Oled Microdisplay Market Report

Published Date: 31 January 2026 | Report Code: oled-microdisplay

Oled Microdisplay Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Oled Microdisplay market, including market size, segmentation, and regional insights, along with forecasted trends from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

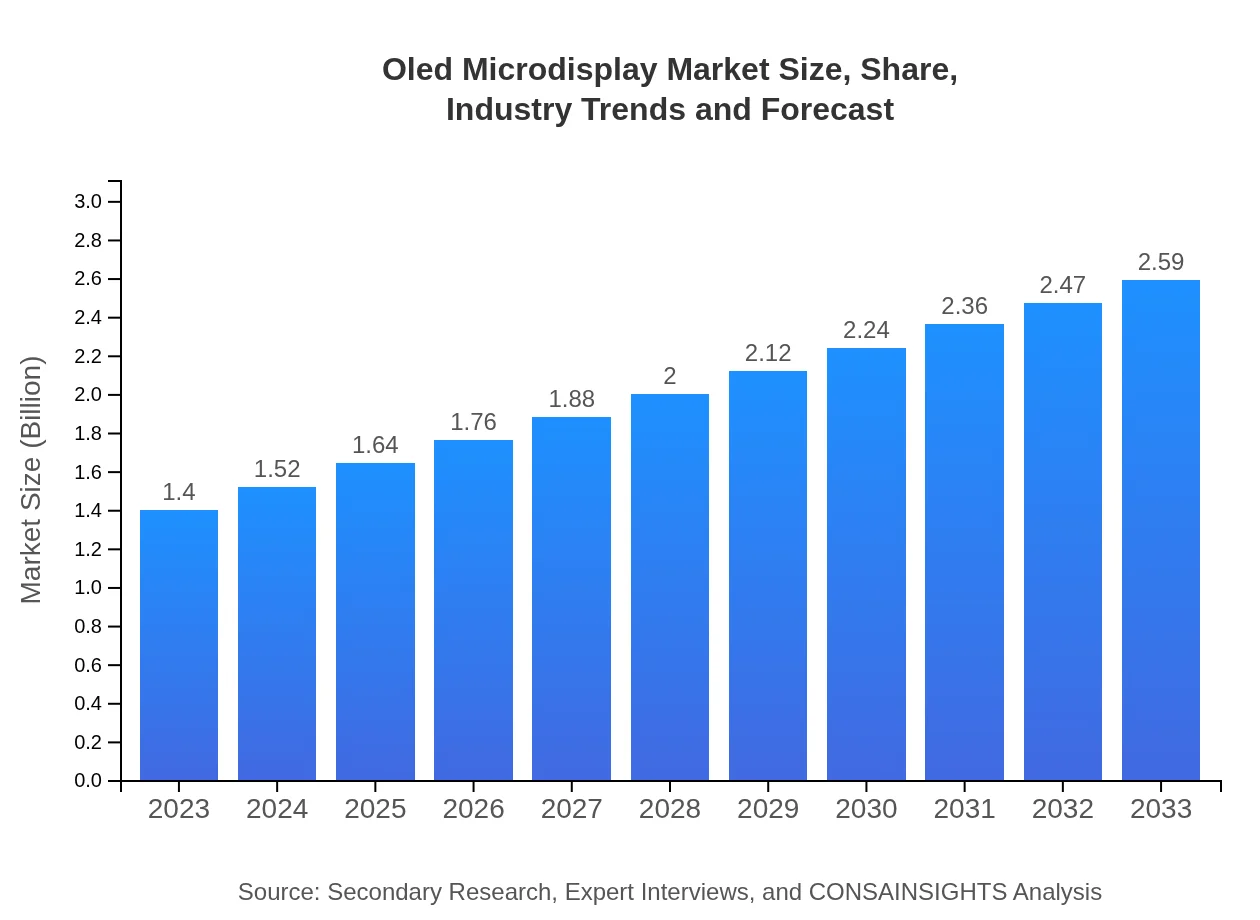

| 2023 Market Size | $1.40 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.59 Billion |

| Top Companies | Samsung Display, Sony Corporation, microOLED, eMagin Corporation |

| Last Modified Date | 31 January 2026 |

Oled Microdisplay Market Overview

Customize Oled Microdisplay Market Report market research report

- ✔ Get in-depth analysis of Oled Microdisplay market size, growth, and forecasts.

- ✔ Understand Oled Microdisplay's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Oled Microdisplay

What is the Market Size & CAGR of Oled Microdisplay market in 2023?

Oled Microdisplay Industry Analysis

Oled Microdisplay Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Oled Microdisplay Market Analysis Report by Region

Europe Oled Microdisplay Market Report:

Europe's market is projected to increase from $0.36 billion in 2023 to $0.67 billion by 2033. The demand for OLED technology in automotive and consumer electronics is a major market driver in this region.Asia Pacific Oled Microdisplay Market Report:

In 2023, the Oled Microdisplay market in the Asia Pacific region is valued at $0.30 billion, expected to grow to $0.56 billion by 2033. This growth is propelled by the presence of major electronics manufacturers and increasing consumer demand for advanced displays.North America Oled Microdisplay Market Report:

North America leads the market with an estimated value of $0.49 billion in 2023, growing to $0.90 billion by 2033. The region's advanced R&D capabilities and the high penetration of AR/VR applications significantly drive market growth.South America Oled Microdisplay Market Report:

South America's Oled Microdisplay market is projected to expand from $0.06 billion in 2023 to $0.11 billion in 2033. The growth is fostered by increased investment in advanced technologies and electronic products in the region.Middle East & Africa Oled Microdisplay Market Report:

In the Middle East and Africa, the Oled Microdisplay market is expected to grow from $0.19 billion in 2023 to $0.35 billion by 2033. Growth factors include rising technology adoption and increased demand for high-quality displays.Tell us your focus area and get a customized research report.

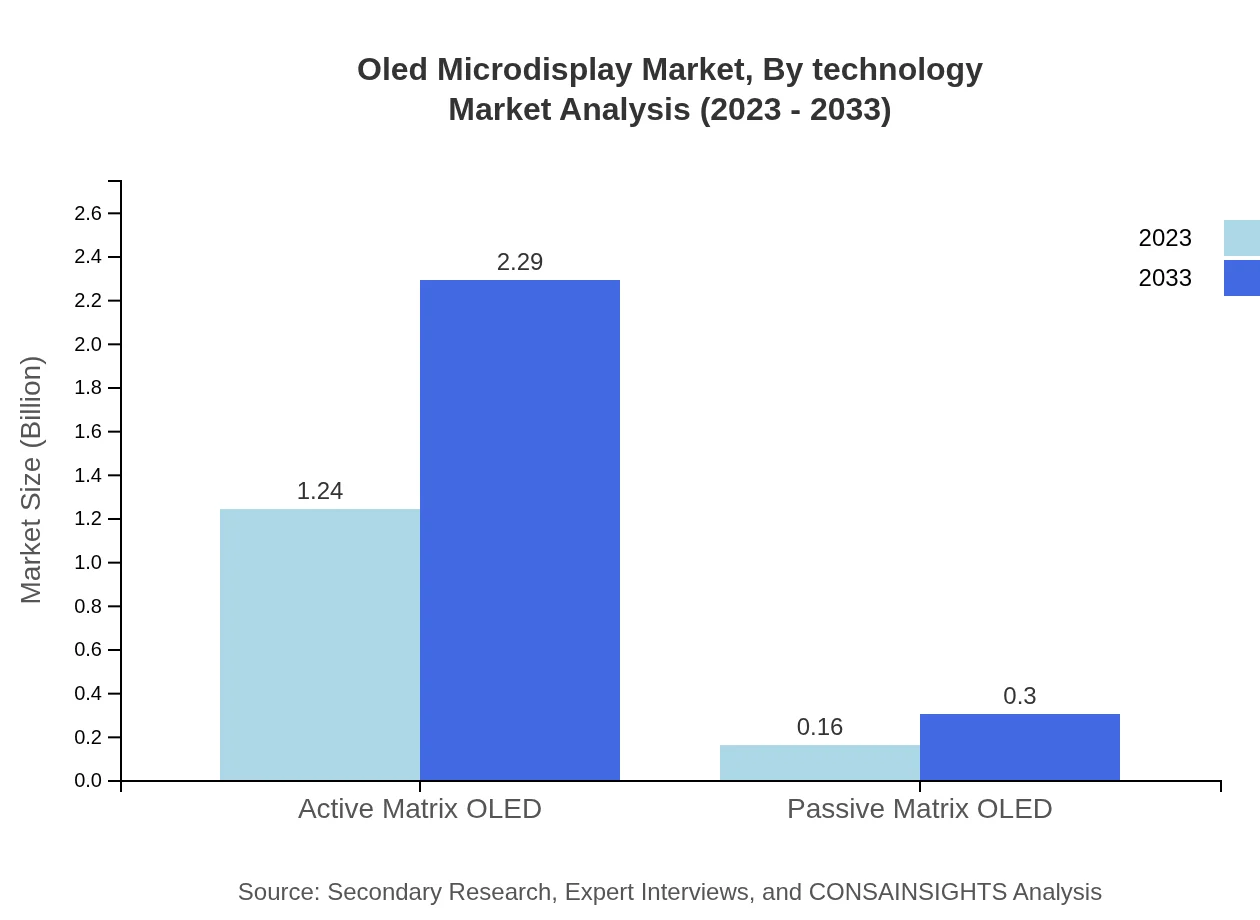

Oled Microdisplay Market Analysis By Technology

In 2023, Active Matrix OLED dominates the market with a share of 88.3%, generating approximately $1.24 billion. This segment is forecasted to grow to $2.29 billion by 2033. Passive Matrix OLED, although smaller, holds a significant niche with a current market size of $0.16 billion, expected to grow to $0.30 billion.

Oled Microdisplay Market Analysis By Application

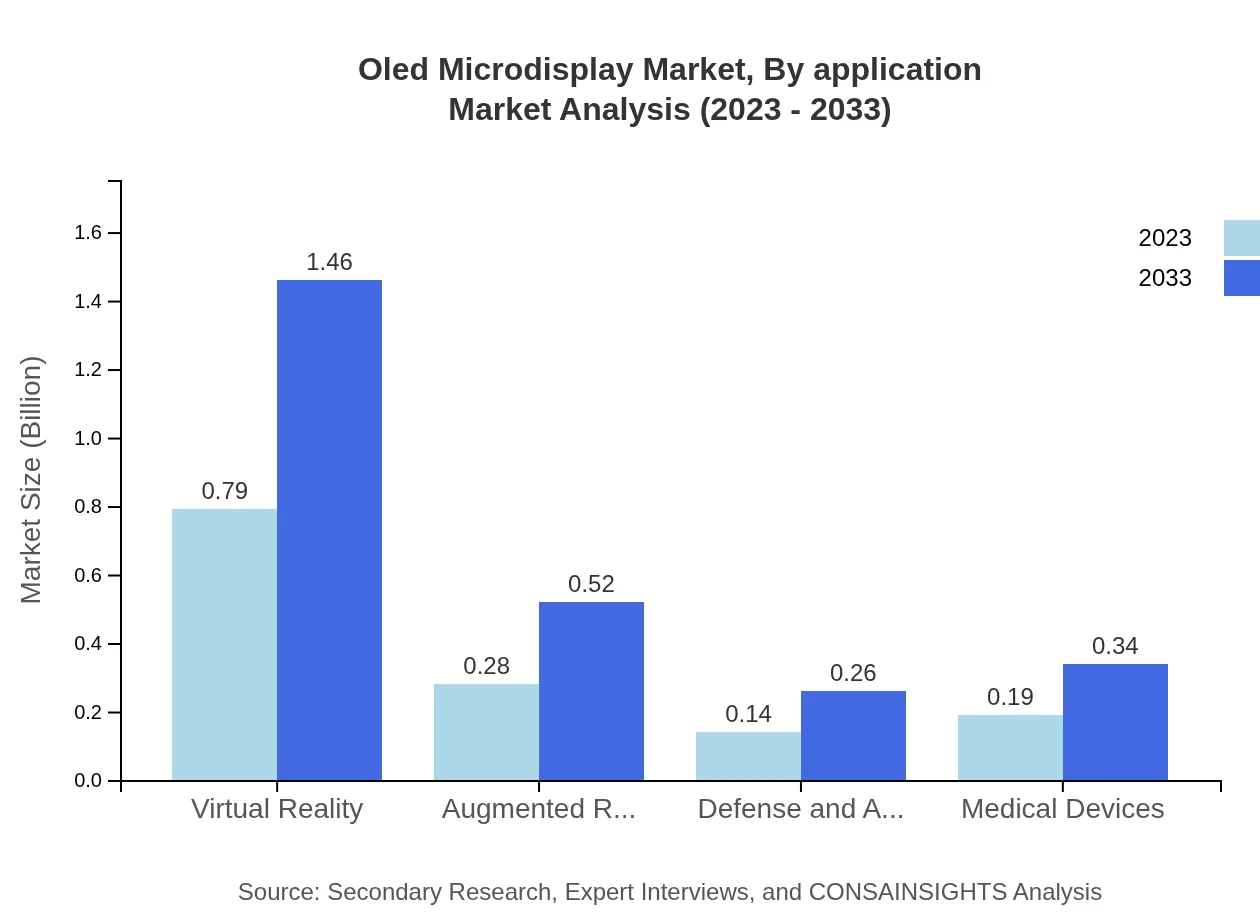

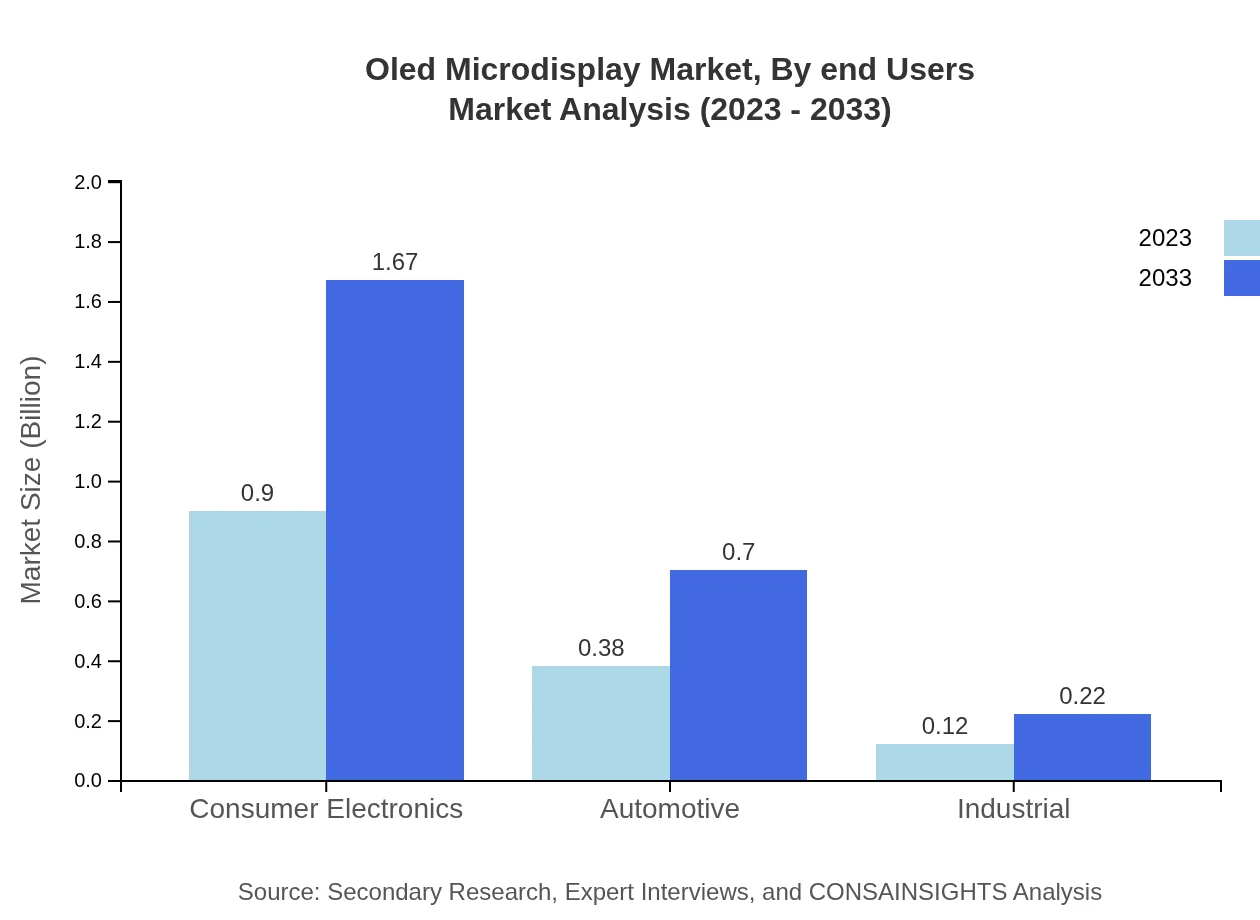

Consumer Electronics remains the leading sector, projected to grow from $0.90 billion in 2023 to $1.67 billion by 2033, contributing over 64% of the total market share. Virtual Reality also shows significant potential, expanding from $0.79 billion in 2023 to $1.46 billion by 2033.

Oled Microdisplay Market Analysis By End Users

The automotive sector is witnessing growth, expected to increase from $0.38 billion in 2023 to $0.70 billion by 2033, reflecting the industry's focus on integrating advanced display technologies for enhanced driver experiences.

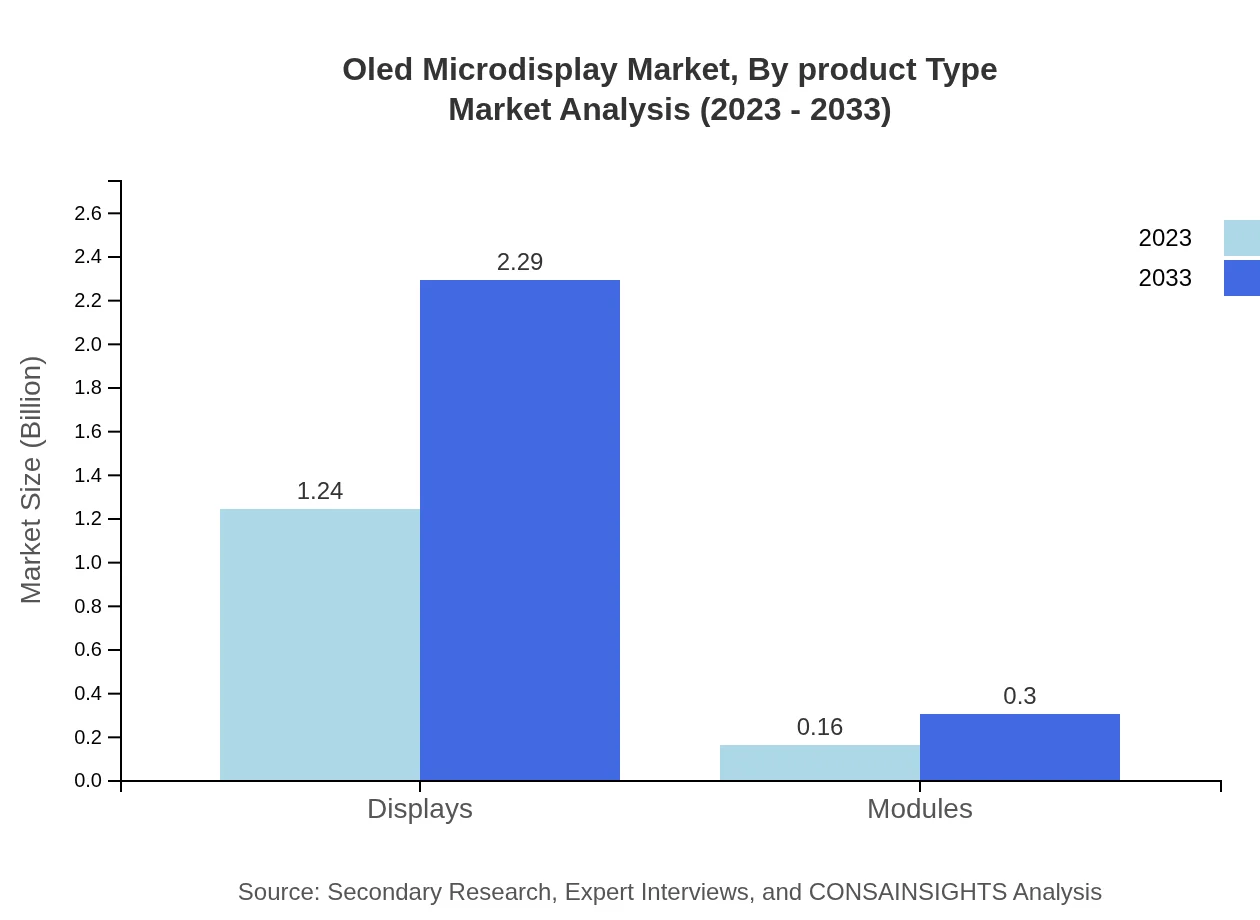

Oled Microdisplay Market Analysis By Product Type

Displays constitute the largest segment accounting for 88.3% of the market share, with a size of $1.24 billion in 2023, increasing to $2.29 billion by 2033. Modules account for a smaller share with a forecasted growth from $0.16 billion to $0.30 billion.

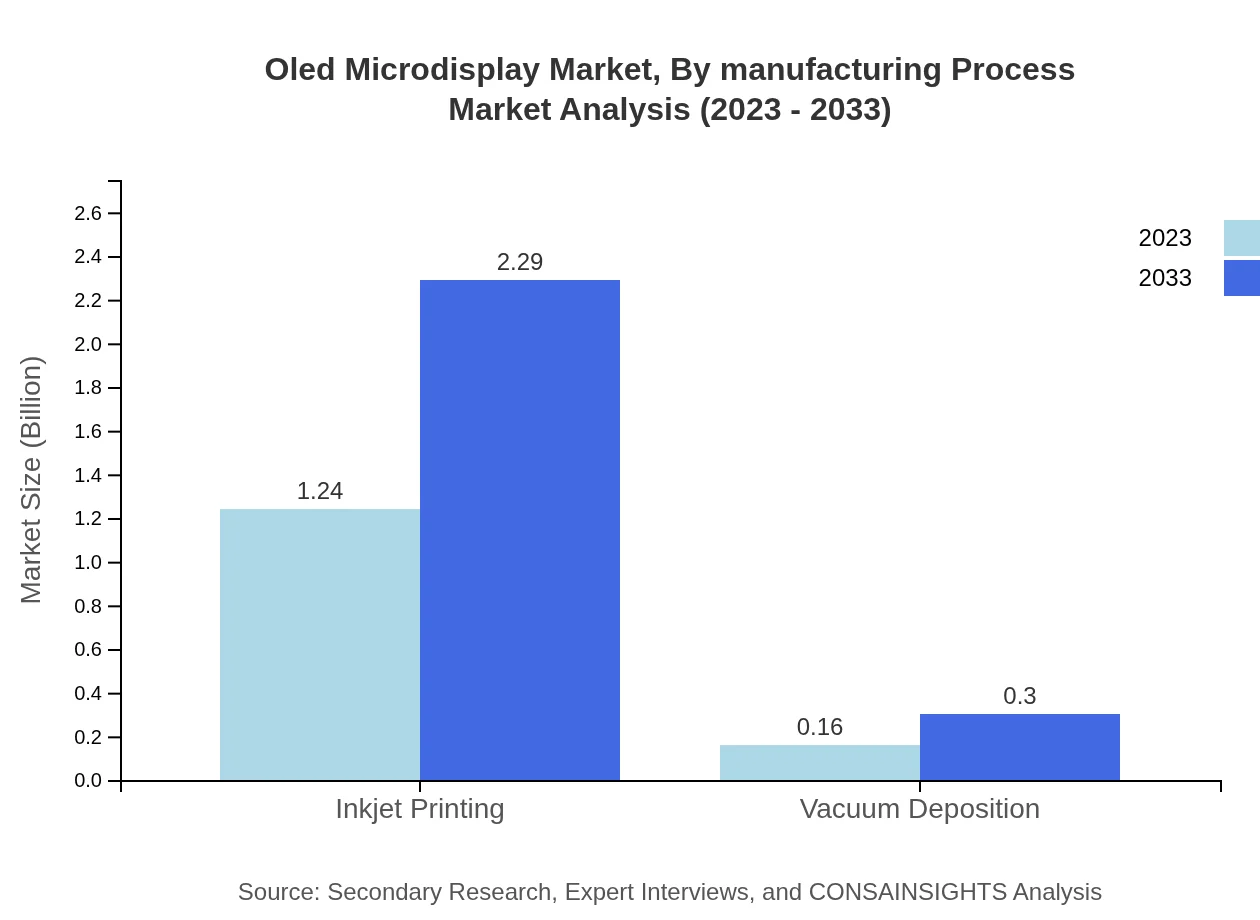

Oled Microdisplay Market Analysis By Manufacturing Process

Inkjet printing is the dominant method, generating $1.24 billion in 2023, with a forecasted growth to $2.29 billion. Vacuum deposition holds significant potential, though lagging behind, projected to grow from $0.16 billion to $0.30 billion.

Oled Microdisplay Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Oled Microdisplay Industry

Samsung Display:

A leader in the display technology sector, Samsung Display is known for its innovations in OLED technologies and offers a wide range of microdisplay solutions for various applications.Sony Corporation:

Sony is a significant player in the Oled Microdisplay sector, focusing on high-end electronic products for both consumer and industrial markets, well-regarded for its technological advancements.microOLED:

Specializing in ultra-small OLED displays, microOLED is known for its cutting-edge microdisplay technology, serving applications in augmented and virtual reality.eMagin Corporation:

eMagin focuses on OLED microdisplays for military and consumer electronics, providing high-resolution products with wide field-of-view capabilities.We're grateful to work with incredible clients.

FAQs

What is the market size of Oled Microdisplay?

The Oled Microdisplay market is valued at $1.4 billion in 2023, with a projected CAGR of 6.2% through 2033. This growth reflects increased adoption in various sectors, notably consumer electronics and virtual reality.

What are the key market players or companies in the Oled Microdisplay industry?

Key players in the Oled Microdisplay industry include major manufacturers and technology firms producing microdisplays. They focus on innovative solutions to improve image quality and reduce power consumption, driving competitive advancements.

What are the primary factors driving the growth in the Oled Microdisplay industry?

The growth of the Oled Microdisplay industry is driven by increased demand in consumer electronics, advancements in augmented and virtual reality applications, and the ongoing development of innovative display technologies.

Which region is the fastest Growing in the Oled Microdisplay?

The fastest-growing region in the Oled Microdisplay market is Asia Pacific, projected to increase from $0.30 billion in 2023 to $0.56 billion by 2033, reflecting a rising demand for advanced display technologies in electronics.

Does ConsaInsights provide customized market report data for the Oled Microdisplay industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the Oled Microdisplay industry, allowing clients to access targeted data and insights for informed decision-making.

What deliverables can I expect from this Oled Microdisplay market research project?

Clients can expect comprehensive market analysis reports, segment breakdowns, competitive landscape insights, and projected growth trends, along with tailored data relevant to their specific interests in the Oled Microdisplay market.

What are the market trends of Oled Microdisplay?

Current market trends in Oled Microdisplay include a strong shift towards enhanced resolution displays, growing applications in automotive and VR sectors, and a continual focus on energy-efficient technologies across various segments.