Nutritional Oil Powder Market Report

Published Date: 31 January 2026 | Report Code: nutritional-oil-powder

Nutritional Oil Powder Market Size, Share, Industry Trends and Forecast to 2033

This report explores the Nutritional Oil Powder market, providing insights into market trends, size, segmentation, and forecasts from 2023 to 2033. It presents a comprehensive analysis of regional markets, industry dynamics, and global market leaders.

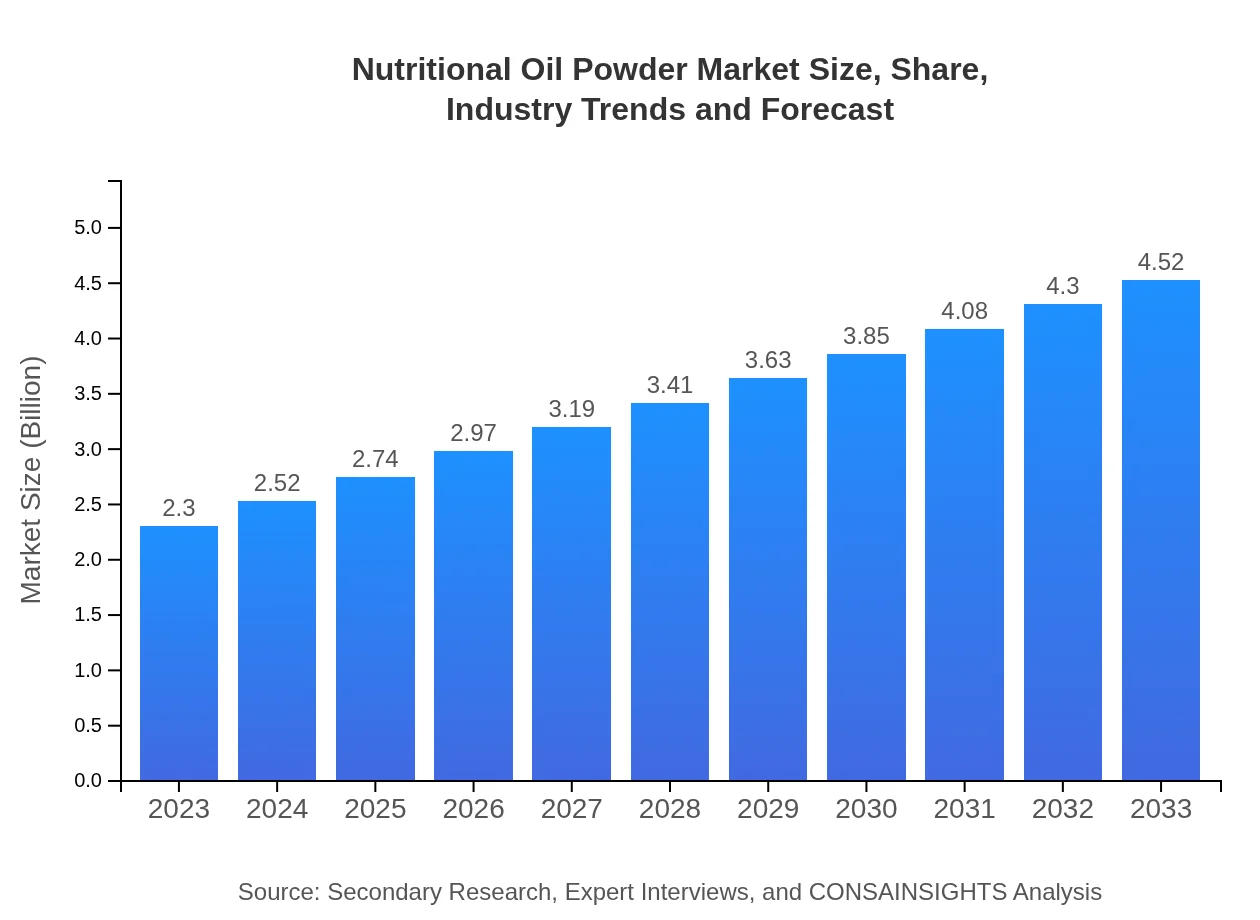

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.30 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.52 Billion |

| Top Companies | Herbalife Nutrition Ltd., NOW Foods, Nutiva, BASF SE |

| Last Modified Date | 31 January 2026 |

Nutritional Oil Powder Market Overview

Customize Nutritional Oil Powder Market Report market research report

- ✔ Get in-depth analysis of Nutritional Oil Powder market size, growth, and forecasts.

- ✔ Understand Nutritional Oil Powder's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Nutritional Oil Powder

What is the Market Size & CAGR of Nutritional Oil Powder market in 2023 and 2033?

Nutritional Oil Powder Industry Analysis

Nutritional Oil Powder Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Nutritional Oil Powder Market Analysis Report by Region

Europe Nutritional Oil Powder Market Report:

Europe's nutritional oil powder market is projected to rise from $0.59 billion in 2023 to $1.16 billion by 2033. This growth is being fueled by increasing consumer awareness of the health benefits of nutritional oil powders and a strong preference for plant-sourced products among European consumers.Asia Pacific Nutritional Oil Powder Market Report:

In the Asia Pacific region, the Nutritional Oil Powder market is set to grow from $0.46 billion in 2023 to $0.91 billion by 2033. Factors such as rising disposable income, urbanization, and an increasing focus on health and wellness contribute to this growth. The region also sees a strong preference for plant-based nutritional components, aligning with dietary trends.North America Nutritional Oil Powder Market Report:

North America's market is expected to expand from $0.81 billion in 2023 to $1.60 billion by 2033 due to a high consumer preference for health supplements. The region boasts a robust food processing industry that incorporates various oil powders in their products, fostering significant growth.South America Nutritional Oil Powder Market Report:

The South American market is anticipated to increase from $0.20 billion in 2023 to $0.40 billion in 2033. Growing health awareness and demand for functional foods in linear countries drive this market. The nutritional oil powder segment is benefiting from consumer shifts toward natural and organic products.Middle East & Africa Nutritional Oil Powder Market Report:

The Middle East and Africa market is expected to grow from $0.23 billion in 2023 to $0.45 billion by 2033. Changes in lifestyle and a burgeoning interest in health and wellness products are expected to drive demand, particularly for plant-based options that align with regional dietary preferences.Tell us your focus area and get a customized research report.

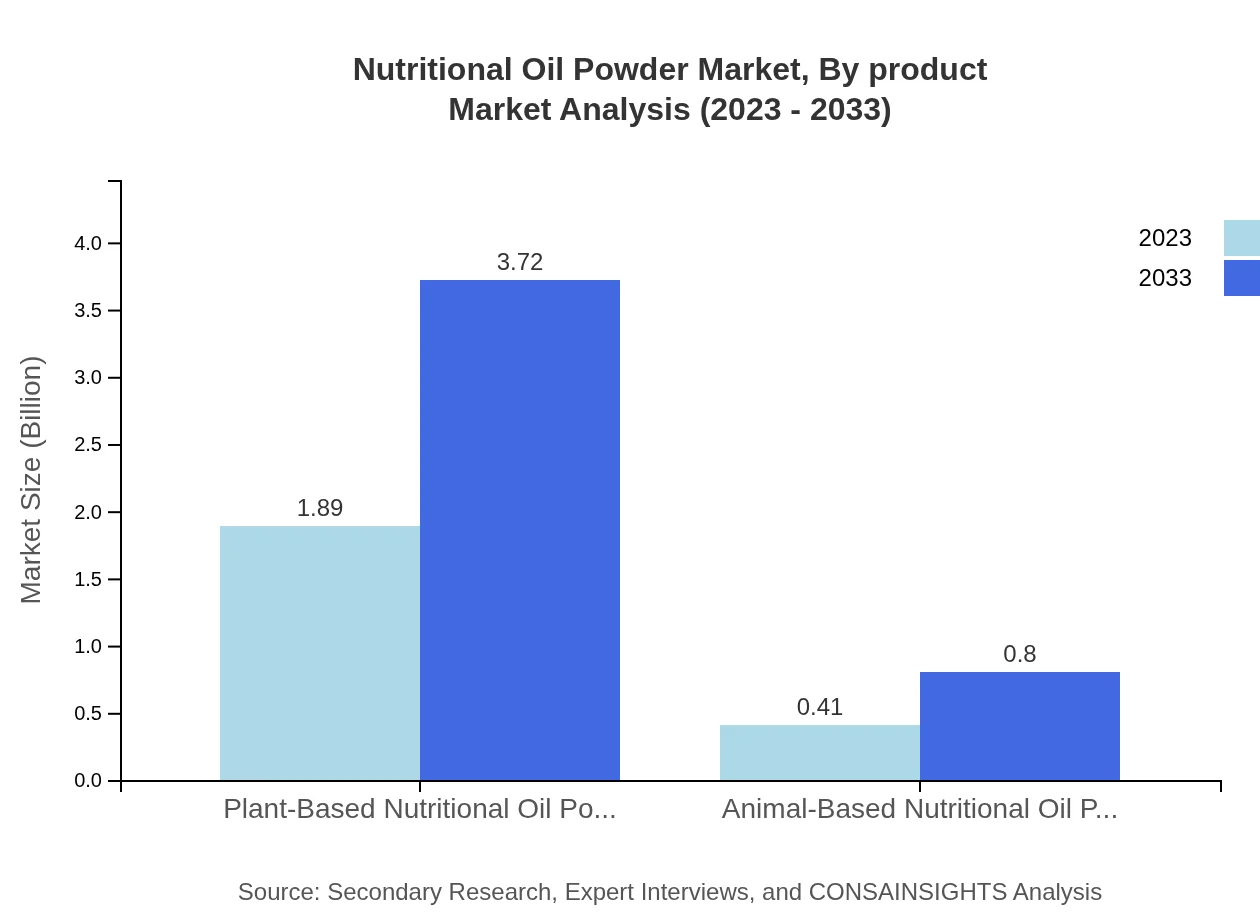

Nutritional Oil Powder Market Analysis By Product

Plant-Based Nutritional Oil Powders dominate the market, valued at $1.89 billion in 2023, expected to grow to $3.72 billion by 2033, holding an 82.36% market share. In contrast, Animal-Based Nutritional Oil Powders represent a smaller segment with a projected increase from $0.41 billion to $0.80 billion, accounting for a 17.64% share.

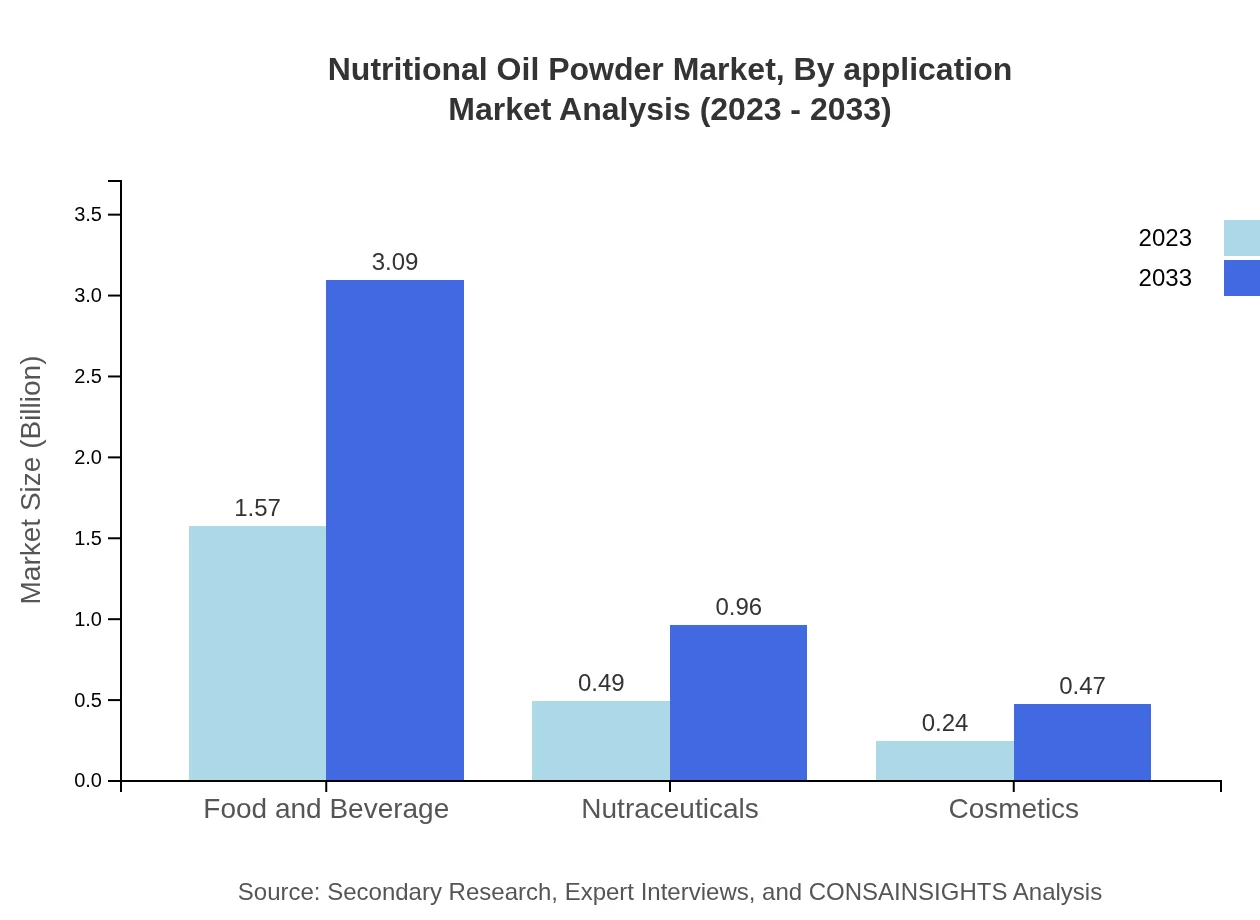

Nutritional Oil Powder Market Analysis By Application

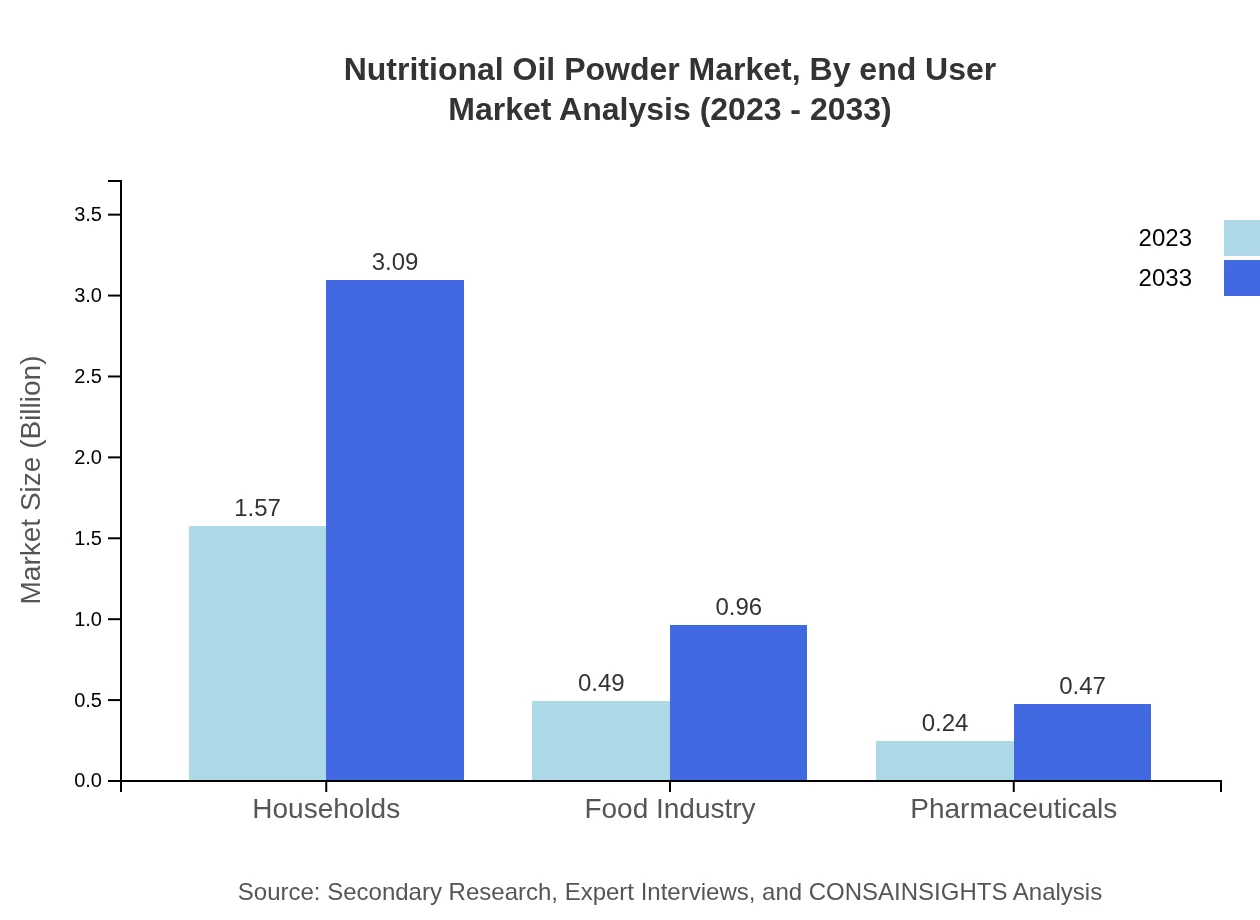

Households constitute the largest application segment, totaling $1.57 billion in 2023, expected to reach $3.09 billion by 2033, accounting for 68.35% of the market. The food industry and nutraceuticals follow, with revenues projected to rise significantly as consumer preferences shift toward health-oriented products.

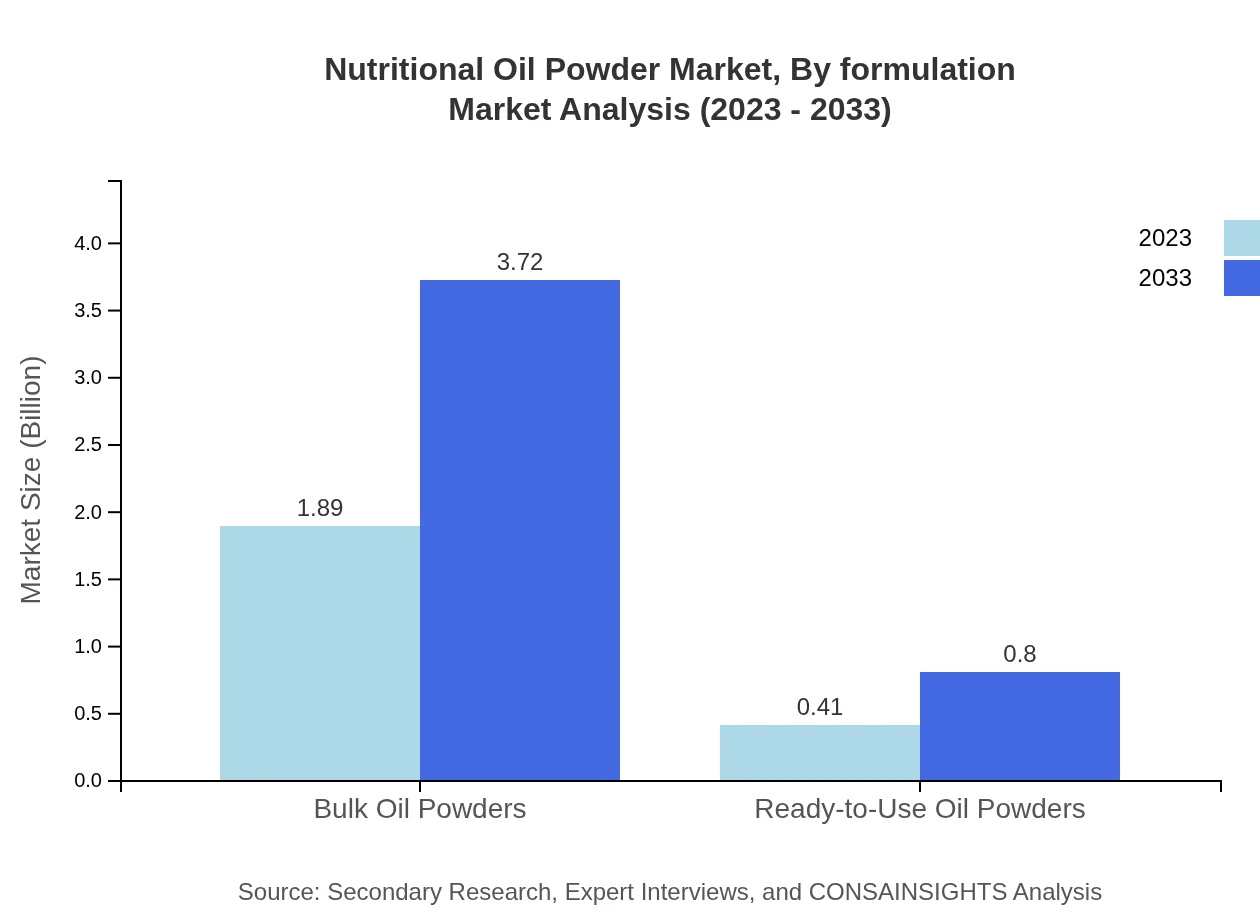

Nutritional Oil Powder Market Analysis By Formulation

The market can be segmented into bulk oil powders, projected to grow significantly due to wide usage in food production, and ready-to-use oil powders that cater to convenience-seeking consumers. Bulk oil powders represent 82.36% share, while ready-to-use formulations hold 17.64%, reflecting changing consumption patterns.

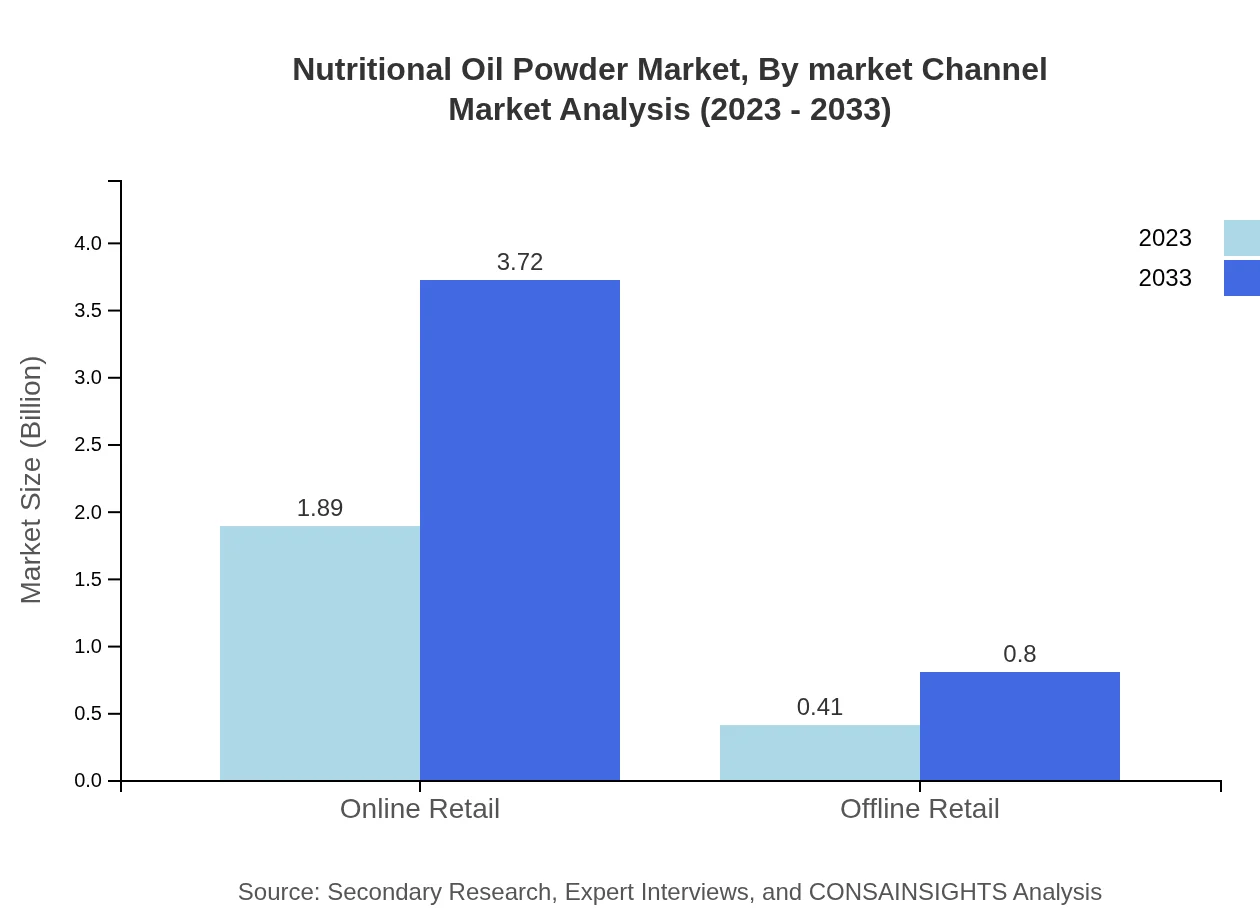

Nutritional Oil Powder Market Analysis By Market Channel

Analysis shows that the online retail segment leads, accounting for $1.89 billion in 2023, anticipated to grow to $3.72 billion by 2033, making up 82.36% of the market. Offline retail is also expanding but at a slower rate, indicating a shift in buying behaviors.

Nutritional Oil Powder Market Analysis By End User

The end-user segment reveals a prominent inclination toward health and wellness in households and the food and beverage sector. The household category holds 68.35% of the market share, indicating a robust demand for health-oriented products that offer nutritional benefits.

Nutritional Oil Powder Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Nutritional Oil Powder Industry

Herbalife Nutrition Ltd.:

A global leader in nutrition, Herbalife offers a variety of nutritional oil powders, focusing on weight management and wellness, emphasizing research and innovation.NOW Foods:

NOW Foods specializes in natural products and supplements, providing high-quality nutritional oil powders aimed at health-conscious consumers.Nutiva:

Nutiva is known for its organic products, including a diverse range of plant-based nutritional oil powders focusing on sustainability and health.BASF SE:

A leader in chemical and nutritional products, BASF provides innovative solutions within the Nutritional Oil Powder market, focusing on health and nutrition advancements.We're grateful to work with incredible clients.

FAQs

What is the market size of nutritional Oil Powder?

The nutritional oil powder market is valued at approximately $2.3 billion in 2023. It is projected to experience a robust growth rate, with a CAGR of 6.8% over the forecast period, highlighting increasing demand across various sectors.

What are the key market players or companies in this nutritional Oil Powder industry?

Key players in the nutritional oil powder market include major food and health companies specializing in oil powder production, focusing on innovation, sustainability, and meeting rising consumer demand for health products.

What are the primary factors driving the growth in the nutritional Oil Powder industry?

Growth in the nutritional oil powder market is driven by health trends, increased preference for plant-based options, and rising demand in food, beverage, and nutraceutical sectors catering to health-conscious consumers.

Which region is the fastest Growing in the nutritional Oil Powder?

The fastest-growing region in the nutritional oil powder market is North America, with market projections indicating growth from $0.81 billion in 2023 to $1.60 billion by 2033, fueled by health awareness.

Does ConsaInsights provide customized market report data for the nutritional Oil Powder industry?

Yes, ConsaInsights offers tailored market research solutions for the nutritional oil powder industry, ensuring that clients receive relevant insights and analyses specific to their needs and strategic goals.

What deliverables can I expect from this nutritional Oil Powder market research project?

Deliverables include detailed market analysis reports, trend assessments, regional breakdowns, key player insights, and forecasts that help navigate the nutritional oil powder industry effectively.

What are the market trends of nutritional Oil Powder?

Trends in the nutritional oil powder market include increasing demand for plant-based options, innovative product formulations, and a shift towards health-oriented products in the food, beverage, and personal care sectors.