Next Generation Transistors Market Report

Published Date: 31 January 2026 | Report Code: next-generation-transistors

Next Generation Transistors Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Next Generation Transistors market from 2023 to 2033. It highlights market size, growth trends, technological advancements, and key players while delivering insights into regional developments and market segmentation.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

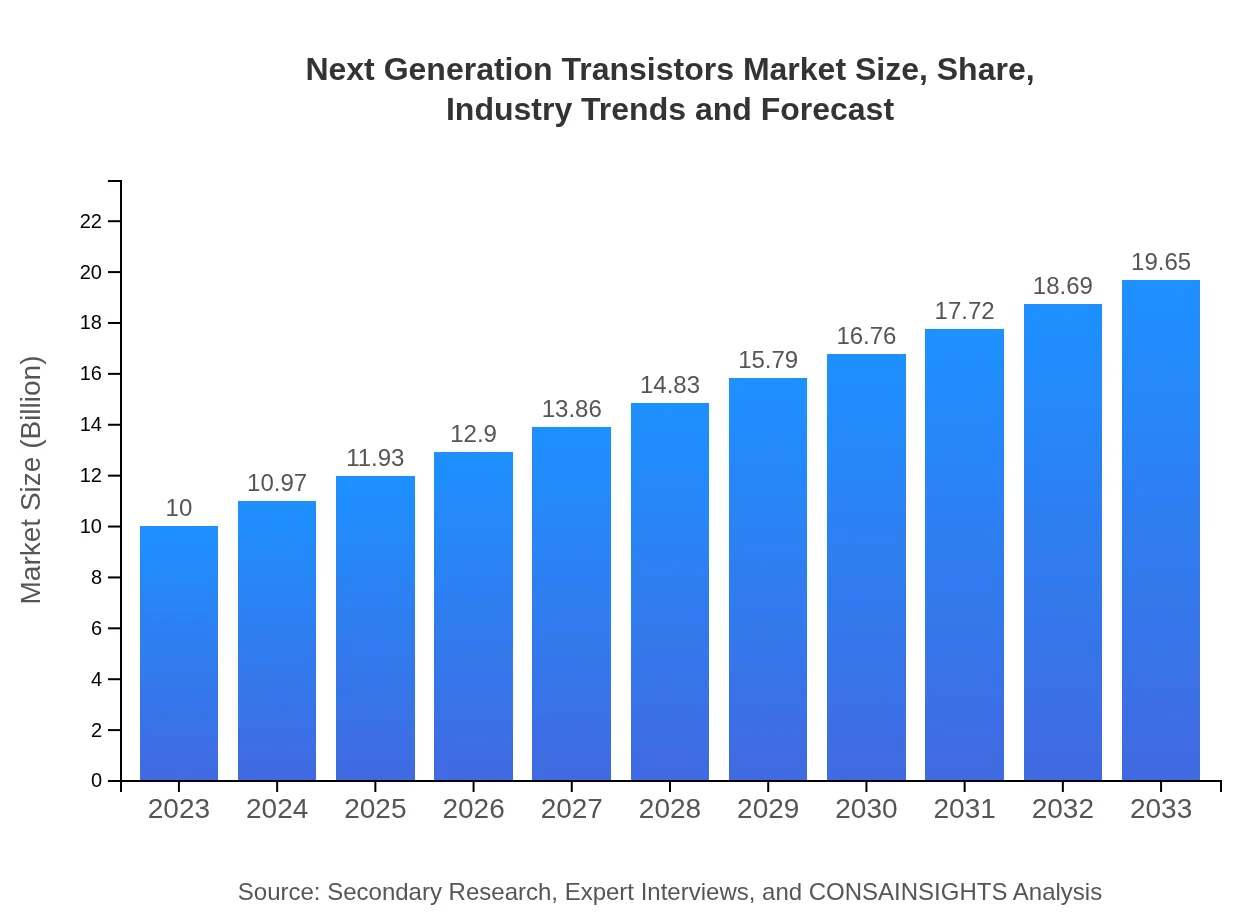

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $19.65 Billion |

| Top Companies | Intel Corporation, NVIDIA Corporation, Texas Instruments, Qualcomm , Broadcom Inc. |

| Last Modified Date | 31 January 2026 |

Next Generation Transistors Market Overview

Customize Next Generation Transistors Market Report market research report

- ✔ Get in-depth analysis of Next Generation Transistors market size, growth, and forecasts.

- ✔ Understand Next Generation Transistors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Next Generation Transistors

What is the Market Size & CAGR of Next Generation Transistors market in 2023?

Next Generation Transistors Industry Analysis

Next Generation Transistors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Next Generation Transistors Market Analysis Report by Region

Europe Next Generation Transistors Market Report:

The European Next Generation Transistors market is expected to grow from $3.36 billion in 2023 to $6.60 billion by 2033. Governments across Europe are prioritizing semiconductor technologies to enhance energy efficiency and drive economic growth. Countries like Germany, France, and the Netherlands are at the forefront of this transition, supported by strong automotive and industrial automation sectors.Asia Pacific Next Generation Transistors Market Report:

The Asia Pacific region represents a significant share of the Next Generation Transistors market, valued at approximately $1.80 billion in 2023 and projected to grow to $3.53 billion by 2033. Leading countries such as China, Japan, and South Korea are focal points for semiconductor manufacturing, bolstered by government initiatives supporting technology development and investment. The region's booming consumer electronics demand and rising automotive applications are substantial growth drivers.North America Next Generation Transistors Market Report:

In North America, the market size for Next Generation Transistors is estimated at $3.37 billion in 2023, anticipating a rise to $6.63 billion by 2033. The United States remains a leader in semiconductor innovation, with a strong focus on automotive systems, IoT, and aerospace applications contributing to robust market growth. The presence of key players and accelerated investments in R&D further amplify this region's prominence.South America Next Generation Transistors Market Report:

The South American market for Next Generation Transistors is relatively smaller, starting at $0.47 billion in 2023 and expected to reach $0.93 billion by 2033. Brazil and Argentina lead the market due to growth in telecom infrastructure and energy solutions. However, challenges such as economic fluctuations and supply chain limitations must be addressed to enhance market potential.Middle East & Africa Next Generation Transistors Market Report:

The Middle East and Africa market for Next Generation Transistors is projected to grow from $1.01 billion in 2023 to $1.98 billion by 2033. The region is gradually increasing investments in technology and telecommunications infrastructure, particularly in countries like the UAE and Saudi Arabia. However, geopolitical factors may pose risks to stable growth.Tell us your focus area and get a customized research report.

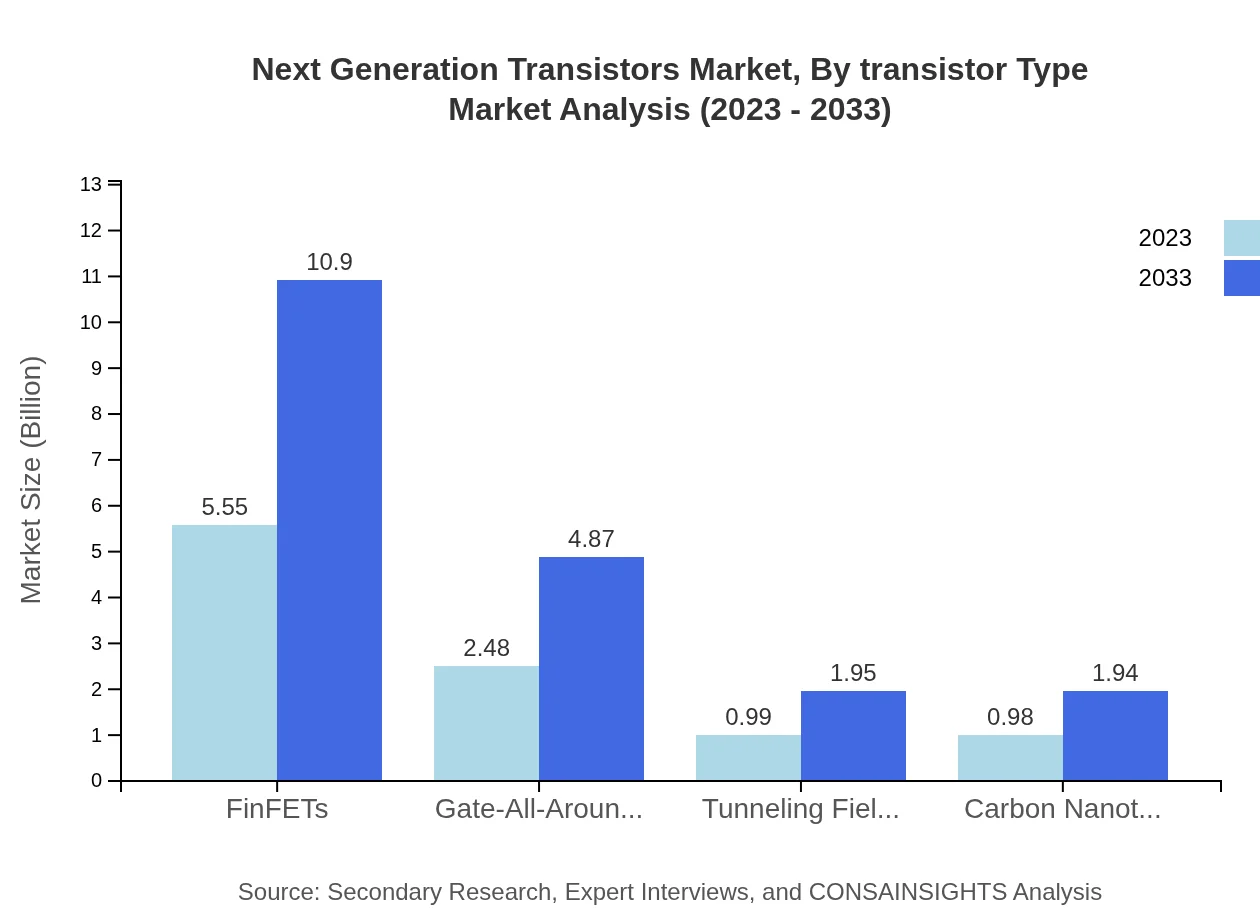

Next Generation Transistors Market Analysis By Transistor Type

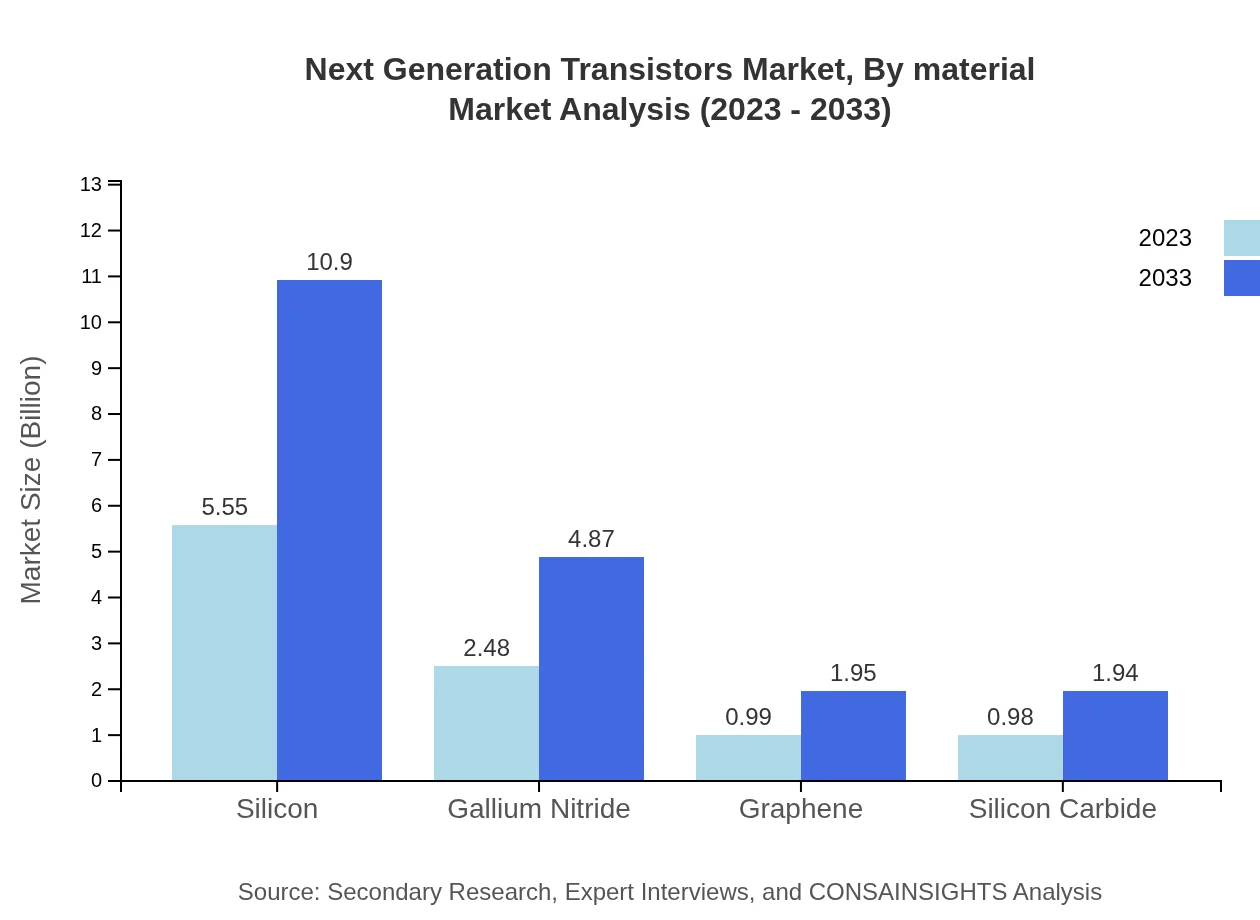

The Next Generation Transistors market is segmented into various transistor types, including FinFETs, GAA transistors, GaN, and silicon carbide. In 2023, FinFETs dominate the market segment with a size of $5.55 billion, a crucial element of modern computers and smartphones due to their compact size and efficiency. GaN transistors, critical for power applications, are expected to grow significantly, with a size of $2.48 billion in 2023. Graphene and silicon carbide transistors also represent emerging technologies, showing a notable growth trajectory.

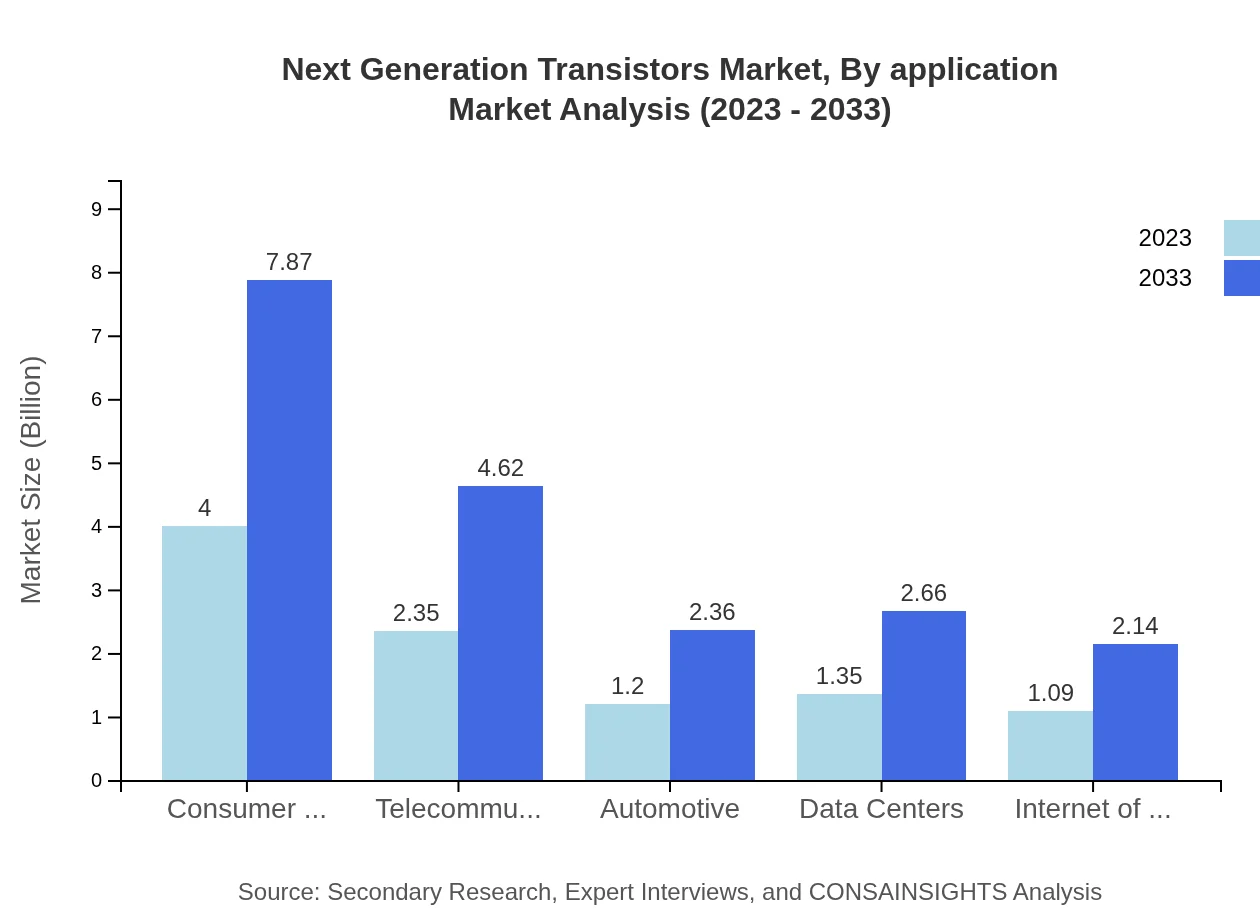

Next Generation Transistors Market Analysis By Application

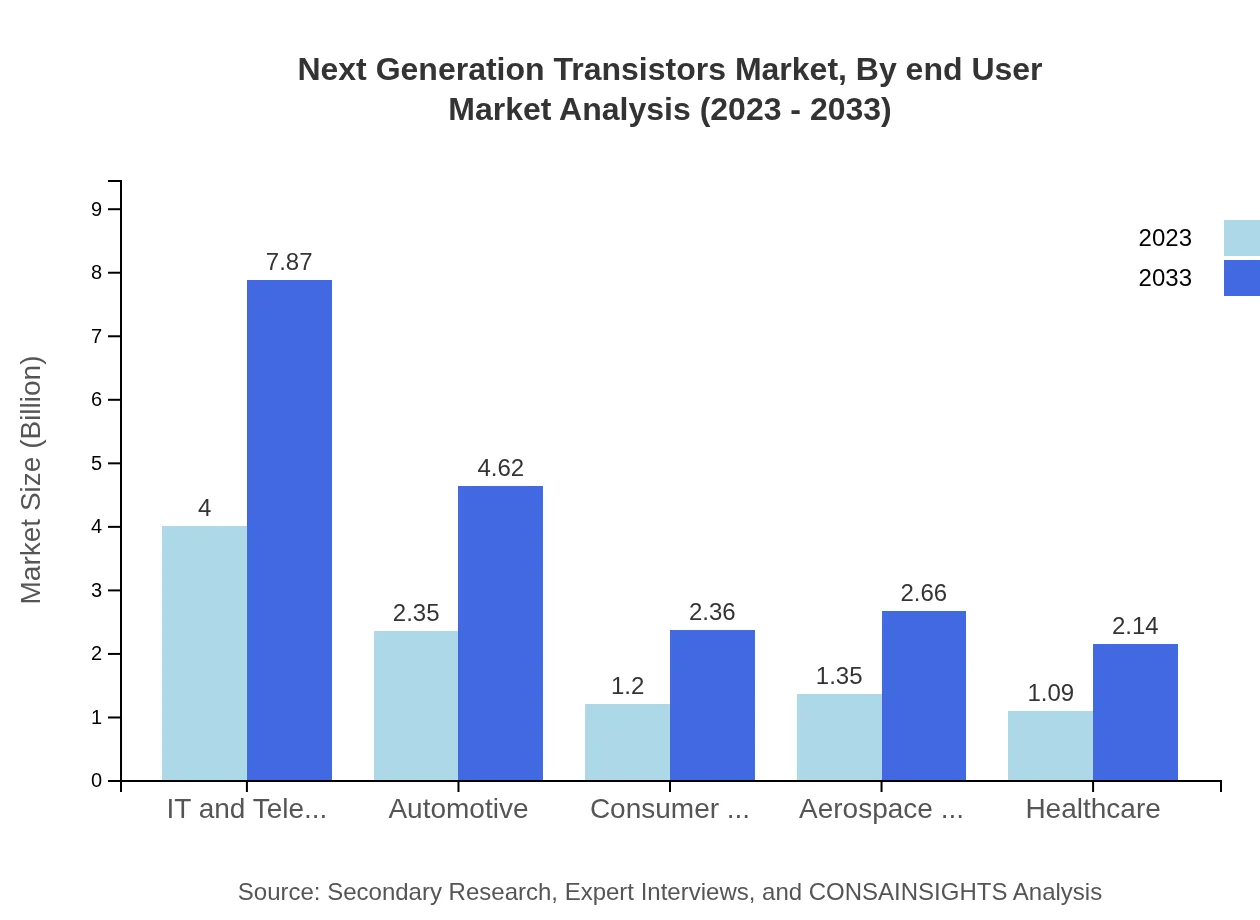

By application, the IT and telecom sector leads with a market size of $4.00 billion in 2023, thriving on the demand for high-performing electronics. The automotive segment follows closely with a size of $2.35 billion, driven by innovations in electric vehicles and autonomous driving technology. Consumer electronics, with a focus on mobile devices, represents a critical area, while sectors like healthcare and aerospace are rapidly integrating advanced transistor technology to enhance efficiencies.

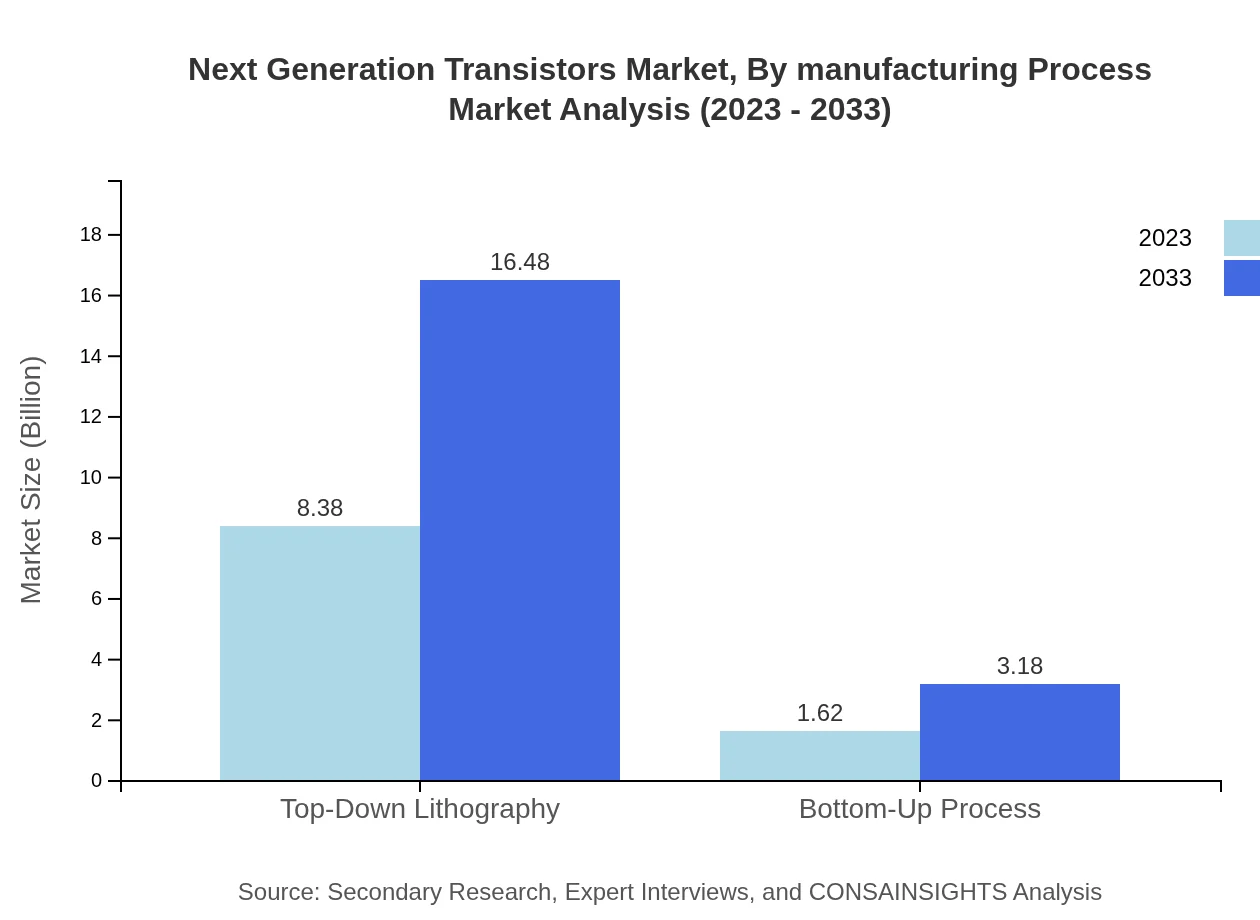

Next Generation Transistors Market Analysis By Manufacturing Process

Manufacturing processes in the Next Generation Transistors market are categorized primarily into top-down lithography and bottom-up processes. The top-down approach dominates with a size of $8.38 billion in 2023 due to its widespread application in traditional semiconductor fabrication. Interestingly, advancements in bottom-up processes are gaining traction, representing a growing segment expected to reach $3.18 billion by 2033, promising more efficient and scalable production methods.

Next Generation Transistors Market Analysis By Material

Material analysis indicates silicon remains the primary choice for transistors, making up about 55.48% of the market share in 2023, valued at $5.55 billion. Gallium nitride follows, constituting 24.76% of the market, supporting the growing need for high-efficiency power devices. Emerging materials like graphene and silicon carbide are expected to increase their relevance, presenting opportunities for new applications.

Next Generation Transistors Market Analysis By End User

The key end-user industries for Next Generation Transistors include telecommunications, IT, automotive, consumer electronics, and defense. The telecommunications sector alone represents a market size of $2.35 billion in 2023. Automotive applications are projected to grow as electric vehicles proliferate, reflecting a shifting demand towards environmentally friendly technologies. Additional sectors such as healthcare and aerospace are integrating advanced transistor technologies to enhance their operational capabilities.

Next Generation Transistors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Next Generation Transistors Industry

Intel Corporation:

A leading semiconductor manufacturer involved in the design and manufacturing of processors utilizing advanced transistor techniques, primarily focusing on FinFET technology.NVIDIA Corporation:

Known for GPU manufacturing, NVIDIA leverages cutting-edge transistor technologies to push the boundaries of graphics computing and artificial intelligence.Texas Instruments:

Specializing in analog and embedded processing technology, Texas Instruments integrates advanced Gallium Nitride transistors in their power management solutions.Qualcomm :

A global leader in wireless technology, Qualcomm uses advanced transistor designs across its diverse product portfolio, impacting mobile and telecommunications markets.Broadcom Inc.:

Focusing on connectivity solutions, Broadcom utilizes next-gen transistors extensively in its various semiconductor products that support both consumer and enterprise markets.We're grateful to work with incredible clients.

FAQs

What is the market size of next Generation transistors?

The global market size for next-generation transistors is estimated at $10 billion, with a robust CAGR of 6.8% anticipated from 2023 to 2033, reflecting significant growth in technological advancements and increased demand for high-performance electronics.

What are the key market players or companies in this next Generation transistors industry?

Leading companies in the next-generation transistors industry include Intel, Samsung, TSMC, and GlobalFoundries, which are focused on innovation and advancing semiconductor technologies, positioning themselves at the forefront of this rapidly growing market.

What are the primary factors driving the growth in the next Generation transistors industry?

Key growth drivers include rising demand for efficiency in electronic devices, advancements in integrated circuit technologies, increased investment in R&D, and the shift towards high-frequency applications across telecom, automotive, and consumer electronics sectors.

Which region is the fastest Growing in the next Generation transistors?

Regionally, Europe is projected to witness significant growth, increasing from $3.36 billion in 2023 to $6.60 billion by 2033. North America follows closely, with a growth from $3.37 billion in 2023 to $6.63 billion.

Does ConsaInsights provide customized market report data for the next Generation transistors industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs, providing detailed and actionable insights, market dynamics, and trends related to the next-generation transistors industry.

What deliverables can I expect from this next Generation transistors market research project?

Expect comprehensive market analysis reports, segmented data on technology types and applications, forecasts, competitive landscape assessments, and regional insights that equip you with strategic market entry guidance.

What are the market trends of next Generation transistors?

Currently, trends include the increasing adoption of GaN and SiC technologies, the shift towards energy-efficient devices, the growing integration of IoT and smart technologies, and ongoing innovations in transistor architecture like GAA and FinFET.