Nutritional Food And Drink Market Report

Published Date: 31 January 2026 | Report Code: nutritional-food-and-drink

Nutritional Food And Drink Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Nutritional Food and Drink market, covering key insights, trends, and data from 2023 to 2033. It encompasses market size, growth predictions, industry analysis, segmentation, regional insights, and profiles of leading companies in the sector.

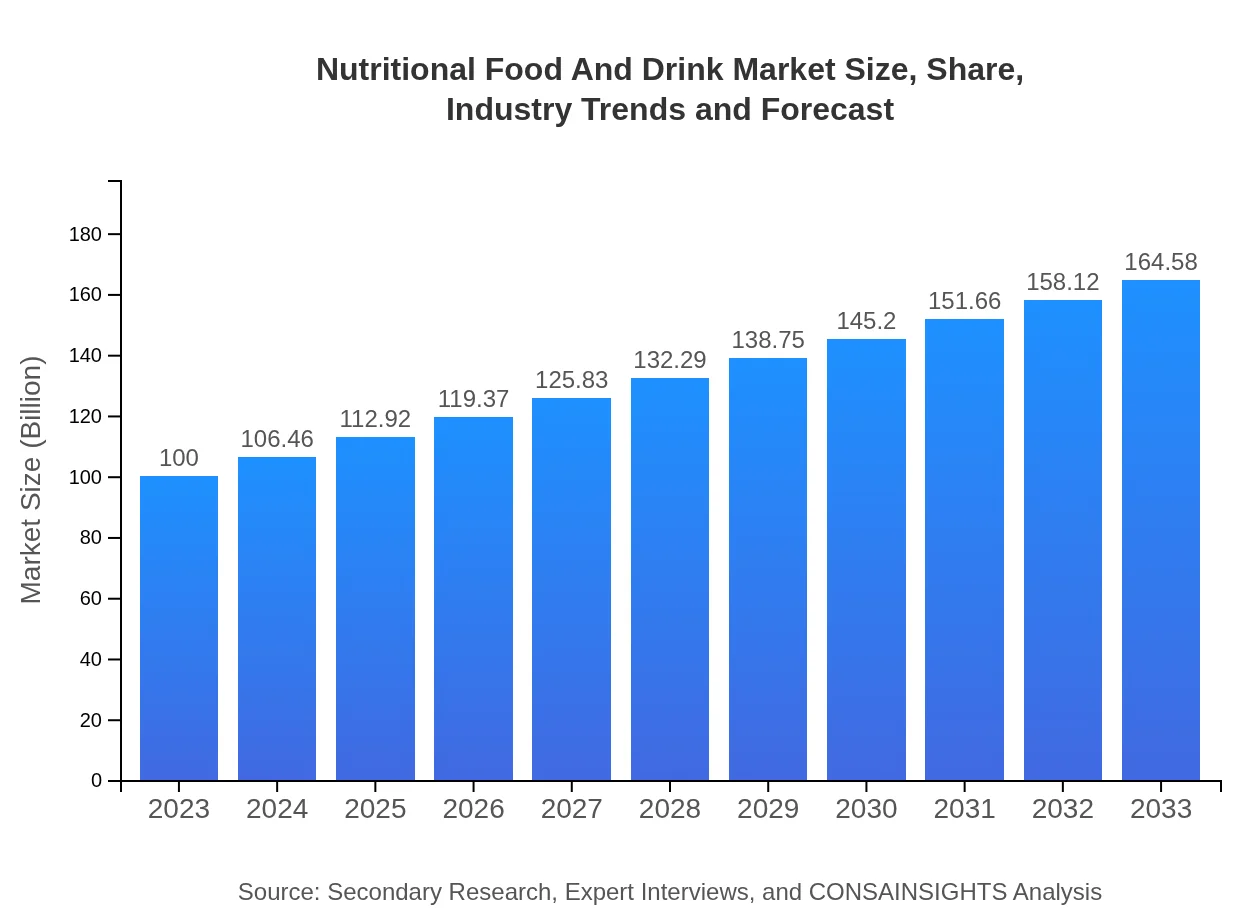

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | Nestlé S.A., PepsiCo Inc., Danone S.A., Unilever PLC, Abbott Laboratories |

| Last Modified Date | 31 January 2026 |

Nutritional Food And Drink Market Overview

Customize Nutritional Food And Drink Market Report market research report

- ✔ Get in-depth analysis of Nutritional Food And Drink market size, growth, and forecasts.

- ✔ Understand Nutritional Food And Drink's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Nutritional Food And Drink

What is the Market Size & CAGR of Nutritional Food And Drink market in 2023?

Nutritional Food And Drink Industry Analysis

Nutritional Food And Drink Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Nutritional Food And Drink Market Analysis Report by Region

Europe Nutritional Food And Drink Market Report:

The European market for Nutritional Food and Drink is anticipated to expand from $34.36 billion in 2023 to about $56.55 billion by 2033. Growing consumer demand for organic and healthier food choices, alongside stringent regulations driving food quality, are supporting this growth. The region's increasing interest in nutrition-specific diets, such as plant-based options, further boosts market potential.Asia Pacific Nutritional Food And Drink Market Report:

The Asia Pacific region shows promising growth for the Nutritional Food and Drink market, projected to reach approximately $30.31 billion by 2033, up from $18.42 billion in 2023. Factors such as increasing health awareness, a growing middle class, and a shift towards nutritious diets are driving this trend. Countries like China and India are significant contributors to this growth due to their large populations and emphasis on health and wellness.North America Nutritional Food And Drink Market Report:

North America is poised to maintain its position as one of the largest markets for Nutritional Food and Drink, projected to grow from $34.36 billion in 2023 to about $56.55 billion by 2033. The rise of dietary supplements, functional foods, and a focus on preventive healthcare are key drivers. The United States continues to be a significant market contributor, with consumers increasingly looking for products that support overall health.South America Nutritional Food And Drink Market Report:

In South America, the Nutritional Food and Drink market is forecasted to grow from $1.62 billion in 2023 to approximately $2.67 billion by 2033. The growth is fueled by rising health consciousness among consumers and an increasing demand for dietary supplements and organic products. Brazil and Argentina are expected to lead this growth trajectory as consumers lean towards healthier food alternatives.Middle East & Africa Nutritional Food And Drink Market Report:

In the Middle East and Africa, the market is expected to grow from $11.24 billion in 2023 to approximately $18.50 billion by 2033. Increasing urbanization and changing dietary habits are encouraging greater consumption of nutritional products. As health awareness rises, consumers are more inclined towards fortified food and dietary supplements, driving market growth in this region.Tell us your focus area and get a customized research report.

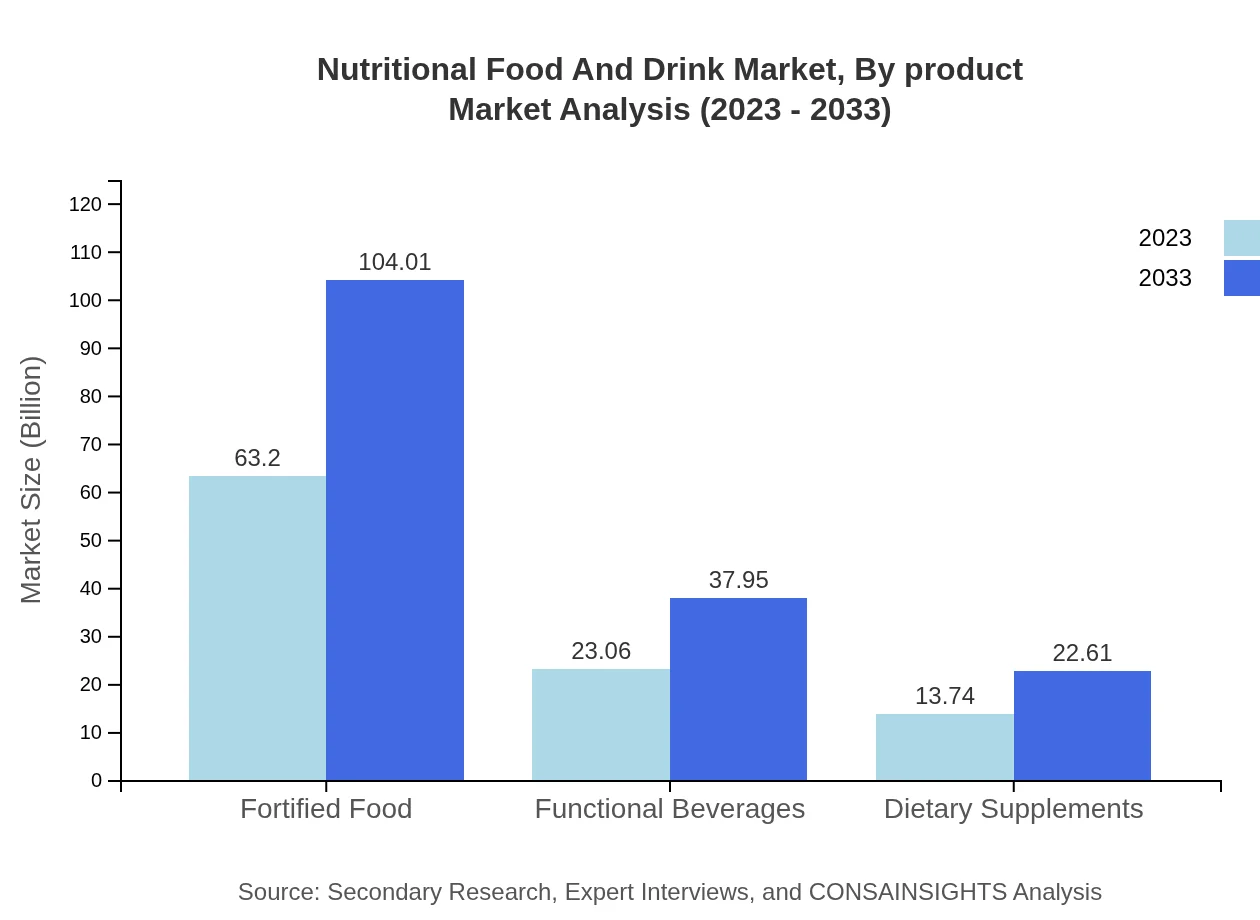

Nutritional Food And Drink Market Analysis By Product

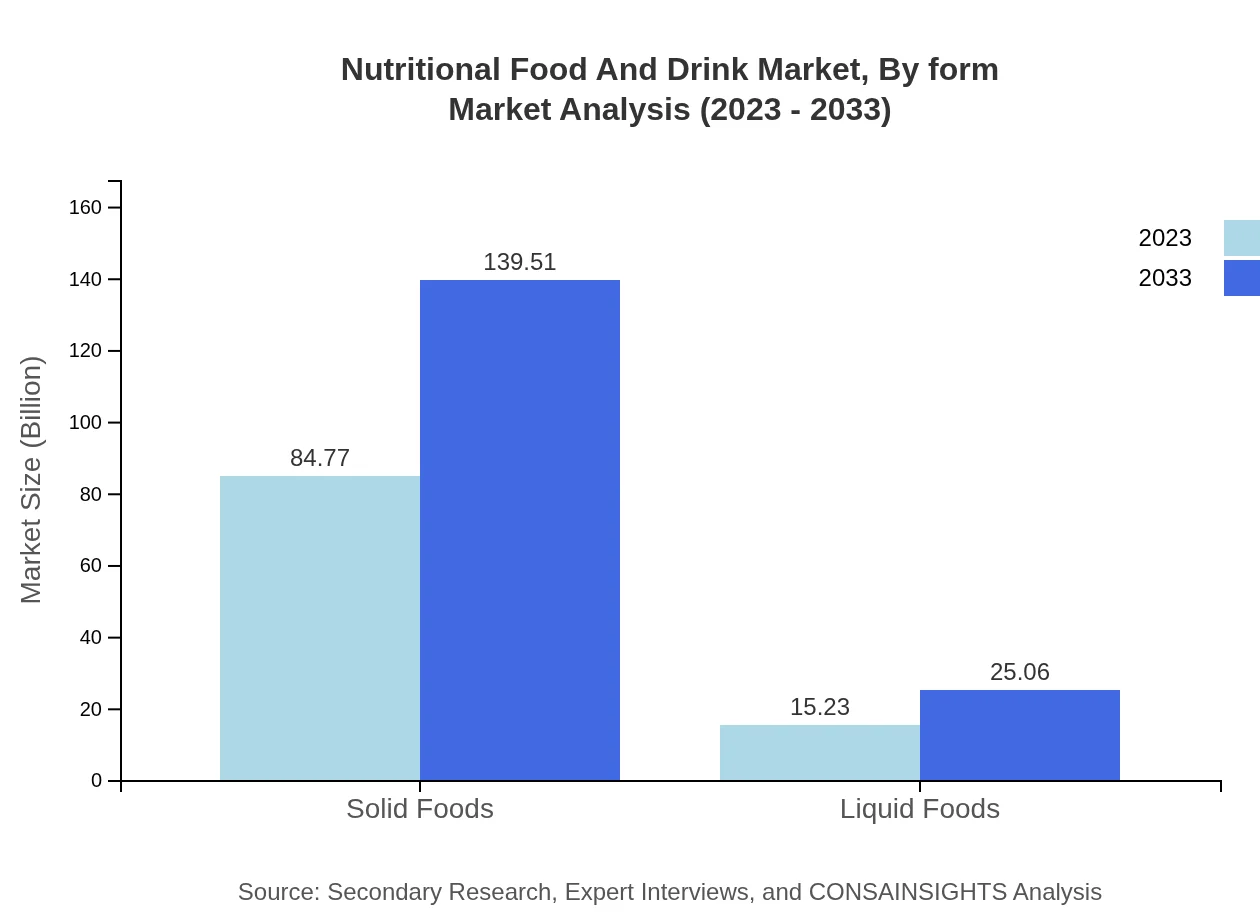

The product segmentation reveals that solid foods dominate the Nutritional Food and Drink market, with market size estimates of $84.77 billion in 2023, forecasted to rise to $139.51 billion by 2033. Among liquid foods, Functional Beverages and Dietary Supplements show considerable growth potential as consumer interest in health-promoting products surges.

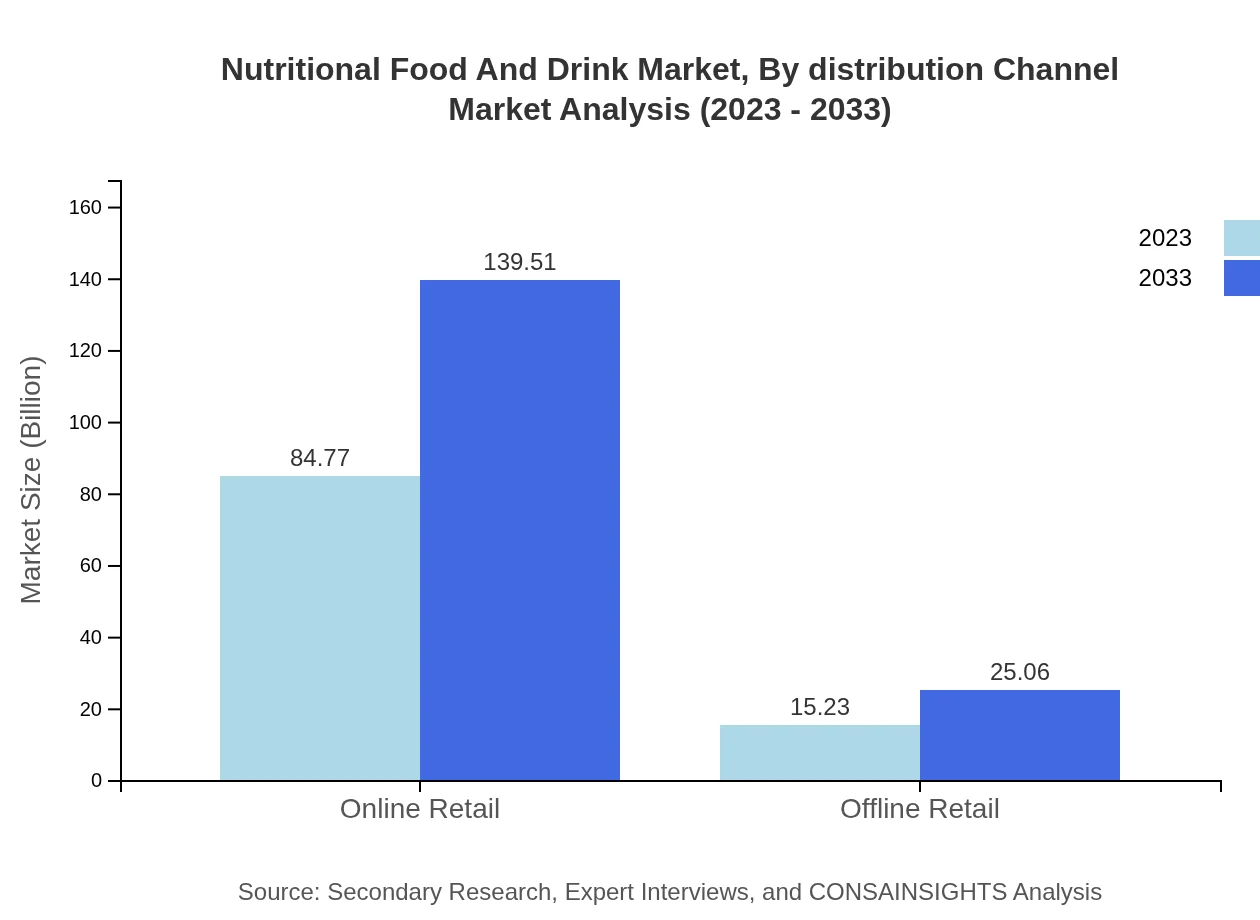

Nutritional Food And Drink Market Analysis By Distribution Channel

The distribution channels for Nutritional Food and Drink products are both online and offline retail, with online channels witnessing significant growth due to convenience and a wider product range. In 2023, the online retail segment is valued at $84.77 billion and is expected to grow to $139.51 billion by 2033, while offline retail is projected to increase from $15.23 billion to $25.06 billion over the same period.

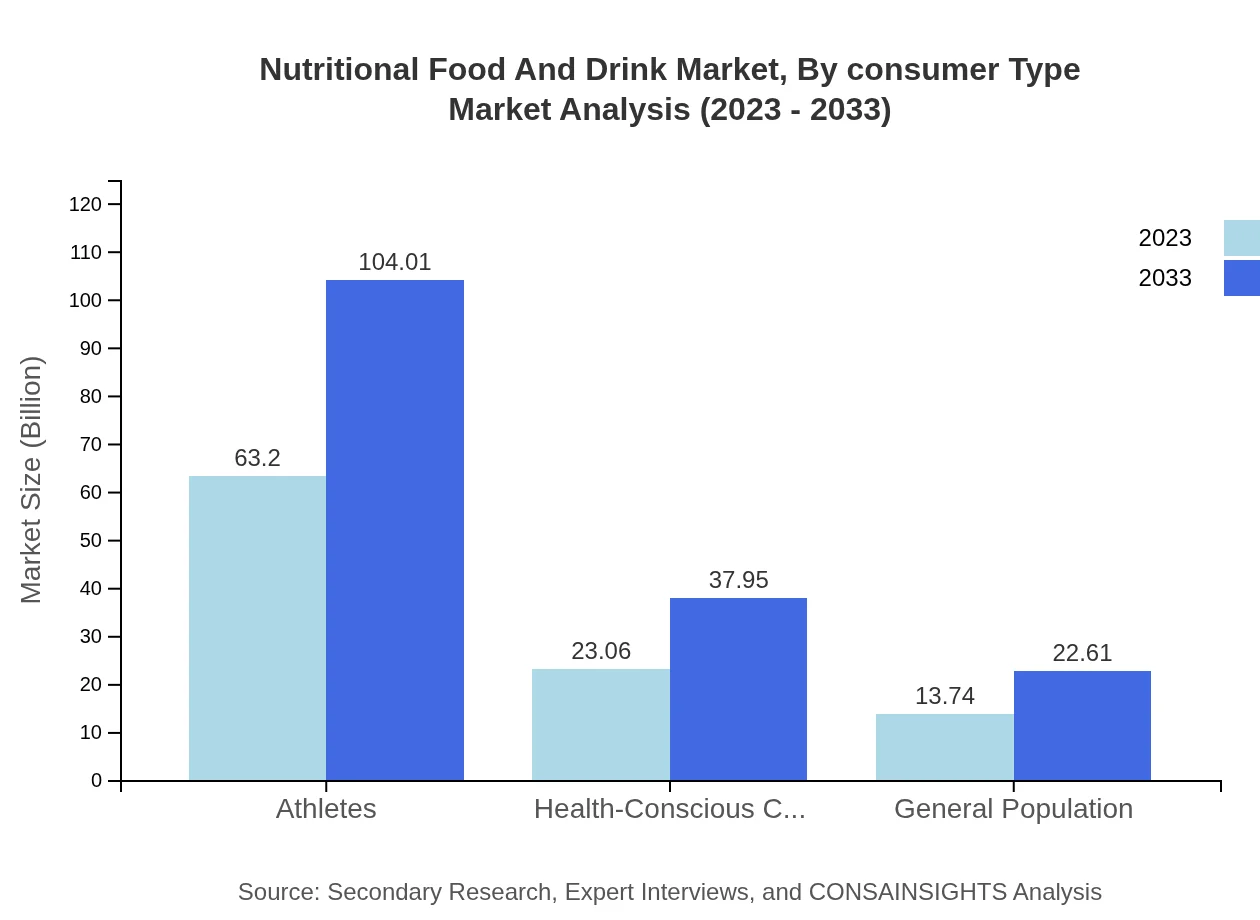

Nutritional Food And Drink Market Analysis By Consumer Type

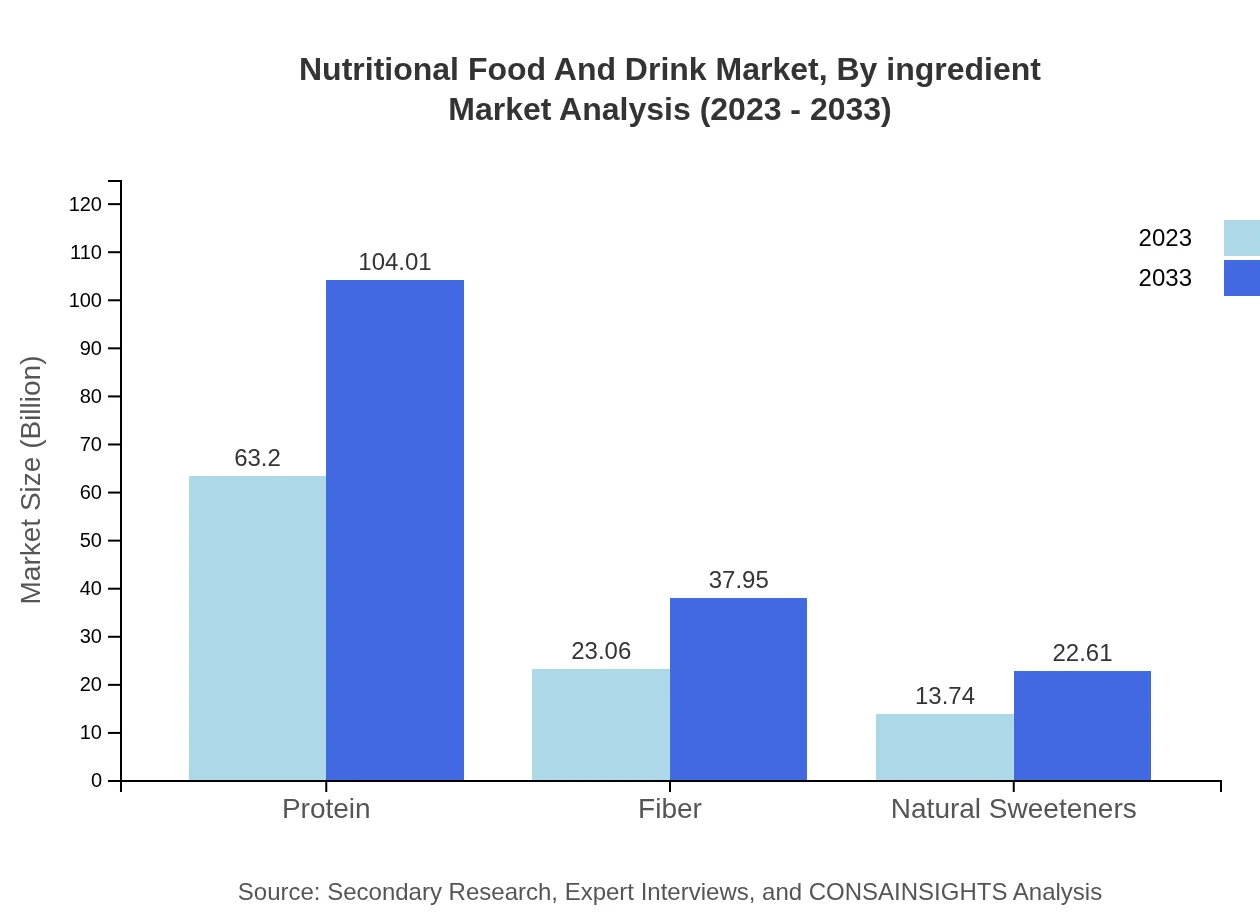

Segmentation by consumer type highlights distinct groups such as athletes, health-conscious consumers, and the general population. Athletes alone constitute a significant part of the market, with a size of $63.20 billion in 2023, anticipated to expand to $104.01 billion by 2033. Health-conscious consumers and the general populace are also increasingly turning towards nutritional product varieties.

Nutritional Food And Drink Market Analysis By Form

The market, categorized by form, includes solid and liquid foods. Solid foods are a larger segment, valued at $84.77 billion in 2023, projected to grow significantly by 2033. Liquid nutritional products and dietary supplements are also pivotal, reflecting changing consumer preferences towards convenience and immediate nutrition.

Nutritional Food And Drink Market Analysis By Ingredient

Ingredients play a crucial role in product appeal. The market size for protein-rich food is estimated at $63.20 billion in 2023, expected to rise to $104.01 billion by 2033. Other significant components include fiber, natural sweeteners, and fortified ingredients, which are gaining traction among health-oriented consumers.

Nutritional Food And Drink Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Nutritional Food And Drink Industry

Nestlé S.A.:

Nestlé S.A. is a globally recognized leader in nutrition, health, and wellness, offering a wide array of Nutritional Food and Drink products encompassing baby food, bottled water, cereals, coffee, and clinical nutrition products.PepsiCo Inc.:

PepsiCo Inc., known for its beverages, is also a significant player in the nutritional food segment, particularly with its Quaker brand, focusing on oats and nutritional bars that cater to health-conscious consumers.Danone S.A.:

Danone S.A. specializes in dairy products and plant-based foods, emphasizing health and nutrition, with a strong focus on sustainability and fostering personal well-being.Unilever PLC:

Unilever PLC holds a prominent market position with its range of health-oriented food and beverage products, including brands that promote nutrition, wellness, and sustainability.Abbott Laboratories:

Abbott is a key player in the dietary supplement sector, providing a range of nutritional products aimed at various consumer demographics, including specialized medical nutrition.We're grateful to work with incredible clients.

FAQs

What is the market size of nutritional food and drink?

The nutritional food and drink market is currently valued at approximately $100 million and is projected to grow at a CAGR of 5% from 2023 to 2033. This growth is being driven by increasing consumer awareness regarding health and nutrition.

What are the key market players or companies in this nutritional food and drink industry?

The key players in the nutritional food and drink industry include major brands known for their fortified foods, dietary supplements, and functional beverages. Their competitive strategies shape market dynamics and influence innovations.

What are the primary factors driving the growth in the nutritional food and drink industry?

Primary growth drivers include the rising health consciousness among consumers, increasing demand for convenience foods, advancements in food technology, and growing awareness of dietary supplements for improved health outcomes.

Which region is the fastest Growing in the nutritional food and drink market?

The fastest-growing region in the nutritional food and drink market is expected to be Europe, with its market size projected to increase from $34.36 million in 2023 to $56.55 million by 2033, leading regional growth rates.

Does ConsaInsights provide customized market report data for the nutritional food and drink industry?

Yes, ConsaInsights definitely offers customized market report data to meet specific client needs within the nutritional food and drink industry, ensuring actionable insights tailored to market dynamics.

What deliverables can I expect from this nutritional food and drink market research project?

Deliverables from the nutritional food and drink market research project typically include detailed market analysis reports, data on market trends, competitive landscape evaluations, forecasts, and strategic recommendations.

What are the market trends of nutritional food and drink?

Market trends in nutritional food and drink include a shift towards plant-based and fortified products, the rise of functional beverages, increasing online sales channels, and a growing emphasis on natural ingredients and health benefits.