Non Chemical Seed Treatment Market Report

Published Date: 02 February 2026 | Report Code: non-chemical-seed-treatment

Non Chemical Seed Treatment Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Non Chemical Seed Treatment market, highlighting key insights and data trends from 2023 to 2033. It covers market size, growth rates, regional dynamics, technology advancements, and competitive landscape.

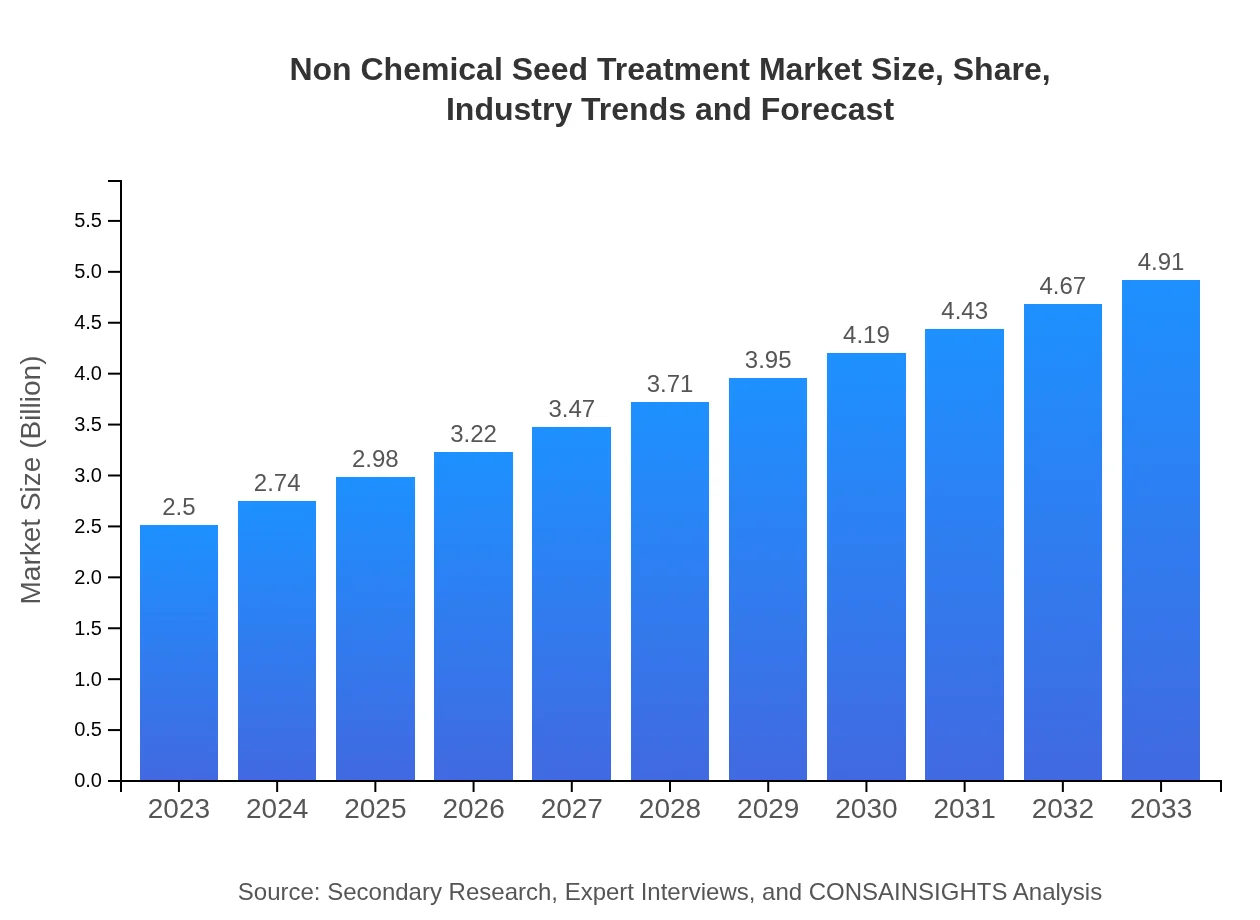

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | BASF SE, Syngenta AG, Monsanto Company, Koppert Biological Systems, Sustainable Seed Systems |

| Last Modified Date | 02 February 2026 |

Non Chemical Seed Treatment Market Overview

Customize Non Chemical Seed Treatment Market Report market research report

- ✔ Get in-depth analysis of Non Chemical Seed Treatment market size, growth, and forecasts.

- ✔ Understand Non Chemical Seed Treatment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Non Chemical Seed Treatment

What is the Market Size & CAGR of Non Chemical Seed Treatment market in 2023?

Non Chemical Seed Treatment Industry Analysis

Non Chemical Seed Treatment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Non Chemical Seed Treatment Market Analysis Report by Region

Europe Non Chemical Seed Treatment Market Report:

Europe shows a robust market for Non Chemical Seed Treatment, expected to rise from USD 0.77 billion in 2023 to USD 1.51 billion by 2033. Strong regulatory frameworks promoting organic farming and environmentally friendly practices in agriculture boost demand for non-chemical seed treatments across the region, particularly in Germany and France.Asia Pacific Non Chemical Seed Treatment Market Report:

In the Asia-Pacific region, the Non Chemical Seed Treatment market is projected to grow from USD 0.51 billion in 2023 to USD 1.00 billion by 2033. Rapid agricultural advancements and a growing population drive the need for effective seed treatments. Countries like India and China are increasingly adopting non-chemical practices to enhance their agricultural productivity and sustainability.North America Non Chemical Seed Treatment Market Report:

In North America, the market is anticipated to expand significantly, growing from USD 0.83 billion in 2023 to USD 1.64 billion by 2033. The region is at the forefront of agricultural innovations, with substantial investments in research focused on sustainable agriculture and the adoption of non-chemical treatments aiming to boost yields and preserve ecological balance.South America Non Chemical Seed Treatment Market Report:

The South American market is expected to witness growth from USD 0.16 billion in 2023 to USD 0.31 billion by 2033. The agricultural sector is pivotal in this region, and increasing awareness regarding sustainable farming practices is propelling the adoption of non-chemical seed treatments, particularly in Brazil and Argentina.Middle East & Africa Non Chemical Seed Treatment Market Report:

The Middle East and Africa market is projected to grow from USD 0.23 billion in 2023 to USD 0.46 billion by 2033. Although still emerging, there is rising interest in sustainable agricultural practices due to food security concerns, particularly in countries such as South Africa and Egypt, leading to increased adoption of non-chemical treatments.Tell us your focus area and get a customized research report.

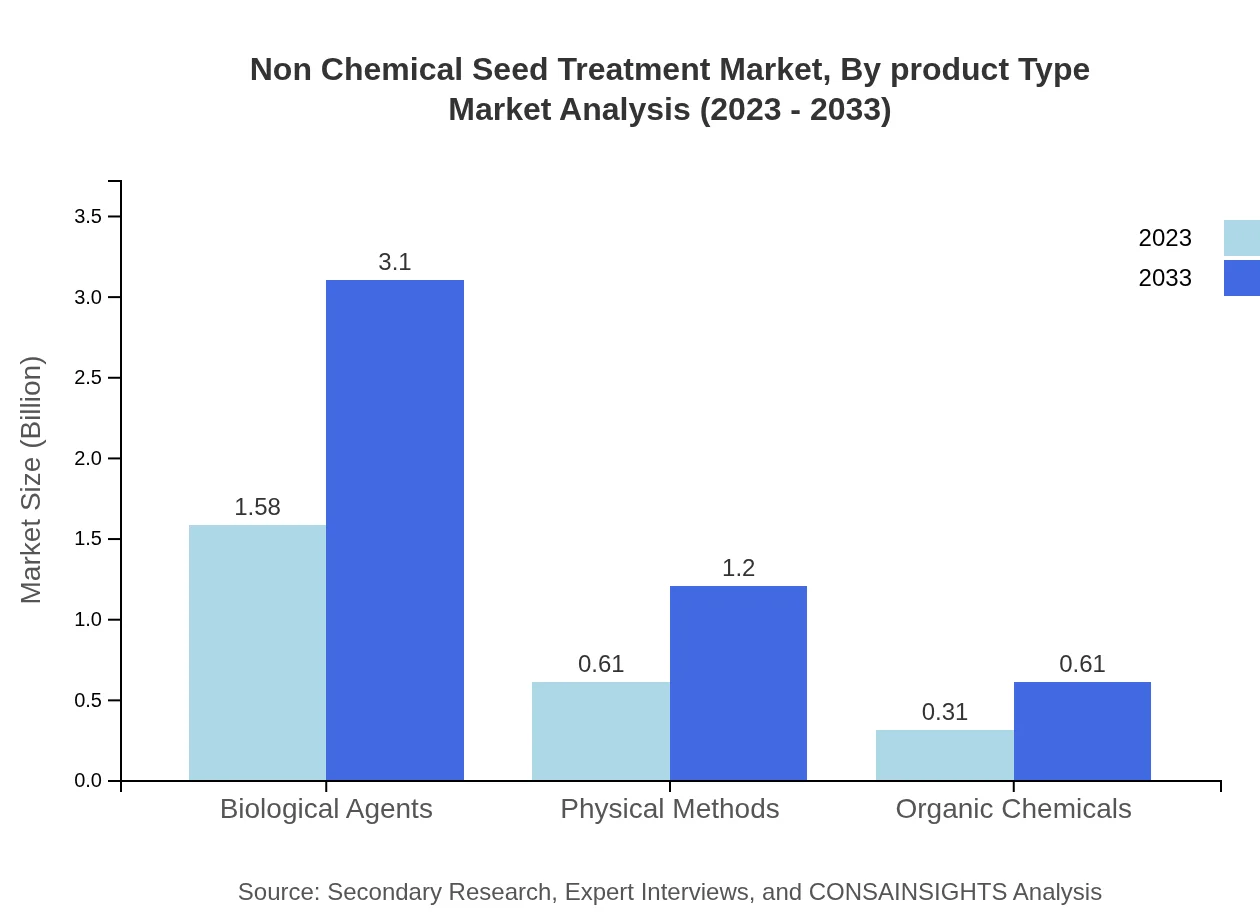

Non Chemical Seed Treatment Market Analysis By Product Type

The Non Chemical Seed Treatment market analysis by product type highlights three main categories: biological agents, physical methods, and organic chemicals. Biological agents dominate the market, accounting for USD 1.58 billion in 2023, projected to rise to USD 3.10 billion by 2033. Physical methods are valued at USD 0.61 billion in 2023, expecting to reach USD 1.20 billion by 2033, while organic chemicals will grow from USD 0.31 billion to USD 0.61 billion in the same period.

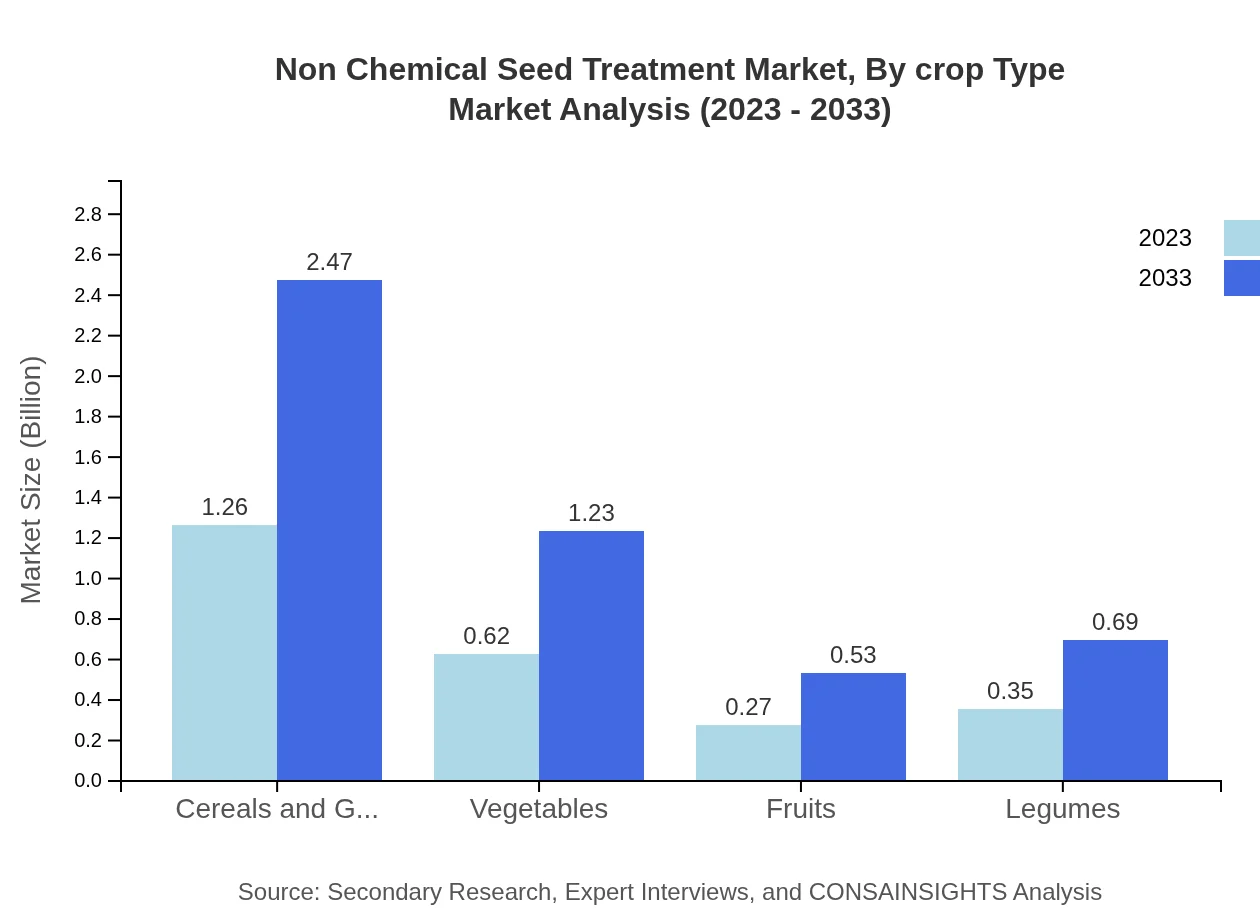

Non Chemical Seed Treatment Market Analysis By Crop Type

Analyzing by crop type, cereals and grains are pivotal in the Non Chemical Seed Treatment market, with a value of USD 1.26 billion in 2023, anticipated to increase to USD 2.47 billion by 2033. Vegetables and fruits represent significant segments, growing respectively from USD 0.62 billion to USD 1.23 billion and USD 0.27 billion to USD 0.53 billion during the forecast period.

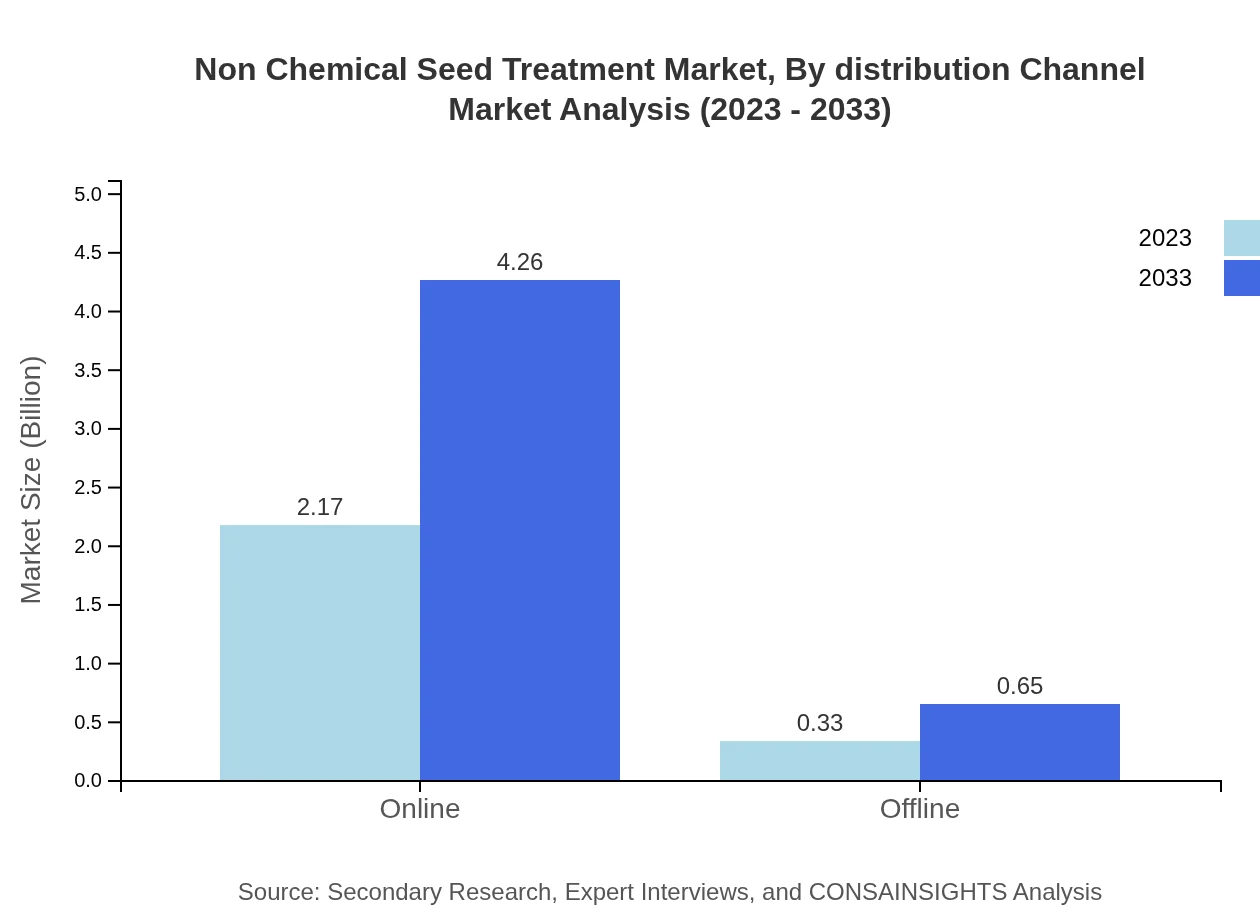

Non Chemical Seed Treatment Market Analysis By Distribution Channel

The distribution channel segment indicates a robust online market presence, with online sales at USD 2.17 billion in 2023 and projected to grow to USD 4.26 billion by 2033. Offline sales are also vital, growing from USD 0.33 billion to USD 0.65 billion, highlighting the importance of both channels in reaching diverse customer bases effectively.

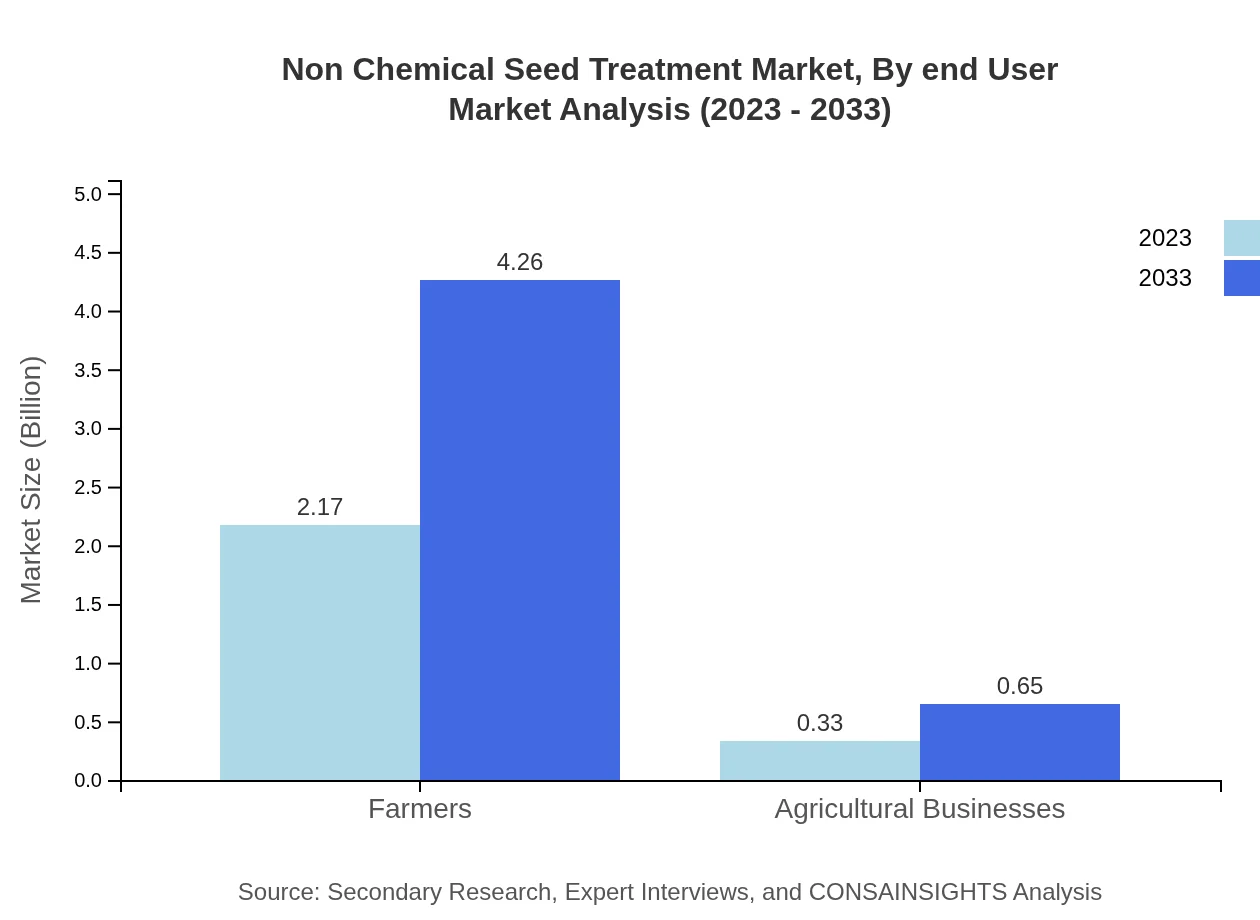

Non Chemical Seed Treatment Market Analysis By End User

The end-user segment is predominantly led by farmers, accounting for USD 2.17 billion in 2023, projected to rise to USD 4.26 billion by 2033. Agricultural businesses slightly trail, with values of USD 0.33 billion for 2023 growing to USD 0.65 billion, underscoring the critical role of farmers in adopting innovative treatments.

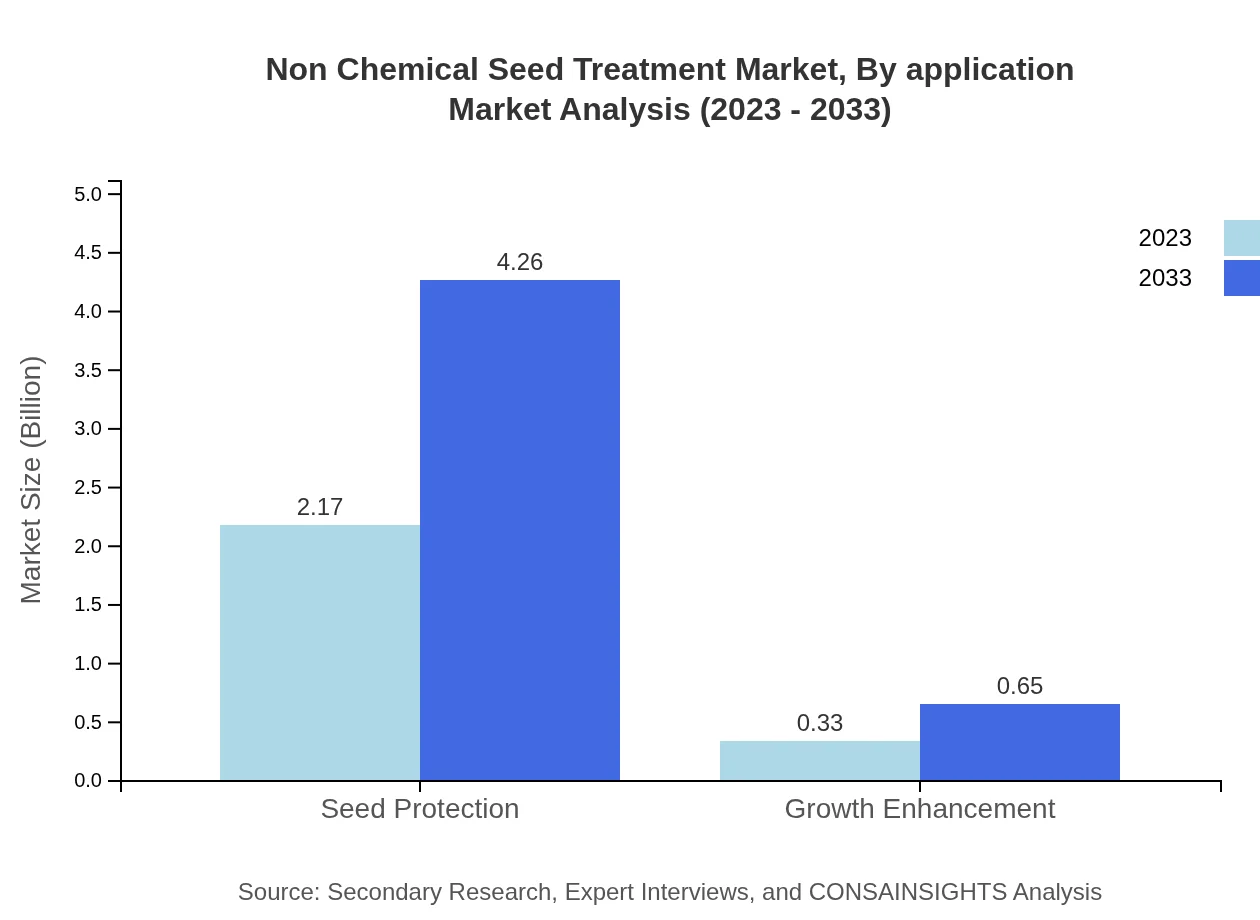

Non Chemical Seed Treatment Market Analysis By Application

In terms of application, the market highlights seed protection, which takes the lead with USD 2.17 billion in 2023, projected to reach USD 4.26 billion by 2033. Growth enhancement applications also represent significant demand, growing from USD 0.33 billion to USD 0.65 billion over the forecast period, showcasing the dual focus on protection and enhancement in non-chemical treatments.

Non Chemical Seed Treatment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Non Chemical Seed Treatment Industry

BASF SE:

A global leader in chemical solutions, BASF provides innovative non-chemical seed treatment solutions aimed at enhancing crop yield while minimizing environmental impact.Syngenta AG:

Syngenta is known for its commitment to sustainable agriculture, offering a range of biological seed treatments tailored to improve crop resilience and productivity.Monsanto Company:

Now part of Bayer, Monsanto has pioneered various non-chemical treatments for seeds, focusing on genetically modified and biological seed innovations.Koppert Biological Systems:

Specializing in natural solutions, Koppert provides a range of biological seed treatments that protect and enhance crops without relying on synthetic chemicals.Sustainable Seed Systems:

Focusing on organic seed treatments, Sustainable Seed Systems offers products that are beneficial for organic farmers looking to promote soil health and crop vigor sustainably.We're grateful to work with incredible clients.

FAQs

What is the market size of Non-Chemical Seed Treatment?

The global non-chemical seed treatment market is valued at approximately $2.5 billion as of 2023, with a compound annual growth rate (CAGR) of 6.8%. Predictions indicate a significant increase in market size by 2033.

What are the key market players or companies in the Non-Chemical Seed Treatment industry?

Key players in the non-chemical seed treatment market include major agricultural companies such as BASF, Syngenta, Bayer, and Corteva. Their innovations in seed treatment solutions drive competitive dynamics within the market.

What are the primary factors driving the growth in the Non-Chemical Seed Treatment industry?

Growth in the non-chemical seed treatment industry is fueled by increasing demand for sustainable agriculture, rising awareness of environmental protection, and the need for enhanced crop yields. Technological advancements further support market expansion.

Which region is the fastest Growing in the Non-Chemical Seed Treatment market?

The Asia Pacific region is the fastest-growing market for non-chemical seed treatment, shifting from $0.51 billion in 2023 to an estimated $1.00 billion by 2033. Europe's market is also expanding rapidly, indicating robust regional growth.

Does ConsaInsights provide customized market report data for the Non-Chemical Seed Treatment industry?

Yes, ConsaInsights offers customized market reports tailored to the specific needs of clients in the non-chemical seed treatment industry, ensuring that they receive relevant and actionable market data.

What deliverables can I expect from this Non-Chemical Seed Treatment market research project?

Deliverables from the non-chemical seed treatment market research project include comprehensive reports, data analysis, insights on market trends, competitive landscapes, and projections for future growth, segmented by region and application.

What are the market trends of Non-Chemical Seed Treatment?

Current market trends in non-chemical seed treatment include a shift towards biological agents, increasing consumer preference for organic products, and a strong focus on sustainable agricultural practices driving innovation and product development.