Non Contact Sensors Market Report

Published Date: 22 January 2026 | Report Code: non-contact-sensors

Non Contact Sensors Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Non Contact Sensors market, including trends, forecasts, and competitive landscapes from 2023 to 2033. Insights include market size, segmentation, regional analysis, and key players in the industry, aiding stakeholders in strategic decision-making.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

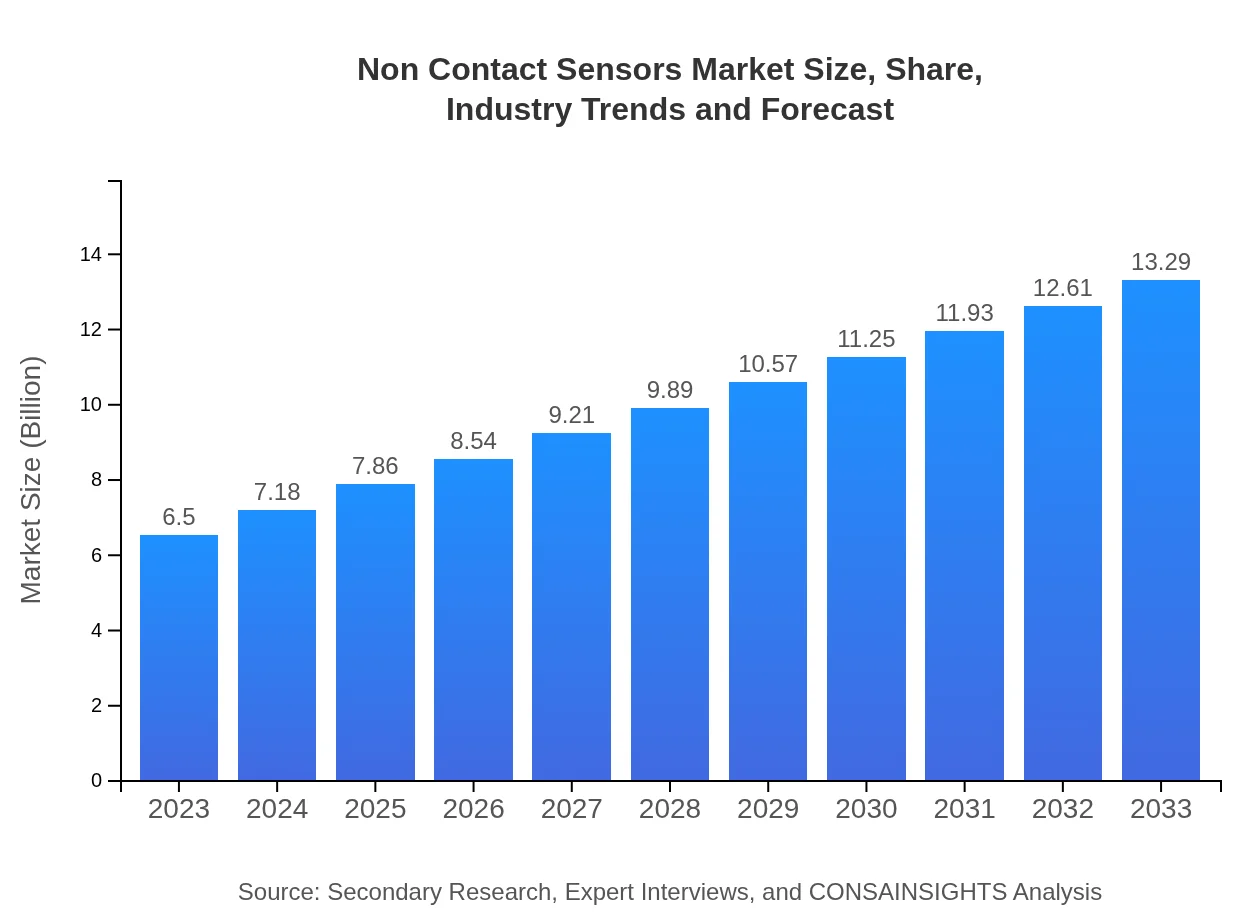

| 2023 Market Size | $6.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $13.29 Billion |

| Top Companies | Honeywell International Inc., Siemens AG, Omron Corporation, Texas Instruments, SICK AG |

| Last Modified Date | 22 January 2026 |

Non Contact Sensors Market Overview

Customize Non Contact Sensors Market Report market research report

- ✔ Get in-depth analysis of Non Contact Sensors market size, growth, and forecasts.

- ✔ Understand Non Contact Sensors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Non Contact Sensors

What is the Market Size & CAGR of Non Contact Sensors market in 2023?

Non Contact Sensors Industry Analysis

Non Contact Sensors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Non Contact Sensors Market Analysis Report by Region

Europe Non Contact Sensors Market Report:

Europe's Non Contact Sensors market is valued at $1.65 billion in 2023, set to grow to $3.38 billion by 2033. The region's emphasis on automation in manufacturing and strict safety regulations contributes to market expansion.Asia Pacific Non Contact Sensors Market Report:

In 2023, the Asia Pacific market is valued at $1.43 billion and projected to reach $2.92 billion by 2033. Significant growth is driven by increasing industrial automation and the adoption of smart technologies in countries like China and Japan, alongside a growing manufacturing base.North America Non Contact Sensors Market Report:

North America holds a substantial share, with a market size of $2.33 billion in 2023, predicted to expand to $4.76 billion by 2033. The region's growth is fueled by a solid technology adoption rate and substantial investments across transportation and healthcare sectors.South America Non Contact Sensors Market Report:

The South American market is expected to grow from $0.65 billion in 2023 to $1.33 billion by 2033. Growth is primarily realized through rising investments in smart infrastructure and a greater focus on sustainable solutions.Middle East & Africa Non Contact Sensors Market Report:

In the Middle East and Africa, the market begins at $0.44 billion in 2023, potentially doubling to $0.89 billion by 2033. The notable growth stems from enhancing operational efficiencies in various industries, spurred by governmental initiatives to elevate technological standards.Tell us your focus area and get a customized research report.

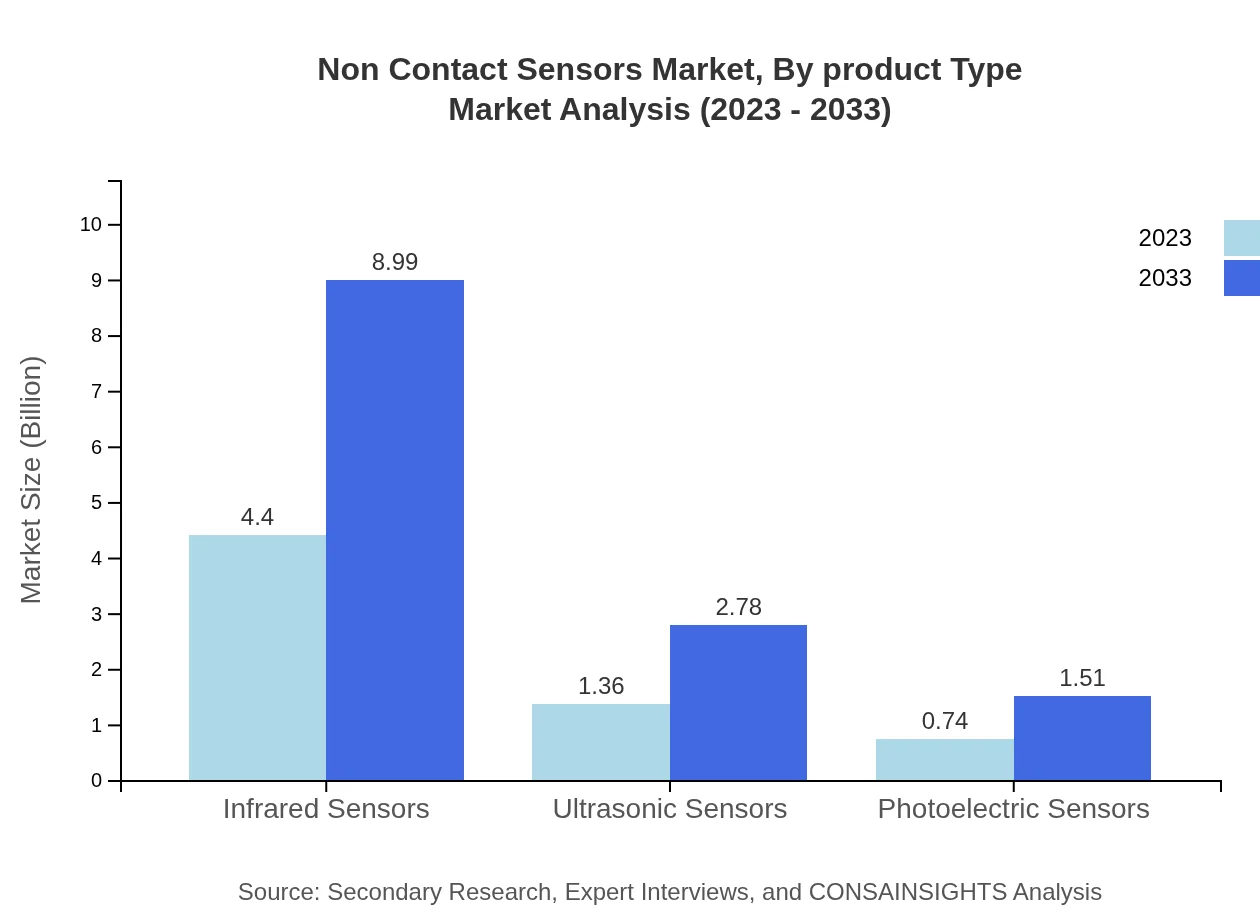

Non Contact Sensors Market Analysis By Product Type

The major product types in the Non Contact Sensors market include Laser Sensors, Capacitive Sensors, Infrared Sensors, Ultrasonic Sensors, and Microwave Sensors. In 2023, Laser Sensors dominate with a market size of $4.40 billion (67.68% share), followed by Infrared Sensors at $4.40 billion (67.68% share). The product type dynamics are crucial as they determine the technological advancements and application areas in which each sensor type excels.

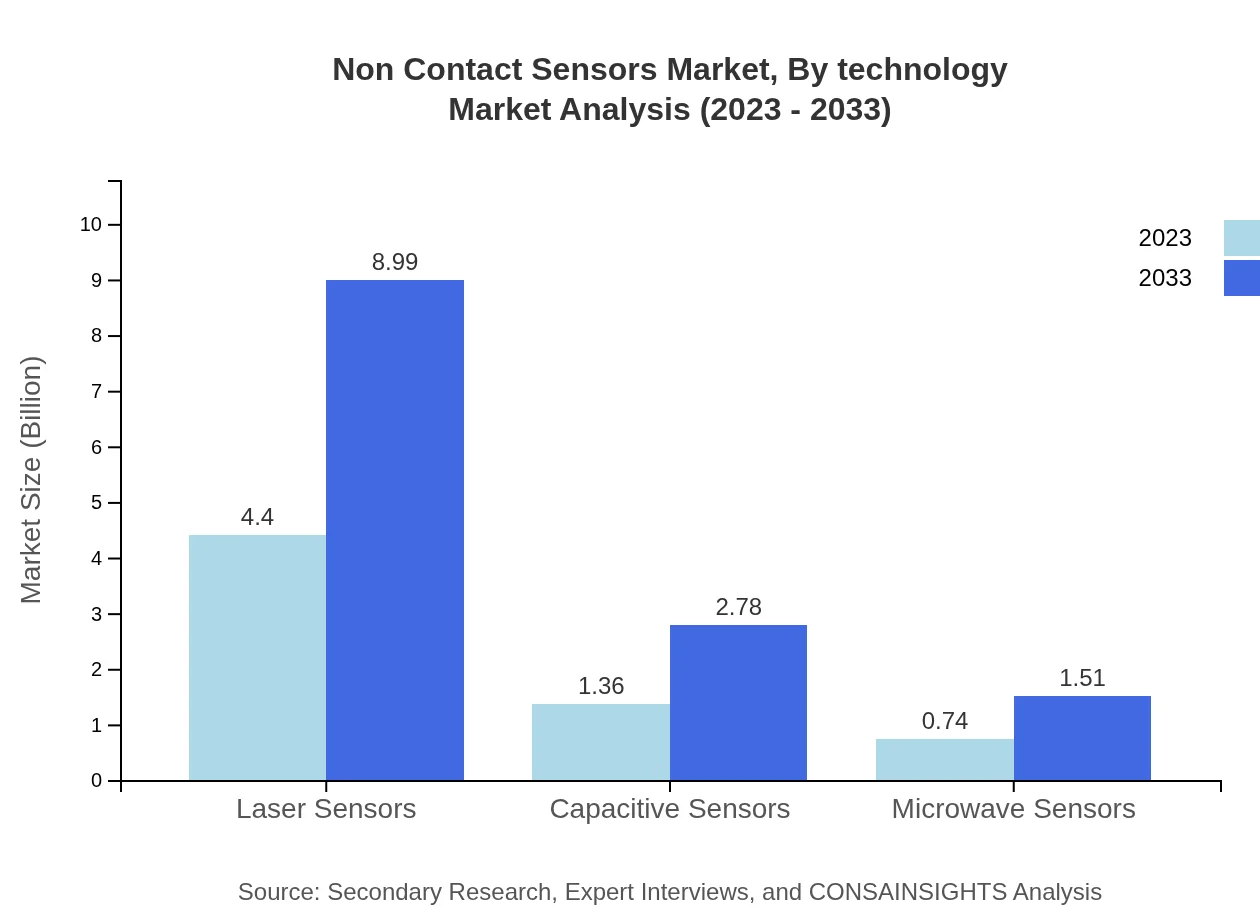

Non Contact Sensors Market Analysis By Technology

The Non Contact Sensors market can also be classified based on the underlying technology. Innovations in optical sensing, ultrasonic technology, and electromagnetic sensors represent the forefront of market technology. Continuous enhancements in these areas are indicative of advancements aimed at improving sensitivity, accuracy, and integration with smart devices. Technologies are evolving to meet the growing demands for efficient monitoring across diverse applications such as healthcare and smart industries.

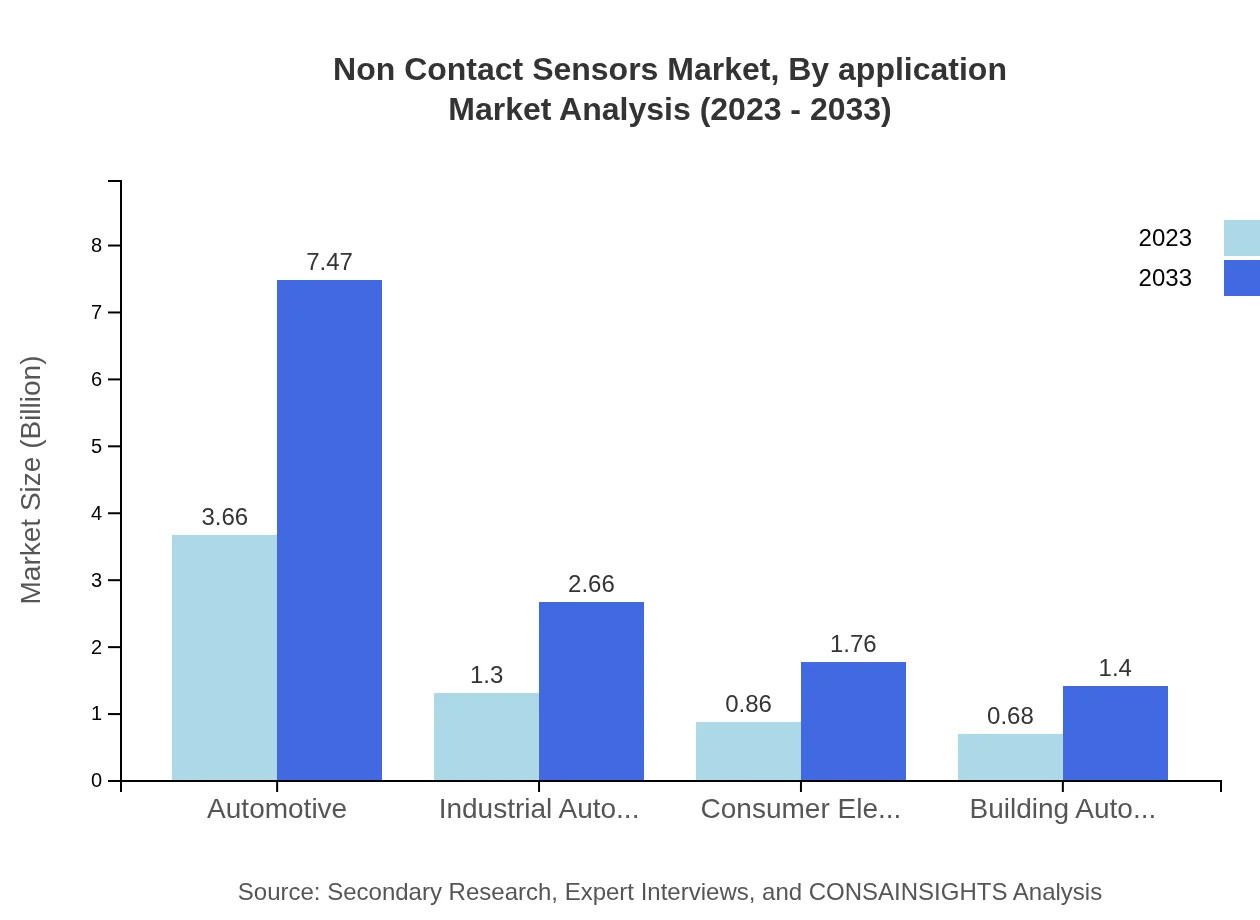

Non Contact Sensors Market Analysis By Application

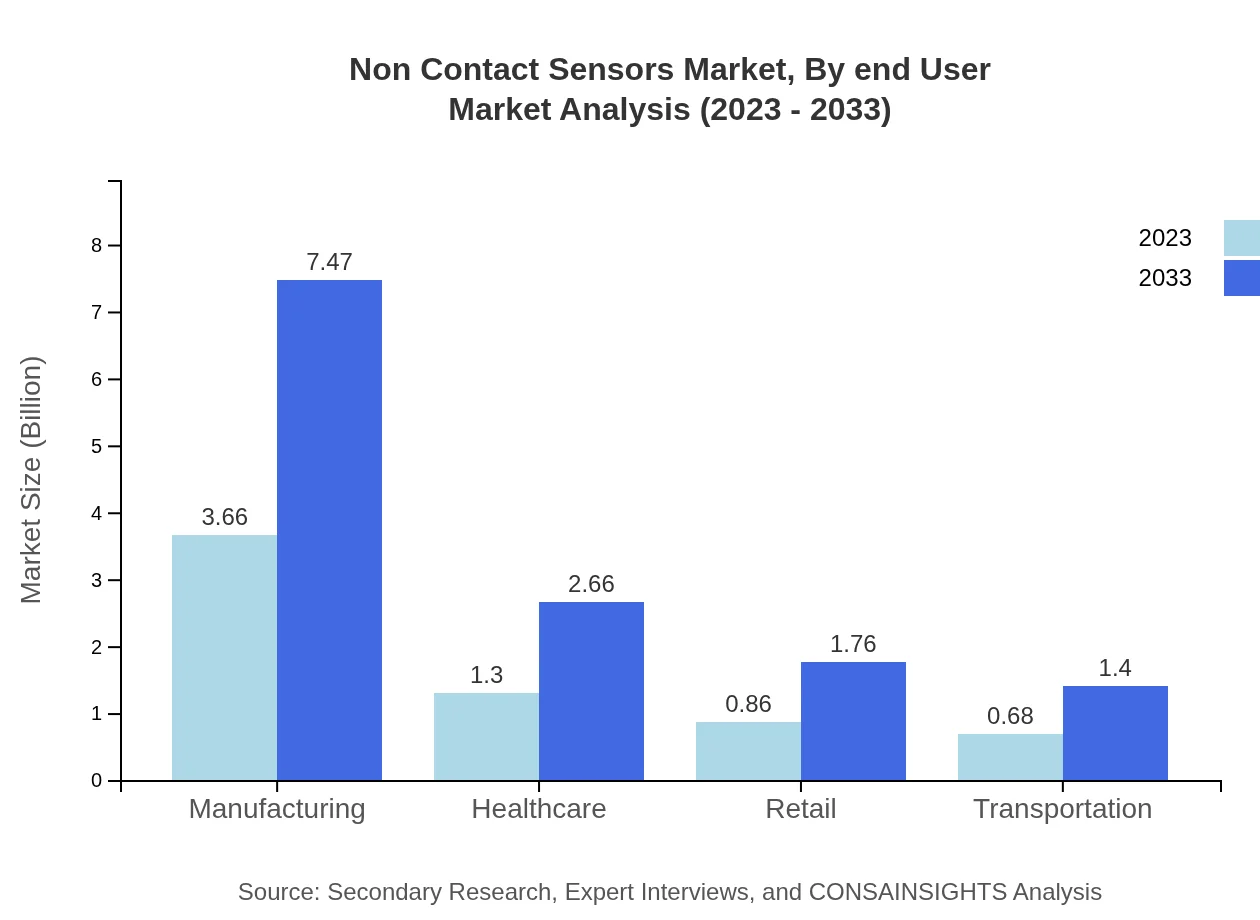

Applications of Non Contact Sensors span industrial automation, healthcare, transportation, consumer electronics, and building automation. The manufacturing sector, for instance, constitutes a significant share, with a $3.66 billion market size in 2023 (56.24% share). The demand for non-contact solutions in healthcare is projected to grow substantially as industries recognize the importance of minimizing contact due to health concerns.

Non Contact Sensors Market Analysis By End User

End-user applications of Non Contact Sensors include automotive, healthcare, industrial automation, retail, and consumer electronics. The automotive sector is anticipated to lead with a market size of $3.66 billion (56.24% share) in 2023, attributed to enhanced safety features and automation in vehicle design. The healthcare industry closely follows as the need for sanitation and safety in diagnostics grows.

Non Contact Sensors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Non Contact Sensors Industry

Honeywell International Inc.:

A leading provider of advanced sensing and control technologies, Honeywell specializes in non-contact sensors for industrial applications, enhancing safety and efficiency.Siemens AG:

Siemens offers innovative non-contact sensor solutions across diverse sectors, particularly in automation and smart infrastructure, emphasizing sustainability.Omron Corporation:

Renowned for its cutting-edge sensing technologies, Omron focuses on industrial and healthcare applications, integrating IoT capabilities.Texas Instruments:

A key player in semiconductor manufacturing, Texas Instruments provides a broad range of non-contact sensing technologies, including infrared and ultrasonic sensors.SICK AG:

SICK AG specializes in sensor solutions for industrial automation, with a strong emphasis on safety and efficiency in various applications.We're grateful to work with incredible clients.

FAQs

What is the market size of non Contact sensors?

The global non-contact sensors market is valued at $6.5 billion in 2023 and is projected to grow at a CAGR of 7.2% through 2033, highlighting a robust trend in adoption across various sectors.

What are the key market players or companies in the non Contact sensors industry?

Key players in the non-contact sensors market include major technology firms and sensor manufacturers, focusing on innovation and competitive strategies, although specific company names are not listed to maintain focus on industry trends.

What are the primary factors driving the growth in the non Contact sensors industry?

Growth factors include advancements in IoT technologies, the increasing demand for automation across industries, a focus on safety and efficiency, and the burgeoning application of sensors in healthcare, automotive, and consumer electronics.

Which region is the fastest Growing in the non Contact sensors market?

The fastest-growing region is North America, projected to increase from $2.33 billion in 2023 to $4.76 billion in 2033. Asia Pacific and Europe are also experiencing substantial growth in this technology sector.

Does ConsaInsights provide customized market report data for the non Contact sensors industry?

Yes, ConsaInsights offers tailored market report data catering to specific inquiries within the non-contact sensors industry, reflecting individual business needs and market dynamics.

What deliverables can I expect from this non Contact sensors market research project?

Deliverables include comprehensive market analysis reports, insights on trends, competitive landscape overviews, growth forecasts, and regional market segmentation data to support strategic decision-making.

What are the market trends of non Contact sensors?

Current trends include the shift towards automation, the integration of smart technologies, an increased emphasis on safety applications, and the expansion of non-contact sensors in emerging markets like healthcare and industrial automation.