Off Highway Vehicle Telematics Market Report

Published Date: 31 January 2026 | Report Code: off-highway-vehicle-telematics

Off Highway Vehicle Telematics Market Size, Share, Industry Trends and Forecast to 2033

This report provides insights into the Off Highway Vehicle Telematics market from 2023 to 2033, including market size, growth trends, regional analysis, and a comprehensive overview of the industry landscape and segmentation.

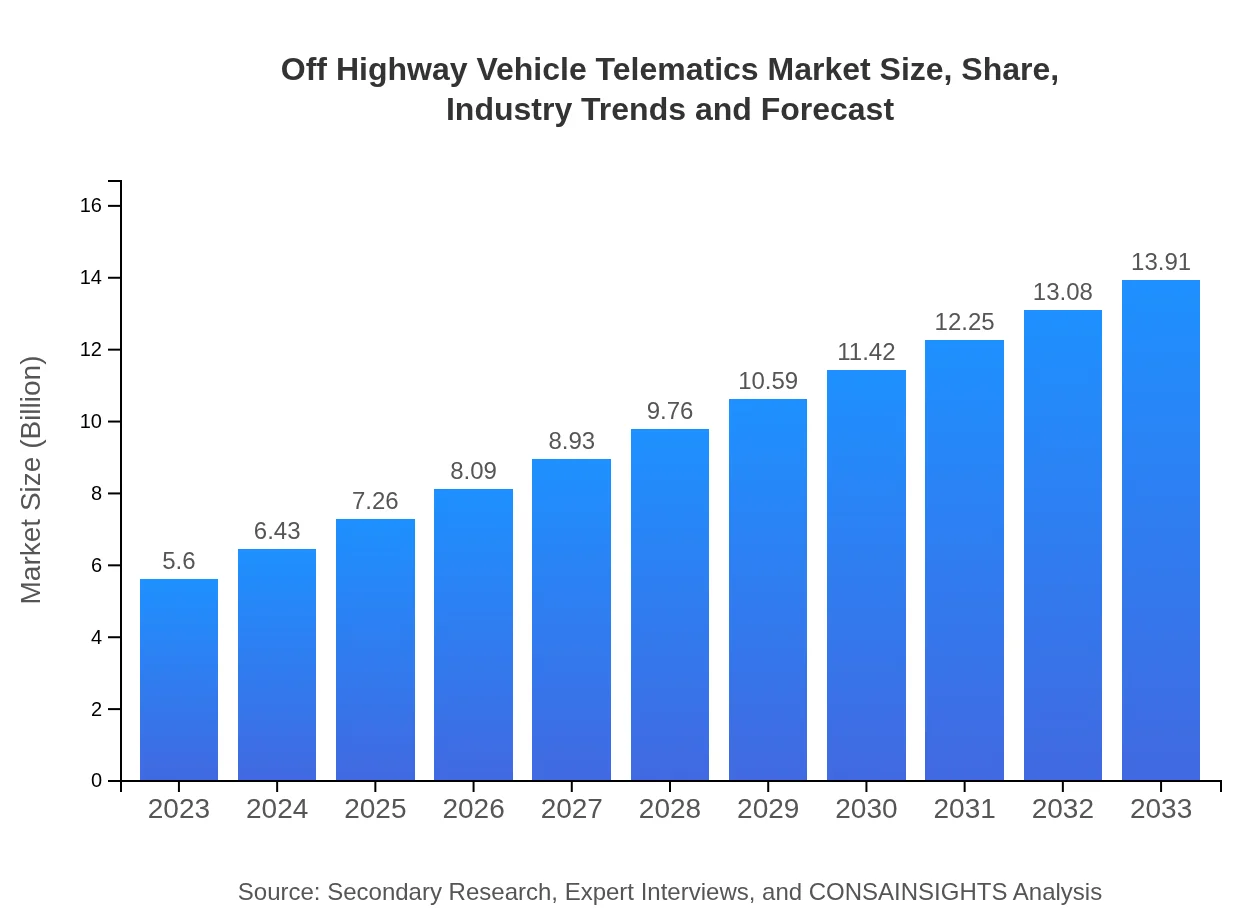

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $13.91 Billion |

| Top Companies | Verizon Connect, Teletrac Navman, Fleet Complete, Trackunit |

| Last Modified Date | 31 January 2026 |

Off Highway Vehicle Telematics Market Overview

Customize Off Highway Vehicle Telematics Market Report market research report

- ✔ Get in-depth analysis of Off Highway Vehicle Telematics market size, growth, and forecasts.

- ✔ Understand Off Highway Vehicle Telematics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Off Highway Vehicle Telematics

What is the Market Size & CAGR of Off Highway Vehicle Telematics market in 2023?

Off Highway Vehicle Telematics Industry Analysis

Off Highway Vehicle Telematics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Off Highway Vehicle Telematics Market Analysis Report by Region

Europe Off Highway Vehicle Telematics Market Report:

With a market size of $1.87 billion in 2023 projected to grow to $4.65 billion by 2033, Europe's focus on sustainable and efficient logistics systems is fostering demand for advanced telematics solutions in off-road vehicles.Asia Pacific Off Highway Vehicle Telematics Market Report:

In the Asia Pacific region, the Off Highway Vehicle Telematics market is projected to grow significantly, with a market size of $1.05 billion in 2023, expanding to $2.61 billion by 2033. This growth is driven by rapid urbanization, increasing infrastructure spending, and advancements in agricultural practices.North America Off Highway Vehicle Telematics Market Report:

North America, being a mature market, will see the Off Highway Vehicle Telematics market grow from $1.84 billion in 2023 to $4.57 billion by 2033. The region's robust construction industry and regulatory pressures to enhance operational efficiencies and safety through telematics are key drivers.South America Off Highway Vehicle Telematics Market Report:

The South American market is expected to grow from $0.41 billion in 2023 to $1.03 billion by 2033. National policies promoting modernization in agriculture and mining are likely to augment demand for telematics solutions.Middle East & Africa Off Highway Vehicle Telematics Market Report:

The Middle East and Africa will experience growth from $0.42 billion in 2023 to $1.05 billion by 2033, fueled by infrastructure projects and greater emphasis on supply chain efficiency.Tell us your focus area and get a customized research report.

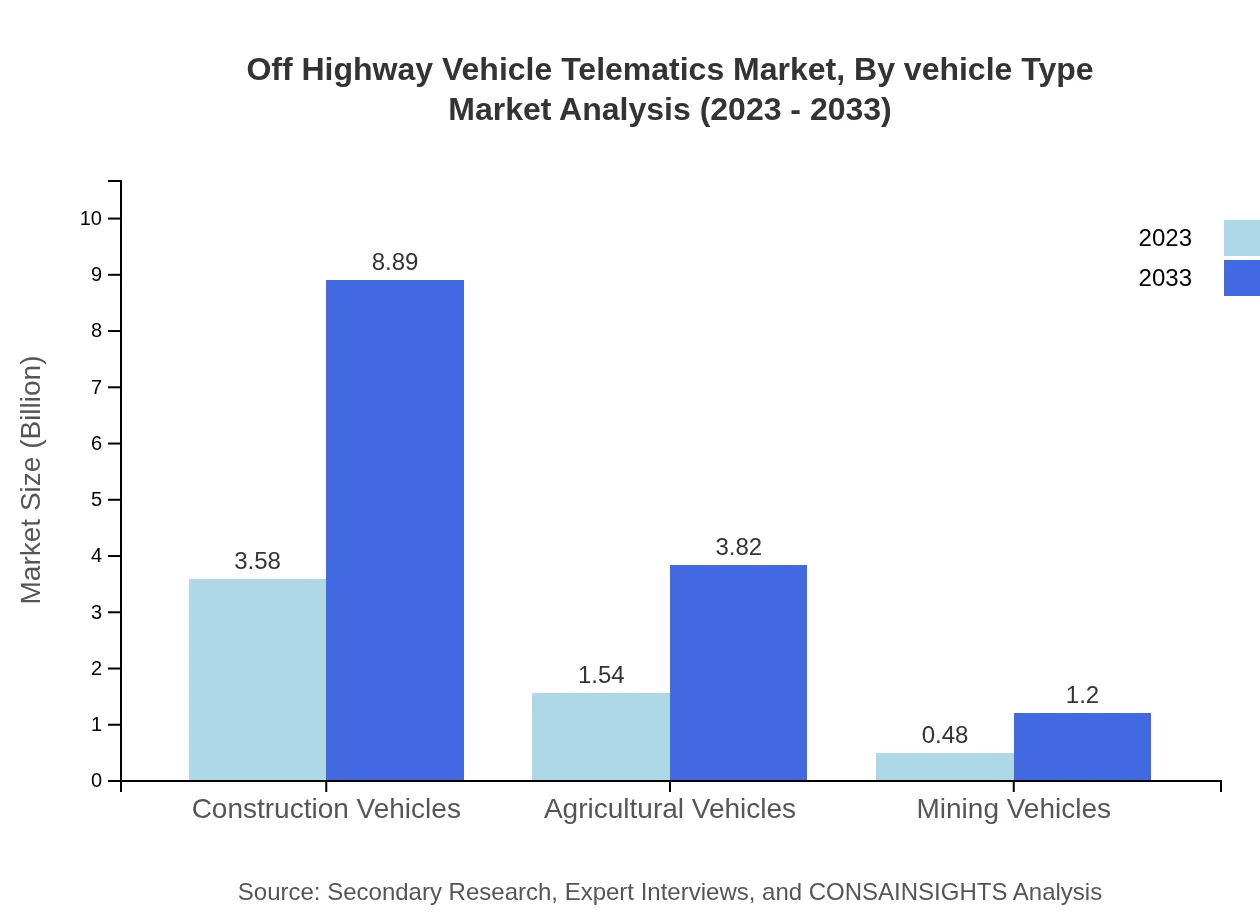

Off Highway Vehicle Telematics Market Analysis By Vehicle Type

In the Off-Highway Vehicle Telematics market, construction vehicles represent the largest market segment, with a size of $3.58 billion in 2023, expected to reach $8.89 billion by 2033, holding a 63.91% market share. Agricultural vehicles account for $1.54 billion in 2023, expanding to $3.82 billion by 2033 (27.49% share). Mining vehicles and forestry vehicles are smaller segments, expected to grow progressively as technology integration enhances operational efficiency and safety.

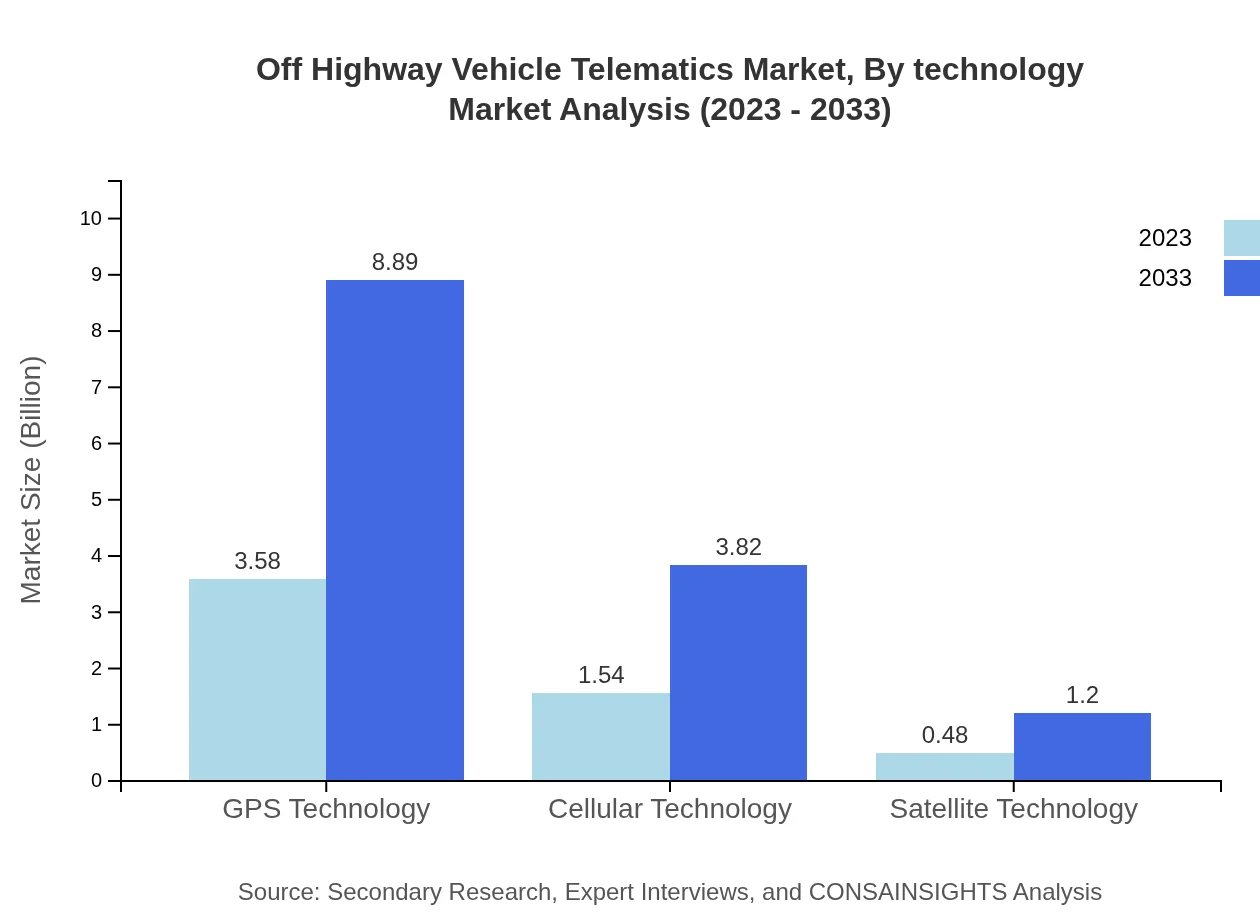

Off Highway Vehicle Telematics Market Analysis By Technology

GPS technology dominates the Off-Highway Vehicle Telematics landscape, with a current market size of $3.58 billion, projected to grow to $8.89 billion by 2033, capturing 63.91% of the market share. Cellular technology and satellite technology follow, with respective market sizes of $1.54 billion and $0.48 billion in 2023, expected to expand significantly, showcasing the increasing reliance on remote connectivity and monitoring.

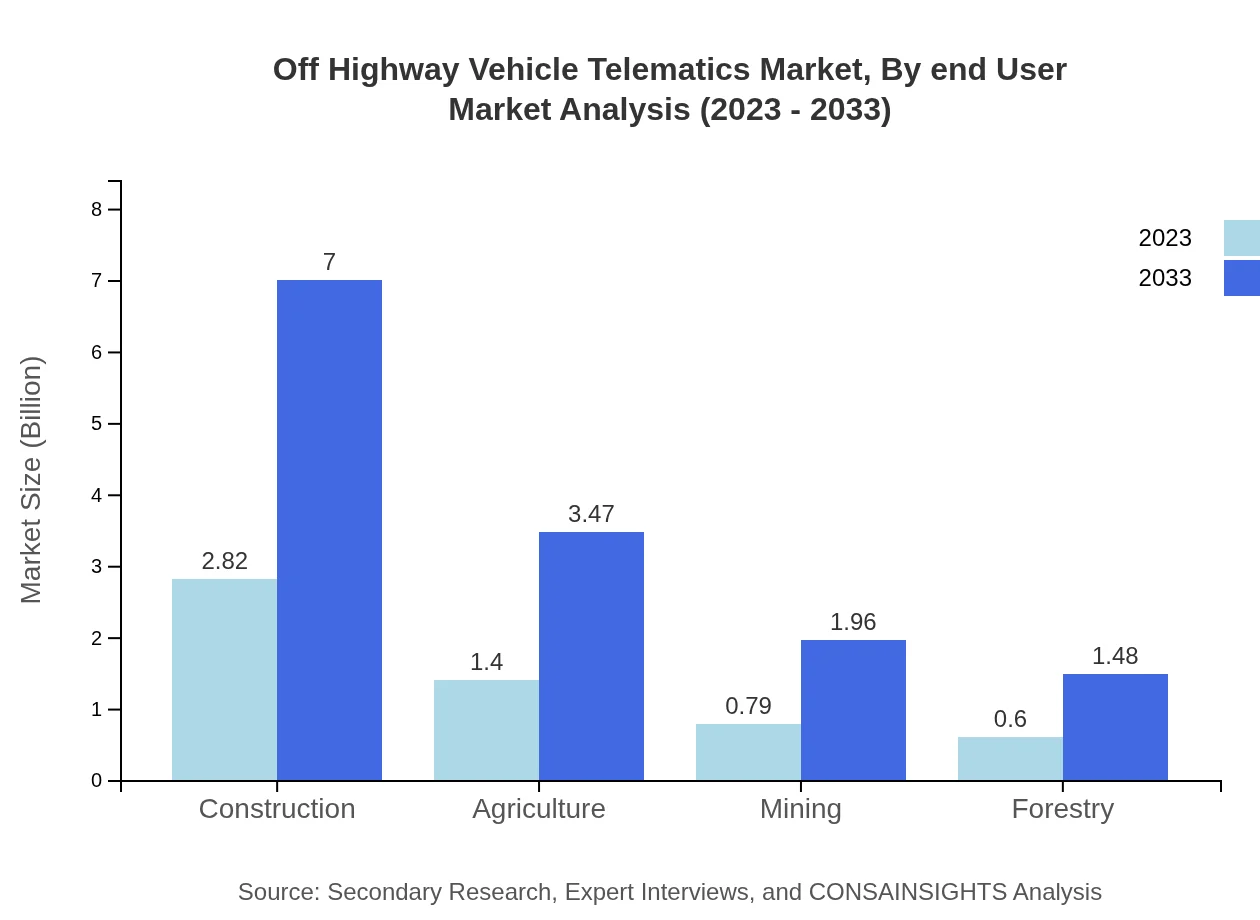

Off Highway Vehicle Telematics Market Analysis By End User

The construction industry remains the dominant end-user in Off-Highway Vehicle Telematics, valued at $2.82 billion in 2023, projected to rise to $7.00 billion by 2033, maintaining a 50.29% market share. Other end-users, including agriculture and mining, contribute significantly with projections reflecting growing demand for telematics solutions.

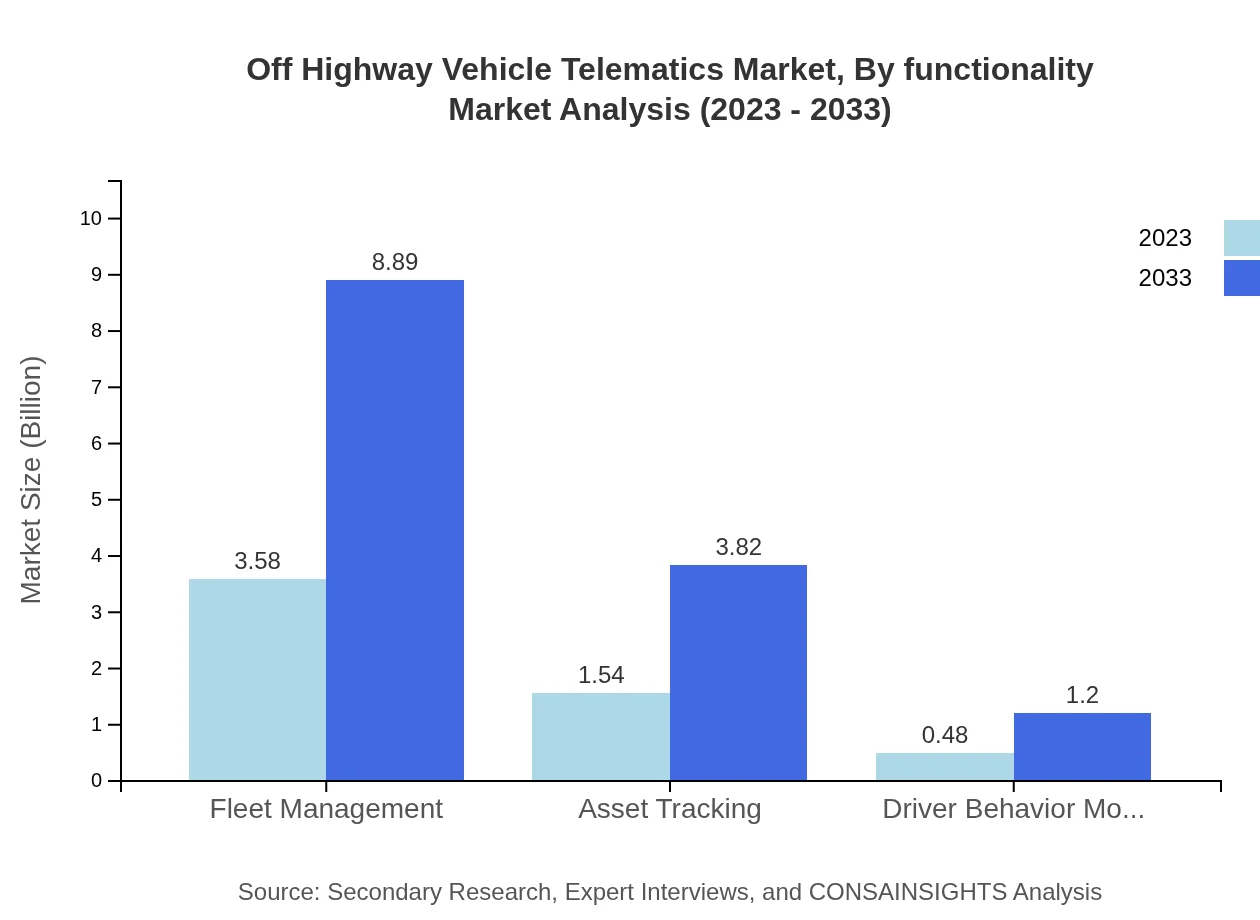

Off Highway Vehicle Telematics Market Analysis By Functionality

In terms of functionality, fleet management is the leading application of Off-Highway Vehicle Telematics, projected to grow from $3.58 billion (63.91% share) in 2023 to $8.89 billion by 2033. Asset tracking, driving behavior monitoring, and similar functionalities are also gaining traction, underlining the diverse applications of telematics across various vehicle types.

Off Highway Vehicle Telematics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Off Highway Vehicle Telematics Industry

Verizon Connect:

A leading provider of telematics and fleet management solutions, Verizon Connect specializes in delivering comprehensive systems that enhance vehicle tracking and management for off-highway applications.Teletrac Navman:

Recognized for its innovative telematics solutions, Teletrac Navman offers services tailored for the construction and agriculture sectors, emphasizing asset tracking, safety, and compliance.Fleet Complete:

Provider of fleet management and telematics technology, Fleet Complete focuses on improving operational efficiencies through advanced tracking solutions and scalable services for off-highway vehicles.Trackunit:

Trackunit enhances equipment efficiency through its telematics solutions, specializing in tracking, monitoring, and fleet optimization across various industries.We're grateful to work with incredible clients.

FAQs

What is the market size of Off-Highway Vehicle Telematics?

The global market size of Off-Highway Vehicle Telematics is projected to reach approximately $5.6 billion by 2033, growing at a CAGR of 9.2% from 2023 to 2033.

What are the key market players or companies in the Off-Highway Vehicle Telematics industry?

Key players in the Off-Highway Vehicle Telematics industry include major firms such as Geotab Inc., Omnicomm, and Trimble Inc., who focus on developing advanced telematics solutions for various off-highway applications.

What are the primary factors driving the growth in the Off-Highway Vehicle Telematics industry?

Growth in the Off-Highway Vehicle Telematics industry is primarily driven by increasing demand for fleet management, advances in technology, regulatory compliance needs, and the growing emphasis on operational efficiency across construction and agriculture.

Which region is the fastest Growing in the Off-Highway Vehicle Telematics?

The fastest-growing region in the Off-Highway Vehicle Telematics market is projected to be Europe, expected to grow from $1.87 billion in 2023 to $4.65 billion by 2033, reflecting a robust increase in telematics adoption.

Does ConsaInsights provide customized market report data for the Off-Highway Vehicle Telematics industry?

Yes, ConsaInsights offers customized market report data for the Off-Highway Vehicle Telematics industry, tailoring insights to specific client needs to enhance decision-making and strategic planning.

What deliverables can I expect from this Off-Highway Vehicle Telematics market research project?

Expect comprehensive deliverables including detailed market analysis, competitive landscape assessments, regional and segment insights, forecasts, and strategic recommendations tailored to your business objectives.

What are the market trends of Off-Highway Vehicle Telematics?

Current market trends in Off-Highway Vehicle Telematics include increased integration of IoT and AI technologies, advancements in real-time data analytics, and a growing focus on sustainability and efficiency in off-highway vehicle operations.

What segments drive the Off-Highway Vehicle Telematics market?

The Off-Highway Vehicle Telematics market is segmented into construction, agriculture, and mining, with construction holding the highest share of 50.29%, reflecting the significance of telematics in fleet management and operational efficiency.