Olive Market Report

Published Date: 02 February 2026 | Report Code: olive

Olive Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report provides an in-depth analysis of the global olive market, covering key insights, market dynamics, and forecasts from 2023 to 2033. It evaluates market size, growth trends, regional performance, and product-wise segmentation of the olive industry.

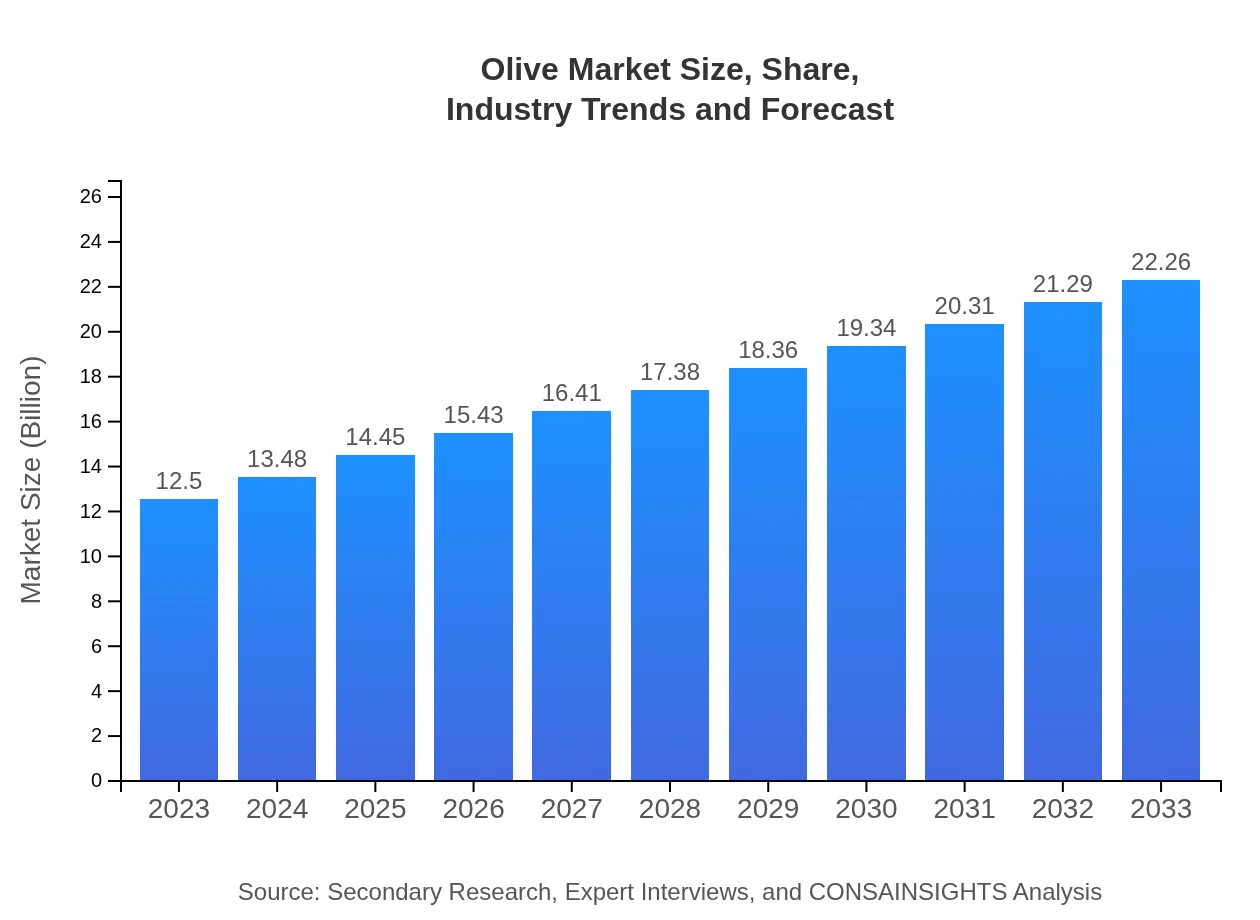

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $22.26 Billion |

| Top Companies | FLOSSO, Bertolli, Mazola, Colavita |

| Last Modified Date | 02 February 2026 |

Olive Market Overview

Customize Olive Market Report market research report

- ✔ Get in-depth analysis of Olive market size, growth, and forecasts.

- ✔ Understand Olive's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Olive

What is the Market Size & CAGR of Olive market in 2023?

Olive Industry Analysis

Olive Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Olive Market Analysis Report by Region

Europe Olive Market Report:

Europe remains the largest market for olives, with a valuation of $3.36 billion in 2023 expected to rise to $5.98 billion by 2033. The continent is a significant producer and consumer, having a well-established olive oil industry including key countries such as Spain, Italy, and Greece.Asia Pacific Olive Market Report:

The Asia Pacific region is projected to witness strong growth, moving from a market value of $2.42 billion in 2023 to $4.31 billion by 2033. Countries like Japan and Australia show increased demand for olive oil due to the adoption of Mediterranean diets and growing awareness regarding health benefits.North America Olive Market Report:

The North American market, valued at $4.64 billion in 2023, is anticipated to reach $8.26 billion by 2033. Strong demand for Mediterranean cuisine and health-oriented products, along with innovations in olive oil production, contribute to this increase.South America Olive Market Report:

South America's olive market is expected to grow from $1.15 billion in 2023 to $2.04 billion by 2033. The expanding food service industry and increasing olive cultivation in countries such as Argentina and Brazil are driving this growth.Middle East & Africa Olive Market Report:

In the Middle East and Africa, the olive market is forecasted to grow from $0.93 billion in 2023 to around $1.66 billion by 2033. The rising cultivation of olive trees in countries like Tunisia and Morocco is a driving force, supported by evolving consumer preferences for healthy fats.Tell us your focus area and get a customized research report.

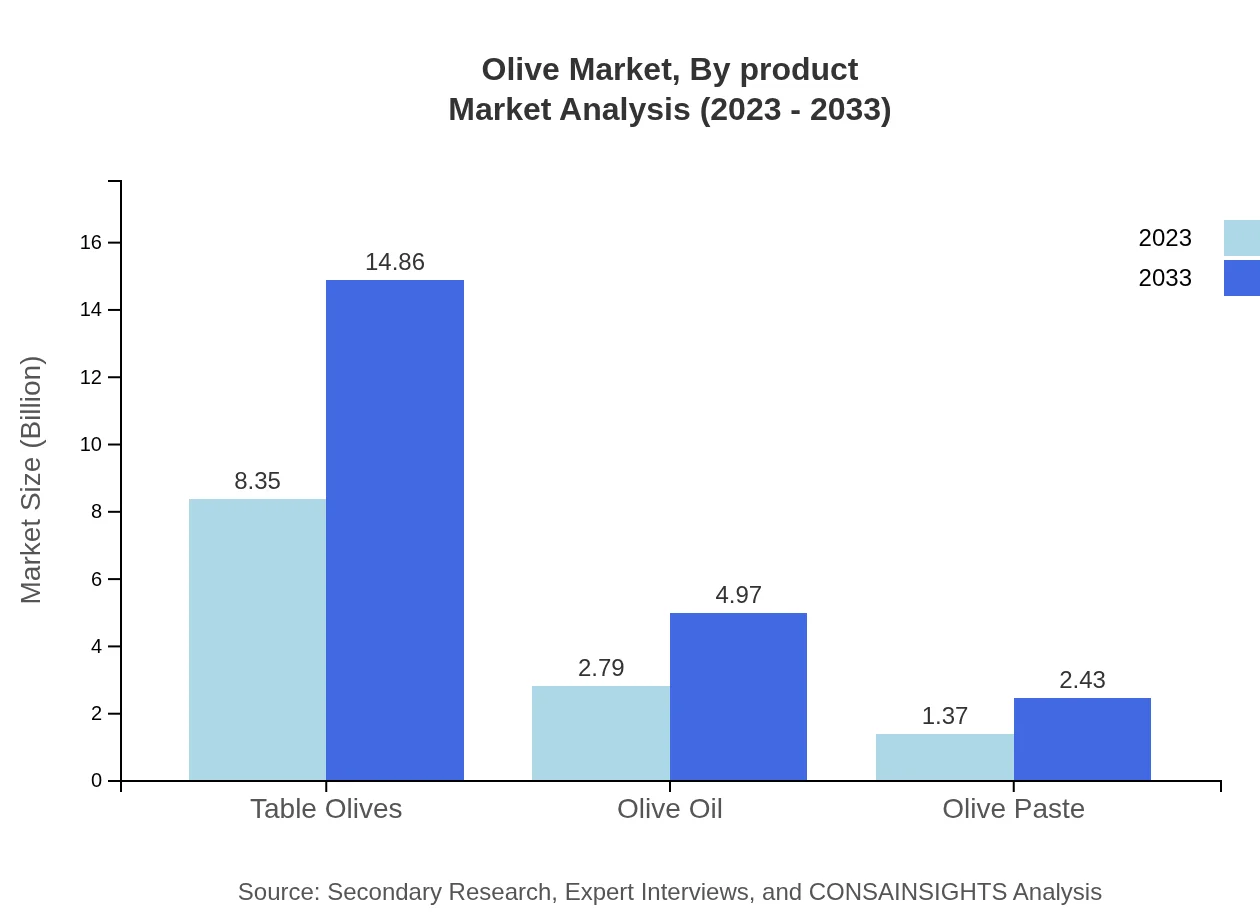

Olive Market Analysis By Product

In 2023, the table olives segment leads the market at $8.35 billion, accounting for approximately 66.76% share. The olive oil segment, valued at $2.79 billion, holds a 22.31% share, while the remaining segments, such as olive paste, contribute to the overall market dynamics.

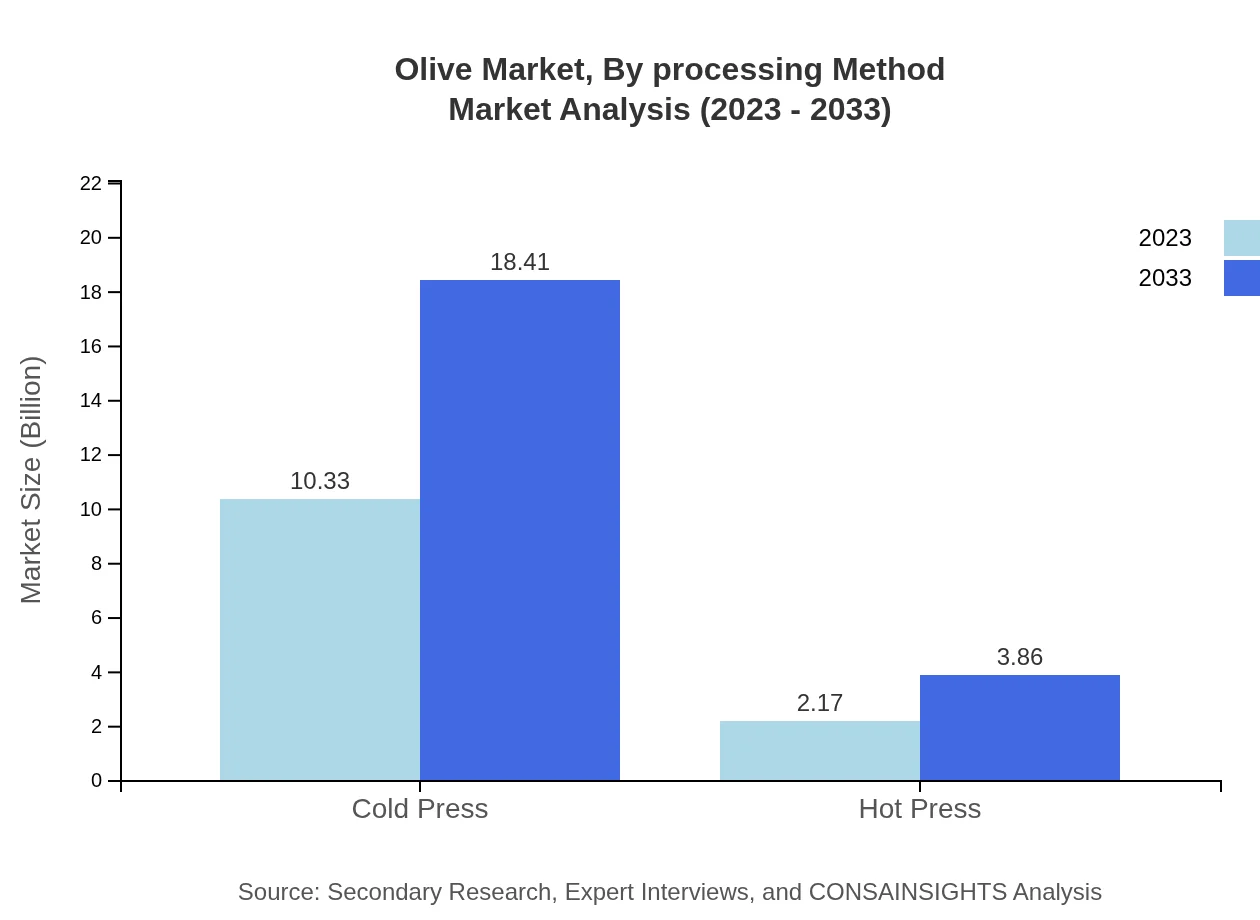

Olive Market Analysis By Processing Method

The cold press method dominates the processing segment with a market size of $10.33 billion (82.67% share). The hot press method, while smaller with $2.17 billion in 2023 (17.33% share), is gaining traction due to innovations in processing technologies.

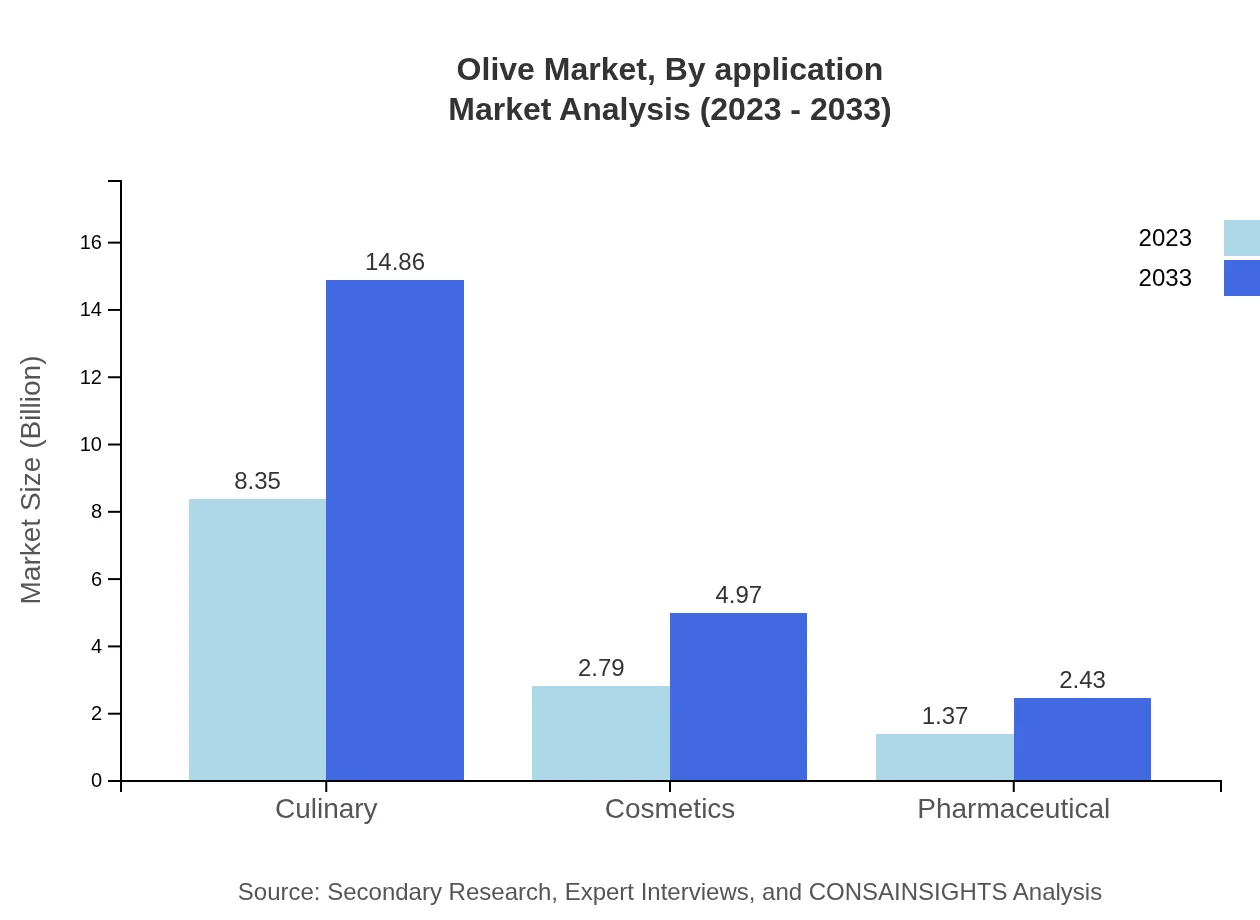

Olive Market Analysis By Application

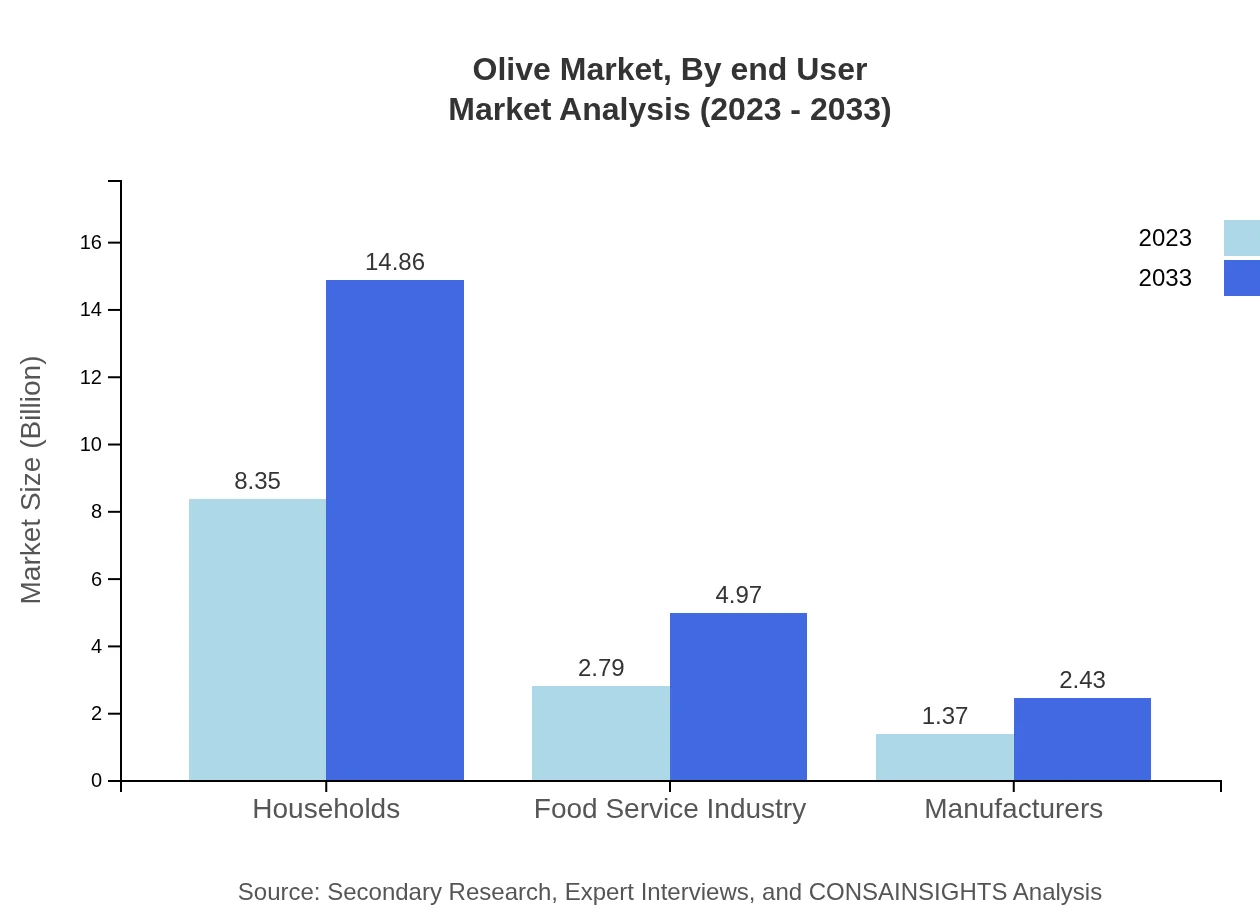

Households represent the largest application segment at $8.35 billion (66.76% share), followed by the food service industry at $2.79 billion (22.31% share). Growing use in cosmetic and pharmaceutical applications are also making their mark in the market.

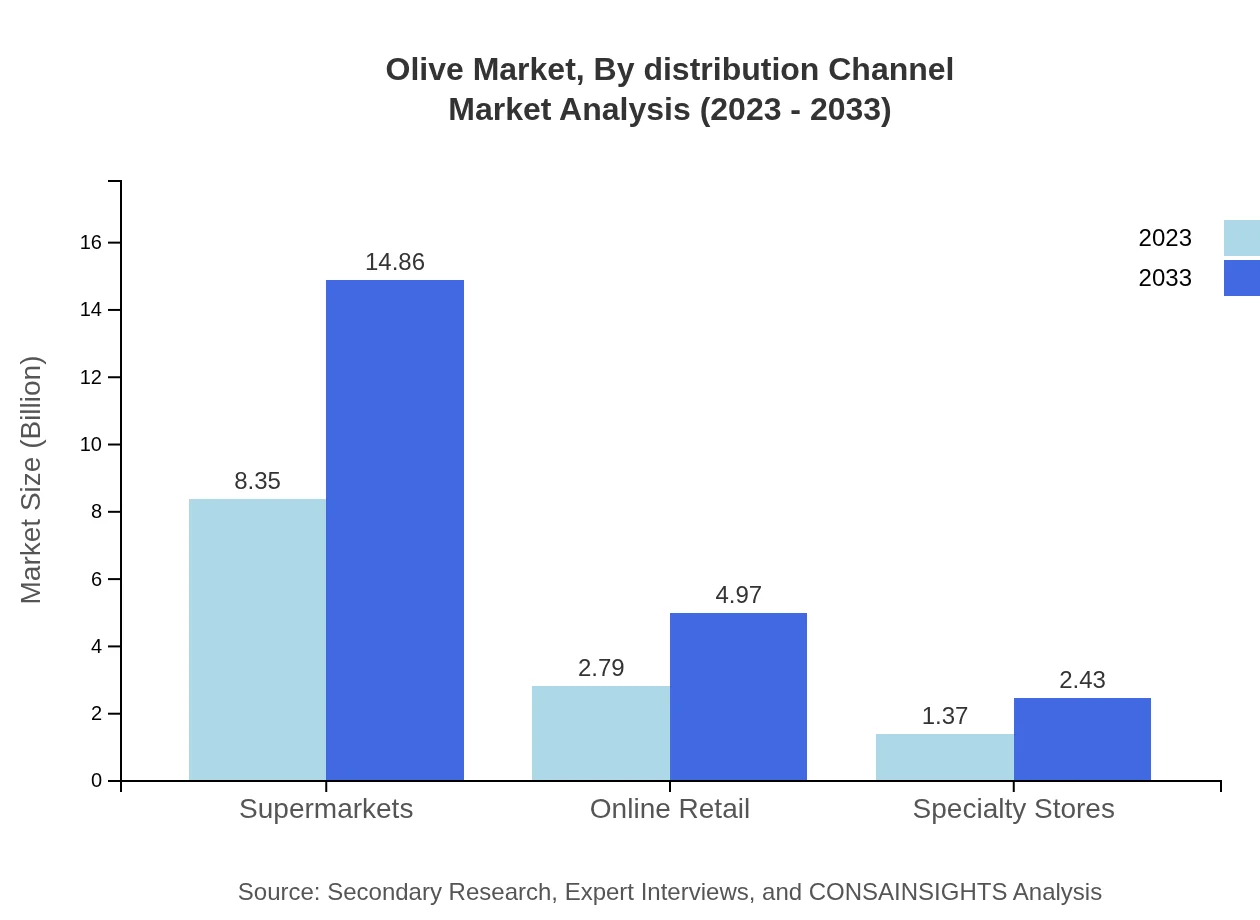

Olive Market Analysis By Distribution Channel

Supermarkets stand as the primary distribution channel with a market size of $8.35 billion (66.76% share), followed by online retail which generates $2.79 billion (22.31% share). Increasing online shopping trends signal a growing share for digital retail channels.

Olive Market Analysis By End User

The culinary sector is the largest end-user for olives, valued at $8.35 billion in 2023 (66.76% share), followed by the pharmaceutical sector at $1.37 billion (10.93% share). Each end-user segment shows unique growth drivers influenced by consumer preferences.

Olive Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Olive Industry

FLOSSO:

FLOSSO is a leader in producing high-quality olives and olive oil, known for its sustainable farming practices and innovative business models catering to both retail and food service sectors.Bertolli:

Bertolli specializes in olive oil production, offering a range of products known for their rich flavor profiles and extensive distribution network across international markets.Mazola:

Mazola is renowned for its wide variety of cooking oils, including olive oil, and focuses on health-oriented products, driving further innovation in the olive market.Colavita:

A family-owned company that prides itself on its Italian heritage, Colavita emphasizes high-quality olive products distributed globally, adhering to traditional and authentic production methods.We're grateful to work with incredible clients.

FAQs

What is the market size of Olive?

The global olive market is valued at approximately $12.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 5.8% anticipated through 2033. This growth reflects rising demand for olive products worldwide.

What are the key market players or companies in the Olive industry?

Key players in the olive industry include major producers and brands renowned for their high-quality products. They play significant roles in cultivation, processing, and distribution, ensuring market stability and fostering innovation in olive-based products.

What are the primary factors driving the growth in the Olive industry?

Growth in the olive industry is driven by increasing health awareness, demand for healthy food options such as olive oil, and expanding culinary uses of olives. Sustainable agriculture practices also attract consumers interested in eco-friendly products.

Which region is the fastest Growing in the Olive market?

The North American region is the fastest-growing market for olives, expected to grow from $4.64 billion in 2023 to $8.26 billion by 2033. This growth indicates a rising acceptance of olive products in diverse culinary applications.

Does ConsaInsights provide customized market report data for the Olive industry?

Yes, ConsaInsights offers customized market report data tailored to the olive industry, addressing specific inquiries and industry needs. Our analysis helps businesses make informed decisions based on the latest market trends and consumer preferences.

What deliverables can I expect from this Olive market research project?

From our olive market research project, you can expect comprehensive reports, market segmentation analysis, competitive landscape insights, growth forecasts, and key trends that will support strategic planning and decision-making.

What are the market trends of Olive?

Key trends in the olive market include an increasing focus on organic and premium olive products, a rise in online retail sales, and growing consumer interest in health benefits associated with olives, leading to higher demand across global markets.