Nucleic Acid Labelling Market Report

Published Date: 31 January 2026 | Report Code: nucleic-acid-labelling

Nucleic Acid Labelling Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Nucleic Acid Labelling market, covering its trends, growth forecast, and market dynamics through 2033, alongside insights on regional performance and industry challenges.

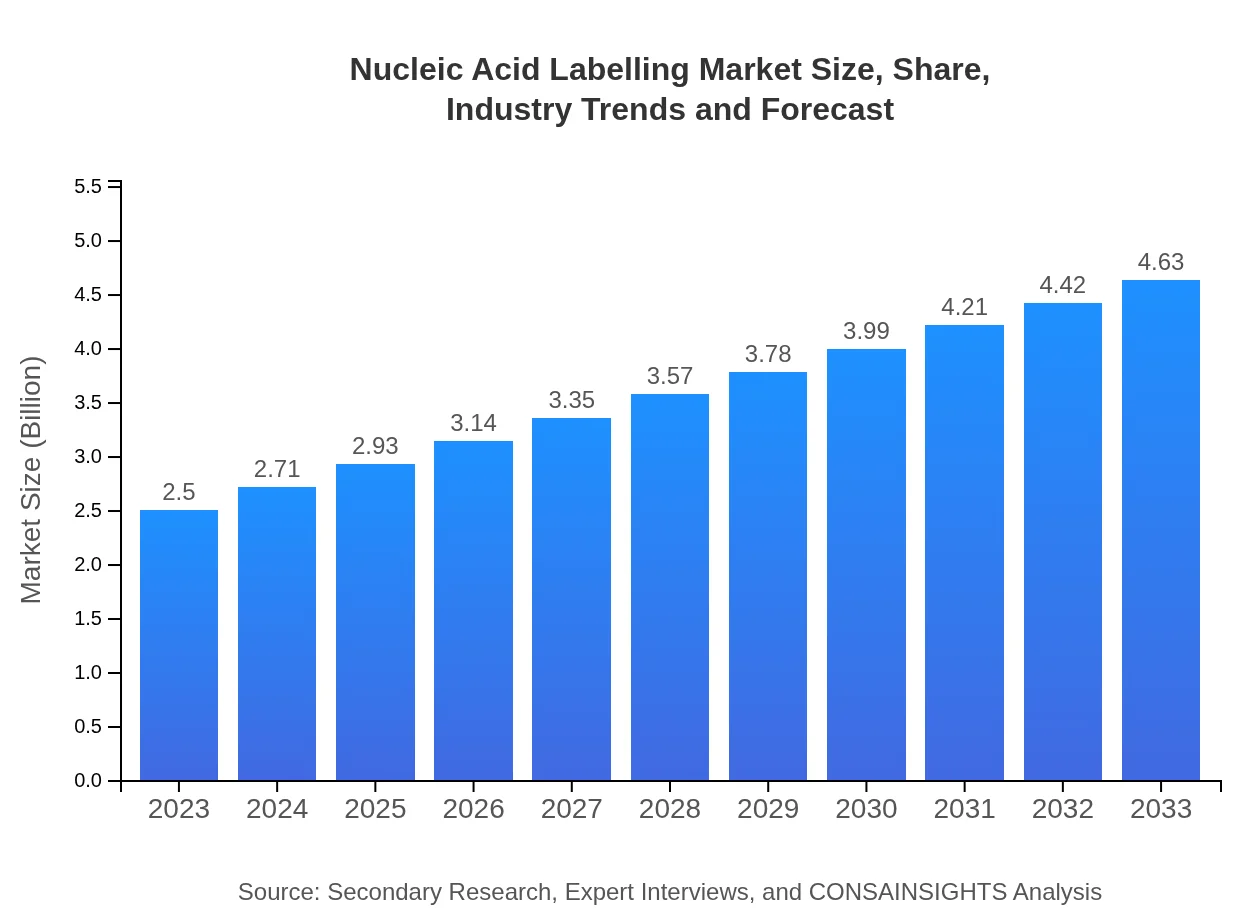

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $4.63 Billion |

| Top Companies | Thermo Fisher Scientific, Inc., Promega Corporation, Agilent Technologies, Bio-Rad Laboratories, Inc. |

| Last Modified Date | 31 January 2026 |

Nucleic Acid Labelling Market Overview

Customize Nucleic Acid Labelling Market Report market research report

- ✔ Get in-depth analysis of Nucleic Acid Labelling market size, growth, and forecasts.

- ✔ Understand Nucleic Acid Labelling's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Nucleic Acid Labelling

What is the Market Size & CAGR of Nucleic Acid Labelling market in 2023 and 2033?

Nucleic Acid Labelling Industry Analysis

Nucleic Acid Labelling Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Nucleic Acid Labelling Market Analysis Report by Region

Europe Nucleic Acid Labelling Market Report:

Europe is characterized by an expanding market size from USD 0.72 billion in 2023 to USD 1.34 billion in 2033, bolstered by rapid advancements in molecular diagnostics and a strong pharmaceutical industry.Asia Pacific Nucleic Acid Labelling Market Report:

In the Asia Pacific region, the Nucleic Acid Labelling market is anticipated to grow from USD 0.47 billion in 2023 to USD 0.87 billion by 2033, driven by increasing research activities and collaborations between universities and industries.North America Nucleic Acid Labelling Market Report:

North America leads the market with a valuation of USD 0.96 billion in 2023, expected to grow to USD 1.78 billion by 2033. The region's robust healthcare infrastructure and significant investments in biotechnology are the primary growth drivers.South America Nucleic Acid Labelling Market Report:

The South American market is relatively nascent, projected to increase from USD 0.02 billion in 2023 to USD 0.03 billion by 2033, attributed to rising interest in biotechnology and agricultural applications.Middle East & Africa Nucleic Acid Labelling Market Report:

The Middle East and Africa market is projected to grow from USD 0.33 billion in 2023 to USD 0.62 billion by 2033, influenced by increasing governmental support for research activities and healthcare improvements.Tell us your focus area and get a customized research report.

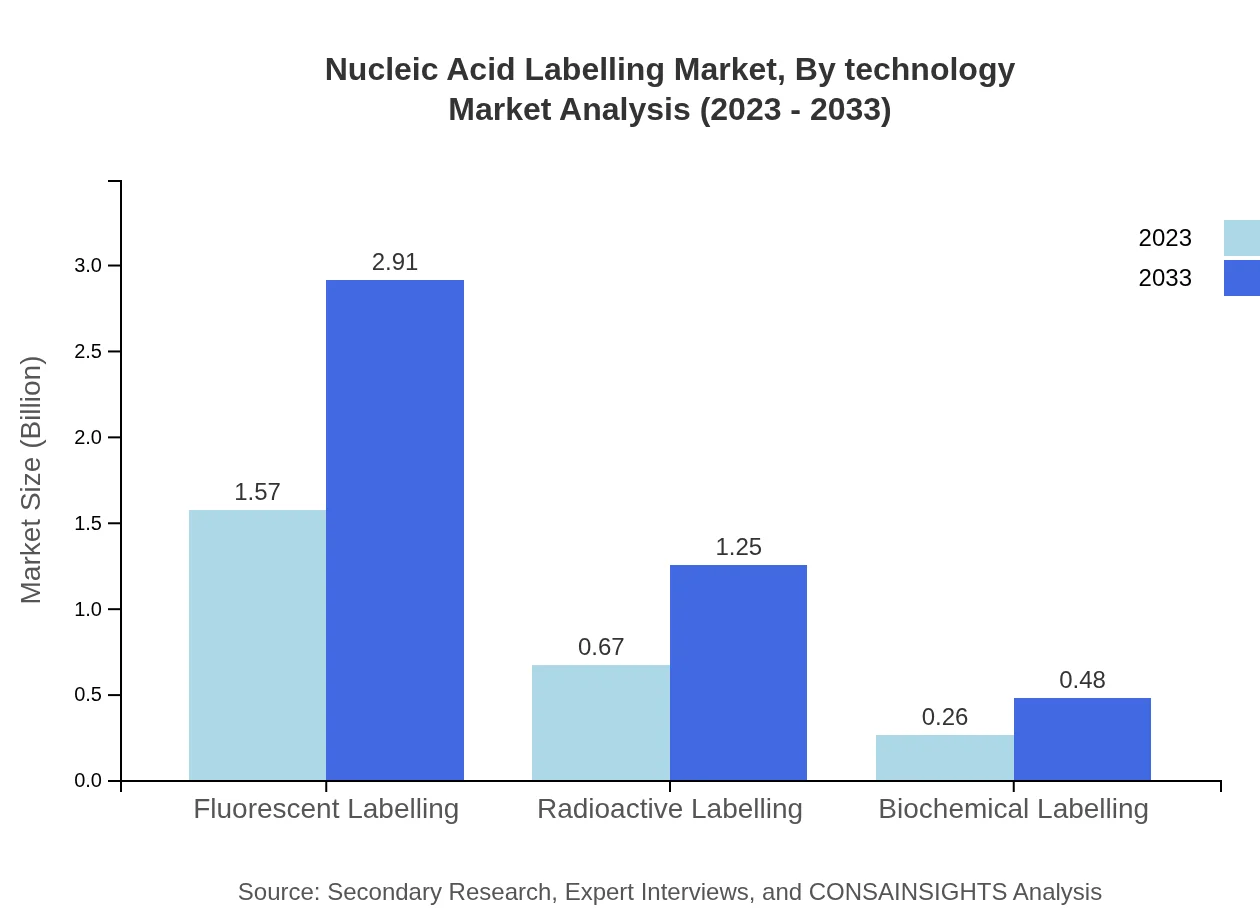

Nucleic Acid Labelling Market Analysis By Technology

In 2023, fluorescent labelling represents a dominant segment, accounting for USD 1.57 billion, expected to reach USD 2.91 billion by 2033. Radioactive labelling, a critical segment, will grow from USD 0.67 billion to USD 1.25 billion over the same period. Such technologies are increasingly utilized for efficient nucleic acid tracking and visualization.

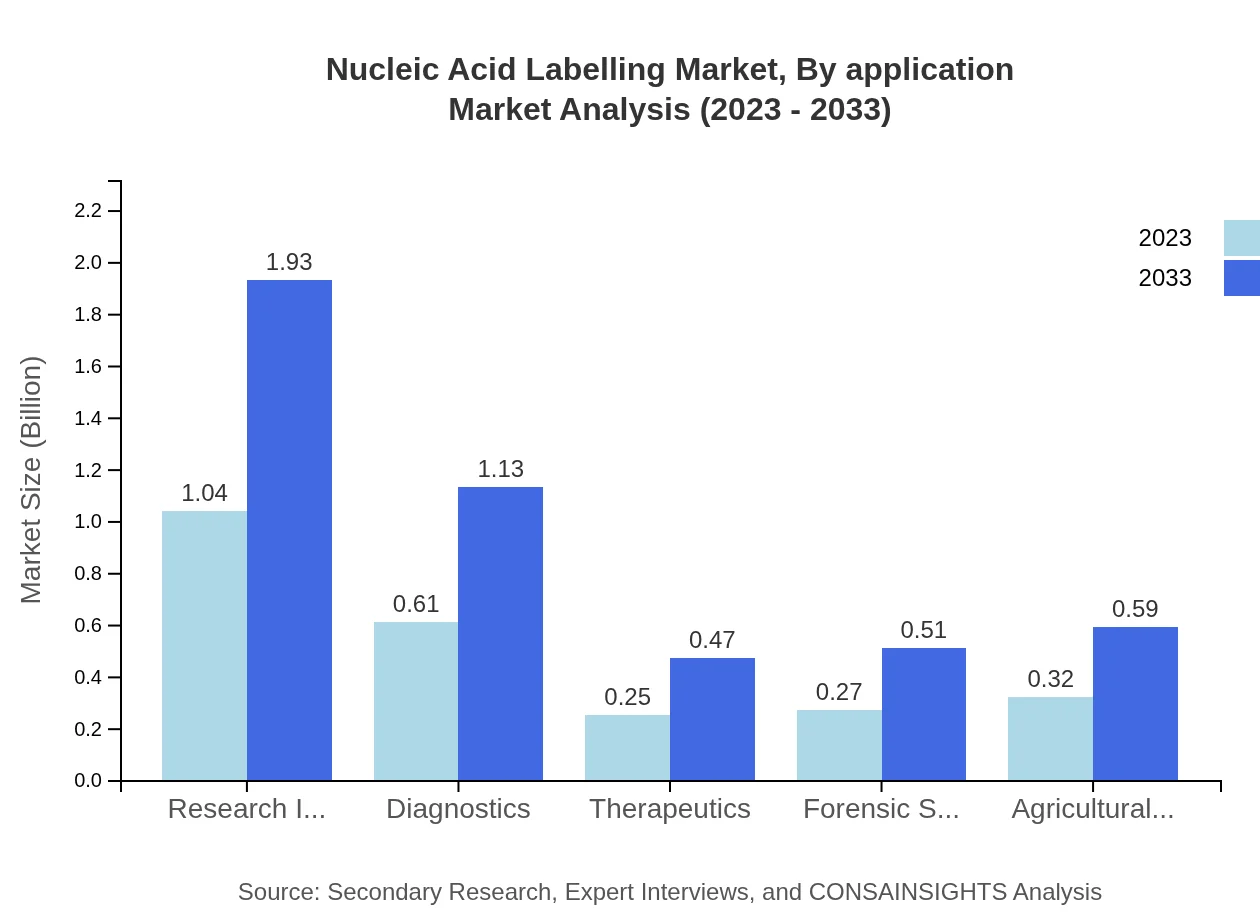

Nucleic Acid Labelling Market Analysis By Application

Academic research accounted for USD 1.31 billion in 2023, expected to reach USD 2.42 billion by 2033. Diagnostics will grow from USD 0.61 billion to USD 1.13 billion during the forecast period, reflecting rising demand for precise diagnostic tools in molecular biology.

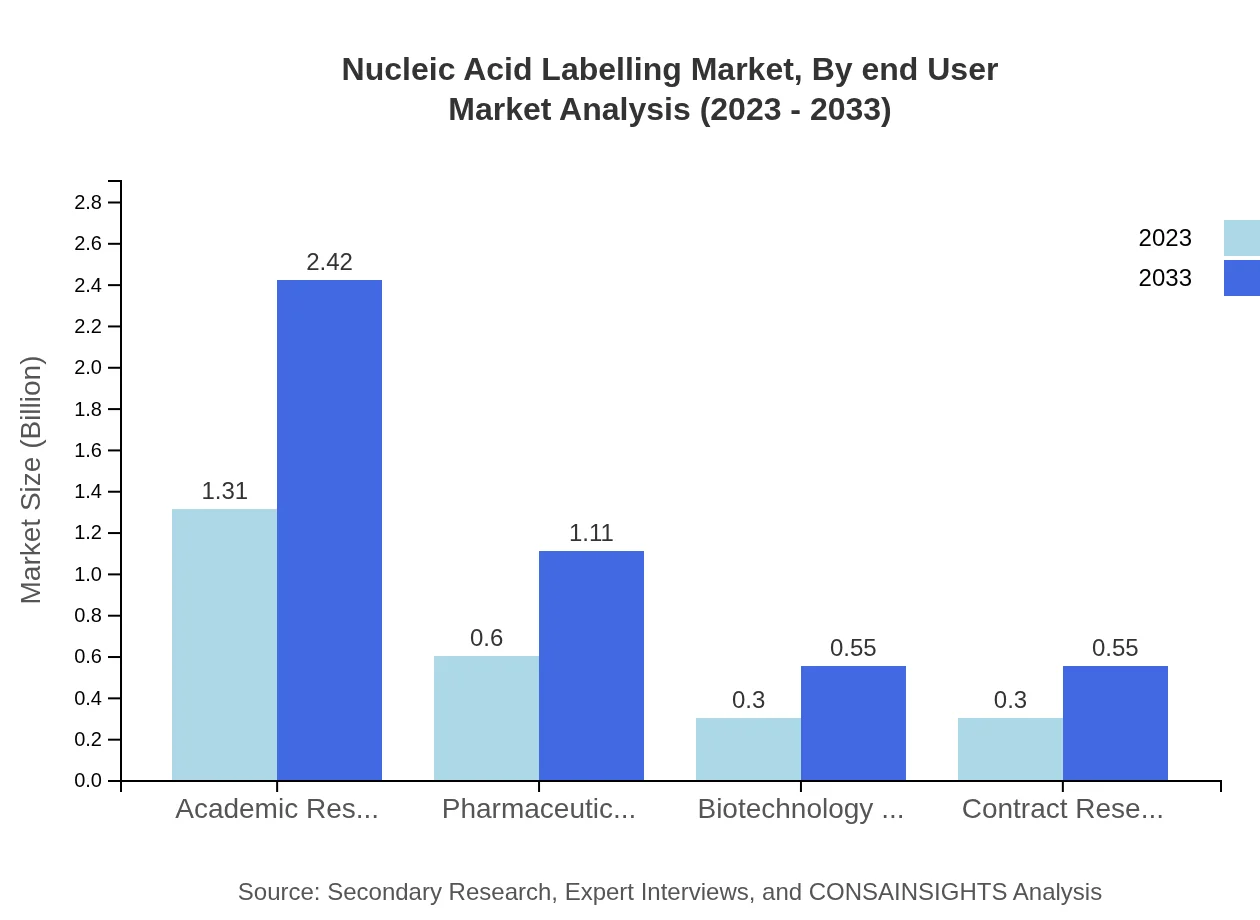

Nucleic Acid Labelling Market Analysis By End User

Pharmaceutical companies generate around USD 0.60 billion in 2023, projected to expand to USD 1.11 billion by 2033. Academic institutions also remain significant with consistent growth due to increasing research funding.

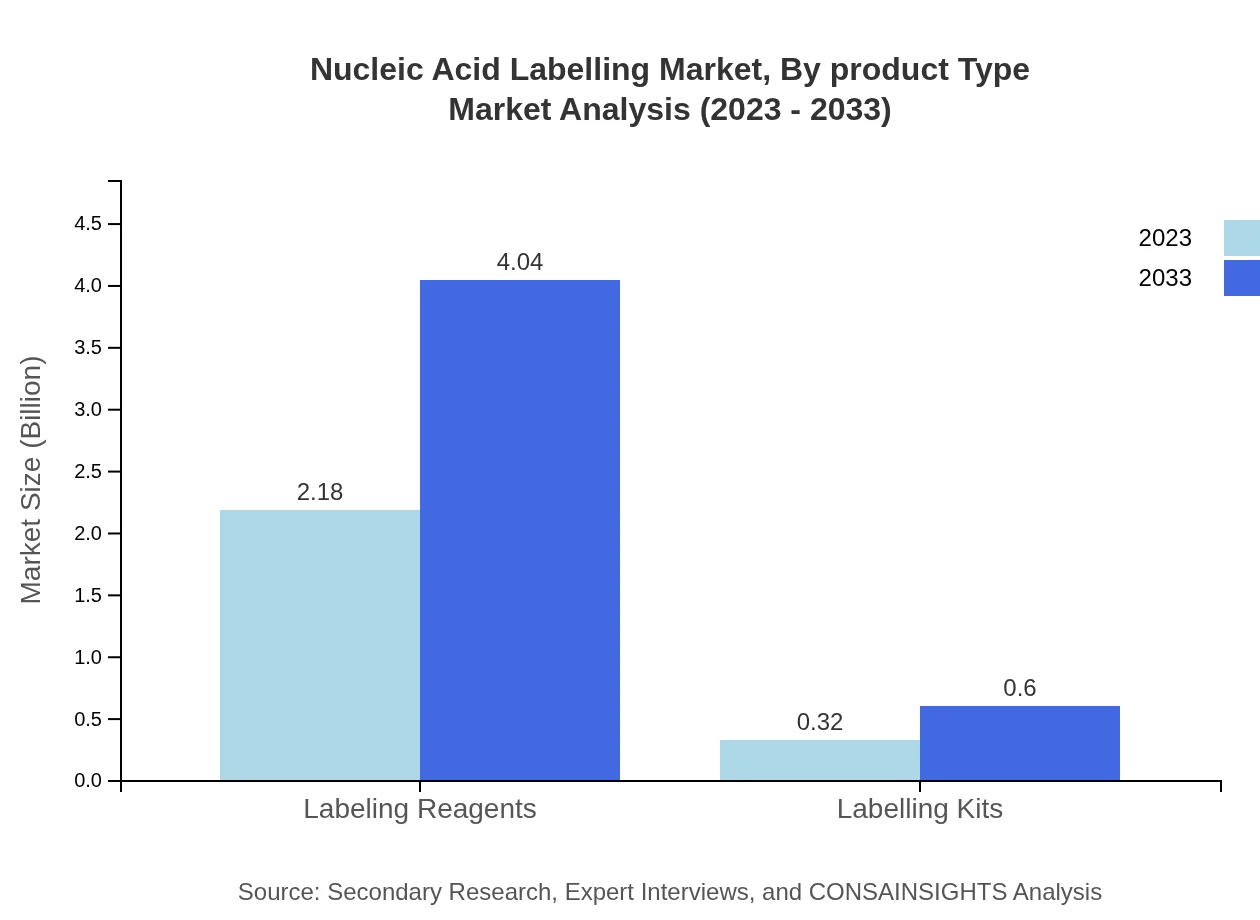

Nucleic Acid Labelling Market Analysis By Product Type

Labeling reagents dominate the product type segment, valued at USD 2.18 billion in 2023 and forecasted to reach USD 4.04 billion by 2033. Labelling kits are also crucial, growing from USD 0.32 billion to USD 0.60 billion, supporting streamlined labelling processes in laboratories.

Nucleic Acid Labelling Market Analysis By Labelling Method

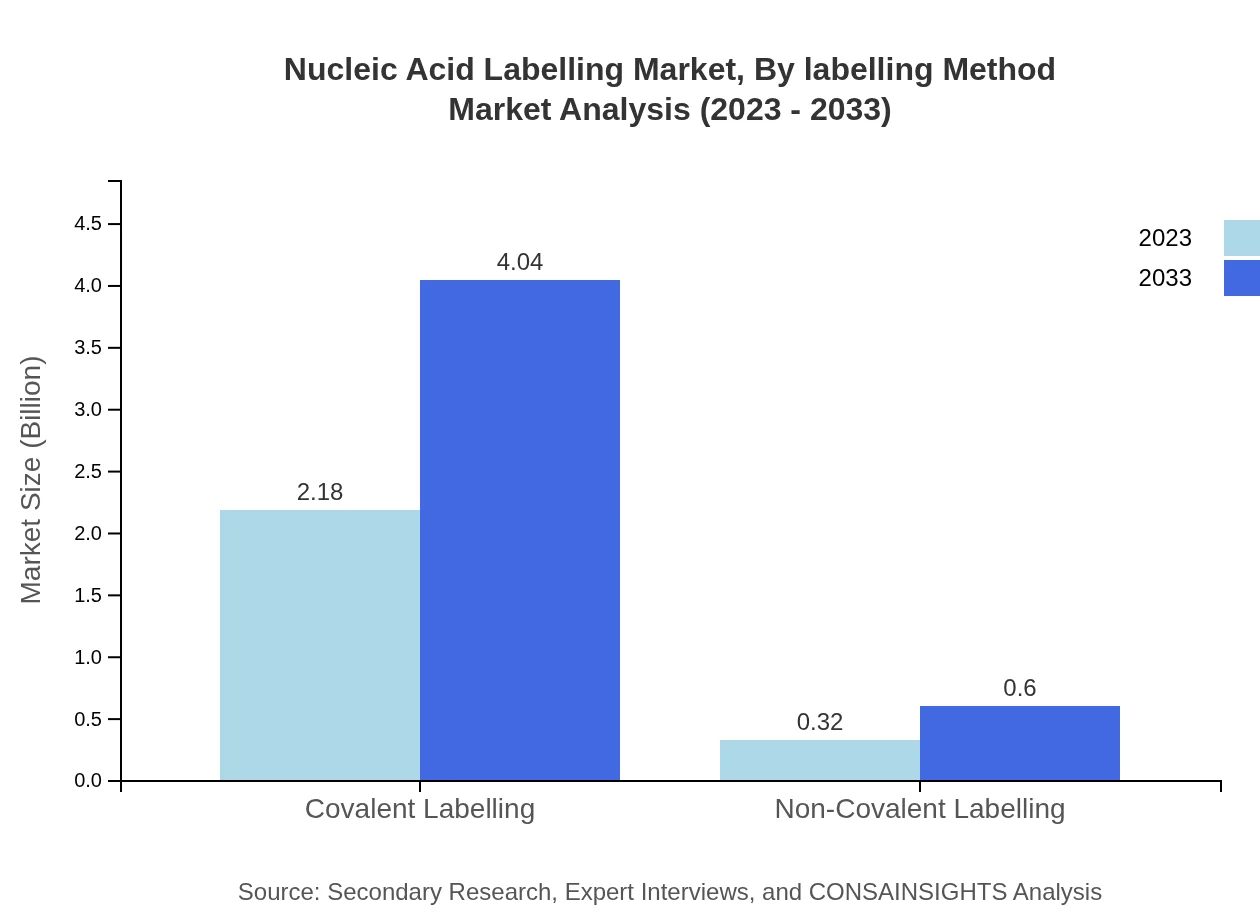

Covalent labelling leads the market with a size of USD 2.18 billion in 2023, predicted to reach USD 4.04 billion by 2033. Non-covalent labelling, although smaller, is projected to grow steadily, backed by its applications in less invasive labelling techniques.

Nucleic Acid Labelling Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Nucleic Acid Labelling Industry

Thermo Fisher Scientific, Inc.:

A leading supplier of analytical instruments and reagents, Thermo Fisher is heavily invested in nucleic acid management and labelling technologies.Promega Corporation:

Promega specializes in bioluminescence and nucleic acid technologies, providing innovative labelling solutions for researchers.Agilent Technologies:

Agilent is known for its comprehensive analytical solutions, focusing on improving nucleic acid labelling methods with precision.Bio-Rad Laboratories, Inc.:

Bio-Rad offers a wide range of products for life science research, routinely updating its catalogue to address nucleic acid labelling needs.We're grateful to work with incredible clients.

FAQs

What is the market size of nucleic Acid Labelling?

The nucleic acid labelling market is currently valued at approximately $2.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.2%, aiming to reach significant growth by 2033.

What are the key market players or companies in this nucleic Acid Labelling industry?

Key players in the nucleic acid labelling industry include major biotechnology firms and pharmaceutical companies that develop labelling reagents, coupled with leading research and contract research organizations, contributing to market innovation and growth.

What are the primary factors driving the growth in the nucleic Acid Labelling industry?

The growth of the nucleic acid labelling industry is driven by factors such as increasing research funding, advancements in molecular diagnostics, rising demand for personalized medicine, and expanding applications in genomics and forensic science.

Which region is the fastest Growing in the nucleic Acid Labelling?

The fastest-growing region in the nucleic acid labelling market is Europe, projected to grow from $0.72 billion in 2023 to $1.34 billion by 2033, driven by rising research activities and healthcare advancements.

Does ConsaInsights provide customized market report data for the nucleic Acid Labelling industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the nucleic acid labelling industry, ensuring that stakeholders receive relevant insights and detailed analytics to inform their strategies.

What deliverables can I expect from this nucleic Acid Labelling market research project?

Deliverables from the nucleic acid labelling market research project include comprehensive market analysis reports, data on market size, regional trends, competitive landscape, and detailed segment analysis for informed decision-making.

What are the market trends of nucleic Acid Labelling?

Current market trends in nucleic acid labelling include a shift towards innovative labelling technologies, increased collaboration among academic and biotech sectors, and a focus on developing non-covalent and covalent labelling methods for diverse applications.