Oncology Based In Vivo Cro Market Report

Published Date: 31 January 2026 | Report Code: oncology-based-in-vivo-cro

Oncology Based In Vivo Cro Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Oncology Based In Vivo CRO market, covering its size, CAGR, industry trends, regional analysis, segmentation, and forecasts from 2023 to 2033.

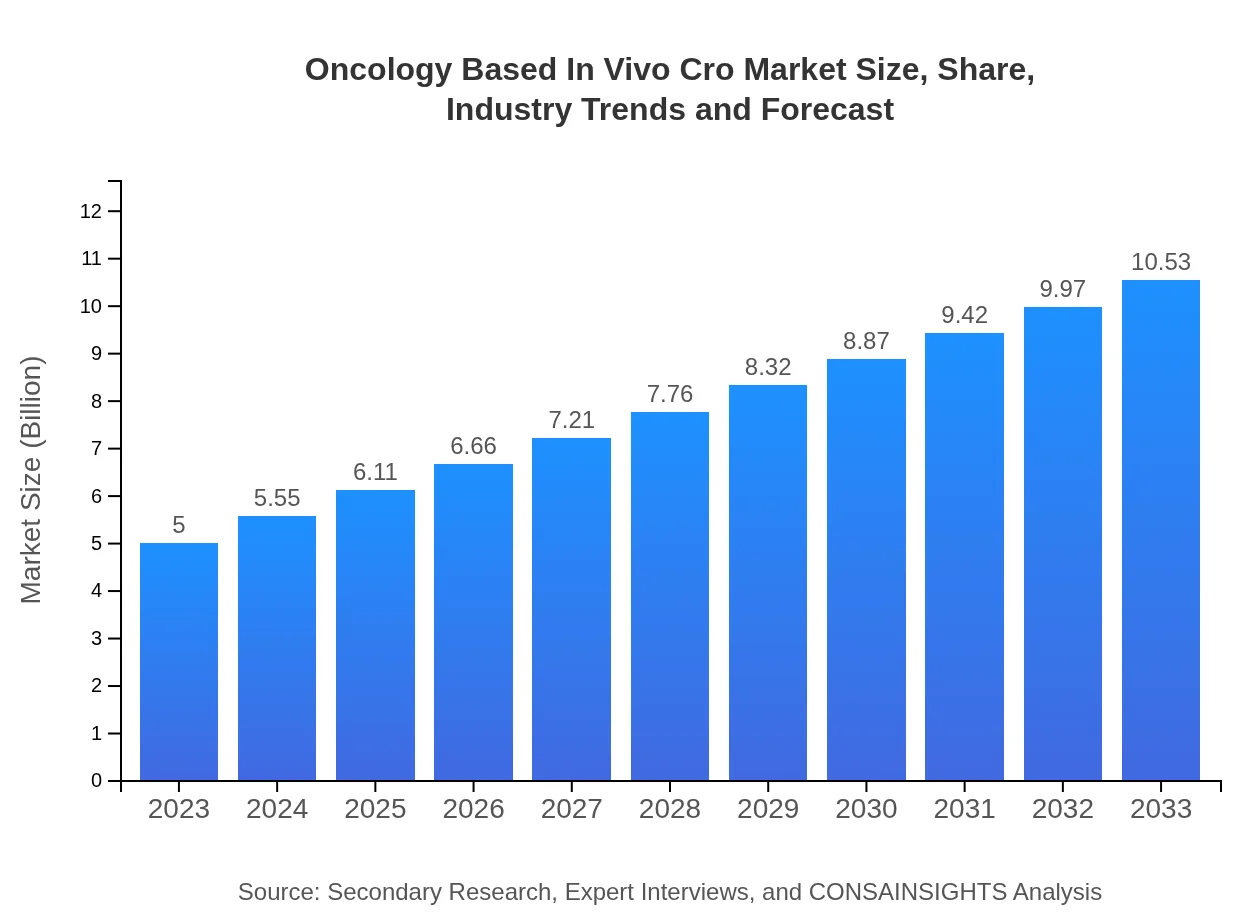

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.00 Billion |

| CAGR (2023-2033) | 7.5% |

| 2033 Market Size | $10.53 Billion |

| Top Companies | Charles River Laboratories, Covance, IQVIA , PRA Health Sciences |

| Last Modified Date | 31 January 2026 |

Oncology Based In Vivo Cro Market Overview

Customize Oncology Based In Vivo Cro Market Report market research report

- ✔ Get in-depth analysis of Oncology Based In Vivo Cro market size, growth, and forecasts.

- ✔ Understand Oncology Based In Vivo Cro's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Oncology Based In Vivo Cro

What is the Market Size & CAGR of Oncology Based In Vivo Cro market in 2023?

Oncology Based In Vivo Cro Industry Analysis

Oncology Based In Vivo Cro Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Oncology Based In Vivo Cro Market Analysis Report by Region

Europe Oncology Based In Vivo Cro Market Report:

The European market for Oncology Based In Vivo CRO is expected to advance from USD 1.37 billion in 2023 to USD 2.88 billion by 2033. Various initiatives by the European Union towards cancer control and growing awareness are contributing to the market growth in this region.Asia Pacific Oncology Based In Vivo Cro Market Report:

The Asia Pacific region is expected to witness remarkable growth in the Oncology Based In Vivo CRO market from USD 0.95 billion in 2023 to USD 1.99 billion in 2033. The rise in healthcare expenditure, coupled with increasing investments from global CROs to establish a presence in emerging markets, is a key driver for growth in this region.North America Oncology Based In Vivo Cro Market Report:

North America holds a significant share of the Oncology Based In Vivo CRO market, with a projected increase from USD 1.94 billion in 2023 to USD 4.08 billion by 2033. The strong presence of several leading pharmaceutical companies and the increasing focus on cancer research are driving this growth in the region.South America Oncology Based In Vivo Cro Market Report:

In South America, the market size for Oncology Based In Vivo CRO is projected to grow from USD 0.10 billion in 2023 to USD 0.20 billion by 2033, reflecting a steady increase in research activities due to growing healthcare demands and potential partnerships with international CROs for improved service delivery.Middle East & Africa Oncology Based In Vivo Cro Market Report:

The Middle East and Africa region is anticipated to grow from USD 0.65 billion in 2023 to USD 1.37 billion by 2033, supported by increasing health investments and a growing focus on combating cancer through enhanced research capabilities.Tell us your focus area and get a customized research report.

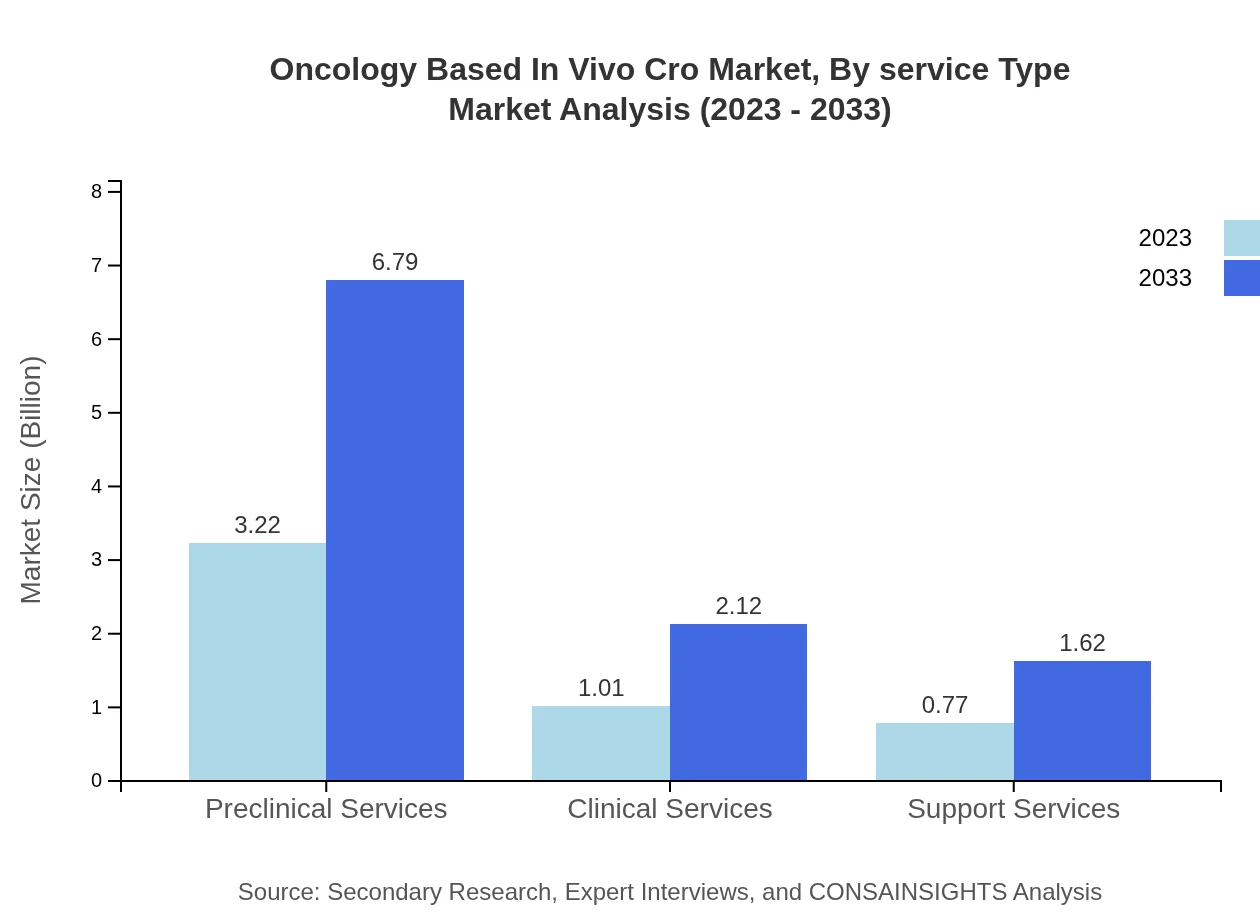

Oncology Based In Vivo Cro Market Analysis By Service Type

For service types, the market is segmented into preclinical services, clinical services, and support services. Preclinical services dominate the market with a size of USD 3.22 billion in 2023 and expected to rise to USD 6.79 billion by 2033, accounting for approximately 64.47% of the overall market share.

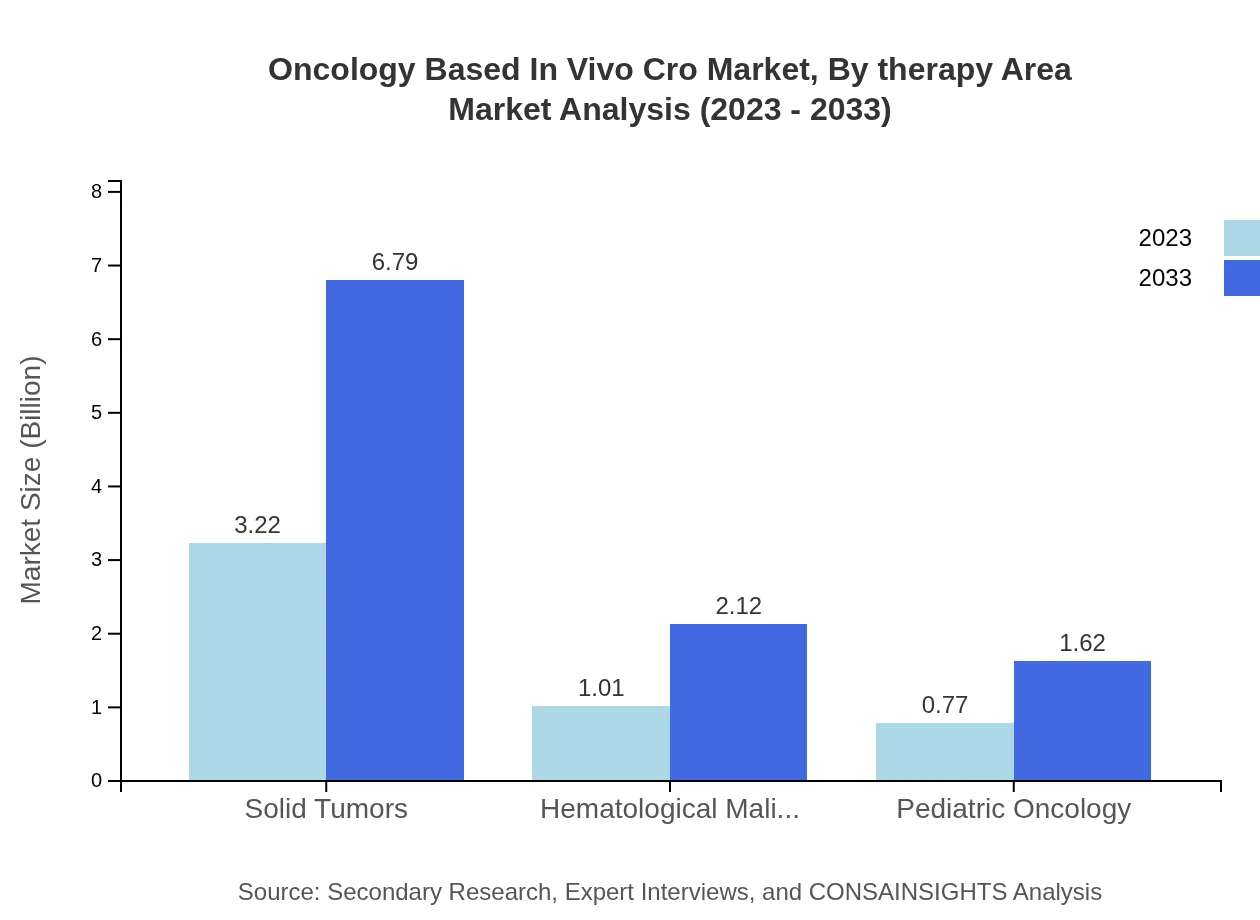

Oncology Based In Vivo Cro Market Analysis By Therapy Area

According to therapy areas, solid tumors lead, with a market size of USD 3.22 billion in 2023, projected to reach USD 6.79 billion by 2033. Hematological malignancies and pediatric oncology are also significant, with respective contributions of USD 1.01 billion and USD 0.77 billion in 2023.

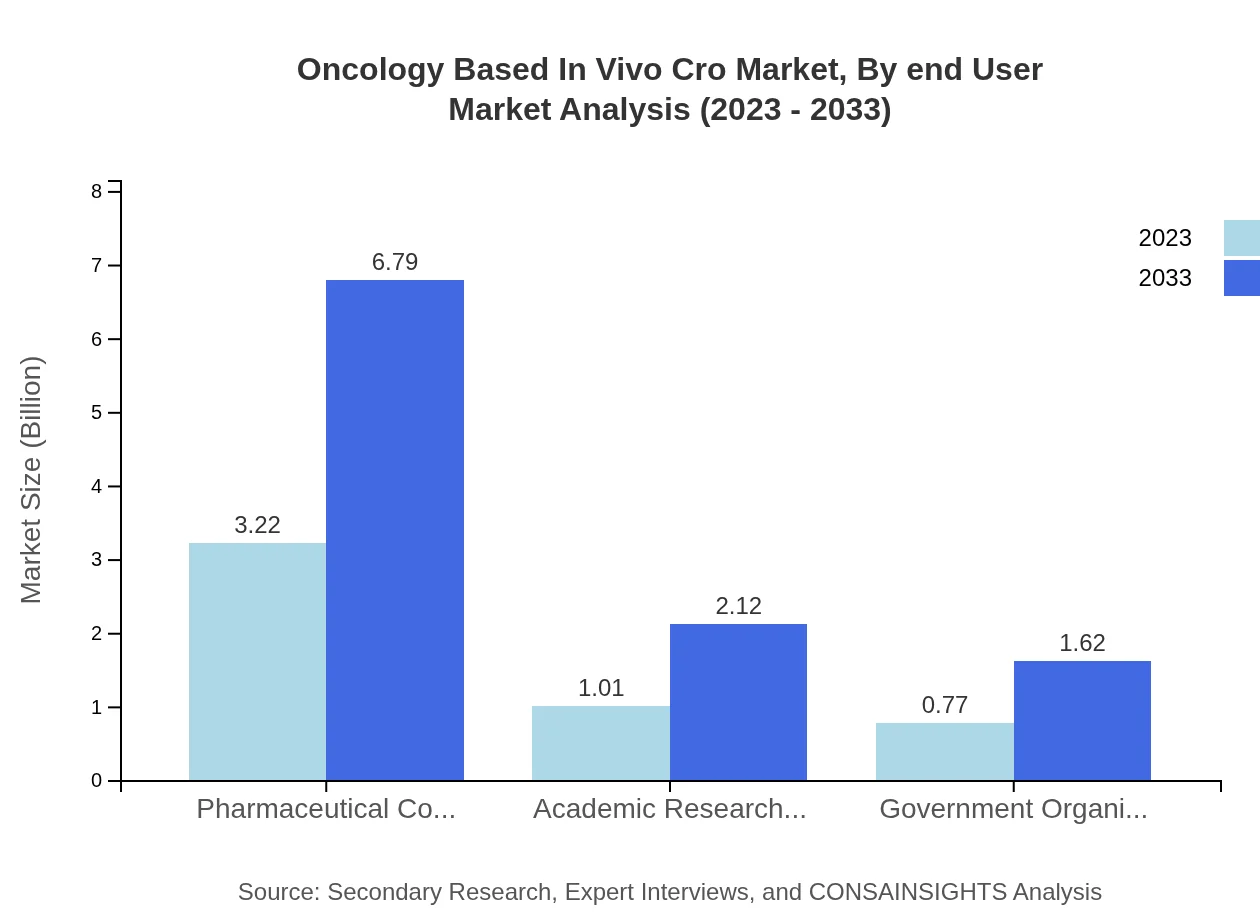

Oncology Based In Vivo Cro Market Analysis By End User

The end-user analysis indicates pharmaceutical companies as the largest segment, holding 64.47% of the market share in 2023 with a size of USD 3.22 billion, forecasted to grow to USD 6.79 billion by 2033, followed by government organizations and academic research institutes.

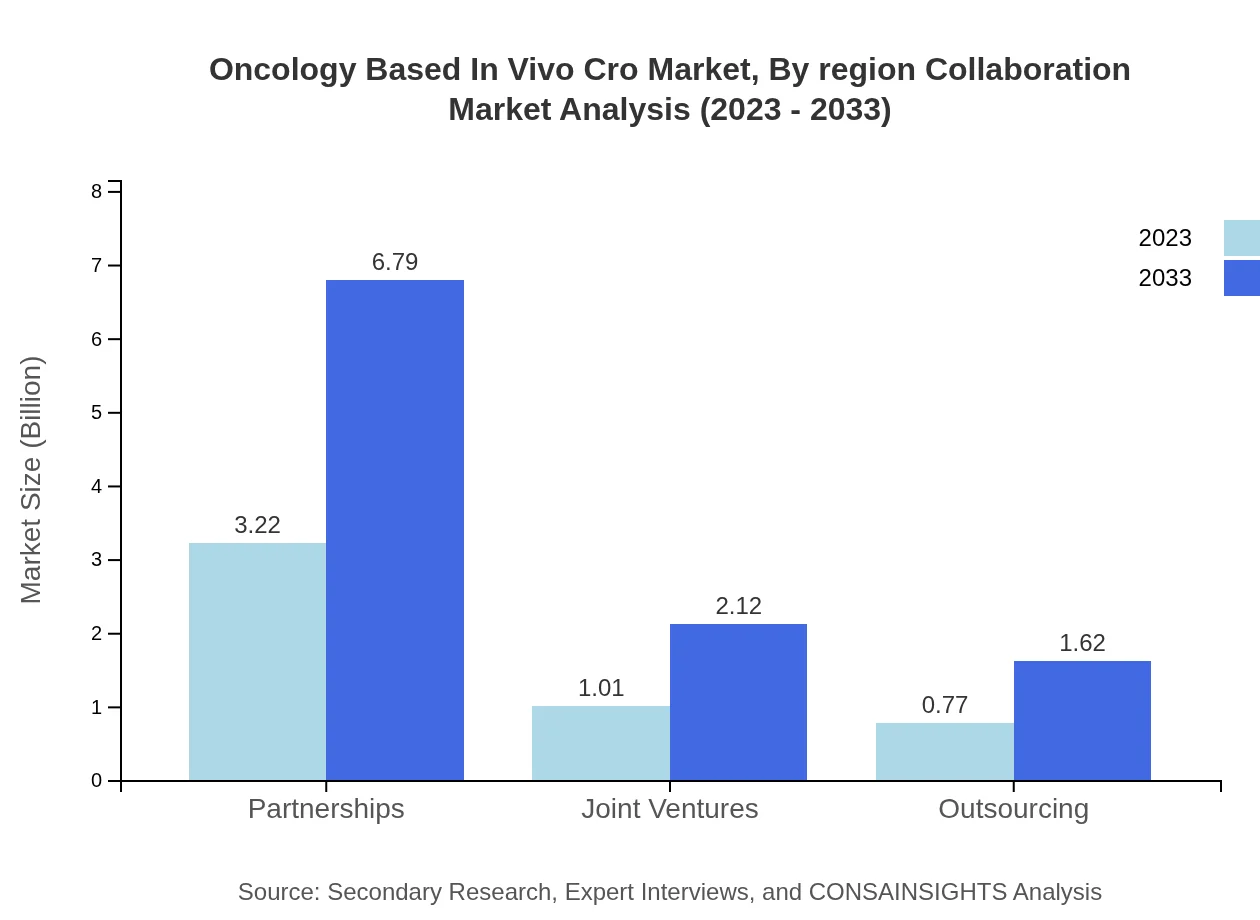

Oncology Based In Vivo Cro Market Analysis By Region Collaboration

Collaboration models such as partnerships, joint ventures, and outsourcing are common in this market. Partnerships, which lead the segment with USD 3.22 billion in 2023, are expected to reach USD 6.79 billion by 2033, illustrating their importance in enhancing research capabilities.

Oncology Based In Vivo Cro Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Oncology Based In Vivo Cro Industry

Charles River Laboratories:

Charles River is a leading provider of comprehensive drug development services and provides critical services in the Oncology Based In Vivo CRO market, particularly focused on preclinical and clinical testing.Covance:

Covance offers a range of drug development services, including specialized expertise in oncology trials, playing a vital role in advancing treatments through innovative research.IQVIA :

With a broad range of global health information and technology services, IQVIA is positioned as a leader in CRO services, particularly in oncology clinical development.PRA Health Sciences:

PRA Health Sciences provides premier global contract research services across all phases, with a strong focus on oncology research and development.We're grateful to work with incredible clients.

FAQs

What is the market size of oncology Based In Vivo-CRO?

The oncology-based in vivo CRO market is projected to reach approximately USD 5 billion by 2033, driven by a CAGR of 7.5%. This growth reflects the increasing demand for personalized cancer treatments and advancements in research methodologies.

What are the key market players or companies in this oncology Based In Vivo-CRO industry?

Key players in the oncology-based in vivo CRO industry include several leading pharmaceutical companies and specialized CROs that focus on drug development. These organizations are crucial for facilitating clinical trials and enhancing drug efficacy.

What are the primary factors driving the growth in the oncology Based In Vivo-CRO industry?

Growth in this industry is driven by increased investment in oncology research, global collaborations among pharma companies, and advancements in biotechnology. Enhanced regulatory frameworks and a growing prevalence of cancer also play significant roles.

Which region is the fastest Growing in the oncology Based In Vivo-CRO?

North America is the fastest-growing region in the oncology-based in vivo CRO market, with expected growth from USD 1.94 billion in 2023 to USD 4.08 billion by 2033. This growth is supported by high healthcare spending and robust research capabilities.

Does ConsaInsights provide customized market report data for the oncology Based In Vivo-CRO industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the oncology-based in vivo CRO industry. These reports can include detailed insights, forecasts, and data segmentation based on client requirements.

What deliverables can I expect from this oncology Based In Vivo-CRO market research project?

Deliverables from the oncology-based in vivo CRO market research project typically include comprehensive market analysis, segment data, growth projections, and strategic recommendations tailored to business needs for better decision-making.

What are the market trends of oncology Based In Vivo-CRO?

Current trends in the oncology-based in vivo CRO market include increased adoption of personalized medicine, advancements in technology such as AI and machine learning, and growing partnerships between CROs and biotech firms to enhance research efficiency.