Ocular Implants Market Report

Published Date: 31 January 2026 | Report Code: ocular-implants

Ocular Implants Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the ocular implants market, covering key trends, growth prospects, and forecasts between 2023 and 2033. It encompasses an analysis of market size, regional dynamics, technological advancements, and leading players, guiding stakeholders in making informed decisions.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

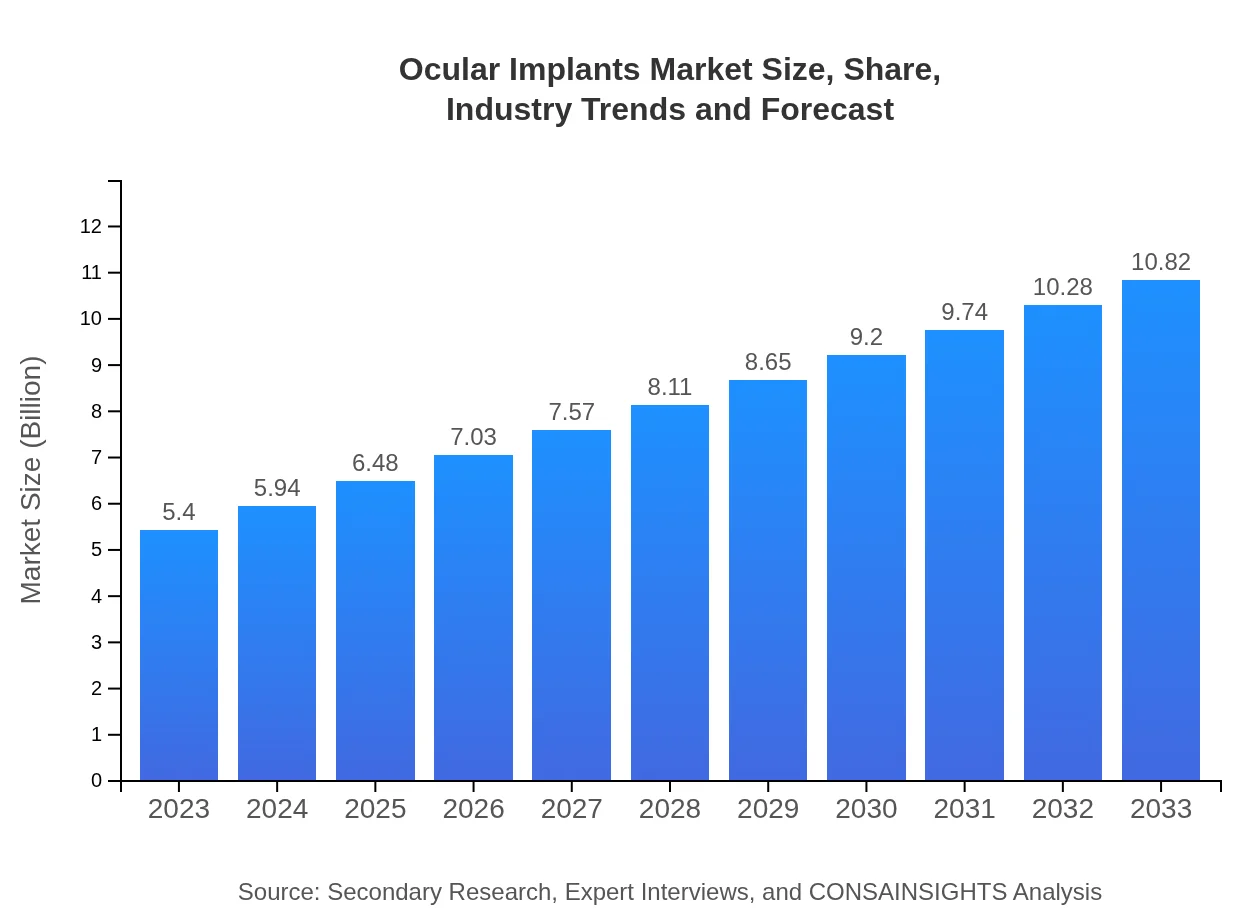

| 2023 Market Size | $5.40 Billion |

| CAGR (2023-2033) | 7% |

| 2033 Market Size | $10.82 Billion |

| Top Companies | Johnson & Johnson, Alcon (Novartis), Bausch + Lomb, Carl Zeiss AG |

| Last Modified Date | 31 January 2026 |

Ocular Implants Market Overview

Customize Ocular Implants Market Report market research report

- ✔ Get in-depth analysis of Ocular Implants market size, growth, and forecasts.

- ✔ Understand Ocular Implants's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ocular Implants

What is the Market Size & CAGR of Ocular Implants market in 2023?

Ocular Implants Industry Analysis

Ocular Implants Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ocular Implants Market Analysis Report by Region

Europe Ocular Implants Market Report:

Europe's ocular implants market is valued at $1.74 billion in 2023, set to double to $3.48 billion by 2033. The growth is propelled by an increasing aging population and the prevalence of eye diseases, along with robust healthcare policies.Asia Pacific Ocular Implants Market Report:

In Asia Pacific, the ocular implants market is valued at $1.04 billion in 2023, projected to reach $2.08 billion by 2033, driven by increasing investments in healthcare infrastructure and growing awareness of eye health.North America Ocular Implants Market Report:

North America holds a significant portion of the ocular implants market, with a valuation of $1.79 billion in 2023, projected to reach $3.60 billion by 2033, driven by advanced healthcare facilities and prominent key players setting innovations.South America Ocular Implants Market Report:

The South American ocular implants market, valued at $0.08 billion in 2023, is expected to grow to $0.15 billion by 2033, supported by rising healthcare spending and improved access to eye care services.Middle East & Africa Ocular Implants Market Report:

In the Middle East and Africa, the market is valued at $0.75 billion in 2023 and is expected to reach $1.51 billion by 2033, driven by improvements in healthcare systems and growing awareness of ocular health.Tell us your focus area and get a customized research report.

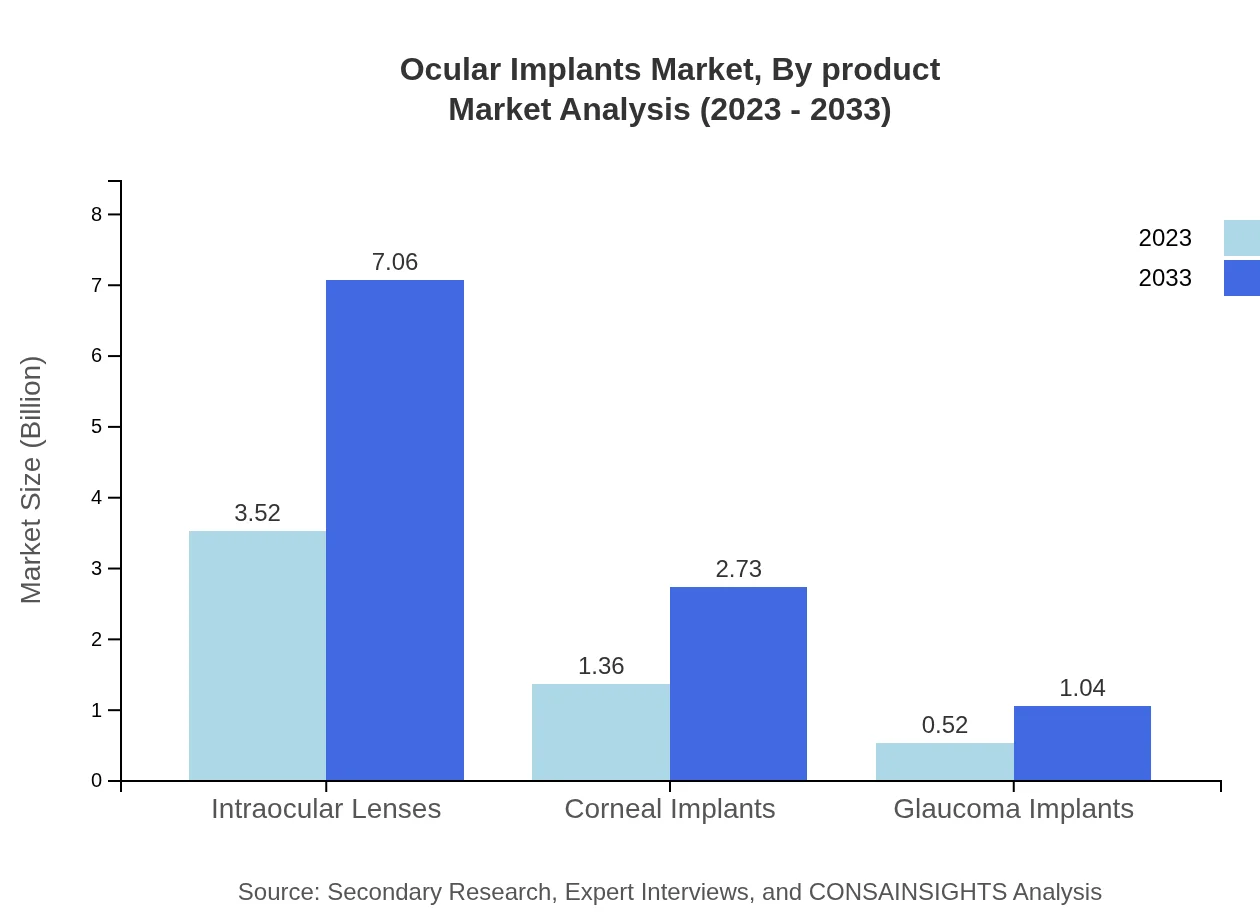

Ocular Implants Market Analysis By Product

In 2023, Intraocular lenses dominate the market with a size of $3.52 billion, projected to grow to $7.06 billion by 2033, reflecting a steady share of 65.2%. Corneal implants follow, growing from $1.36 billion in 2023 to $2.73 billion in 2033, maintaining a share of 25.23%. Glaucoma implants, though smaller in size at $0.52 billion in 2023, are expected to see double in size to $1.04 billion by 2033, holding a 9.57% market share.

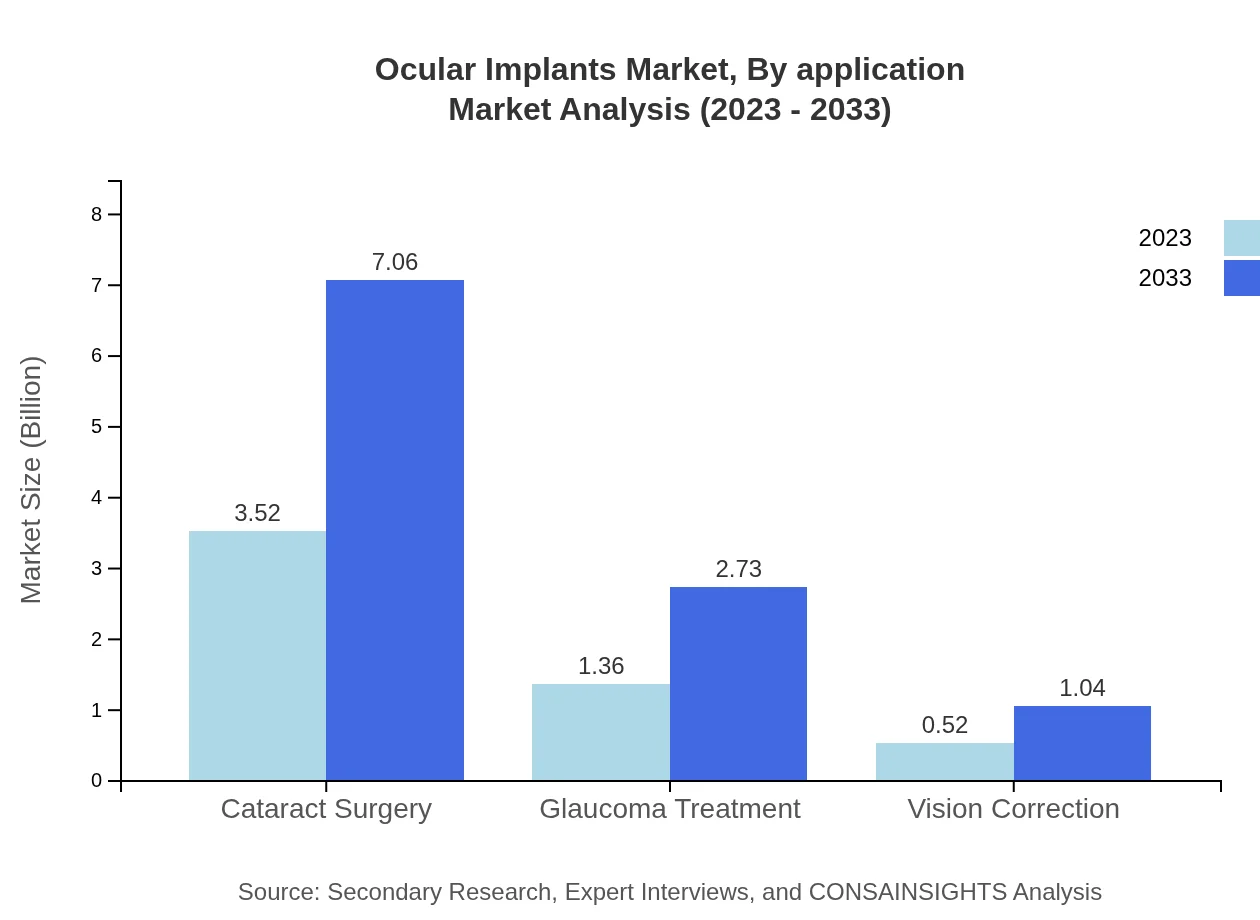

Ocular Implants Market Analysis By Application

Cataract surgery remains the dominant application segment, accounting for $3.52 billion in 2023, projected to rise to $7.06 billion by 2033. This represents a 65.2% market share. Glaucoma treatment is also significant, expected to double from $1.36 billion in 2023 to $2.73 billion in 2033, maintaining a share of 25.23%. Vision correction applications are smaller, growing from $0.52 billion in 2023 to $1.04 billion by 2033, with a share of 9.57%.

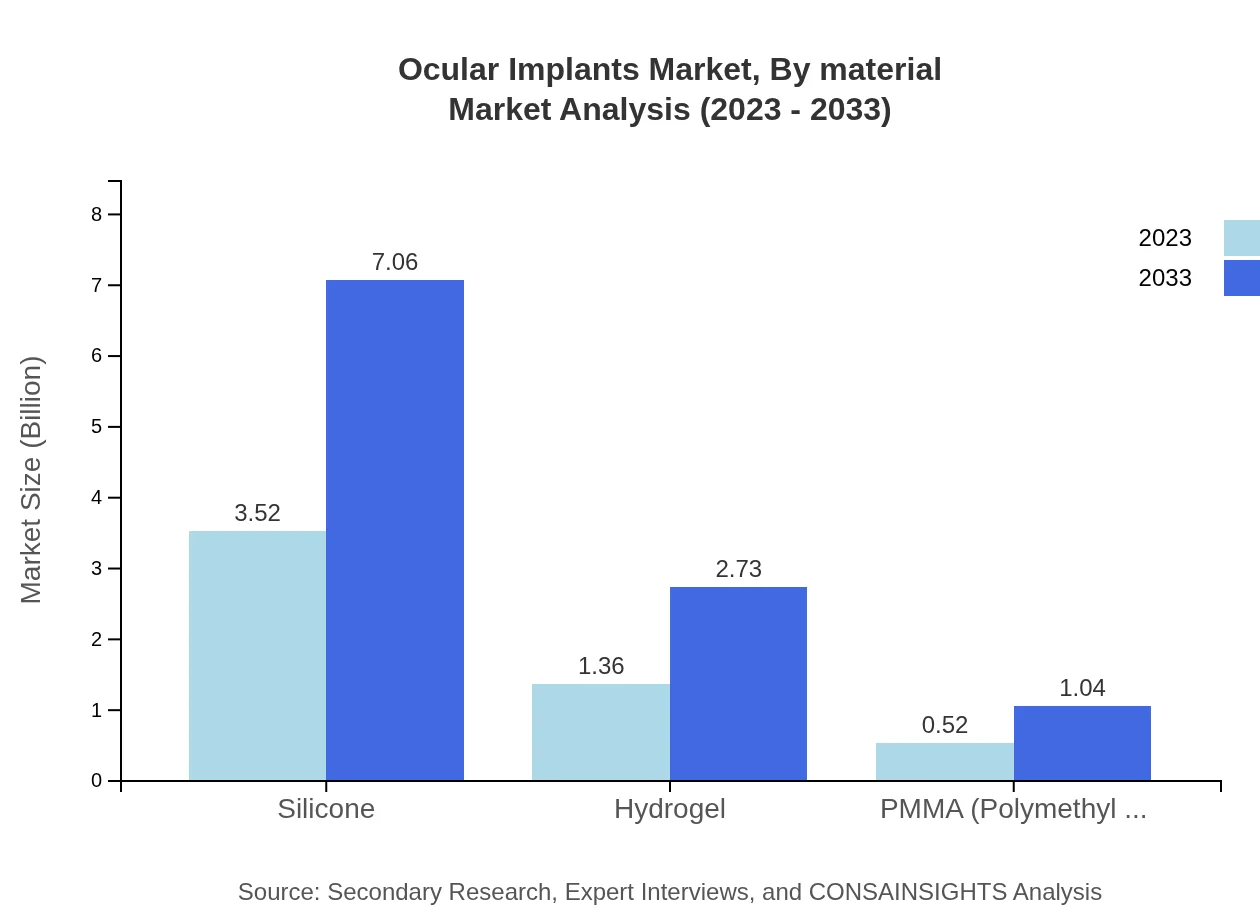

Ocular Implants Market Analysis By Material

The market by material highlights silicone implants predominating the segment with a size of $3.52 billion in 2023, projected to grow to $7.06 billion by 2033. Hydrogel implants comprise a smaller segment, growing from $1.36 billion to $2.73 billion during the same period, representing 25.23%. PMMA implants grow from $0.52 billion in 2023 to $1.04 billion by 2033, holding a 9.57% market share.

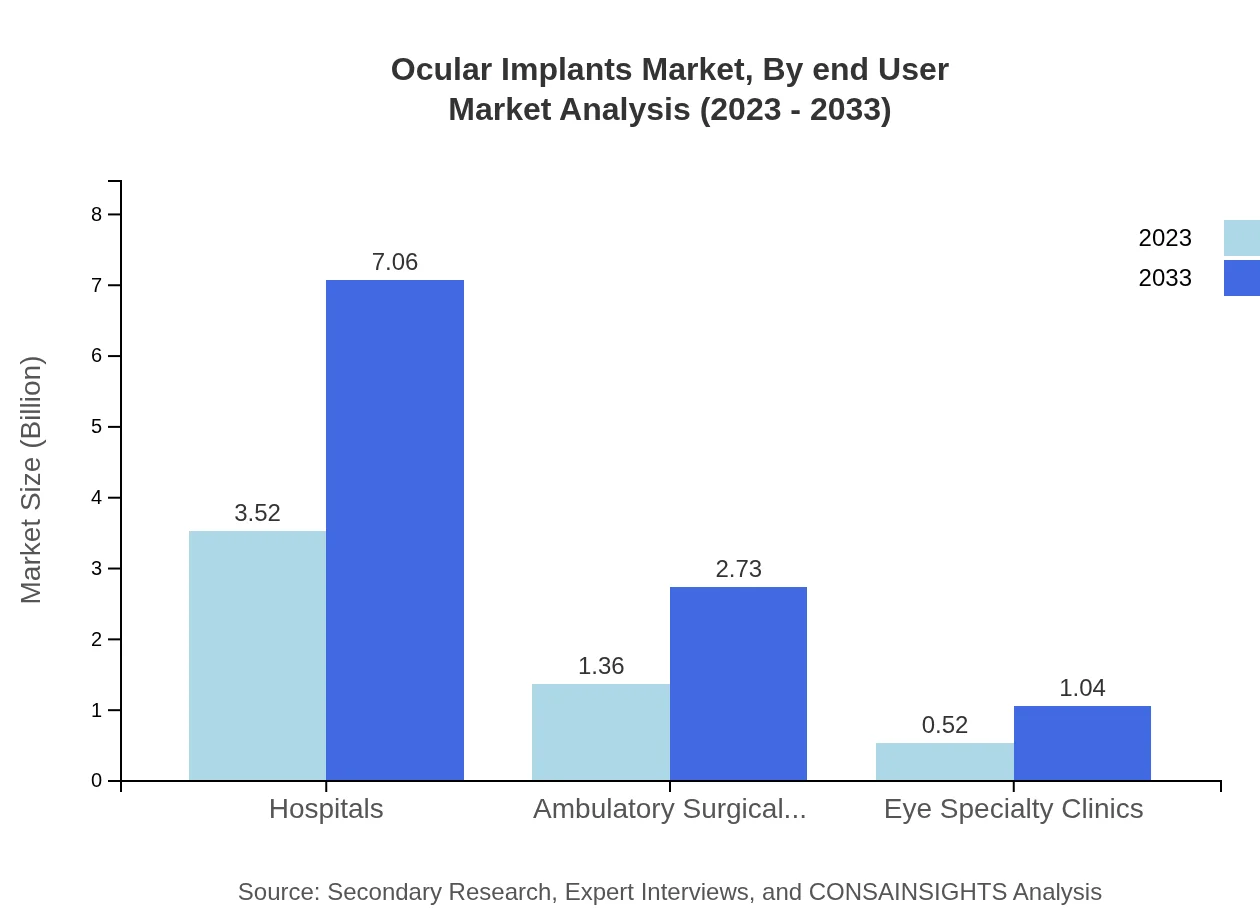

Ocular Implants Market Analysis By End User

Hospitals make up the largest share in the ocular implants market, holding a size of $3.52 billion in 2023. This segment is projected to grow to $7.06 billion by 2033, maintaining a 65.2% share. Ambulatory surgical centers follow, growing from $1.36 billion to $2.73 billion during the forecast period, with a share of 25.23%. Eye specialty clinics are a smaller segment, expected to grow from $0.52 billion to $1.04 billion, holding a 9.57% market share.

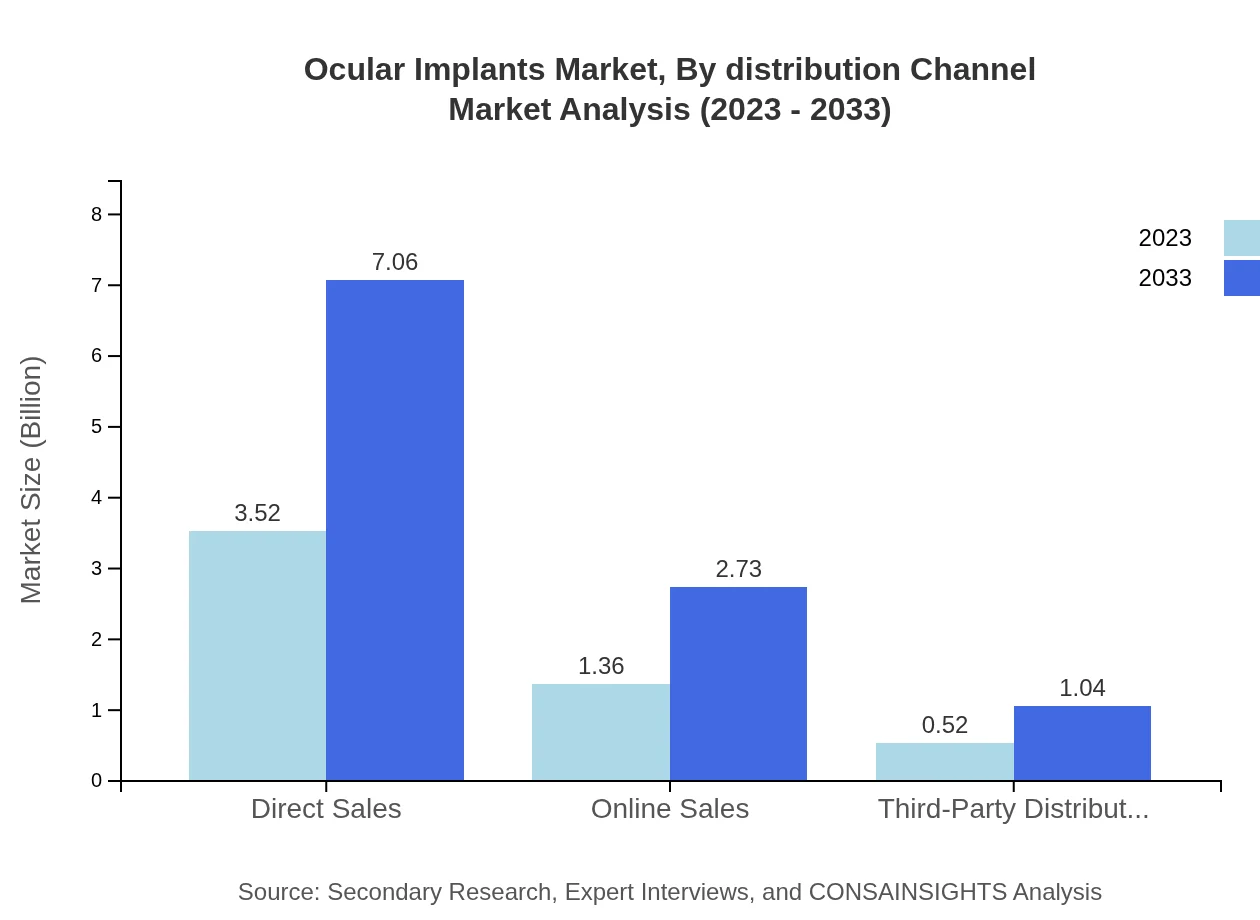

Ocular Implants Market Analysis By Distribution Channel

The dominant distribution channel for ocular implants is direct sales, holding a size of $3.52 billion in 2023 and projected to rise to $7.06 billion by 2033, equating to 65.2%. Online sales cover a growing segment, increasing from $1.36 billion to $2.73 billion, reflecting a share of 25.23%. Third-party distributors hold 9.57% of the market, from $0.52 billion in 2023 to $1.04 billion by 2033.

Ocular Implants Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ocular Implants Industry

Johnson & Johnson:

Occupying a leading position in the ocular implants market, Johnson & Johnson delivers innovative intraocular lenses and surgical solutions that enhance ocular health and restore vision.Alcon (Novartis):

Alcon is renowned for its advanced technology in ocular implants, especially in cataract and refractive surgery, significantly contributing to the growth and development of the industry.Bausch + Lomb:

Bausch + Lomb is a premier company in eye health products, focusing on implantable lenses and other innovative solutions that cater to ocular conditions.Carl Zeiss AG:

Carl Zeiss AG specializes in innovative optical and optoelectronic products and plays a crucial role in the ocular implant sector through premium imaging and surgical tools.We're grateful to work with incredible clients.

FAQs

What is the market size of ocular Implants?

The ocular implants market is currently valued at approximately $5.4 billion in 2023. It is projected to experience a compound annual growth rate (CAGR) of 7%, indicating robust growth in the coming years, reflecting advancing technologies and increasing demand for vision correction.

What are the key market players or companies in the ocular Implants industry?

Key players in the ocular implants market include major companies such as Alcon, Johnson & Johnson Vision, Bausch + Lomb, and Abbott. These companies lead the industry with their innovative product offerings, extensive distribution networks, and strong market presence globally.

What are the primary factors driving the growth in the ocular Implants industry?

The growth of the ocular implants market is stimulated by rising incidences of eye-related disorders, advancements in implant technology, and the increasing adoption of minimally invasive surgeries. Additionally, the growing aging population enhances the demand for ocular implants.

Which region is the fastest Growing in the ocular Implants?

Within the ocular implants market, North America is the fastest-growing region, projected to expand from $1.79 billion in 2023 to $3.60 billion by 2033. Growth is driven by increased surgical procedures and investments in healthcare.

Does ConsaInsights provide customized market report data for the ocular Implants industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the ocular implants industry. This includes in-depth analysis and insights on sub-segments, regional dynamics, and competitive landscapes to support informed decision-making.

What deliverables can I expect from this ocular Implants market research project?

Deliverables from the ocular implants market research include comprehensive market analysis reports, segment breakdowns, regional insights, competitive landscape assessments, and actionable recommendations, aimed at supporting strategic business planning.

What are the market trends of ocular implants?

Current trends in the ocular implants market include increasing demand for intraocular lenses, growing focus on technological advancements, and a shift towards outpatient surgical procedures. Additionally, there is a rising preference for silicone-based implants due to their biocompatibility.