Offshore Oil Gas Communications Market Report

Published Date: 31 January 2026 | Report Code: offshore-oil-gas-communications

Offshore Oil Gas Communications Market Size, Share, Industry Trends and Forecast to 2033

This market report provides exhaustive insights into the Offshore Oil Gas Communications industry, covering market size, trends, regional analysis, and future forecasts from 2023 to 2033.

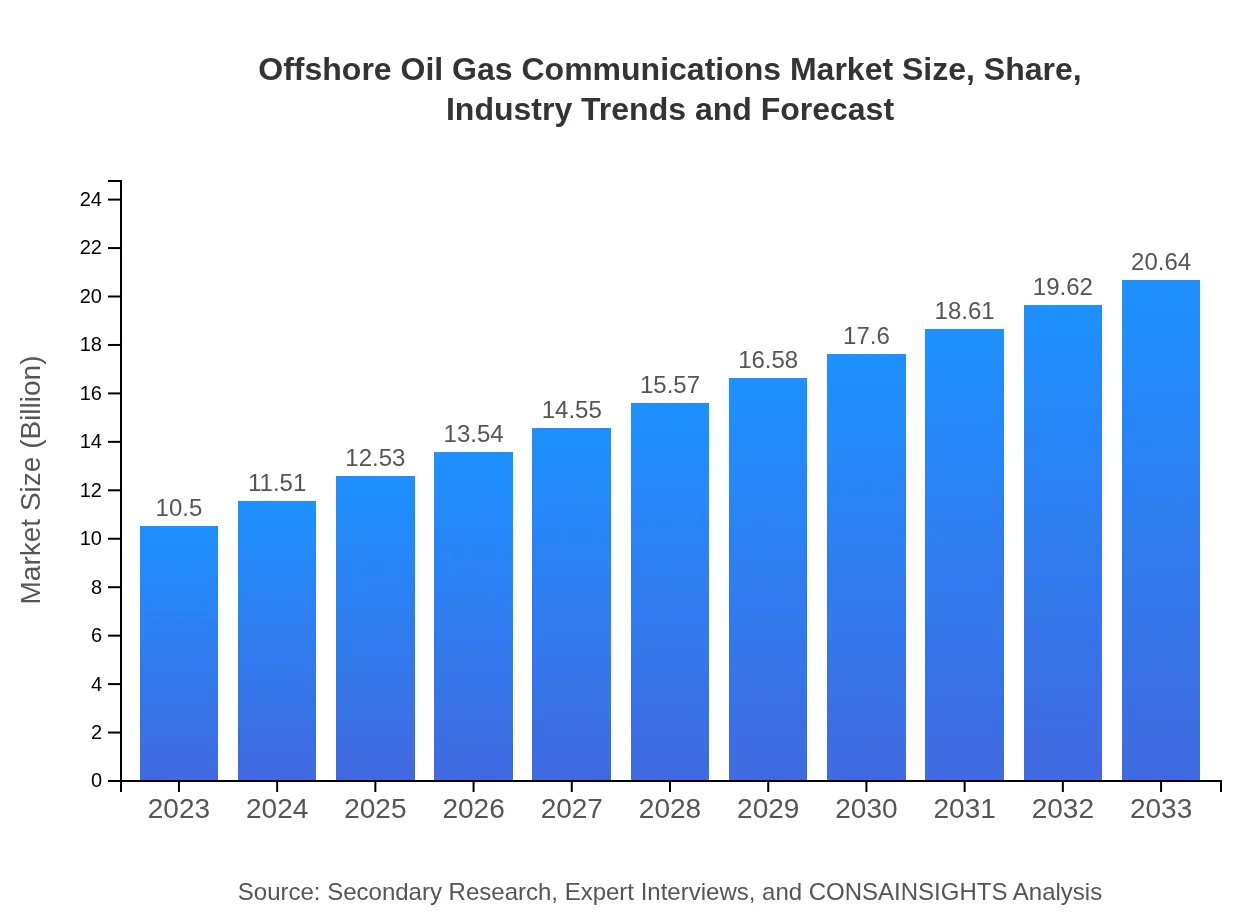

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $20.64 Billion |

| Top Companies | Siemens AG, General Electric (GE), Harris Corporation, Honeywell International Inc. |

| Last Modified Date | 31 January 2026 |

Offshore Oil Gas Communications Market Overview

Customize Offshore Oil Gas Communications Market Report market research report

- ✔ Get in-depth analysis of Offshore Oil Gas Communications market size, growth, and forecasts.

- ✔ Understand Offshore Oil Gas Communications's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Offshore Oil Gas Communications

What is the Market Size & CAGR of Offshore Oil Gas Communications market in 2023?

Offshore Oil Gas Communications Industry Analysis

Offshore Oil Gas Communications Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Offshore Oil Gas Communications Market Analysis Report by Region

Europe Offshore Oil Gas Communications Market Report:

In Europe, the Offshore Oil Gas Communications market value is estimated at $2.53 billion in 2023, with expectations of rising to $4.97 billion by 2033. The region’s commitment to sustainability and reducing emissions propels advancements in communication technologies.Asia Pacific Offshore Oil Gas Communications Market Report:

In the Asia Pacific region, the market size was valued at $2.12 billion in 2023 and is expected to grow to $4.16 billion by 2033. This growth is driven by increasing offshore drilling activities and investments in new technologies amidst rising energy demands in the region.North America Offshore Oil Gas Communications Market Report:

The North American market was valued at $3.46 billion in 2023 and is anticipated to grow to $6.80 billion by 2033. The increase in offshore exploration activities and technological adoption in communication systems are key drivers of growth in this region.South America Offshore Oil Gas Communications Market Report:

South America’s market size stood at $0.95 billion in 2023, projected to reach $1.87 billion by 2033. Brazil's expanding offshore oil sector and new discoveries are primarily responsible for this growth, along with infrastructural expansions.Middle East & Africa Offshore Oil Gas Communications Market Report:

The Middle East and Africa's market stood at $1.44 billion in 2023, reaching approximately $2.83 billion by 2033. The region’s hydrocarbon resources continue to attract technological enhancements in communication systems to maintain competitive operational standards.Tell us your focus area and get a customized research report.

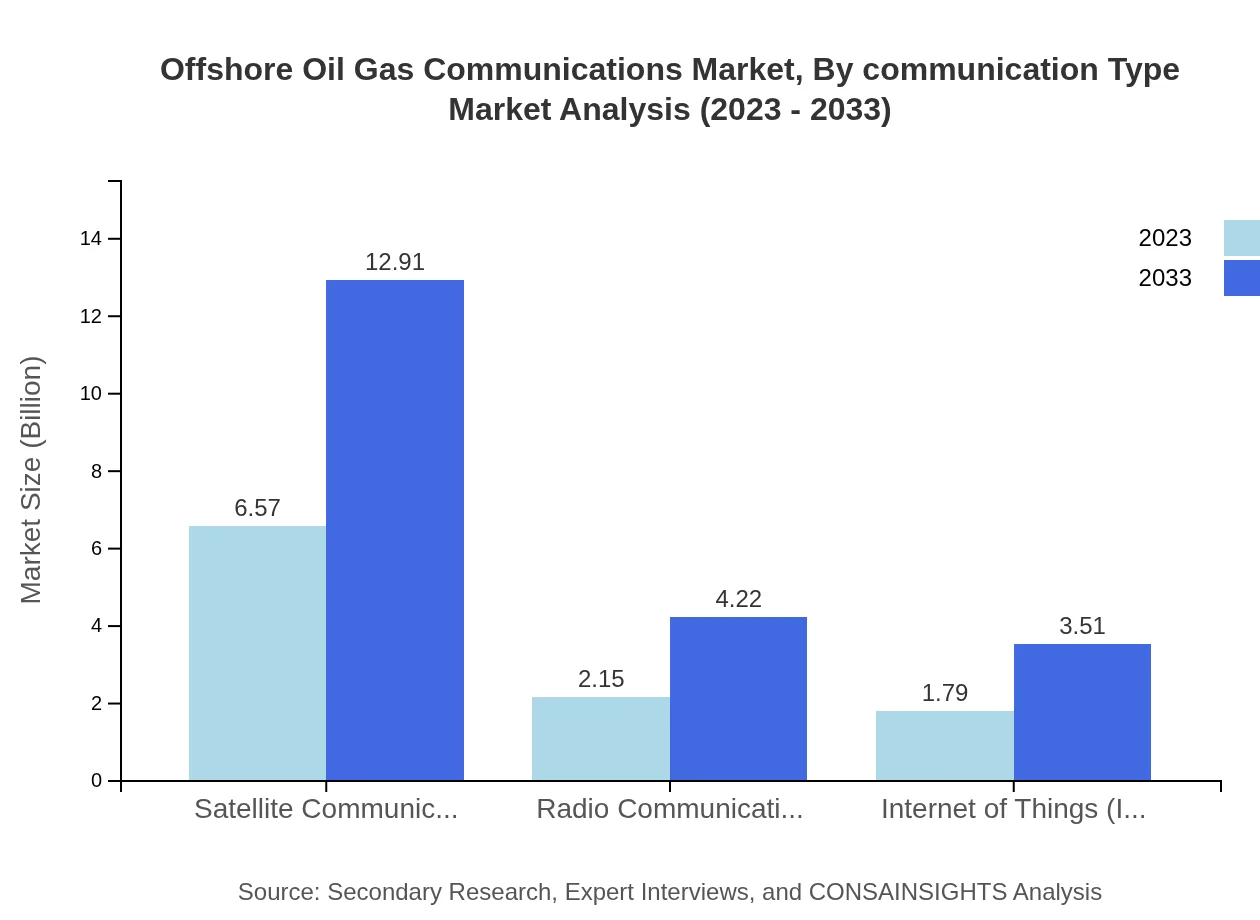

Offshore Oil Gas Communications Market Analysis By Communication Type

In 2023, the satellite communications segment dominated the market with a size of $6.57 billion and is projected to maintain its leadership with a growth to $12.91 billion by 2033, representing a 62.54% share throughout this period. Radio communications and IoT communications exhibited growing demand, expanding from $2.15 billion to $4.22 billion and $1.79 billion to $3.51 billion, respectively.

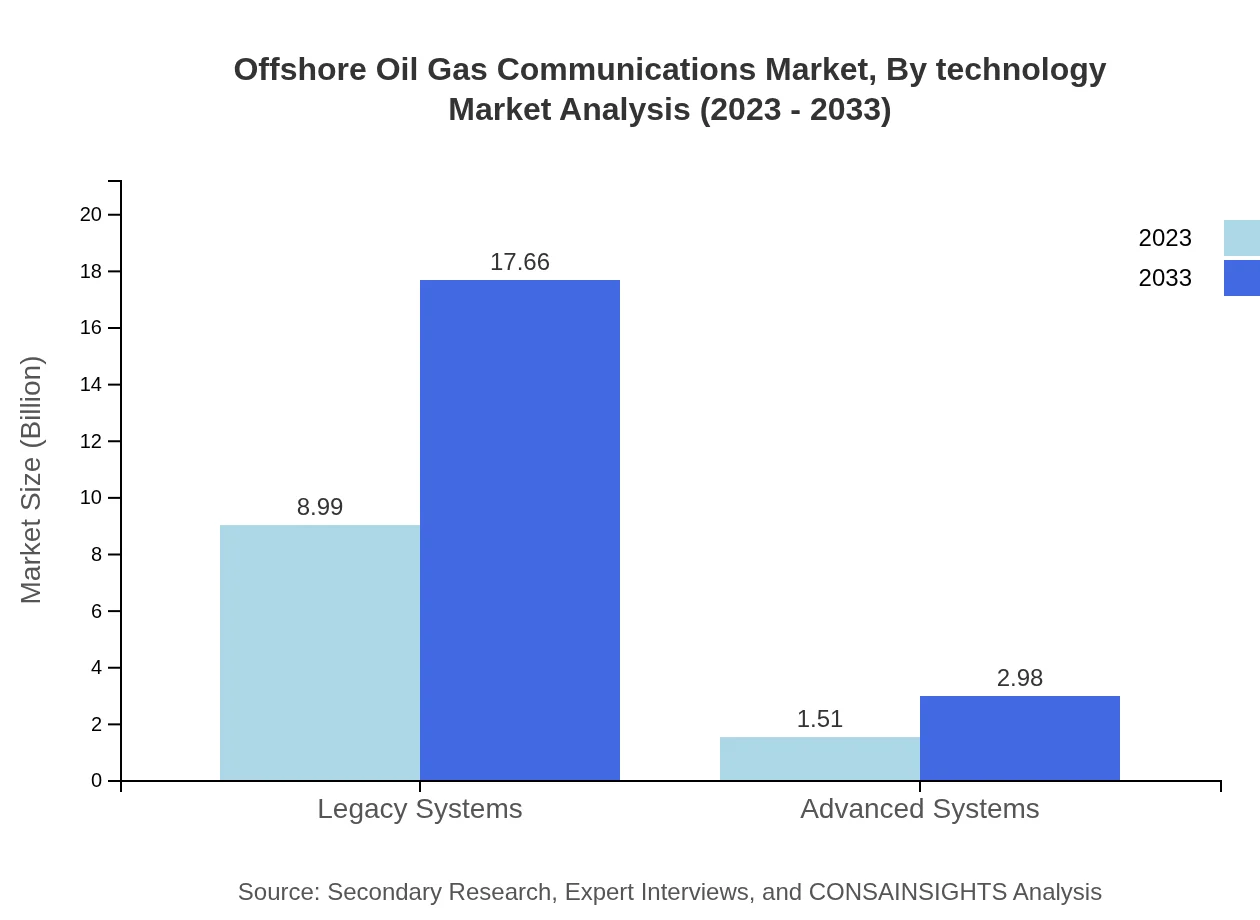

Offshore Oil Gas Communications Market Analysis By Technology

Legacy systems have historically comprised the largest segment, representing 85.58% of the market share in 2023, with a size of $8.99 billion projected to surge to $17.66 billion by 2033. Advanced systems, though smaller, are gaining traction, with a 14.42% share growing from $1.51 billion in 2023 to $2.98 billion by 2033.

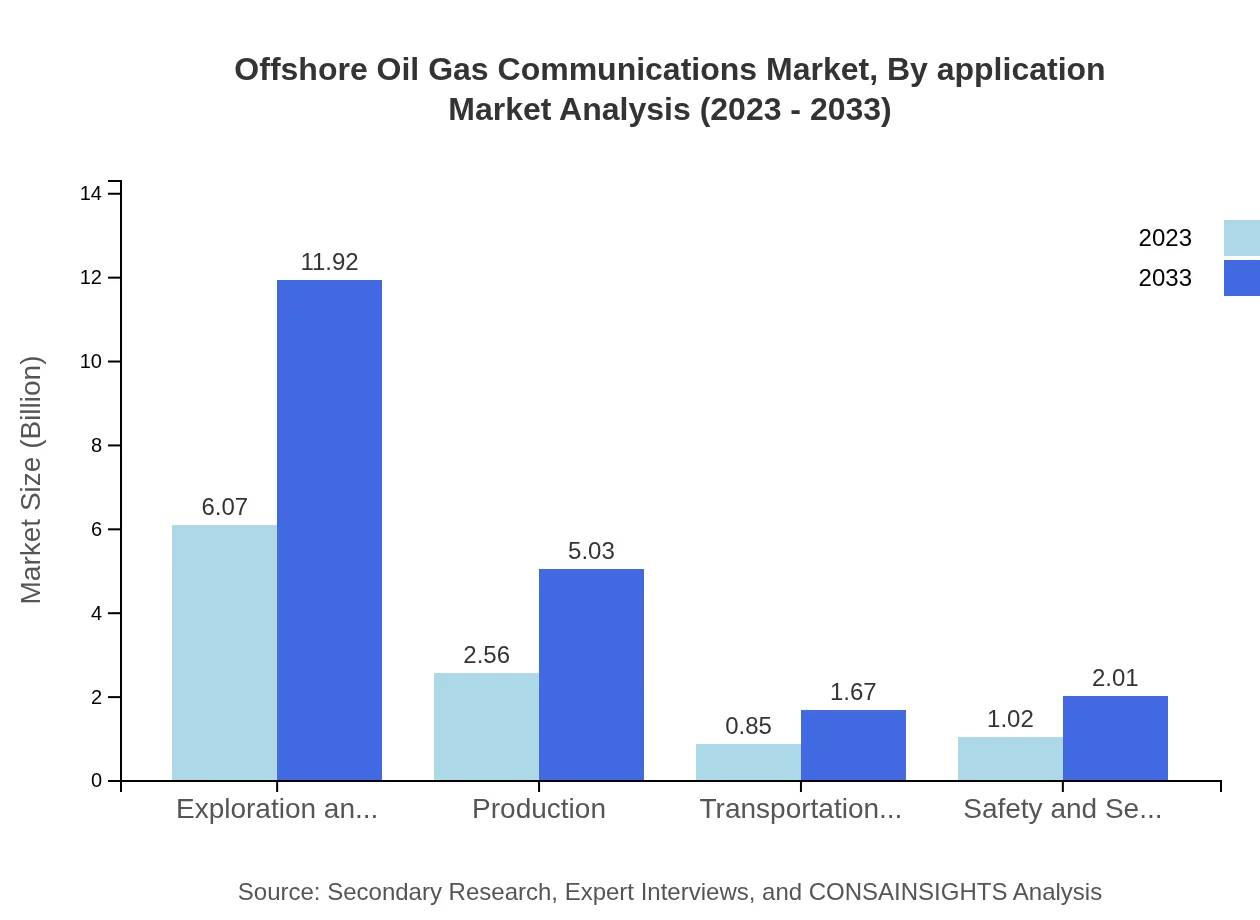

Offshore Oil Gas Communications Market Analysis By Application

Exploration and drilling accounts for a significant portion of the market, valued at $6.07 billion in 2023, projected to advance to $11.92 billion by 2033, holding a 57.77% market share. Production applications follow, expanding from $2.56 billion to $5.03 billion, attributed to the ongoing enhancements in communication reliability.

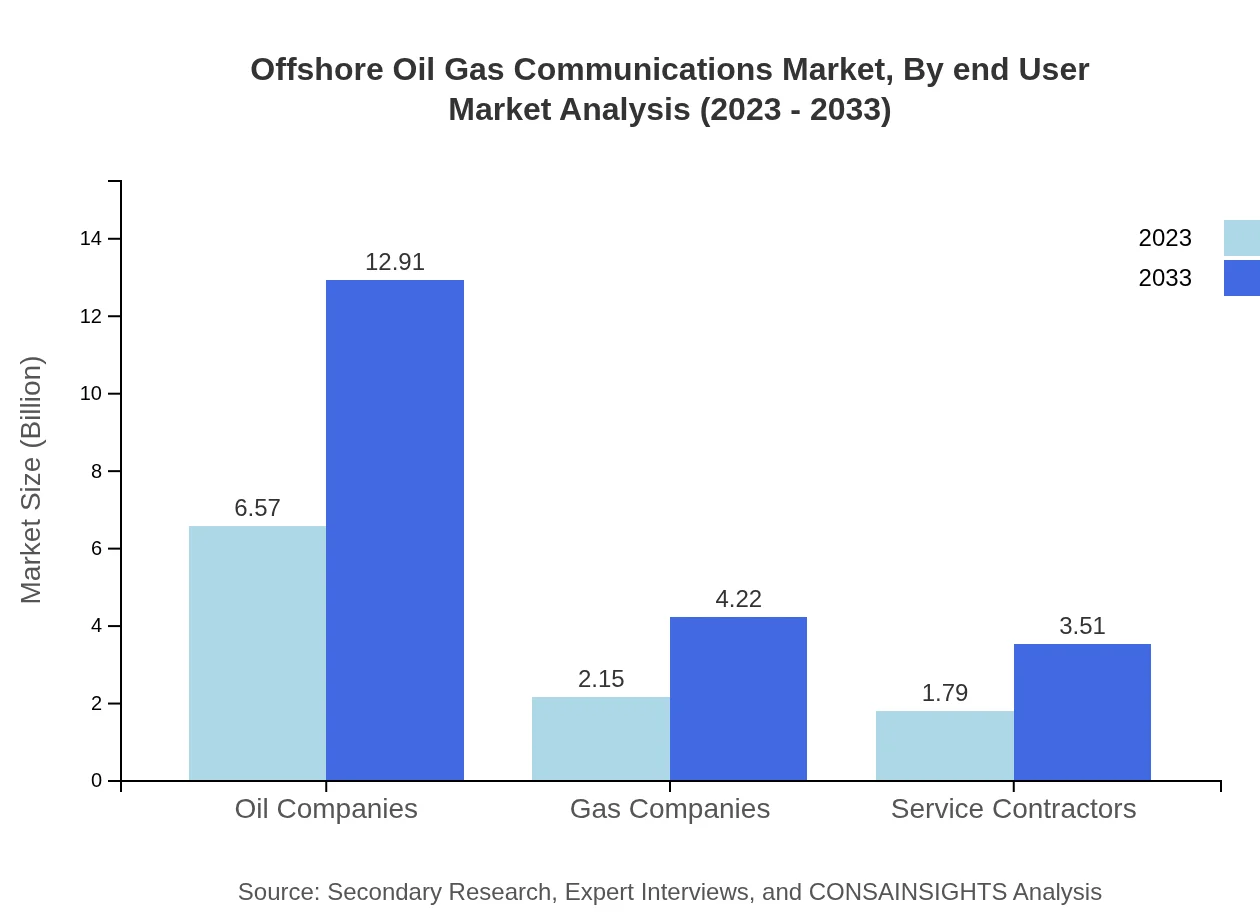

Offshore Oil Gas Communications Market Analysis By End User

Oil companies are the principal end-users, making up a $6.57 billion market in 2023, with projections of reaching $12.91 billion by 2033. Gas companies and service contractors also play vital roles, with sizes of $2.15 billion and $1.79 billion respectively, both expected to undergo substantial growth.

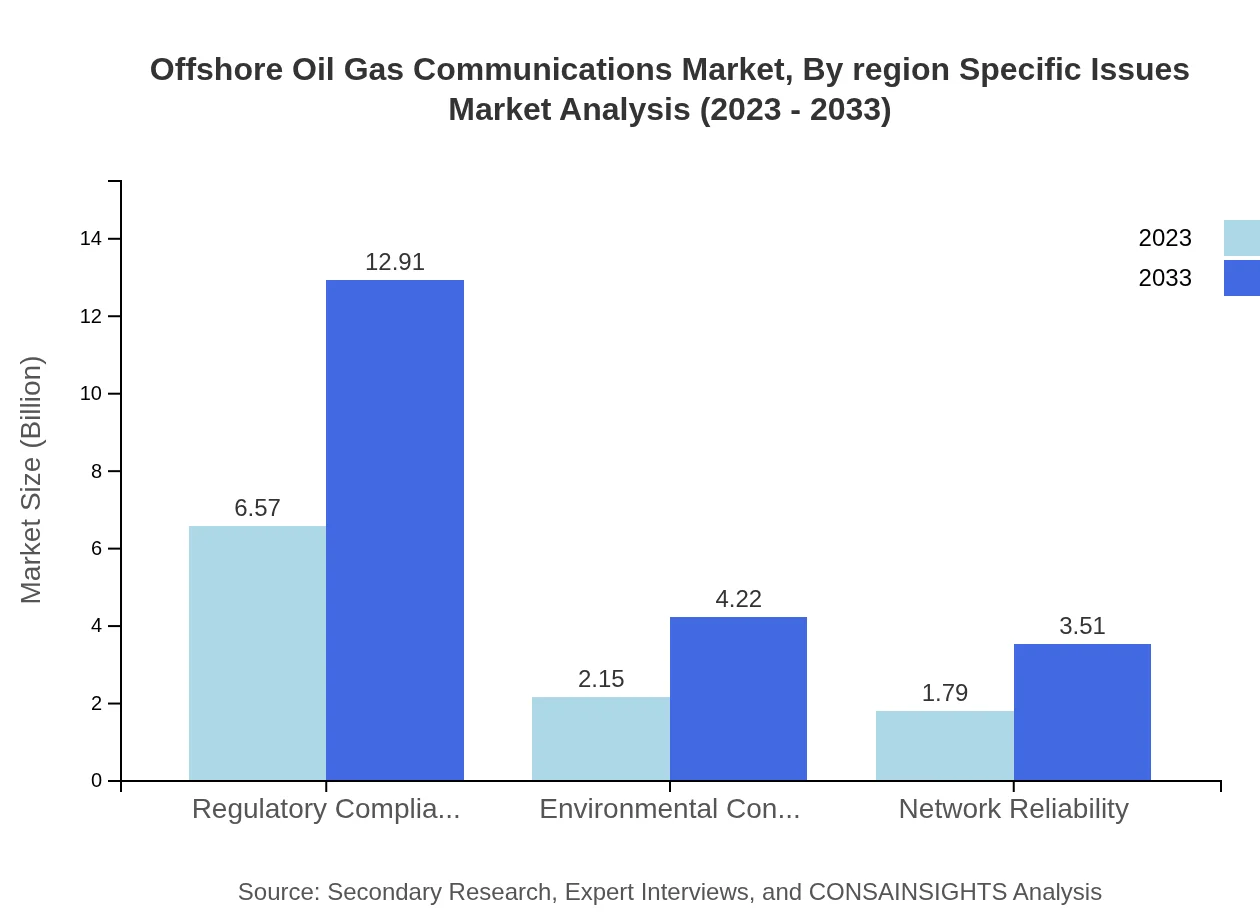

Offshore Oil Gas Communications Market Analysis By Region Specific Issues

Challenges such as regulatory compliance and environmental concerns are key market drivers. The regulatory compliance segment is poised to grow from $6.57 billion to $12.91 billion. Additionally, issues related to network reliability and safety/security are significant, with expected growth indicators from $1.02 billion to $2.01 billion and a 9.74% market share for safety/security.

Offshore Oil Gas Communications Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Offshore Oil Gas Communications Industry

Siemens AG:

Siemens AG is a leading global technology company that provides advanced solutions for automation and communication systems in the offshore oil and gas sectors, enhancing operational efficiency and safety.General Electric (GE):

General Electric is known for its innovative technologies in energy and communications, offering integrated systems for offshore operations that prioritize connectivity and real-time data exchange.Harris Corporation:

Harris Corporation specializes in communication systems and is a significant player in satellite and radio communications, providing crucial technologies for offshore applications.Honeywell International Inc.:

Honeywell International provides sophisticated communication solutions, focusing on safety and efficiency in offshore operations, aiding companies in navigating regulatory challenges.We're grateful to work with incredible clients.

FAQs

What is the market size of Offshore Oil Gas Communications?

The Offshore Oil Gas Communications market is currently valued at approximately $10.5 billion, with a projected CAGR of 6.8% between 2023 and 2033, indicating significant growth potential in the coming decade.

What are the key market players or companies in this Offshore Oil Gas Communications industry?

Key players in the Offshore Oil Gas Communications industry include major oil and gas companies, service contractors, satellite communications providers, and technology firms specializing in communications and data management solutions.

What are the primary factors driving the growth in the Offshore Oil Gas Communications industry?

Growth in offshore oil and gas communications is driven by increasing energy demand, technological advancements in communication systems, regulatory requirements, safety concerns, and the need for efficient data management and real-time decision-making.

Which region is the fastest Growing in Offshore Oil Gas Communications?

The fastest-growing region for Offshore Oil Gas Communications is North America, projected to grow from $3.46 billion in 2023 to $6.80 billion by 2033, followed closely by Europe and Asia Pacific, indicating robust development in offshore activities.

Does ConsaInsights provide customized market report data for the Offshore Oil Gas Communications industry?

Yes, ConsaInsights offers customized market reports tailored to client specifications, providing deep insights, data segmentation, and analysis according to various parameters relevant to the Offshore Oil Gas Communications industry.

What deliverables can I expect from this Offshore Oil Gas Communications market research project?

Deliverables typically include comprehensive market analysis reports, detailed data insights, trends, competitive landscape assessments, and forecasts, along with tailored recommendations to guide strategic decision-making.

What are the market trends of Offshore Oil Gas Communications?

Current market trends for Offshore Oil Gas Communications include a shift towards advanced communication technologies, increased focus on safety and regulatory compliance, growth in IoT applications, and an emphasis on network reliability and environmental solutions.