Occlusion Devices Market Report

Published Date: 31 January 2026 | Report Code: occlusion-devices

Occlusion Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Occlusion Devices market, covering key trends, regional insights, segmentation, and forecasts from 2023 to 2033, helping stakeholders understand market dynamics and growth opportunities.

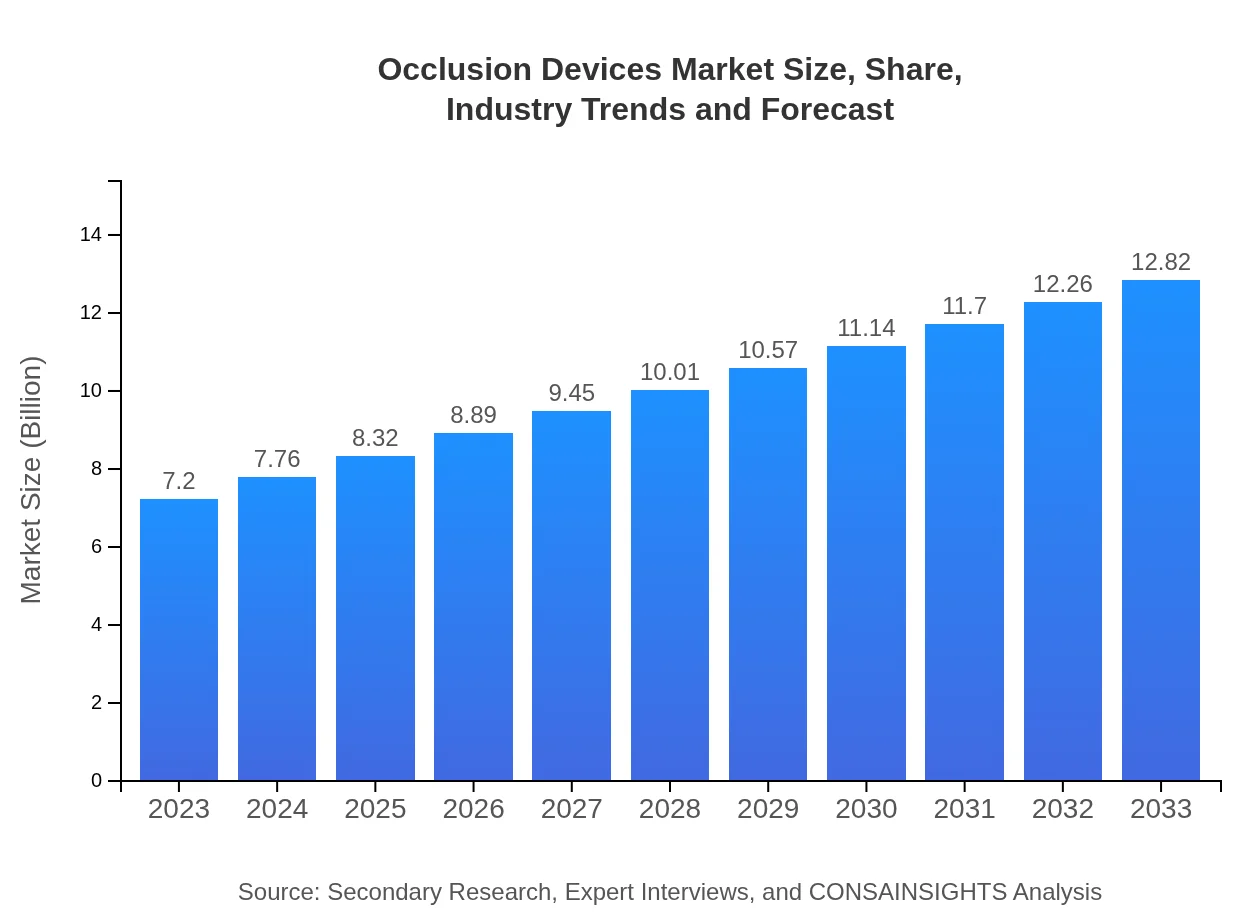

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $7.20 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $12.82 Billion |

| Top Companies | Medtronic , Boston Scientific, Abbott Laboratories, Johnson & Johnson |

| Last Modified Date | 31 January 2026 |

Occlusion Devices Market Overview

Customize Occlusion Devices Market Report market research report

- ✔ Get in-depth analysis of Occlusion Devices market size, growth, and forecasts.

- ✔ Understand Occlusion Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Occlusion Devices

What is the Market Size & CAGR of Occlusion Devices market in 2023?

Occlusion Devices Industry Analysis

Occlusion Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Occlusion Devices Market Analysis Report by Region

Europe Occlusion Devices Market Report:

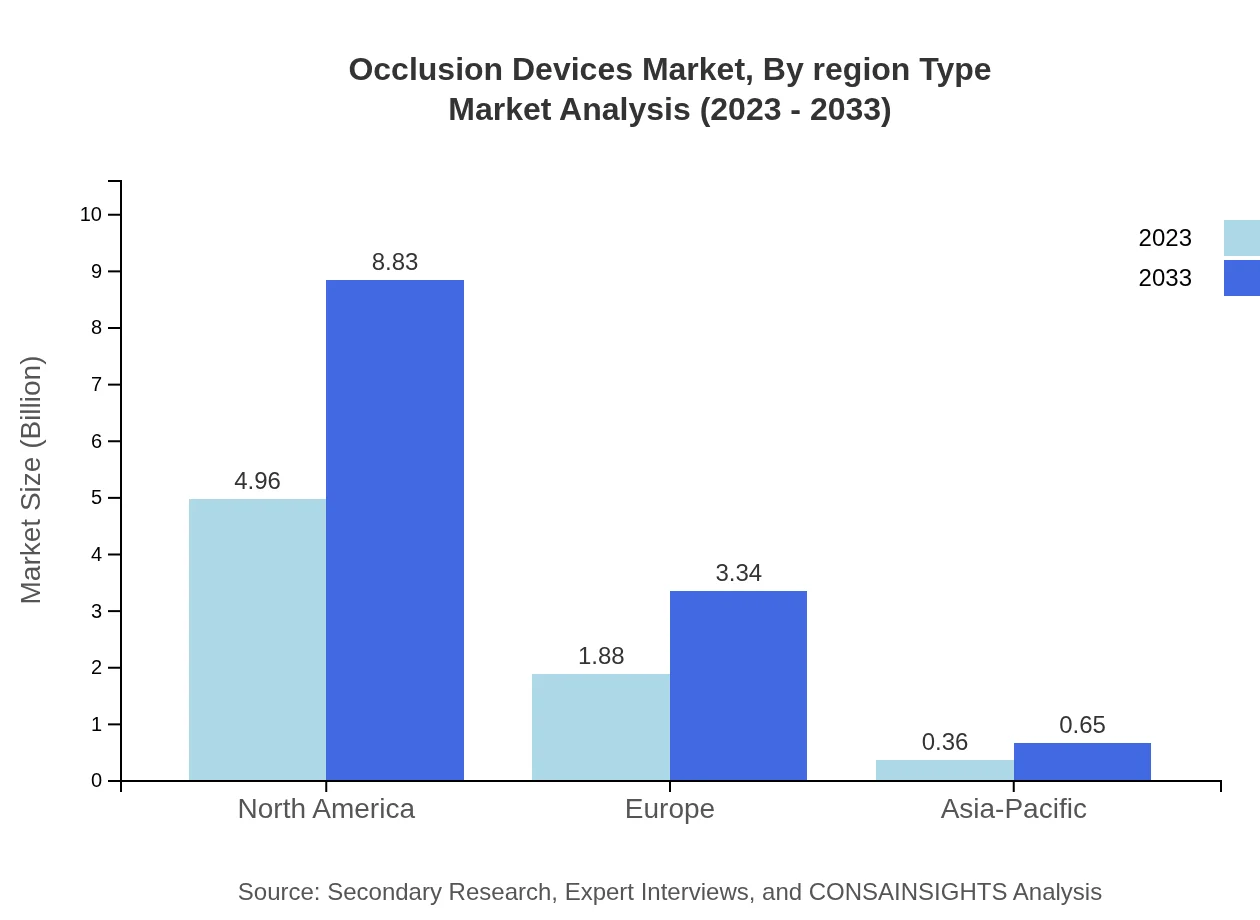

The European market for Occlusion Devices is projected to expand from USD 2.36 billion in 2023 to USD 4.21 billion by 2033. The presence of well-established medical device manufacturers and increasing investment in healthcare technology contribute to this growth.Asia Pacific Occlusion Devices Market Report:

The Asia Pacific region is experiencing an upward trend in the Occlusion Devices market, anticipated to grow from USD 1.40 billion in 2023 to USD 2.50 billion by 2033. Rapid urbanization, rising healthcare expenditure, and increasing awareness regarding advanced medical treatments are fuelling this growth.North America Occlusion Devices Market Report:

North America dominates the Occlusion Devices market, estimated to grow from USD 2.35 billion in 2023 to USD 4.18 billion in 2033. This growth is attributed to advanced healthcare facilities, high adoption rates of innovative technologies, and significant healthcare spending.South America Occlusion Devices Market Report:

In South America, the market is forecasted to grow from USD 0.60 billion in 2023 to USD 1.07 billion by 2033. Factors such as the rising incidence of chronic diseases and enhancements in healthcare infrastructure are driving this expansion.Middle East & Africa Occlusion Devices Market Report:

The Middle East and Africa market is expected to grow from USD 0.49 billion in 2023 to USD 0.87 billion by 2033. The region is witnessing improvements in healthcare infrastructure and growing demand for advanced medical devices.Tell us your focus area and get a customized research report.

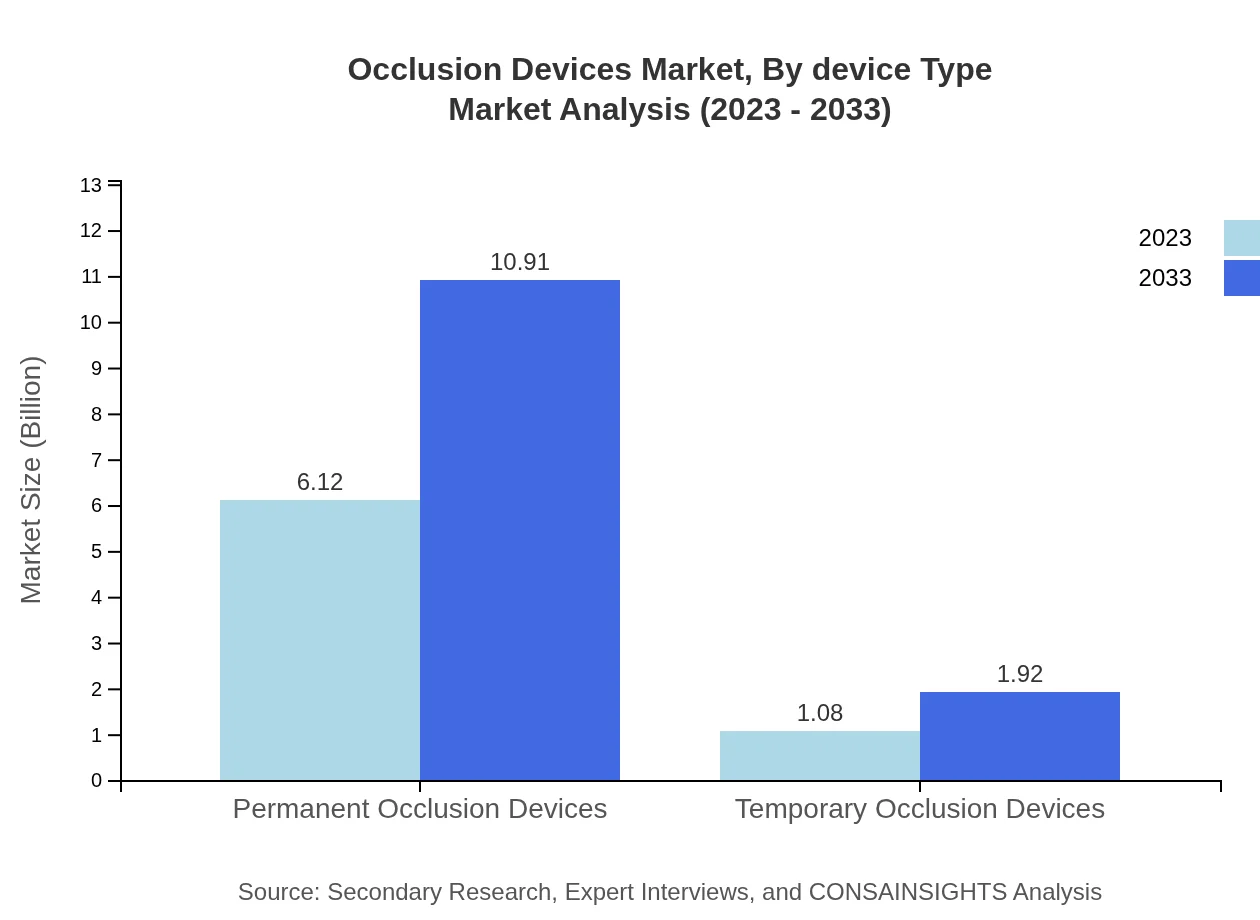

Occlusion Devices Market Analysis By Device Type

Permanent occlusion devices dominate the market, projected to grow from USD 6.12 billion in 2023 to USD 10.91 billion by 2033, capturing 85.06% of the market share. Temporary occlusion devices, while smaller, are also seeing significant growth, increasing from USD 1.08 billion to USD 1.92 billion and holding a 14.94% market share.

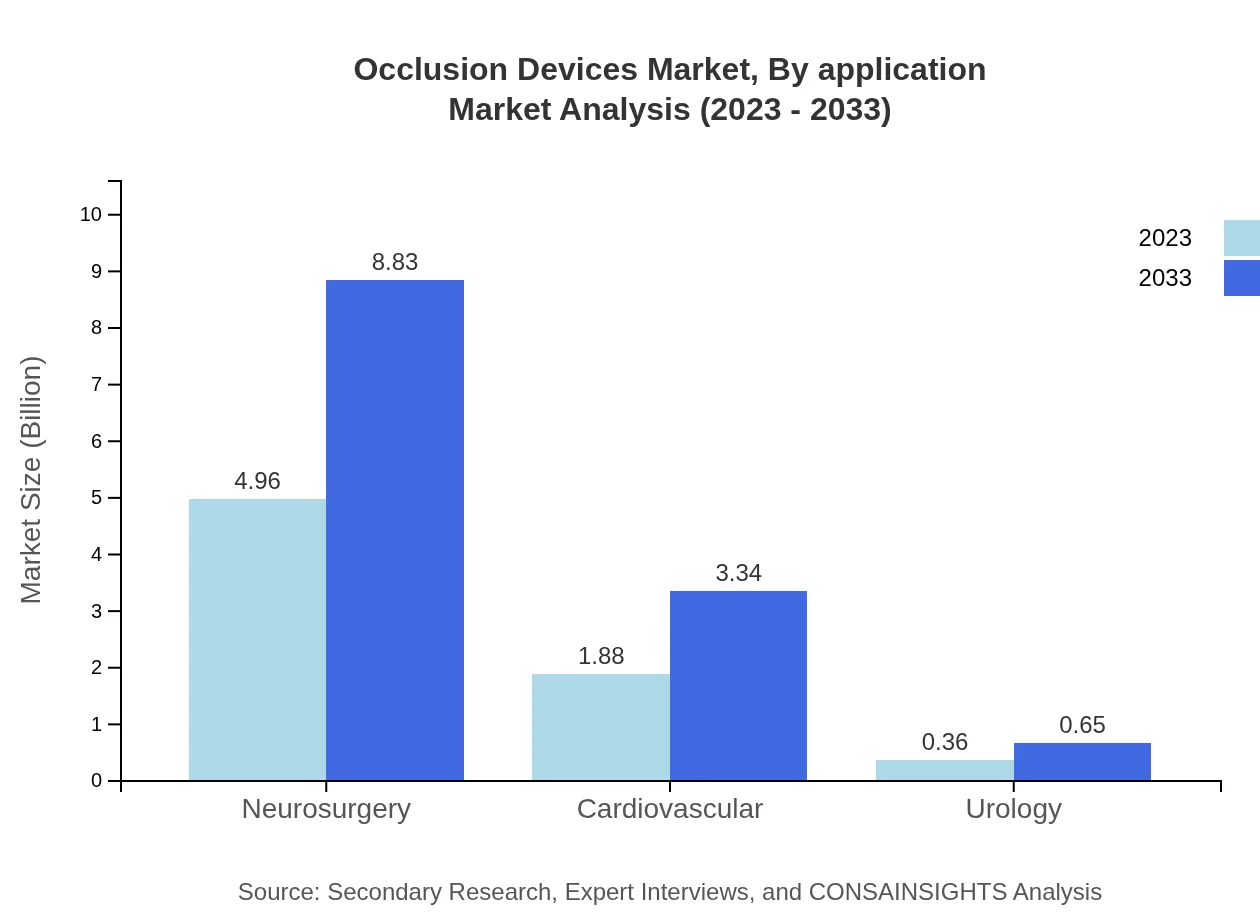

Occlusion Devices Market Analysis By Application

By application, neurosurgery leads the segment, with an anticipated growth from USD 4.96 billion in 2023 to USD 8.83 billion by 2033, maintaining a share of 68.88%. Cardiovascular applications follow, expanding from USD 1.88 billion to USD 3.34 billion, representing 26.08% of the share.

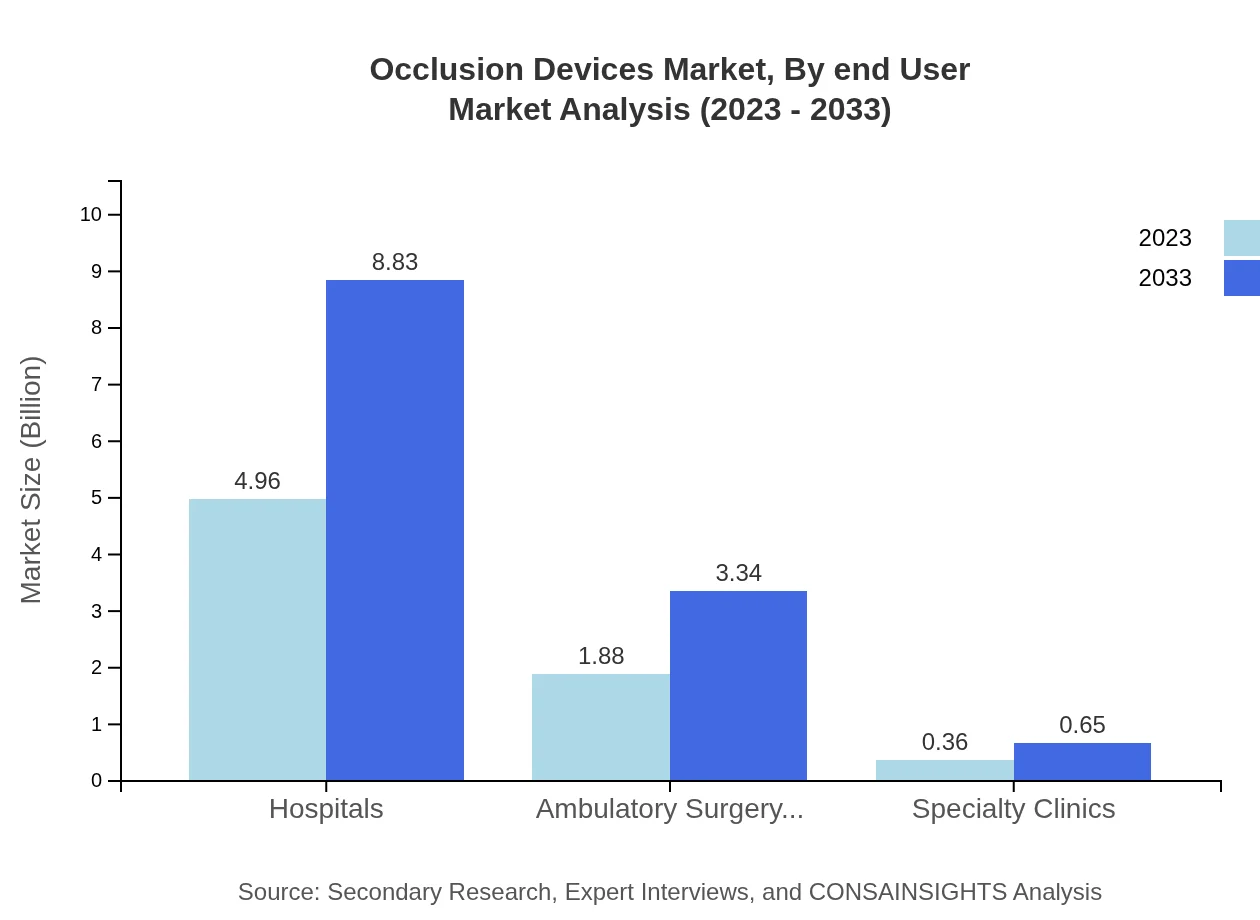

Occlusion Devices Market Analysis By End User

Hospitals remain the primary end-user segment, projected to increase from USD 4.96 billion in 2023 to USD 8.83 billion by 2033, capturing 68.88% of the market. Ambulatory surgery centers are also on the rise, from USD 1.88 billion to USD 3.34 billion, holding 26.08% market share.

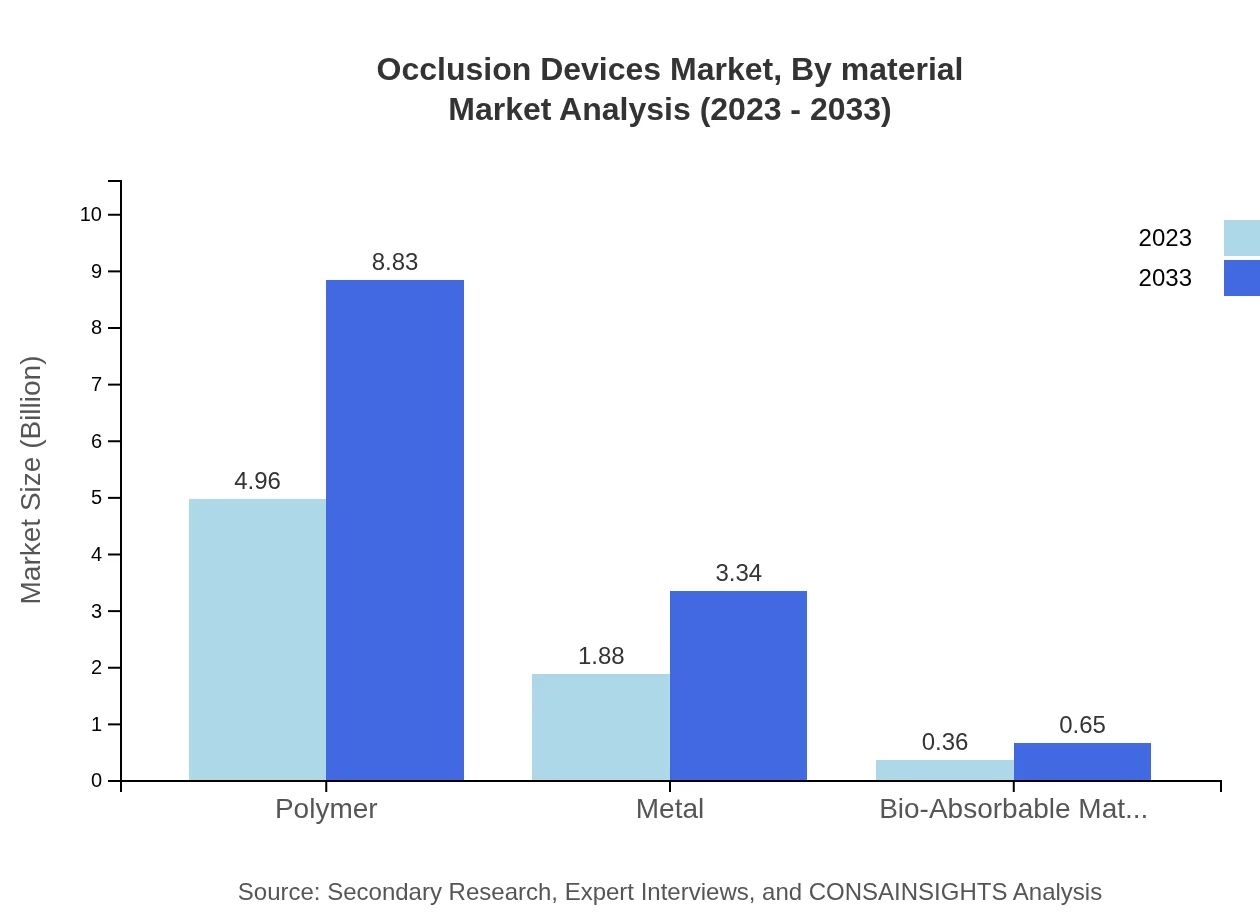

Occlusion Devices Market Analysis By Material

From a material perspective, polymers continue to dominate, with market values increasing from USD 4.96 billion to USD 8.83 billion, maintaining a significant share of 68.88%. Metal-based devices follow with a market size expanding from USD 1.88 billion to USD 3.34 billion, accounting for 26.08%.

Occlusion Devices Market Analysis By Region Type

The regional landscape shows North America leading, followed closely by Europe and Asia Pacific. Each region presents unique growth drivers, with environmental factors and healthcare policies influencing market dynamics significantly.

Occlusion Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Occlusion Devices Industry

Medtronic :

Medtronic is a global leader in medical technology, offering a range of innovative occlusion devices across multiple specialties, including cardiovascular and neurological interventions.Boston Scientific:

Boston Scientific specializes in less invasive devices and is recognized for its innovative products in the occlusion space, particularly in cardiology and urology.Abbott Laboratories:

Abbott is a major player dedicated to advancing healthcare through innovative devices and therapies, with a strong focus on occlusion strategies.Johnson & Johnson:

Johnson & Johnson produces a wide array of medical devices and has made significant contributions to the development of occlusion devices known for their quality and efficacy.We're grateful to work with incredible clients.

FAQs

What is the market size of occlusion Devices?

The global occlusion devices market is valued at approximately 7.2 billion USD in 2023, with a CAGR of 5.8% projected for the next decade, indicating significant growth potential in this sector until 2033.

What are the key market players or companies in this occlusion Devices industry?

Key players in the occlusion devices market include Medtronic, Abbott Laboratories, Boston Scientific, and Becton Dickinson. These companies lead in innovation and market share, driving advancements in clinical applications and product development.

What are the primary factors driving the growth in the occlusion devices industry?

Growth in the occlusion devices sector is primarily driven by increasing cardiovascular diseases, rising demand for minimally invasive surgical procedures, advancements in medical technologies, and a growing geriatric population that requires effective treatment options.

Which region is the fastest Growing in the occlusion devices market?

The Asia-Pacific region is the fastest-growing market for occlusion devices, with projected growth increasing from 1.40 billion in 2023 to 2.50 billion USD by 2033, reflecting expanding healthcare infrastructure and rising awareness.

Does ConsaInsights provide customized market report data for the occlusion Devices industry?

Yes, ConsaInsights offers customized market report data tailored to the occlusion devices industry. Clients can specify particular segments or regions for personalized insights and analysis to better suit their business needs.

What deliverables can I expect from this occlusion Devices market research project?

Deliverables from this market research project on occlusion devices typically include a comprehensive report with market size data, CAGR forecasts, competitive landscape analysis, segmented trends, and regional insights encompassing upcoming market opportunities.

What are the market trends of occlusion devices?

Current trends in the occlusion devices market include increasing adoption of permanent occlusion devices, preference for minimally invasive surgical techniques, innovation in device materials, and a growing focus on patient-centric care pathways.