Oem Insulation Market Report

Published Date: 22 January 2026 | Report Code: oem-insulation

Oem Insulation Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Oem Insulation market from 2023 to 2033, providing insights into market size, growth trends, regional dynamics, and leading industry players.

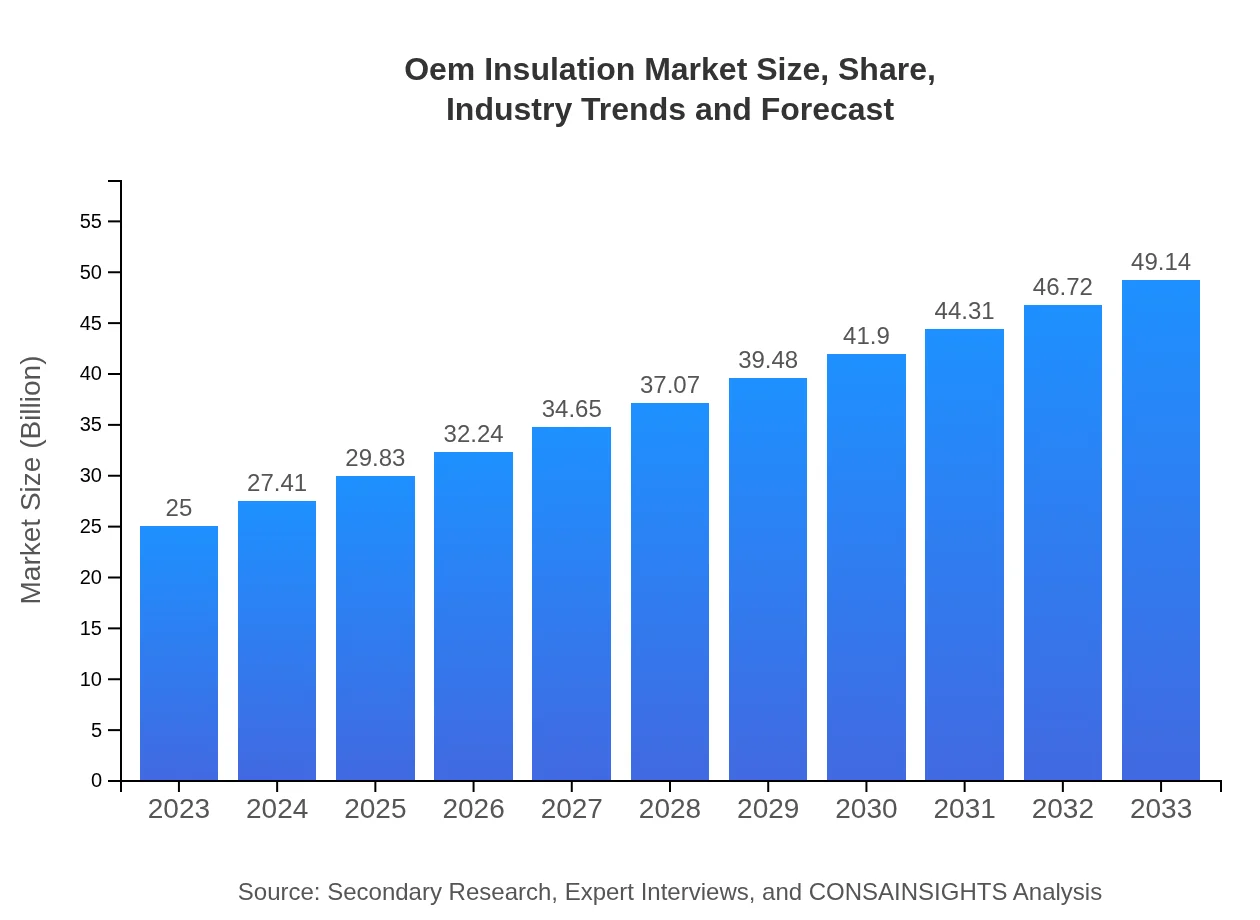

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $49.14 Billion |

| Top Companies | Owens Corning, Rockwool International, Saint-Gobain, Johns Manville |

| Last Modified Date | 22 January 2026 |

Oem Insulation Market Overview

Customize Oem Insulation Market Report market research report

- ✔ Get in-depth analysis of Oem Insulation market size, growth, and forecasts.

- ✔ Understand Oem Insulation's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Oem Insulation

What is the Market Size & CAGR of Oem Insulation market in 2023?

Oem Insulation Industry Analysis

Oem Insulation Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Oem Insulation Market Analysis Report by Region

Europe Oem Insulation Market Report:

The European market is expected to see substantial growth, increasing from $7.57 billion in 2023 to $14.88 billion by 2033. The emphasis on reducing greenhouse gas emissions and energy consumption in Europe is influencing the accelerated adoption of insulation products.Asia Pacific Oem Insulation Market Report:

The Asia Pacific region is experiencing exponential growth, with the market increasing from $4.22 billion in 2023 to $8.29 billion by 2033. The rapid expansion of the construction industry in countries like China and India, alongside government initiatives for energy efficiency, propels this market forward.North America Oem Insulation Market Report:

North America represents a significant market, projected to grow from $9.65 billion in 2023 to $18.97 billion by 2033. The region's commitment to energy efficiency and sustainable practices, supported by stringent regulations, fuels demand for advanced insulation solutions.South America Oem Insulation Market Report:

In South America, the Oem Insulation market is set to grow from $0.75 billion in 2023 to $1.48 billion in 2033. Growing urbanization and increasing investments in infrastructure are key drivers of growth in this region.Middle East & Africa Oem Insulation Market Report:

The Oem Insulation market in the Middle East and Africa is projected to grow from $2.81 billion in 2023 to $5.51 billion by 2033. The region's increasing focus on infrastructure development and energy efficiency initiatives are contributing to this growth.Tell us your focus area and get a customized research report.

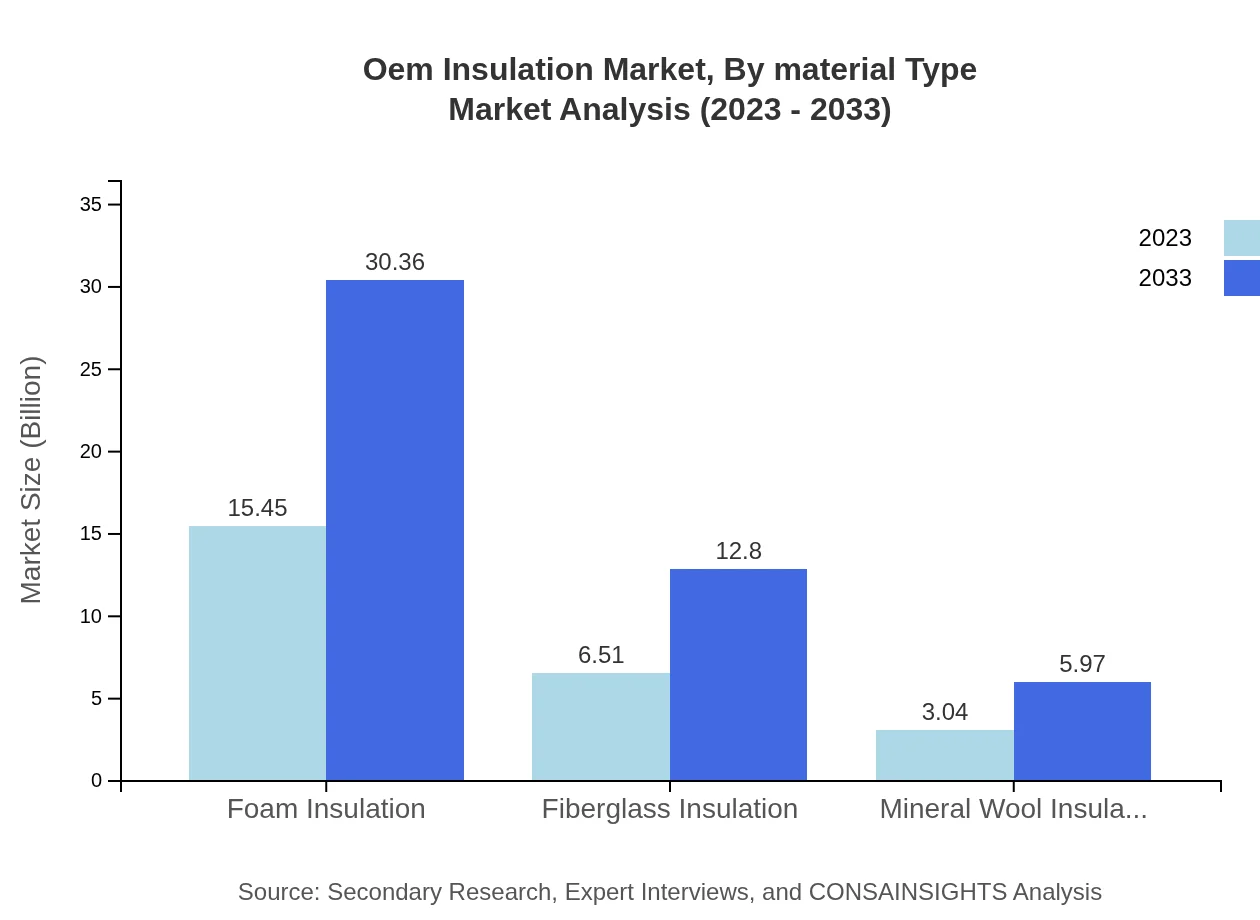

Oem Insulation Market Analysis By Material Type

In 2023, foam insulation, leading the market, stood at $15.45 billion, and is expected to reach $30.36 billion by 2033. Fiberglass insulation captures a significant market share, valued at $6.51 billion and moving towards $12.80 billion within the forecast period. Mineral wool insulation, although a smaller segment, is projected to grow from $3.04 billion to $5.97 billion. The rising emphasis on energy conservation across industries is expected to bolster demand for a diverse array of insulation types.

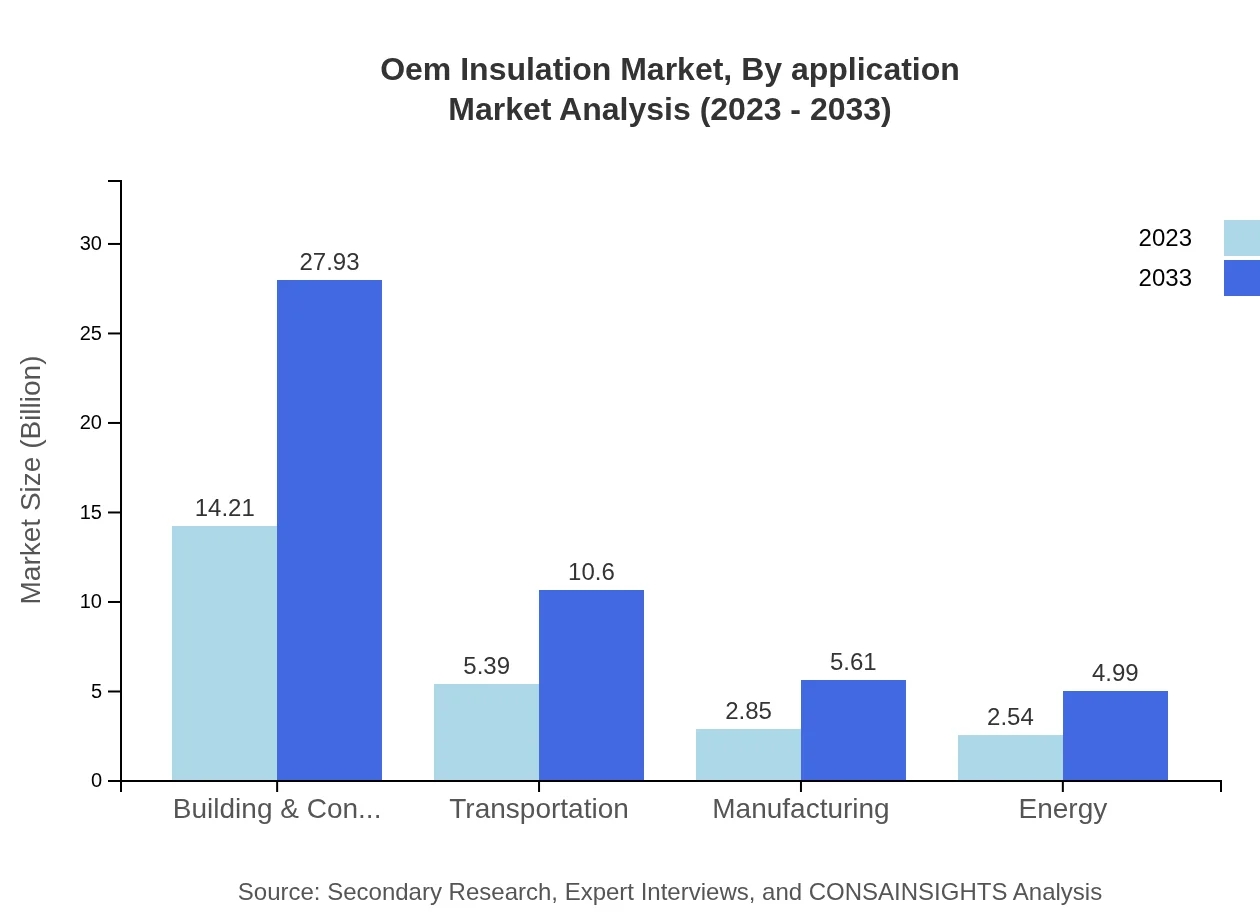

Oem Insulation Market Analysis By Application

The construction application segment dominates the market with revenues projected to increase from $14.21 billion in 2023 to $27.93 billion by 2033, maintaining a share of 56.85%. Other key applications include automotive, electronics, and petrochemicals, collectively contributing significantly to the overall market. The rising demand for insulation in these sectors underlines the diverse applications of Oem Insulation materials.

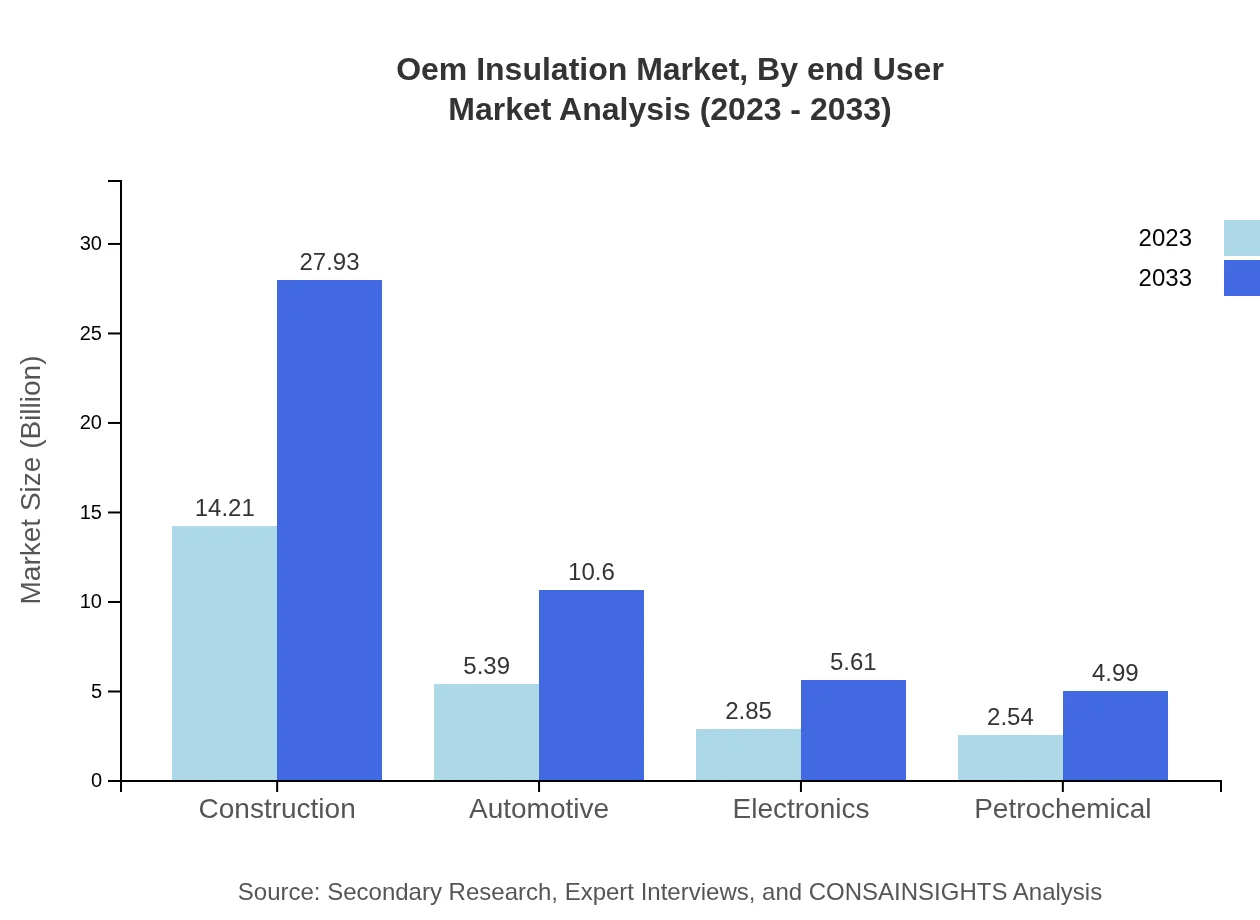

Oem Insulation Market Analysis By End User

The construction industry, as the largest end-user of Oem Insulation products, is experiencing growth from $14.21 billion in 2023 to $27.93 billion by 2033. Other substantial end-users include automotive and energy sectors, with automotive expected to grow from $5.39 billion to $10.60 billion. The demand from these sectors emphasizes the need for high-performance insulation solutions.

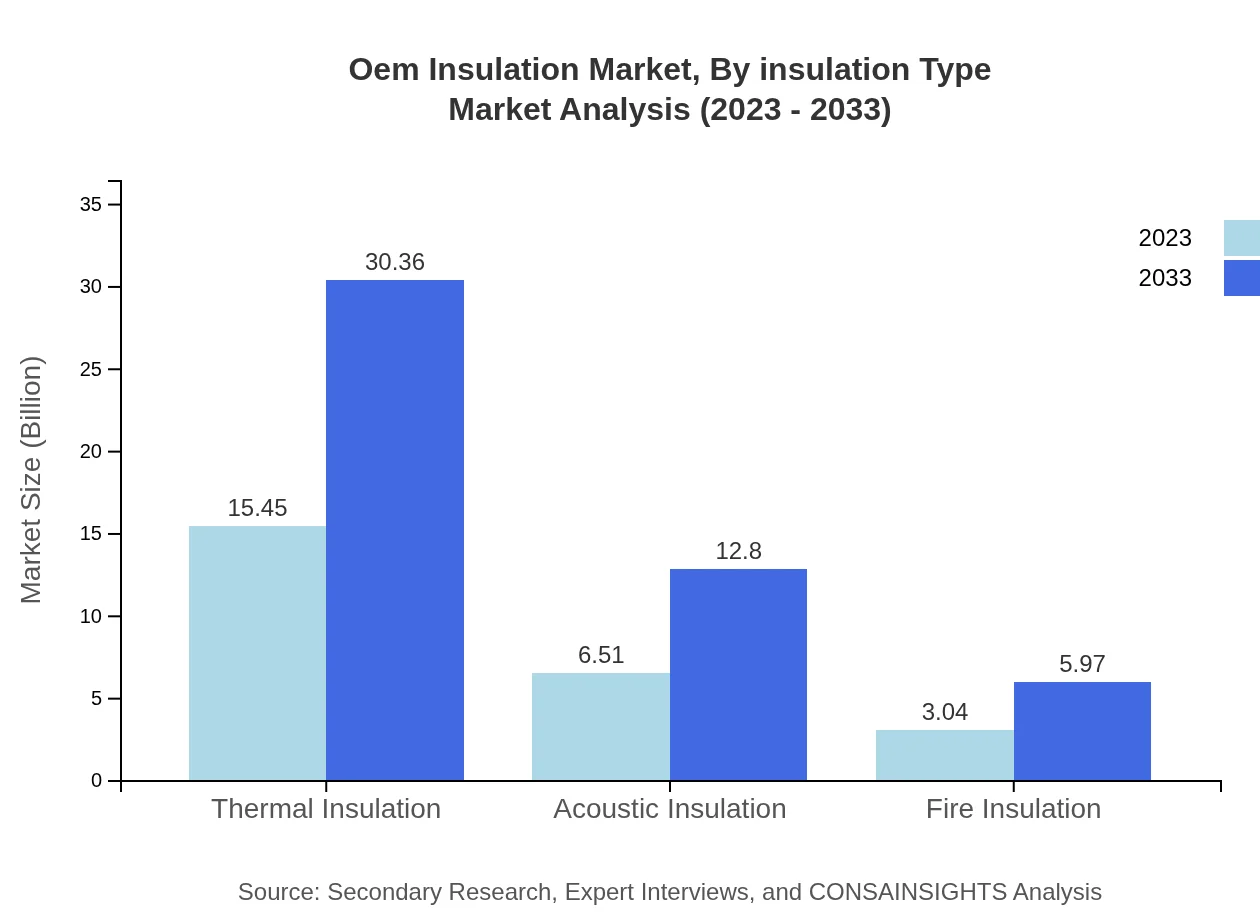

Oem Insulation Market Analysis By Insulation Type

Thermal insulation holds the majority market share, capturing $15.45 billion in 2023 and projected to expand to $30.36 billion by 2033. The acoustic insulation segment is also significant, with an expected increase from $6.51 billion to $12.80 billion. Fire insulation, while smaller in scale, is competitive with expected growth from $3.04 billion to $5.97 billion.

Oem Insulation Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Oem Insulation Industry

Owens Corning:

A leader in insulation, Owens Corning develops advanced insulation products that enhance energy efficiency across various applications including residential and commercial buildings.Rockwool International:

Specializing in stone wool insulation solutions, Rockwool focuses on sustainability and energy efficiency, contributing significantly to the global insulation landscape.Saint-Gobain:

A multinational company that manufactures a variety of insulation products, Saint-Gobain is recognized for its innovative solutions that meet the highest performance standards.Johns Manville:

Part of the Berkshire Hathaway group, Johns Manville provides insulation and roofing materials, emphasizing sustainability and high-performance products.We're grateful to work with incredible clients.

FAQs

What is the market size of OEM Insulation?

The OEM insulation market is projected to reach approximately $25 billion by 2033, growing at a CAGR of 6.8% from its current valuation. This growth is driven by increasing demand across various sectors including construction, automotive, and electronics.

What are the key market players or companies in the OEM insulation industry?

Key players in the OEM insulation market include major manufacturers and suppliers known for their innovative products and extensive distribution networks. These companies play a crucial role in shaping market dynamics and ensuring product availability across regions.

What are the primary factors driving the growth in the OEM insulation industry?

Significant factors driving growth in the OEM insulation industry include rising energy efficiency needs, increasing building constructions, and growing automotive production. Additionally, stringent environmental regulations promote the use of insulation in various applications.

Which region is the fastest Growing in the OEM insulation?

The fastest-growing region in the OEM insulation market is projected to be North America, with market growth from approximately $9.65 billion in 2023 to $18.97 billion in 2033. This is followed by Europe and the Asia-Pacific regions.

Does ConsaInsights provide customized market report data for the OEM insulation industry?

Yes, ConsaInsights offers customized market report data for the OEM insulation industry. Clients can request specific insights tailored to their needs, focusing on various market segments, regions, and trends.

What deliverables can I expect from this OEM insulation market research project?

Deliverables from this OEM insulation market research project include comprehensive reports, detailed market analysis, segment data, regional insights, forecasts, and recommendations tailored to client needs and industry trends.

What are the market trends of OEM insulation?

Current trends in the OEM insulation market include increased adoption of sustainable materials, technological advancements in insulation products, and a shift towards eco-friendly building practices, which enhances product demand across various sectors.