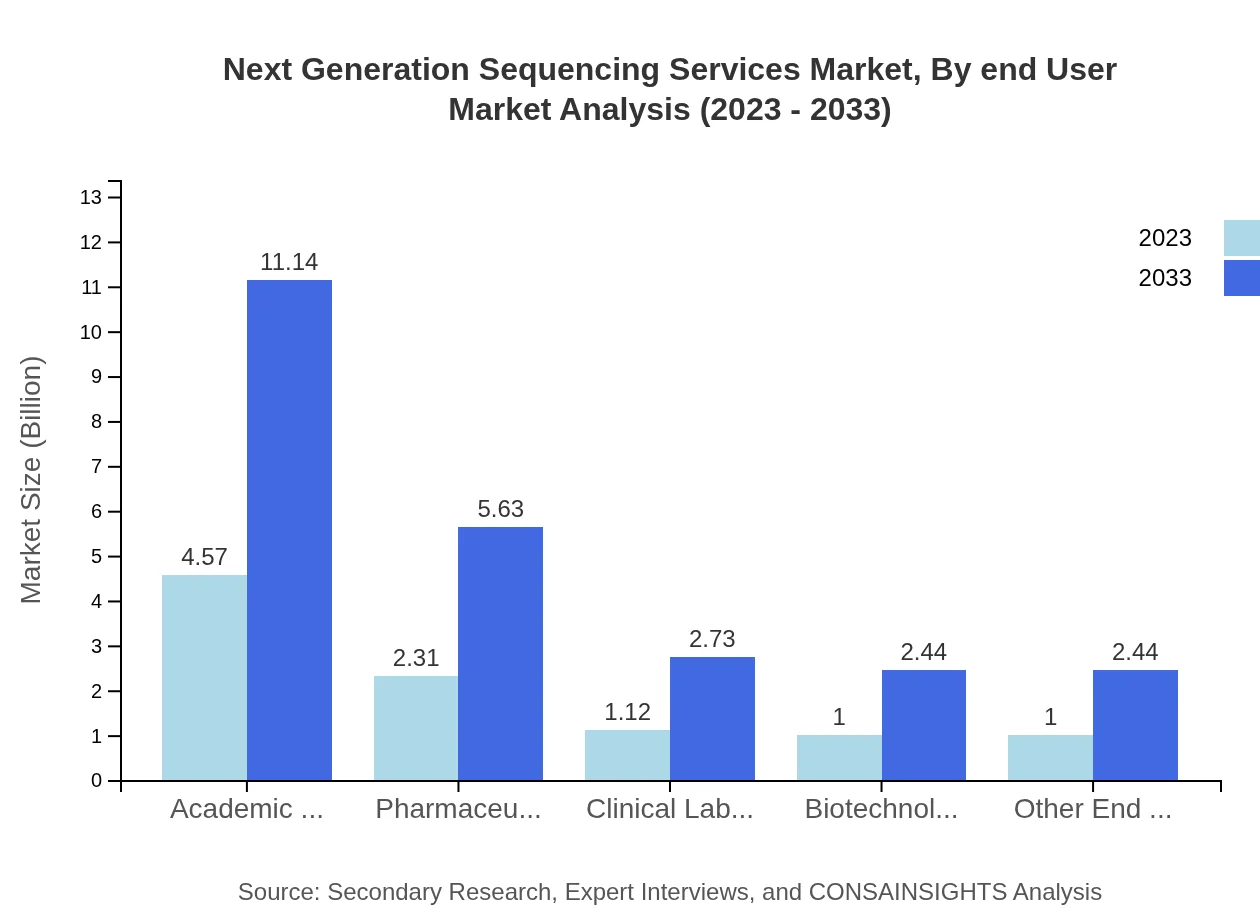

Next Generation Sequencing Services Market Analysis By End User

Key end-users of NGS services include Academic Research Institutes which comprise 45.71% at a market size of $4.57 billion, promising growth to $11.14 billion by 2033. Pharmaceutical Companies play an essential role too, accounting for 23.1% of the market share. Clinical Laboratories and Biotechnology Firms are critical end-users contributing to the market's development.

Next Generation Sequencing Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Next Generation Sequencing Services Industry

Illumina, Inc.:

Illumina is a leading developer, manufacturer, and marketer of life sciences tools and integrated systems for the analysis of genetic variation and function. Its sequencing technology is widely used in genomic research and clinical applications worldwide.Thermo Fisher Scientific Inc.:

Thermo Fisher provides innovative sequencing solutions that enable researchers and clinical laboratories to harness the power of genomics to advance the understanding of disease and improve patient care.PacBio:

Pacific Biosciences of California, Inc. (PacBio) is known for its SMRT sequencing technology that provides high accuracy and long reads, making significant contributions to genomic research, especially in complex genomic regions.Oxford Nanopore Technologies Ltd.:

Oxford Nanopore Technologies offers a disruptive technology that enables real-time, portable DNA sequencing. Their devices cater to users from academic researchers to field-based applications in clinical and environmental settings.We're grateful to work with incredible clients.

FAQs

What is the market size of Next Generation Sequencing Services?

The market size of Next Generation Sequencing Services is projected to reach $10 billion by 2033, growing at a CAGR of 9% from its current value. This growth is driven by increasing adoption in healthcare and research.

What are the key market players or companies in the Next Generation Sequencing Services industry?

Key players in the Next Generation Sequencing Services industry include Illumina, Thermo Fisher Scientific, and BGI Genomics. These companies dominate the market through continuous innovations and strategic partnerships to expand their service offerings.

What are the primary factors driving the growth in the Next Generation Sequencing Services industry?

Factors driving growth include advancements in sequencing technologies, increasing genomic research funding, and rising demand for personalized medicine. Additionally, the growing prevalence of genetic disorders is fostering market expansion.

Which region is the fastest Growing in the Next Generation Sequencing Services?

The fastest-growing region is North America, projected to grow from $3.42 billion in 2023 to $8.34 billion by 2033. Europe follows, with significant growth due to increased research activities and funding in genomics.

Does ConsaInsights provide customized market report data for the Next Generation Sequencing Services industry?

Yes, Consainsights offers customized market report data tailored to specific client needs within the Next Generation Sequencing Services industry, ensuring relevant insights and actionable intelligence for business strategies.

What deliverables can I expect from this Next Generation Sequencing Services market research project?

Deliverables include detailed market analysis reports, competitive landscape assessments, and growth forecasts. Additionally, clients receive segmentation data and actionable insights for strategic planning in the sequencing services market.

What are the market trends of Next Generation Sequencing Services?

Market trends indicate a shift towards personalized medicine and genomic research, with growing investment in SNP genotyping and metagenomics. Increased awareness and adoption of data analysis services are also notable trends in the sector.