Nuclear Imaging Equipment Market Report

Published Date: 31 January 2026 | Report Code: nuclear-imaging-equipment

Nuclear Imaging Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Nuclear Imaging Equipment market, including trends, forecasts, regional insights, and competitive landscape from 2023 to 2033, equipping stakeholders with critical insights for strategic decision-making.

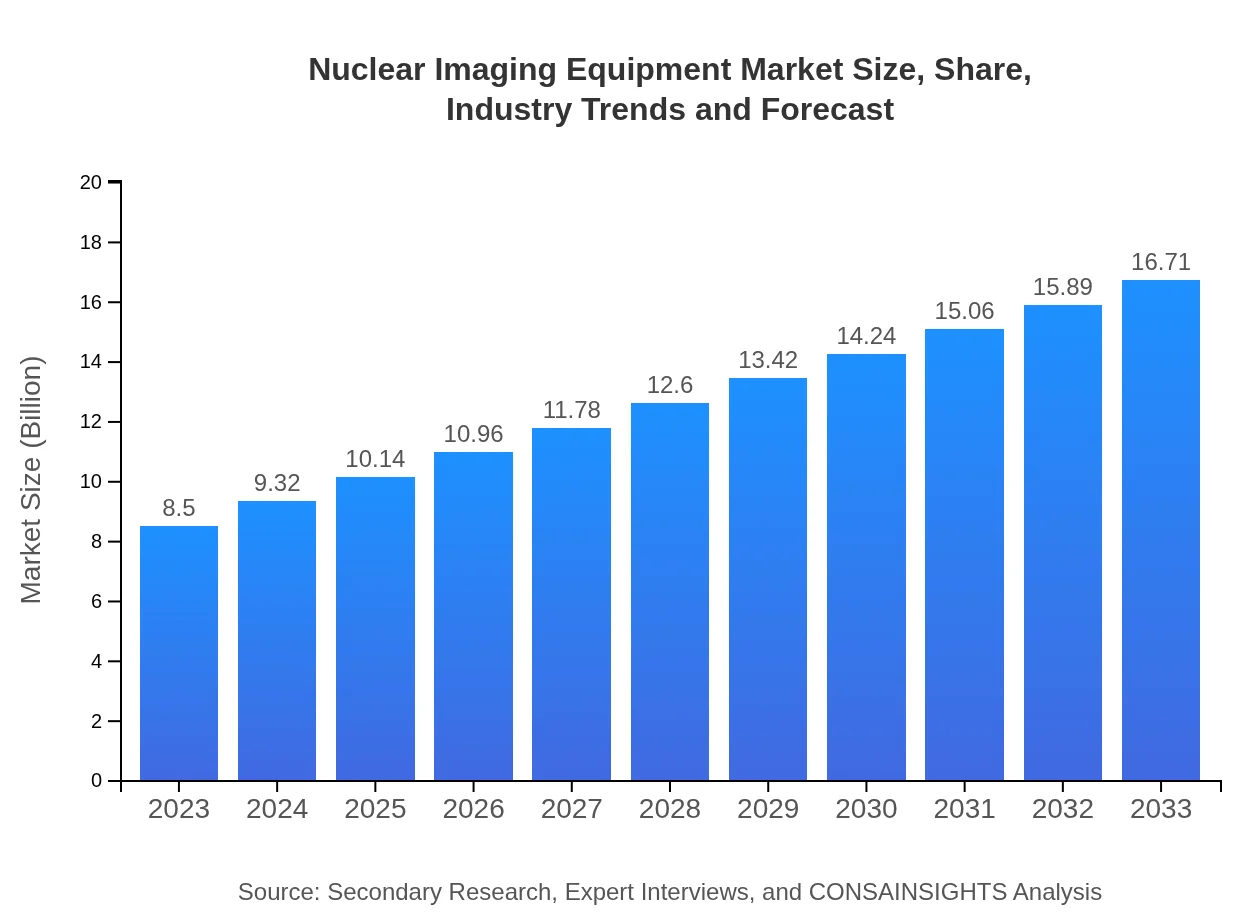

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $16.71 Billion |

| Top Companies | Siemens Healthineers, GE Healthcare, Philips Healthcare, Canon Medical Systems, Hitachi Medical Systems |

| Last Modified Date | 31 January 2026 |

Nuclear Imaging Equipment Market Overview

Customize Nuclear Imaging Equipment Market Report market research report

- ✔ Get in-depth analysis of Nuclear Imaging Equipment market size, growth, and forecasts.

- ✔ Understand Nuclear Imaging Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Nuclear Imaging Equipment

What is the Market Size & CAGR of Nuclear Imaging Equipment market from 2023 to 2033?

Nuclear Imaging Equipment Industry Analysis

Nuclear Imaging Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Nuclear Imaging Equipment Market Analysis Report by Region

Europe Nuclear Imaging Equipment Market Report:

The European region is notably significant in the Nuclear Imaging Equipment sector, beginning at $2.97 billion in 2023 and expected to reach $5.83 billion by 2033, driven by advancements in healthcare technologies and stringent healthcare standards.Asia Pacific Nuclear Imaging Equipment Market Report:

In 2023, the Asia-Pacific Nuclear Imaging Equipment market will account for $1.48 billion, expected to grow to $2.91 billion by 2033, reflecting a steady rise fueled by improvements in health infrastructure and increasing health awareness initiatives.North America Nuclear Imaging Equipment Market Report:

North America's market was $2.91 billion in 2023, anticipated to expand to $5.71 billion by 2033. This growth is primarily driven by high healthcare spending, sophisticated R&D, and a strong foothold of key manufacturers in the region.South America Nuclear Imaging Equipment Market Report:

South America presents a unique market landscape, starting with a size of $0.48 billion in 2023 and projected to reach $0.95 billion by 2033 due to rising healthcare expenditures and a growing emphasis on diagnostic imaging techniques.Middle East & Africa Nuclear Imaging Equipment Market Report:

In the Middle East and Africa, the market starts at $0.67 billion in 2023, likely reaching $1.31 billion by 2033, supported by increasing investments in healthcare infrastructure and an uptick in diagnostic imaging needs.Tell us your focus area and get a customized research report.

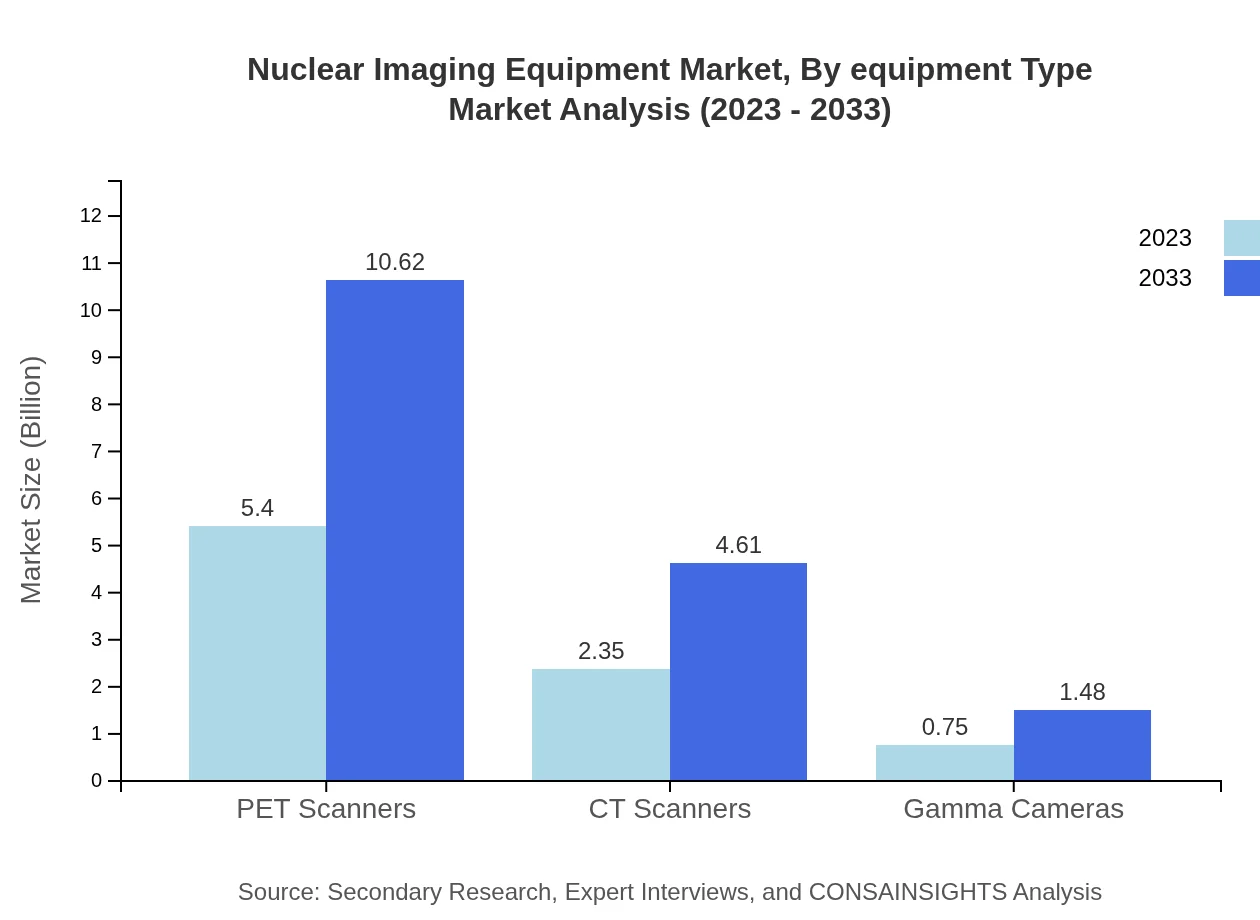

Nuclear Imaging Equipment Market Analysis By Equipment Type

Within the equipment type segment, PET scanners dominate with a market size of $5.40 billion in 2023, growing to $10.62 billion by 2033, holding a share of 63.57%. Gamma cameras follow, holding a 8.84% market share, expected to grow from $0.75 billion in 2023 to $1.48 billion by 2033.

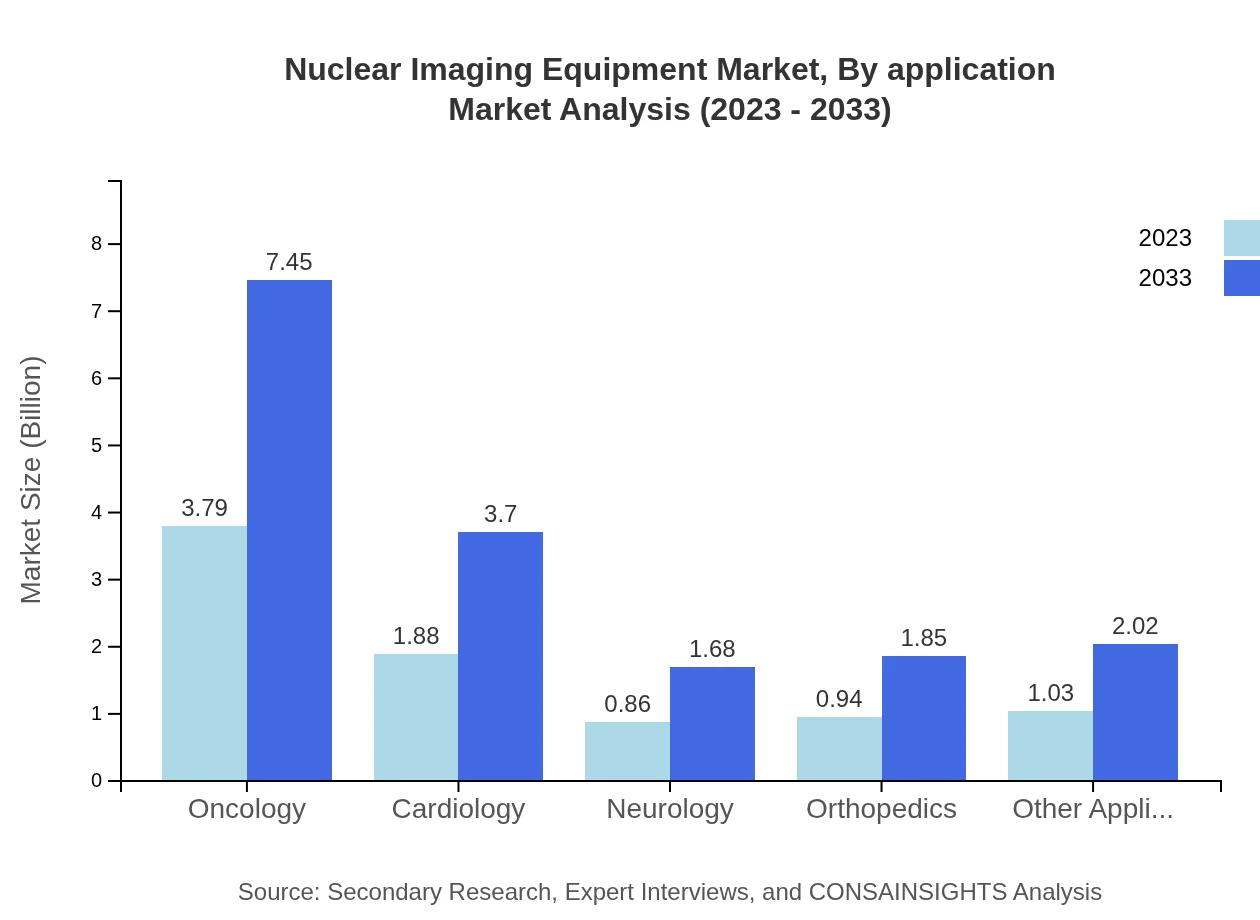

Nuclear Imaging Equipment Market Analysis By Application

Oncology is the leading application segment, accounting for $3.79 billion in 2023 and projected to reach $7.45 billion by 2033. It holds a 44.6% market share, reflecting the critical role of imaging in cancer diagnostics and treatment.

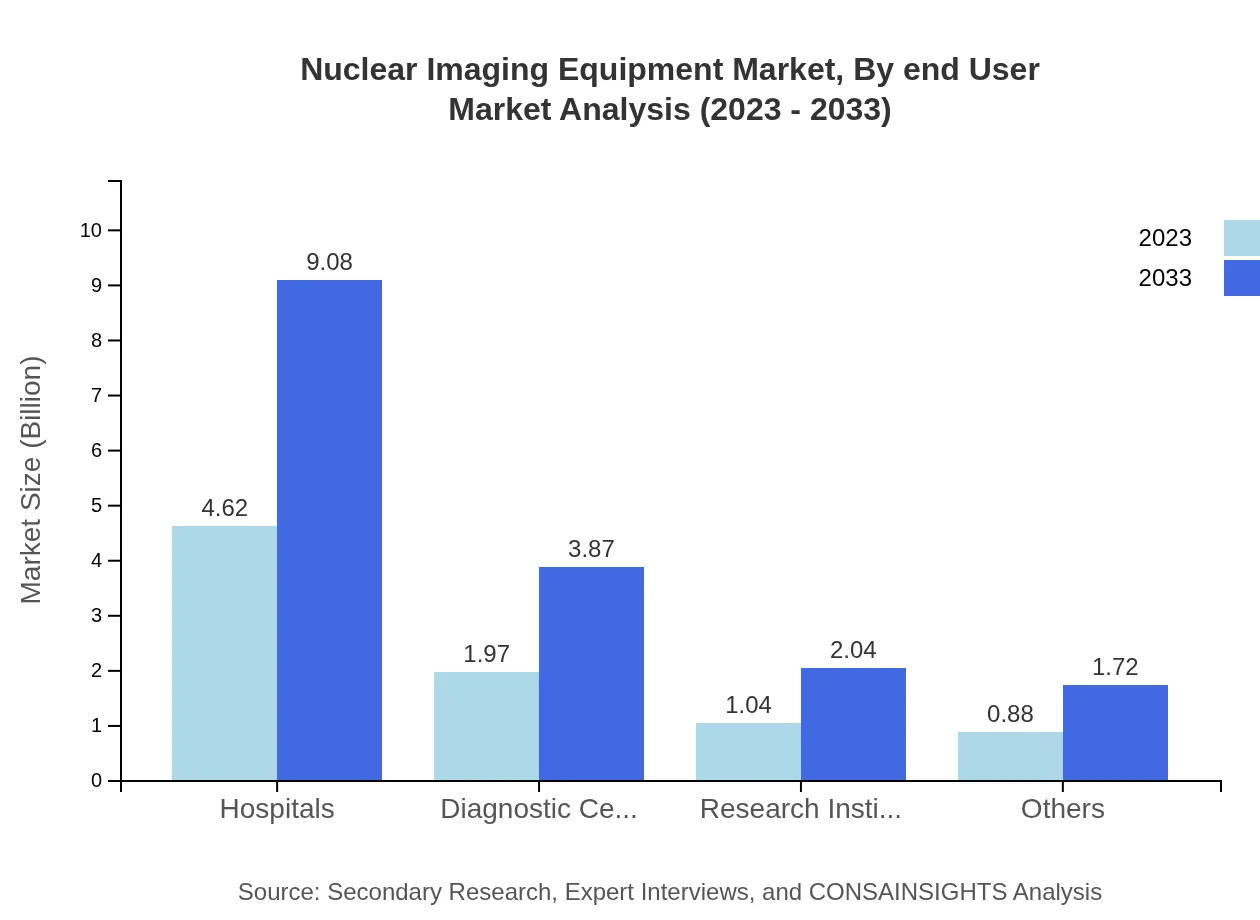

Nuclear Imaging Equipment Market Analysis By End User

Hospitals remain the primary end-users of Nuclear Imaging Equipment, with a market size of $4.62 billion in 2023 expected to reach $9.08 billion by 2033, maintaining a substantial share of 54.35%. Diagnostic centers and research institutes follow, emphasizing the diverse applications of nuclear imaging.

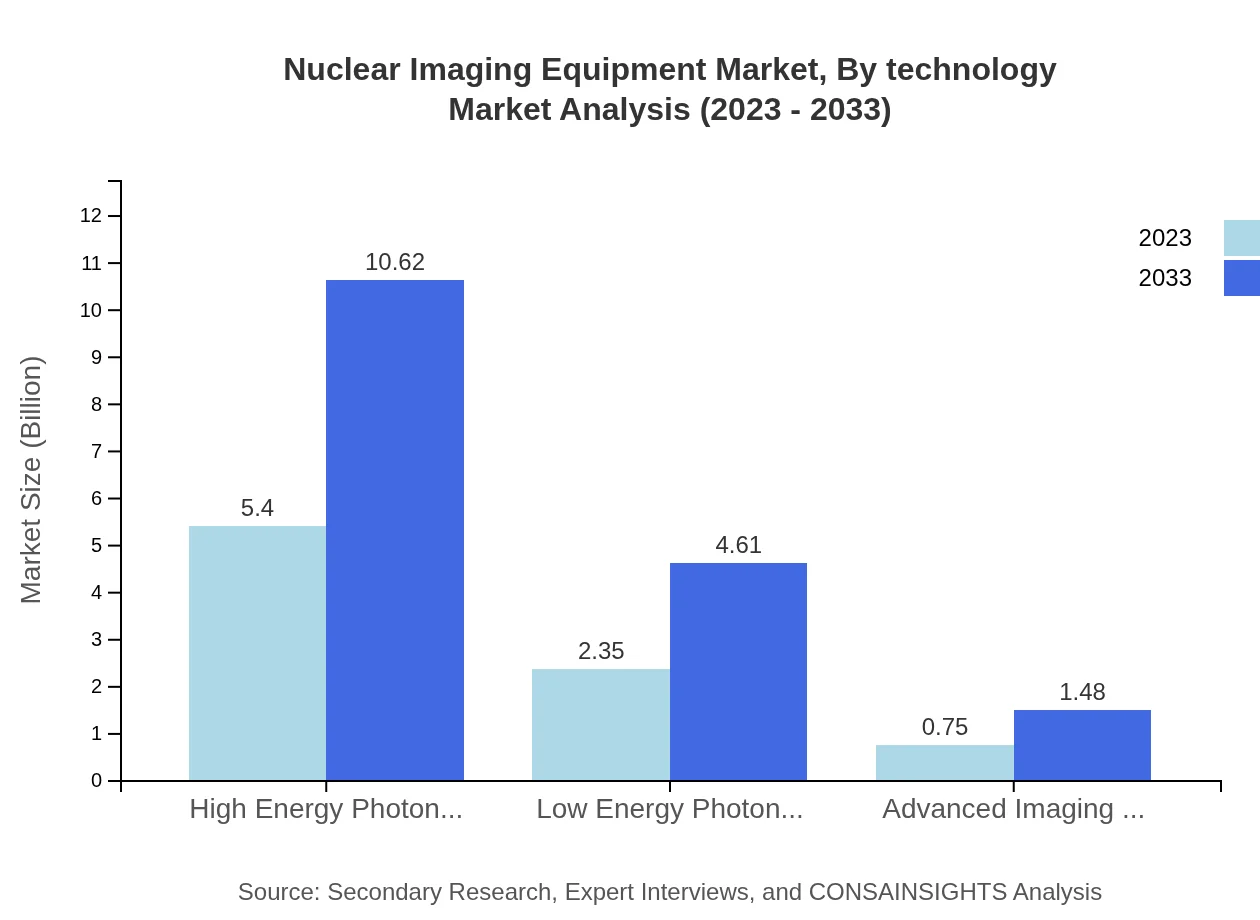

Nuclear Imaging Equipment Market Analysis By Technology

High Energy Photon Detection technology achieves $5.40 billion in 2023, projected to hit $10.62 billion by 2033 due to its efficiency in imaging applications. Low Energy Photon Detection and Advanced Imaging Techniques also represent significant areas of technological advancement.

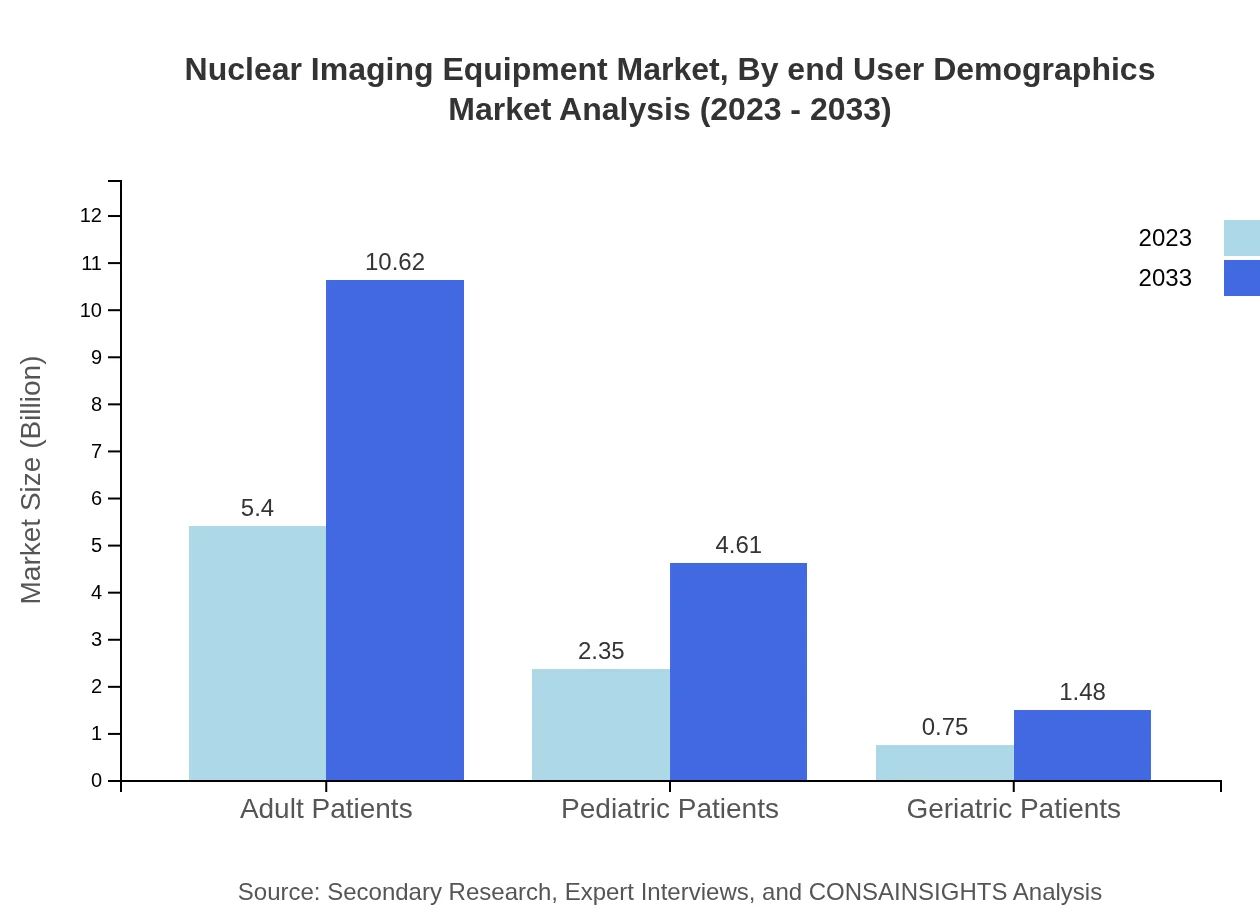

Nuclear Imaging Equipment Market Analysis By End User Demographics

The demographic analysis highlights adult patients, comprising a market size of $5.40 billion in 2023, while pediatric and geriatric segments also show promising growth due to increasing diagnostic needs across all age categories.

Nuclear Imaging Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Nuclear Imaging Equipment Industry

Siemens Healthineers:

Siemens Healthineers provides a wide range of innovative imaging solutions with a focus on enhancing productivity in healthcare settings, advancing nuclear imaging with cutting-edge technology.GE Healthcare:

GE Healthcare leads in medical imaging technologies, offering leading nuclear imaging equipment such as PET and SPECT solutions, with an emphasis on image quality and operational efficiency.Philips Healthcare:

Philips Healthcare specializes in medical imaging systems and has developed comprehensive nuclear medicine solutions, focusing on integration and advanced imaging technologies.Canon Medical Systems:

Canon Medical Systems actively participates in the nuclear imaging market with innovative products that promote diagnostic excellence and patient care through advanced technology.Hitachi Medical Systems:

Hitachi Medical Systems is recognized for its reliable and efficient imaging solutions, contributing significantly to the nuclear imaging sector with a focus on enhancing patient outcomes through technology.We're grateful to work with incredible clients.

FAQs

What is the market size of nuclear Imaging Equipment?

The nuclear imaging equipment market is valued at approximately $8.5 billion in 2023, with an anticipated compound annual growth rate (CAGR) of 6.8%, forecasted to grow significantly by 2033.

What are the key market players or companies in this nuclear Imaging Equipment industry?

Key players in the nuclear imaging equipment industry include major healthcare companies and technology firms that specialize in medical devices, imaging technologies, and hospital equipment service providers.

What are the primary factors driving the growth in the nuclear Imaging Equipment industry?

The growth in the nuclear imaging equipment market is propelled by advancements in medical technologies, increased healthcare expenditure, a growing patient pool requiring diagnostic imaging, and a rise in chronic diseases.

Which region is the fastest Growing in the nuclear Imaging Equipment?

Europe is projected to be the fastest-growing region in the nuclear imaging equipment market, growing from $2.97 billion in 2023 to $5.83 billion by 2033, demonstrating robust market expansion opportunities.

Does ConsaInsights provide customized market report data for the nuclear Imaging Equipment industry?

Yes, Consainsights offers customized market report data, tailored to specific client needs, providing in-depth analysis and insights focused on the nuclear imaging equipment industry.

What deliverables can I expect from this nuclear Imaging Equipment market research project?

Expect comprehensive market research deliverables, including market size analysis, growth forecasts, regional insights, competitive analysis, and detailed segmentation data for the nuclear imaging equipment market.

What are the market trends of nuclear Imaging Equipment?

Current market trends in nuclear imaging equipment include technological advancements, a shift towards outpatient procedures, increased demand for precision diagnostics, and a growing emphasis on personalized medicine.