Oil And Gas Cloud Applications Market Report

Published Date: 31 January 2026 | Report Code: oil-and-gas-cloud-applications

Oil And Gas Cloud Applications Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Oil and Gas Cloud Applications market covering critical insights and data forecasts from 2023 to 2033, focusing on market size, trends, segmentation, and regional dynamics.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

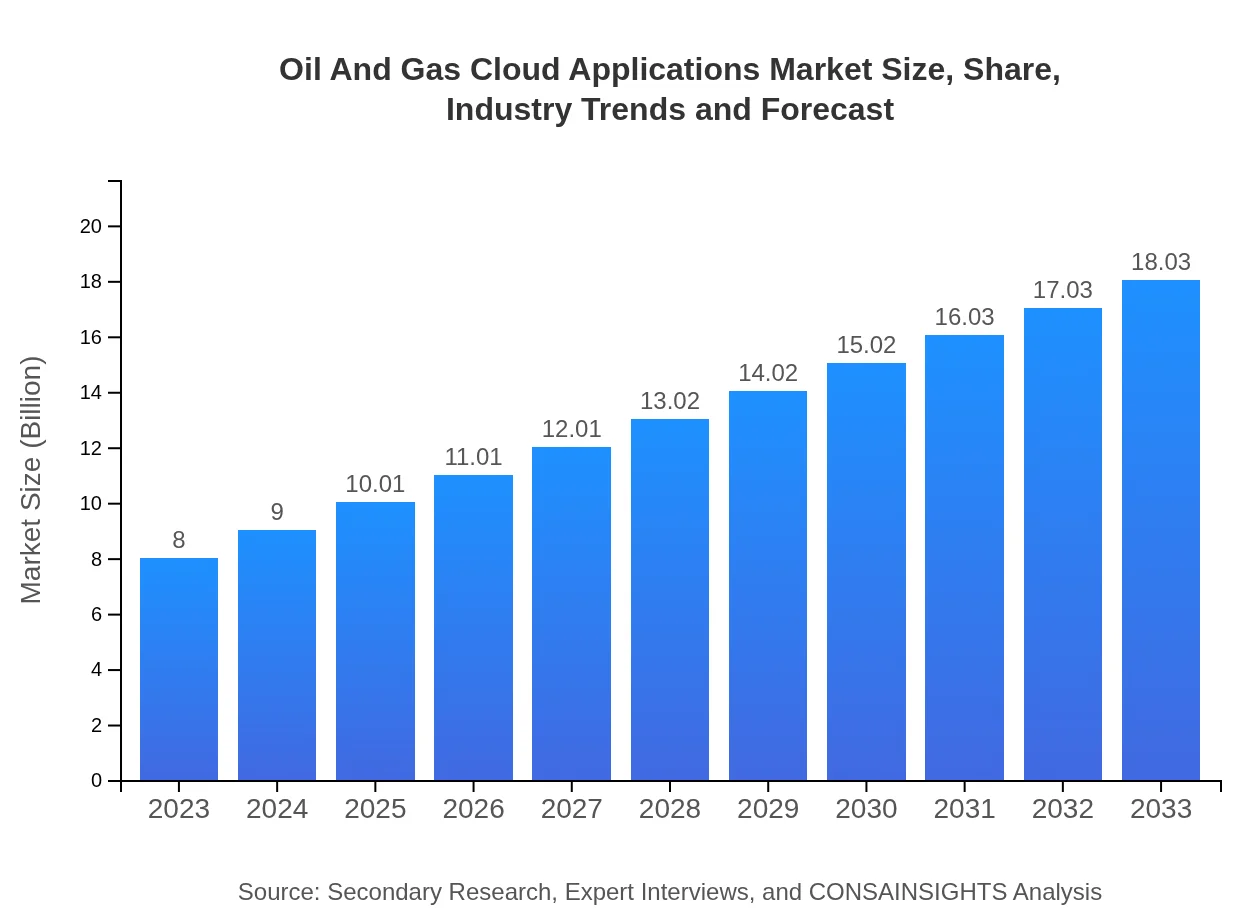

| 2023 Market Size | $8.00 Billion |

| CAGR (2023-2033) | 8.2% |

| 2033 Market Size | $18.03 Billion |

| Top Companies | Microsoft Corporation, IBM Corporation, SAP SE, Oracle Corporation |

| Last Modified Date | 31 January 2026 |

Oil And Gas Cloud Applications Market Overview

Customize Oil And Gas Cloud Applications Market Report market research report

- ✔ Get in-depth analysis of Oil And Gas Cloud Applications market size, growth, and forecasts.

- ✔ Understand Oil And Gas Cloud Applications's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Oil And Gas Cloud Applications

What is the Market Size & CAGR of Oil And Gas Cloud Applications market in 2023?

Oil And Gas Cloud Applications Industry Analysis

Oil And Gas Cloud Applications Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Oil And Gas Cloud Applications Market Analysis Report by Region

Europe Oil And Gas Cloud Applications Market Report:

Europe's Oil And Gas Cloud Applications market is expected to expand from $2.06 billion in 2023 to $4.64 billion in 2033, driven by initiatives aimed at energy transition and stringent environmental regulations fostering technological adoption.Asia Pacific Oil And Gas Cloud Applications Market Report:

In the Asia Pacific region, the Oil And Gas Cloud Applications market is expected to grow from $1.62 billion in 2023 to $3.65 billion in 2033. Rapid industrialization, increasing energy demands, and growing investments in digital technologies are primary growth drivers in this region.North America Oil And Gas Cloud Applications Market Report:

North America leads the Oil And Gas Cloud Applications market with a size of $2.77 billion in 2023, projected to reach $6.25 billion by 2033. The region's robust infrastructure, significant oil production levels, and early adoption of cloud technologies are critical influences.South America Oil And Gas Cloud Applications Market Report:

The South American market for Oil And Gas Cloud Applications is projected to grow from $0.43 billion in 2023 to $0.97 billion by 2033. Factors such as rising exploration activities and the need for efficiency in operations contribute to this growth.Middle East & Africa Oil And Gas Cloud Applications Market Report:

In the Middle East and Africa, the market is growing from $1.12 billion in 2023 to $2.52 billion by 2033. The region's ongoing investments in oil production modernization and digital transformation initiatives are propelling market growth.Tell us your focus area and get a customized research report.

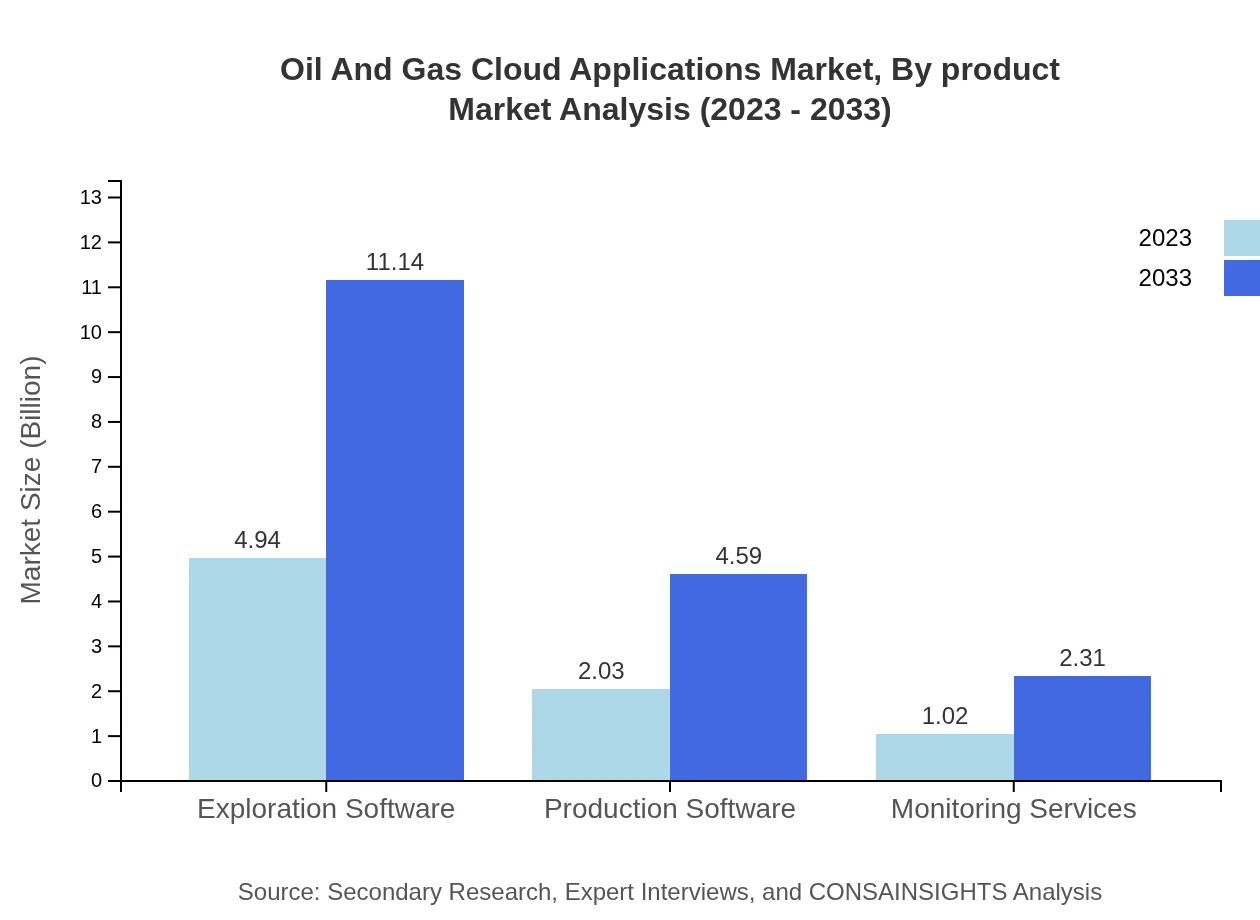

Oil And Gas Cloud Applications Market Analysis By Product

The Oil and Gas Cloud Applications market, segmented by product, includes Exploration Software, Production Software, and Monitoring Services. By 2033, Exploration Software is expected to dominate with a market size of $11.14 billion, demonstrating significant growth from $4.94 billion in 2023. Production Software and Monitoring Services will also see major growth, expanding from $2.03 billion to $4.59 billion, and $1.02 billion to $2.31 billion, respectively.

Oil And Gas Cloud Applications Market Analysis By Application

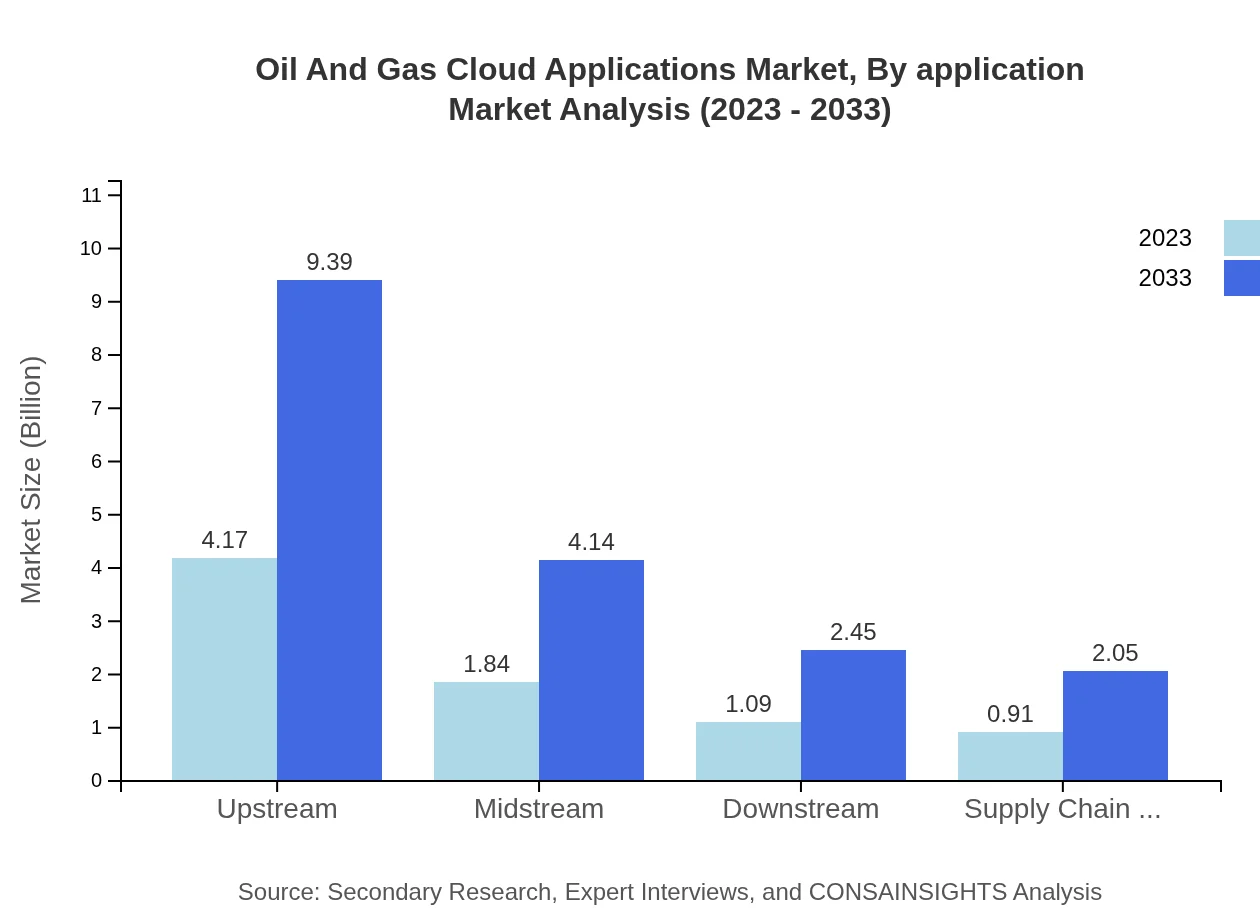

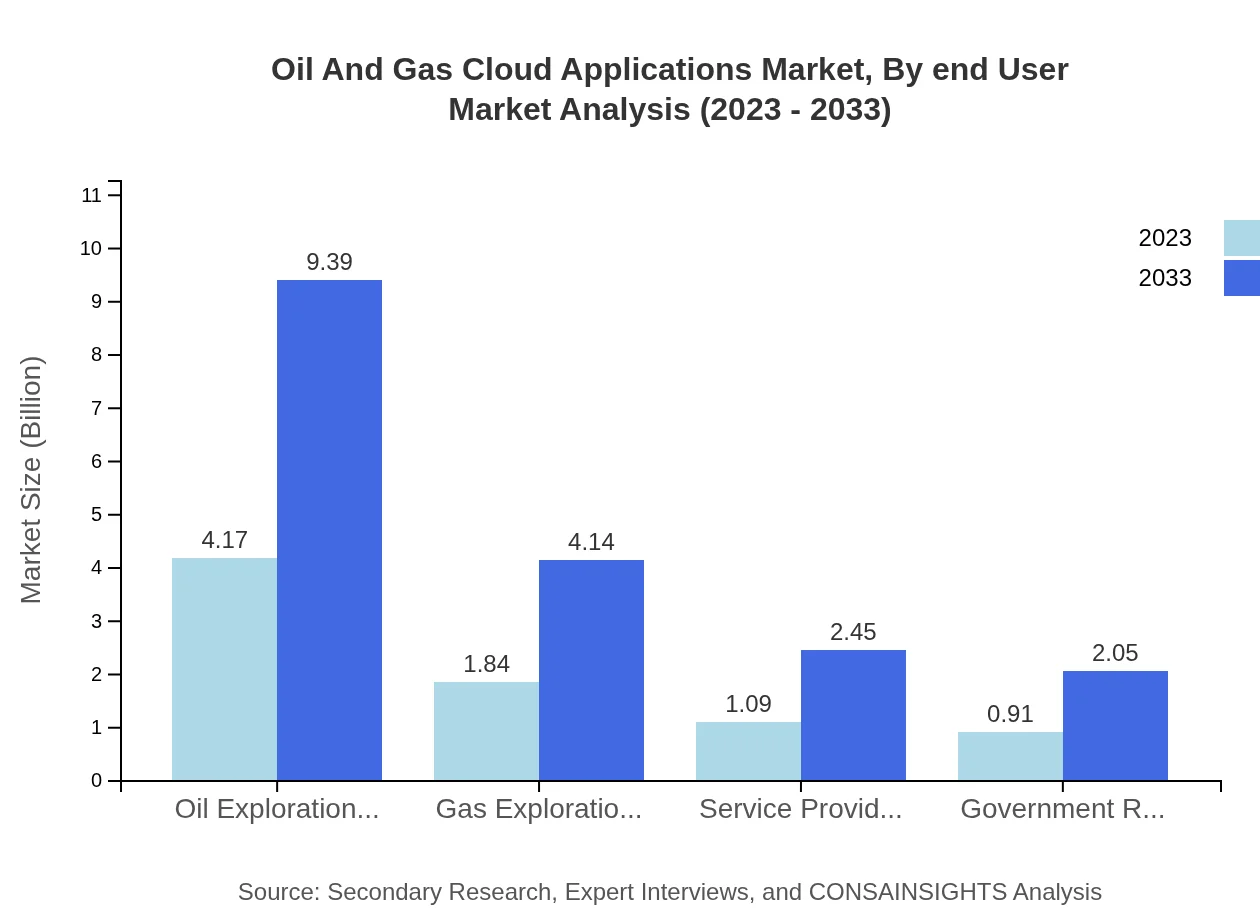

The application segment includes Oil Exploration, Gas Exploration, and various support services. Oil Exploration companies will dominate with a market share of 52.07% and a size of $4.17 billion in 2023, increasing to $9.39 billion by 2033. Gas Exploration companies, holding 22.96% market share, are expected to achieve extensive growth alongside other application sectors.

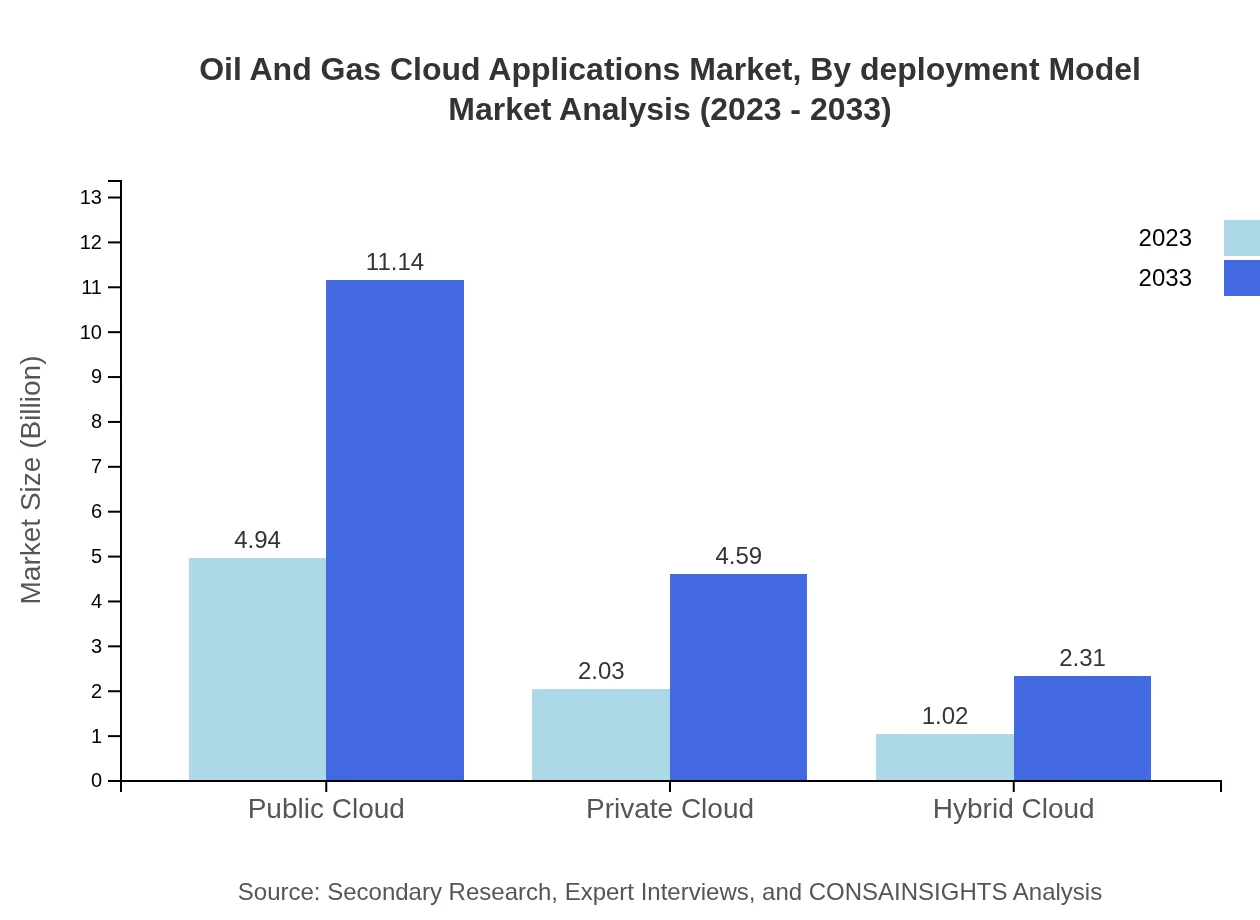

Oil And Gas Cloud Applications Market Analysis By Deployment Model

The market is divided into Public, Private, and Hybrid Cloud deployment models. The Public Cloud segment leads with a size of $4.94 billion in 2023, projected to grow to $11.14 billion by 2033. The Private Cloud segment is also significant, forecasted to rise from $2.03 billion to $4.59 billion in the same period.

Oil And Gas Cloud Applications Market Analysis By End User

The Oil and Gas Cloud Applications are segmented by end-user industries such as Upstream, Midstream, and Downstream. The Upstream sector is projected to maintain the highest share at 52.07%, growing from $4.17 billion to $9.39 billion over the decade. Midstream and Downstream applications will also experience robust growth, supporting logistical operations and refining processes.

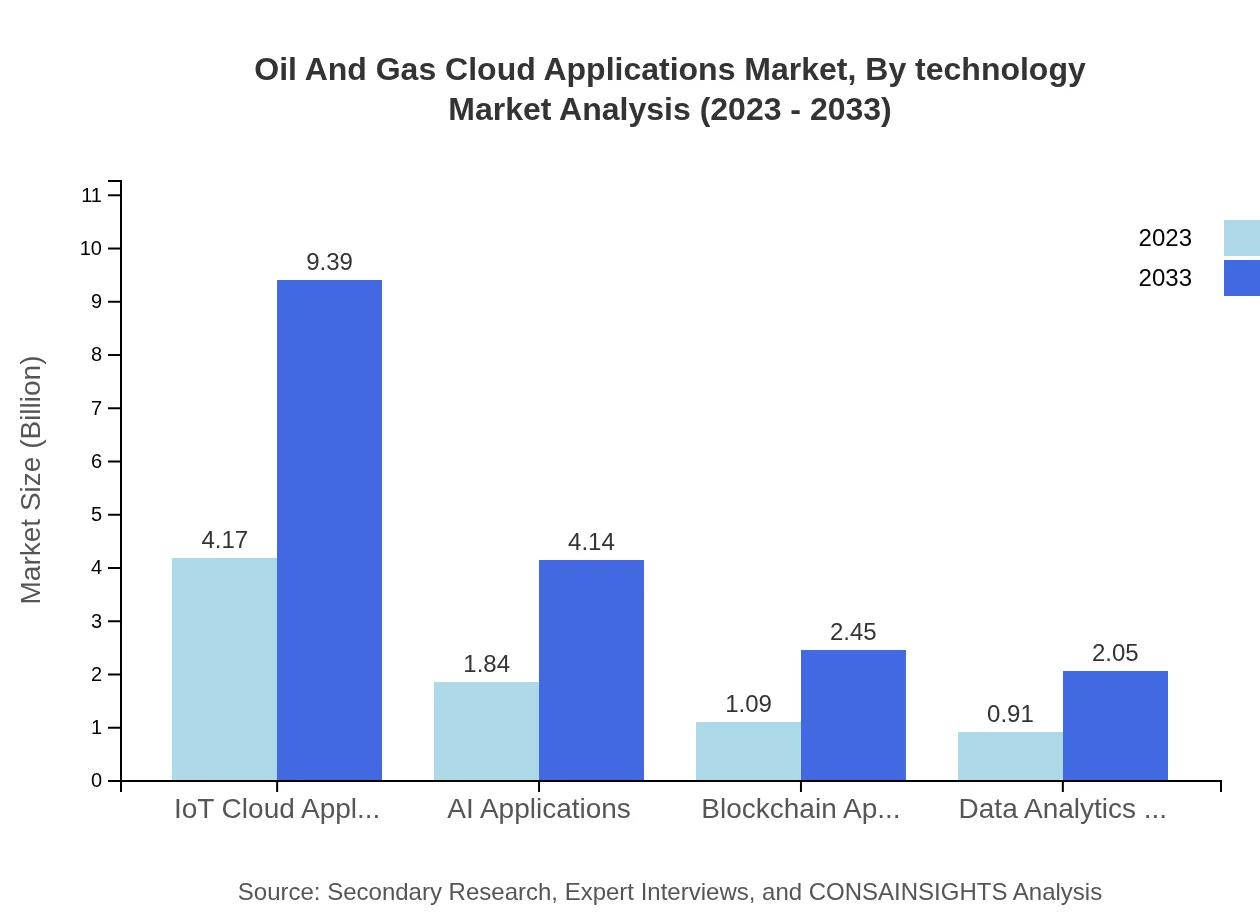

Oil And Gas Cloud Applications Market Analysis By Technology

This segment explores advancements such as IoT, AI, Blockchain, and Data Analytics Applications. These technologies are pivotal, expected to see substantial growth rates across various applications, enhancing real-time data processing, operational efficiency, and compliance management.

Oil And Gas Cloud Applications Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Oil And Gas Cloud Applications Industry

Microsoft Corporation:

A leader in cloud technologies with its Azure platform, providing customized solutions for oil and gas operations, enhancing data management and analytics.IBM Corporation:

Offers advanced cloud computing services tailored to the oil and gas sector, focusing on AI and blockchain technologies to improve operational efficiency.SAP SE:

Delivers extensive cloud-based solutions that optimize supply chain processes, enhance data visibility, and support regulatory compliance in oil and gas.Oracle Corporation:

Provides integrated cloud solutions to manage complex data workloads in oil and gas, facilitating better resource management and strategic operations.We're grateful to work with incredible clients.

FAQs

What is the market size of oil And Gas Cloud Applications?

The oil and gas cloud applications market is valued at approximately $8 billion in 2023 and is projected to grow at a CAGR of 8.2% over the next decade, reaching substantial growth by 2033.

What are the key market players or companies in this oil And Gas Cloud Applications industry?

Key players in the oil and gas cloud applications industry include major tech firms and specialized vendors like IBM, Microsoft, and SAP, which provide solutions along with innovative startups catering to niche needs.

What are the primary factors driving the growth in the oil And Gas Cloud Applications industry?

The growth factors include digital transformation initiatives, increasing demand for data analytics and IoT applications, operational efficiency demands, regulatory compliance needs, and the push towards cloud-based solutions in the industry.

Which region is the fastest Growing in the oil And Gas Cloud Applications?

Europe is projected to be the fastest-growing region, reaching a market size of $4.64 billion by 2033, followed closely by North America and Asia Pacific, reflecting robust investments in digital solutions.

Does ConsaInsights provide customized market report data for the oil And Gas Cloud Applications industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs, enabling businesses to gain targeted insights and strategies relevant to their unique operational challenges within the oil and gas cloud application sector.

What deliverables can I expect from this oil And Gas Cloud Applications market research project?

Deliverables include comprehensive market analysis reports, regional growth forecasts, competitive landscape assessments, segmented data insights, and strategic recommendations based on the latest industry trends.

What are the market trends of oil And Gas Cloud Applications?

Current trends include increasing adoption of AI and IoT in cloud solutions, growing emphasis on cybersecurity, shifts towards hybrid cloud models, and more focus on sustainable practices within cloud applications.