Npk Market Report

Published Date: 31 January 2026 | Report Code: npk

Npk Market Size, Share, Industry Trends and Forecast to 2033

This market report provides in-depth insights on the global Npk market, featuring current trends, market size, and growth projections for the forecast period of 2023 to 2033. It covers various segments and regional analyses to aid stakeholders in strategic decision-making.

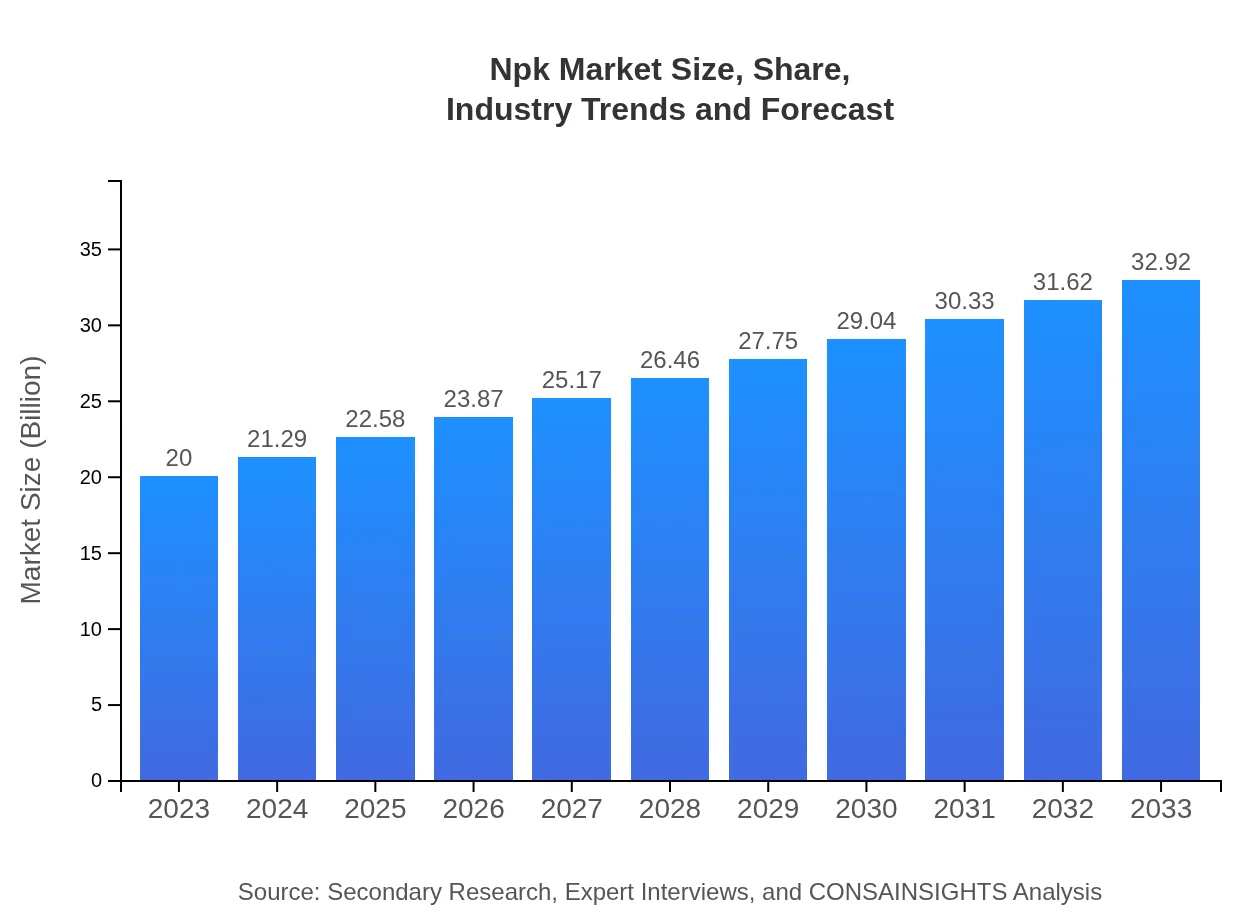

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $20.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $32.92 Billion |

| Top Companies | Nutrien Ltd., Yara International, The Mosaic Company, CF Industries Holdings Inc., ICL Group |

| Last Modified Date | 31 January 2026 |

Npk Market Overview

Customize Npk Market Report market research report

- ✔ Get in-depth analysis of Npk market size, growth, and forecasts.

- ✔ Understand Npk's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Npk

What is the Market Size & CAGR of Npk market in 2023?

Npk Industry Analysis

Npk Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Npk Market Analysis Report by Region

Europe Npk Market Report:

In Europe, the market is expected to rise from $5.08 billion in 2023 to $8.37 billion in 2033, fueled by a comprehensive regulatory framework promoting sustainable agricultural practices. The increasing emphasis on organic farming is expected to create a significant niche for eco-friendly Npk fertilizers.Asia Pacific Npk Market Report:

In the Asia Pacific region, the Npk market is projected to grow from $4.03 billion in 2023 to $6.64 billion in 2033. The region benefits from extensive agricultural activities and a growing population, leading to increased fertilizer usage. The adoption of precision farming technologies and government initiatives to improve crop yields are also enhancing market prospects in countries like China and India.North America Npk Market Report:

The North American Npk market is anticipated to grow from $7.62 billion in 2023 to $12.53 billion in 2033. Increased adoption of innovative agricultural techniques, including enhanced efficiency fertilizer management, and high demand for corn, soybeans, and wheat, are major contributors to this growth.South America Npk Market Report:

For South America, the Npk market will increase from $1.03 billion in 2023 to $1.70 billion in 2033. Key countries involved in agricultural production, such as Brazil and Argentina, are expected to enhance their fertilizer application rates to meet international agricultural export demands, further driving market growth.Middle East & Africa Npk Market Report:

The Npk market in the Middle East and Africa is forecasted to grow from $2.24 billion in 2023 to $3.68 billion in 2033. As several countries seek to diversify their agricultural production portfolios amidst climate improvements and economic diversification initiatives, the demand for fertilizers that meet increased food production needs will rise.Tell us your focus area and get a customized research report.

Npk Market Analysis By Product Type

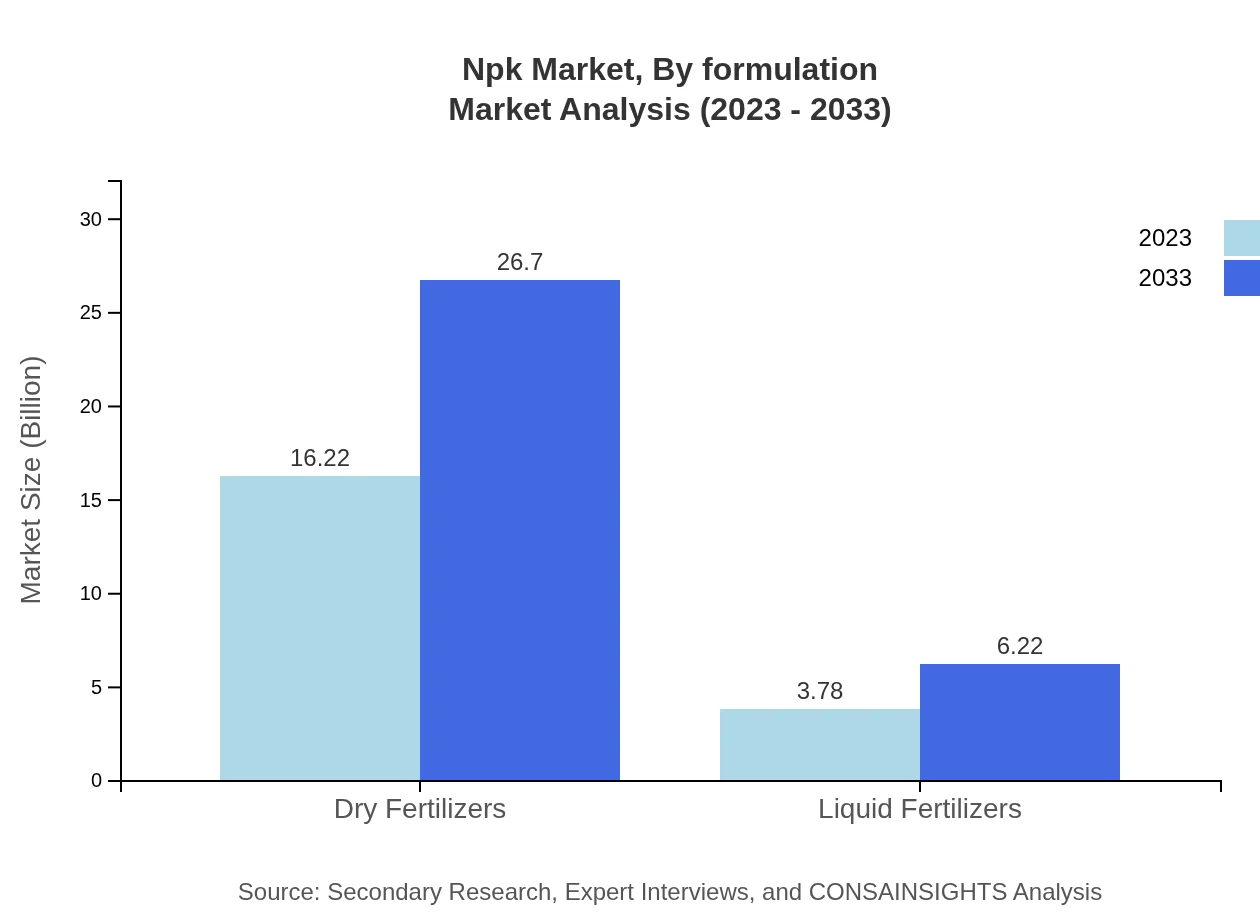

In terms of product types, the Npk fertilizers market is mainly divided into dry fertilizers and liquid fertilizers. Dry fertilizers dominate the market, with a share of 81.11% in 2023, expected to remain stable through 2033. Liquid fertilizers, though smaller in market share, are gaining traction for their ease of application and effective nutrient delivery.

Npk Market Analysis By End Use

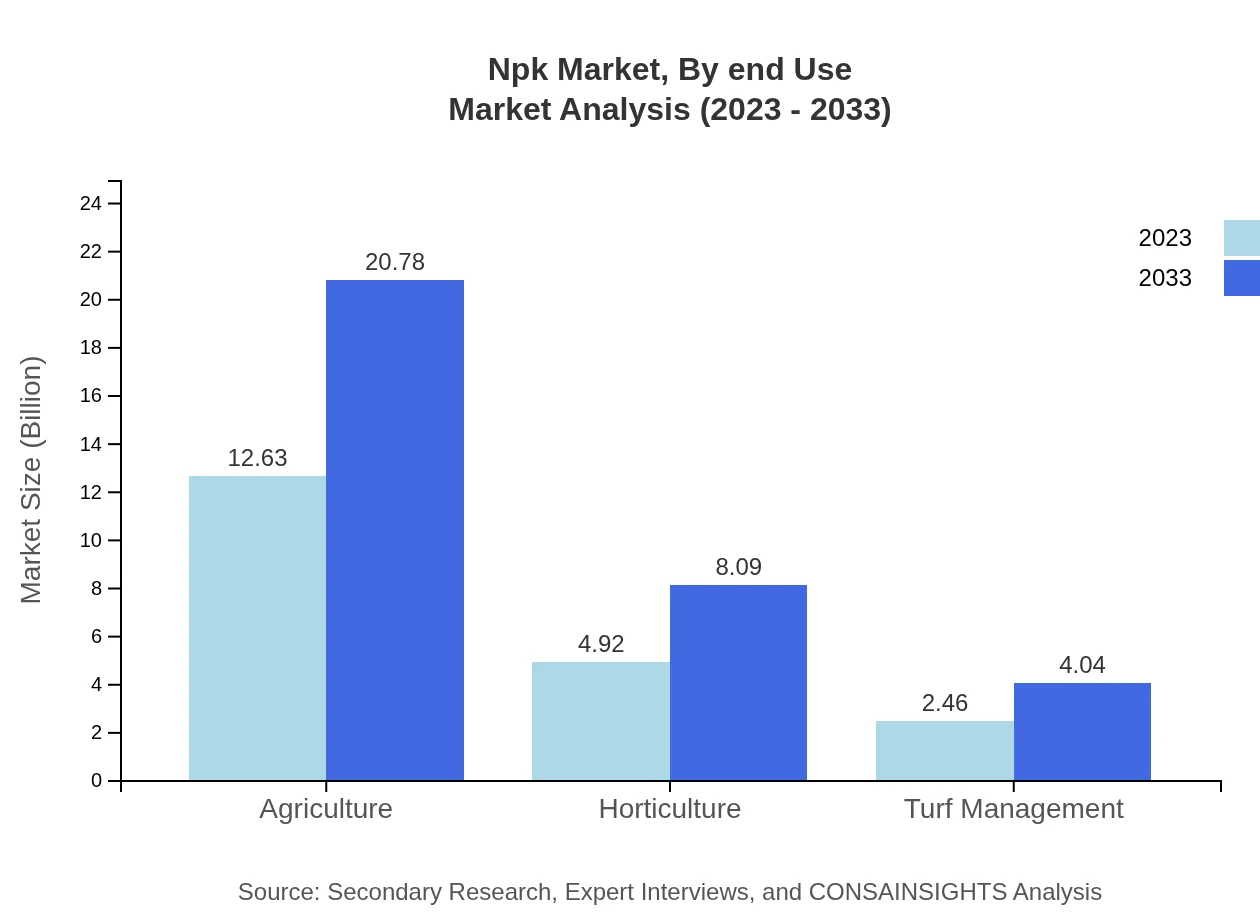

The agriculture segment holds the largest share of the Npk market, contributing 63.14% in 2023 and expected to continue at the same level through 2033. Horticulture follows with significant growth driven by urbanization and demand for landscaping. Additionally, turf management is emerging as a critical end-use sector as recreational areas increase.

Npk Market Analysis By Formulation

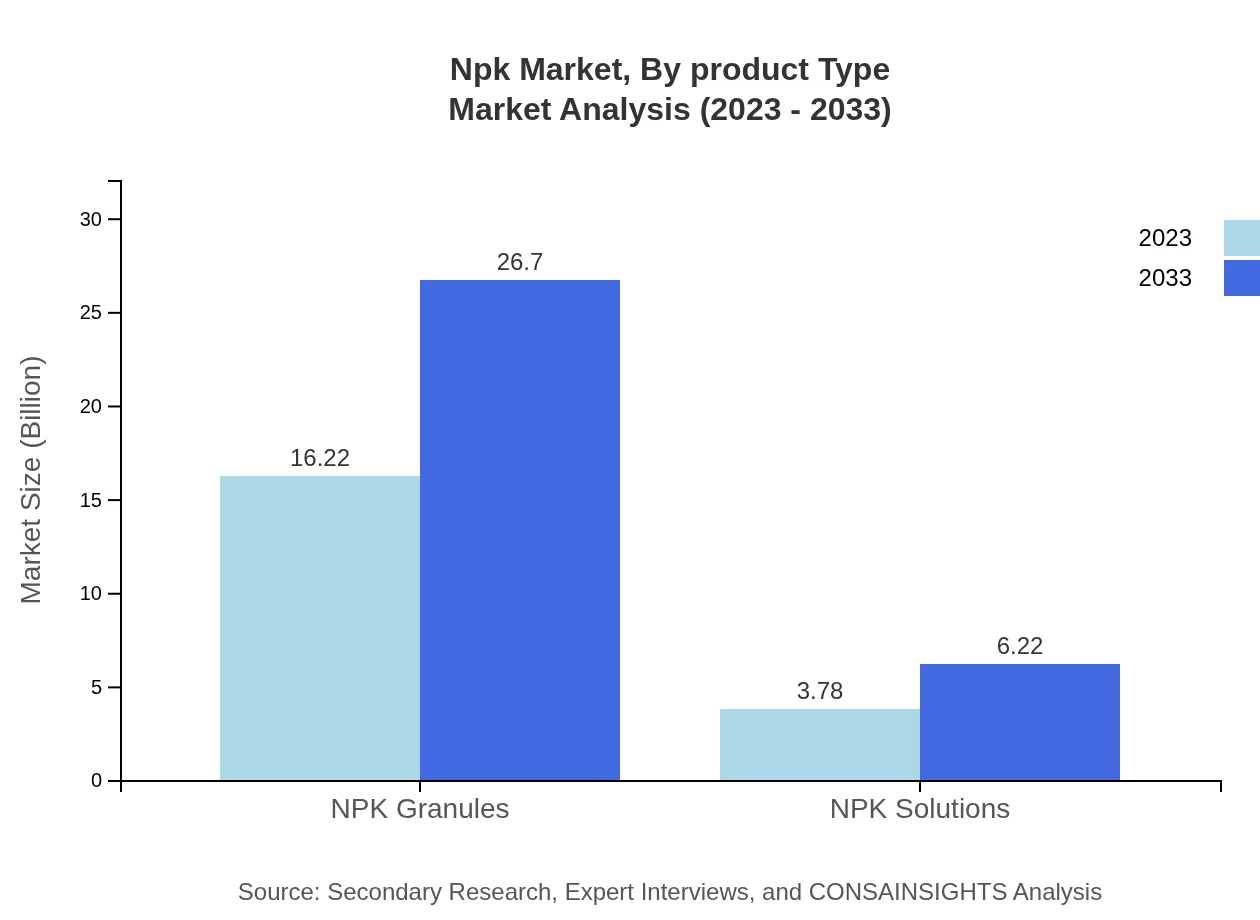

The Npk market is divided into granules and solutions, with granules occupying a dominant position due to ease of storage and application. Granules accounted for 81.11% of the market share in 2023. However, solutions are gradually gaining popularity for specific applications requiring precise nutrient delivery.

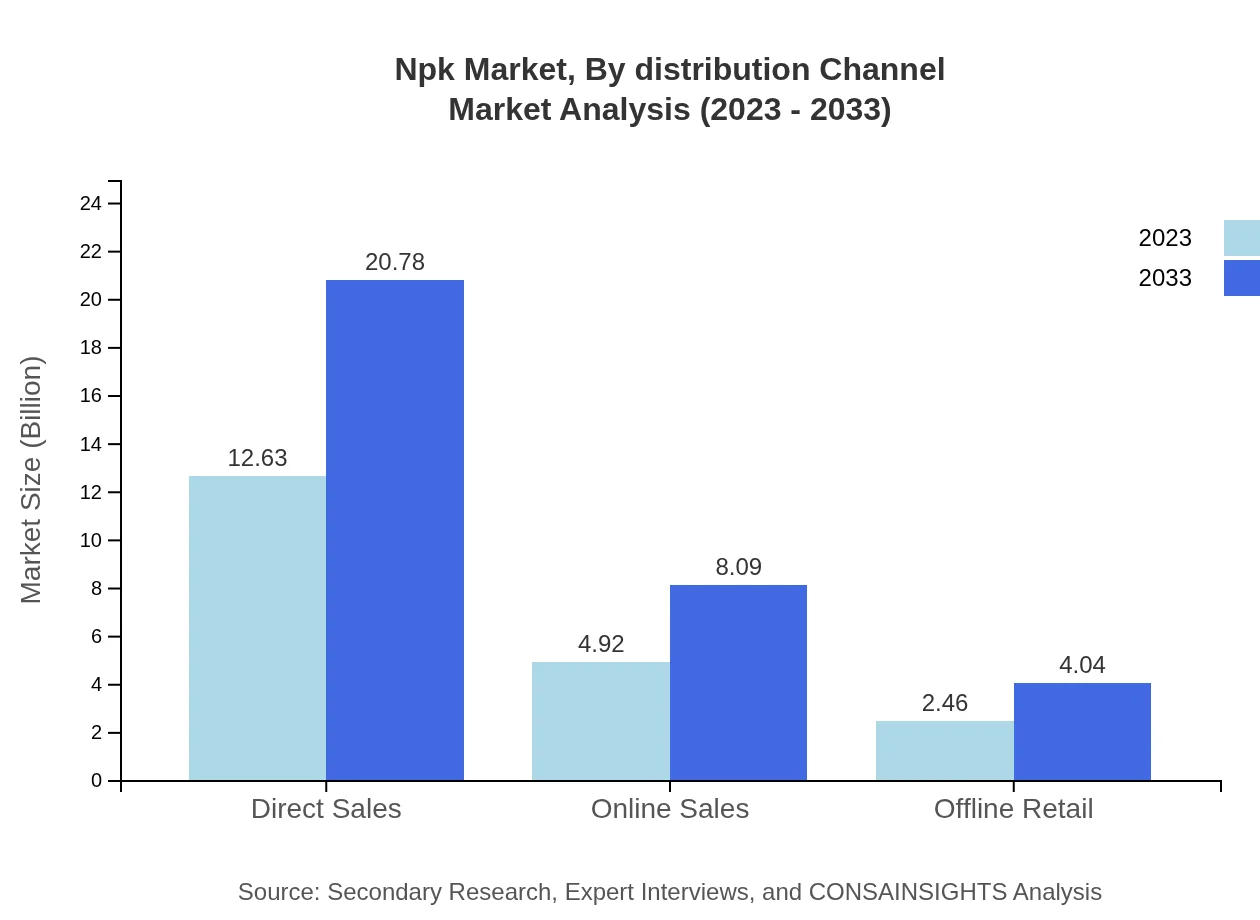

Npk Market Analysis By Distribution Channel

The distribution channels for Npk fertilizers include direct sales, online sales, and offline retail. Direct sales is the leading channel, contributing 63.14% of the market share in 2023, while online sales offer potential for growth as digital transformation continues, particularly among younger farmers.

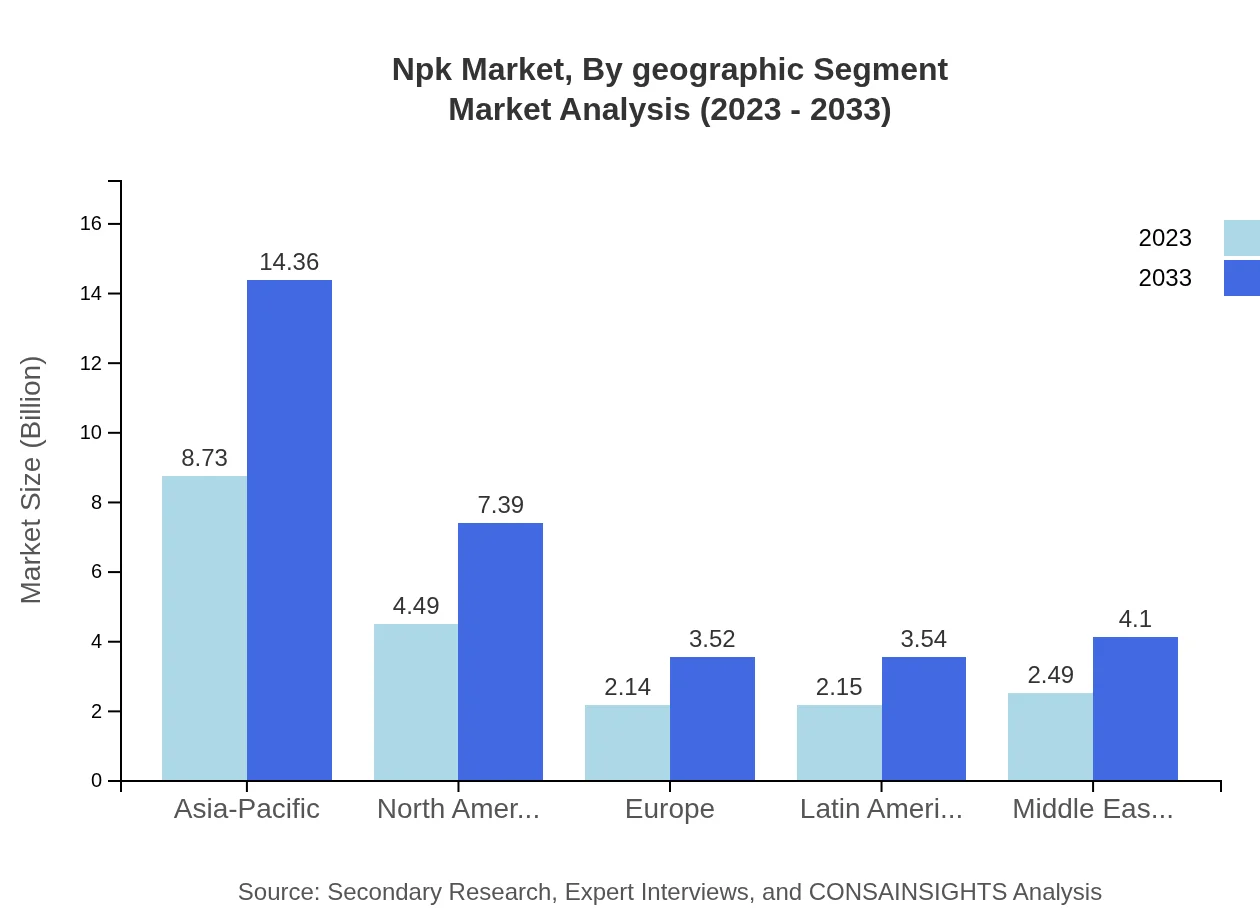

Npk Market Analysis By Geographic Segment

Geographically, the Asia-Pacific region holds the largest market share, contributing 43.63% in 2023. North America and Europe follow, with each contributing 22.45% and 10.68% respectively. Understanding these geographical dynamics is crucial for tailoring marketing and distribution strategies.

Npk Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Npk Industry

Nutrien Ltd.:

Nutrien is a global leader in agriculture and fertilizer production, offering a vast range of Npk products aimed at boosting agricultural productivity.Yara International:

Yara specializes in mineral fertilizers and has developed innovative Npk solutions that enhance crop growth while focusing on sustainability.The Mosaic Company:

Mosaic plays a significant role in the Npk market by producing and marketing phosphate and potash fertilizers required for crop production.CF Industries Holdings Inc.:

CF Industries is known for its nitrogen and Npk fertilizers, with a strong emphasis on improving soil health and crop performance.ICL Group:

ICL Group delivers a diversified portfolio, including Npk products designed to meet various agricultural needs globally.We're grateful to work with incredible clients.

FAQs

What is the market size of NPK?

The global NPK market is currently valued at approximately $20 billion and is projected to grow at a CAGR of 5% from 2023 to 2033, indicating a significant expansion as demand rises for efficient fertilizers.

What are the key market players or companies in the NPK industry?

Key players in the NPK market include major chemical manufacturers and fertilizer companies, renowned for their innovative products and strategic growth initiatives that shape competitive dynamics in the agricultural sector.

What are the primary factors driving the growth in the NPK industry?

Factors such as rising global population, increasing food production demand, advancements in agricultural practices, and the need for soil health improvement are propelling growth in the NPK market.

Which region is the fastest Growing in the NPK market?

The Asia-Pacific region is the fastest-growing in the NPK market, projected to increase from $4.03 billion in 2023 to $6.64 billion by 2033 due to rising agricultural demands and government initiatives.

Does ConsaInsights provide customized market report data for the NPK industry?

Yes, ConsaInsights offers customized market report data tailored to specific company needs, enabling stakeholders to gain valuable insights into the NPK industry, regional variations, and trends.

What deliverables can I expect from this NPK market research project?

Deliverables from the NPK market research project may include comprehensive reports on market size, growth projections, regional analysis, competitive landscape evaluations, and tailored insights specific to market segments.

What are the market trends of NPK?

Current market trends for NPK include an increased focus on sustainability, the adoption of precision agriculture technologies, and a growing preference for optimized fertilizer formulations that enhance crop yields and reduce environmental impact.