Oil Seed Crop Protection Chemicals Market Report

Published Date: 02 February 2026 | Report Code: oil-seed-crop-protection-chemicals

Oil Seed Crop Protection Chemicals Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Oil Seed Crop Protection Chemicals market, highlighting market trends, forecasts from 2023 to 2033, and insights into regional dynamics. It aims to equip stakeholders with valuable information for decision-making.

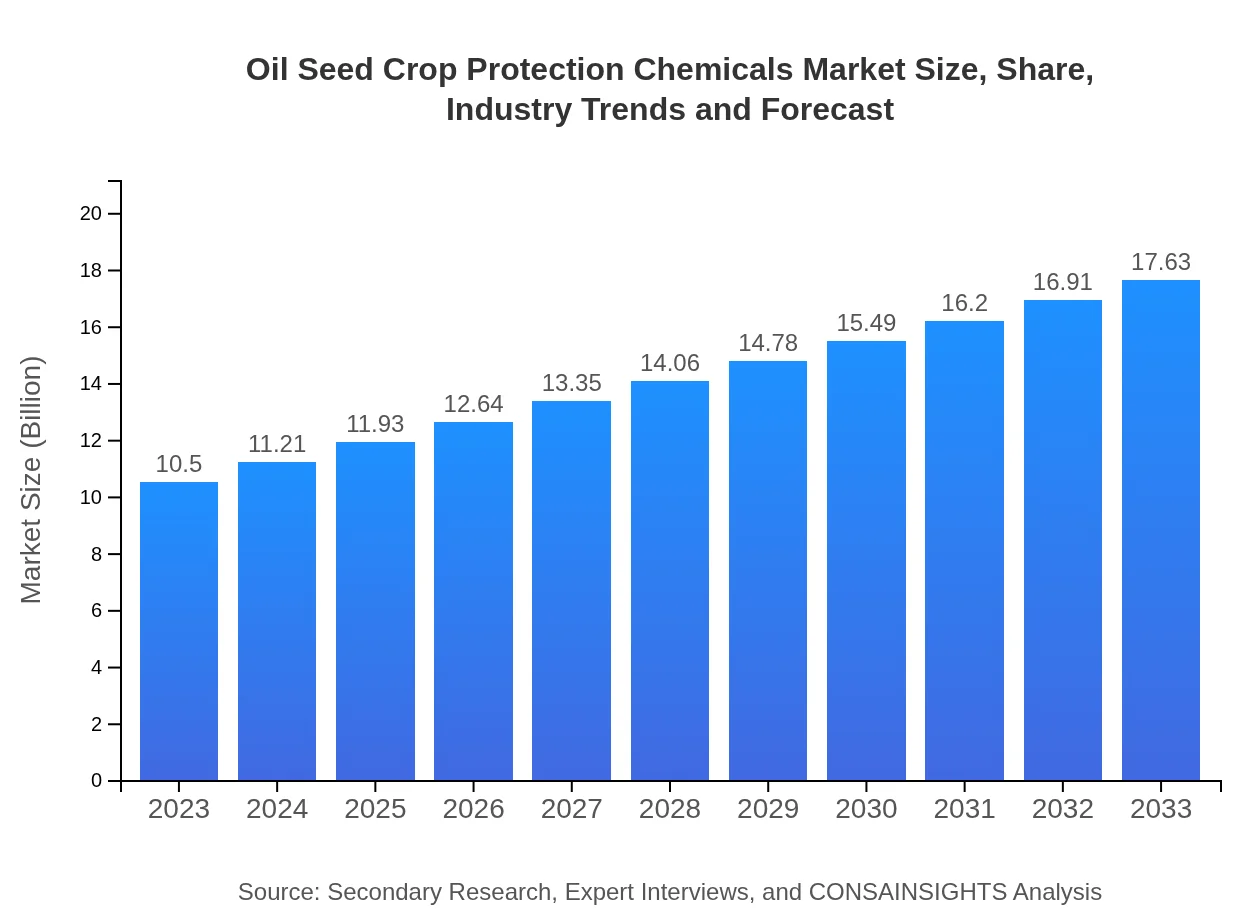

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $17.63 Billion |

| Top Companies | BASF SE, Syngenta AG, Corteva Agriscience, Bayer AG |

| Last Modified Date | 02 February 2026 |

Oil Seed Crop Protection Chemicals Market Overview

Customize Oil Seed Crop Protection Chemicals Market Report market research report

- ✔ Get in-depth analysis of Oil Seed Crop Protection Chemicals market size, growth, and forecasts.

- ✔ Understand Oil Seed Crop Protection Chemicals's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Oil Seed Crop Protection Chemicals

What is the Market Size & CAGR of Oil Seed Crop Protection Chemicals market in 2023?

Oil Seed Crop Protection Chemicals Industry Analysis

Oil Seed Crop Protection Chemicals Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Oil Seed Crop Protection Chemicals Market Analysis Report by Region

Europe Oil Seed Crop Protection Chemicals Market Report:

The European market shows a growth trajectory from $2.90 billion in 2023 to $4.87 billion by 2033. The European Union's regulations are pushing producers to seek sustainable crop protection methods, which is creating demand for bio-based protective solutions.Asia Pacific Oil Seed Crop Protection Chemicals Market Report:

In the Asia Pacific region, the Oil Seed Crop Protection Chemicals market is projected to grow from $2.12 billion in 2023 to $3.57 billion by 2033, fueled by increasing oilseed production and rising demands for modern agricultural practices. Countries like China and India are significant contributors, driven by the need to protect crops from prevalent pests.North America Oil Seed Crop Protection Chemicals Market Report:

North America leads the market, with an estimated value of $3.69 billion in 2023, rising to $6.19 billion in 2033. The US and Canada play pivotal roles, influenced by advanced agricultural practices and significant investments in crop research and action against pests.South America Oil Seed Crop Protection Chemicals Market Report:

The South American market is expected to increase from $1.00 billion in 2023 to $1.69 billion by 2033. This growth is largely supported by the expansion of soybean production, especially in Brazil and Argentina, where farmers are adopting advanced crop protection chemicals for better yield.Middle East & Africa Oil Seed Crop Protection Chemicals Market Report:

The Middle East and Africa markets are expected to rise from $0.78 billion in 2023 to $1.31 billion by 2033, stimulated by increased agricultural activities and government initiatives aimed at boosting agricultural productivity in the region.Tell us your focus area and get a customized research report.

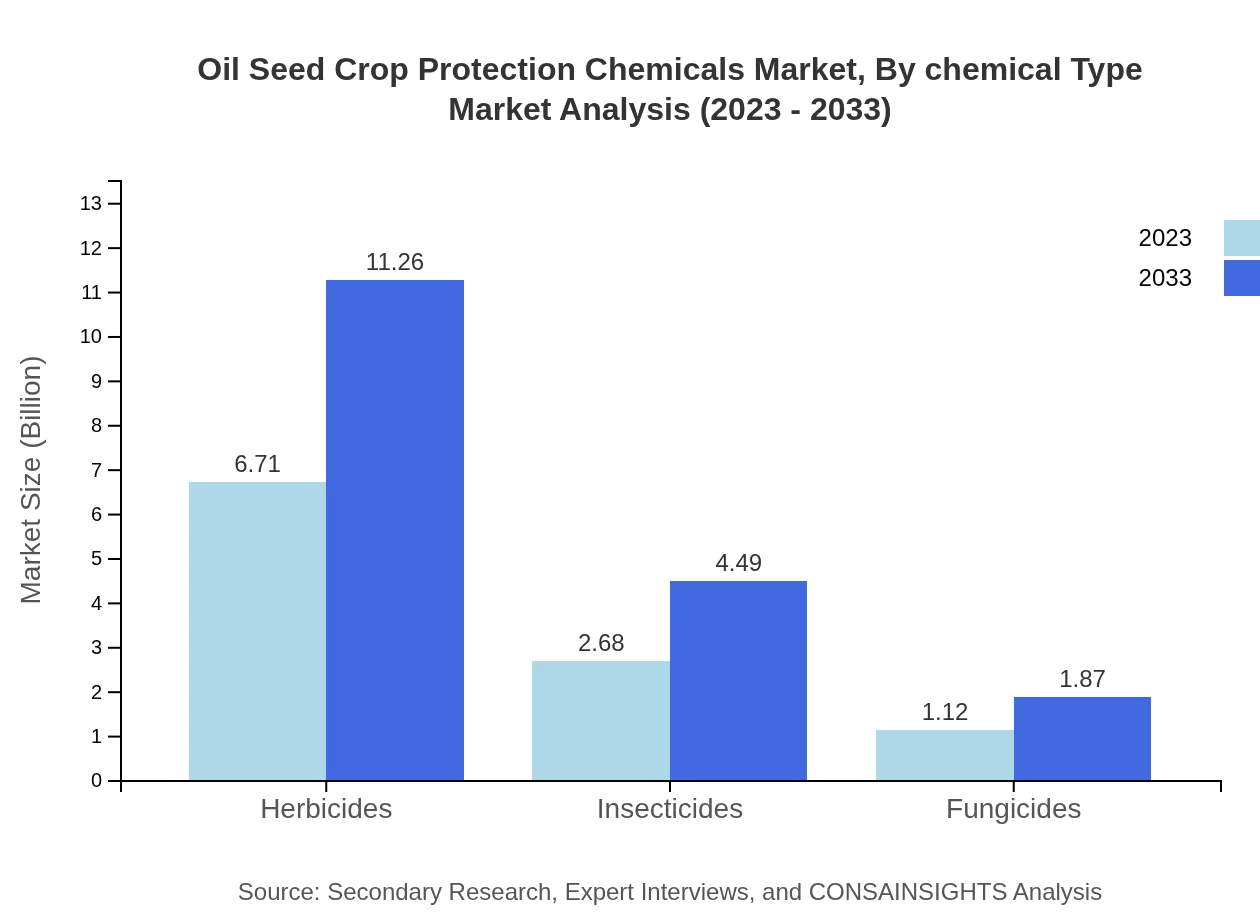

Oil Seed Crop Protection Chemicals Market Analysis By Chemical Type

The market is primarily composed of herbicides, insecticides, and fungicides, with herbicides holding the largest market share at 63.9% in 2023, valued at $6.71 billion, projected to grow to $11.26 billion by 2033. Insecticides and fungicides represent significant segments as well, with respective market sizes of $2.68 billion and $1.12 billion in 2023.

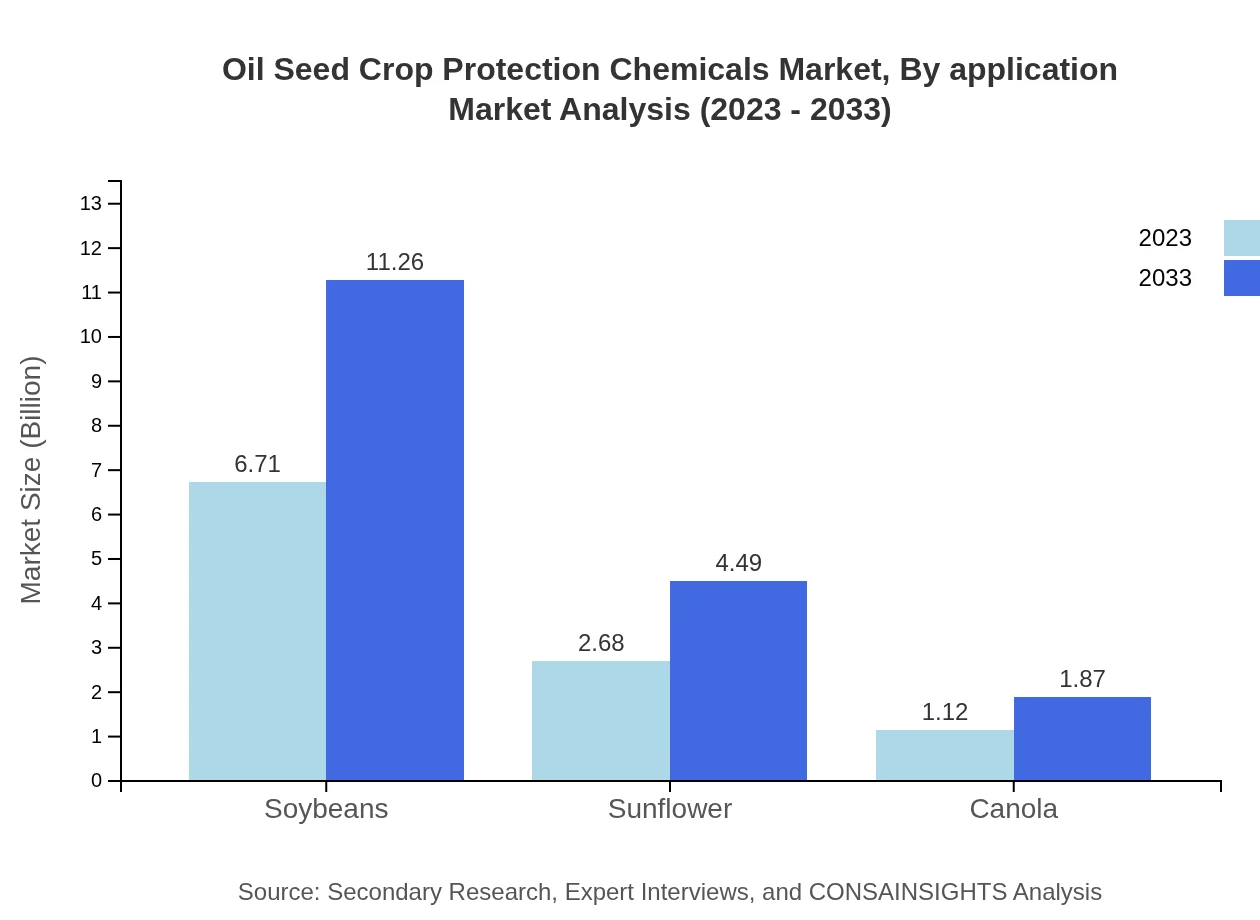

Oil Seed Crop Protection Chemicals Market Analysis By Application

The primary application of oil seed crop protection chemicals serves farmers, who command an 85.56% share of the market, translating to a size of $8.98 billion in 2023, expected to exceed $15.08 billion by 2033.

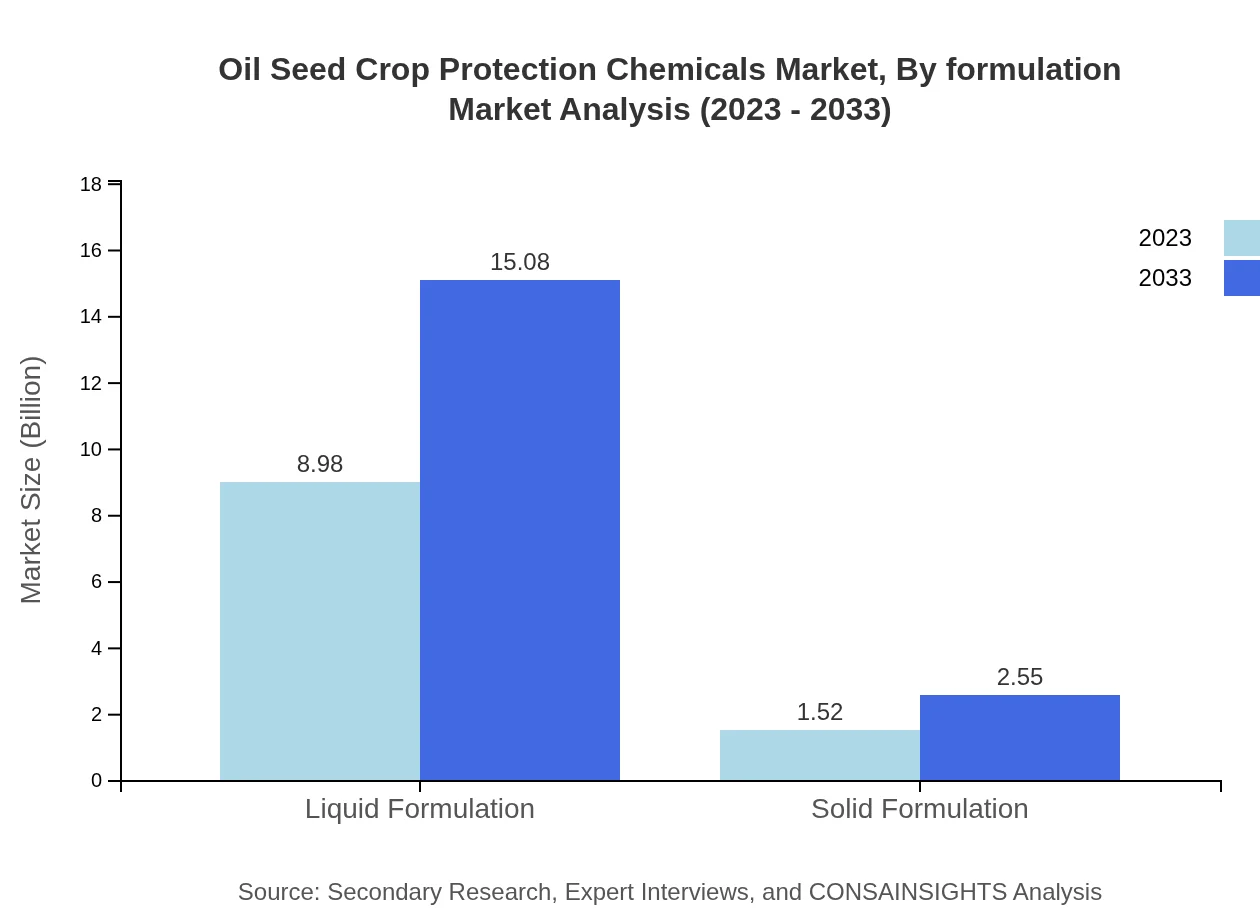

Oil Seed Crop Protection Chemicals Market Analysis By Formulation

The liquid formulation segment dominates the market, accounting for 85.56% of sales. In 2023, liquid formulations are valued at $8.98 billion, with projected growth to $15.08 billion by 2033. Solid formulations, while smaller at $1.52 billion in 2023 (14.44% share), are expected to increase to $2.55 billion by 2033.

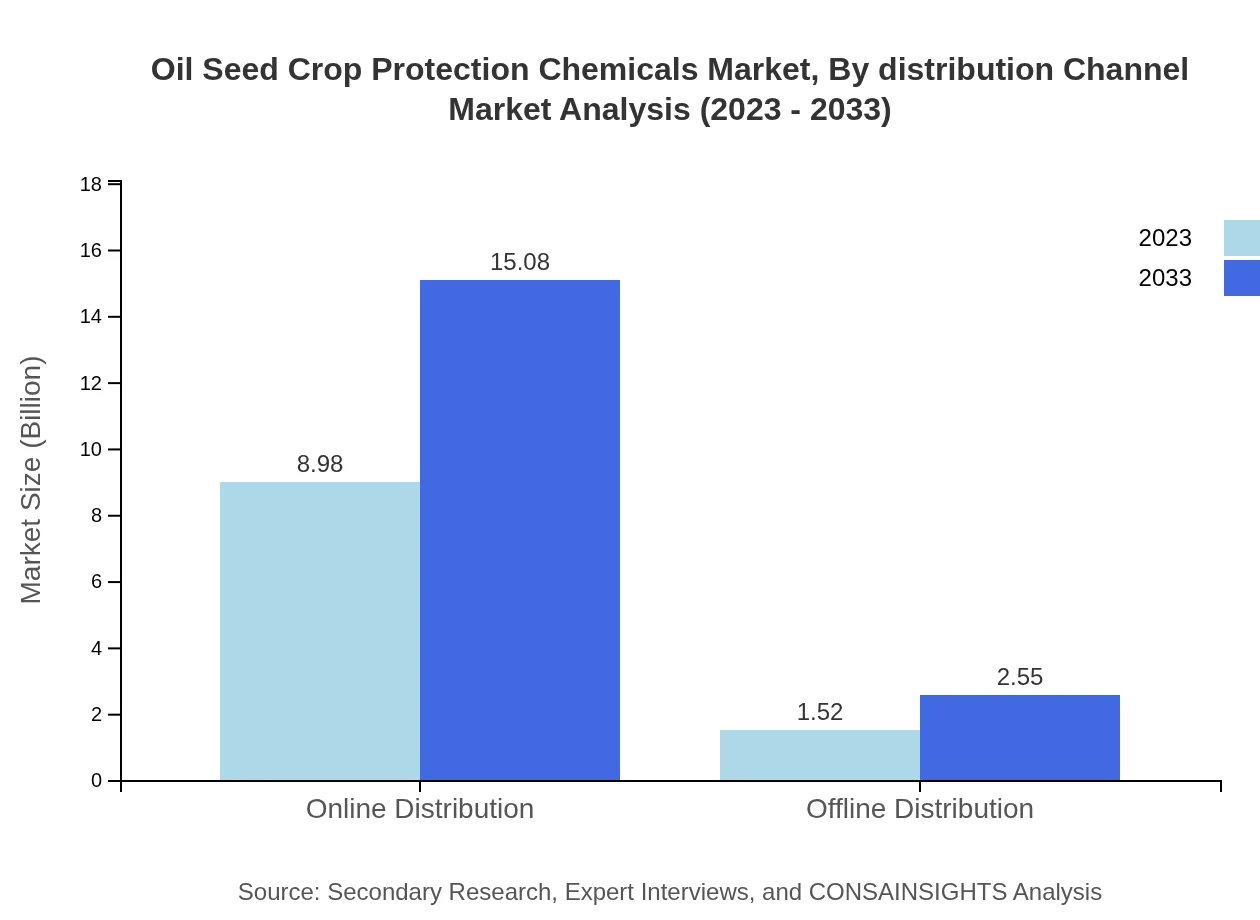

Oil Seed Crop Protection Chemicals Market Analysis By Distribution Channel

Distribution channels are primarily divided into online and offline segments. Online sales are expected to grow significantly, from $8.98 billion in 2023 to $15.08 billion by 2033, reflecting a shift in buying preferences amongst farmers and agricultural companies.

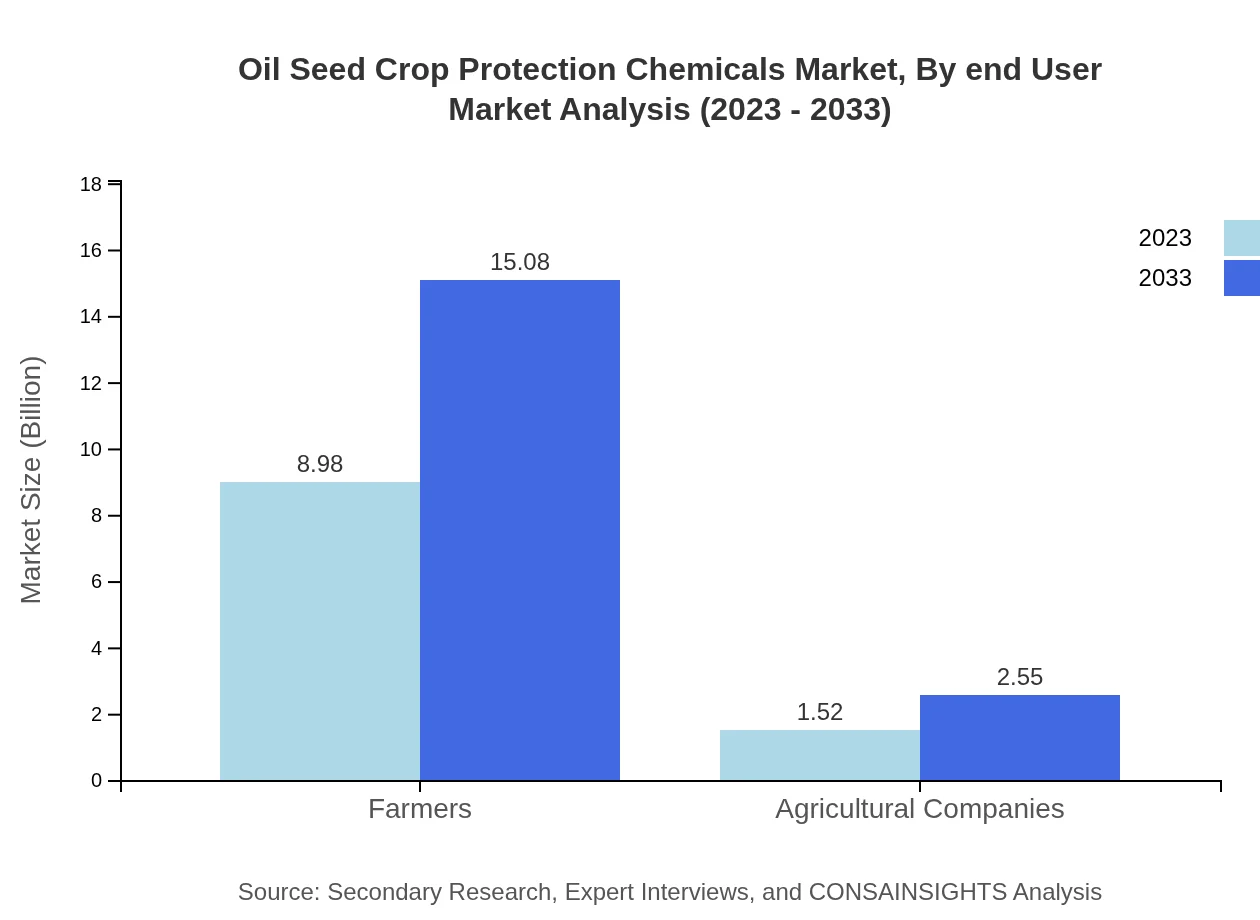

Oil Seed Crop Protection Chemicals Market Analysis By End User

The market's end-users include farmers and agricultural companies. Farmers hold a significant share whereas agricultural companies account for a smaller share of up to 14.44%, valued at $1.52 billion in 2023 and poised to grow to $2.55 billion by 2033.

Oil Seed Crop Protection Chemicals Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Oil Seed Crop Protection Chemicals Industry

BASF SE:

A leading chemical company that develops crop protection solutions designed to protect oilseed crops, known for their innovation and sustainability approach.Syngenta AG:

A top global agribusiness that is heavily involved in the production of crop protection products and seeds, significantly impacting the oilseed sector.Corteva Agriscience:

A pioneer in agricultural chemicals aiming to fortify agricultural sustainability while enhancing crop productivity, influencing the oilseed market.Bayer AG:

A global leader in crop protection products, offering a range of solutions tailored for oilseed crops, focusing on innovation and environmental stewardship.We're grateful to work with incredible clients.

FAQs

What is the market size of oil Seed Crop Protection Chemicals?

The global market size for oil-seed crop protection chemicals is projected at $10.5 billion in 2023, with a CAGR of 5.2% expected until 2033, reflecting steady growth driven by increasing agricultural demand.

What are the key market players or companies in this oil Seed Crop Protection Chemicals industry?

Key players in the oil-seed crop protection chemicals market include multinational companies such as BASF, Bayer CropScience, Syngenta, Corteva Agriscience, and FMC Corporation, which dominate through extensive product portfolios and innovative solutions.

What are the primary factors driving the growth in the oil Seed Crop Protection Chemicals industry?

Growth drivers for the oil-seed crop protection chemicals market include rising global food demand, increasing adoption of advanced agricultural practices, the need for high-yield crop varieties, and stringent pest control regulations fostering innovation in crop protection solutions.

Which region is the fastest Growing in the oil Seed Crop Protection Chemicals?

The fastest-growing region for oil-seed crop protection chemicals is North America, forecasted to expand from $3.69 billion in 2023 to $6.19 billion by 2033, attributed to advanced farming techniques and robust agricultural infrastructure.

Does Consainsights provide customized market report data for the oil Seed Crop Protection Chemicals industry?

Yes, Consainsights offers customized market report data for the oil-seed crop protection chemicals industry, providing tailored insights and analysis to meet specific client needs and industry requirements.

What deliverables can I expect from this oil Seed Crop Protection Chemicals market research project?

Deliverables from the oil-seed crop protection chemicals market research project include comprehensive market analysis reports, detailed segment data, competitive landscape assessments, and forecasts on market trends and growth drivers.

What are the market trends of oil Seed Crop Protection Chemicals?

Market trends in oil-seed crop protection chemicals show a shift towards sustainable practices, increased investment in bio-based products, advanced formulations such as liquid and solid forms, and growth in online distribution channels enhancing market accessibility.