Oil And Gas Automation Market Report

Published Date: 22 January 2026 | Report Code: oil-and-gas-automation

Oil And Gas Automation Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Oil And Gas Automation market, offering insights into market dynamics, major players, and growth forecasts from 2023 to 2033. It addresses key trends, technological advancements, and the challenges faced by the industry.

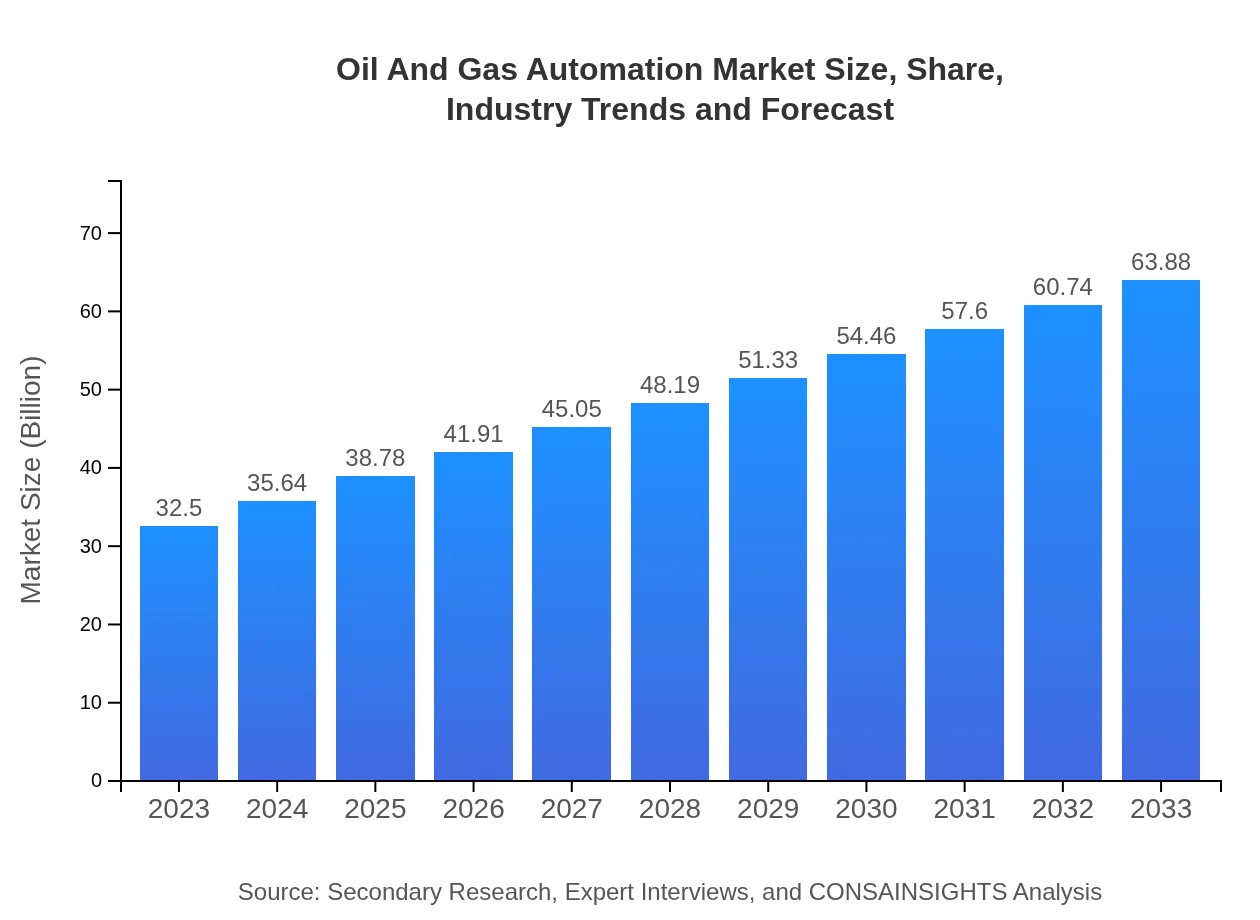

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $32.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $63.88 Billion |

| Top Companies | Siemens AG, Honeywell International Inc., Schneider Electric, Rockwell Automation, ABB Ltd. |

| Last Modified Date | 22 January 2026 |

Oil And Gas Automation Market Overview

Customize Oil And Gas Automation Market Report market research report

- ✔ Get in-depth analysis of Oil And Gas Automation market size, growth, and forecasts.

- ✔ Understand Oil And Gas Automation's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Oil And Gas Automation

What is the Market Size & CAGR of Oil And Gas Automation market in 2023?

Oil And Gas Automation Industry Analysis

Oil And Gas Automation Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Oil And Gas Automation Market Analysis Report by Region

Europe Oil And Gas Automation Market Report:

Europe's market is set to increase from USD 8.95 billion in 2023 to USD 17.59 billion in 2033, as countries within the region focus on transitioning towards cleaner energy practices while maintaining operational efficiency through automation.Asia Pacific Oil And Gas Automation Market Report:

In the Asia Pacific region, the Oil And Gas Automation market is expected to grow from USD 6.33 billion in 2023 to USD 12.44 billion in 2033. The growth is driven by increasing energy demands, rising investments in oil and gas infrastructure, and the push for operational efficiency.North America Oil And Gas Automation Market Report:

The North America Oil And Gas Automation market stands out as the largest, with a market size of USD 12.34 billion in 2023 expected to double to USD 24.25 billion by 2033. This is owing to the region's advanced technological landscape and established oil and gas industry.South America Oil And Gas Automation Market Report:

South America's Oil And Gas Automation market is emerging, with a market size projected to rise from USD 1.73 billion in 2023 to USD 3.40 billion by 2033. The region's focus on developing its oil reserves and reducing operational costs is driving market growth.Middle East & Africa Oil And Gas Automation Market Report:

In the Middle East and Africa, the Oil And Gas Automation market is anticipated to grow from USD 3.15 billion in 2023 to USD 6.19 billion in 2033, primarily driven by regional investments in oil exploration and production.Tell us your focus area and get a customized research report.

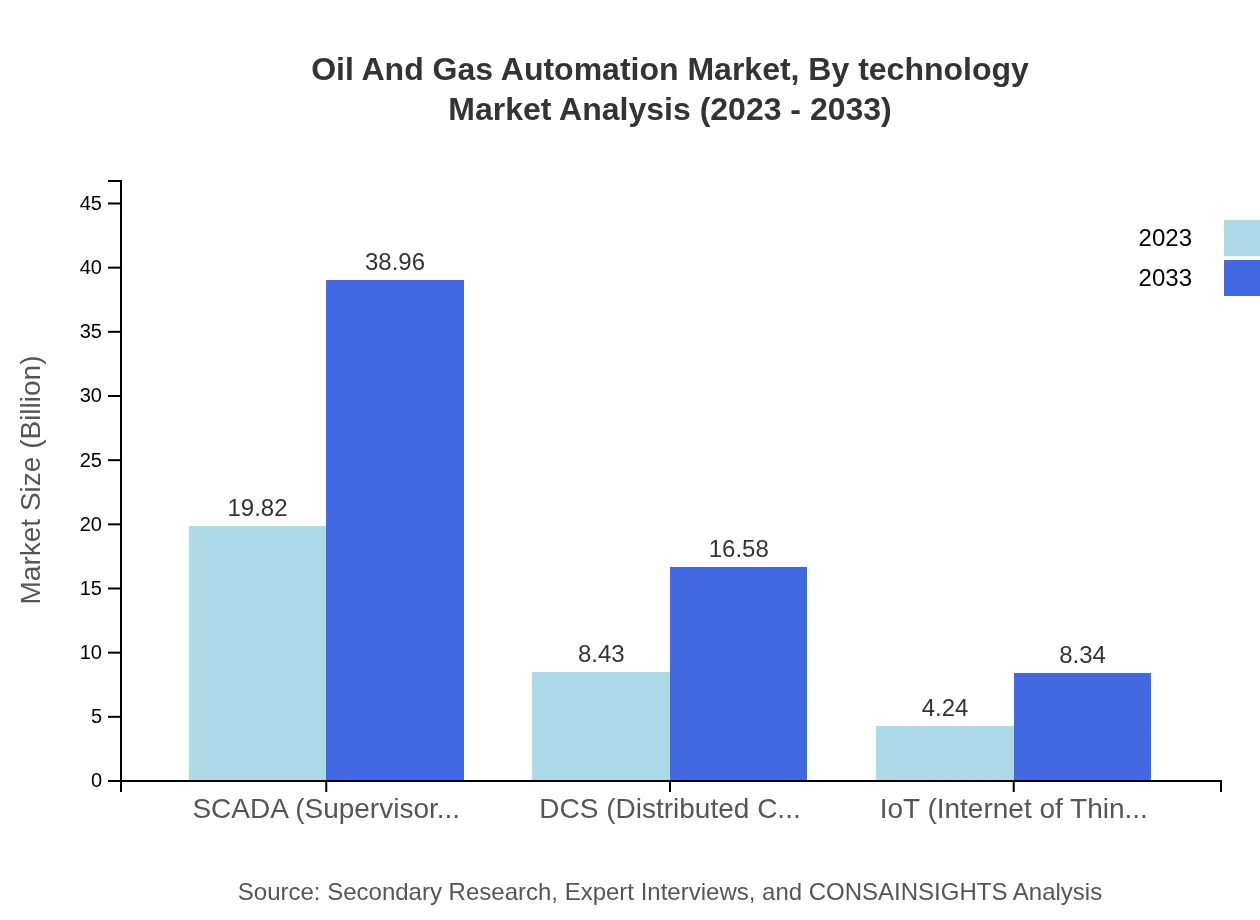

Oil And Gas Automation Market Analysis By Technology

The technology segment in Oil and Gas Automation includes Automation Solutions, Control Systems, Safety Systems, SCADA, DCS, and IoT. Automation Solutions dominate with a market of USD 19.82 billion in 2023, expected to increase to USD 38.96 billion by 2033. Control Systems also demonstrate strong growth, supported by advancements in DCS and SCADA technologies.

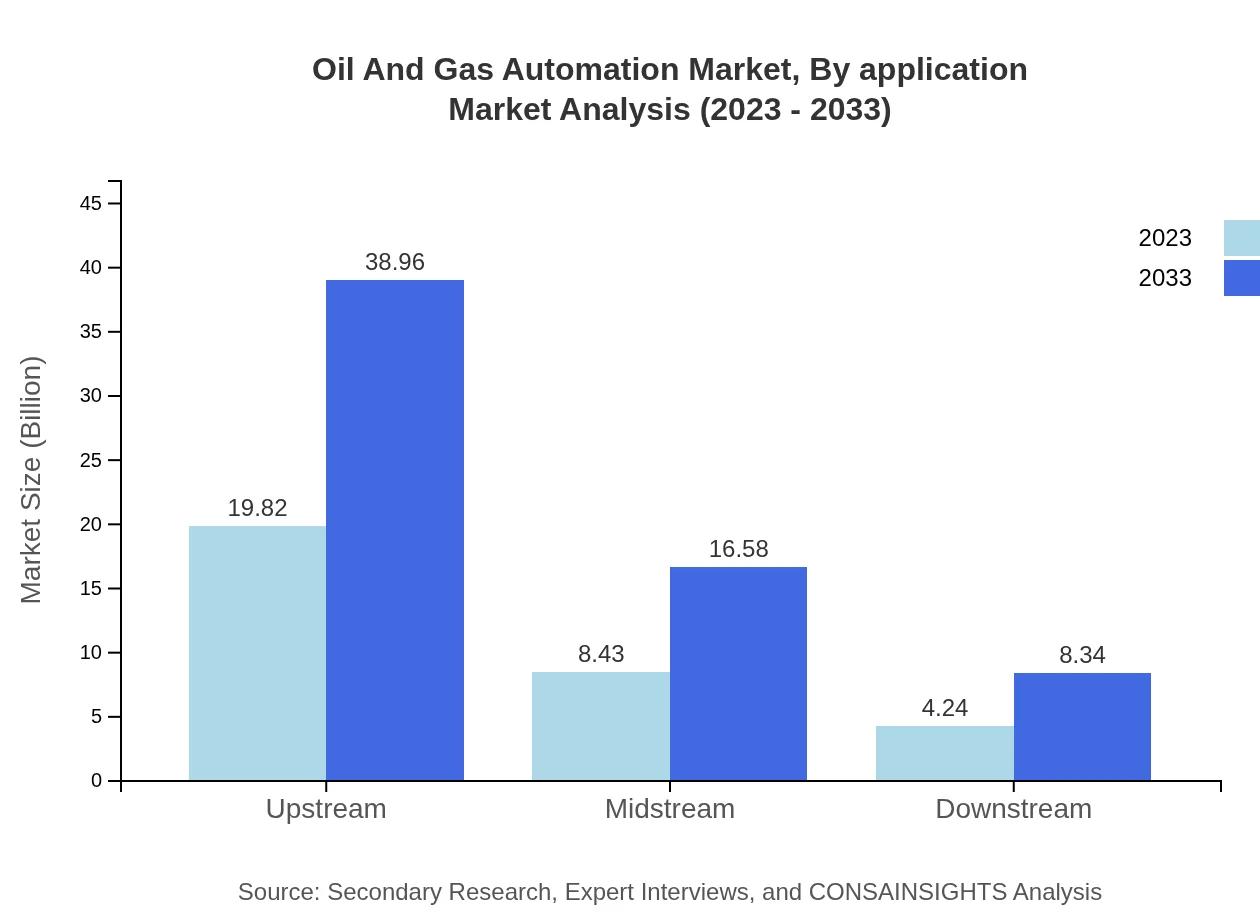

Oil And Gas Automation Market Analysis By Application

Key applications in the Oil and Gas Automation market include upstream, midstream, and downstream. The upstream sector has the highest share, emphasizing the critical need for automation in exploration and production processes, while downstream operations focus on refining and distribution.

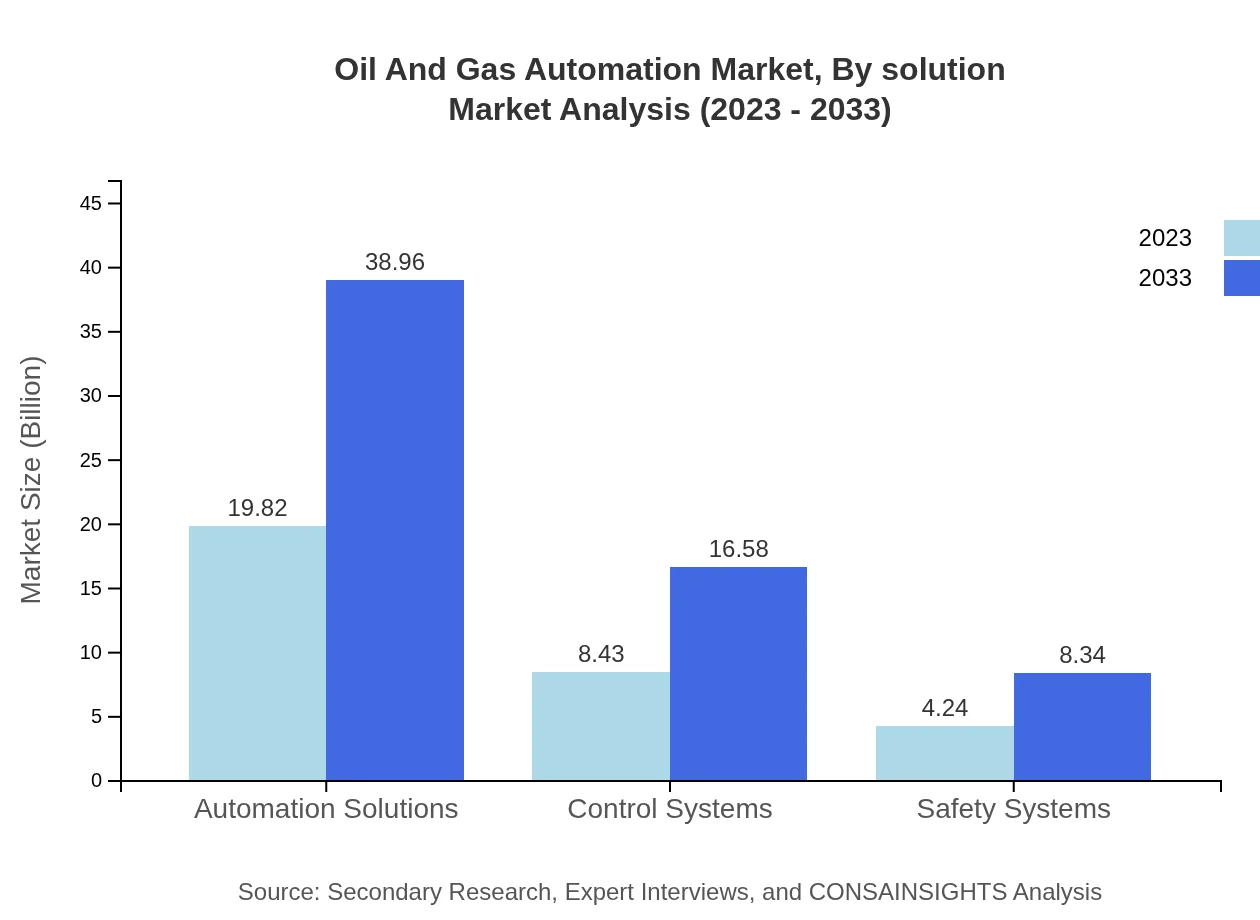

Oil And Gas Automation Market Analysis By Solution

Solutions within the Oil and Gas Automation market encompass not only traditional automation tools but also innovative technologies that enable better data utilization, predictive maintenance, and enhanced operational visibility.

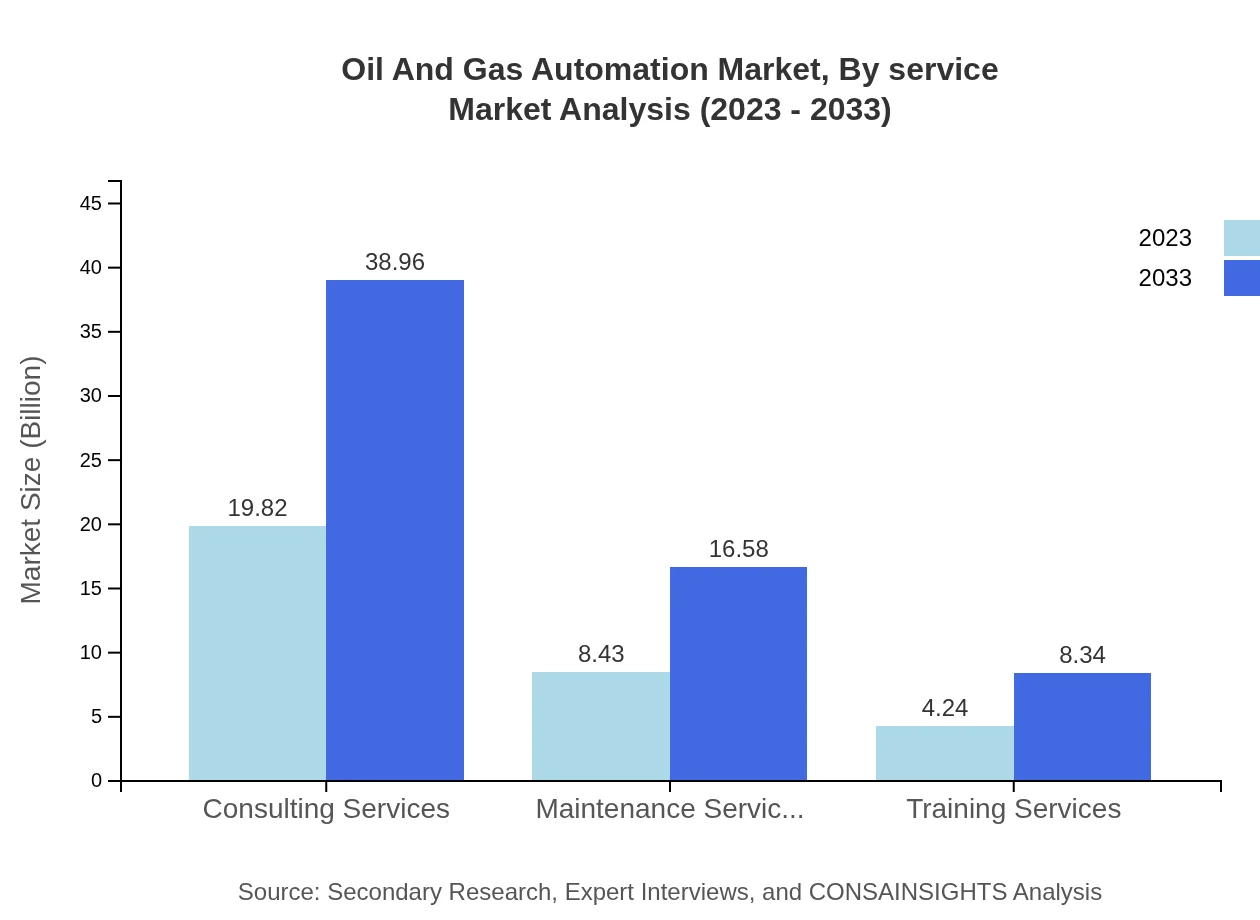

Oil And Gas Automation Market Analysis By Service

Service segments include Consulting Services, Maintenance Services, Training Services, and others. Consulting Services are expected to grow significantly from USD 19.82 billion in 2023 to USD 38.96 billion in 2033, highlighting the need for expertise in implementing automation solutions.

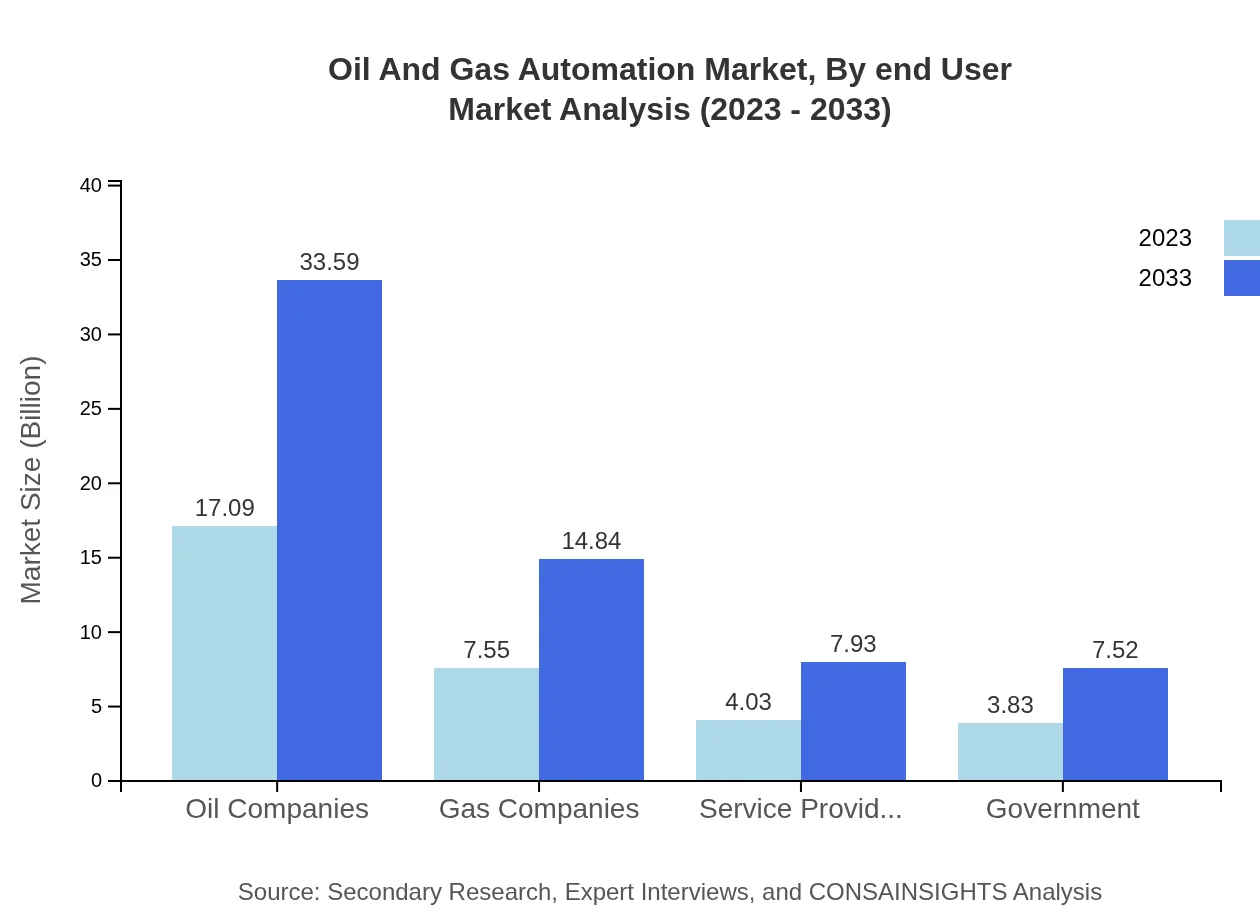

Oil And Gas Automation Market Analysis By End User

The end-user landscape features Oil Companies, Gas Companies, Service Providers, and Government sectors, each contributing to the growing demand for automation solutions vital for operational efficiencies and compliance.

Oil And Gas Automation Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Oil And Gas Automation Industry

Siemens AG:

Siemens AG is a global leader in automation solutions, providing innovative technology to optimize energy production and operations within the oil and gas sector.Honeywell International Inc.:

Honeywell is renowned for its automation technologies, focusing on process control and instrumentation, driving significant advancements in operational efficiency.Schneider Electric:

Schneider Electric offers a wide range of energy management and automation solutions that enhance efficiency from extraction to delivery in the energy sector.Rockwell Automation:

Rockwell Automation is a significant player in industrial automation, committed to creating connected, reliable solutions for the oil and gas industries.ABB Ltd.:

ABB is a leader in power and automation technologies, delivering value across the oil and gas sector with its comprehensive suite of automation solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of oil And Gas Automation?

The oil-and-gas-automation market is valued at approximately $32.5 billion in 2023, with a projected CAGR of 6.8% over the next decade, indicating substantial growth driven by increasing automation needs within the industry.

What are the key market players or companies in the oil And Gas Automation industry?

Key players in the oil-and-gas-automation market include major companies such as Schlumberger, Halliburton, Honeywell, and Siemens, each contributing to innovative automation solutions to enhance operational efficiency and safety within the sector.

What are the primary factors driving the growth in the oil And Gas Automation industry?

Growth in the oil-and-gas-automation industry is primarily driven by technological advancements, the need for operational efficiency, regulatory compliance, and the necessity for enhanced safety measures in hazardous environments.

Which region is the fastest Growing in the oil And Gas Automation?

North America is currently the fastest-growing region in the oil-and-gas-automation market, with a market size increasing from $12.34 billion in 2023 to $24.25 billion by 2033, driven by high demand for automation technologies.

Does ConsaInsights provide customized market report data for the oil And Gas Automation industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the oil-and-gas-automation industry, ensuring that businesses receive relevant insights for strategic planning and decision-making.

What deliverables can I expect from this oil And Gas Automation market research project?

Deliverables from the oil-and-gas-automation market research project typically include detailed market analysis reports, segment data, competitive landscape assessments, and forecasts on market trends and growth opportunities.

What are the market trends of oil And Gas Automation?

Current market trends in oil-and-gas-automation include increased adoption of IoT technologies, a shift towards digital twin solutions, enhanced safety protocols, and a growing focus on smart infrastructure to optimize resource management.