Oil Condition Monitoring Market Report

Published Date: 22 January 2026 | Report Code: oil-condition-monitoring

Oil Condition Monitoring Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Oil Condition Monitoring market covering insights, trends, and forecasts from 2023 to 2033. Key elements include market size, growth patterns, competitive landscape, and regional variations in demand.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

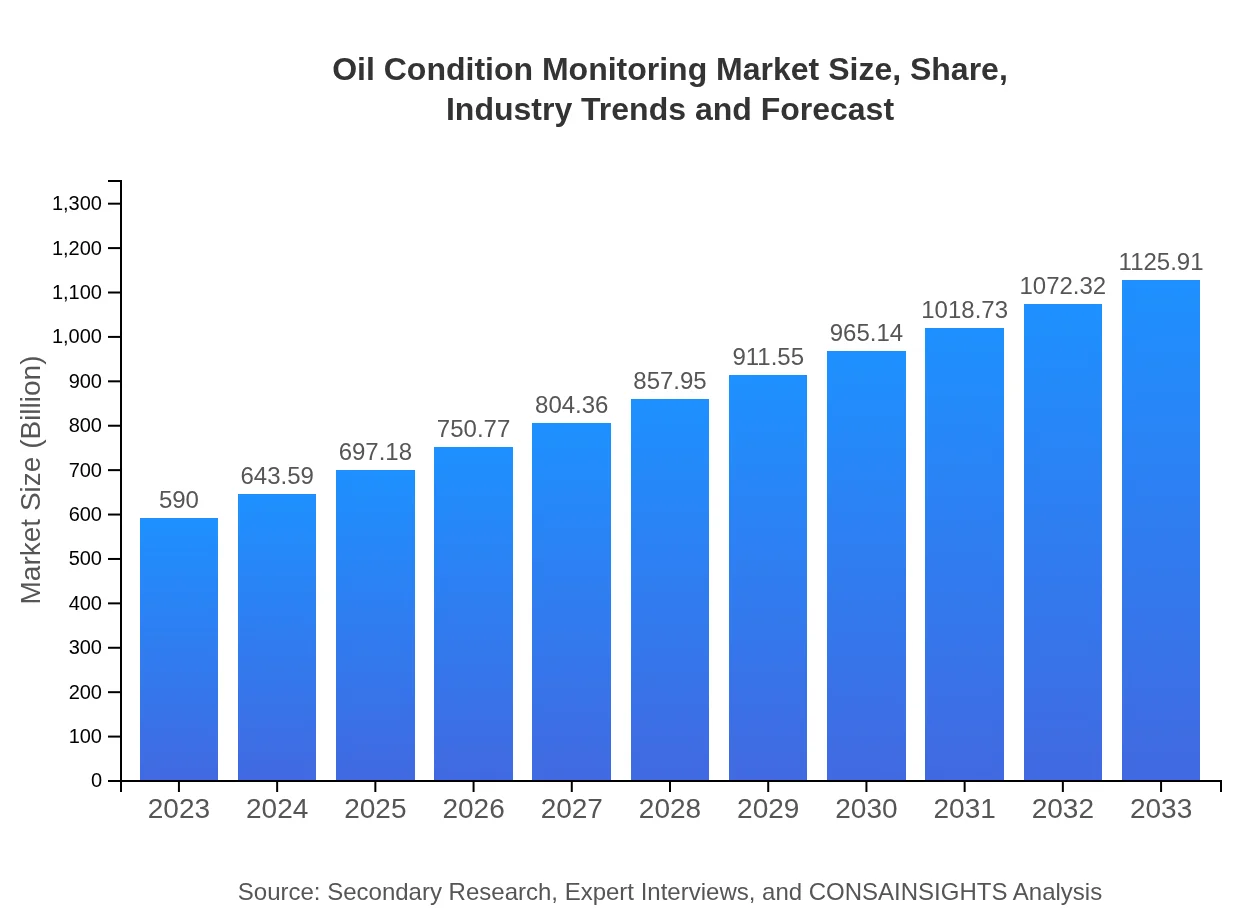

| 2023 Market Size | $590.00 Million |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $1125.91 Million |

| Top Companies | Parker Hannifin, SKF, Emerson, Siemens , General Electric |

| Last Modified Date | 22 January 2026 |

Oil Condition Monitoring Market Overview

Customize Oil Condition Monitoring Market Report market research report

- ✔ Get in-depth analysis of Oil Condition Monitoring market size, growth, and forecasts.

- ✔ Understand Oil Condition Monitoring's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Oil Condition Monitoring

What is the Market Size & CAGR of Oil Condition Monitoring market in 2023?

Oil Condition Monitoring Industry Analysis

Oil Condition Monitoring Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Oil Condition Monitoring Market Analysis Report by Region

Europe Oil Condition Monitoring Market Report:

Europe's Oil Condition Monitoring market is set to grow significantly, from $193.93 million in 2023 to $370.09 million by 2033. As one of the leading regions in adopting cutting-edge technologies for operational efficiency, Europe maintains a strong focus on sustainability and regulatory measures.Asia Pacific Oil Condition Monitoring Market Report:

The Asia Pacific region is projected to grow from $112.04 million in 2023 to $213.81 million by 2033, driven by increasing industrialization, particularly in countries like China and India. The growing automotive and manufacturing sectors, alongside rising awareness regarding maintenance strategies, will enhance market demand.North America Oil Condition Monitoring Market Report:

North America will see its market rise from $196.29 million in 2023 to $374.59 million in 2033. The demand here is primarily driven by advanced technological adoption and high investments in predictive maintenance across various industries, particularly in manufacturing and transportation.South America Oil Condition Monitoring Market Report:

In South America, the market is expected to expand from $22.01 million in 2023 to $42.00 million by 2033. Though still developing, there is a growing recognition of the importance of condition monitoring, especially in oil sectors, which will catalyze growth.Middle East & Africa Oil Condition Monitoring Market Report:

The Middle East and Africa region is anticipated to increase from $65.73 million in 2023 to $125.43 million by 2033. The oil-rich economies here are likely to leverage monitoring technologies to enhance operational reliability and reduce maintenance costs.Tell us your focus area and get a customized research report.

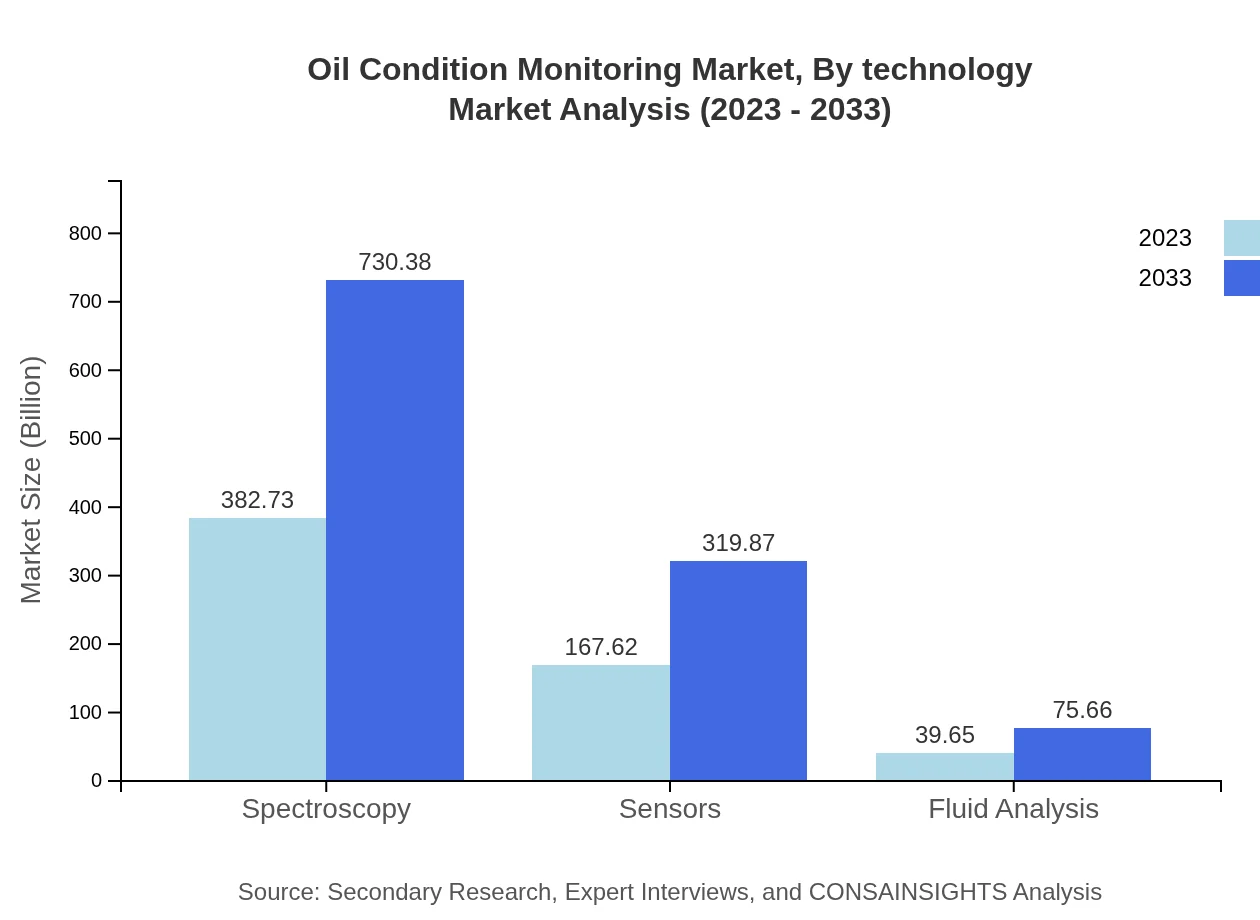

Oil Condition Monitoring Market Analysis By Technology

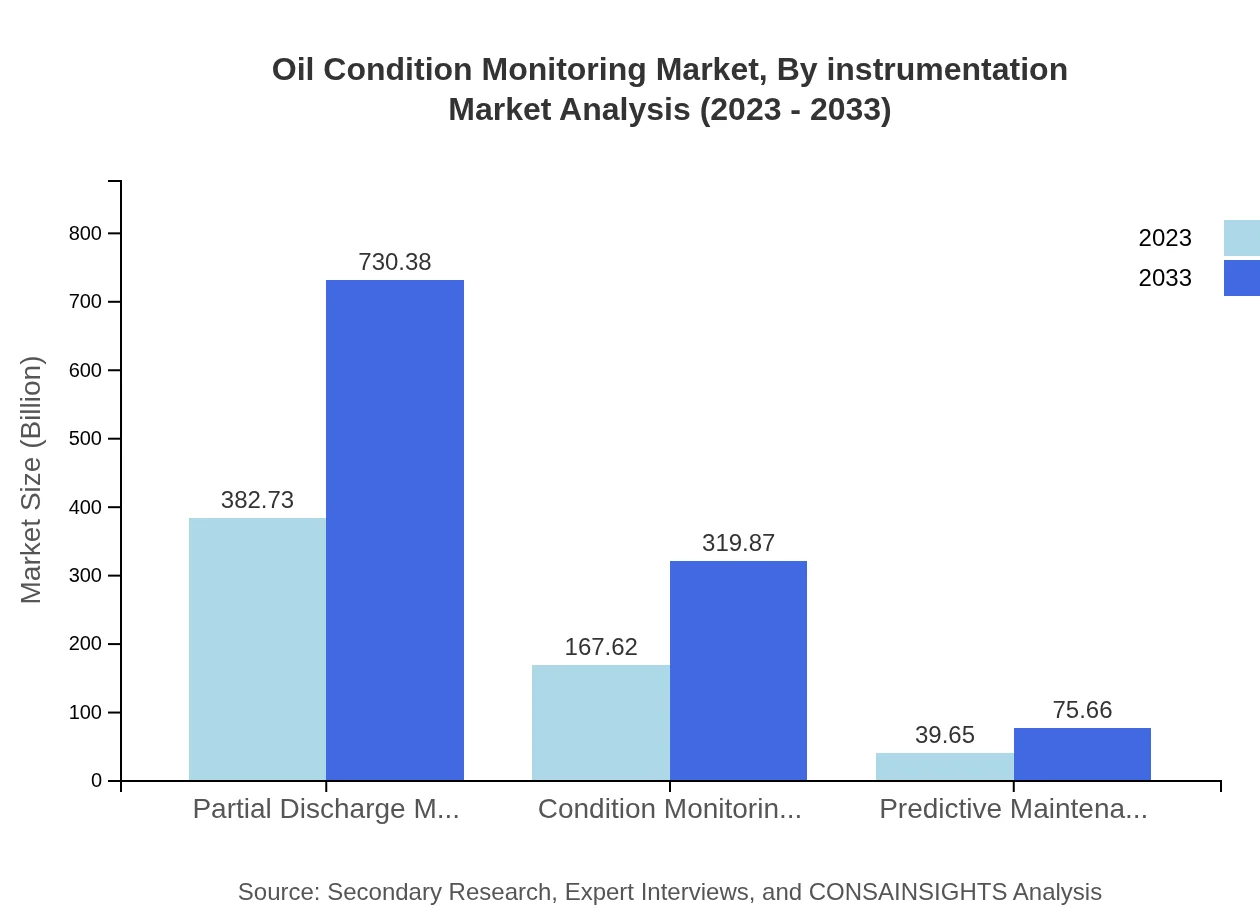

Segmenting by technology, major categories include spectroscopy, sensors, fluid analysis, and condition monitoring systems. Spectroscopy leads with a market size of $382.73 million in 2023, expected to grow to $730.38 million by 2033. Sensors follow, projected to grow from $167.62 million to $319.87 million, driven by advances in sensor technologies that enable accurate real-time monitoring.

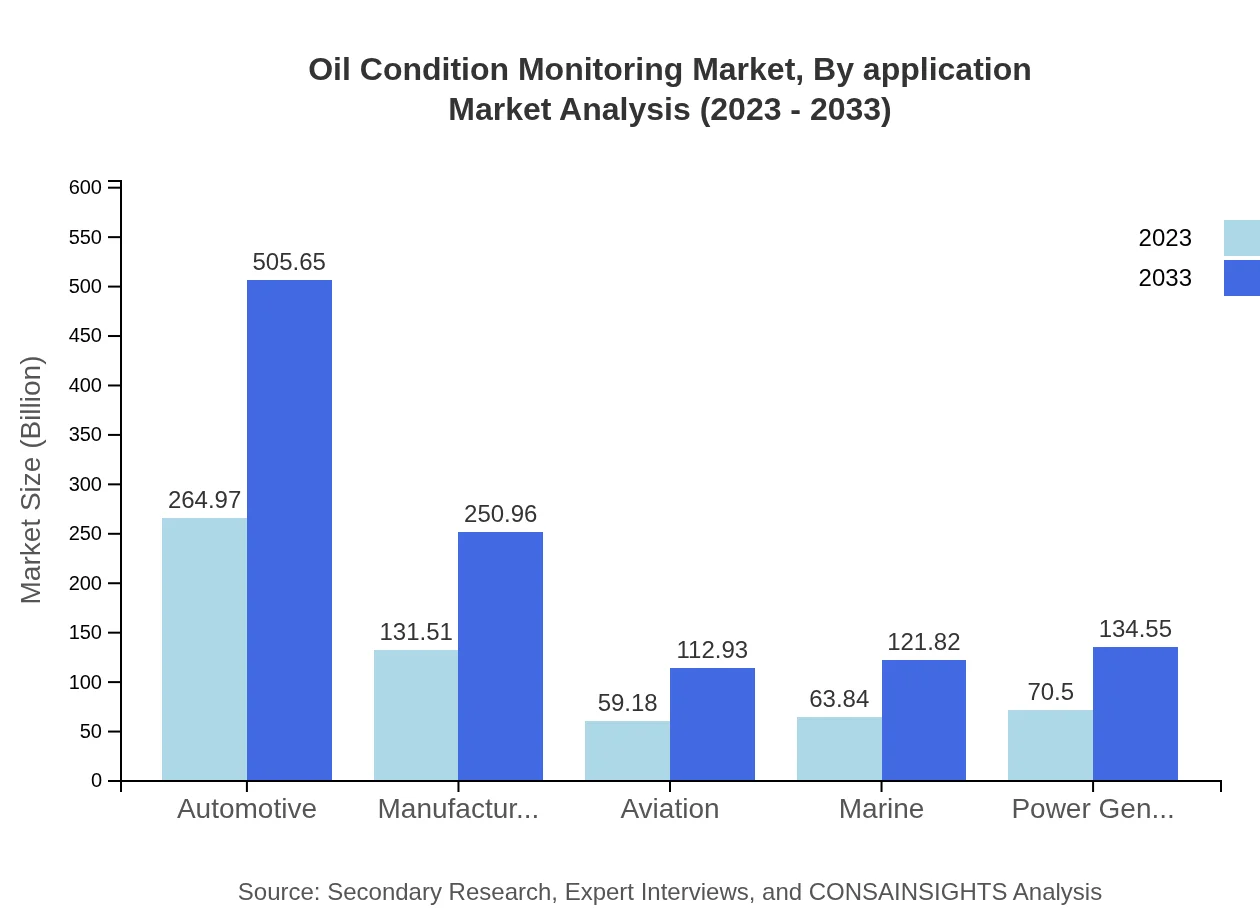

Oil Condition Monitoring Market Analysis By Application

Key applications include predictive maintenance tools, commonly used in all industrial sections, set to rise from $39.65 million to $75.66 million. Fluid Analysis covers a significant market share, growing from $39.65 million to $75.66 million, underscoring its necessity in maintaining equipment efficiency and safety.

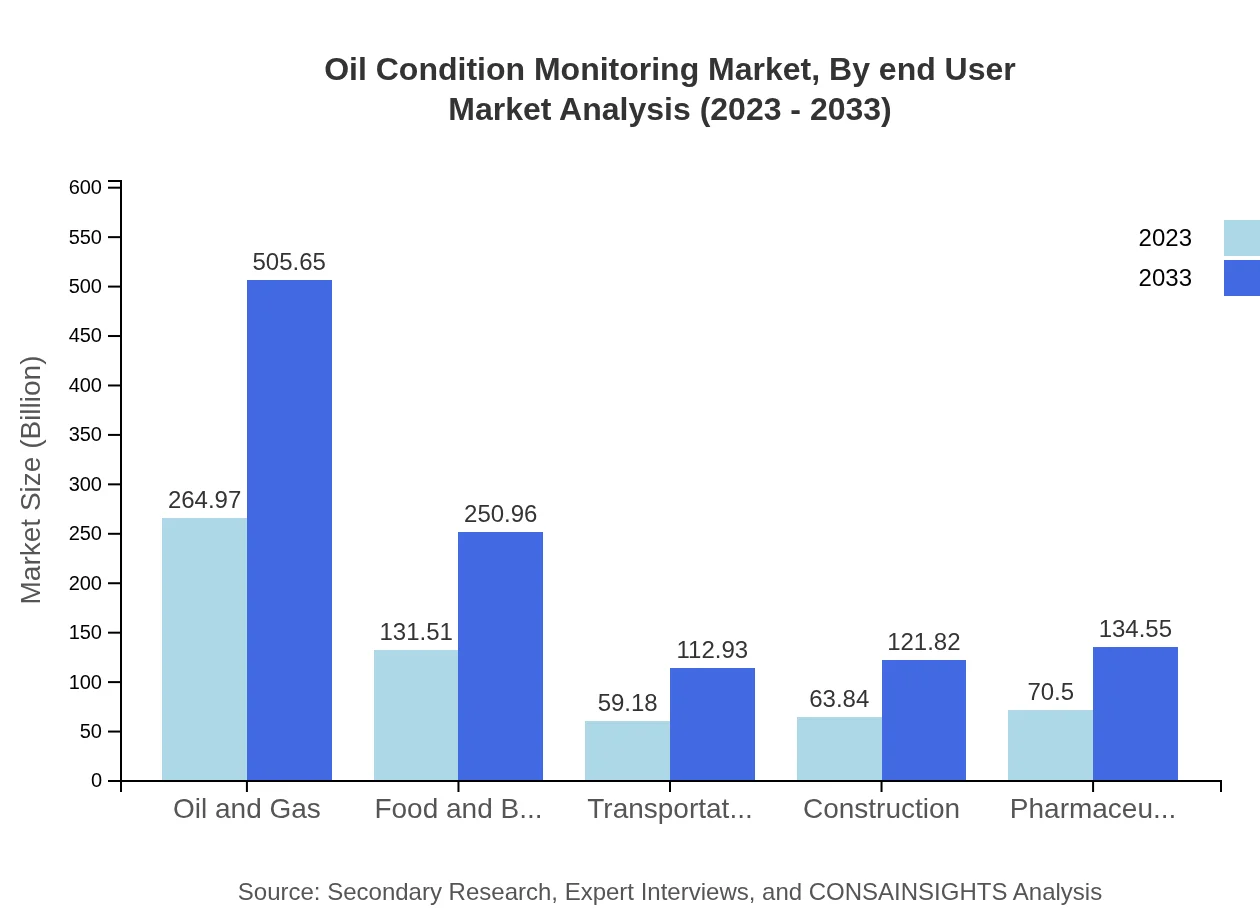

Oil Condition Monitoring Market Analysis By End User

Key end-user industries include oil and gas, manufacturing, automotive, and marine. The oil and gas sector commands a significant share of the market, growing from $264.97 million to $505.65 million. Automotive and manufacturing are also crucial players, with respective growth from $131.51 million to $250.96 million and from $59.18 million to $112.93 million.

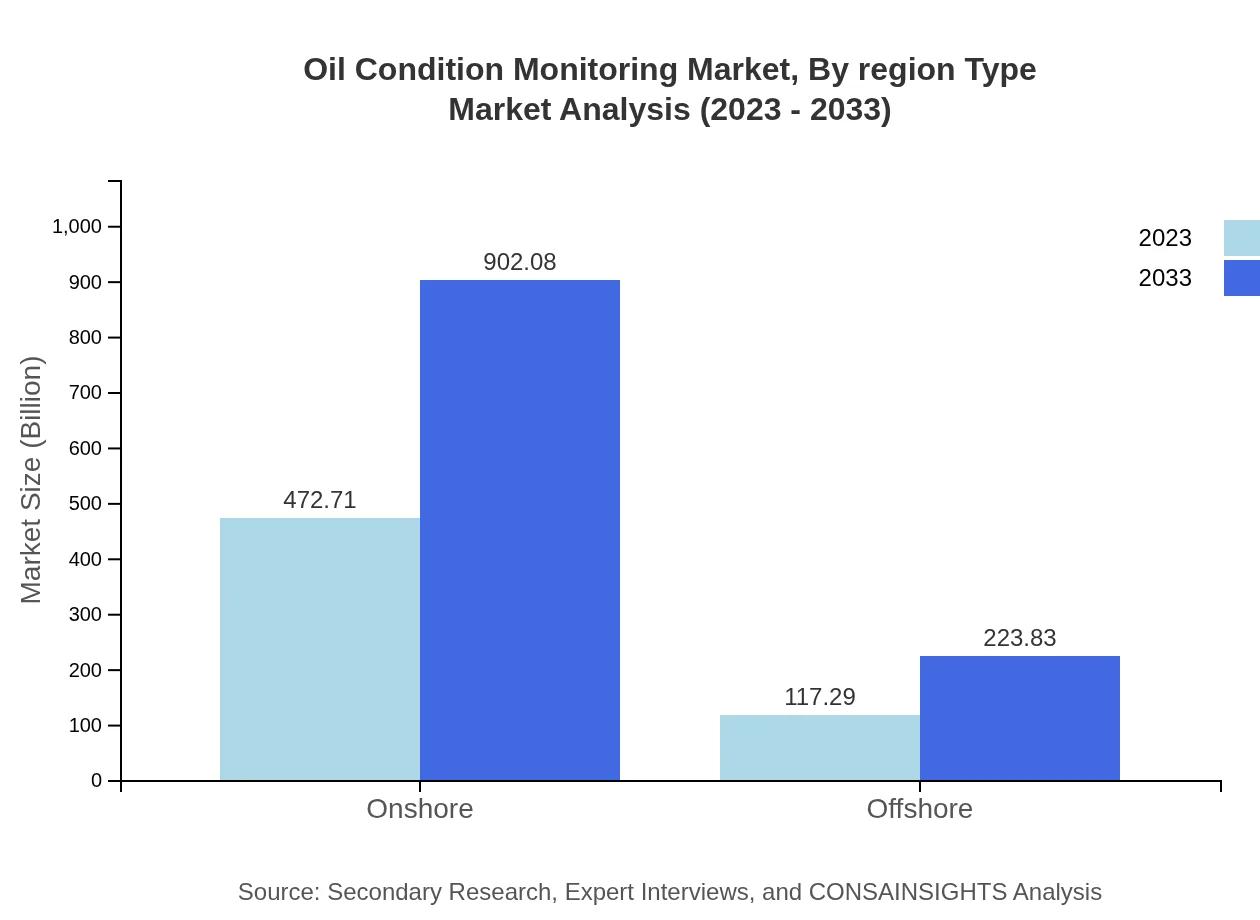

Oil Condition Monitoring Market Analysis By Region Type

Regional analysis indicates that onshore activities will dominate, valued at $472.71 million in 2023 and expected to reach $902.08 million by 2033. Offshore monitoring systems will also see growth, expanding from $117.29 million to $223.83 million. Both segments highlight the importance of monitoring in maximizing operational efficiency.

Oil Condition Monitoring Market Analysis By Instrumentation

Instrumentation in oil monitoring includes devices for both direct and remote analyzing, with sensors and monitoring systems finding significant usage. The sector is set to expand, particularly with advances in wireless technology and IoT-integrated monitoring systems enhancing maintenance capabilities.

Oil Condition Monitoring Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Oil Condition Monitoring Industry

Parker Hannifin:

A global leader in motion and control technologies, Parker Hannifin plays a significant role in providing monitoring solutions that enhance equipment reliability and performance across various industries.SKF:

Specializing in bearings and seals, SKF has expanded into condition monitoring, offering advanced technologies that improve machine efficiency and reduce downtime.Emerson:

Emerson offers a wide range of monitoring solutions that integrate data analytics and IoT to optimize performance and maintenance strategies across sectors including oil and gas.Siemens :

Siemens utilizes its extensive expertise in automation technology to deliver condition monitoring solutions tailored for industrial applications, enhancing operational reliability.General Electric:

GE’s industrial IoT solutions offer comprehensive monitoring capabilities across multiple sectors, leveraging data insights to maximize equipment efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of oil Condition Monitoring?

The global oil-condition-monitoring market is currently valued at approximately $590 million, with a projected CAGR of 6.5% through 2033. This growth is driven by increasing industrial requirements for oil monitoring and predictive maintenance.

What are the key market players or companies in this oil Condition Monitoring industry?

Key players in the oil-condition-monitoring industry include companies like Parker Hannifin, ExxonMobil, and Siemens. These organizations lead through innovation, technology advancement, and comprehensive service offerings, catering to various sectors such as oil and gas, transportation, and manufacturing.

What are the primary factors driving the growth in the oil Condition Monitoring industry?

Growth in the oil-condition-monitoring industry is driven by rising industrial automation, increasing focus on equipment reliability, and the growing need for predictive maintenance solutions. Additionally, regulatory standards for environmental safety are motivating firms to adopt sophisticated monitoring techniques.

Which region is the fastest Growing in the oil Condition Monitoring?

Currently, the Asia Pacific region is the fastest-growing market for oil-condition-monitoring, projected to grow from $112.04 million in 2023 to $213.81 million by 2033, driven by industrial expansion and increasing demand for effective oil management solutions.

Does ConsaInsights provide customized market report data for the oil Condition Monitoring industry?

Yes, ConsaInsights offers tailored market research reports on oil-condition-monitoring. Clients can request customized insights based on specific parameters, including company size, regional focus, or industry sector to meet unique business needs.

What deliverables can I expect from this oil Condition Monitoring market research project?

Upon completion of the oil-condition-monitoring market research project, clients will receive comprehensive deliverables such as detailed market sizing reports, growth forecasts, competitive analysis, segment breakdowns, and actionable insights for strategic decision-making.

What are the market trends of oil Condition Monitoring?

Current trends in the oil-condition-monitoring market include the integration of IoT for real-time data analytics, rising adoption of condition-based monitoring systems, and increased investment in predictive maintenance technologies to enhance operational efficiency across various industries.