Oil And Gas Sensors Market Report

Published Date: 31 January 2026 | Report Code: oil-and-gas-sensors

Oil And Gas Sensors Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Oil And Gas Sensors market, detailing market trends, size projections, segmentation, and competitive landscape from 2023 to 2033.

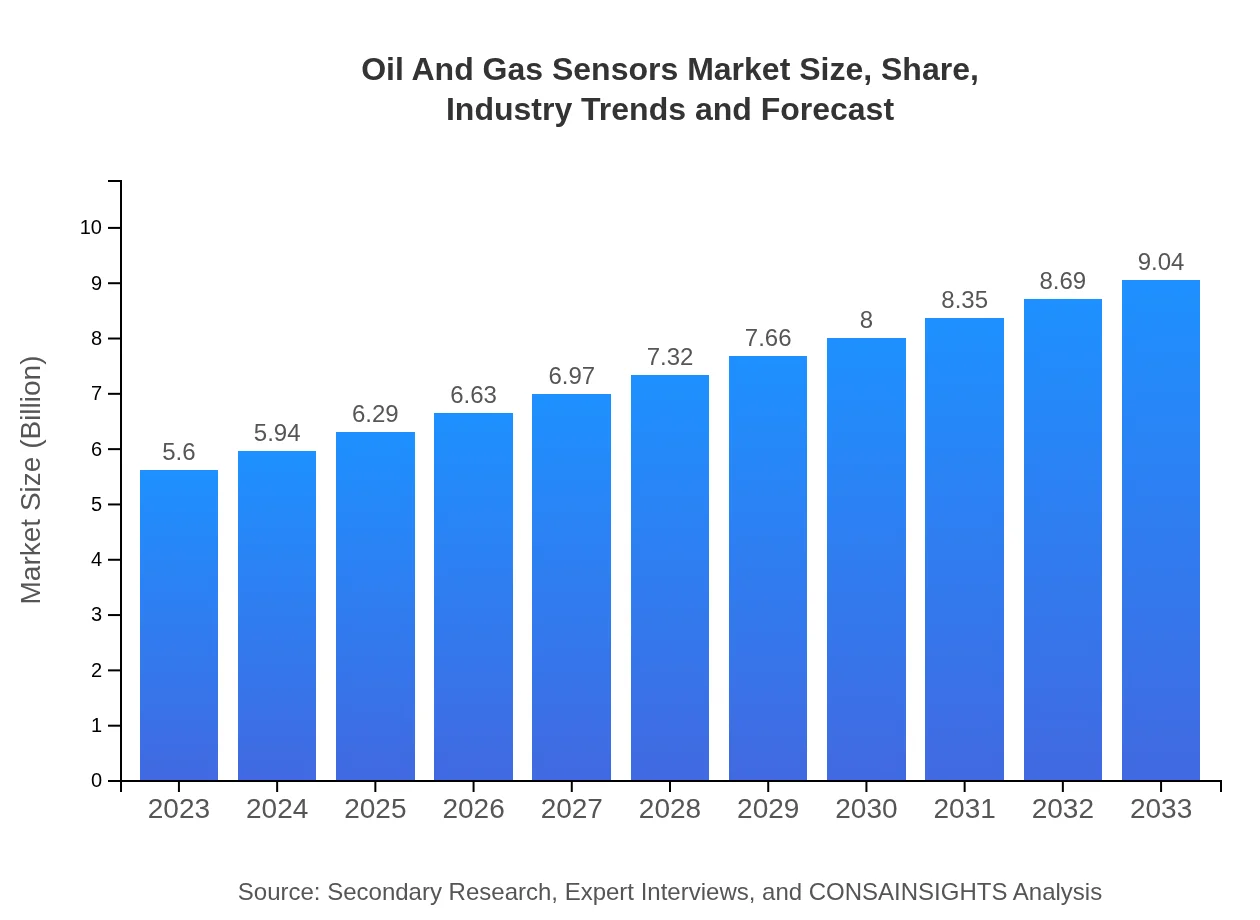

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $9.04 Billion |

| Top Companies | Siemens AG, Honeywell International Inc., Emerson Electric Co., Schneider Electric, ABB Ltd. |

| Last Modified Date | 31 January 2026 |

Oil And Gas Sensors Market Overview

Customize Oil And Gas Sensors Market Report market research report

- ✔ Get in-depth analysis of Oil And Gas Sensors market size, growth, and forecasts.

- ✔ Understand Oil And Gas Sensors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Oil And Gas Sensors

What is the Market Size & CAGR of Oil And Gas Sensors market in 2033?

Oil And Gas Sensors Industry Analysis

Oil And Gas Sensors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Oil And Gas Sensors Market Analysis Report by Region

Europe Oil And Gas Sensors Market Report:

The European Oil And Gas Sensors market is anticipated to grow from $1.42 billion in 2023 to $2.30 billion by 2033. An increasing emphasis on green technologies and sustainable practices is driving European firms to invest in sensor innovations for better monitoring and compliance with regulations.Asia Pacific Oil And Gas Sensors Market Report:

In the Asia Pacific region, the Oil And Gas Sensors market is projected to grow from $1.19 billion in 2023 to $1.92 billion by 2033. Countries like China and India are increasing their investments in energy infrastructure, driving demand for advanced sensors. The need for enhanced safety measures amidst rigorous environmental regulations also fuels this rapid growth.North America Oil And Gas Sensors Market Report:

North America currently holds a substantial share of the market, valued at $2.10 billion in 2023 and expected to rise to $3.40 billion by 2033. The U.S. is at the forefront due to its shale oil production, coupled with high technology adoption rates. Strong investments in automation are fostered by oil companies seeking efficiency gains.South America Oil And Gas Sensors Market Report:

The South American market is set to increase from $0.21 billion to $0.33 billion in the same period. Growth in oil production in countries like Brazil and Colombia is expected to drive sensor demand, despite the region's challenges such as regulatory hurdles and fluctuating oil prices.Middle East & Africa Oil And Gas Sensors Market Report:

In the Middle East and Africa, the market is forecasted to expand from $0.67 billion to $1.09 billion. The region’s oil production capacity, along with the ongoing infrastructural developments, necessitates the deployment of sensors to optimize resource management and ensure safety protocols are met.Tell us your focus area and get a customized research report.

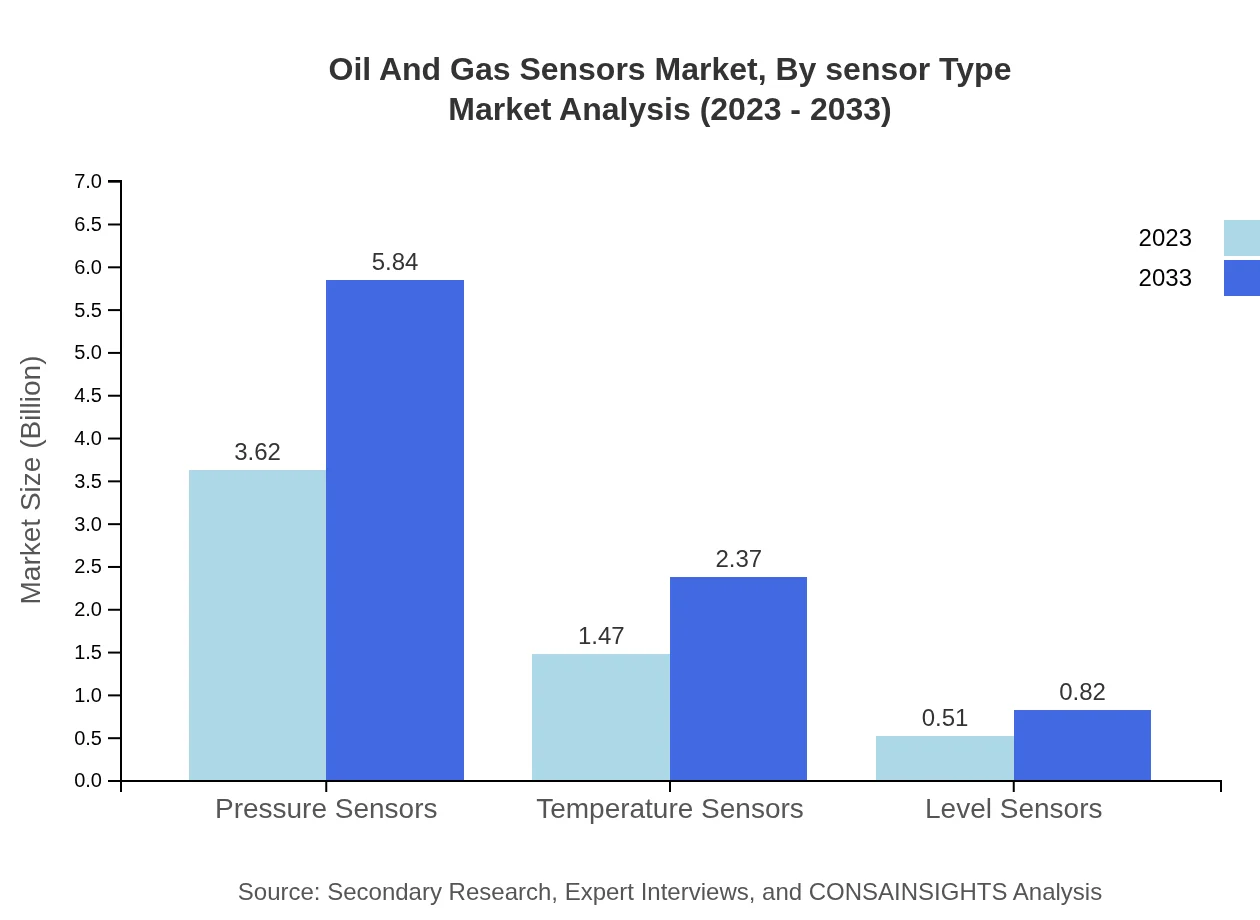

Oil And Gas Sensors Market Analysis By Sensor Type

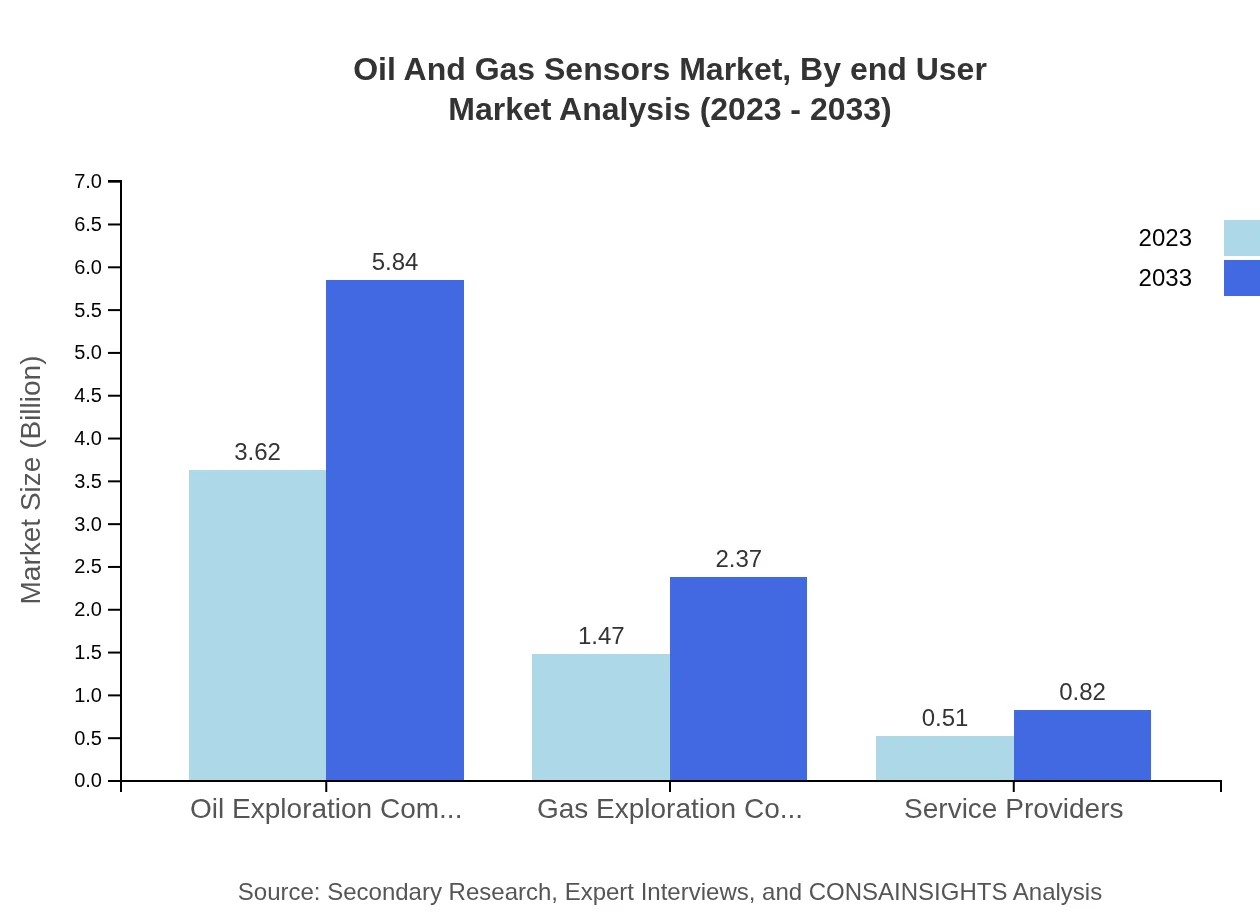

The sensor types in this market predominantly consist of pressure sensors, temperature sensors, and level sensors. The market for pressure sensors is set to grow from $3.62 billion in 2023 to $5.84 billion in 2033, retaining a market share of 64.67%. Temperature sensors follow with a projected growth from $1.47 billion to $2.37 billion, holding a steady share of 26.25%. Level sensors will see a rise from $0.51 billion to $0.82 billion, comprising 9.08% market share.

Oil And Gas Sensors Market Analysis By Application

In terms of application, the Oil Exploration Companies segment dominates with a size of $3.62 billion in 2023, projected to reach $5.84 billion by 2033, accounting for a continuous 64.67% market share. Gas Exploration Companies are expected to expand from $1.47 billion to $2.37 billion, thriving on a 26.25% share, while Service Providers will experience growth from $0.51 billion to $0.82 billion, maintaining 9.08%. This segmentation showcases the significant role of oil and gas exploration in driving market growth.

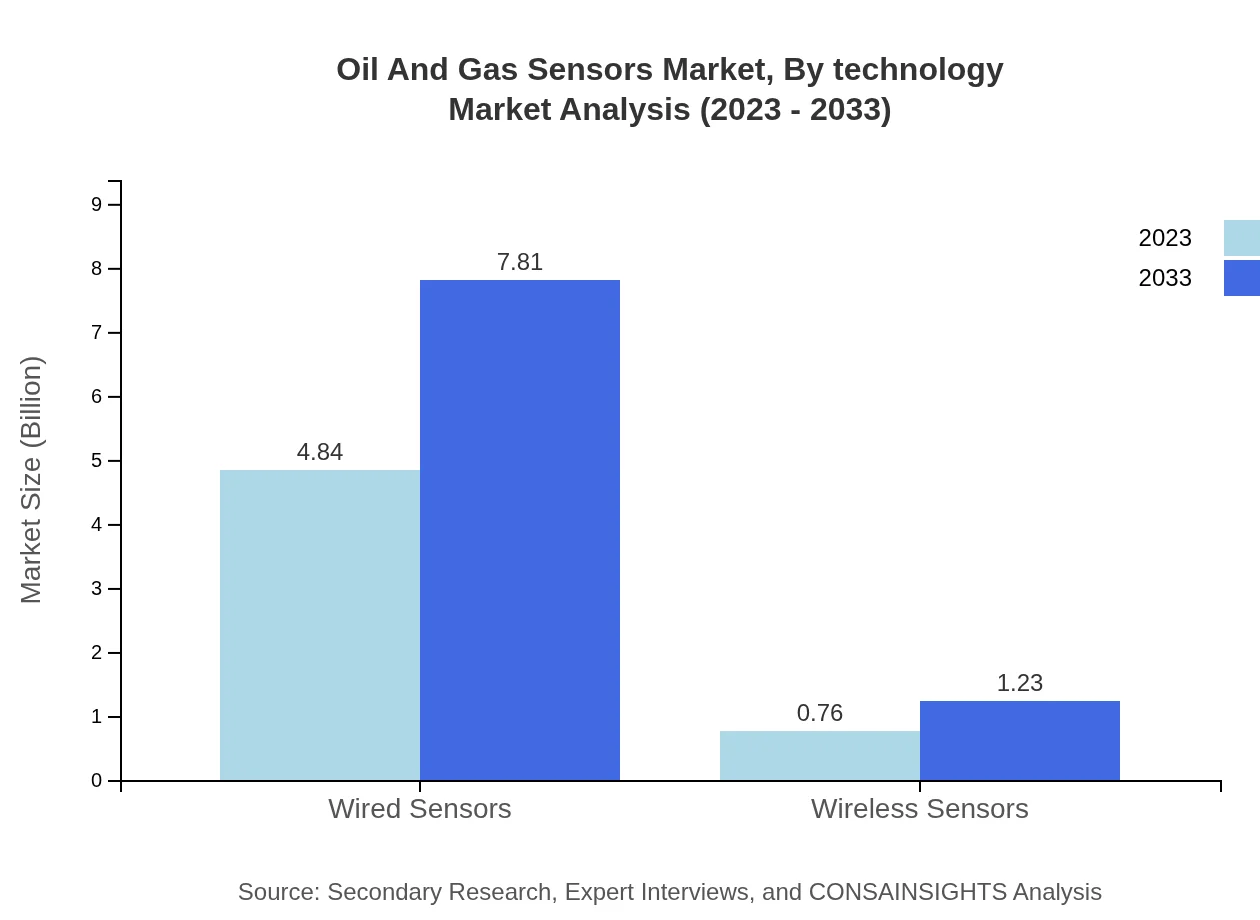

Oil And Gas Sensors Market Analysis By Technology

When looking at technology types, the market is majorly divided into wired and wireless sensors. The wired sensors market is projected to increase from $4.84 billion in 2023 to $7.81 billion in 2033, exemplifying the traditional approach that still holds the highest share at 86.44%. On the other hand, wireless sensors are experiencing a surge, expected to grow from $0.76 billion to $1.23 billion, capturing a 13.56% market share, showcasing the shift towards more flexible technologies.

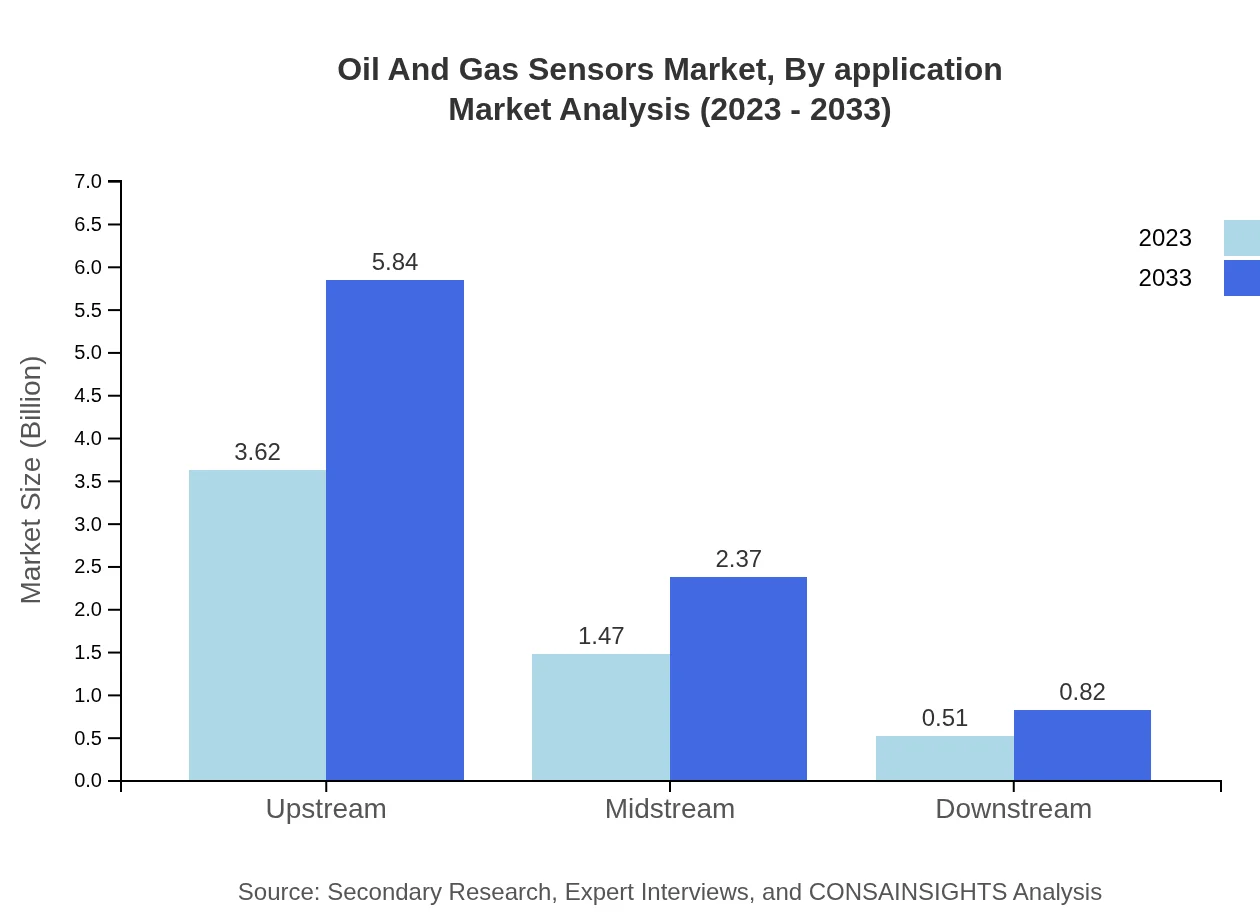

Oil And Gas Sensors Market Analysis By End User

This market is segmented into upstream, midstream, and downstream applications. The upstream segment leads with a current market size of $3.62 billion expected to reach $5.84 billion by 2033, maintaining 64.67%. Midstream is projected to grow from $1.47 billion to $2.37 billion, reflecting a 26.25% market share, while downstream shall rise from $0.51 billion to $0.82 billion, accounting for 9.08%. This illustrates the critical application of sensors across all stages of oil and gas production.

Oil And Gas Sensors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Oil And Gas Sensors Industry

Siemens AG:

Siemens AG is a global leader in the automation and digitalization of the oil and gas industry, providing advanced sensor technologies to streamline production and enhance operational visibility.Honeywell International Inc.:

Honeywell offers a range of innovative sensors and automation solutions tailored for the oil and gas sector, focusing on safety, reliability, and efficiency.Emerson Electric Co.:

Emerson provides precision sensors that assist oil and gas operators in monitoring processes and maintaining energy efficiency through intelligent data analytics.Schneider Electric:

Schneider Electric specializes in energy management and automation, providing sensor solutions designed to improve efficiency and sustainability in the oil and gas industry.ABB Ltd.:

ABB offers industry-leading sensor solutions designed to optimize performance and capitalize on digitalization trends across the oil and gas sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of oil And Gas Sensors?

The global oil and gas sensors market was valued at approximately $5.6 billion in 2023 and is projected to grow at a CAGR of 4.8%, reaching an estimated size in 2033 that reflects ongoing technological advancements and rising demand.

What are the key market players or companies in this oil And Gas Sensors industry?

Key players in the oil-and-gas-sensors market include major energy companies, sensor manufacturers, and technology solutions providers who specialize in advanced sensor technologies. Notable companies compete to provide innovative and efficient sensing solutions.

What are the primary factors driving the growth in the oil And Gas Sensors industry?

Growth in the oil-and-gas-sensors market is driven by increasing demand for automation, stringent safety regulations, technological advancements, and the critical need for operational efficiency and real-time monitoring in the energy sector.

Which region is the fastest Growing in the oil And Gas Sensors?

The North American region is the fastest-growing segment of the oil-and-gas-sensors market. It is projected to increase from $2.10 billion in 2023 to $3.40 billion by 2033, reflecting robust exploration and production activities.

Does ConsaInsights provide customized market report data for the oil And Gas Sensors industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the oil-and-gas-sensors industry, ensuring that clients receive information that aligns with their strategic objectives and decision-making processes.

What deliverables can I expect from this oil And Gas Sensors market research project?

Expect comprehensive reports including market size projections, competitive landscape analyses, segment breakdowns, trends, and insights into regional developments. These deliverables are designed to support informed business strategies.

What are the market trends of oil And Gas Sensors?

Current trends in the oil-and-gas-sensors market include increased adoption of smart and wireless sensing technologies, focus on environmental monitoring, and integration with IoT solutions to enhance operational efficiency and data analytics capabilities.