Oil And Gas Pumps Market Report

Published Date: 22 January 2026 | Report Code: oil-and-gas-pumps

Oil And Gas Pumps Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Oil and Gas Pumps market, providing an in-depth analysis of market trends, sizes, industry dynamics, and growth forecasts from 2023 to 2033. Insights include segmentation by product, region, and technology, helping stakeholders understand market opportunities and competitive landscapes.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

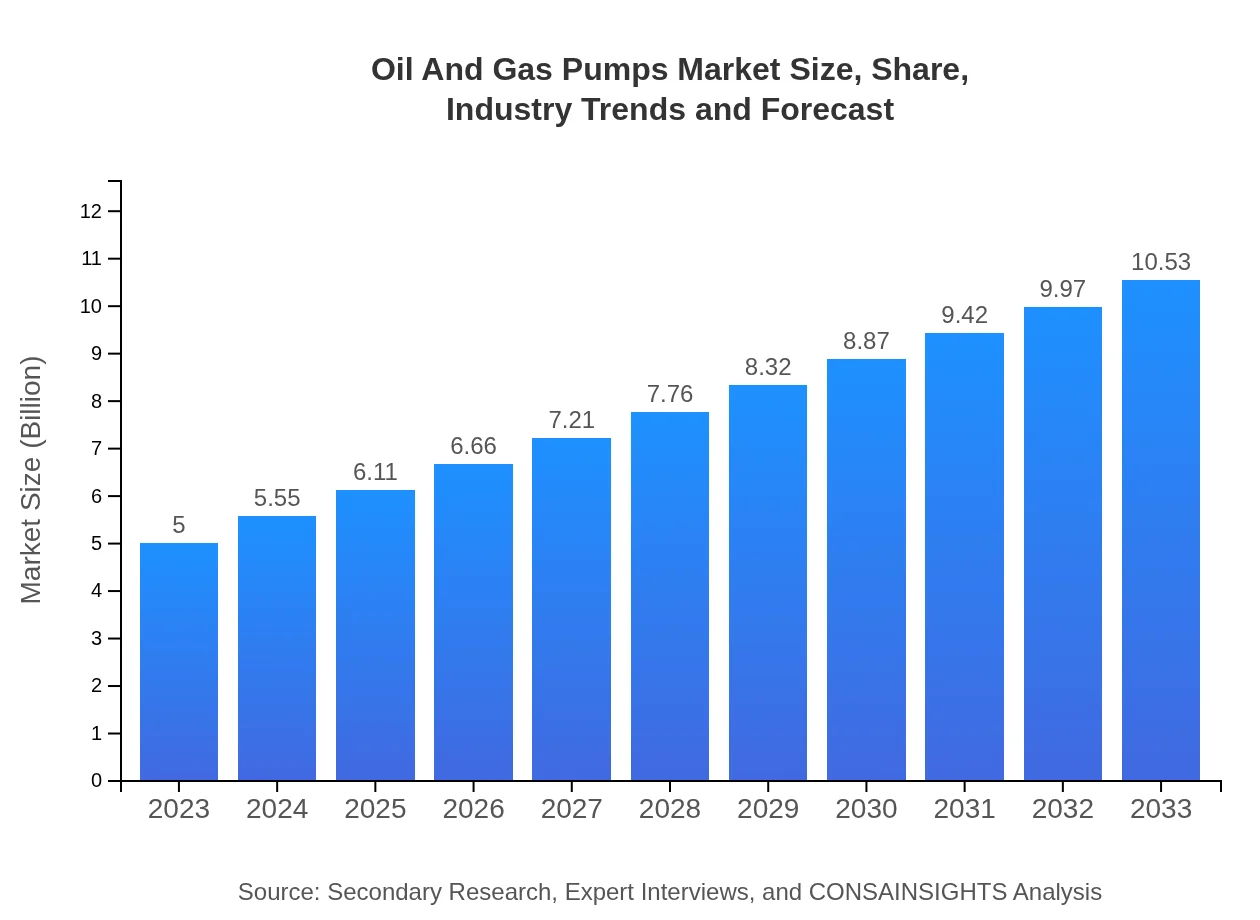

| 2023 Market Size | $5.00 Billion |

| CAGR (2023-2033) | 7.5% |

| 2033 Market Size | $10.53 Billion |

| Top Companies | Schlumberger Limited, Flowserve Corporation, Cameron International (a Schlumberger company), KSB SE & Co. KGaA |

| Last Modified Date | 22 January 2026 |

Oil And Gas Pumps Market Overview

Customize Oil And Gas Pumps Market Report market research report

- ✔ Get in-depth analysis of Oil And Gas Pumps market size, growth, and forecasts.

- ✔ Understand Oil And Gas Pumps's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Oil And Gas Pumps

What is the Market Size & CAGR of Oil And Gas Pumps market in 2023?

Oil And Gas Pumps Industry Analysis

Oil And Gas Pumps Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Oil And Gas Pumps Market Analysis Report by Region

Europe Oil And Gas Pumps Market Report:

Europe's Oil and Gas Pumps market is expected to grow from $1.28 billion in 2023 to about $2.70 billion by 2033. Factors such as stringent environmental regulations and the EU's commitment to reducing carbon emissions are pushing companies towards sustainable pumping technologies, fostering innovation in energy-efficient systems.Asia Pacific Oil And Gas Pumps Market Report:

In the Asia Pacific region, the Oil and Gas Pumps market was valued at approximately $0.99 billion in 2023 and is expected to grow to around $2.08 billion by 2033, driven by increasing investments in exploration and production activities in countries like China and India. The region's expanding urbanization and energy needs further amplify demand for efficient pumping solutions.North America Oil And Gas Pumps Market Report:

North America holds a significant portion of the market, starting at $1.87 billion in 2023 and projected to nearly double to $3.94 billion by 2033. This growth is supported by a resurgence in shale oil production, along with extensive pipeline networks that require advanced pumping technologies to facilitate efficient distribution.South America Oil And Gas Pumps Market Report:

The South American market, although smaller at $0.22 billion in 2023, is anticipated to reach $0.47 billion by 2033. The growth is primarily a result of rising oil production in Brazil and Venezuela, coupled with increased infrastructure development in oil transportation, which boosts demand for reliable pumping systems.Middle East & Africa Oil And Gas Pumps Market Report:

In the Middle East and Africa, the market is forecasted to grow from $0.64 billion in 2023 to $1.35 billion by 2033. This growth is attributed to the region's significant oil reserves and ongoing infrastructure projects, which increase the demand for high-performance pumps suited for challenging environments.Tell us your focus area and get a customized research report.

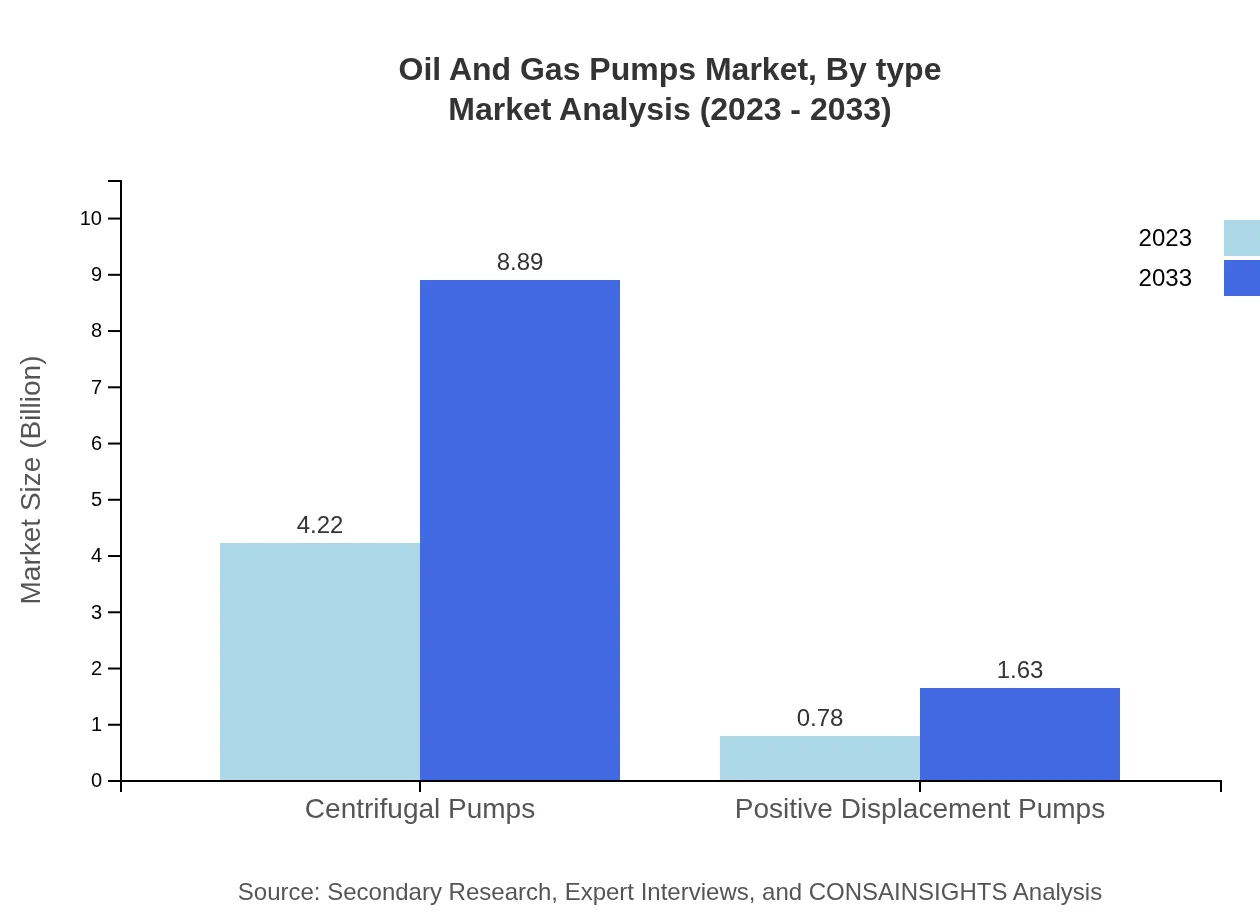

Oil And Gas Pumps Market Analysis By Type

The Oil and Gas Pumps market, by type, includes Centrifugal and Positive Displacement Pumps. Centrifugal Pumps dominate the market, holding a significant share due to their efficiency in high-flow applications. In 2023, centrifugal pumps accounted for about 84.47% of the market share, with projections of similar trends in 2033. Positive Displacement Pumps, while smaller in market share (15.53% in 2023), are crucial in applications requiring precise flow control.

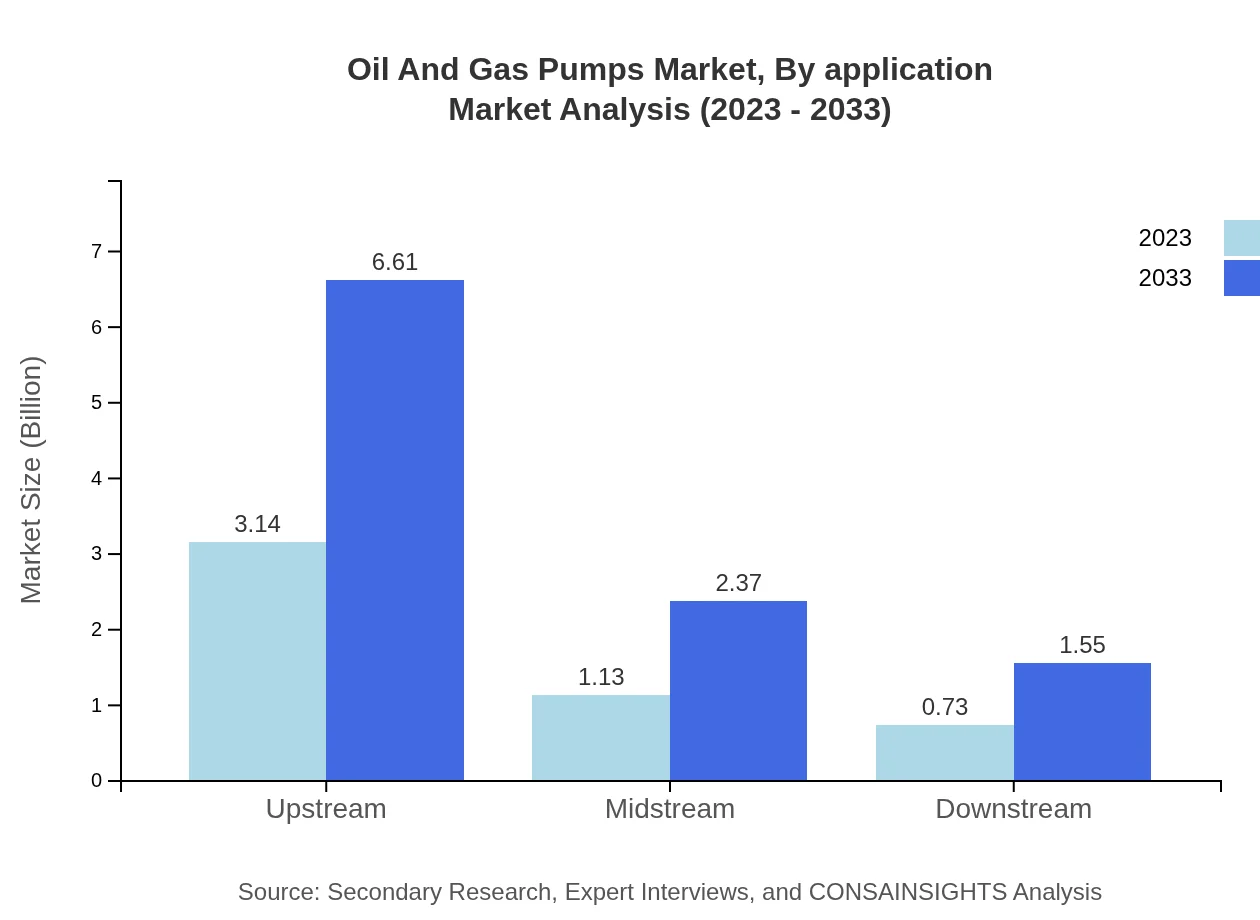

Oil And Gas Pumps Market Analysis By Application

The market segmentation by application includes Upstream, Midstream, and Downstream. Upstream applications, which involve the extraction of oil and gas, dominate the market with a share of 62.8% in 2023, growing steadily as exploration activities increase. Midstream operations (22.52%) and Downstream processes (14.68%) are also significant, with midstream focusing on transportation and storage.

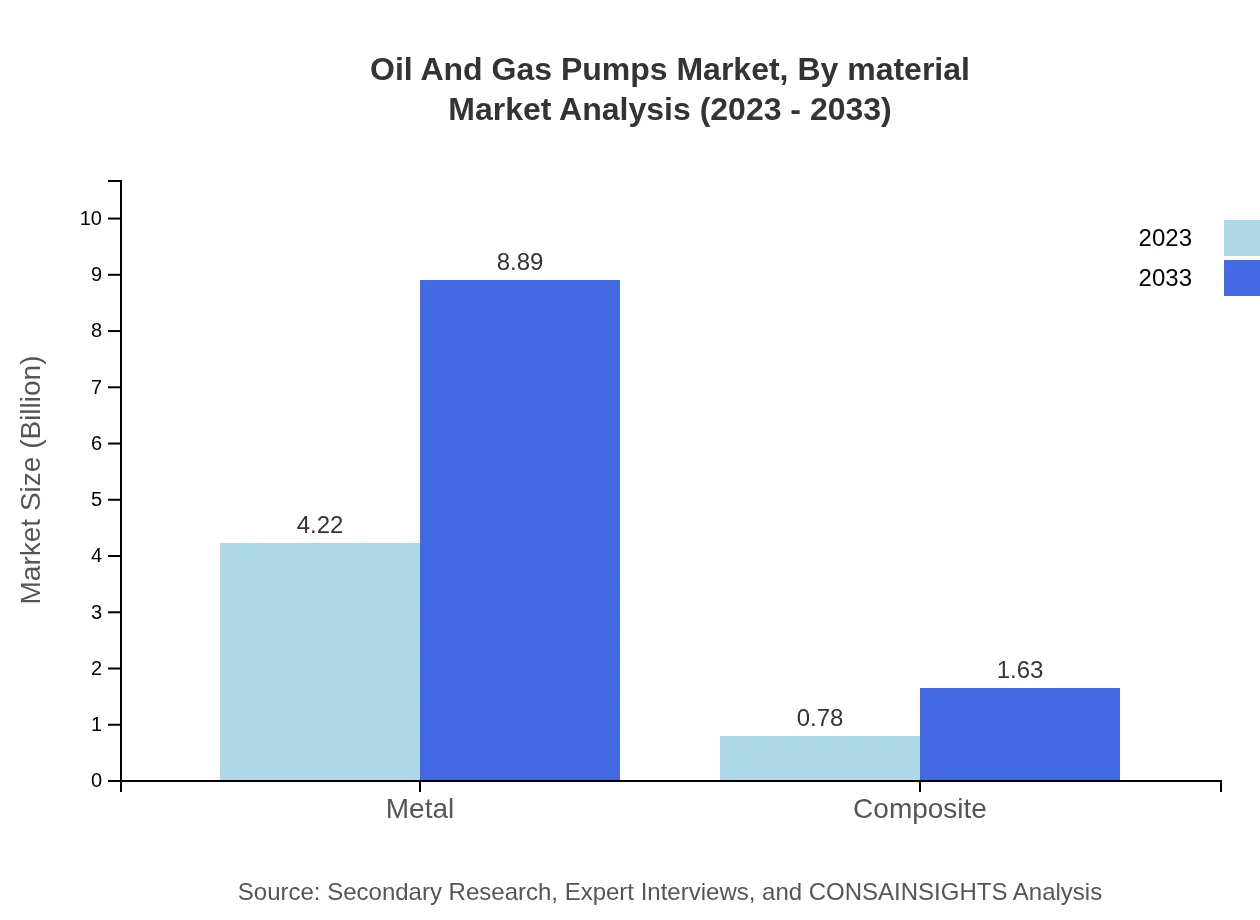

Oil And Gas Pumps Market Analysis By Material

Material composition in the Oil and Gas Pumps market is divided into Metal and Composite materials. Metal pumps, primarily made of stainless steel, dominate the market due to their durability and ability to withstand harsh environments. Composite materials are gradually gaining traction, especially in areas requiring lightweight solutions, holding a 15.53% market share.

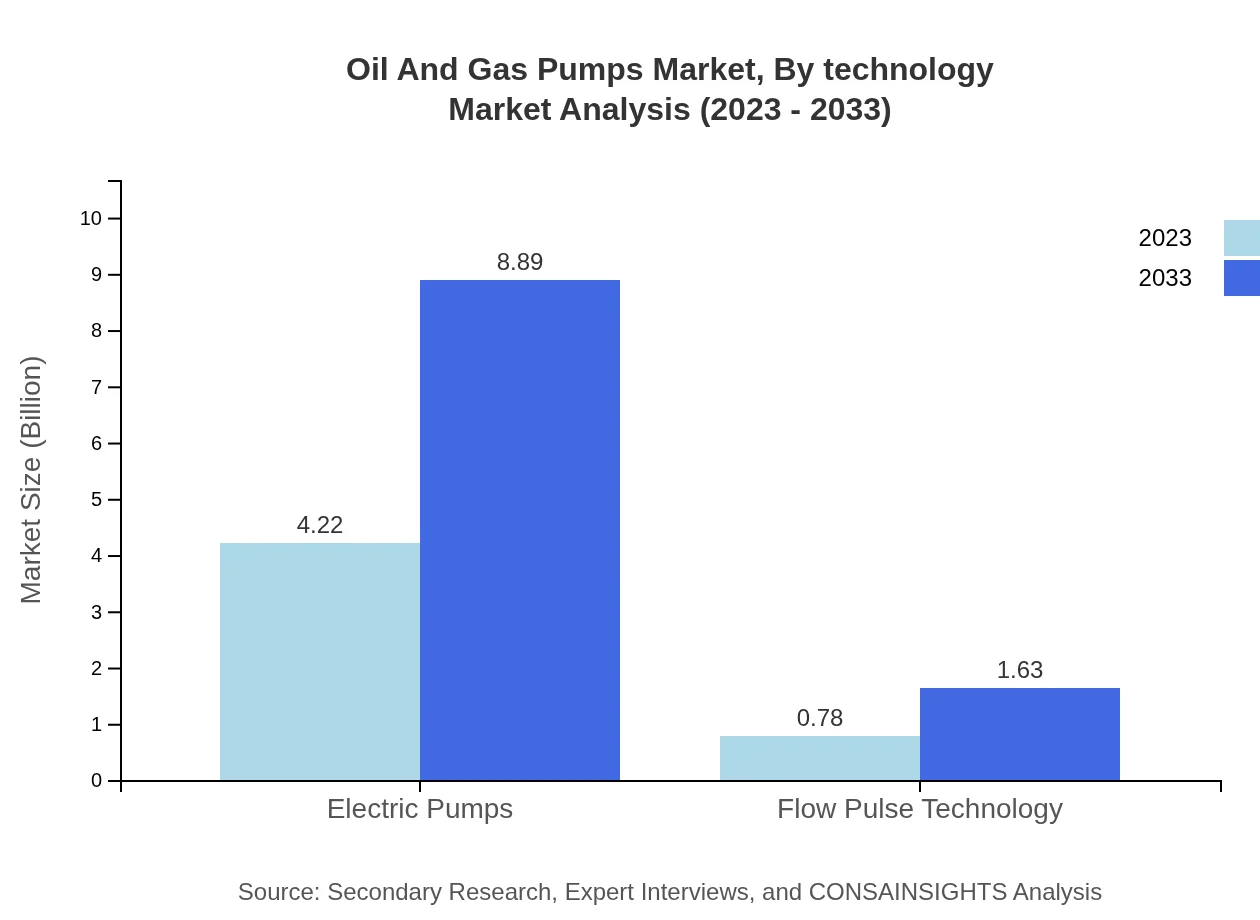

Oil And Gas Pumps Market Analysis By Technology

Technological advancements in pumps include Electric and Automated pumps, which are becoming increasingly popular in the industry. Electric Pumps dominate the market with an 84.47% share, favored for their efficiency. Automated pumps (15.53%), which allow for greater control and monitoring, are gaining ground as digitalization reshapes oil and gas operations.

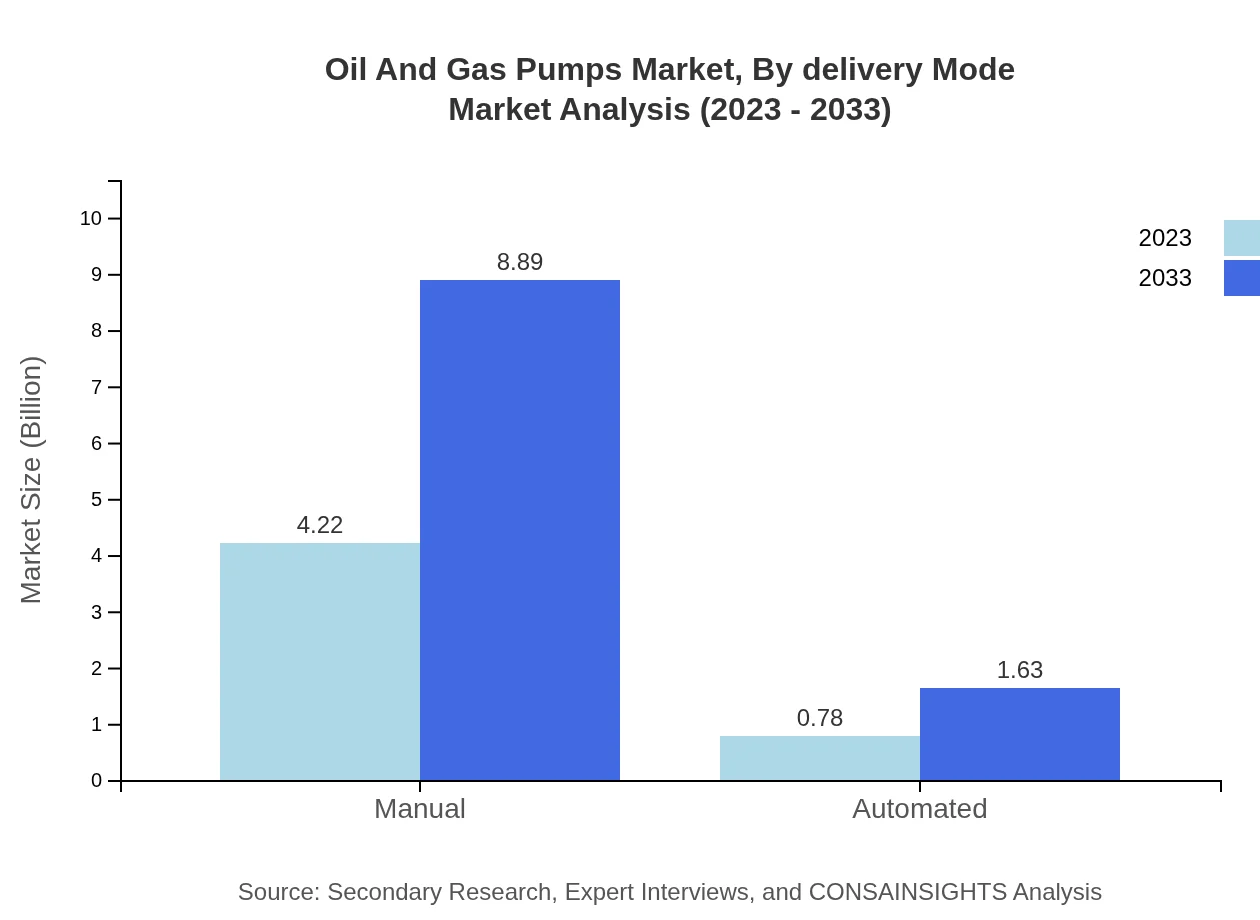

Oil And Gas Pumps Market Analysis By Delivery Mode

The delivery mode segment is categorized into Manual and Automated systems, with manual pumps retaining a dominant share of 84.47%. However, automated delivery systems (15.53%) are expected to witness significant growth, driven by the industry's trend towards automation and smart technologies that enhance operational efficiency.

Oil And Gas Pumps Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Oil And Gas Pumps Industry

Schlumberger Limited:

A global leader in the oil and gas sector, Schlumberger offers cutting-edge pumps and technology solutions aimed at enhancing operational efficiency and reducing costs.Flowserve Corporation:

Flowserve is a key player in the pump industry, known for its innovative pumping solutions that cater to both oil and gas sectors, focusing on durability and reliability.Cameron International (a Schlumberger company):

Cameron specializes in pipeline and refining technologies, including advanced pumping systems designed to maximize productivity in oil and gas operations.KSB SE & Co. KGaA:

KSB is known for its high-quality pumps and valves for various industrial applications, including robust solutions for oil and gas extraction.We're grateful to work with incredible clients.

FAQs

What is the market size of oil And Gas Pumps?

The global oil and gas pumps market is valued at approximately $5 billion in 2023, and it is expected to grow at a CAGR of 7.5% over the next decade, indicating a robust expansion in demand within this sector.

What are the key market players or companies in this oil And Gas Pumps industry?

Key players in the oil and gas pumps industry include major manufacturers such as Schlumberger, Flowserve Corporation, and Grundfos. Their innovations and strategic partnerships significantly influence market dynamics and technological advancements.

What are the primary factors driving the growth in the oil And Gas Pumps industry?

Growth drivers include increasing oil and gas exploration activities, rising demand for efficient pumping systems, and advancements in pump technology aimed at improving energy efficiency and reducing environmental impact.

Which region is the fastest Growing in the oil And Gas Pumps?

The Asia Pacific region is the fastest-growing market for oil and gas pumps, projected to expand from $0.99 billion in 2023 to $2.08 billion by 2033, showcasing the region's increasing industrial activities and energy demands.

Does ConsaInsights provide customized market report data for the oil And Gas Pumps industry?

Yes, ConsaInsights offers customized market reports tailored to specific requirements, helping businesses make informed decisions based on precision data and in-depth analysis of the oil and gas pumps market.

What deliverables can I expect from this oil And Gas Pumps market research project?

Deliverables include comprehensive reports on market size, trends, competitive analysis, segment data, regional insights, and forecasts, providing clients with actionable intelligence aimed at strategic planning.

What are the market trends of oil And Gas Pumps?

Current trends highlight the shift towards automation and digital monitoring, increasing adoption of energy-efficient pumps, and a growing focus on sustainability as companies seek to minimize their ecological footprint.