Non Protein Nitrogen Market Report

Published Date: 02 February 2026 | Report Code: non-protein-nitrogen

Non Protein Nitrogen Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Non-Protein Nitrogen market, focusing on key insights, market size, growth forecasts, and trends from 2023 to 2033. It covers regional variations, technological advancements, and a competitive landscape of major players in the industry.

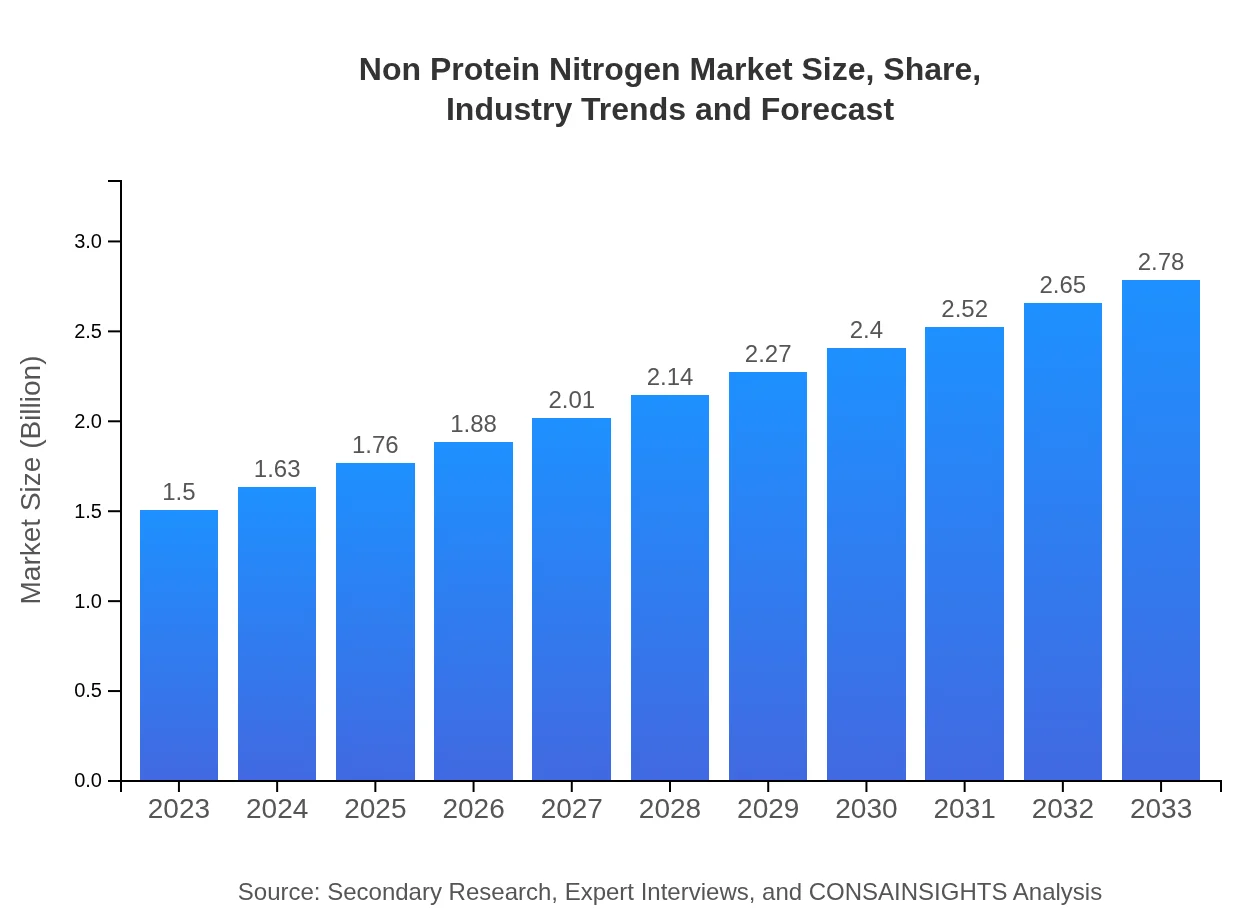

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | Nutrien Ltd., Yara International ASA, CF Industries Holdings, Inc., BASF SE |

| Last Modified Date | 02 February 2026 |

Non Protein Nitrogen Market Overview

Customize Non Protein Nitrogen Market Report market research report

- ✔ Get in-depth analysis of Non Protein Nitrogen market size, growth, and forecasts.

- ✔ Understand Non Protein Nitrogen's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Non Protein Nitrogen

What is the Market Size & CAGR of Non Protein Nitrogen market in 2023?

Non Protein Nitrogen Industry Analysis

Non Protein Nitrogen Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Non Protein Nitrogen Market Analysis Report by Region

Europe Non Protein Nitrogen Market Report:

The European Non-Protein Nitrogen market is forecasted to increase from $0.50 billion in 2023 to $0.92 billion by 2033. Europe emphasizes stringent regulations on chemical usage in agriculture, which encourages the adoption of more environmentally friendly nitrogen products. Innovations in biotechnological applications in fertilizers are expected to present significant growth opportunities in the coming years.Asia Pacific Non Protein Nitrogen Market Report:

In the Asia Pacific region, the Non-Protein Nitrogen market is valued at approximately $0.26 billion in 2023 and is expected to grow to $0.48 billion by 2033. This growth is fueled by increasing agricultural activities, particularly in countries like China and India, where there is a strong emphasis on food security and productivity enhancements. The rising adoption of advanced farming techniques and government initiatives supporting fertilizer use are pivotal drivers in this market.North America Non Protein Nitrogen Market Report:

In North America, the market size is set to grow from $0.55 billion in 2023 to $1.01 billion by 2033. The U.S. dominates this market, supported by advanced agricultural practices and a high demand for nitrogen fertilizers in corn and soy cultivation. The trend toward precision agriculture and regulatory frameworks promoting efficient fertilizer use are positively impacting growth in this region.South America Non Protein Nitrogen Market Report:

The South American Non-Protein Nitrogen market is projected to expand from $0.11 billion in 2023 to $0.21 billion by 2033. The region's agricultural sector is significantly growing due to the increasing production of soybeans and maize. However, challenges such as varying climatic conditions and access to fertilizer distribution may impact growth. The shift towards sustainable farming practices is driving demand for environmentally friendly fertilizers.Middle East & Africa Non Protein Nitrogen Market Report:

The Middle East and Africa region's Non-Protein Nitrogen market is anticipated to grow from $0.08 billion in 2023 to $0.15 billion by 2033, driven by increasing agricultural investments, though hindered by harsh climatic conditions and variable agricultural productivity. Efforts towards improving water management and soil health will promote the injection of nitrogenous fertilizers in the region.Tell us your focus area and get a customized research report.

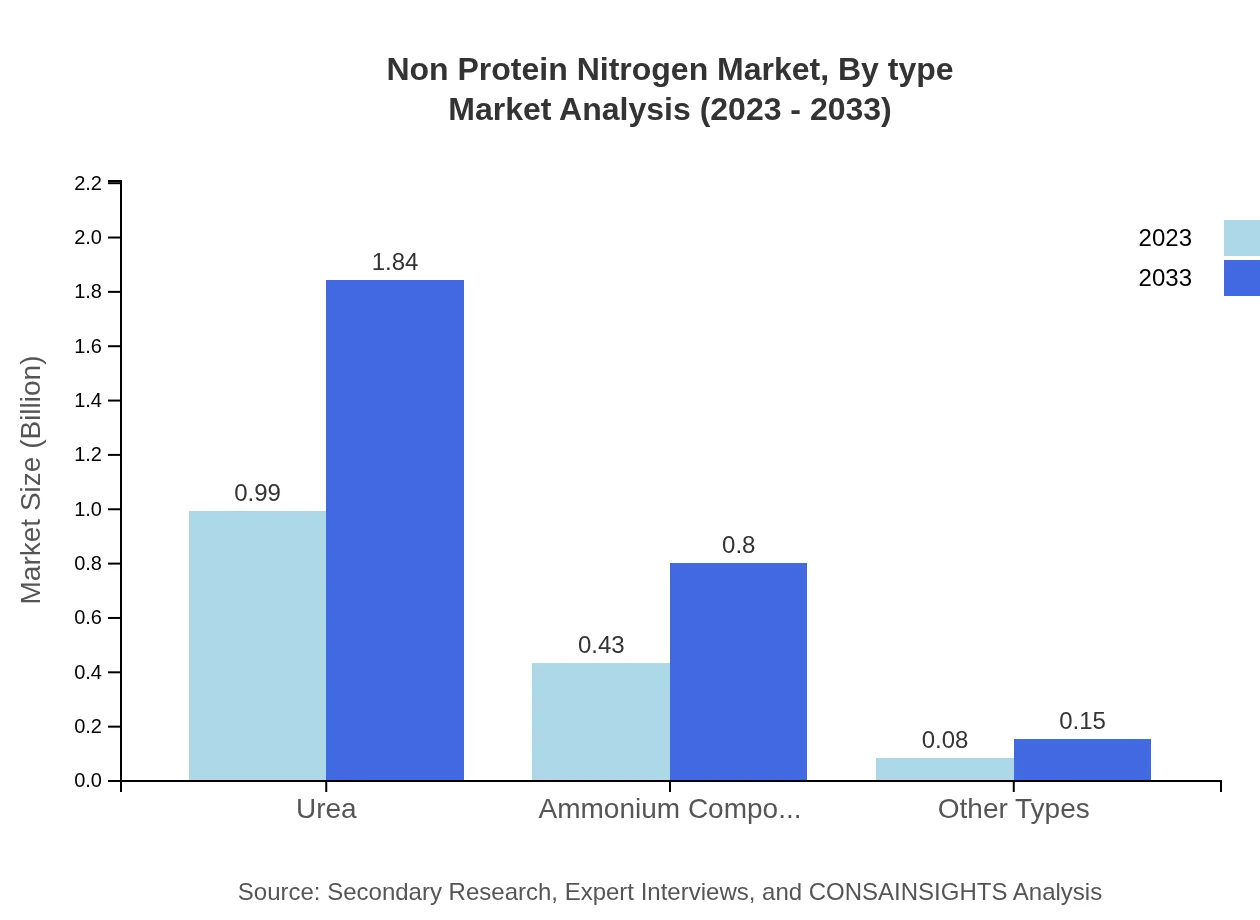

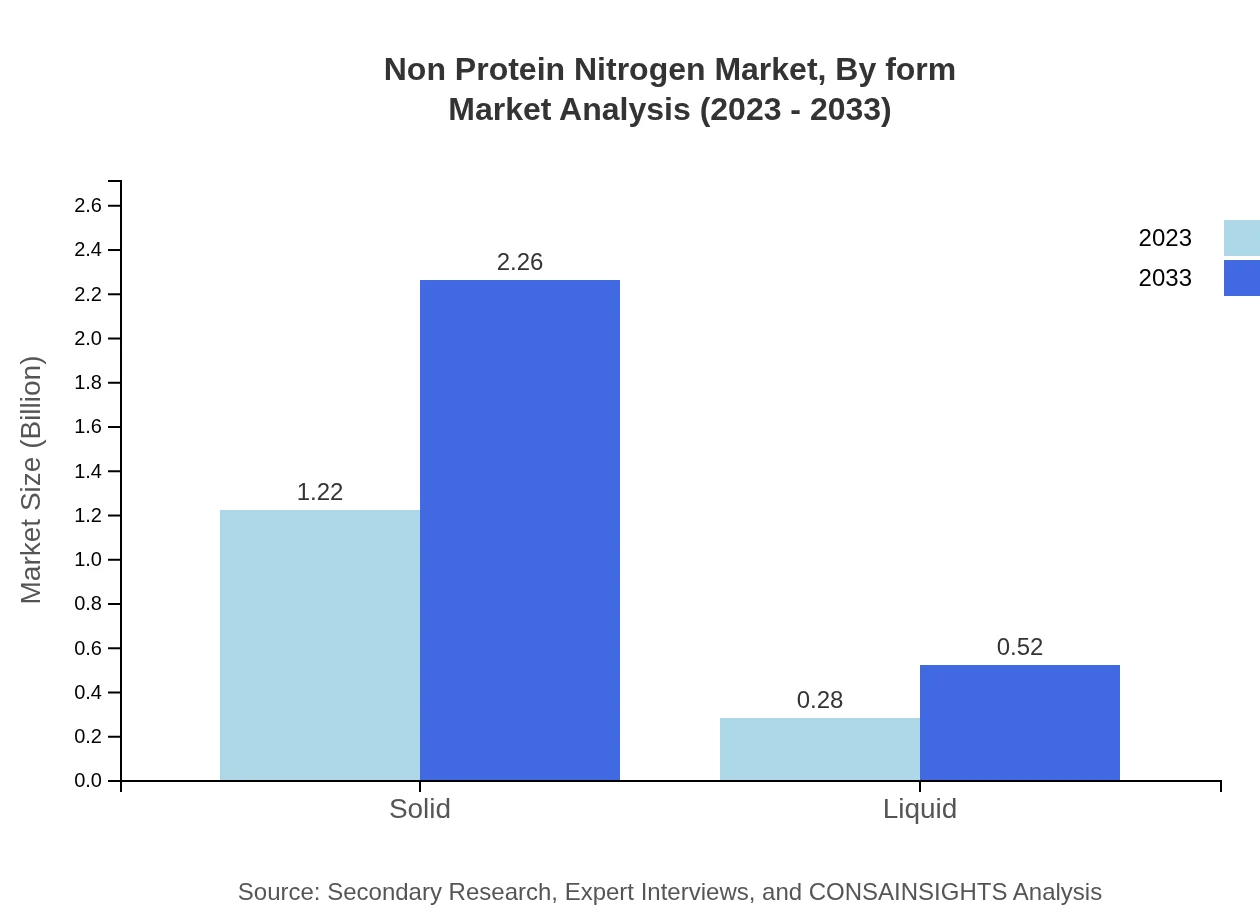

Non Protein Nitrogen Market Analysis By Type

The Non-Protein Nitrogen Market is primarily segmented into solid and liquid forms. As of 2023, solid types represent a substantial market segment with a size of approximately $1.22 billion, expected to reach $2.26 billion by 2033, maintaining an 81.37% market share. Liquid forms, currently valued at approximately $0.28 billion, are anticipated to reach $0.52 billion by 2033, holding an 18.63% share. Urea remains the leading product type, with a market size of $0.99 billion expected to grow to $1.84 billion in ten years, while ammonium compounds and other types also exhibit significant market potentials.

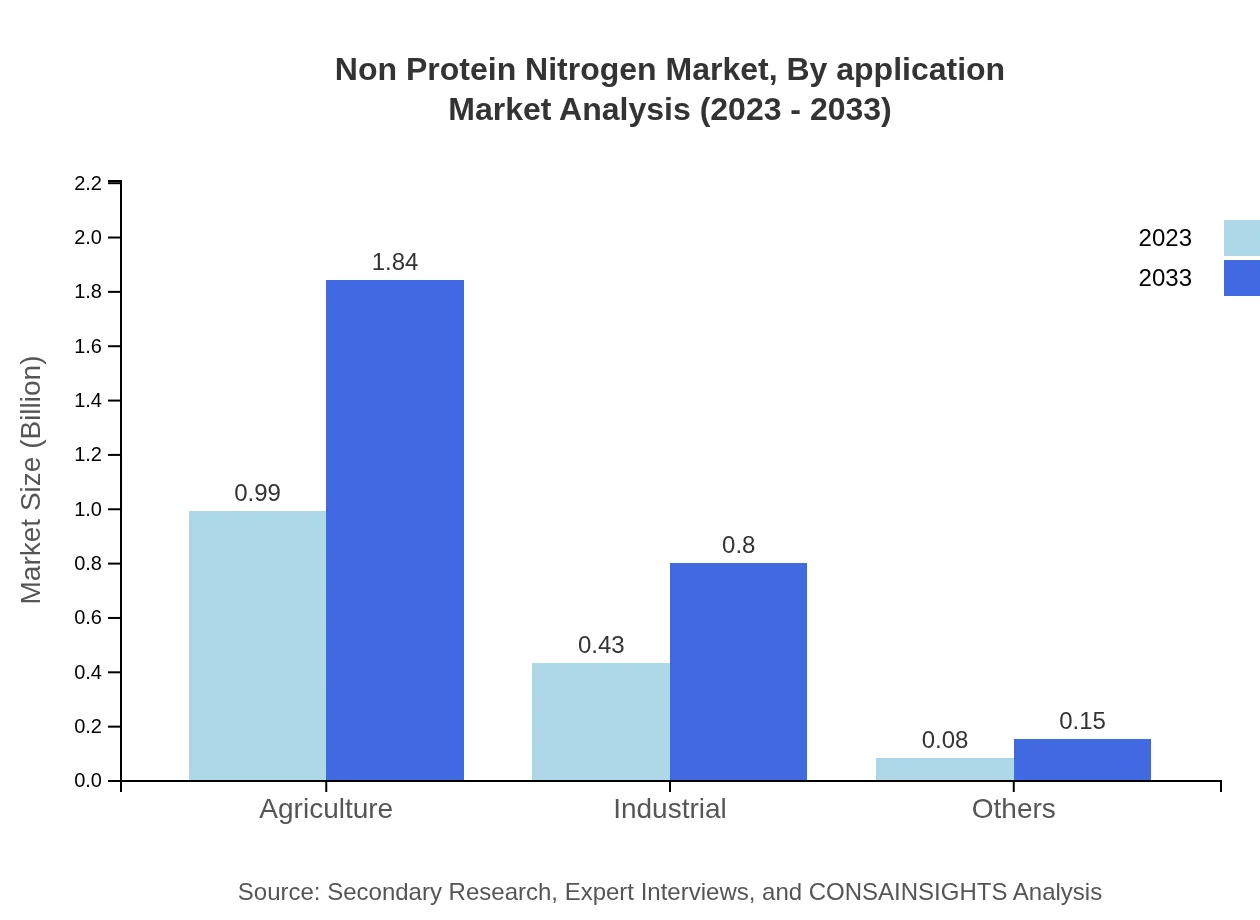

Non Protein Nitrogen Market Analysis By Application

Segmentation in terms of applications highlights agriculture as the primary sector consuming Non-Protein Nitrogen products, accounting for a market size starting at $0.99 billion in 2023 and projected to grow to $1.84 billion by 2033, representing 66.09% of the market. The industrial segment follows, increasingly integrating Nitrogen into processes with a market size estimated to rise from $0.43 billion to $0.80 billion over the decade, comprising 28.64% of the market share.

Non Protein Nitrogen Market Analysis By Form

The market is also segmented by form, distinguishing between solid and liquid Non-Protein Nitrogen fertilizers. Solid fertilizers dominate the sector, with anticipated sizes from $1.22 billion to $2.26 billion by 2033, whereas liquid fertilizers, valued at $0.28 billion in 2023, are expected to increase to $0.52 billion, indicating comprehensive adoption across various agricultural sectors.

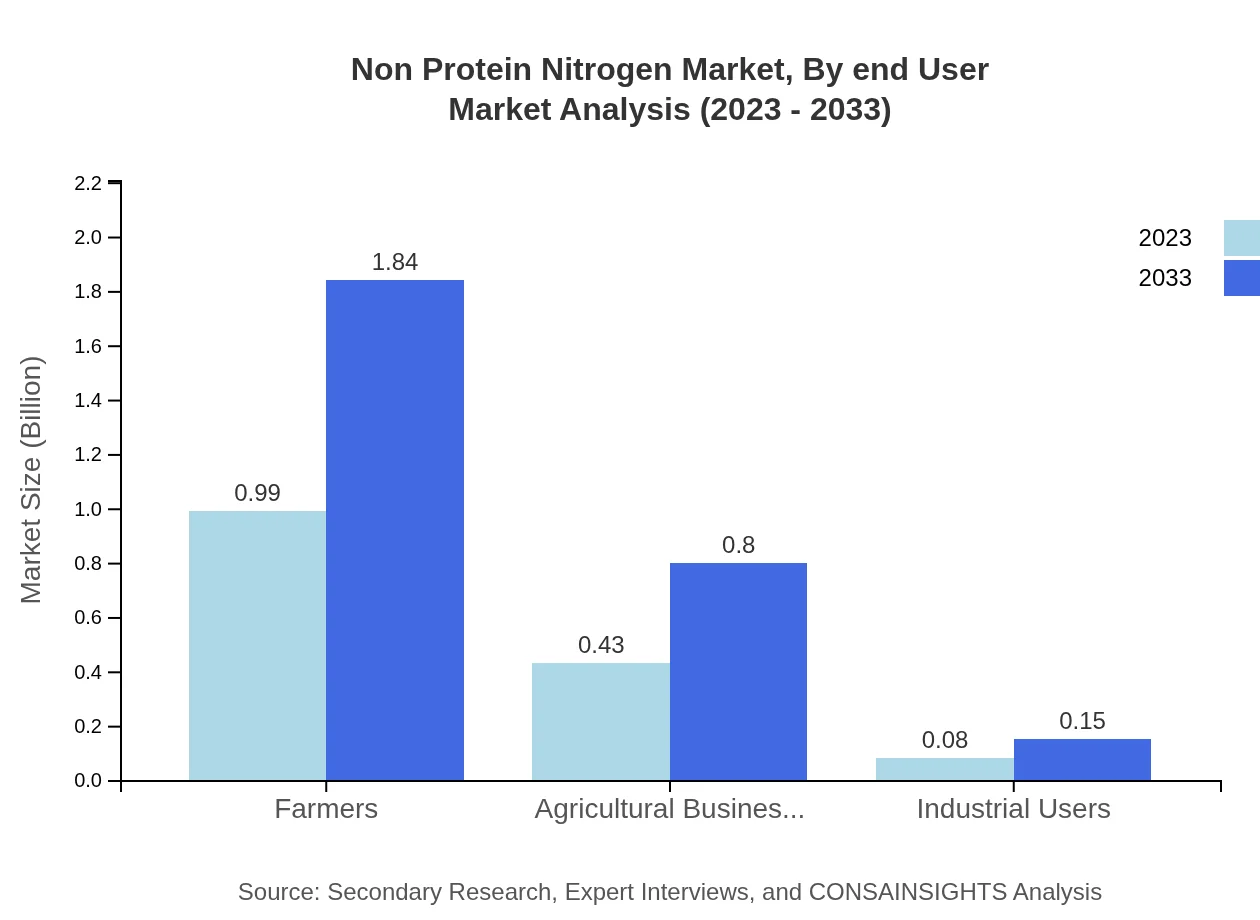

Non Protein Nitrogen Market Analysis By End User

The Non-Protein Nitrogen market illustrates diverse end-users, with farmers primarily representing a colossal segment projected to grow from $0.99 billion to $1.84 billion by 2033. Agricultural businesses also maintain a significant share, with expected growth from $0.43 billion to $0.80 billion, while industrial users remain relatively small, contributing approximately $0.08 billion in 2023, rising to $0.15 billion, representing a steady yet modest growth trajectory.

Non Protein Nitrogen Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Non Protein Nitrogen Industry

Nutrien Ltd.:

Nutrien Ltd. is a global leader in the production of crop inputs, primarily nitrogen fertilizers, and serves a diversified portfolio of agricultural products to farmers worldwide.Yara International ASA:

Yara International ASA, based in Norway, specializes in plant nutrition and different fertilizer products, focusing on sustainable agriculture and responsible farming practices.CF Industries Holdings, Inc.:

CF Industries is one of the largest manufacturers of nitrogen fertilizer in the world, offering a wide range of products designed to meet the agricultural market's needs.BASF SE:

BASF SE is prominent in the chemical industry, providing innovative solutions for crop production and fertilizers, including advanced Non-Protein Nitrogen products.We're grateful to work with incredible clients.

FAQs

What is the market size of Non-Protein-Nitrogen?

The non-protein nitrogen market is projected to reach a size of approximately $1.5 billion by 2033, growing at a compound annual growth rate (CAGR) of 6.2%. This growth indicates robust demand across various industry applications.

What are the key market players or companies in the Non-Protein-Nitrogen industry?

The non-protein nitrogen industry is characterized by key players, including prominent manufacturers and suppliers of fertilizers and nitrogen compounds. Their developments and innovations significantly influence market growth and competitive dynamics.

What are the primary factors driving the growth in the Non-Protein-Nitrogen industry?

Key factors driving the growth in the non-protein nitrogen industry include increasing agricultural activities, growing demand for sustainable fertilizers, and advancements in nitrogen usage efficiency. These elements collectively contribute to market expansion.

Which region is the fastest Growing in the Non-Protein-Nitrogen?

Asia-Pacific is the fastest-growing region in the non-protein nitrogen market, projected to increase from $0.26 billion in 2023 to $0.48 billion by 2033. This growth is fueled by rising agricultural production needs.

Does ConsaInsights provide customized market report data for the Non-Protein-Nitrogen industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the non-protein nitrogen industry. This service enables stakeholders to gain insights relevant to their operations.

What deliverables can I expect from this Non-Protein-Nitrogen market research project?

Key deliverables from the non-protein nitrogen market research project include comprehensive analysis reports, market size forecasts, segment data, competitive landscape insights, and regional growth assessments.

What are the market trends of Non-Protein-Nitrogen?

Market trends in non-protein nitrogen indicate a shift towards eco-friendly products, increased application in livestock feed, and innovation in nitrogen formulations. These trends reflect growing consumer awareness and regulatory shifts.