Non Alcoholic Drinks Market Report

Published Date: 31 January 2026 | Report Code: non-alcoholic-drinks

Non Alcoholic Drinks Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Non Alcoholic Drinks market, covering insights into market dynamics, segmentation, technological advancements, regional insights, and forecasts from 2023 to 2033. It aims to equip stakeholders with the necessary data to make informed decisions.

| Metric | Value |

|---|---|

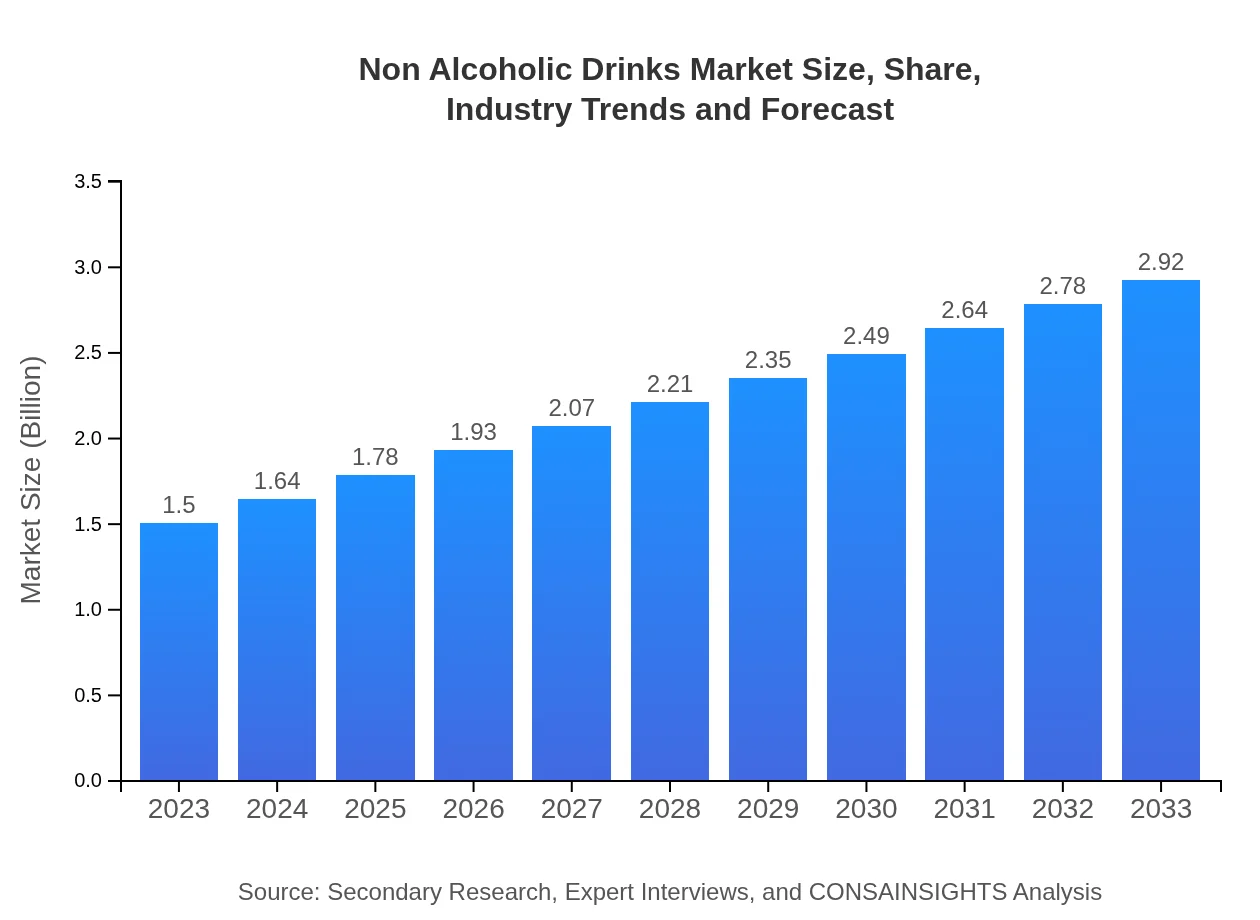

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Trillion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $2.92 Trillion |

| Top Companies | Coca-Cola Company, PepsiCo, Nestlé S.A., Dr Pepper Snapple Group |

| Last Modified Date | 31 January 2026 |

Non Alcoholic Drinks Market Overview

Customize Non Alcoholic Drinks Market Report market research report

- ✔ Get in-depth analysis of Non Alcoholic Drinks market size, growth, and forecasts.

- ✔ Understand Non Alcoholic Drinks's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Non Alcoholic Drinks

What is the Market Size & CAGR of Non Alcoholic Drinks market in 2023?

Non Alcoholic Drinks Industry Analysis

Non Alcoholic Drinks Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Non Alcoholic Drinks Market Analysis Report by Region

Europe Non Alcoholic Drinks Market Report:

The European Non Alcoholic Drinks market is projected to rise from $0.45 trillion in 2023 to $0.88 trillion by 2033. Trends towards healthier lifestyles and sustainability are shaping preferences, leading to a surge in demand for organic and plant-based non-alcoholic options.Asia Pacific Non Alcoholic Drinks Market Report:

In the Asia Pacific region, the Non Alcoholic Drinks market is projected to grow from $0.32 trillion in 2023 to $0.62 trillion by 2033, driven by a young population and increasing disposable income. The demand for flavored carbonated and non-carbonated beverages continues to rise as consumers become more health-conscious and seek refreshing alternatives.North America Non Alcoholic Drinks Market Report:

In North America, the market size is expected to escalate from $0.50 trillion in 2023 to $0.96 trillion by 2033. This growth can be attributed to the rising trend of health-conscious consumers gravitating towards alternatives like sparkling water, organic juices, and low-calorie options, driven by lifestyle changes.South America Non Alcoholic Drinks Market Report:

The South American market for Non Alcoholic Drinks is estimated to progress from $0.09 trillion in 2023 to $0.18 trillion by 2033. The region is witnessing increased consumption of juices and flavored drinks, particularly among younger demographics seeking more flavor and nutritional value in their beverages.Middle East & Africa Non Alcoholic Drinks Market Report:

In the Middle East and Africa, the market is expected to increase from $0.14 trillion in 2023 to $0.28 trillion by 2033. Growing urbanization, changing lifestyles, and increasing awareness towards health and fitness are influencing the growth of the Non Alcoholic Drinks market in this diverse and rapidly developing region.Tell us your focus area and get a customized research report.

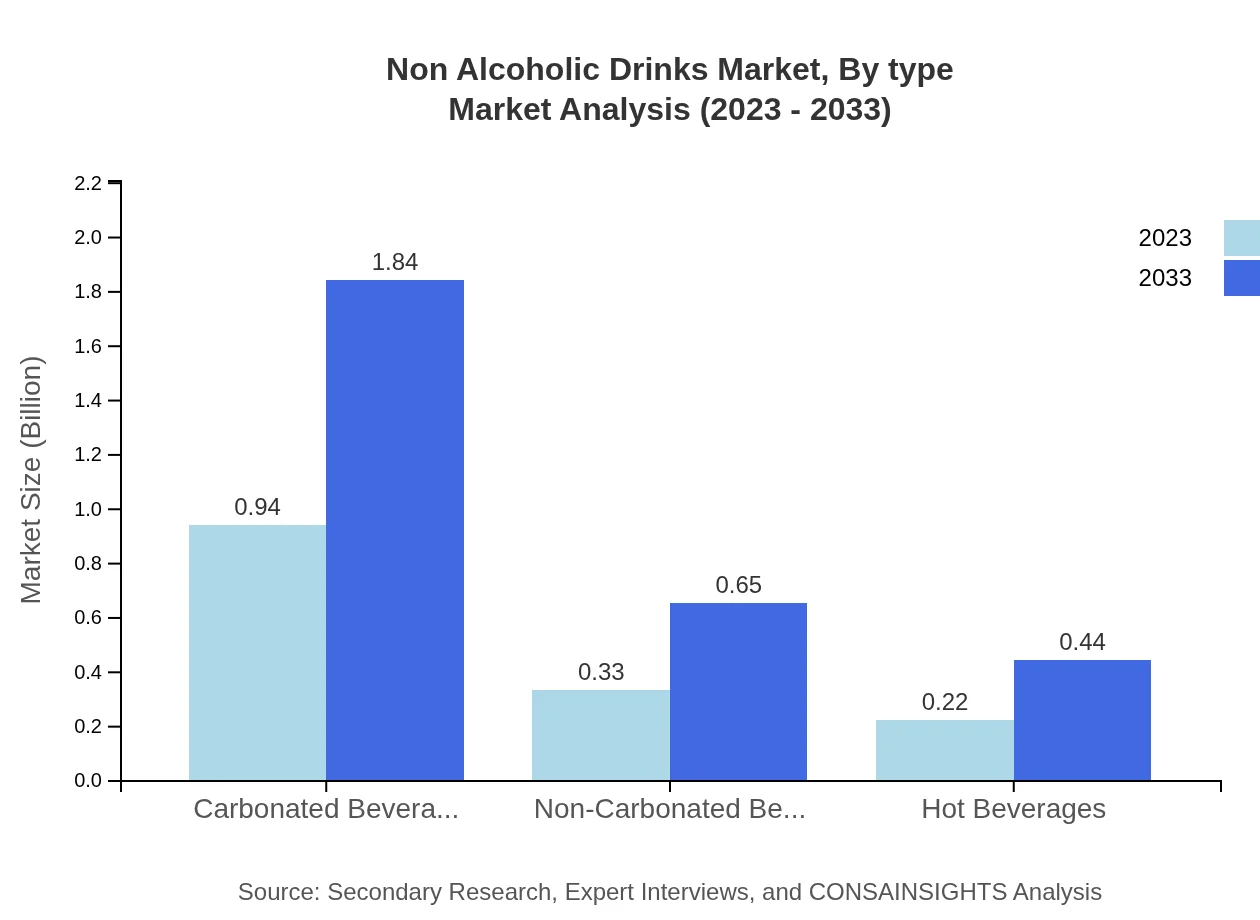

Non Alcoholic Drinks Market Analysis By Type

The Non-Alcoholic Drinks market, By Type, is dominated by carbonated beverages, representing a market size of $0.94 trillion in 2023, expected to grow to $1.84 trillion by 2033, holding a 62.88% market share. Non-carbonated beverages are also gaining momentum, increasing from $0.33 trillion in 2023 to $0.65 trillion in 2033, while hot beverages are projected to grow from $0.22 trillion to $0.44 trillion in the same period.

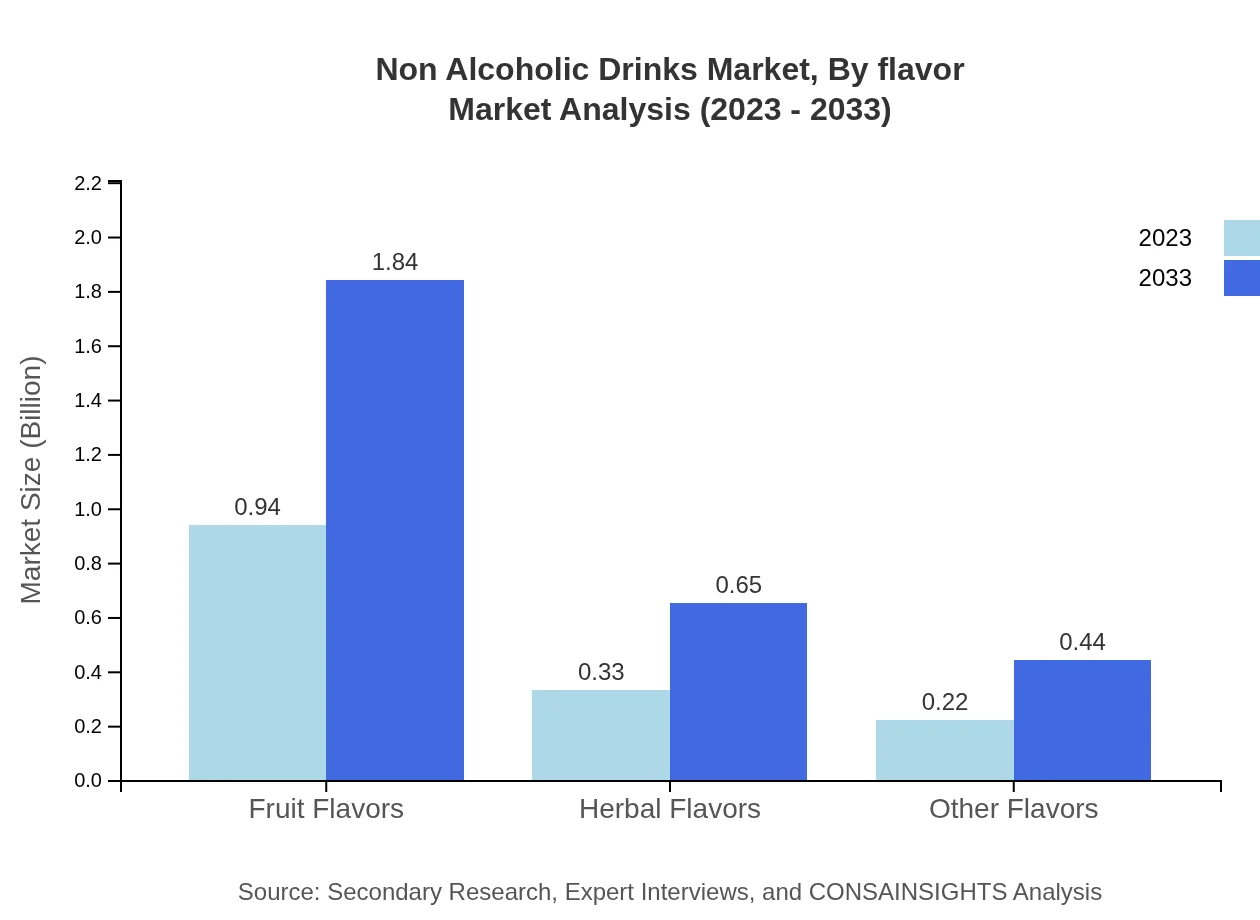

Non Alcoholic Drinks Market Analysis By Flavor

In terms of flavor, fruit flavors dominate the Non-Alcoholic Drinks Market, accounting for $0.94 trillion in 2023 and projected to reach $1.84 trillion by 2033, with a consistent market share of 62.88%. Herbal flavors and other flavors follow, growing from $0.33 trillion and $0.22 trillion respectively in 2023 to $0.65 trillion and $0.44 trillion by 2033.

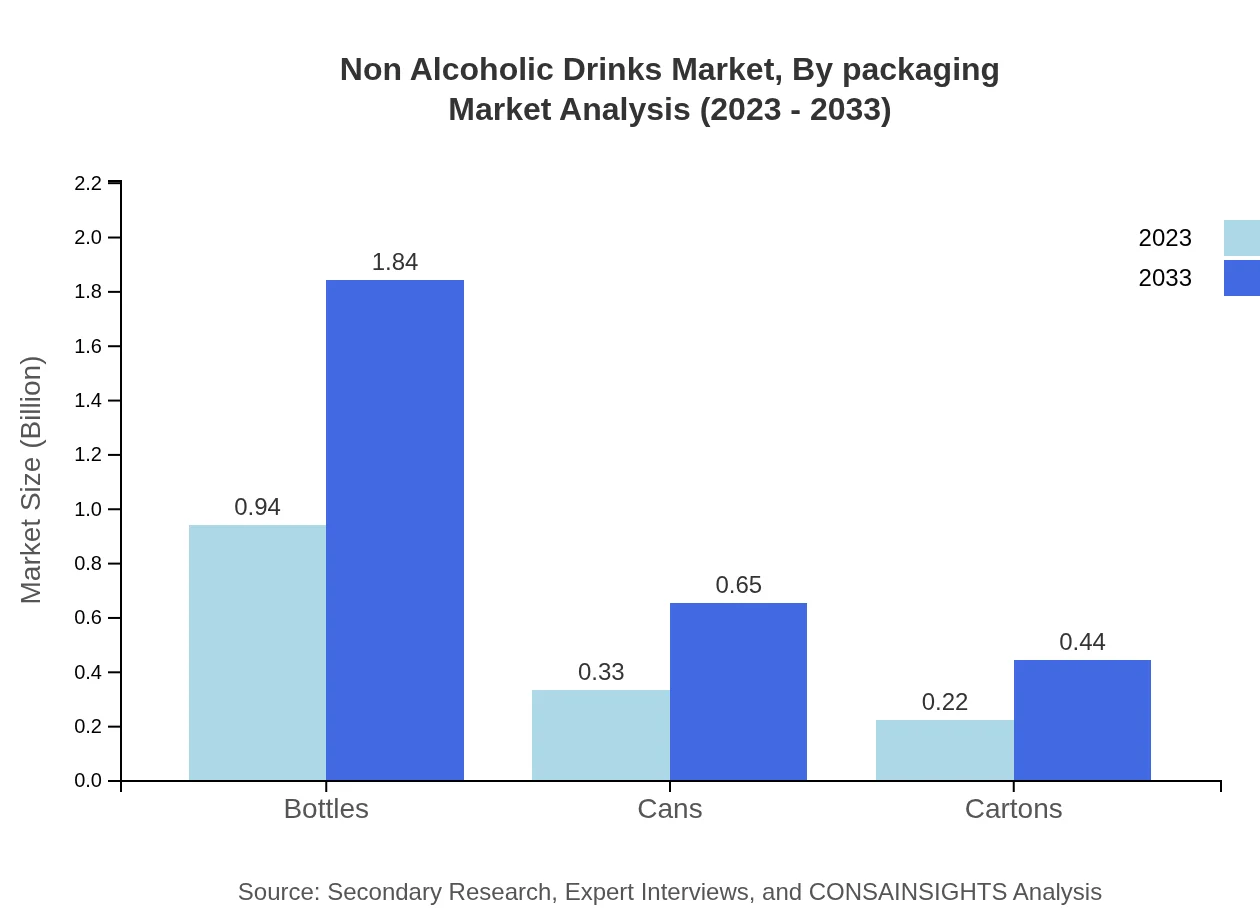

Non Alcoholic Drinks Market Analysis By Packaging

Bottles lead the packaging segment with a market size of $0.94 trillion in 2023, expected to double to $1.84 trillion by 2033, maintaining a dominant 62.88% share. Cans and cartons represent the next tiers, growing from $0.33 trillion and $0.22 trillion respectively in 2023 to $0.65 trillion and $0.44 trillion by 2033.

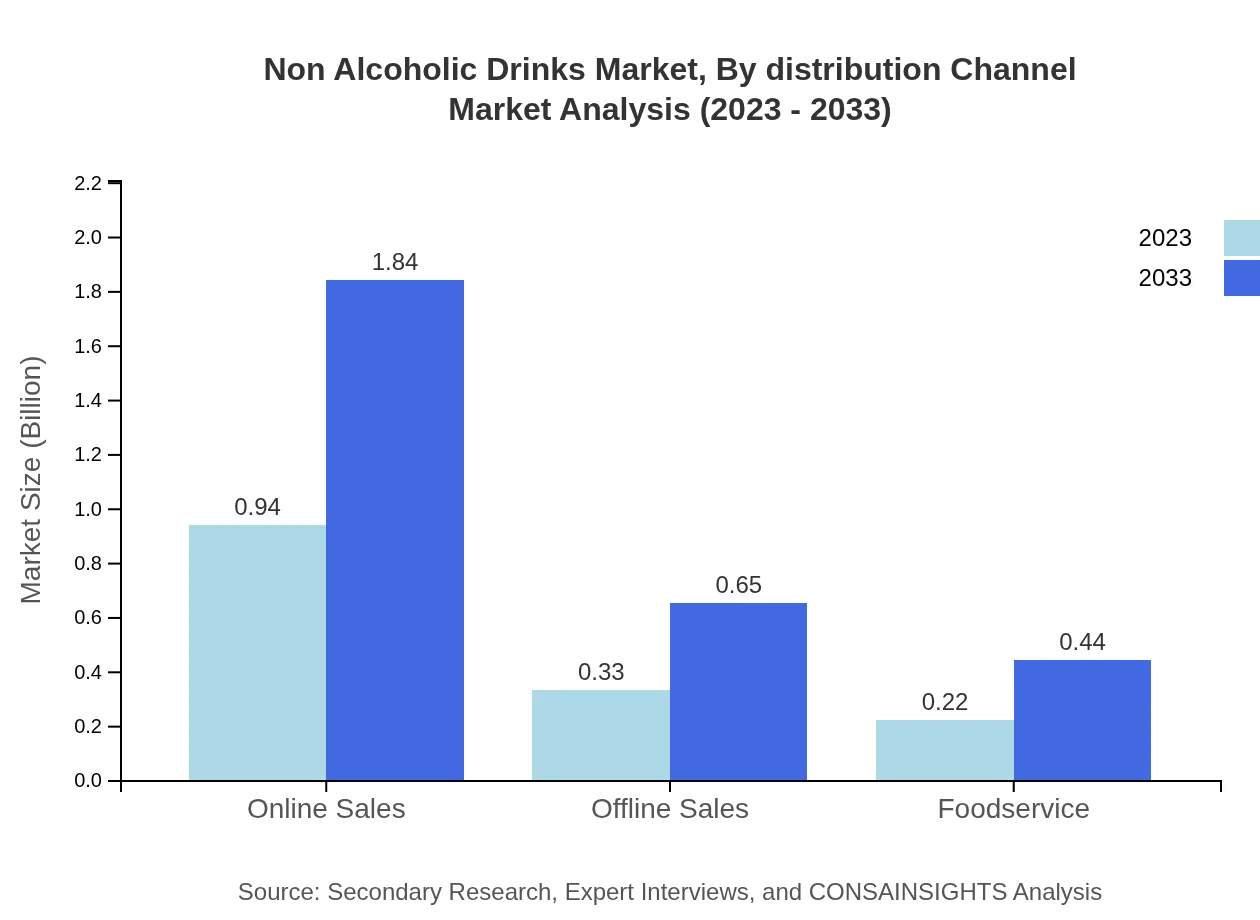

Non Alcoholic Drinks Market Analysis By Distribution Channel

The online sales channel continues to grow significantly, with $0.94 trillion in 2023, projected to reach $1.84 trillion by 2033, holding a substantial share of 62.88%. Offline sales remain relevant but are showing slower growth, expected to move from $0.33 trillion to $0.65 trillion by 2033.

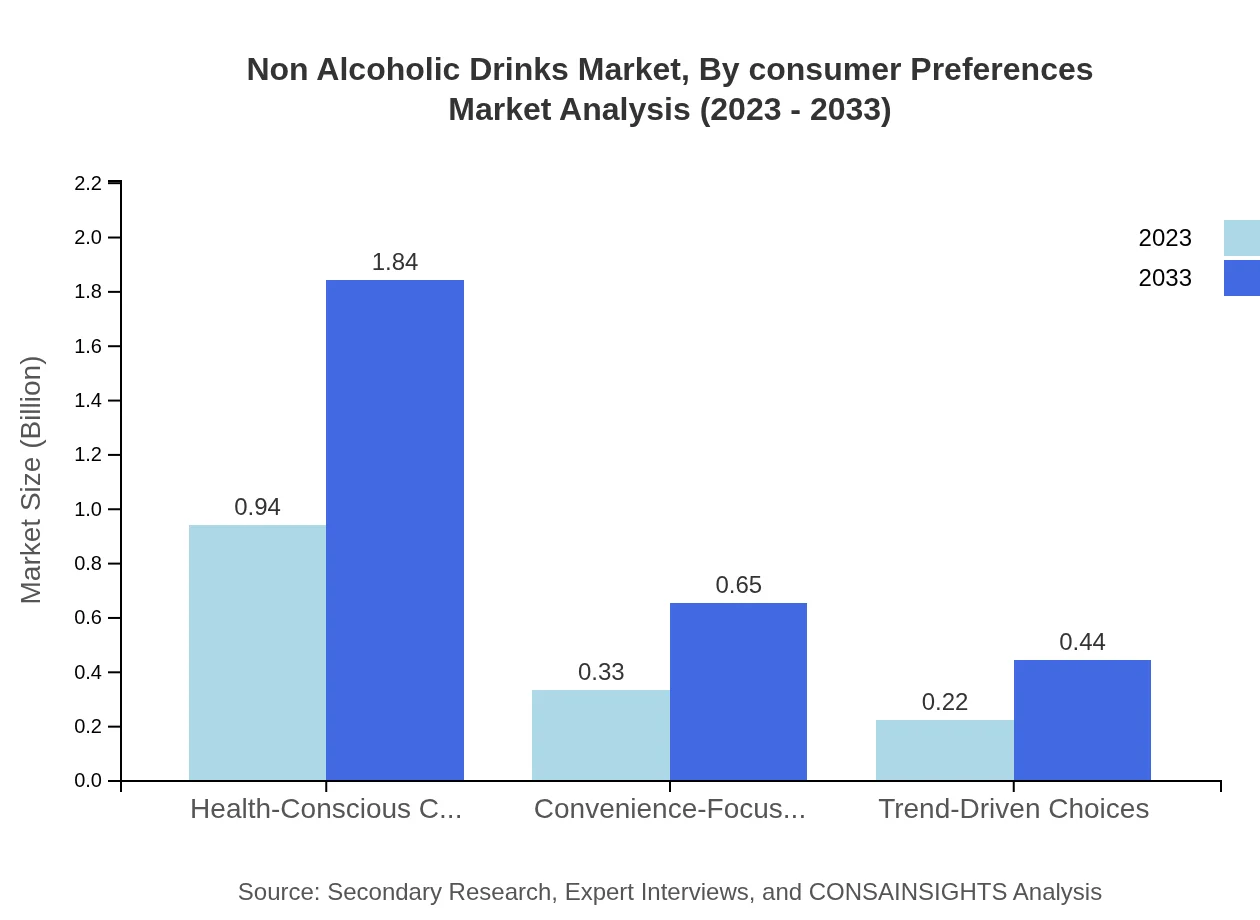

Non Alcoholic Drinks Market Analysis By Consumer Preferences

Health-conscious choices dominate with market figures reflecting $0.94 trillion in 2023, growing to $1.84 trillion by 2033. Convenience-focused choices and trend-driven choices are also parts of this analysis, with projections of $0.33 trillion and $0.22 trillion in 2023 growing to $0.65 trillion and $0.44 trillion respectively by 2033.

Non Alcoholic Drinks Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Non Alcoholic Drinks Industry

Coca-Cola Company:

A leading global beverage corporation known for its soft drinks and a wide array of non-alcoholic beverages, focusing on innovation and sustainability.PepsiCo:

One of the largest food and beverage companies in the world, PepsiCo offers a diverse range of non-alcoholic drinks, enhancing its portfolio with health-centric options.Nestlé S.A.:

A multinational food and beverage leader, Nestlé is committed to health and wellness, producing water and functional beverages that cater to changing consumer preferences.Dr Pepper Snapple Group:

A notable player providing a myriad of flavored and carbonated beverages, focusing on diversifying their product offerings to meet market demands.We're grateful to work with incredible clients.

FAQs

What is the market size of non Alcoholic drinks?

The non-alcoholic drinks market is valued at approximately $1.5 trillion in 2023, with an expected CAGR of 6.7% from 2023 to 2033, indicating robust growth across various segments and regions over the next decade.

What are the key market players or companies in this non Alcoholic drinks industry?

Key players in the non-alcoholic drinks industry include major beverage companies such as Coca-Cola, PepsiCo, Nestlé, Diageo, and Red Bull, who dominate with diverse offerings competing in carbonated, non-carbonated, and health-oriented beverage segments.

What are the primary factors driving the growth in the non Alcoholic drinks industry?

Growth is primarily driven by increasing health consciousness, rising demand for healthier beverage options, innovative product offerings, and changing consumer preferences towards refreshing, flavorful non-alcoholic alternatives over traditional alcoholic drinks.

Which region is the fastest Growing in the non Alcoholic drinks market?

The Asia Pacific region is expected to be the fastest-growing market for non-alcoholic drinks, increasing from $0.32 trillion in 2023 to $0.62 trillion by 2033, driven by urbanization, rising disposable incomes, and changing dietary habits.

Does ConsaInsights provide customized market report data for the non Alcoholic drinks industry?

Yes, ConsaInsights offers customized market report data to tailor insights to specific business needs within the non-alcoholic drinks industry, ensuring that clients have access to relevant market trends, forecasts, and segmented analyses.

What deliverables can I expect from this non Alcoholic drinks market research project?

Deliverables from the market research project include comprehensive reports, data analytics on market size and trends, regional insights, competitive analyses, and strategic recommendations to help inform business decisions in the non-alcoholic drinks sector.

What are the market trends of non Alcoholic drinks?

Key trends in the non-alcoholic drinks market include a shift towards health-conscious products, the rise of online sales channels, and a growing interest in innovative flavors and sustainable packaging, reflecting changing consumer demands and lifestyle choices.