Non Invasive Cancer Diagnostics Market Report

Published Date: 31 January 2026 | Report Code: non-invasive-cancer-diagnostics

Non Invasive Cancer Diagnostics Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Non Invasive Cancer Diagnostics market, highlighting market size, trends, technologies, and regional performance from 2023 to 2033.

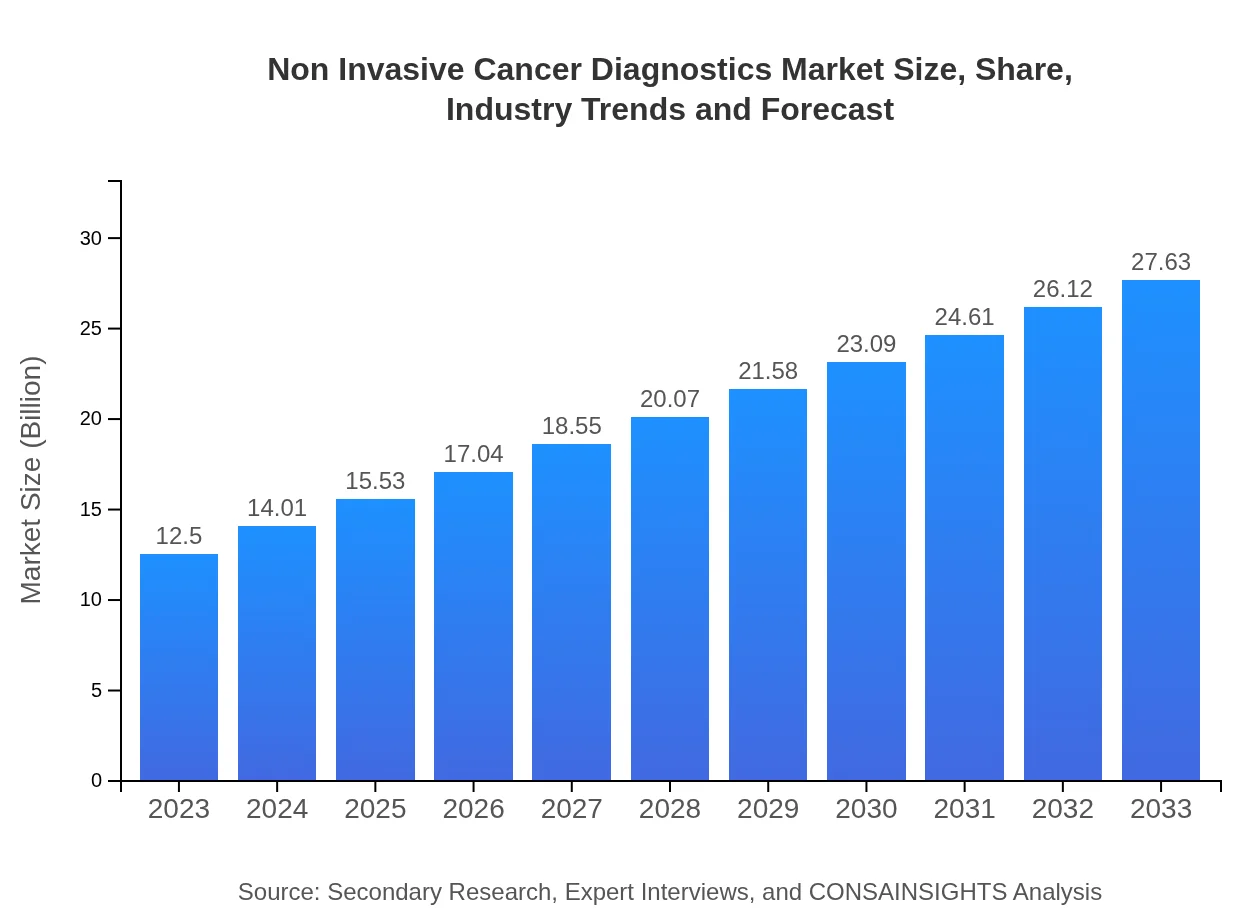

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 8% |

| 2033 Market Size | $27.63 Billion |

| Top Companies | Guardant Health, Roche Diagnostics, Exact Sciences Corporation, Foundation Medicine |

| Last Modified Date | 31 January 2026 |

Non Invasive Cancer Diagnostics Market Overview

Customize Non Invasive Cancer Diagnostics Market Report market research report

- ✔ Get in-depth analysis of Non Invasive Cancer Diagnostics market size, growth, and forecasts.

- ✔ Understand Non Invasive Cancer Diagnostics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Non Invasive Cancer Diagnostics

What is the Market Size & CAGR of Non Invasive Cancer Diagnostics market in 2023?

Non Invasive Cancer Diagnostics Industry Analysis

Non Invasive Cancer Diagnostics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Non Invasive Cancer Diagnostics Market Analysis Report by Region

Europe Non Invasive Cancer Diagnostics Market Report:

Europe's Non Invasive Cancer Diagnostics market will increase from $3.45 billion in 2023 to $7.62 billion by 2033, owing to stringent regulations promoting early detection methods and a rising population of cancer patients.Asia Pacific Non Invasive Cancer Diagnostics Market Report:

In the Asia Pacific region, the Non Invasive Cancer Diagnostics market is anticipated to grow from $2.38 billion in 2023 to $5.26 billion by 2033, displaying a strong CAGR of 8.63%. This growth is propelled by increasing healthcare investments, enhancing patient access to diagnostic services, and rising awareness about early cancer detection.North America Non Invasive Cancer Diagnostics Market Report:

North America's market, the largest globally, is projected to expand from $4.76 billion in 2023 to $10.53 billion by 2033, with a robust CAGR of 8.53%. The region benefits from advanced healthcare systems, high levels of research funding, and innovative diagnostic solutions.South America Non Invasive Cancer Diagnostics Market Report:

The South American market is expected to witness growth from $0.64 billion in 2023 to $1.41 billion by 2033, driven by improving healthcare infrastructure, increasing prevalence of cancer, and expanding diagnostic labs across the region.Middle East & Africa Non Invasive Cancer Diagnostics Market Report:

The Middle East and Africa region is projected to grow from $1.27 billion in 2023 to $2.81 billion by 2033, driven by advancements in healthcare technologies, partnerships among local and international firms, and growing awareness about cancer.Tell us your focus area and get a customized research report.

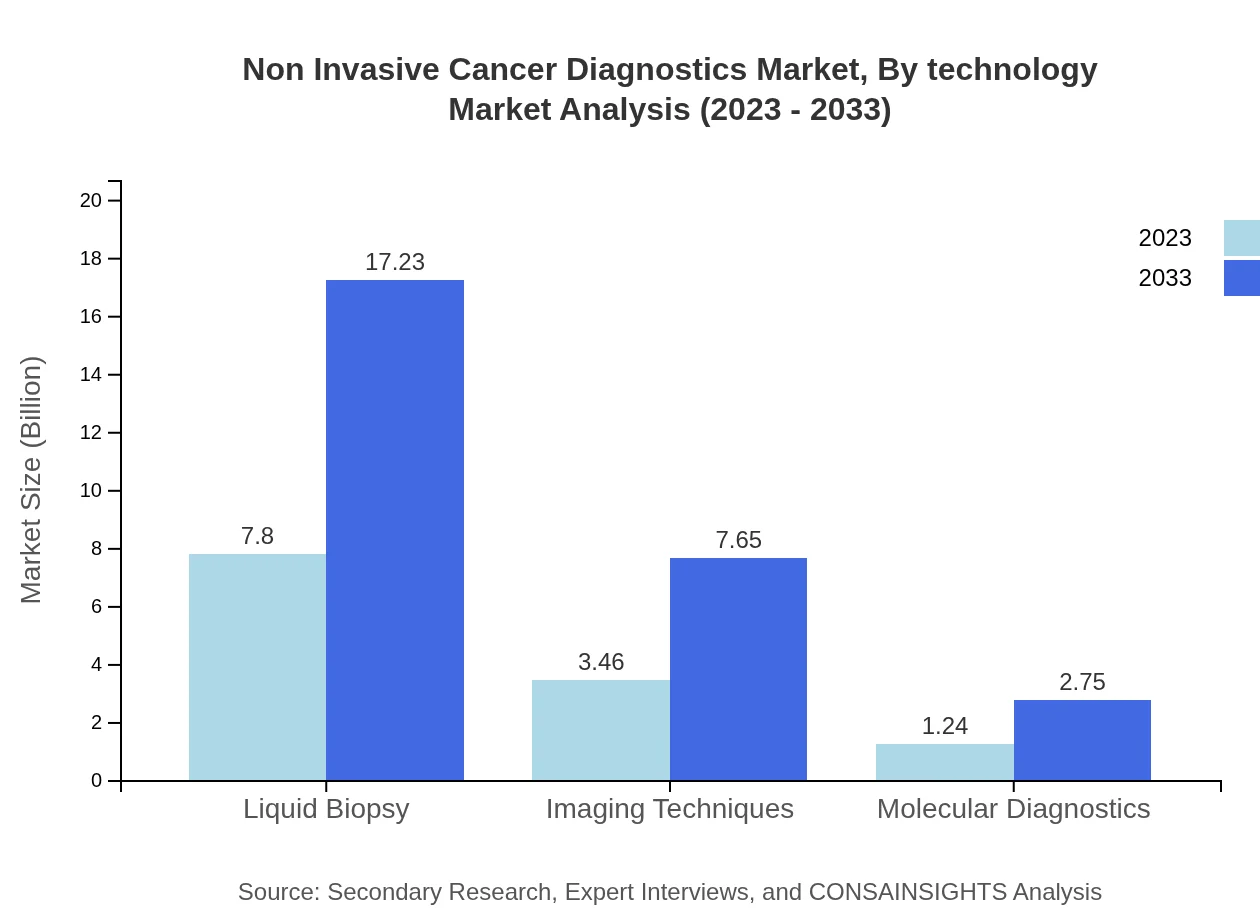

Non Invasive Cancer Diagnostics Market Analysis By Technology

The Non Invasive Cancer Diagnostics market shows significant performances by various technologies. Liquid biopsy holds the largest market share, valued at $7.80 billion in 2023, and projected to reach $17.23 billion by 2033, accounting for 62.36% of the market share. Imaging techniques follow with a 27.69% share, projected to grow from $3.46 billion to $7.65 billion. Molecular diagnostics encompass 9.95% of the market, with size growing to $2.75 billion.

Non Invasive Cancer Diagnostics Market Analysis By Application

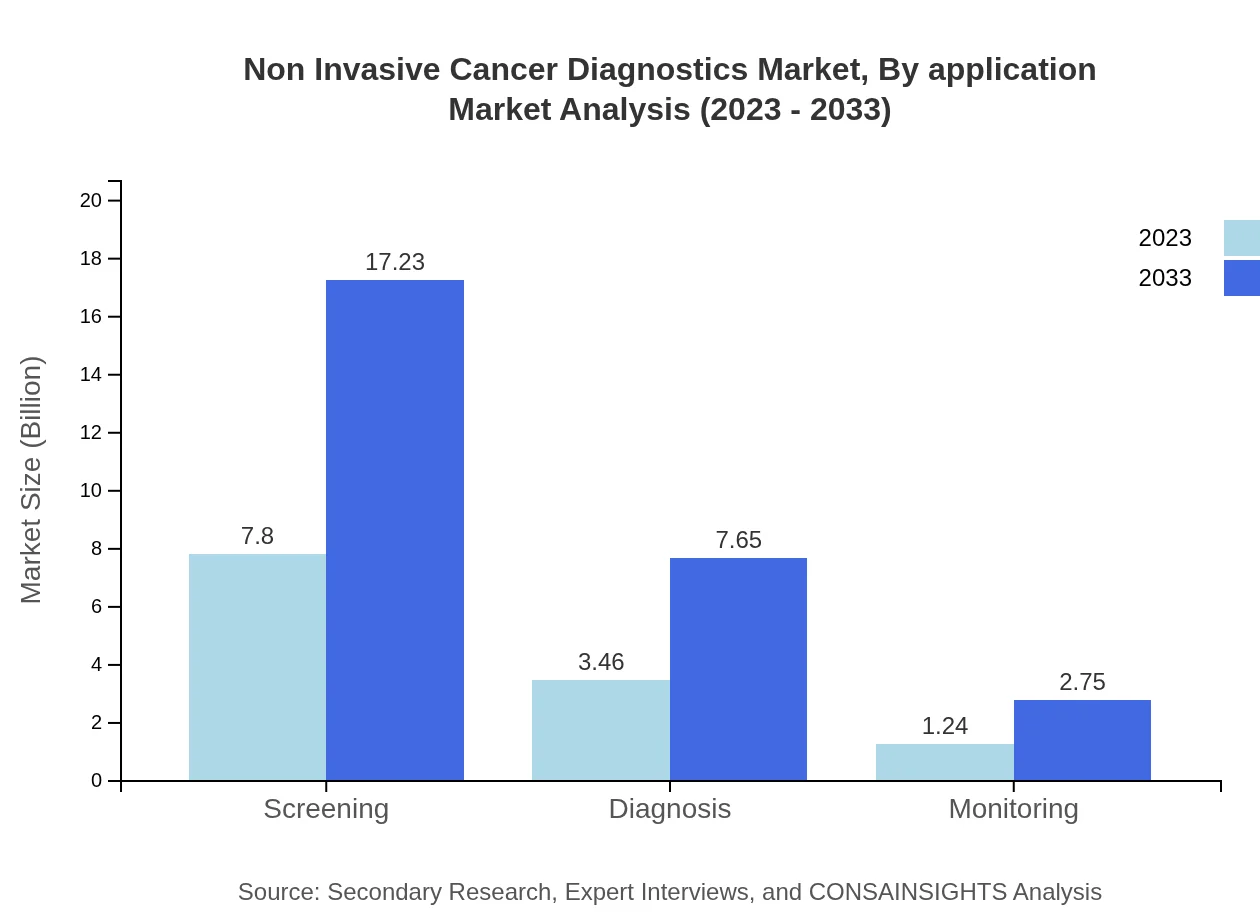

In terms of application, Non-Invasive Cancer Diagnostics primarily caters to diagnosis (27.69% share), which is seeing growth from $3.46 billion to $7.65 billion from 2023 to 2033. Monitoring (9.95% share) shows an increasing trend, from $1.24 billion to $2.75 billion, emphasizing ongoing surveillance in oncology.

Non Invasive Cancer Diagnostics Market Analysis By End User

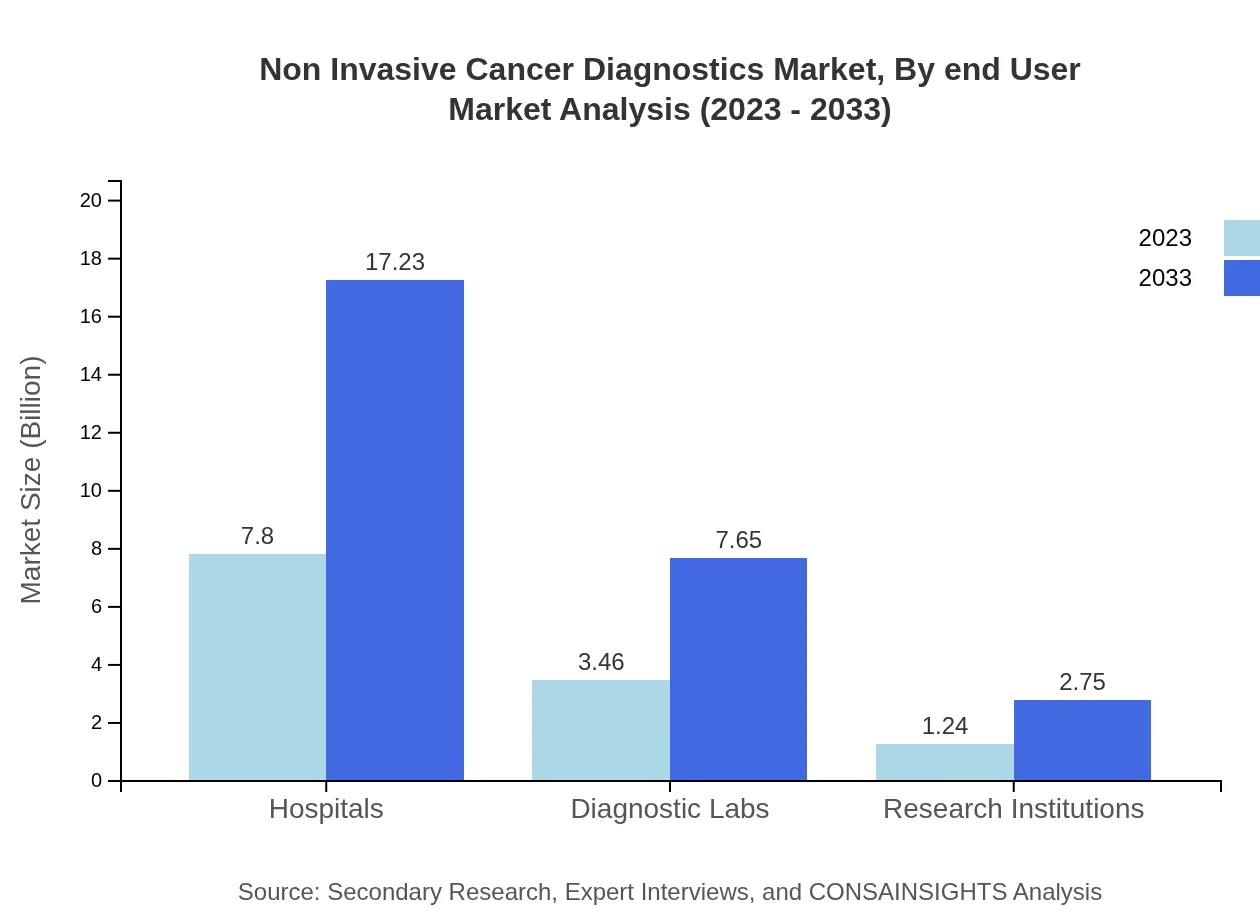

The end-user segment of hospitals leads the market with a size of $7.80 billion in 2023, expected to grow to $17.23 billion, maintaining a share of 62.36% throughout the forecast period. Diagnostic laboratories contribute significantly as well, growing from $3.46 billion to $7.65 billion.

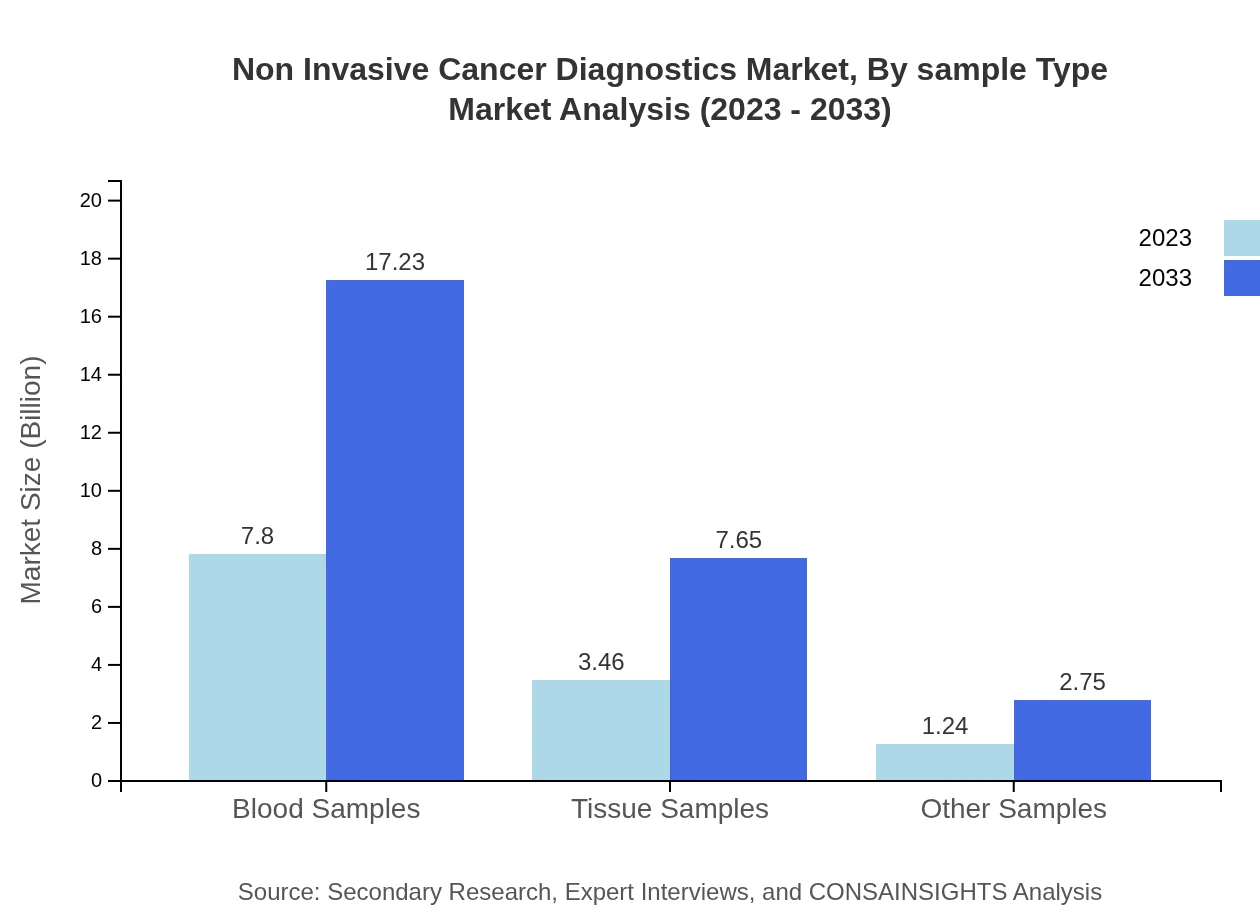

Non Invasive Cancer Diagnostics Market Analysis By Sample Type

Blood samples dominate the market for sample types, with a size of $7.80 billion in 2023 and anticipated to grow to $17.23 billion, holding a continuous share of 62.36%. Tissue samples are also important, growing from $3.46 billion to $7.65 billion, representing a share of 27.69%.

Non Invasive Cancer Diagnostics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Non Invasive Cancer Diagnostics Industry

Guardant Health:

Specializes in precision oncology and the development of liquid biopsy tests for cancer detection and monitoring.Roche Diagnostics:

A leading player in diagnostics, offering innovative solutions for cancer detection and molecular profiling.Exact Sciences Corporation:

Offers non-invasive screening tests for colorectal cancer, emphasizing early detection and patient care.Foundation Medicine:

Focuses on molecular information and next-generation sequencing for tailored cancer treatment strategies.We're grateful to work with incredible clients.

FAQs

What is the market size of non Invasive cancer diagnostics?

The non-invasive cancer diagnostics market is valued at approximately $12.5 billion in 2023, with an expected compound annual growth rate (CAGR) of 8% from 2023 to 2033, indicating significant growth in demand and innovation within the sector.

What are the key market players or companies in this non Invasive cancer diagnostics industry?

Key players in the non-invasive cancer diagnostics industry include renowned companies specializing in liquid biopsy technologies and diagnostic imaging, contributing to innovative solutions in cancer detection and monitoring, although specific company names are not provided.

What are the primary factors driving the growth in the non Invasive cancer diagnostics industry?

The growth in the non-invasive cancer diagnostics industry is driven by advancements in technology, increasing cancer prevalence, demand for early detection, patient preference for less invasive procedures, and growing investments in research and development.

Which region is the fastest Growing in the non Invasive cancer diagnostics?

North America is the fastest-growing region in the non-invasive cancer diagnostics market, projected to grow from $4.76 billion in 2023 to $10.53 billion by 2033, with Europe and Asia Pacific also showing significant growth trajectories.

Does ConsaInsights provide customized market report data for the non Invasive cancer diagnostics industry?

Yes, ConsaInsights offers customized market report data for the non-invasive cancer diagnostics industry, allowing clients to tailor the information to their specific needs and strategic goals, facilitating informed decision-making.

What deliverables can I expect from this non Invasive cancer diagnostics market research project?

Deliverables from the non-invasive cancer diagnostics market research project include detailed market analysis, forecasts, competitive landscape assessments, segment insights, and trends analysis, tailored to client requirements.

What are the market trends of non Invasive cancer diagnostics?

Emerging trends in non-invasive cancer diagnostics include increasing adoption of liquid biopsy technologies, advancements in molecular diagnostics, integration of AI in diagnostics, and a shift toward personalized medicine, enhancing diagnostic accuracy and patient outcomes.