Non Insulin Diabetes Therapies Market Report

Published Date: 31 January 2026 | Report Code: non-insulin-diabetes-therapies

Non Insulin Diabetes Therapies Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Non Insulin Diabetes Therapies market, highlighting key trends, market size, segmentation, and regional insights. It covers data and forecasts for the period 2023-2033, offering valuable insights for stakeholders in the diabetes management domain.

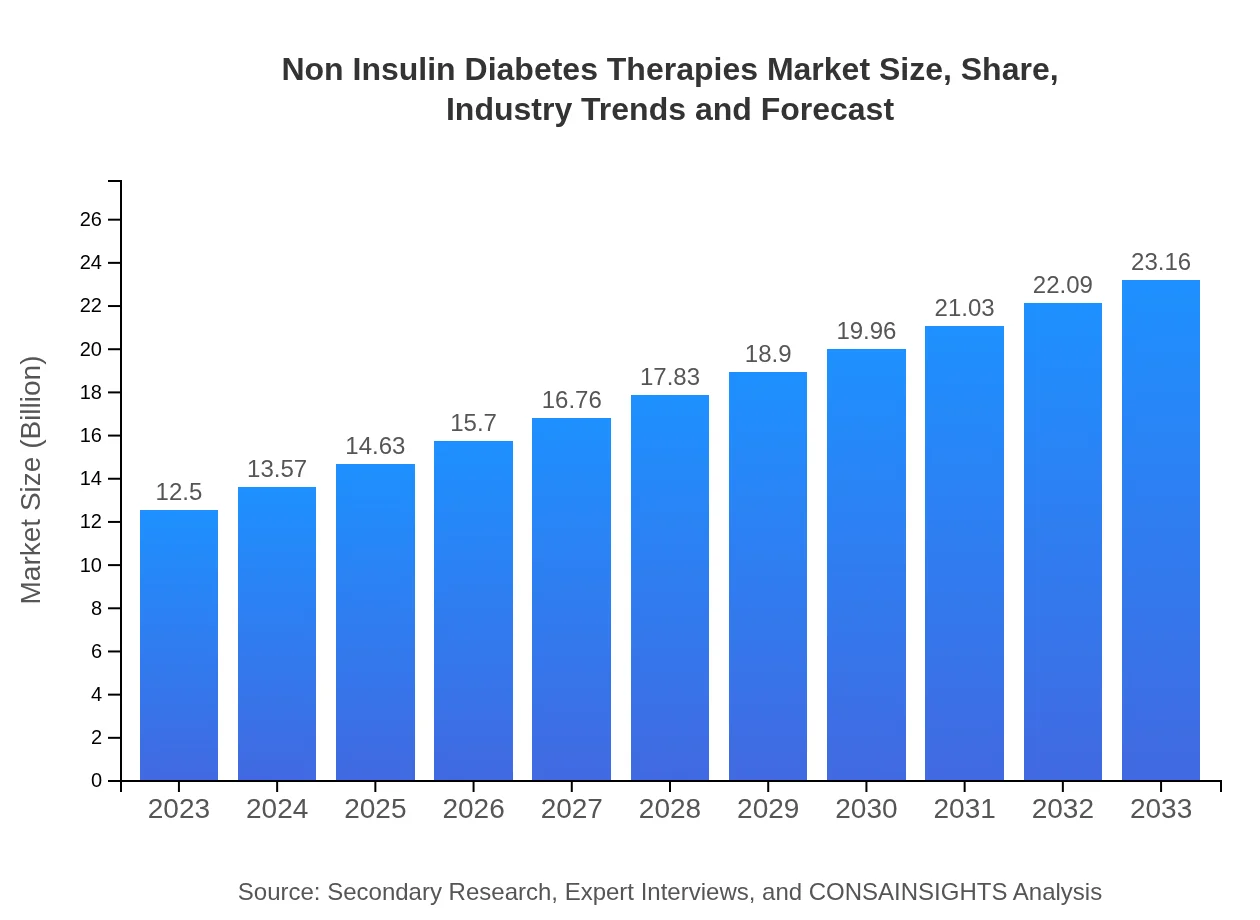

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $23.16 Billion |

| Top Companies | Metformin Pharmaceuticals, AstraZeneca, Sanofi, Bristol-Myers Squibb, Novo Nordisk |

| Last Modified Date | 31 January 2026 |

Non Insulin Diabetes Therapies Market Overview

Customize Non Insulin Diabetes Therapies Market Report market research report

- ✔ Get in-depth analysis of Non Insulin Diabetes Therapies market size, growth, and forecasts.

- ✔ Understand Non Insulin Diabetes Therapies's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Non Insulin Diabetes Therapies

What is the Market Size & CAGR of Non Insulin Diabetes Therapies market in 2023?

Non Insulin Diabetes Therapies Industry Analysis

Non Insulin Diabetes Therapies Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Non Insulin Diabetes Therapies Market Analysis Report by Region

Europe Non Insulin Diabetes Therapies Market Report:

European markets are projected to rise from $3.58 billion in 2023 to $6.62 billion by 2033. The growing diabetic population and stringent regulations supporting diabetes care are significant contributors to this growth.Asia Pacific Non Insulin Diabetes Therapies Market Report:

In the Asia Pacific region, the Non Insulin Diabetes Therapies market is valued at $2.34 billion in 2023 and is projected to grow to $4.34 billion by 2033, fueled by rising diabetes prevalence and increasing healthcare expenditure.North America Non Insulin Diabetes Therapies Market Report:

North America leads the market with a size of $4.87 billion in 2023, anticipated to grow to $9.03 billion by 2033. This growth is attributed to advanced healthcare infrastructure, higher disposable incomes, and increased investment in diabetes management solutions.South America Non Insulin Diabetes Therapies Market Report:

South America is experiencing growth in its Non Insulin Diabetes Therapies market, with a valuation of $1.13 billion in 2023, expected to reach $2.10 billion by 2033, driven largely by an increasing awareness and acceptance of diabetes treatments.Middle East & Africa Non Insulin Diabetes Therapies Market Report:

The Middle East and Africa region is expected to see growth from $0.58 billion in 2023 to $1.07 billion by 2033, with increasing healthcare initiatives aimed at managing chronic diseases.Tell us your focus area and get a customized research report.

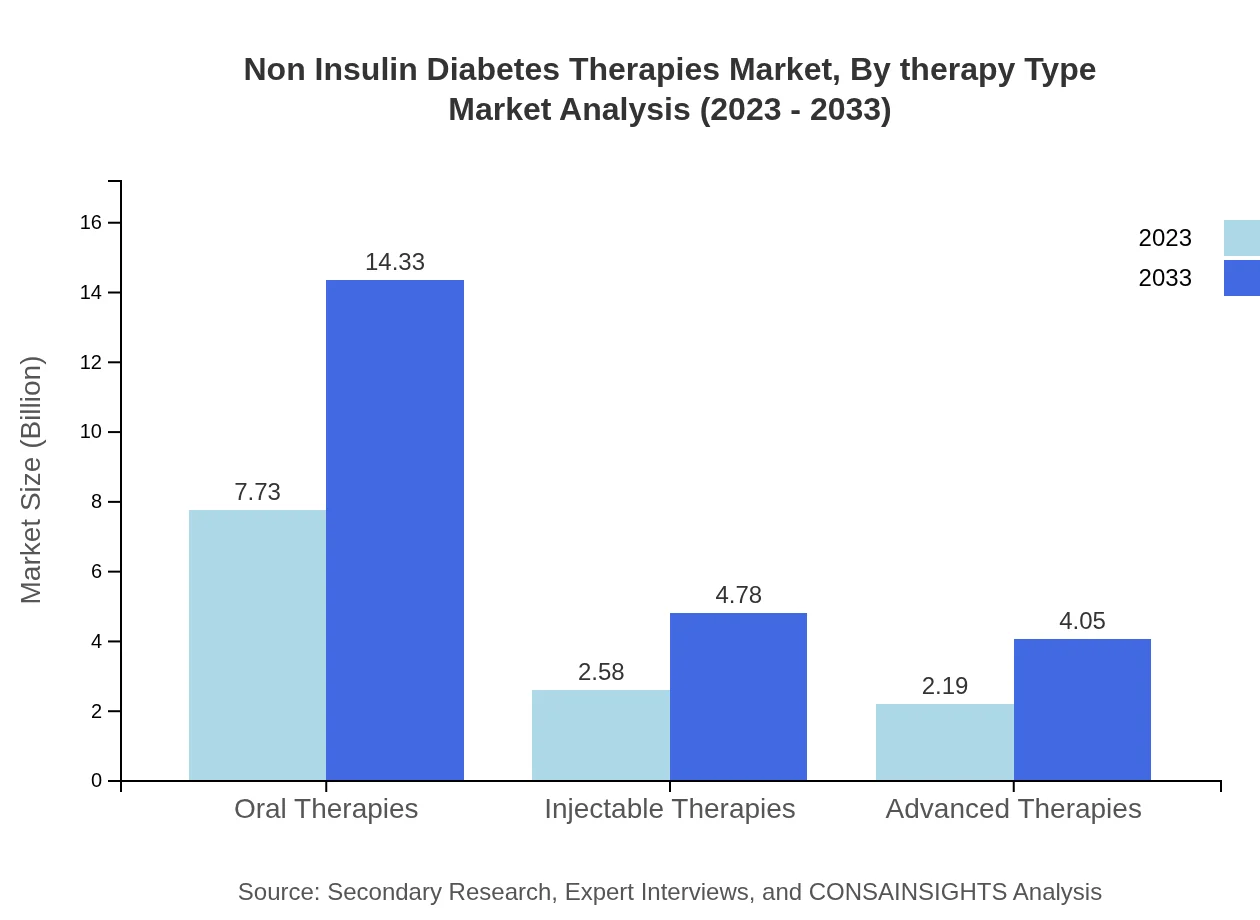

Non Insulin Diabetes Therapies Market Analysis By Therapy Type

The market for Non-Insulin Diabetes Therapies is divided into oral and injectable therapies. By 2033, oral therapies are expected to capture a 61.87% market share by size, increasing from $7.73 billion in 2023 to $14.33 billion. Injectable therapies, while smaller, are projected to grow from $2.58 billion in 2023 to $4.78 billion by 2033, making up 20.63% of the market share.

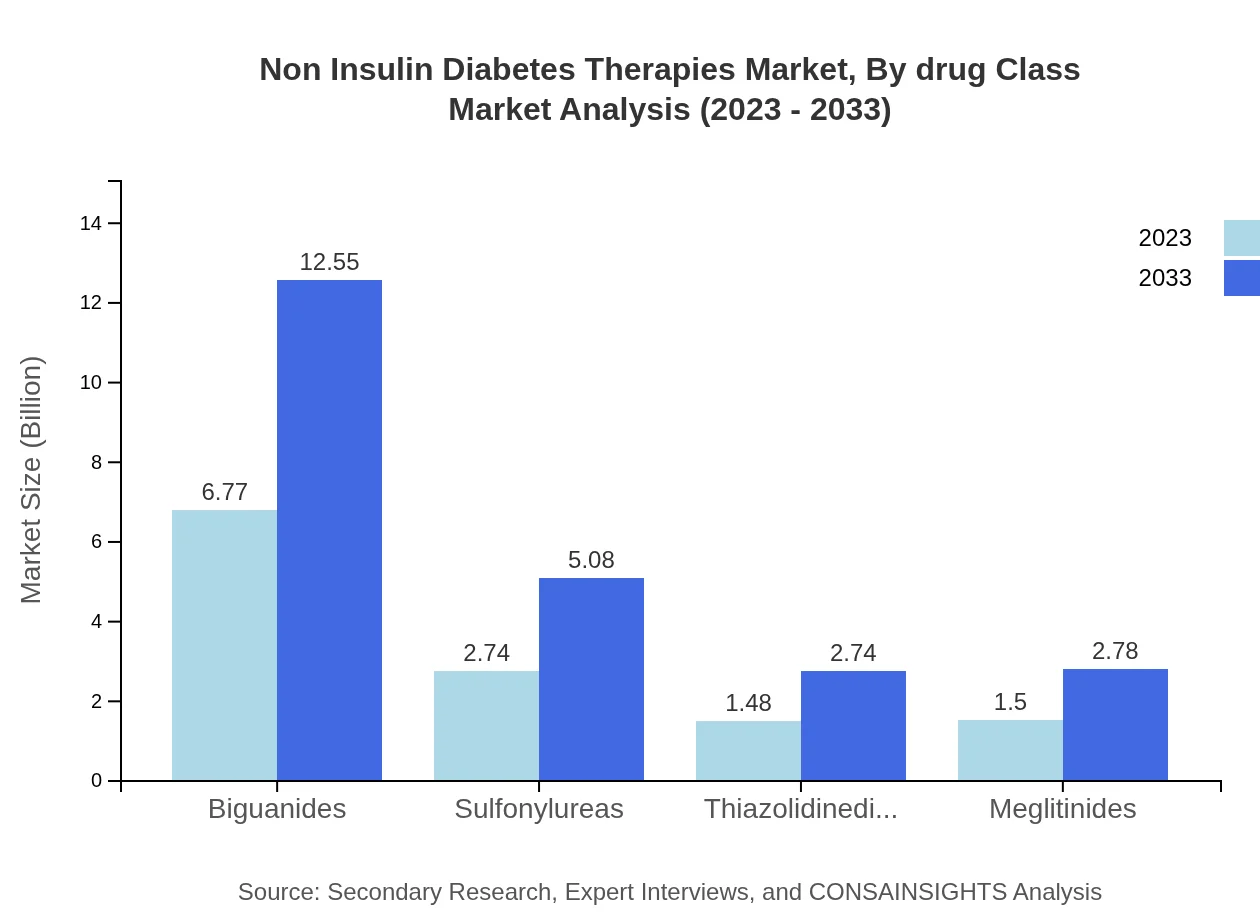

Non Insulin Diabetes Therapies Market Analysis By Drug Class

Within the Non-Insulin Diabetes Therapies, biguanides dominate, with a size projected to grow from $6.77 billion (54.18% share) in 2023 to $12.55 billion by 2033. Sulfonylureas and thiazolidinediones hold market shares of 21.95% and 11.85%, respectively. This segmentation highlights the critical importance of these classes in managing diabetes effectively.

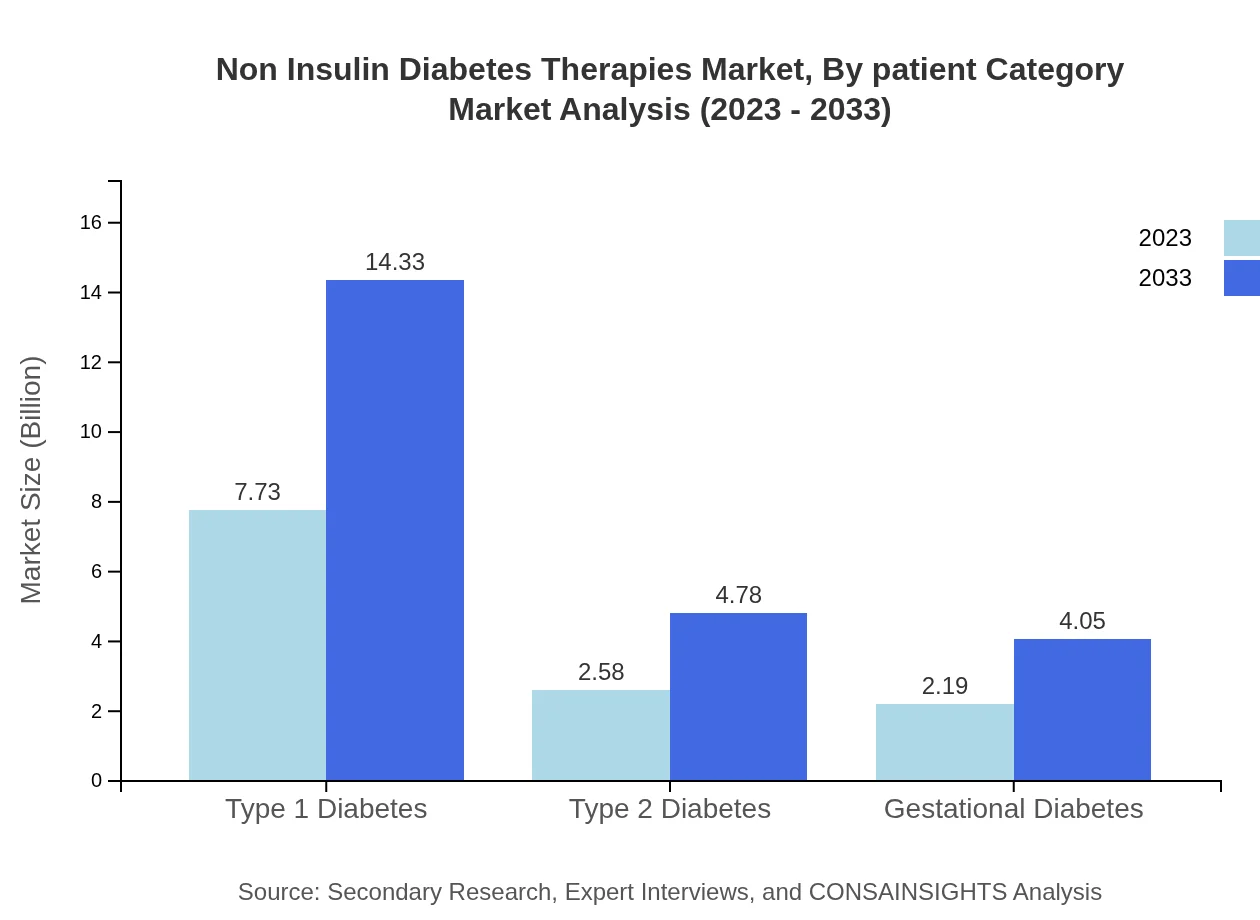

Non Insulin Diabetes Therapies Market Analysis By Patient Category

Segmentation shows that Type 1 diabetes therapies hold a significant market share at 61.87%, increasing in value from $7.73 billion in 2023 to $14.33 billion by 2033. Type 2 diabetes therapies are projected to grow from $2.58 billion to $4.78 billion (20.63% share), while therapies for gestational diabetes will grow modestly.

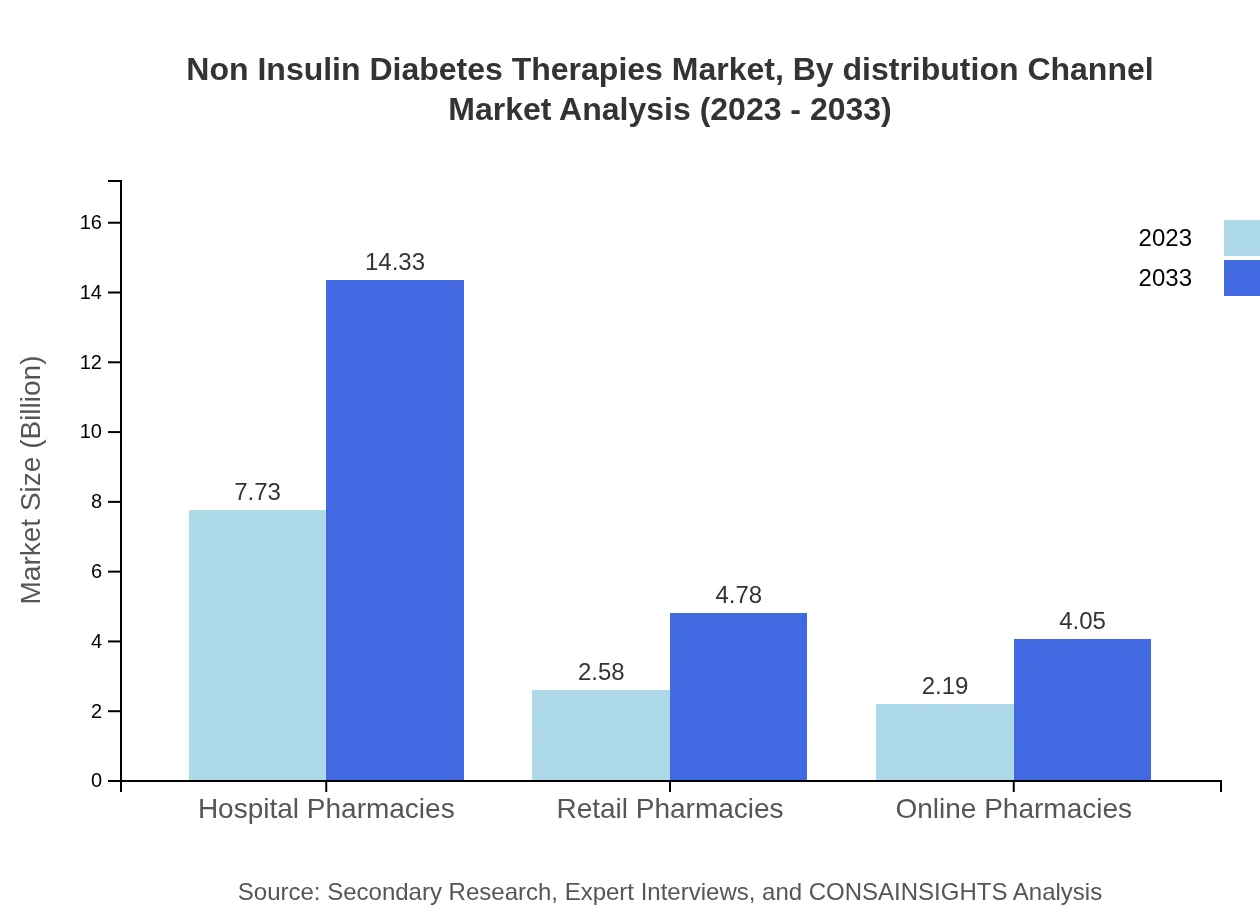

Non Insulin Diabetes Therapies Market Analysis By Distribution Channel

Hospital pharmacies continue to dominate distribution for Non-Insulin Diabetes Therapies, representing 61.87% of the market. The value is expected to rise from $7.73 billion in 2023 to $14.33 billion by 2033. Retail and online pharmacies also show healthy growth trajectories, catering to increasing demand from consumers.

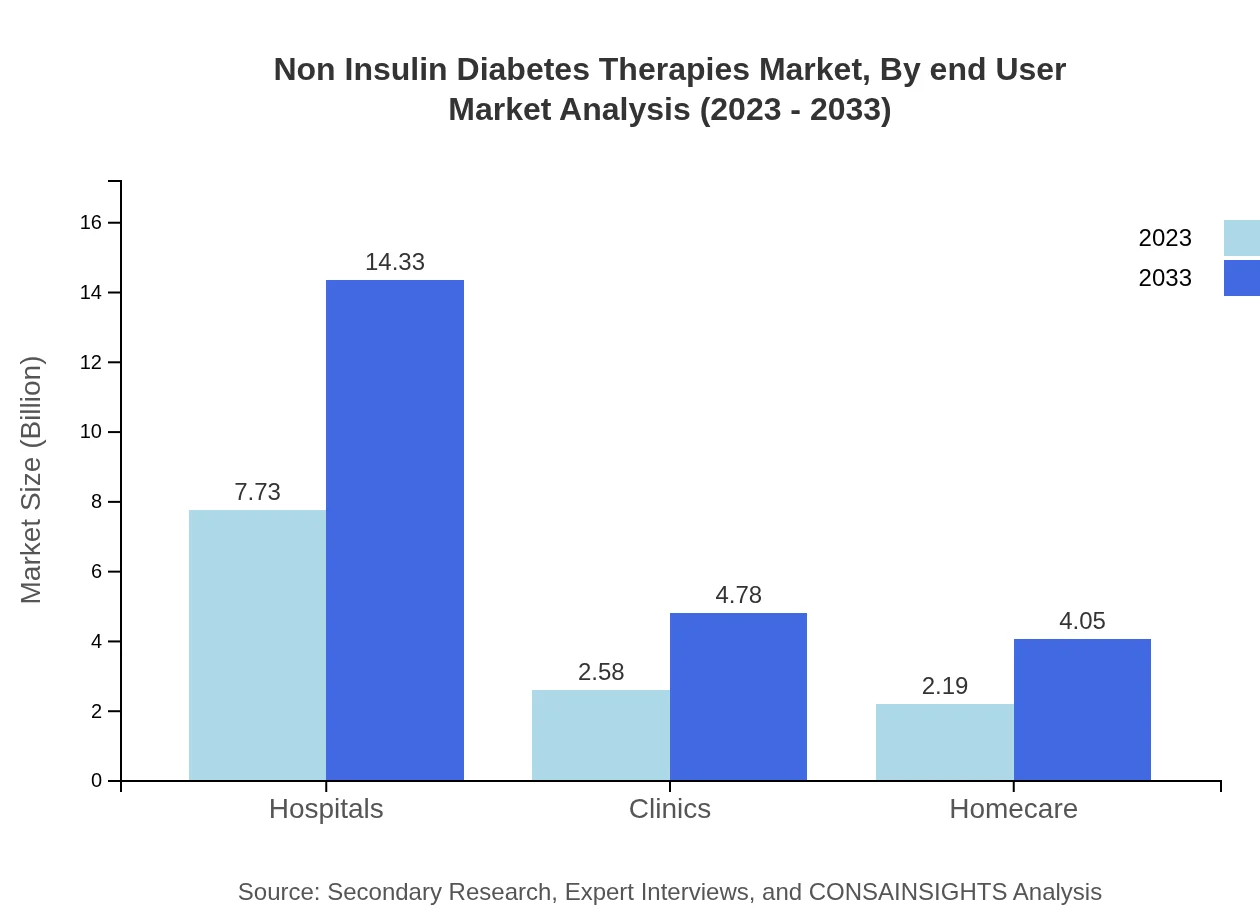

Non Insulin Diabetes Therapies Market Analysis By End User

The end-user market indicates a healthy distribution between hospitals (61.87% share), clinics (20.63%), and homecare settings (17.5%). The growth in hospital pharmacies primarily reflects a consolidated patient care model emphasizing professional management of diabetes therapies.

Non Insulin Diabetes Therapies Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Non Insulin Diabetes Therapies Industry

Metformin Pharmaceuticals:

A leading manufacturer of biguanide therapies, Metformin Pharmaceuticals is renowned for its robust portfolio that provides effective management solutions for Type 2 diabetes patients.AstraZeneca:

Known for innovative pharmaceuticals in diabetes management, AstraZeneca has a strong focus on SGLT-2 inhibitors, offering advanced therapies for diabetic patients.Sanofi:

Sanofi is a significant player in the sector, providing solutions across oral and injectable diabetes therapies, with a strong global presence and research capabilities.Bristol-Myers Squibb:

This company offers therapeutic solutions recognizing the importance of individualized diabetes management strategies, focusing on integrative care approaches.Novo Nordisk:

Prominent for their contributions to diabetes care, Novo Nordisk specializes in a range of diabetes therapeutics, including innovative non-insulin therapies.We're grateful to work with incredible clients.

FAQs

What is the market size of Non-Insulin Diabetes Therapies?

The global Non-Insulin Diabetes Therapies market is projected to reach a size of $12.5 billion by 2033, growing at a CAGR of 6.2%. This significant growth reflects rising diabetes prevalence and increasing awareness of therapeutic options.

What are the key market players or companies in this Non-Insulin Diabetes Therapies industry?

Key players in the Non-Insulin Diabetes Therapies market include prominent pharmaceutical companies like Merck & Co., Novo Nordisk, Sanofi, and Pfizer. These entities focus on developing innovative therapies to enhance diabetic patient care and manage blood glucose levels.

What are the primary factors driving the growth in the Non-Insulin Diabetes Therapies industry?

Major factors driving growth in the Non-Insulin Diabetes Therapies market include an increasing prevalence of diabetes globally, rising obesity rates, advancements in drug development, and greater patient education regarding diabetes management and treatment options.

Which region is the fastest Growing in the Non-Insulin Diabetes Therapies?

The fastest-growing region for Non-Insulin Diabetes Therapies is North America, expected to expand from $4.87 billion in 2023 to $9.03 billion by 2033. Significant investments in healthcare and robust market presence contribute to this growth.

Does ConsaInsights provide customized market report data for the Non-Insulin Diabetes Therapies industry?

Yes, ConsaInsights offers customized market report data tailored to client specifications within the Non-Insulin Diabetes Therapies industry, addressing specific market segments, geographic areas, and consumer preferences.

What deliverables can I expect from this Non-Insulin Diabetes Therapies market research project?

Deliverables from the Non-Insulin Diabetes Therapies market research project include detailed reports on market dynamics, segmentation analysis, trend forecasts, competitive landscapes, and actionable insights tailored to support strategic decision-making.

What are the market trends of Non-Insulin Diabetes Therapies?

Current market trends in Non-Insulin Diabetes Therapies include a rising focus on personalized medicine, the integration of technology in glucose monitoring, an increase in patient-centric therapies, and a growing preference for oral therapies compared to injectables.