Oilseed Processing Market Report

Published Date: 02 February 2026 | Report Code: oilseed-processing

Oilseed Processing Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Oilseed Processing market, covering key insights, trends, and data from 2023 to 2033. It includes market size assessments, industry analysis, regional insights, and forecasts for future growth.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

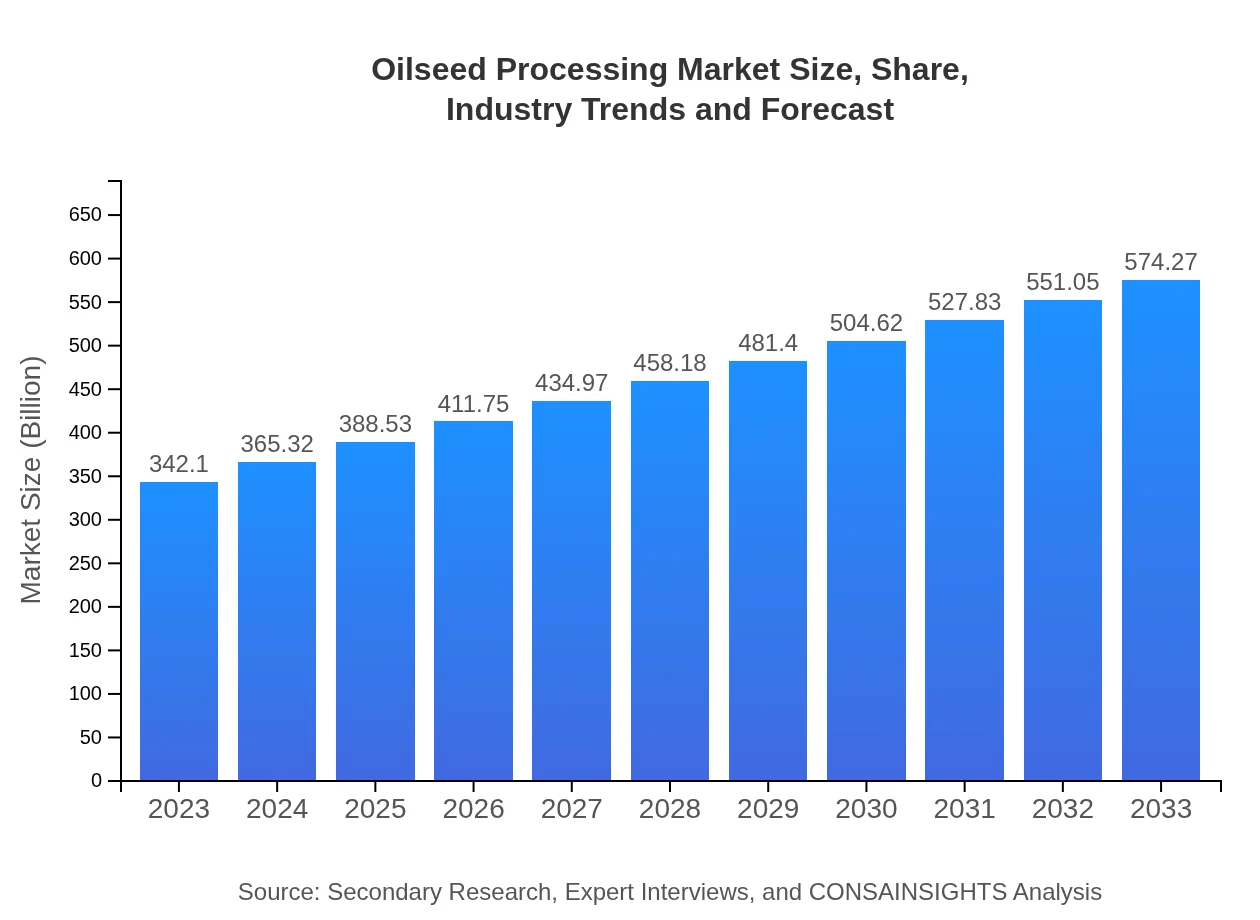

| 2023 Market Size | $342.10 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $574.27 Billion |

| Top Companies | Cargill, Incorporated, Archer Daniels Midland Company (ADM), Bunge Limited, Louis Dreyfus Company |

| Last Modified Date | 02 February 2026 |

Oilseed Processing Market Overview

Customize Oilseed Processing Market Report market research report

- ✔ Get in-depth analysis of Oilseed Processing market size, growth, and forecasts.

- ✔ Understand Oilseed Processing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Oilseed Processing

What is the Market Size & CAGR of Oilseed Processing market in 2023?

Oilseed Processing Industry Analysis

Oilseed Processing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Oilseed Processing Market Analysis Report by Region

Europe Oilseed Processing Market Report:

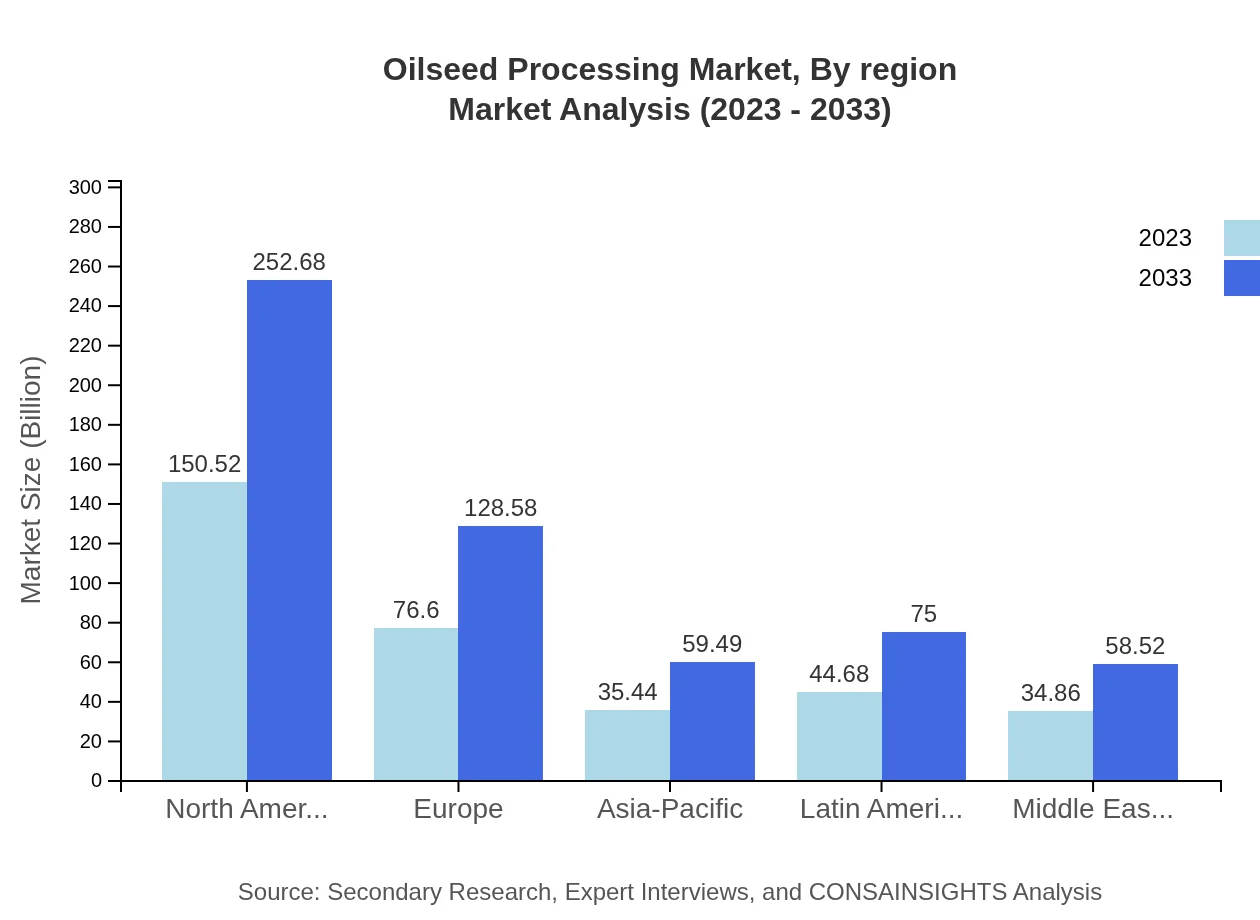

In Europe, the oilseed processing market is projected to rise from $85.87 billion in 2023 to $144.14 billion by 2033. Increasing health awareness among consumers combined with a demand for biofuels is propelling the market. European policies promoting renewable energy are considerably supporting the growth of biofuel production from oilseeds, enhancing the region's position in the global oilseed landscape.Asia Pacific Oilseed Processing Market Report:

The Asia Pacific region is witnessing rapid growth in the oilseed processing market, projected to reach approximately $121.34 billion by 2033, up from $72.29 billion in 2023. This growth is attributed to a rising population, increasing disposable incomes, and heightened consumption of oils and meals across food and feed sectors. Countries like China and India are pivotal facilitators of this growth, leveraging advancements in agricultural technology and processing methods.North America Oilseed Processing Market Report:

The North American oilseed processing market is expected to grow from $132.43 billion in 2023 to $222.30 billion by 2033. The U.S. leads this growth, with a focus on sustainable practices, high-quality meal production for livestock, and significant investments in R&D. The region's robust regulatory environment foster innovation and competitiveness, catering to both domestic and international markets in the oil and meal sectors.South America Oilseed Processing Market Report:

South America, particularly Brazil and Argentina, continues to be a powerhouse in oilseed production and processing. Its market size is anticipated to grow from $31.10 billion in 2023 to $52.20 billion in 2033, driven by expanding export markets and increasing domestic consumption of vegetable oils. Moreover, sustainable farming practices and governmental support play a role in enhancing market capacities in this region.Middle East & Africa Oilseed Processing Market Report:

The Middle East and Africa oilseed processing market is forecasted to escalate from $20.42 billion in 2023 to $34.28 billion by 2033. This region is experiencing growth due to increasing urbanization and food demand, alongside initiatives for food security. Investments in processing capacities and technological advancements are vital in responding to the rising needs of the population.Tell us your focus area and get a customized research report.

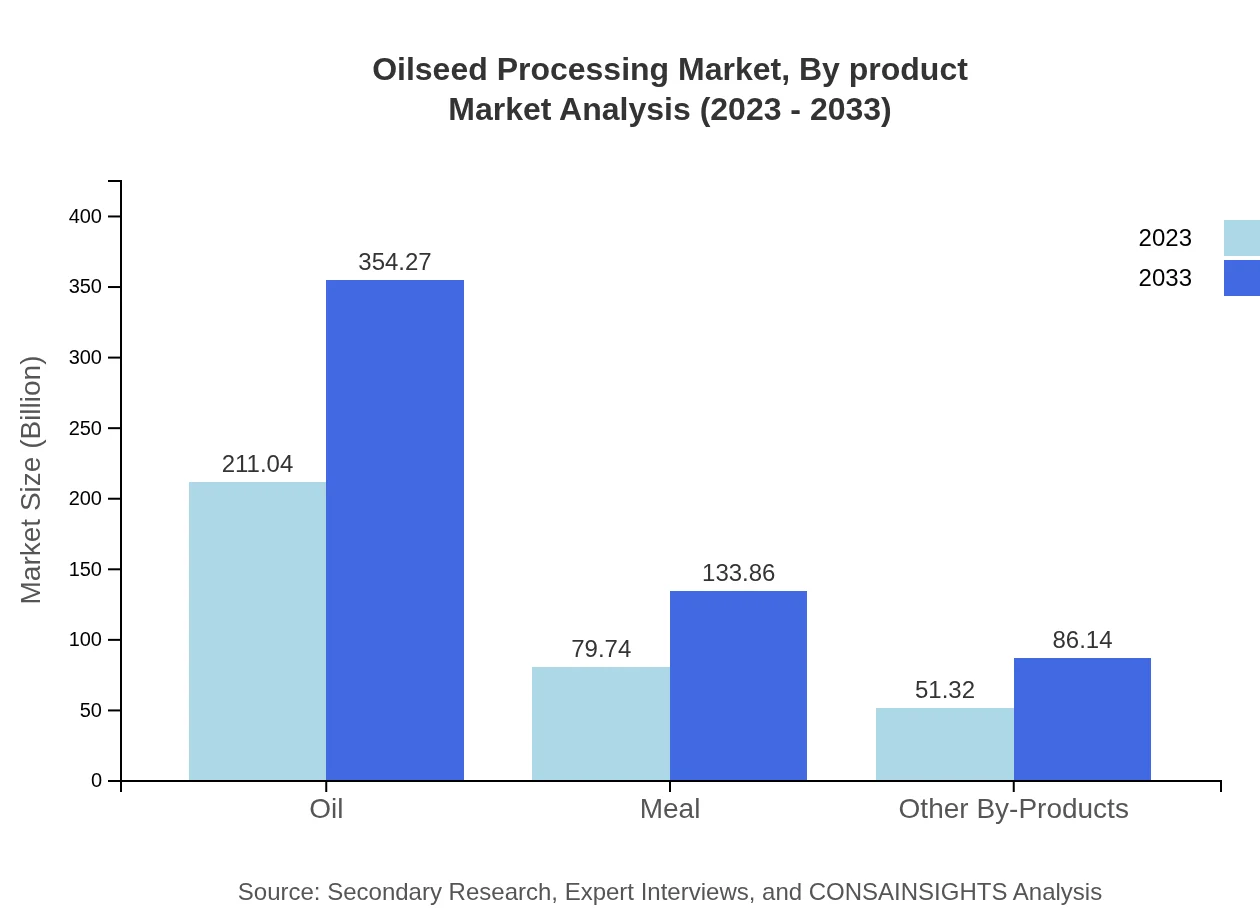

Oilseed Processing Market Analysis By Product

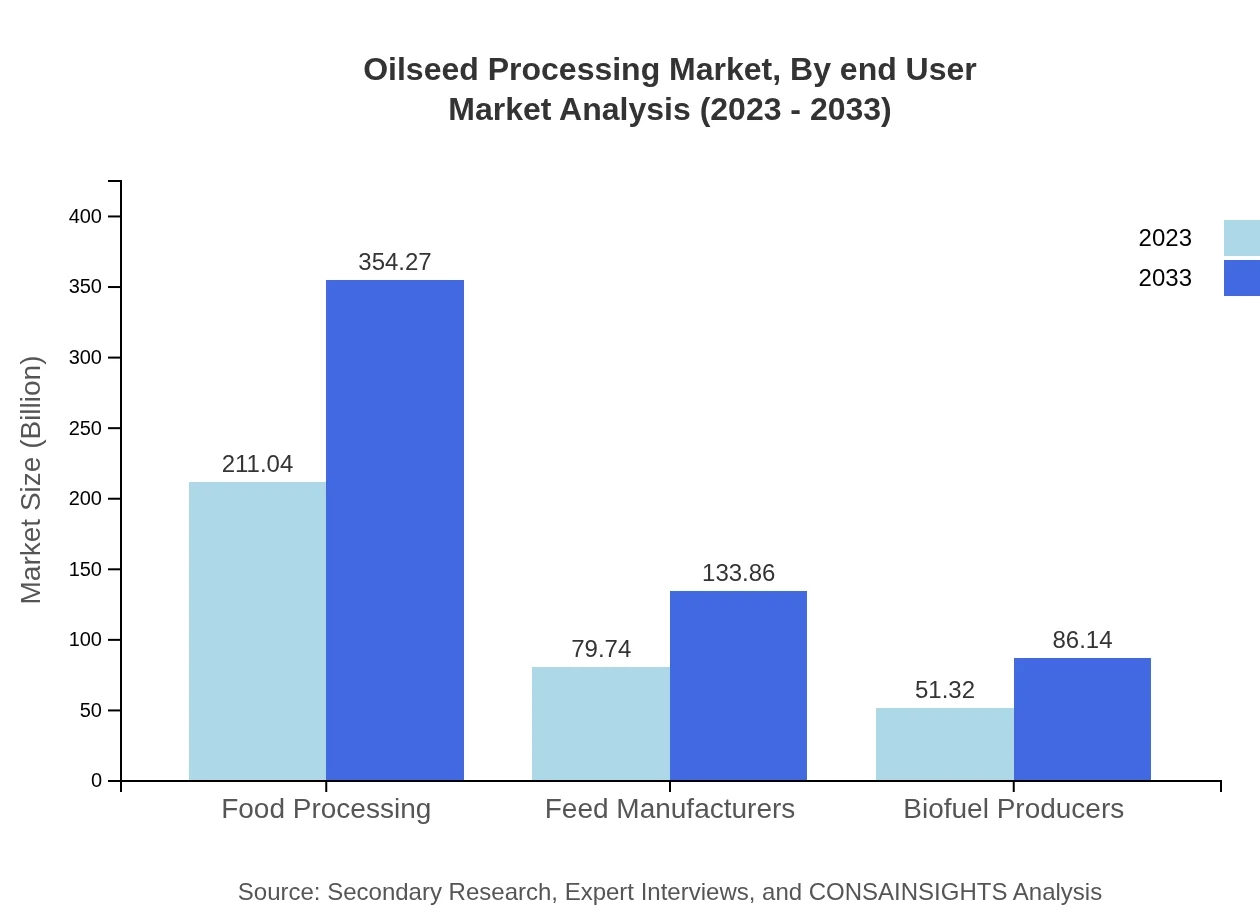

In 2023, the crude oil segment dominates the market, valued at $211.04 billion, while protein meals account for $79.74 billion. By 2033, crude oil is expected to reach $354.27 billion, maintaining a 61.69% market share, while protein meals will grow to $133.86 billion, representing 23.31%. Other by-products are also forecasted to rise significantly as consumers embrace diverse culinary and nutritional applications.

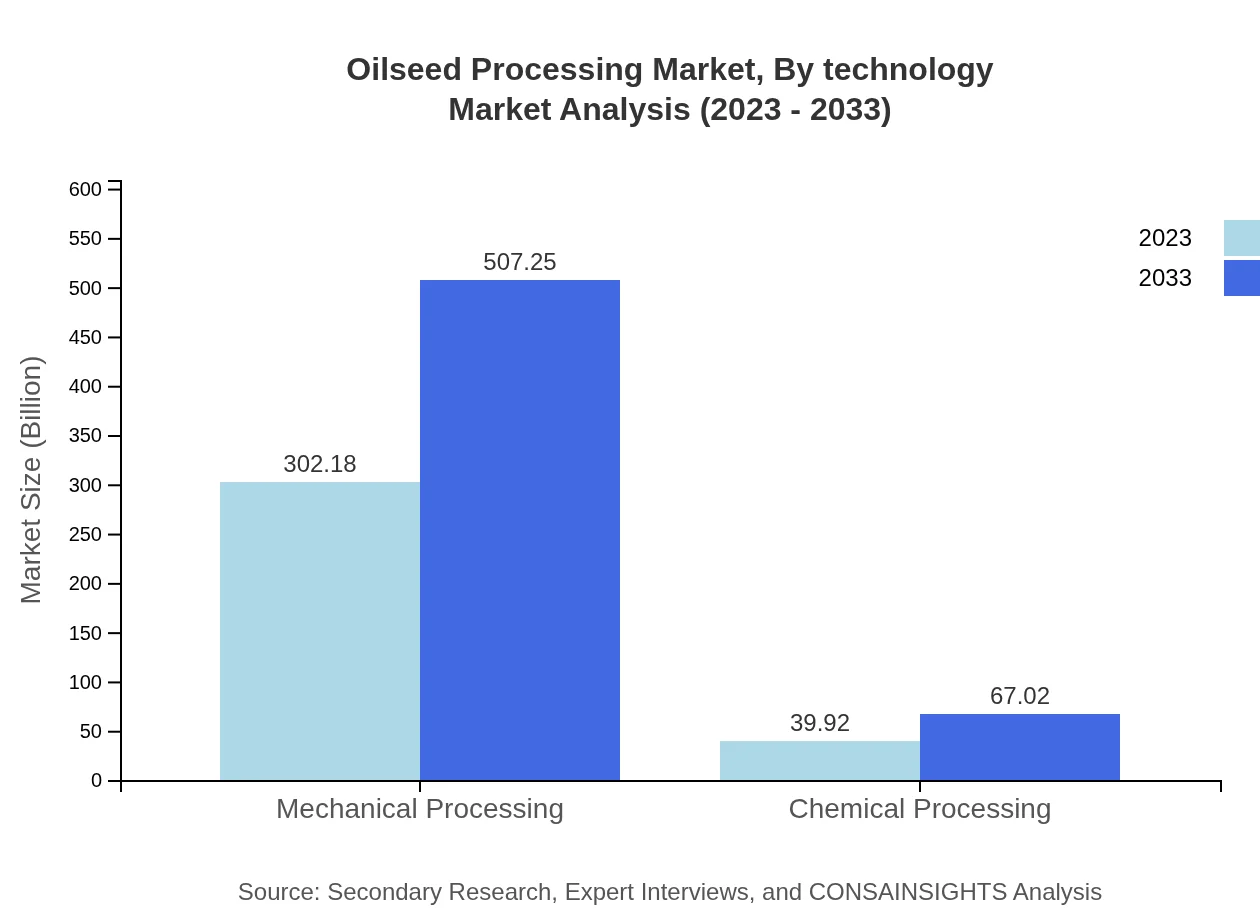

Oilseed Processing Market Analysis By Technology

The market is primarily driven by mechanical processing methods, accounting for 88.33% market share in 2023, with a size of $302.18 billion. Chemical processing boasts a smaller share but is expected to grow from $39.92 billion in 2023 to $67.02 billion by 2033, driven by innovations aimed at enhancing yield and reducing operational costs.

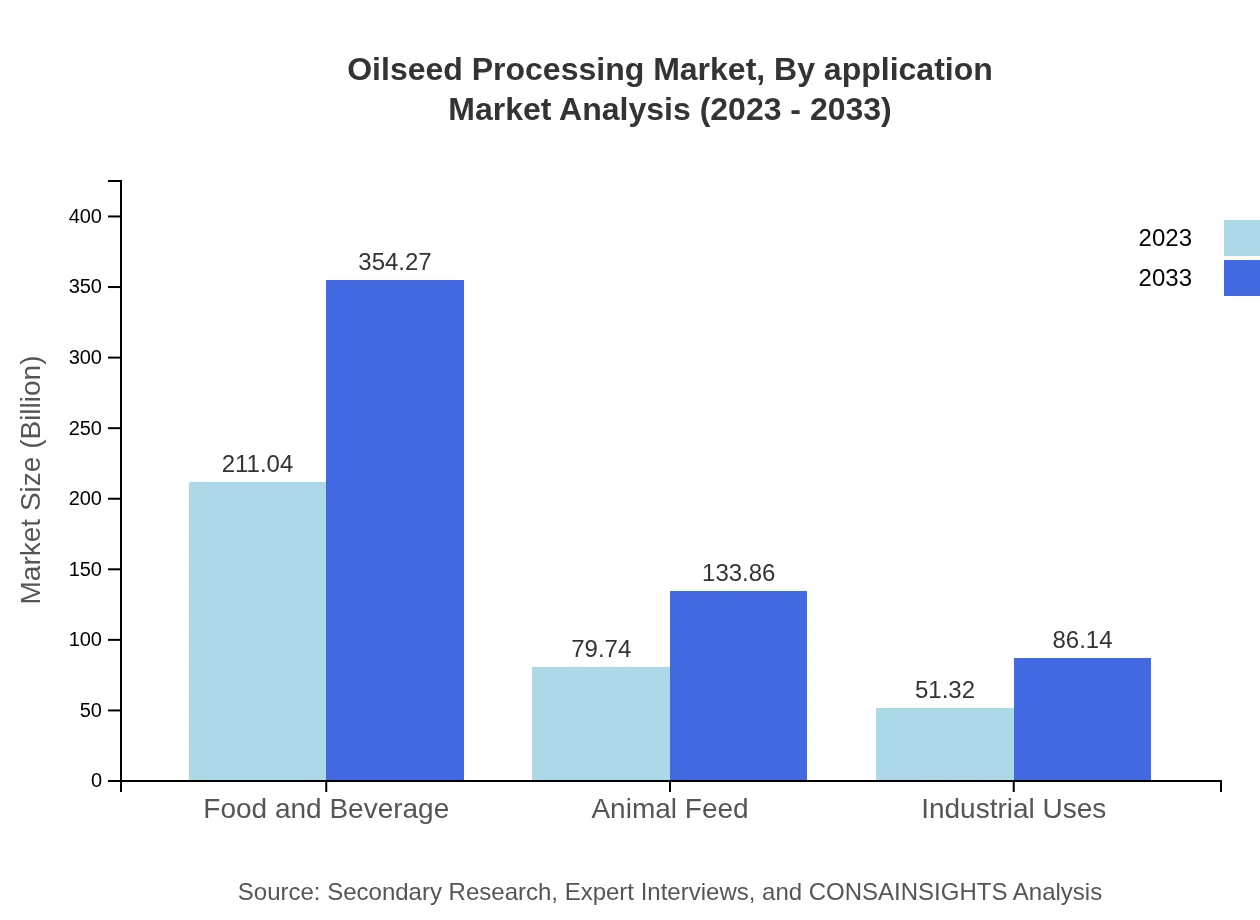

Oilseed Processing Market Analysis By Application

The food processing application is substantial, valued at $211.04 billion in 2023 and expected to reach $354.27 billion by 2033, maintaining a steady share of 61.69%. The feed manufacturers' segment is also significant, projected to increase from $79.74 billion to $133.86 billion, indicating rising livestock and aquaculture demands globally.

Oilseed Processing Market Analysis By End User

End-user analysis shows that the food and beverage industry remains the largest consumer, with a market value of $211.04 billion in 2023, expected to grow consistentlý by 2033. The biofuel sector is evolving, with producers expected to see significant growth prospects, aligning with global initiatives towards renewable energy sources.

Oilseed Processing Market Analysis By Region

Regional performance highlights that North America holds the largest market share, projected at 44% in 2023. Europe follows closely at 22.39%, while Asia Pacific and Latin America show promising growth potential, each at 10.36% and 13.06% respectively. This distribution reflects competitive pricing strategies, quality perceptions, and consumption patterns unique to each region.

Oilseed Processing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Oilseed Processing Industry

Cargill, Incorporated:

Cargill is a leading provider of food, agricultural, financial, and industrial products and services worldwide, with a significant presence in the oilseed processing market, driving advancements in sustainability and innovation.Archer Daniels Midland Company (ADM):

ADM operates as a major global producer of food and feed ingredients, leveraging its integrated supply chain to provide high-quality oilseed products and meet increasing consumer demands.Bunge Limited:

Bunge is a global leader in agribusiness and food production, focusing on oilseed processing and ensuring sustainable practices in its supply chain and operations.Louis Dreyfus Company:

Louis Dreyfus is an agricultural commodities merchant and processor with a strong footprint in oilseed processing, emphasizing efficiency and sustainability in its operations.We're grateful to work with incredible clients.

FAQs

What is the market size of oilseed Processing?

The global oilseed processing market is valued at approximately $342.1 billion as of 2023, with a compound annual growth rate (CAGR) of 5.2% projected through 2033.

What are the key market players or companies in this oilseed Processing industry?

The oilseed processing industry features several key players including Archer Daniels Midland Company, Cargill, and Bunge Limited, who dominate the market with substantial production capacities and market shares.

What are the primary factors driving the growth in the oilseed processing industry?

Key growth factors include increasing demand for vegetable oil, rising food consumption, and the growing biofuels industry, which significantly utilize oilseed products for production.

Which region is the fastest Growing in the oilseed processing?

The Asia-Pacific region is the fastest-growing market for oilseed processing, with a projected growth from $72.29 billion in 2023 to $121.34 billion by 2033, reflecting high consumption rates.

Does ConsaInsights provide customized market report data for the oilseed processing industry?

Yes, ConsaInsights provides customized market reports tailored to specific needs within the oilseed processing industry, allowing clients to access targeted data and insights.

What deliverables can I expect from this oilseed processing market research project?

Expect detailed market analysis, trend reports, regional insights, segmentation studies, and actionable recommendations, all tailored to aid strategic decision-making in the oilseed processing sector.

What are the market trends of oilseed processing?

Current trends include increased mechanization in oilseed production, growing health consciousness among consumers, and a shift towards sustainable practices in oilseed processing.