Oil Gas Engineering Services Market Report

Published Date: 31 January 2026 | Report Code: oil-gas-engineering-services

Oil Gas Engineering Services Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Oil Gas Engineering Services market, including market size, trends, and forecasts from 2023 to 2033. Insights into region-specific dynamics, technology advancements, and major market players are also covered to guide strategic decision-making.

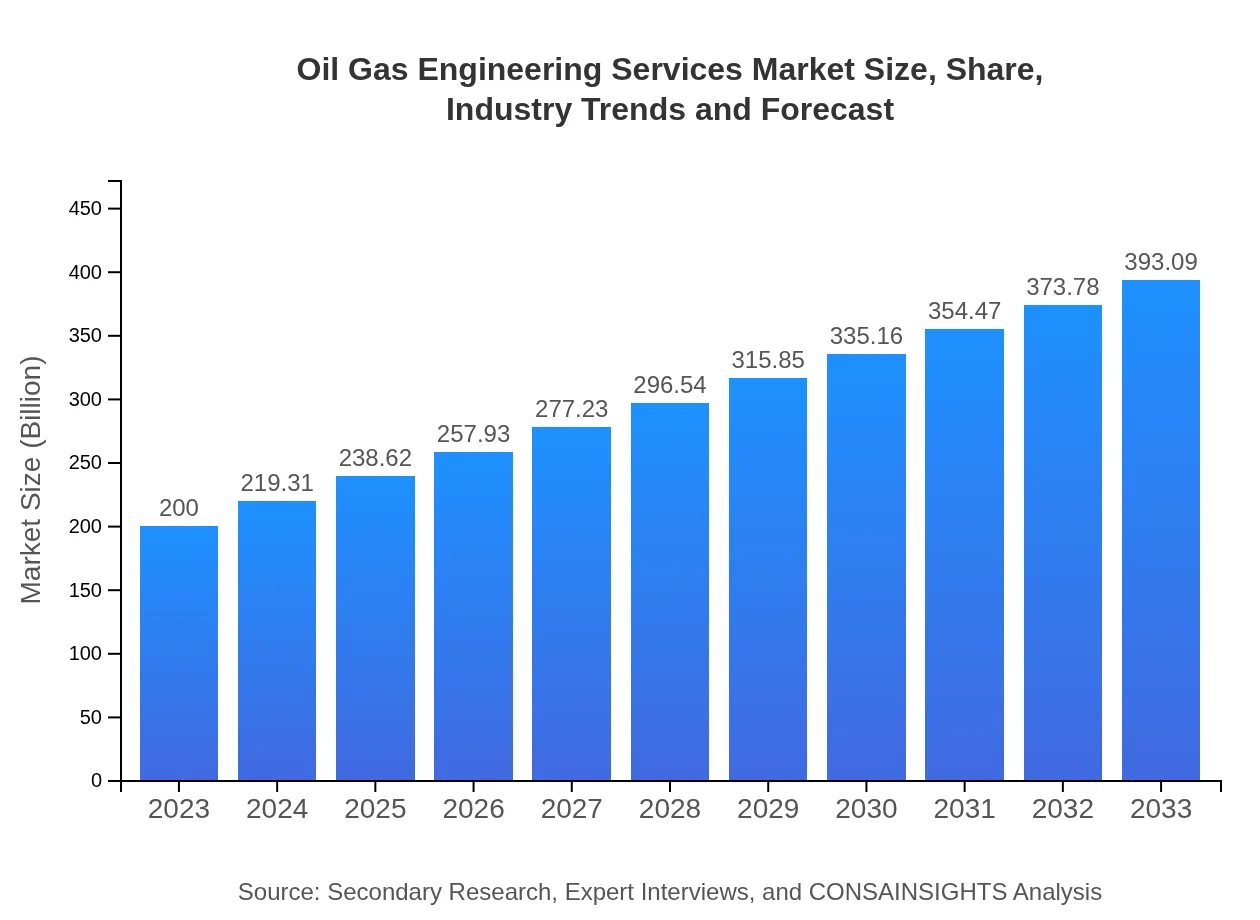

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $200.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $393.09 Billion |

| Top Companies | Schlumberger, Halliburton, Baker Hughes, Wood Group, TechnipFMC |

| Last Modified Date | 31 January 2026 |

Oil Gas Engineering Services Market Overview

Customize Oil Gas Engineering Services Market Report market research report

- ✔ Get in-depth analysis of Oil Gas Engineering Services market size, growth, and forecasts.

- ✔ Understand Oil Gas Engineering Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Oil Gas Engineering Services

What is the Market Size & CAGR of Oil Gas Engineering Services market in 2023?

Oil Gas Engineering Services Industry Analysis

Oil Gas Engineering Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Oil Gas Engineering Services Market Analysis Report by Region

Europe Oil Gas Engineering Services Market Report:

Europe's market for Oil Gas Engineering Services is estimated to grow from $55.04 billion in 2023 to $108.18 billion by 2033. A strong regulatory framework for carbon emissions and sustainable energy practices are driving investments in innovative engineering solutions, making Europe a hub for advanced technologies.Asia Pacific Oil Gas Engineering Services Market Report:

In 2023, the Asia Pacific region's Oil Gas Engineering Services market is valued at approximately $39.12 billion, projected to grow to $76.89 billion by 2033. This growth is driven by heightened energy demands and large-scale infrastructure developments in countries like China and India, emphasizing renewable energy projects alongside traditional oil and gas services.North America Oil Gas Engineering Services Market Report:

North America, currently valued at $75.08 billion in 2023, is projected to reach $147.56 billion by 2033. The U.S. dominates this region due to advanced technologies and infrastructure, alongside a growing trend towards energy independence and cleaner technologies. The shift towards renewables and natural gas plays a pivotal role.South America Oil Gas Engineering Services Market Report:

The South American market is expected to grow from $11.08 billion in 2023 to $21.78 billion by 2033. The region sees significant investments in oil exploration and production, especially in Brazil and Guyana, fostering robust demand for engineering services. The sector is gradually aligning with global standards for sustainability.Middle East & Africa Oil Gas Engineering Services Market Report:

The Middle East and Africa market is expected to see an increase from $19.68 billion in 2023 to $38.68 billion by 2033. The region is heavily reliant on oil exports, sustaining demand for engineering services. There's a notable emphasis on modernizing oil sectors while adhering to sustainability goals.Tell us your focus area and get a customized research report.

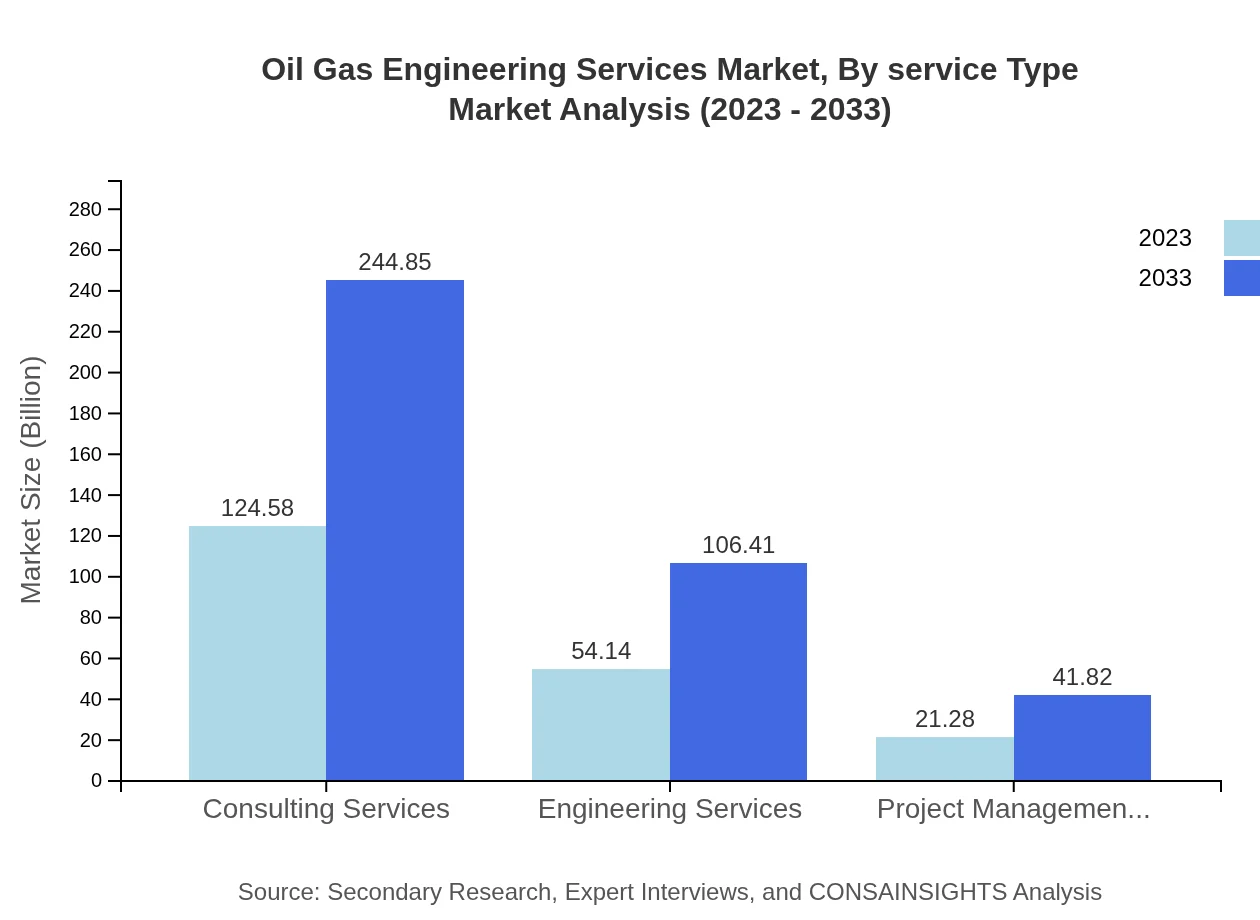

Oil Gas Engineering Services Market Analysis By Service Type

In the Oil Gas Engineering Services market, conventional technologies dominate the landscape, comprising approximately 62.29% of market share in 2023, projected to remain the same by 2033. Advanced technologies, growing in importance, are gaining market share from around 27.07% to the same figure in the future. Sustainable technologies, although currently smaller at 10.64%, are expected to become a focal point as industries pivot towards energy efficiency.

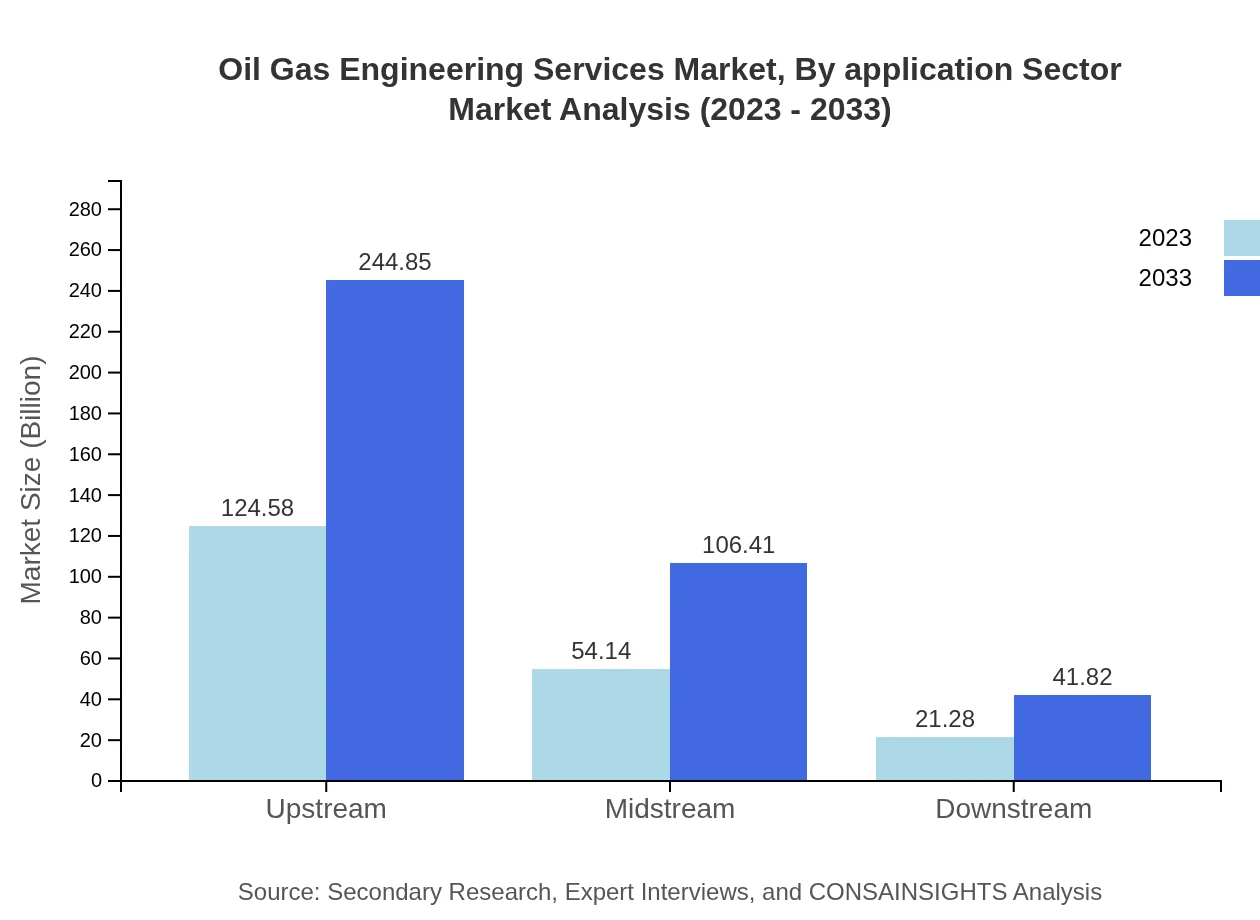

Oil Gas Engineering Services Market Analysis By Application Sector

The Oil Gas Engineering Services market is segmented across application sectors including upstream, midstream, and downstream, with upstream services taking the lion's share of 62.29% in 2023 and maintaining this proportion through 2033. Midstream applications are also significant, expected to grow steadily as infrastructure enhances, while downstream services will continue to be a crucial component rising from 10.64% to a stable state.

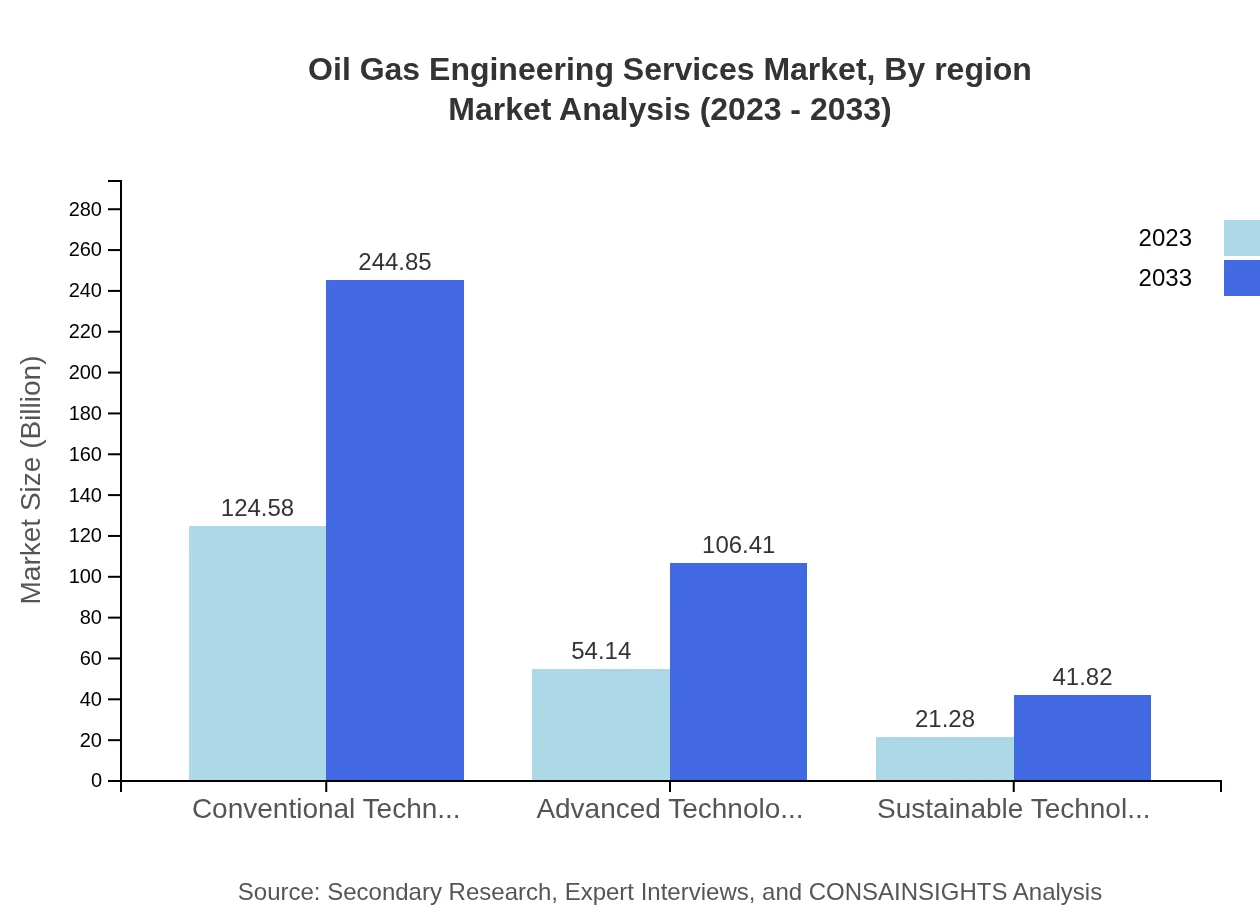

Oil Gas Engineering Services Market Analysis By Region

Technological advancements play a central role in the oil gas engineering services market. The adoption of digital tools, IoT, and automation technologies are reshaping traditional methodologies. This tech-driven transition fosters improved safety, operational efficiency, and data gathering, which are becoming vital for companies looking to thrive amid stringent regulations and cost pressures.

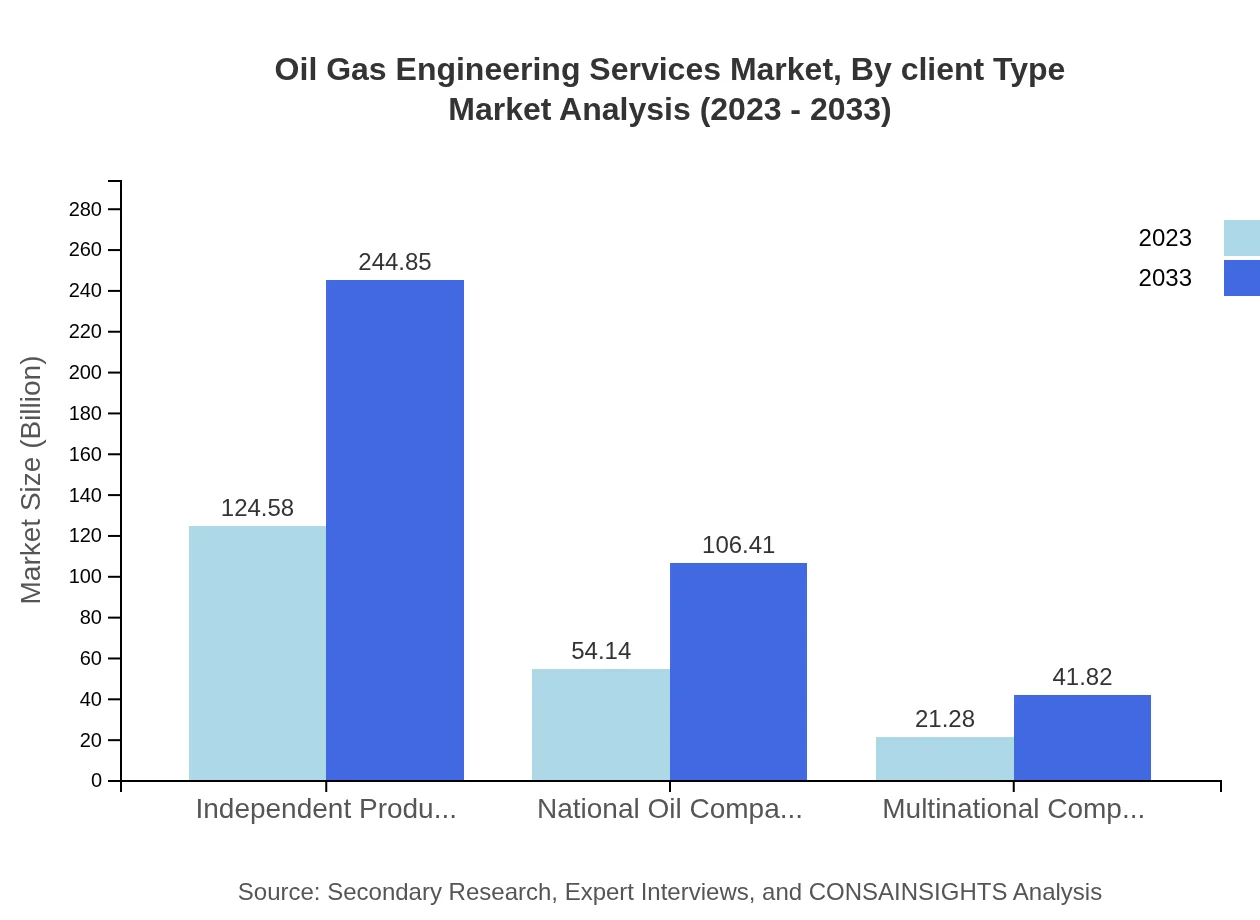

Oil Gas Engineering Services Market Analysis By Client Type

Clients in the Oil Gas Engineering Services market include independent producers, national oil companies, and multinational companies. Independent producers comprise about 62.29% of the market's client base in 2023, marking stability in demand as these players emphasize operational efficiencies. National oil companies and multinational firms are also significant, with growing needs for advanced technologies and efficient project management, projected to rise accordingly.

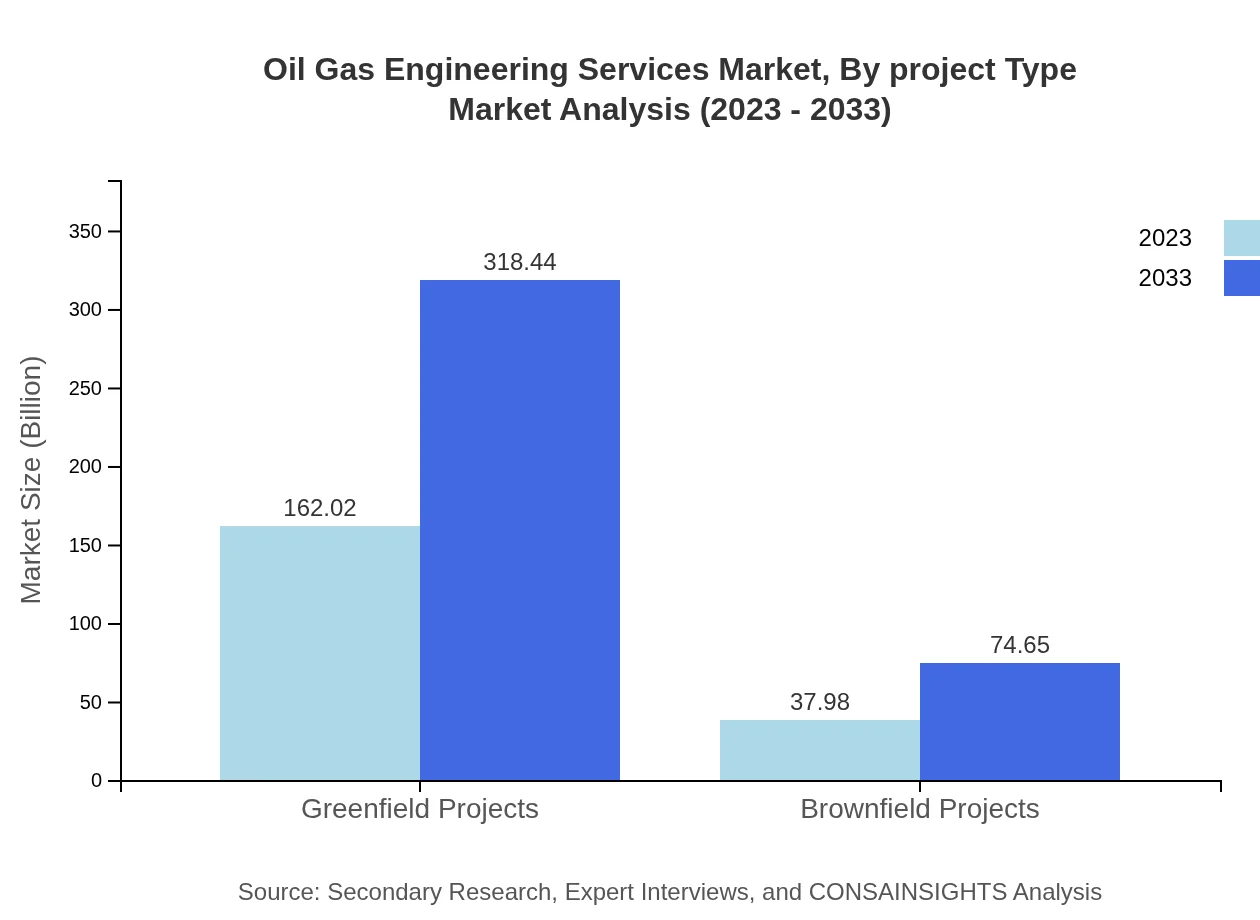

Oil Gas Engineering Services Market Analysis By Project Type

The segmentation of project types illustrates a major bifurcation between greenfield projects, which dominate at 81.01% market share, and brownfield projects which maintain an 18.99% share. The focus on new developments significantly impacts service demand, reflecting the global market's overarching trend of expansion and modernization efforts within the oil and gas realms.

Oil Gas Engineering Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Oil Gas Engineering Services Industry

Schlumberger:

As one of the largest oilfield services companies globally, Schlumberger offers a range of technologies, integrated project management services, and expertise across every phase of the oil and gas exploration lifecycle.Halliburton:

A major player in the oil and gas sector, Halliburton specializes in providing services and products for the exploration, development, and production of oil and natural gas.Baker Hughes:

Baker Hughes is known for its advanced technologies and services in the oil and gas sector, focusing on solving complex resource challenges through efficient engineering solutions.Wood Group:

Providing global engineering solutions, Wood Group excels in project management and technical consultancy for the oil and gas industries.TechnipFMC:

A leader in subsea engineering, TechnipFMC specializes in project delivery for the oil and gas sector, enhancing efficiency through innovative solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of Oil-Gas-Engineering-Services?

The current market size of Oil-Gas-Engineering-Services is estimated to be around $200 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.8% leading to significant growth in the coming years.

What are the key market players or companies in this Oil-Gas-Engineering-Services industry?

Key players in the Oil-Gas-Engineering-Services industry include large national oil companies, independent producers, multinational corporations, and firms specializing in engineering and consulting services. These entities drive innovation and sustain market growth.

What are the primary factors driving the growth in the Oil-Gas-Engineering-Services industry?

Growth in the Oil-Gas-Engineering-Services sector is primarily driven by rising energy demand, advancements in technology, increasing investment in infrastructure, and the shift towards sustainable energy solutions which enhance operational efficiencies.

Which region is the fastest Growing in the Oil-Gas-Engineering-Services?

The Asia Pacific region is currently the fastest-growing market for Oil-Gas-Engineering-Services, expected to expand from $39.12 billion in 2023 to $76.89 billion by 2033, reflecting a robust market opportunity.

Does ConsaInsights provide customized market report data for the Oil-Gas-Engineering-Services industry?

Yes, ConsaInsights offers customized market report data tailored to specific interests in the Oil-Gas-Engineering-Services sector, helping businesses gain insights suited to their strategic needs and market entry plans.

What deliverables can I expect from this Oil-Gas-Engineering-Services market research project?

Expect comprehensive deliverables including detailed market analysis reports, segment breakdowns, growth forecasts, competitive landscape assessments, and specific regional insights relevant to the Oil-Gas-Engineering-Services industry.

What are the market trends of Oil-Gas-Engineering-Services?

Current trends in the Oil-Gas-Engineering-Services market include a significant shift towards advanced and sustainable technologies, increasing focus on digital engineering solutions, and a heightened emphasis on environmental sustainability in engineering practices.