Oligonucleotide Synthesis Market Report

Published Date: 31 January 2026 | Report Code: oligonucleotide-synthesis

Oligonucleotide Synthesis Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Oligonucleotide Synthesis market, covering trends, segmentation, regional insights, and forecasts from 2023 to 2033.

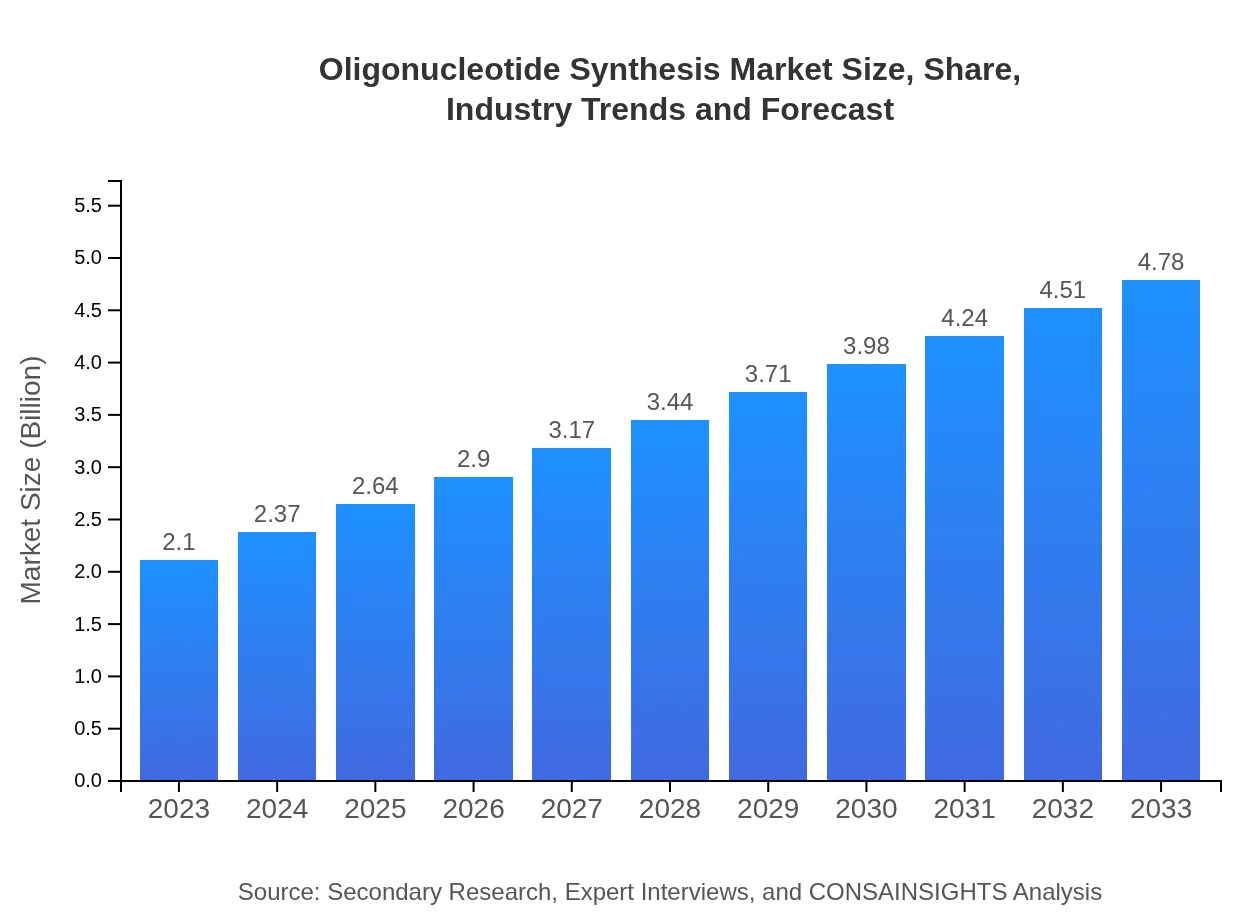

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.10 Billion |

| CAGR (2023-2033) | 8.3% |

| 2033 Market Size | $4.78 Billion |

| Top Companies | Thermo Fisher Scientific, Integrated DNA Technologies (IDT), Eurofins Genomics, Sigma-Aldrich (Merck KGaA) |

| Last Modified Date | 31 January 2026 |

Oligonucleotide Synthesis Market Overview

Customize Oligonucleotide Synthesis Market Report market research report

- ✔ Get in-depth analysis of Oligonucleotide Synthesis market size, growth, and forecasts.

- ✔ Understand Oligonucleotide Synthesis's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Oligonucleotide Synthesis

What is the Market Size & CAGR of Oligonucleotide Synthesis market in 2023?

Oligonucleotide Synthesis Industry Analysis

Oligonucleotide Synthesis Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Oligonucleotide Synthesis Market Analysis Report by Region

Europe Oligonucleotide Synthesis Market Report:

The Oligonucleotide Synthesis market in Europe is set to expand from USD 0.72 billion in 2023 to USD 1.65 billion by 2033. Strong presence of key players and increasing demand for custom oligonucleotides in pharmaceutical development are primary drivers for this growth.Asia Pacific Oligonucleotide Synthesis Market Report:

In 2023, the Oligonucleotide Synthesis market in Asia Pacific is valued at approximately USD 0.39 billion and is projected to reach USD 0.89 billion by 2033. Growth in this region is driven by increasing investments in biotechnology and pharmaceutical research, alongside supportive government initiatives to enhance healthcare capabilities and genomics research.North America Oligonucleotide Synthesis Market Report:

North America dominates the Oligonucleotide Synthesis market with initial values of around USD 0.69 billion for 2023, leading to an anticipated growth to USD 1.58 billion by 2033. This can be attributed to high healthcare expenditure and ongoing research initiatives funded by public and private sectors.South America Oligonucleotide Synthesis Market Report:

The South American market for Oligonucleotide Synthesis is expected to grow from USD 0.09 billion in 2023 to USD 0.20 billion by 2033. This growth is attributed to rising investment in healthcare infrastructure and an increasing focus on disease prevention and personalized medicine.Middle East & Africa Oligonucleotide Synthesis Market Report:

In the Middle East and Africa, the market for Oligonucleotide Synthesis is preliminarily estimated at USD 0.20 billion in 2023, with expectations to reach approximately USD 0.47 billion by 2033. Factors facilitating this growth include increasing healthcare investments and rising public awareness around genetic testing solutions.Tell us your focus area and get a customized research report.

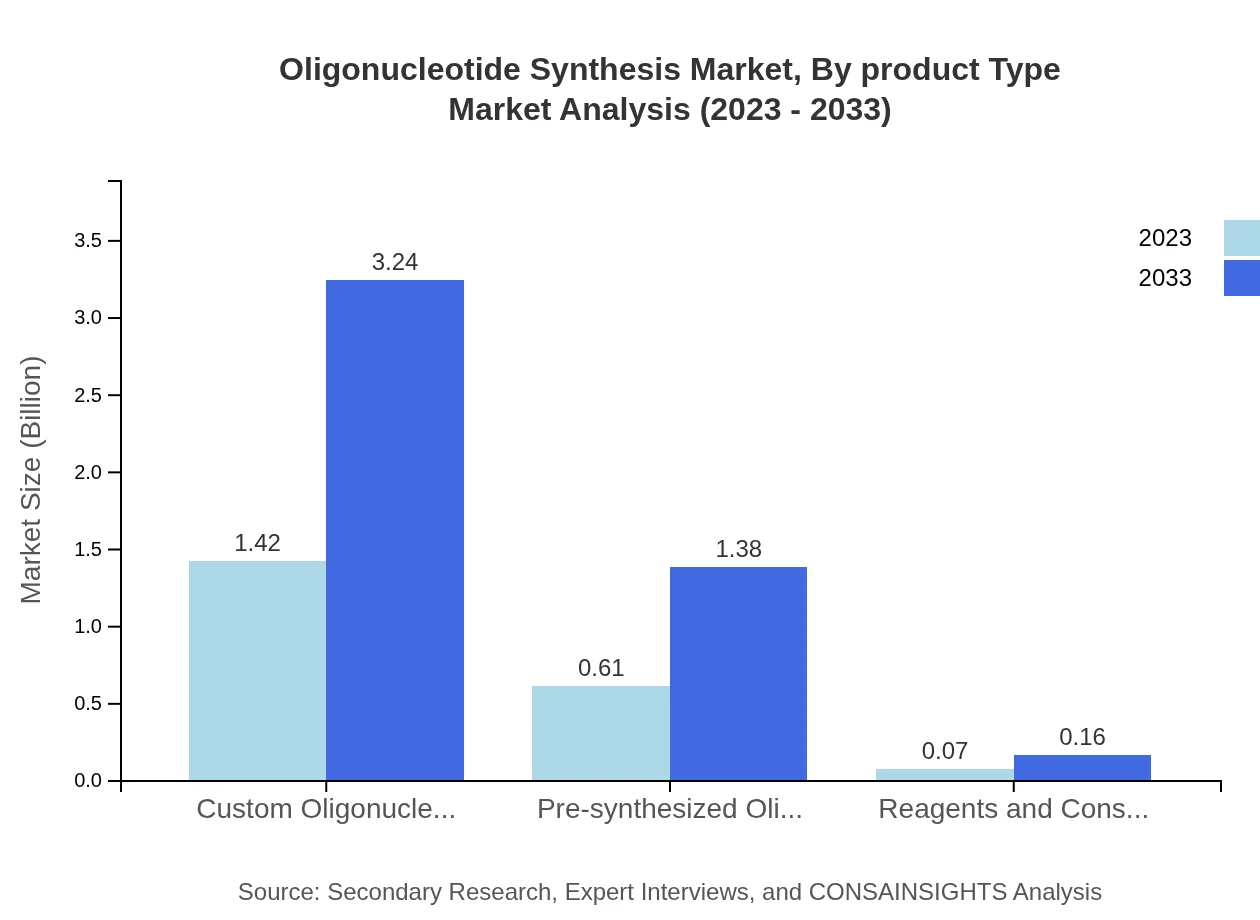

Oligonucleotide Synthesis Market Analysis By Product Type

In 2023, the custom oligonucleotides market is valued at USD 1.42 billion and is projected to grow to USD 3.24 billion by 2033, capturing about 67.72% of the total market share. Pre-synthesized oligonucleotides hold a market size of USD 0.61 billion, expected to expand to USD 1.38 billion by 2033, accounting for 28.89% of the market...

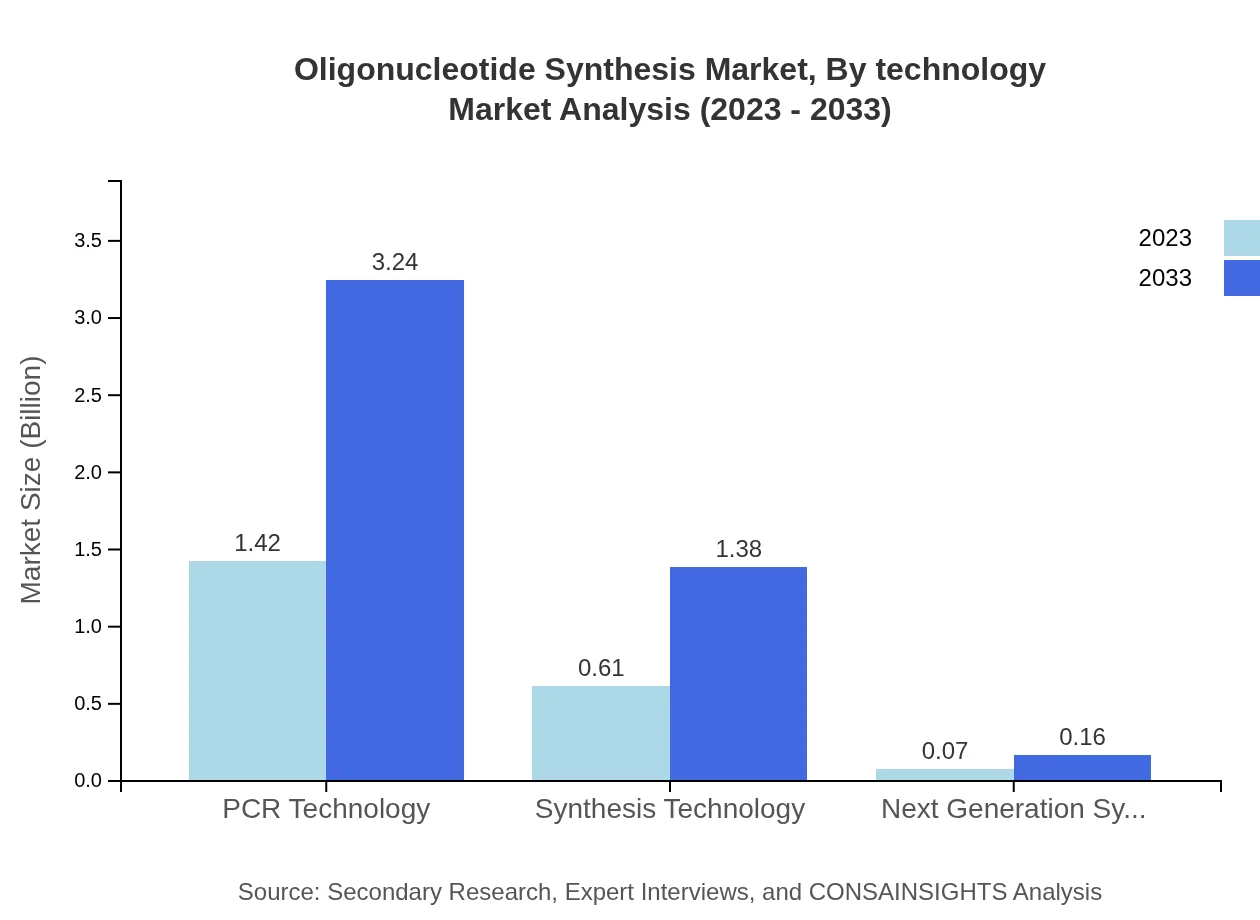

Oligonucleotide Synthesis Market Analysis By Technology

The market for PCR Technology in 2023 is noted at USD 1.42 billion with a projected CAGR that would bring it to USD 3.24 billion by 2033, making it a predominant segment at 67.72% market share. Synthesis Technology follows at USD 0.61 billion for 2023, growing to USD 1.38 billion by the end of the forecast period, making up 28.89% of the market.

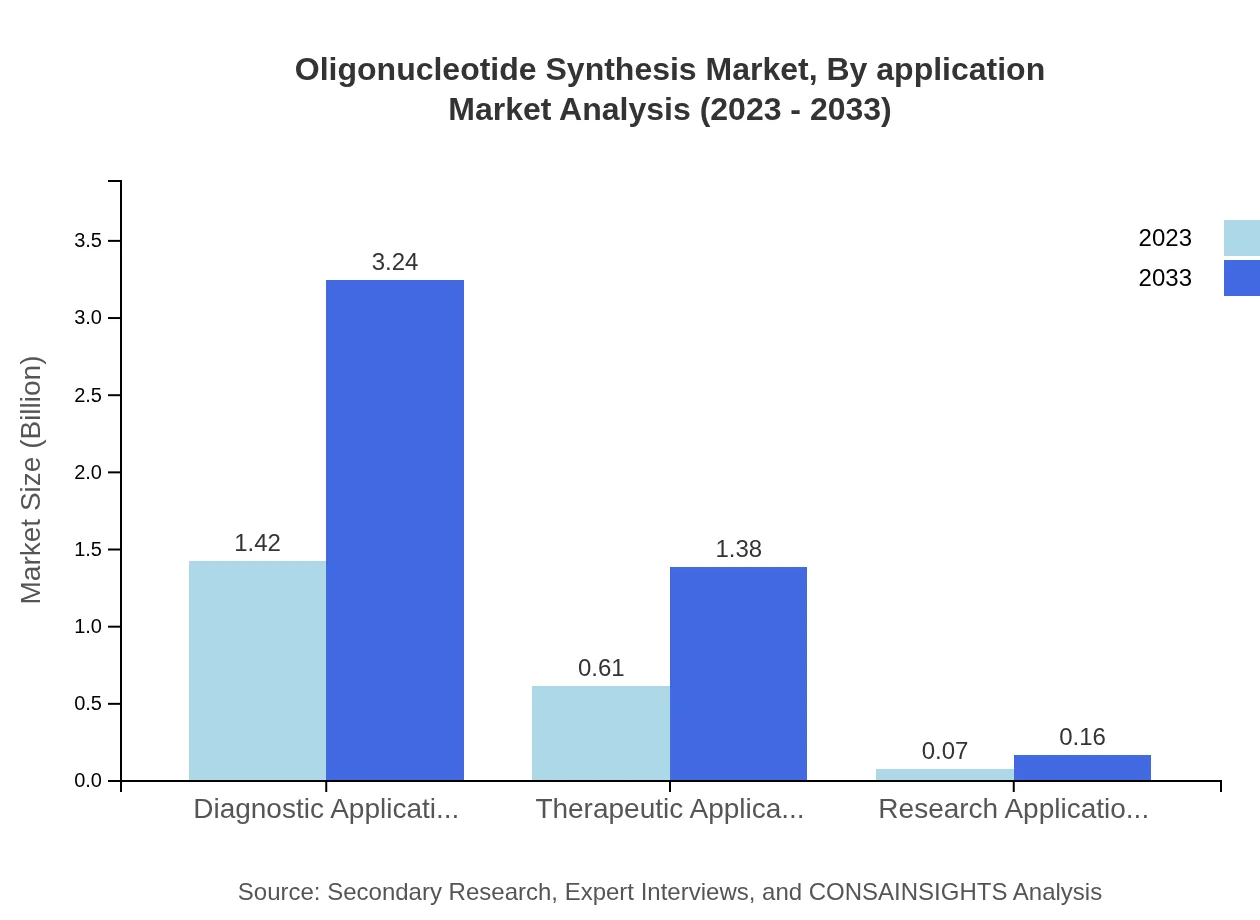

Oligonucleotide Synthesis Market Analysis By Application

Oligonucleotide Synthesis in diagnostic applications holds a commanding market share at USD 1.42 billion in 2023. This segment is expected to grow to USD 3.24 billion by 2033, maintaining a major influence with 67.72%. Therapeutic applications are poised for growth from USD 0.61 billion to USD 1.38 billion, representing 28.89% of the application scope.

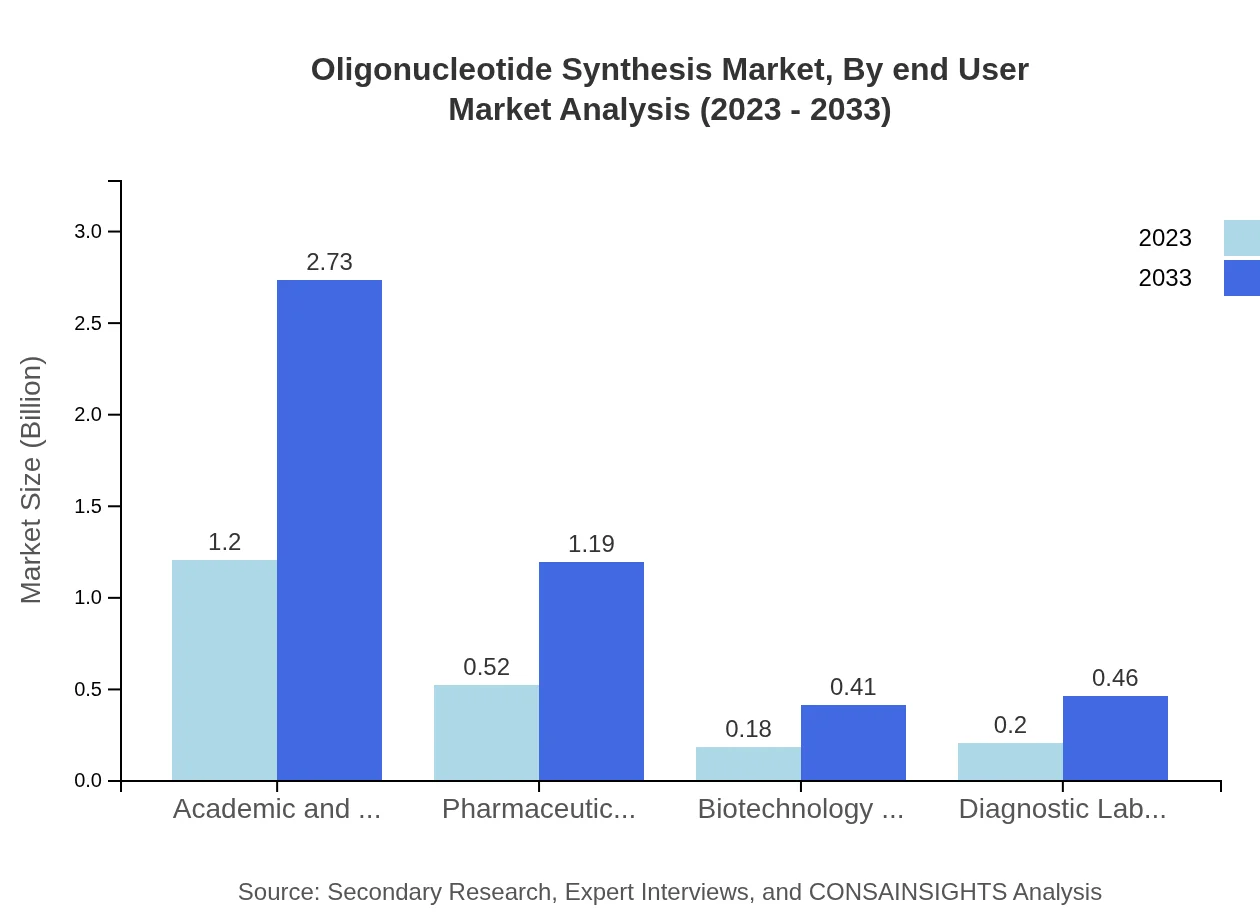

Oligonucleotide Synthesis Market Analysis By End User

Academic and research institutions lead the market with a valuation of USD 1.20 billion in 2023, set to reach USD 2.73 billion by 2033. The pharmaceutical industries currently stand at USD 0.52 billion and are expected to grow to USD 1.19 billion over the same period.

Oligonucleotide Synthesis Market Analysis By Region

Global Oligonucleotide Synthesis Market, By Region Market Analysis (2023 - 2033)

Regional analysis highlights North America as a leader in market size, with Europe and Asia Pacific following due to rising healthcare innovations. The Middle East and Africa show slower growth but increasing influence owing to improving healthcare infrastructure.

Oligonucleotide Synthesis Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Oligonucleotide Synthesis Industry

Thermo Fisher Scientific:

A leading company in the field, Thermo Fisher Scientific provides comprehensive solutions for nucleic acid synthesis and related technologies, focusing on innovation and quality.Integrated DNA Technologies (IDT):

IDT specializes in custom DNA and RNA oligonucleotides with a commitment to providing high-quality products and exceptional customer service.Eurofins Genomics:

Known for its extensive oligonucleotide synthesis and genomic services, Eurofins Genomics aims to support research and therapeutic applications globally.Sigma-Aldrich (Merck KGaA):

Merck's Sigma-Aldrich division offers a wide range of oligonucleotide synthesis services, focusing on biotech and pharma industries.We're grateful to work with incredible clients.

FAQs

What is the market size of oligonucleotide Synthesis?

The oligonucleotide synthesis market is valued at approximately $2.1 billion in 2023, with a projected CAGR of 8.3%. This growth indicates a strong demand for oligonucleotide-based products across various applications in the coming decade.

What are the key market players or companies in this oligonucleotide Synthesis industry?

Key players in the oligonucleotide synthesis market include major biotech firms and established pharmaceutical companies. Their innovative developments and strategic partnerships play a crucial role in shaping the industry landscape, enhancing research capabilities and product availability.

What are the primary factors driving the growth in the oligonucleotide synthesis industry?

The growth in the oligonucleotide synthesis industry is primarily driven by increased research activities in genomics, rising demand for personalized medicine, and advancements in synthesis technologies that facilitate more efficient production of oligonucleotides.

Which region is the fastest Growing in the oligonucleotide synthesis?

The fastest-growing region in the oligonucleotide synthesis market is Europe, expected to rise from $0.72 billion in 2023 to $1.65 billion by 2033, outperforming other regions like North America and Asia Pacific during the same period.

Does ConsaInsights provide customized market report data for the oligonucleotide synthesis industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the oligonucleotide synthesis industry. Clients can obtain detailed insights on market trends, forecasts, and competitive analyses tailored to their interests.

What deliverables can I expect from this oligonucleotide synthesis market research project?

You can expect comprehensive deliverables, including detailed market analysis reports, segmentation data, key player insights, forecasts, and trend analyses that highlight the dynamics of the oligonucleotide synthesis market.

What are the market trends of oligonucleotide synthesis?

Current trends in the oligonucleotide synthesis market include a shift toward automated synthesis technologies, an increase in demand from diagnostic applications, and a growing focus on custom oligonucleotide production for specific research and therapeutic needs.