Oilseed Farming Market Report

Published Date: 02 February 2026 | Report Code: oilseed-farming

Oilseed Farming Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Oilseed Farming market, focusing on the trends, forecasts, and regional dynamics from 2023 to 2033. Insights on market size, growth factors, industry challenges, and key players are highlighted to inform strategic decision-making.

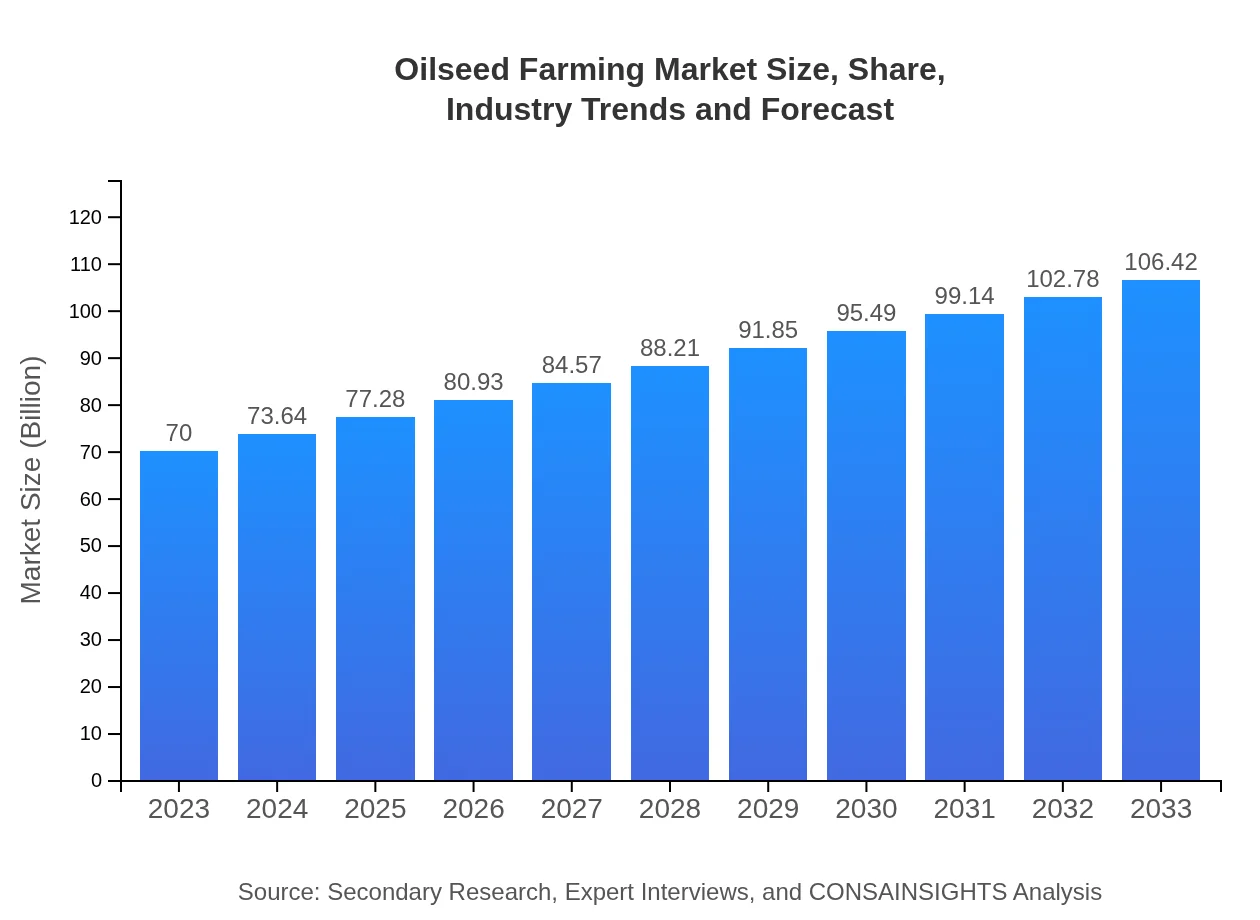

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $70.00 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $106.42 Billion |

| Top Companies | Cargill Incorporated, Bunge Limited, Archer-Daniels-Midland Company (ADM), Louis Dreyfus Company, Olam Group |

| Last Modified Date | 02 February 2026 |

Oilseed Farming Market Overview

Customize Oilseed Farming Market Report market research report

- ✔ Get in-depth analysis of Oilseed Farming market size, growth, and forecasts.

- ✔ Understand Oilseed Farming's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Oilseed Farming

What is the Market Size & CAGR of Oilseed Farming market in 2023?

Oilseed Farming Industry Analysis

Oilseed Farming Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Oilseed Farming Market Analysis Report by Region

Europe Oilseed Farming Market Report:

Europe's Oilseed Farming market is expected to grow from $24.56 billion in 2023 to $37.33 billion by 2033. The European Union's policies supporting sustainable agriculture and biofuel production are driving sector growth. Germany and France lead the rapeseed production efforts in this region.Asia Pacific Oilseed Farming Market Report:

The Asia Pacific region holds a significant share of the Oilseed Farming market, with a market size of $13.17 billion in 2023, projected to grow to $20.02 billion by 2033. Key countries, including China and India, are major contributors, utilizing advanced agricultural techniques and favorable climatic conditions to boost yields.North America Oilseed Farming Market Report:

North America, valued at $22.61 billion in 2023, is projected to expand to $34.37 billion by 2033. The United States dominates this market, leveraging advanced technologies in farming and high demand for both edible oils and biofuels. The integration of technology is enhancing productivity and sustainability in the region.South America Oilseed Farming Market Report:

South America, with a market value of $2.66 billion in 2023, is expected to reach $4.04 billion by 2033, primarily driven by Brazil's substantial soybean production. This region benefits from vast arable land and investments in sustainable farming practices, making it a key player in the global oilseed trade.Middle East & Africa Oilseed Farming Market Report:

The market in the Middle East and Africa is projected to grow from $7.01 billion in 2023 to $10.65 billion by 2033. The expansion is driven by the rising demand for vegetable oils and protein sources in food. Countries like South Africa and Nigeria are making strides in oilseed cultivation to enhance food security.Tell us your focus area and get a customized research report.

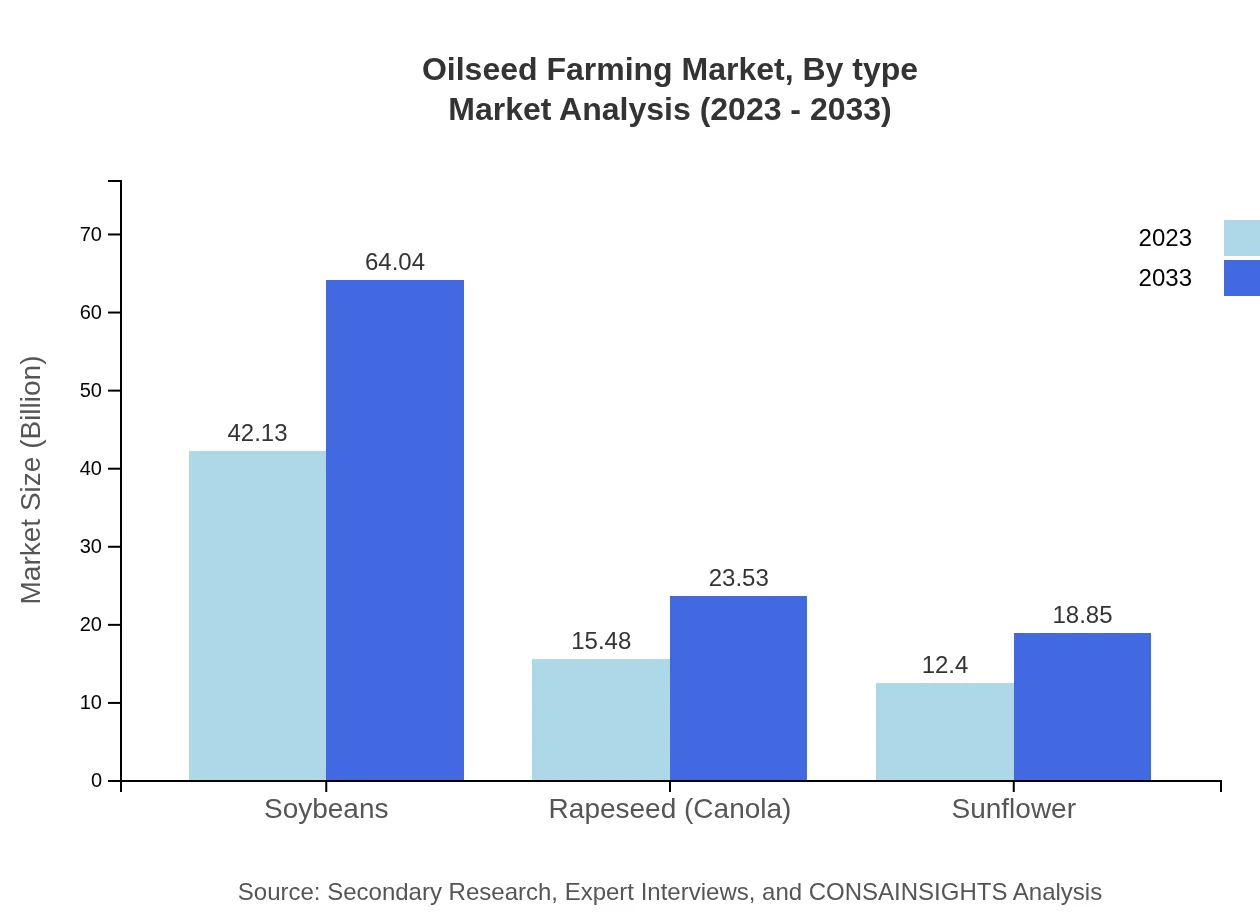

Oilseed Farming Market Analysis By Type

In terms of type: - **Soybeans**: The largest segment with a market size of $42.13 billion in 2023, projected to reach $64.04 billion by 2033, holding a 60.18% market share through the forecast period. - **Rapeseed (Canola)**: Expected to grow from $15.48 billion in 2023 to $23.53 billion in 2033, maintaining a 22.11% share. - **Sunflower**: Anticipated to grow from $12.40 billion in 2023 to $18.85 billion by 2033, representing a 17.71% market share.

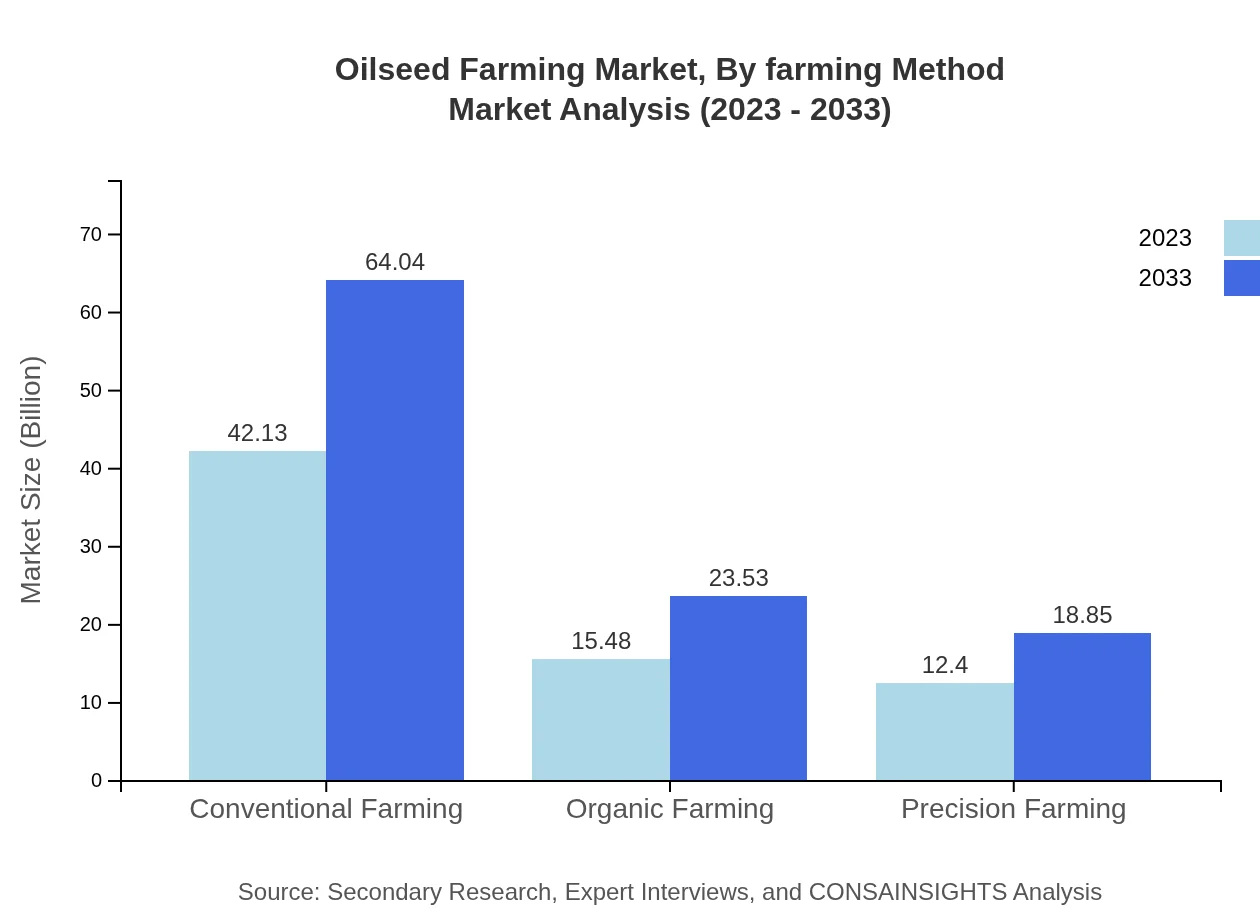

Oilseed Farming Market Analysis By Farming Method

Key farming methods include: - **Conventional Farming**: Dominates with a market size of $42.13 billion in 2023, projected to grow to $64.04 billion by 2033, maintaining a 60.18% share. - **Organic Farming**: Expected to increase from $15.48 billion in 2023 to $23.53 billion in 2033, capturing a 22.11% share. - **Precision Farming**: Forecasted to grow from $12.40 billion in 2023 to $18.85 billion by 2033, with a 17.71% market share.

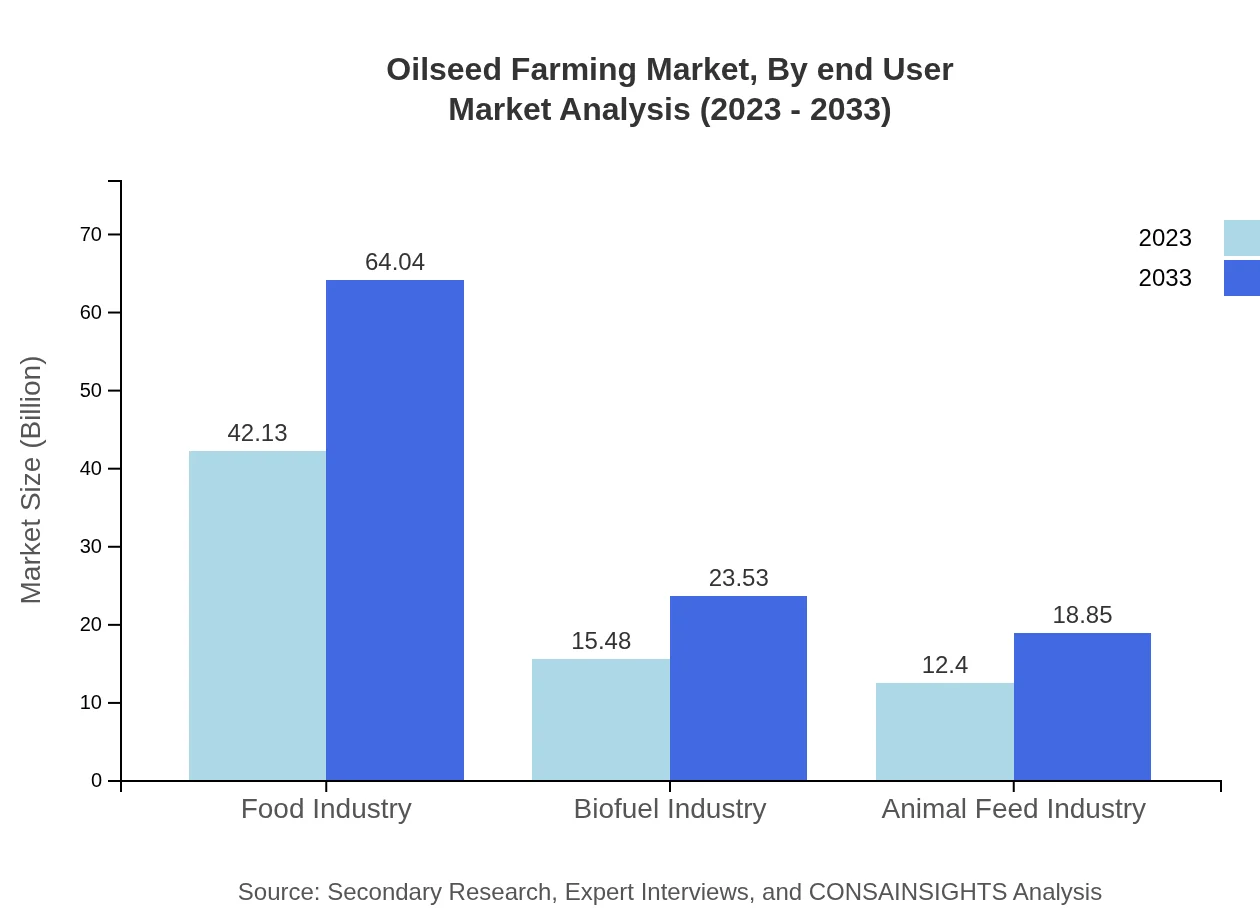

Oilseed Farming Market Analysis By End User

End-user segments include: - **Food Industry**: The leading segment valued at $42.13 billion in 2023, expected to rise to $64.04 billion by 2033, holding a 60.18% market share. - **Biofuel Industry**: Forecasted to grow from $15.48 billion in 2023 to $23.53 billion by 2033, with a 22.11% share. - **Animal Feed Industry**: Expected to rise from $12.40 billion in 2023 to $18.85 billion by 2033, capturing a 17.71% share.

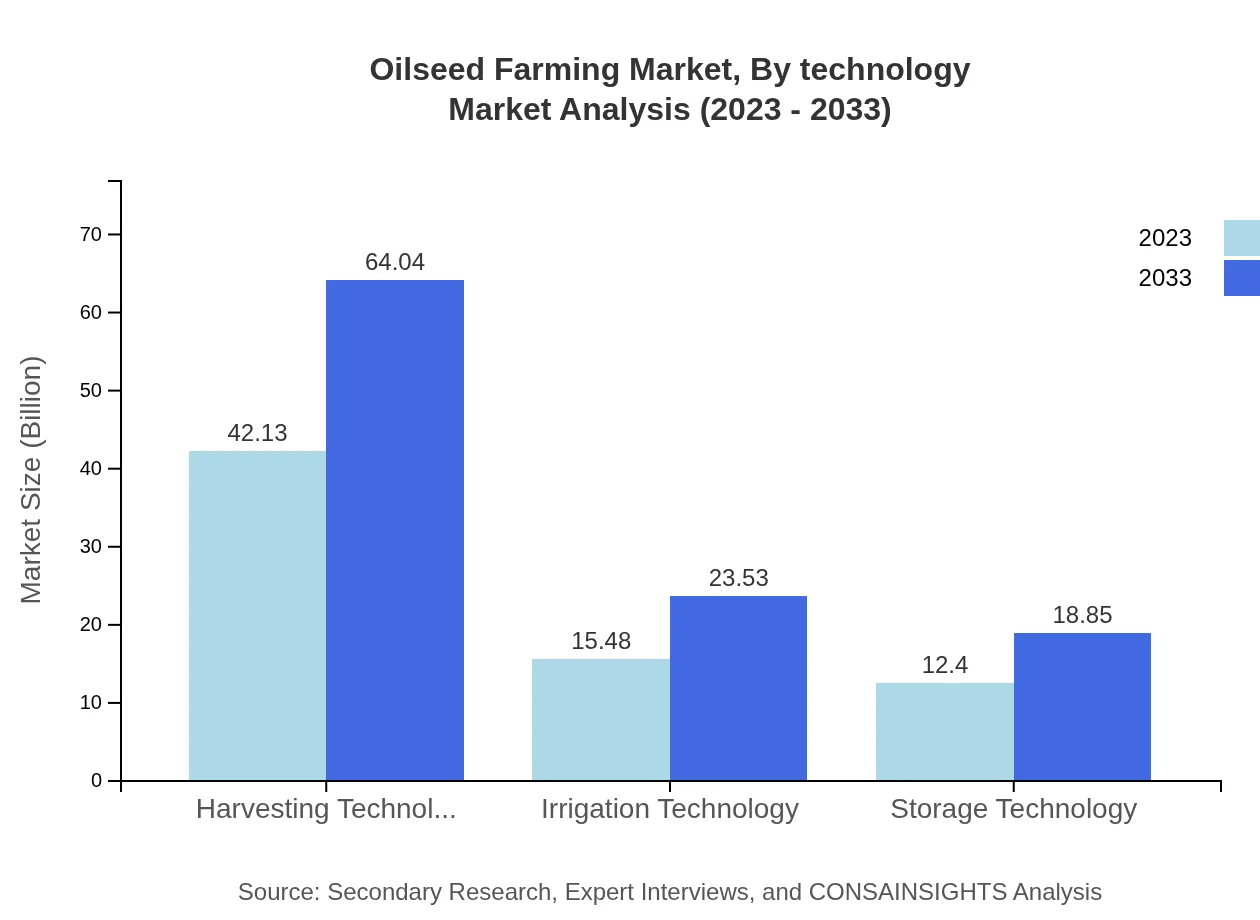

Oilseed Farming Market Analysis By Technology

Technological segments play a crucial role: - **Harvesting Technology**: Leading the market with a size of $42.13 billion in 2023, expected to reach $64.04 billion by 2033. - **Irrigation Technology**: Projected to grow from $15.48 billion in 2023 to $23.53 billion by 2033. - **Storage Technology**: Expected to grow from $12.40 billion in 2023 to $18.85 billion by 2033.

Oilseed Farming Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Oilseed Farming Industry

Cargill Incorporated:

A leader in the agricultural sector, specializing in the production and marketing of oilseeds and related products, contributing significantly to both food and biofuel sectors.Bunge Limited:

A key player in oilseed processing, Bunge operates globally with a focus on sustainable agricultural practices and innovation in oilseed farming technologies.Archer-Daniels-Midland Company (ADM):

A major contributor in the oilseeds processing sector, ADM offers various products derived from oilseeds, demonstrating advances in crop technology and production efficiency.Louis Dreyfus Company:

This global merchant and processor of agricultural goods focuses on efficiently sourcing, producing, and marketing oilseeds and their derivatives on a large scale.Olam Group:

Olam is a global leader in transforming the agriculture supply chain, focusing on sustainable practices in oilseed farming and processing across multiple regions.We're grateful to work with incredible clients.

FAQs

What is the market size of oilseed Farming?

The global oilseed farming market is currently valued at approximately $70 billion, with a projected CAGR of 4.2% from 2023 to 2033, indicating continual growth driven by rising demand for oilseeds globally.

What are the key market players or companies in the oilseed Farming industry?

Key players in the oilseed farming industry include major agribusinesses, seed companies, and distributors such as Cargill, Archer Daniels Midland Company, Bunge Limited, and BASF, which dominate various segments of the market.

What are the primary factors driving the growth in the oilseed farming industry?

Growth in the oilseed farming industry is driven by increased global demand for edible oils, animal feed, and biofuels, as well as advancements in agricultural technology and practices that enhance productivity and yield.

Which region is the fastest Growing in the oilseed farming market?

The fastest-growing market for oilseed farming is projected to be Europe, with market size growing from $24.56 billion in 2023 to $37.33 billion by 2033, highlighting significant opportunities in this region.

Does ConsaInsights provide customized market report data for the oilseed farming industry?

Yes, ConsaInsights offers customized market report data for the oilseed farming industry, allowing clients to gain tailored insights that cater to specific interests and regional market dynamics.

What deliverables can I expect from this oilseed farming market research project?

Deliverables from the oilseed farming market research project typically include detailed market analysis reports, forecasts, competitive landscape assessments, segment insights, and strategic recommendations.

What are the market trends of oilseed farming?

Key trends in the oilseed farming market include the rise of precision farming, increasing preference for organic farming, advancements in irrigation technology, and growing demand for biofuels, shaping the industry's future.