Non Destructive Testing Ndt In The Aerospace And Defense Market Report

Published Date: 31 January 2026 | Report Code: non-destructive-testing-ndt-in-the-aerospace-and-defense

Non Destructive Testing Ndt In The Aerospace And Defense Market Size, Share, Industry Trends and Forecast to 2033

This report explores the Non Destructive Testing (NDT) market in the Aerospace and Defense sectors, providing insights on market dynamics, segmentation, regional analysis, trends, and forecasts for the years 2023 to 2033.

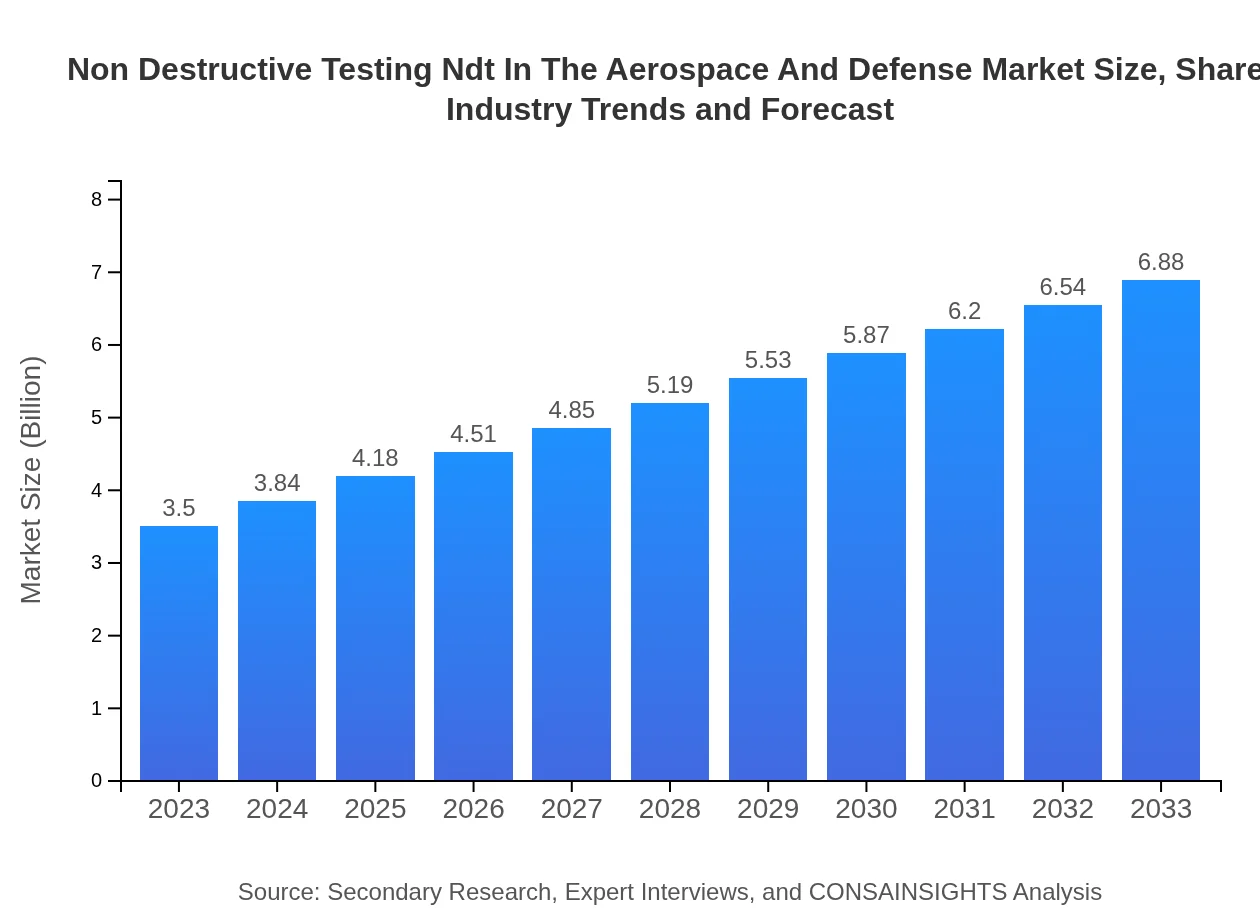

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.88 Billion |

| Top Companies | Baker Hughes, Olympus Corporation, GE Inspection Technologies, Intertek Group |

| Last Modified Date | 31 January 2026 |

Non Destructive Testing Ndt In The Aerospace And Defense Market Overview

Customize Non Destructive Testing Ndt In The Aerospace And Defense Market Report market research report

- ✔ Get in-depth analysis of Non Destructive Testing Ndt In The Aerospace And Defense market size, growth, and forecasts.

- ✔ Understand Non Destructive Testing Ndt In The Aerospace And Defense's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Non Destructive Testing Ndt In The Aerospace And Defense

What is the Market Size & CAGR of Non Destructive Testing Ndt In The Aerospace And Defense market in 2023?

Non Destructive Testing Ndt In The Aerospace And Defense Industry Analysis

Non Destructive Testing Ndt In The Aerospace And Defense Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Non Destructive Testing Ndt In The Aerospace And Defense Market Analysis Report by Region

Europe Non Destructive Testing Ndt In The Aerospace And Defense Market Report:

The European market for NDT was valued at USD 1.12 billion in 2023 and is predicted to reach USD 2.21 billion by 2033, benefiting from strict regulatory requirements and a large fleet of aging aircraft requiring extensive maintenance.Asia Pacific Non Destructive Testing Ndt In The Aerospace And Defense Market Report:

The Asia-Pacific NDT market was valued at USD 0.63 billion in 2023 and is expected to reach USD 1.24 billion by 2033, highlighting a strong growth trajectory driven by increasing defense budgets and burgeoning aerospace manufacturing in countries like China and India.North America Non Destructive Testing Ndt In The Aerospace And Defense Market Report:

North America leads the NDT market, valued at USD 1.24 billion in 2023, forecasted to grow to USD 2.44 billion by 2033. This region is bolstered by the presence of major aerospace manufacturers and military contracts.South America Non Destructive Testing Ndt In The Aerospace And Defense Market Report:

In South America, the market was valued at USD 0.12 billion in 2023, projected to grow to USD 0.23 billion by 2033, supported by government investments in aerospace infrastructure and military modernization.Middle East & Africa Non Destructive Testing Ndt In The Aerospace And Defense Market Report:

In the Middle East and Africa, the market was valued at USD 0.39 billion in 2023, with projections to reach USD 0.77 billion by 2033, driven by growing defense needs and investments in aviation safety.Tell us your focus area and get a customized research report.

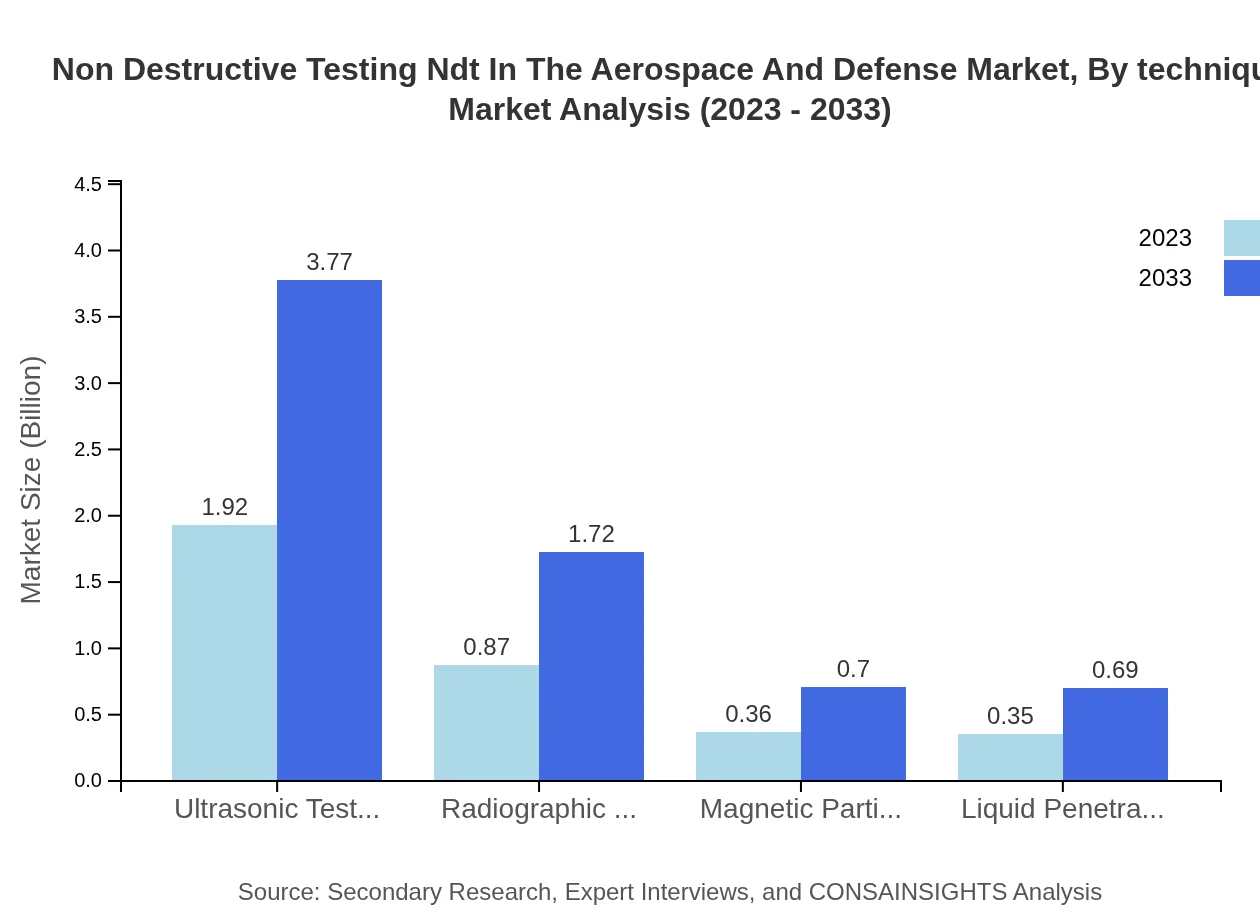

Non Destructive Testing Ndt In The Aerospace And Defense Market Analysis By Technique

Ultrasonic testing holds the largest share of the market, with USD 1.92 billion in 2023, expected to reach USD 3.77 billion by 2033, accounting for 54.75% of the market share. Other significant techniques include radiographic testing, valued at USD 0.87 billion in 2023, growing to USD 1.72 billion by 2033 (24.96% market share), and magnetic particle testing at USD 0.36 billion in 2023, estimated to rise to USD 0.70 billion by 2033 (10.23%).

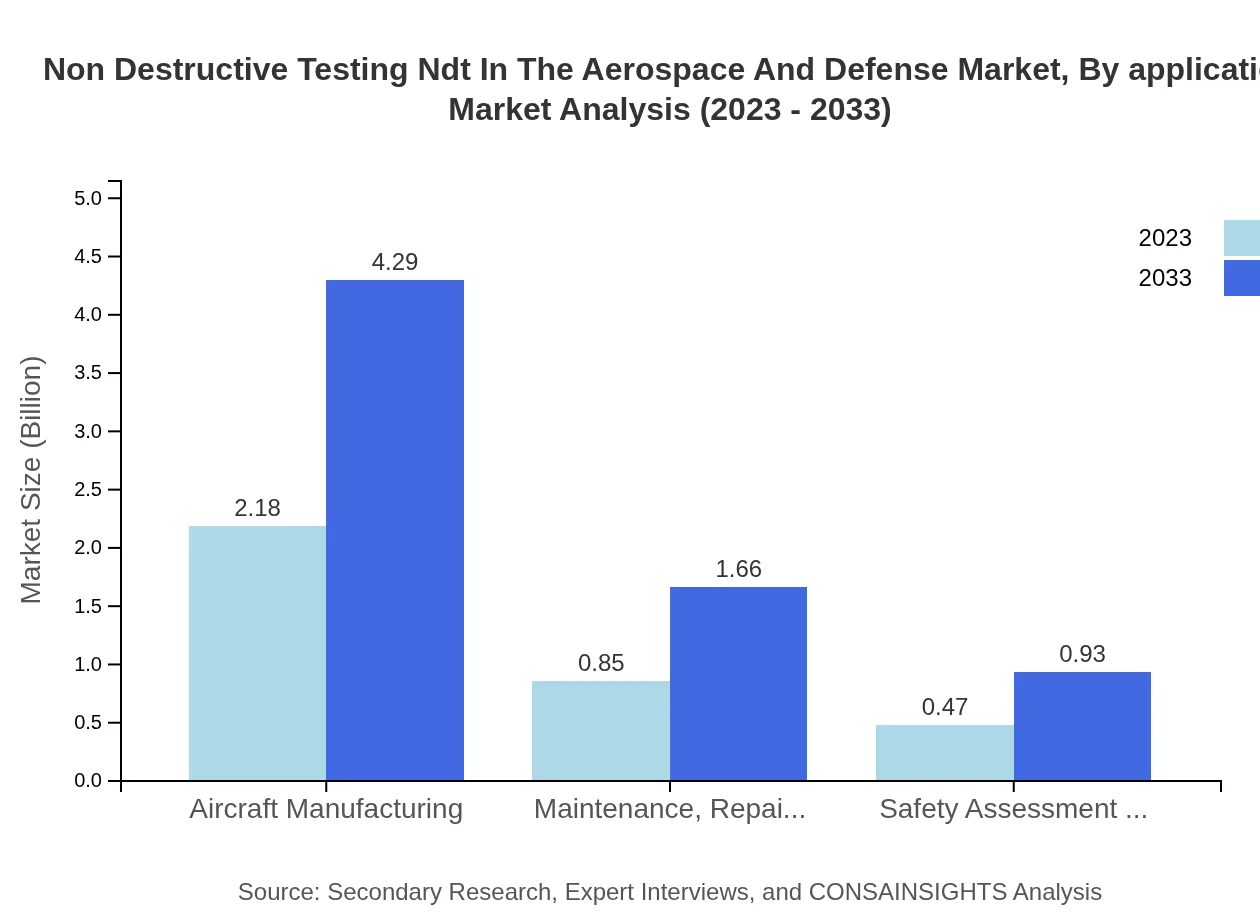

Non Destructive Testing Ndt In The Aerospace And Defense Market Analysis By Application

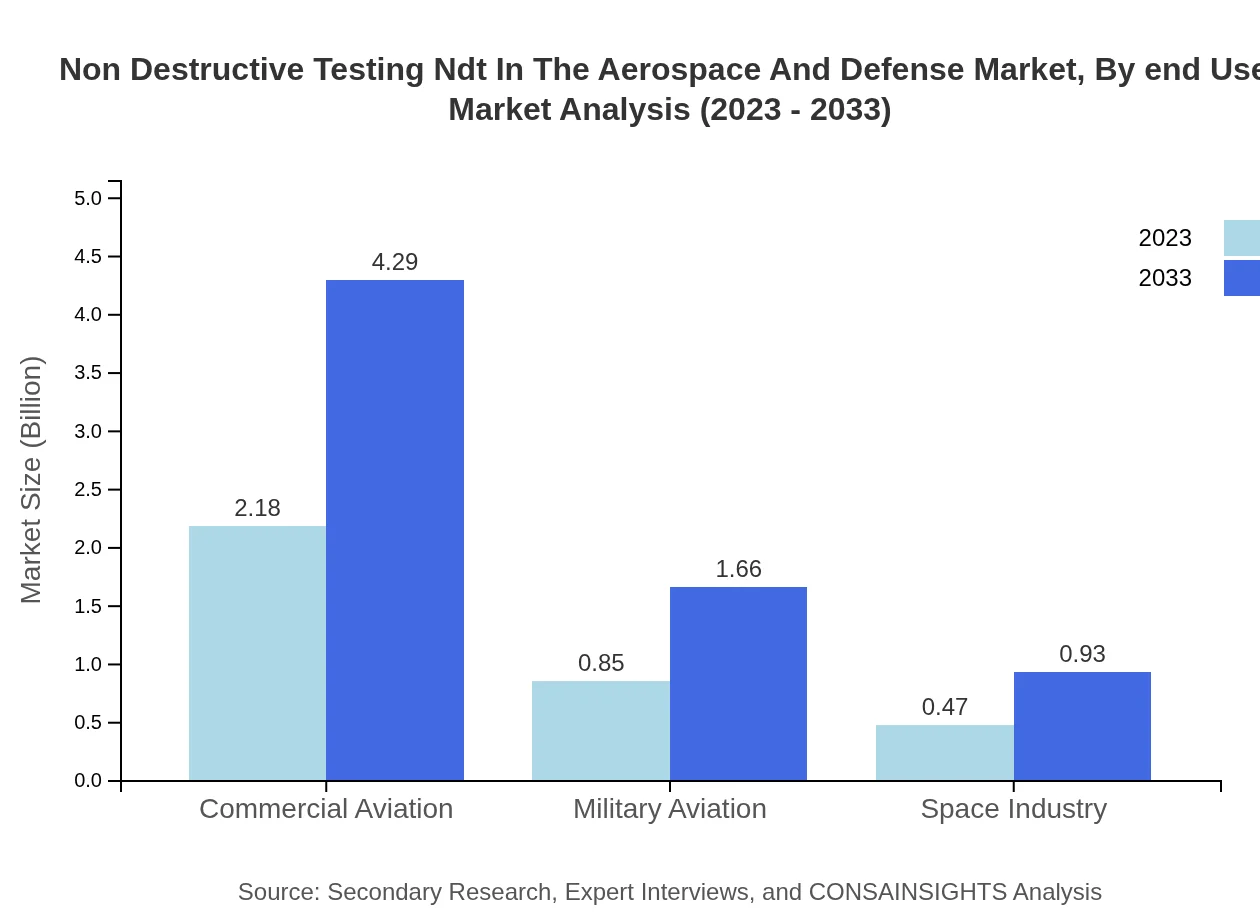

The commercial aviation segment is dominant, with a value of USD 2.18 billion in 2023, projected to rise to USD 4.29 billion by 2033, maintaining a 62.36% market share. Military aviation follows closely with USD 0.85 billion in 2023, expected to reach USD 1.66 billion (24.19%). The space industry represents USD 0.47 billion in 2023, expected to double to USD 0.93 billion (13.45%).

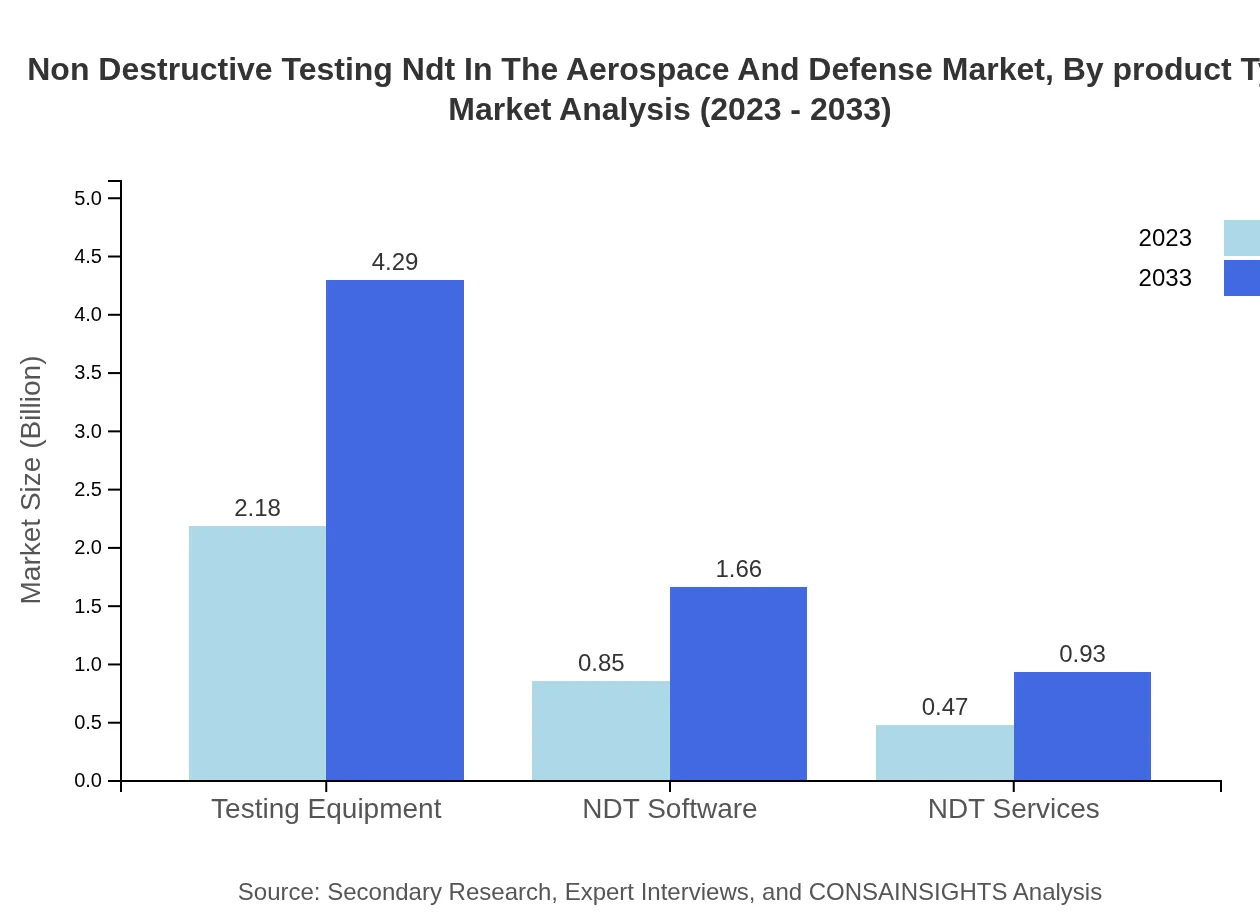

Non Destructive Testing Ndt In The Aerospace And Defense Market Analysis By Product Type

Testing equipment currently leads the market with USD 2.18 billion in 2023, anticipated to grow to USD 4.29 billion by 2033 (62.36% share). NDT software reached USD 0.85 billion in 2023, expected to grow to USD 1.66 billion (24.19%), while NDT services are likely to increase from USD 0.47 billion in 2023 to USD 0.93 billion (13.45%).

Non Destructive Testing Ndt In The Aerospace And Defense Market Analysis By End User

Aircraft manufacturing represents the largest end-user segment, valued at USD 2.18 billion in 2023 and projected to grow to USD 4.29 billion by 2033 (62.36%). Maintenance, Repair, and Overhaul (MRO) activities accounted for USD 0.85 billion in 2023, set to increase to USD 1.66 billion (24.19%). The Safety Assessment and Compliance segment is estimated to grow similarly from USD 0.47 billion to USD 0.93 billion (13.45%).

Non Destructive Testing Ndt In The Aerospace And Defense Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Non Destructive Testing Ndt In The Aerospace And Defense Industry

Baker Hughes:

Baker Hughes has a global presence in the NDT market, offering advanced inspection technologies and solutions tailored to the aerospace and defense sectors.Olympus Corporation:

Olympus provides a broad range of NDT solutions, including ultrasonic testing equipment renowned for their accuracy and reliability, specifically designed for aerospace applications.GE Inspection Technologies:

GE Inspection Technologies is a leader in the development of innovative NDT methods and equipment, focusing on enhancing safety and operational efficiency in the aerospace and defense sectors.Intertek Group:

Intertek Group offers comprehensive NDT services and solutions for the aerospace and defense segments, emphasizing compliance and safety in manufacturing processes.We're grateful to work with incredible clients.

FAQs

What is the market size of non Destructive Testing Ndt In The Aerospace And Defense?

The market size for Non-Destructive Testing (NDT) in the Aerospace and Defense sector is estimated at $3.5 billion in 2023, with a projected CAGR of 6.8% from 2023 to 2033.

What are the key market players or companies in the non Destructive Testing Ndt In The Aerospace And Defense industry?

Key players in the Non-Destructive Testing market include major aerospace and defense contractors, though specific company names are not provided. These companies typically have significant capabilities in NDT technologies, contributing to the industry growth.

What are the primary factors driving the growth in the non Destructive Testing Ndt In The Aerospace And Defense industry?

Growth in the NDT industry is driven by increasing safety regulations, advancements in NDT technologies, and the growing demand for aircraft and defense systems. Moreover, the necessity for maintenance and compliance fuels the market.

Which region is the fastest Growing in the non Destructive Testing Ndt In The Aerospace And Defense?

The fastest-growing region for Non-Destructive Testing in Aerospace and Defense is Europe. The market is projected to grow from $1.12 billion in 2023 to $2.21 billion by 2033, reflecting strong regional development.

Does ConsaInsights provide customized market report data for the non Destructive Testing Ndt In The Aerospace And Defense industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the Non-Destructive Testing sector, ensuring clients receive insights relevant to their objectives.

What deliverables can I expect from this non Destructive Testing Ndt In The Aerospace And Defense market research project?

Deliverables from the NDT market research include comprehensive reports, detailed market analysis, segment forecasts, and regional data, all designed to facilitate informed decision-making for stakeholders.

What are the market trends of non Destructive Testing Ndt In The Aerospace And Defense?

Current trends in the NDT market include technological innovation in testing methods, integration of AI for data analysis, and an increasing emphasis on regulatory compliance within aerospace and defense sectors.