Offshore Wind Market Report

Published Date: 22 January 2026 | Report Code: offshore-wind

Offshore Wind Market Size, Share, Industry Trends and Forecast to 2033

This report offers in-depth insights into the Offshore Wind market, covering its current status, growth prospects until 2033, and regional analyses. Key aspects include market size, trends, innovations, and a thorough assessment of leading companies in the industry.

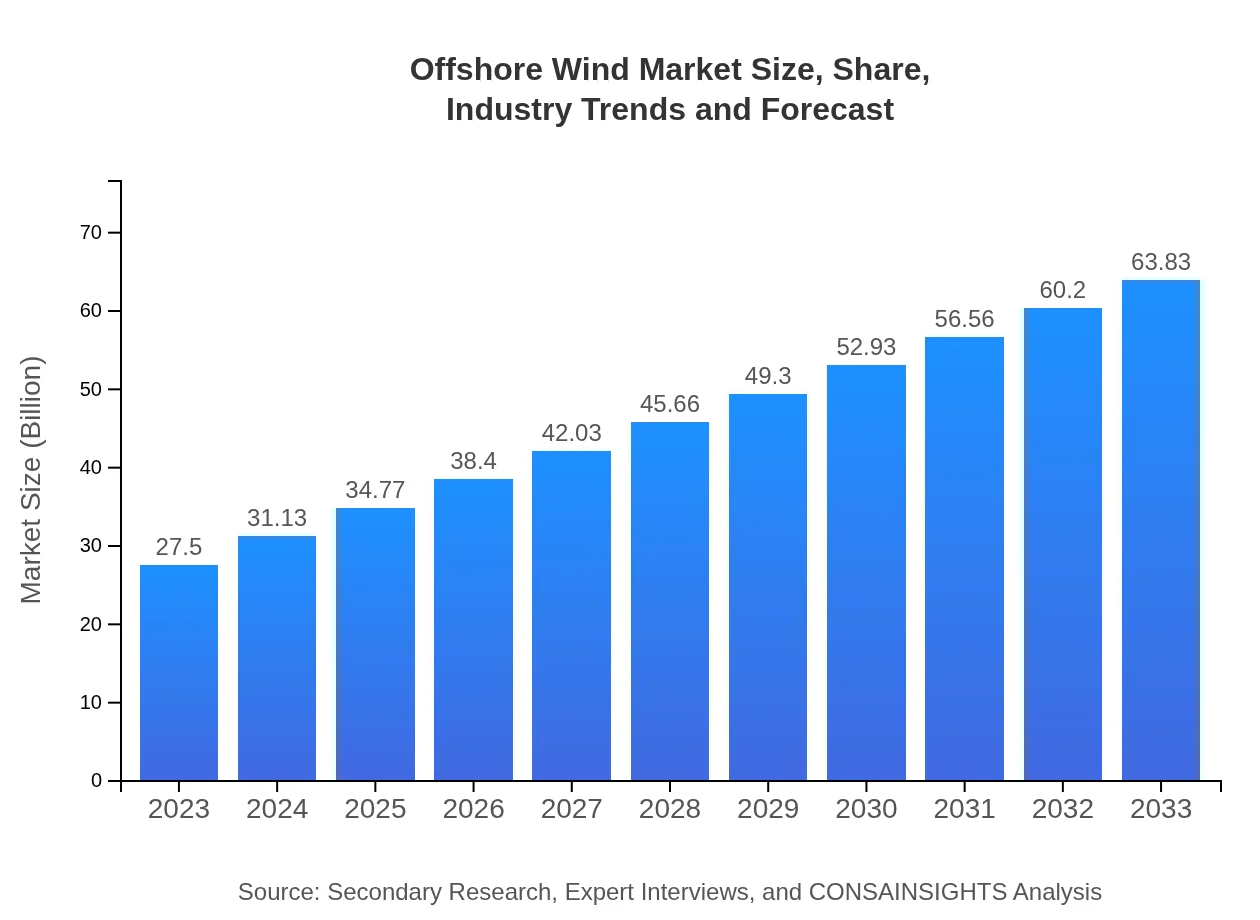

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $27.50 Billion |

| CAGR (2023-2033) | 8.5% |

| 2033 Market Size | $63.83 Billion |

| Top Companies | Siemens Gamesa, Vestas, GE Renewable Energy, Ørsted, MHI Vestas Offshore Wind |

| Last Modified Date | 22 January 2026 |

Offshore Wind Market Overview

Customize Offshore Wind Market Report market research report

- ✔ Get in-depth analysis of Offshore Wind market size, growth, and forecasts.

- ✔ Understand Offshore Wind's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Offshore Wind

What is the Market Size & CAGR of Offshore Wind market in 2023?

Offshore Wind Industry Analysis

Offshore Wind Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Offshore Wind Market Analysis Report by Region

Europe Offshore Wind Market Report:

Europe remains the dominant region in the Offshore Wind market, with expectations for the market size to increase from USD 8.18 billion in 2023 to USD 18.99 billion by 2033. Leading nations such as the UK, Germany, and Denmark are pioneering extensive offshore wind farms, reflecting a commitment to reducing carbon emissions.Asia Pacific Offshore Wind Market Report:

In the Asia Pacific region, the Offshore Wind market is set to experience robust growth, with market size expected to expand from USD 5.45 billion in 2023 to USD 12.64 billion by 2033. Countries like China and Japan are leading the charge, supported by ambitious renewable energy targets and substantial government investments.North America Offshore Wind Market Report:

North America showcases a favorable market environment for offshore wind energy, with a market size projected to grow from USD 9.62 billion in 2023 to USD 22.33 billion by 2033. The U.S. is significantly investing in offshore wind projects, driven by state mandates for clean energy and federal support.South America Offshore Wind Market Report:

South America is gradually recognizing the potential of offshore wind energy, with the market projected to grow from USD 1.16 billion in 2023 to USD 2.69 billion by 2033. Brazil is at the forefront of this development, encouraged by favorable wind conditions and policy reforms aimed at supporting renewable energy.Middle East & Africa Offshore Wind Market Report:

In the Middle East and Africa, the Offshore Wind market is projected to grow from USD 3.09 billion in 2023 to USD 7.17 billion by 2033. Countries like South Africa are exploring offshore wind potential as part of broader renewable energy initiatives to harness their unique wind resources.Tell us your focus area and get a customized research report.

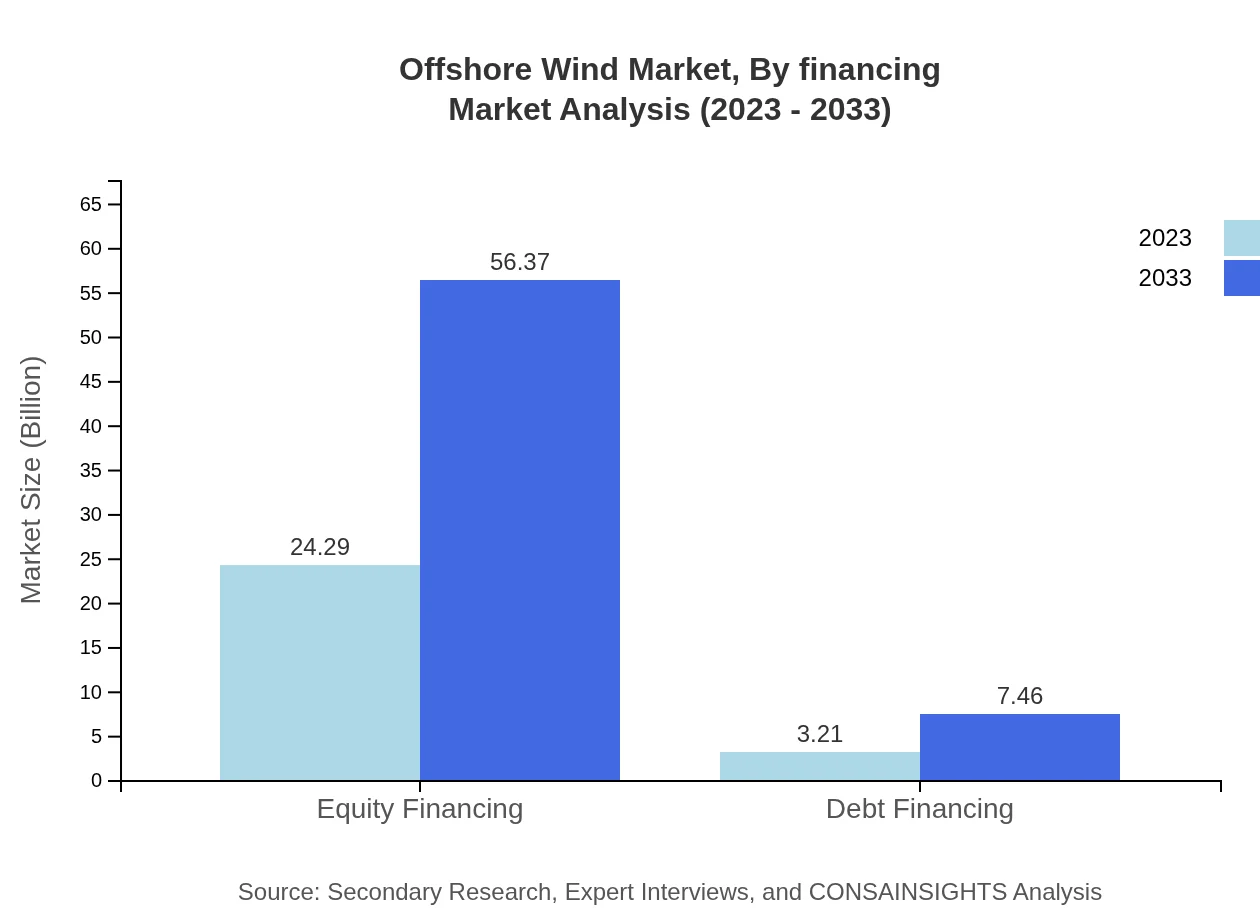

Offshore Wind Market Analysis By Financing

Equity financing is expected to grow significantly, rising from USD 24.29 billion in 2023 to USD 56.37 billion by 2033, representing a consistent share of 88.31%. Conversely, debt financing is projected to increase from USD 3.21 billion in 2023 to USD 7.46 billion, maintaining an 11.69% share throughout.

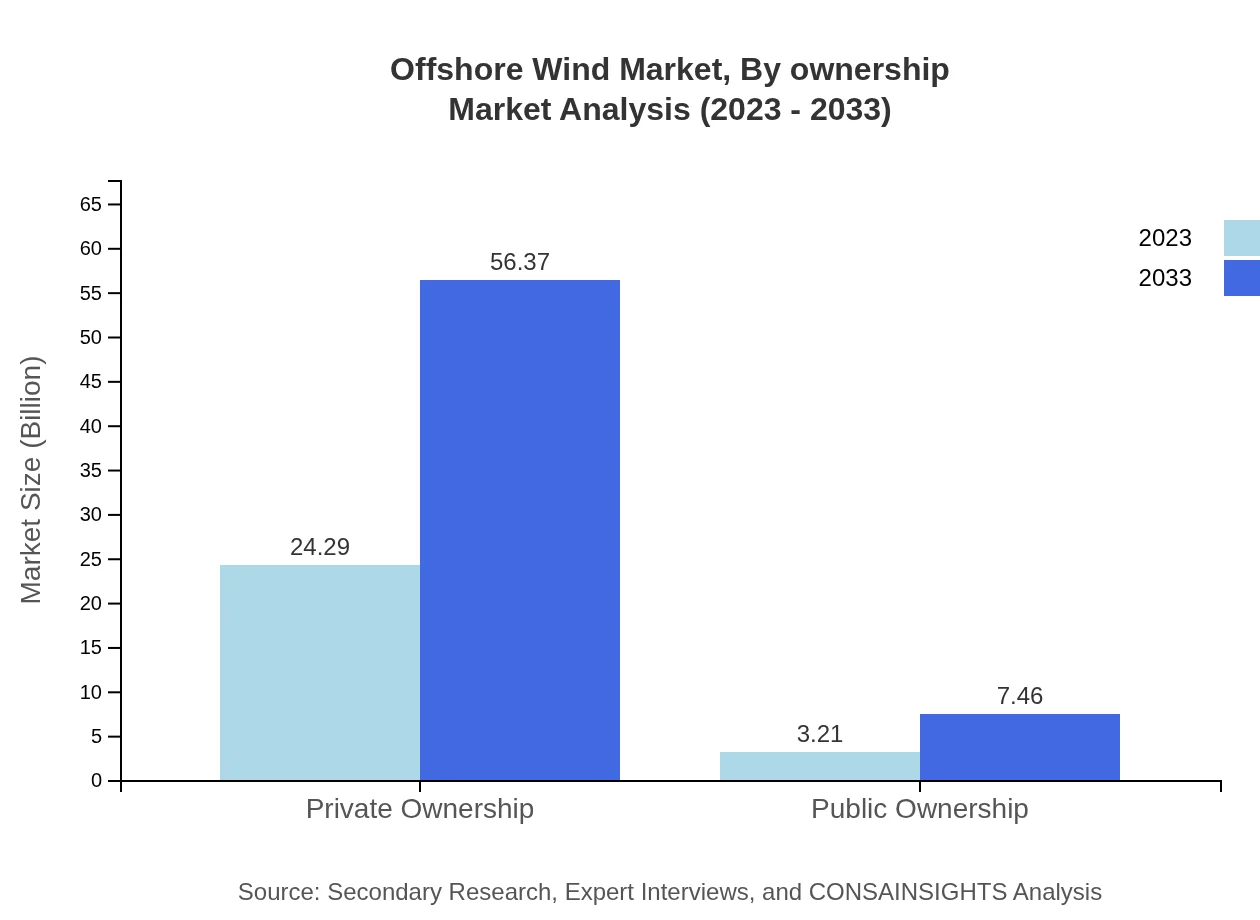

Offshore Wind Market Analysis By Ownership

Private ownership is a key segment, expected to reach USD 56.37 billion by 2033, rising from USD 24.29 billion in 2023, while public ownership will grow from USD 3.21 billion to USD 7.46 billion, remaining at an 11.69% share.

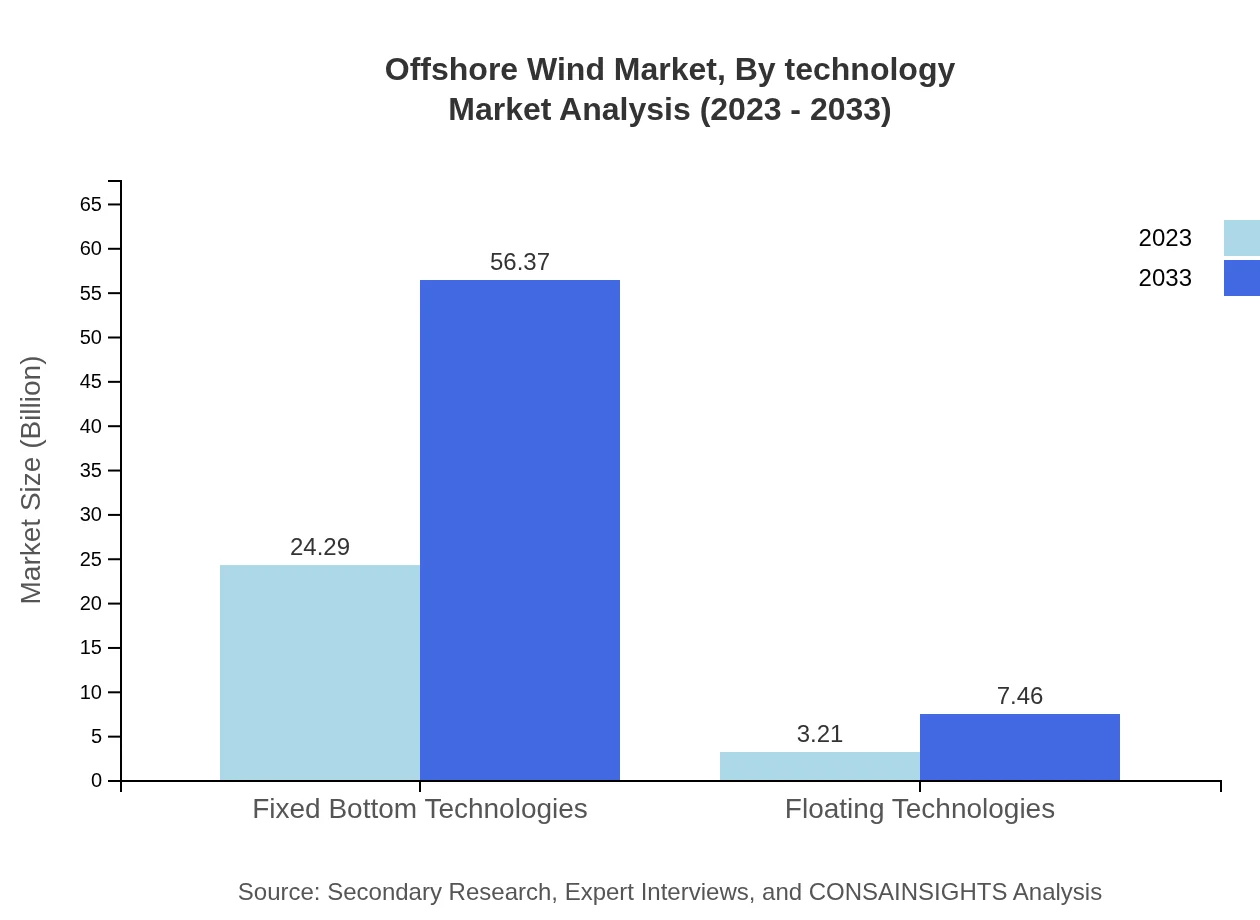

Offshore Wind Market Analysis By Technology

The Offshore Wind market, categorized by technology, shows significant profitability for fixed bottom technologies, projected to increase from USD 24.29 billion to USD 56.37 billion by 2033. Floating technologies, although still emerging, are expected to grow from USD 3.21 billion to USD 7.46 billion.

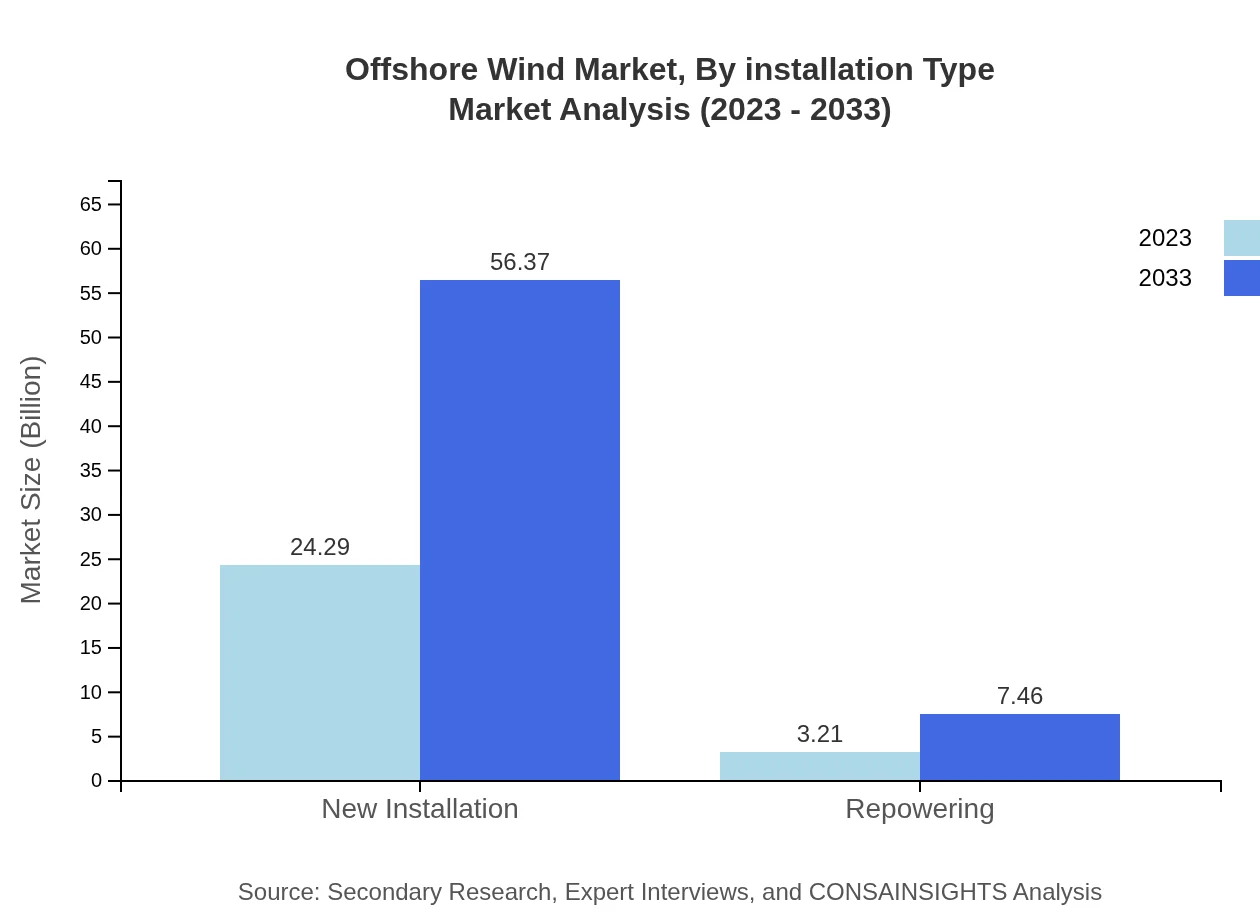

Offshore Wind Market Analysis By Installation Type

The market for new installations is projected to dominate, growing from USD 24.29 billion in 2023 to USD 56.37 billion by 2033. Repowering, although smaller, is expected to see growth from USD 3.21 billion to USD 7.46 billion over the same period.

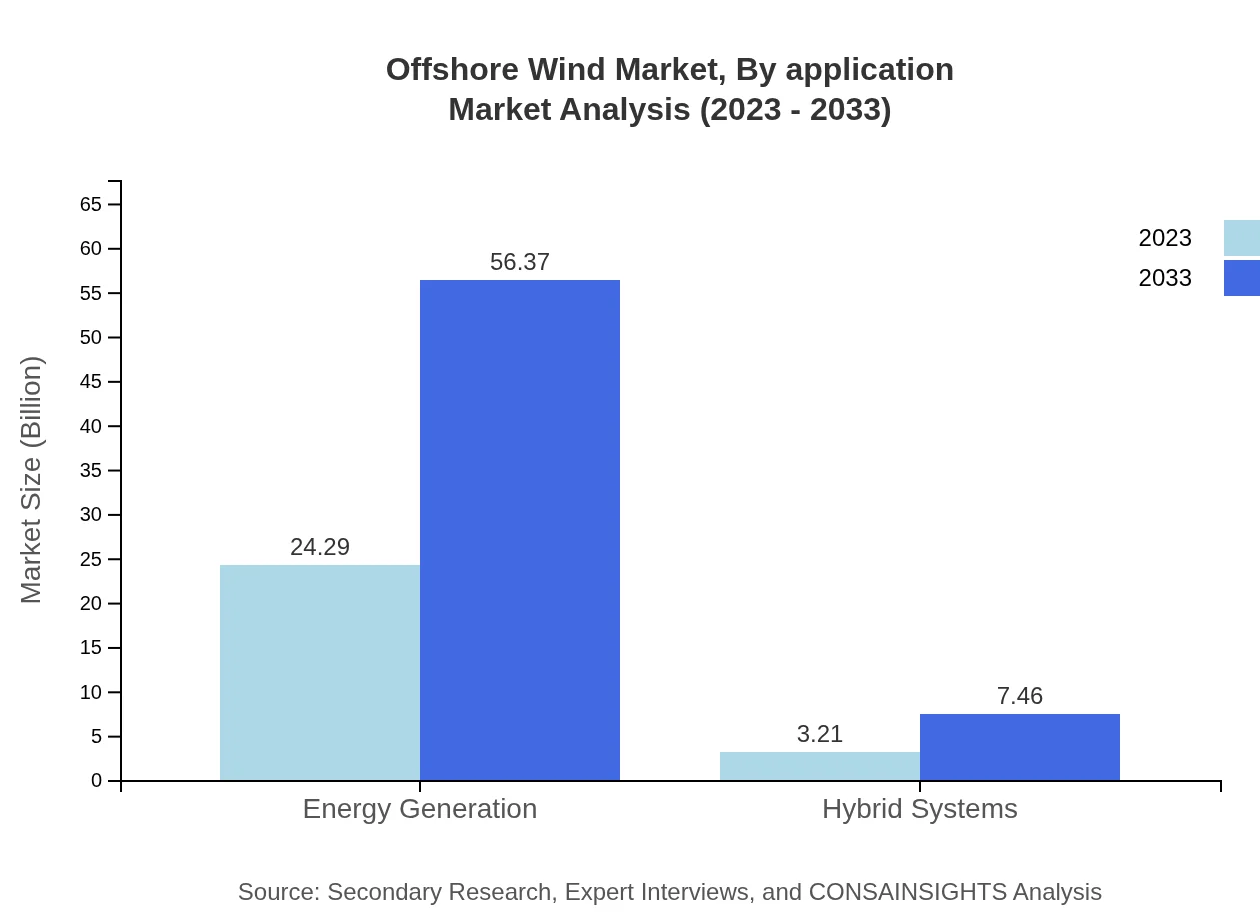

Offshore Wind Market Analysis By Application

Energy generation is poised to be the leading application segment, forecasted to increase significantly and sustain stable growth. Hybrid systems, albeit developing, are also anticipated to double in market size, indicating a diversification of applications in Offshore Wind energy.

Offshore Wind Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Offshore Wind Industry

Siemens Gamesa:

Siemens Gamesa is a leader in wind energy solutions, providing cutting-edge turbines and services for offshore projects, leveraging innovative technology to enhance energy production.Vestas:

Vestas is a global frontrunner in wind turbine manufacturing, renowned for advancing offshore wind technology, delivering substantial capacity, and supporting project development worldwide.GE Renewable Energy:

GE Renewable Energy is a major player in the offshore wind sector, specializing in large-scale wind turbine solutions and contributing significantly to reducing the levelized cost of energy.Ørsted:

Ørsted specializes in offshore wind farms and is recognized for its commitment to sustainability, operating numerous projects across Europe and North America.MHI Vestas Offshore Wind:

A joint venture between Mitsubishi Heavy Industries and Vestas, MHI Vestas focuses on the growing offshore wind segment, combining state-of-the-art technologies for project delivery.We're grateful to work with incredible clients.

FAQs

What is the market size of Offshore Wind?

The offshore wind market is projected to reach $27.5 billion by 2033, growing at a remarkable CAGR of 8.5%. This growth indicates a significant increase in the adoption and development of offshore wind energy globally.

What are the key market players or companies in the Offshore Wind industry?

Key players in the offshore wind industry include Siemens Gamesa, Vestas, GE Renewable Energy, and Orsted. These companies lead in technology development, installation, and operation of offshore wind farms, significantly shaping market dynamics.

What are the primary factors driving the growth in the Offshore Wind industry?

Growth in the offshore wind industry is driven by increasing demand for clean energy, governmental incentives, technological advancements, and growing awareness of climate change. These factors combine to enhance investment attractiveness and project viability.

Which region is the fastest Growing in the Offshore Wind market?

North America is recognized as the fastest-growing region in the offshore wind market, expected to rise from $9.62 billion in 2023 to $22.33 billion by 2033, fueled by increased installations and supportive policies.

Does ConsaInsights provide customized market report data for the Offshore Wind industry?

Yes, ConsaInsights offers customizable market report data tailored to specific needs in the offshore wind industry, allowing businesses to access detailed insights based on their unique requirements.

What deliverables can I expect from this Offshore Wind market research project?

Deliverables include a comprehensive market analysis report, data on market size and forecasts, competitive landscape insights, and segmented data relevant to offshore wind which supports strategic decision-making.

What are the market trends of Offshore Wind?

Current trends in the offshore wind market include increasing investments in floating technology, focus on hybrid systems, and a shift towards sustainable energy solutions, highlighting a broader commitment to renewable energy adoption.