Oncology Drugs Market Report

Published Date: 31 January 2026 | Report Code: oncology-drugs

Oncology Drugs Market Size, Share, Industry Trends and Forecast to 2033

This report offers an extensive analysis of the Oncology Drugs market, providing insights on market size, growth forecasts, regional trends, and competitive landscape from 2023 to 2033.

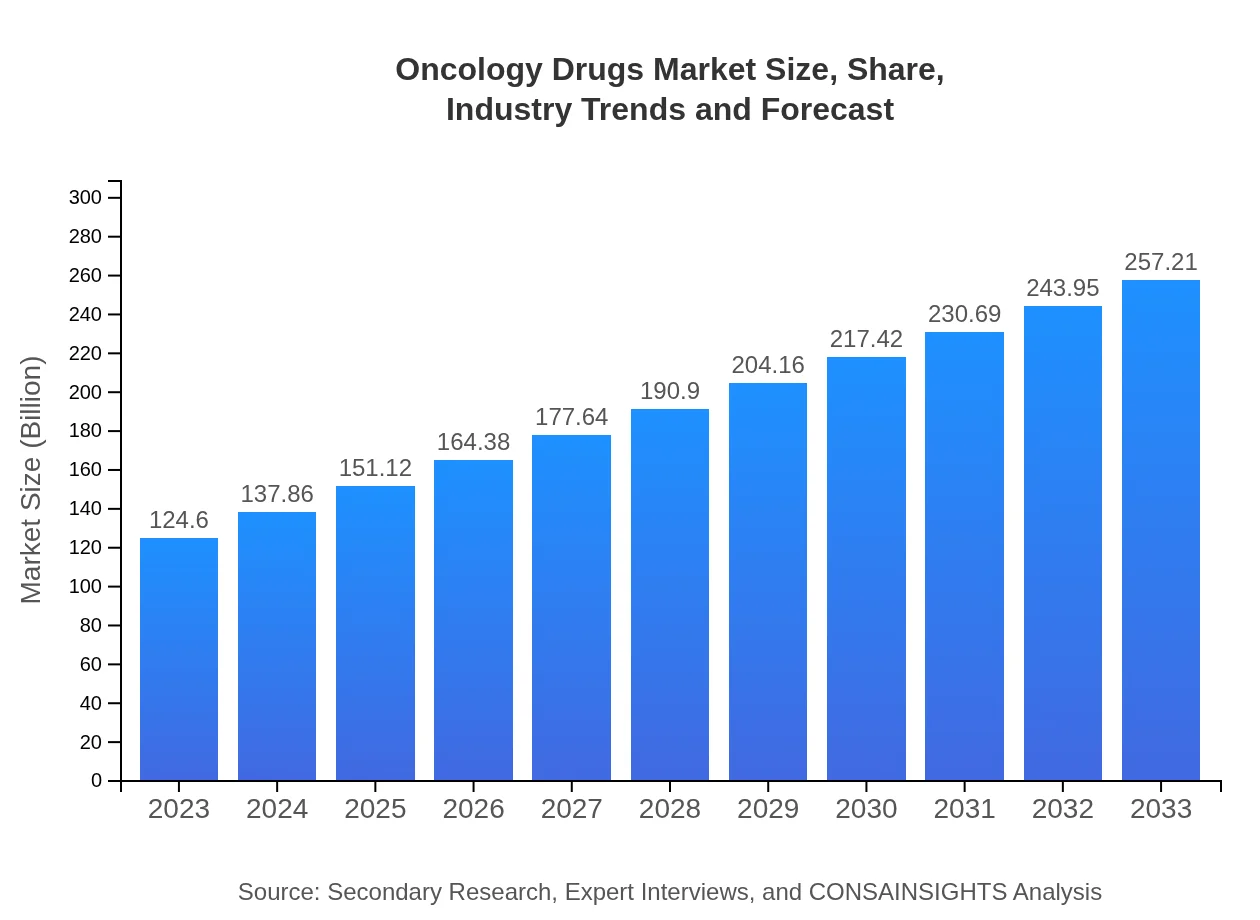

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $124.60 Billion |

| CAGR (2023-2033) | 7.3% |

| 2033 Market Size | $257.21 Billion |

| Top Companies | Roche, Merck & Co., Pfizer , Bristol-Myers Squibb |

| Last Modified Date | 31 January 2026 |

Oncology Drugs Market Overview

Customize Oncology Drugs Market Report market research report

- ✔ Get in-depth analysis of Oncology Drugs market size, growth, and forecasts.

- ✔ Understand Oncology Drugs's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Oncology Drugs

What is the Market Size & CAGR of Oncology Drugs market in 2023?

Oncology Drugs Industry Analysis

Oncology Drugs Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Oncology Drugs Market Analysis Report by Region

Europe Oncology Drugs Market Report:

Europe's Oncology Drugs market is expected to grow from $42.63 billion in 2023 to $87.99 billion by 2033. Strong regulatory frameworks, coupled with a focus on research and development, propel the market forward. Additionally, increasing investments in cancer research and the rising incidence of cancer across European nations further strengthen the market.Asia Pacific Oncology Drugs Market Report:

The Asia Pacific region is poised for significant growth, with the market projected to reach $45.45 billion by 2033, up from $22.02 billion in 2023. Increasing investment in healthcare infrastructure and a rising prevalence of cancer are key factors. Furthermore, the region benefits from a large patient population and improving healthcare services that enhance access to oncology drugs.North America Oncology Drugs Market Report:

North America remains the largest market for Oncology Drugs, projected to reach $85.26 billion by 2033 from $41.30 billion in 2023. The U.S. leads in pharmaceutical research and development, with robust healthcare infrastructure and advanced cancer care practices fueling market growth. The presence of major pharmaceutical companies in the region also supports the swift introduction of innovative therapies.South America Oncology Drugs Market Report:

In South America, the Oncology Drugs market is expected to grow from $7.35 billion in 2023 to $15.18 billion by 2033. This growth is driven by increased awareness about cancer treatment options and government initiatives to improve healthcare access. The rising demand for advanced oncology treatments contributes significantly to market expansion.Middle East & Africa Oncology Drugs Market Report:

Market growth in the Middle East and Africa is anticipated to rise from $11.30 billion in 2023 to $23.33 billion by 2033. Improved healthcare infrastructure and rising awareness regarding cancer treatments significantly influence this upward trend. The region is gradually adopting innovative drug therapies and strategies to address the growing cancer burden.Tell us your focus area and get a customized research report.

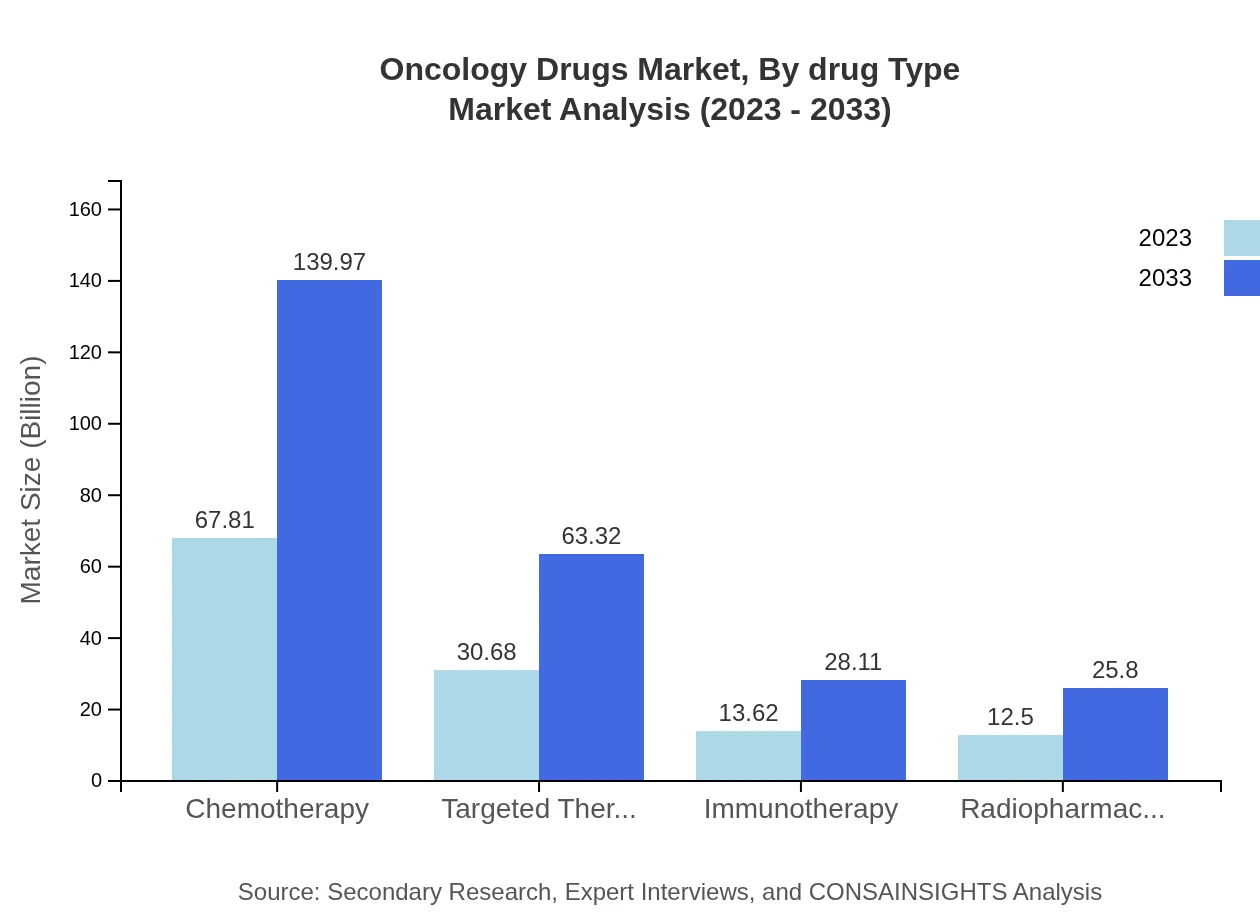

Oncology Drugs Market Analysis By Drug Type

The Oncology Drugs market, segmented by drug type, showcases significant growth in chemotherapy, targeted therapy, and immunotherapy. Chemotherapy remains dominant, rising from $67.81 billion in 2023 to $139.97 billion in 2033. Targeted therapy and immunotherapy are also gaining traction, driven by advancements in molecular biology and clinical efficacy.

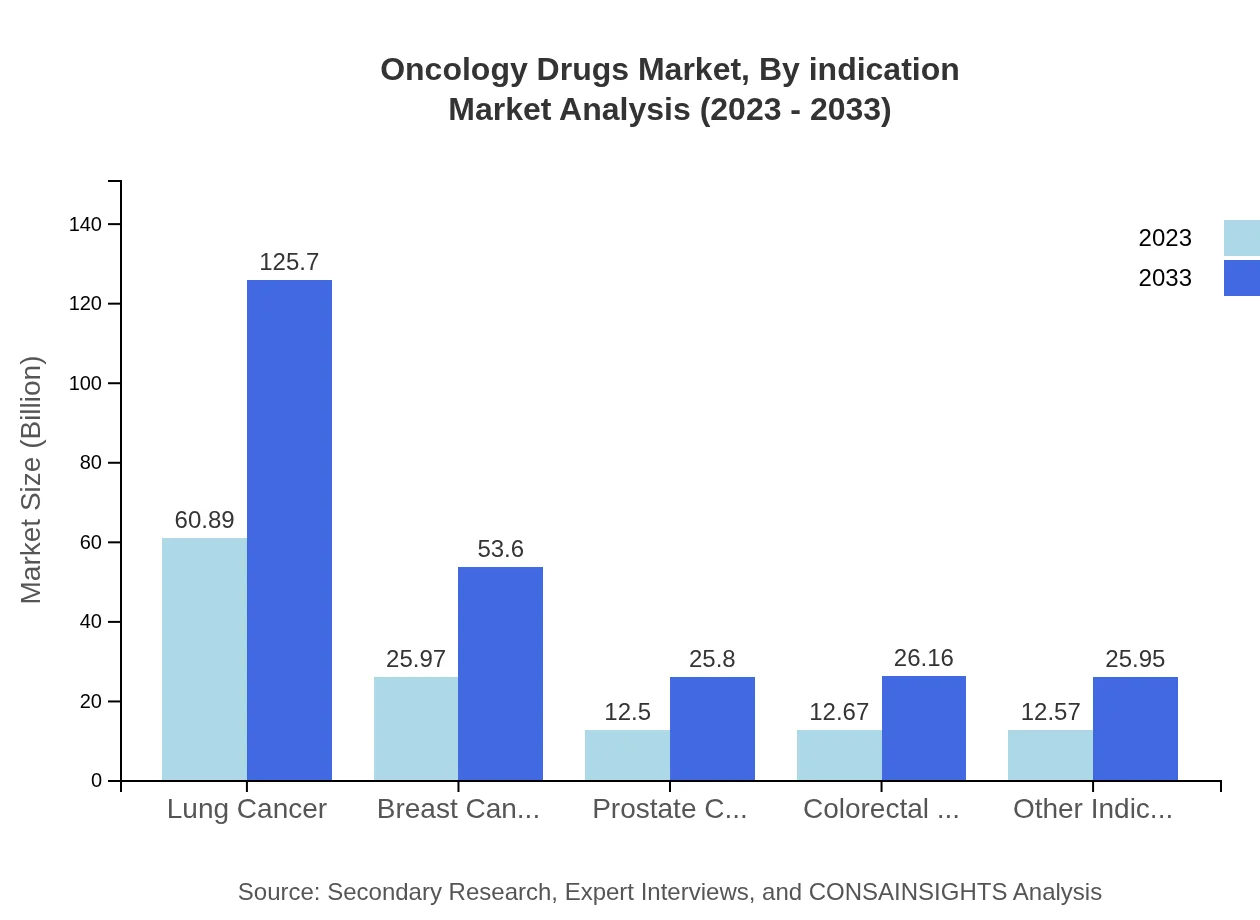

Oncology Drugs Market Analysis By Indication

By indication, lung cancer dominates the Oncology Drugs market, with a market size expected to increase from $60.89 billion in 2023 to $125.70 billion by 2033. Breast cancer treatment also holds a significant share, with figures projected to rise from $25.97 billion to $53.60 billion. A growing focus on personalized treatment strategies drives this segment's rapid development.

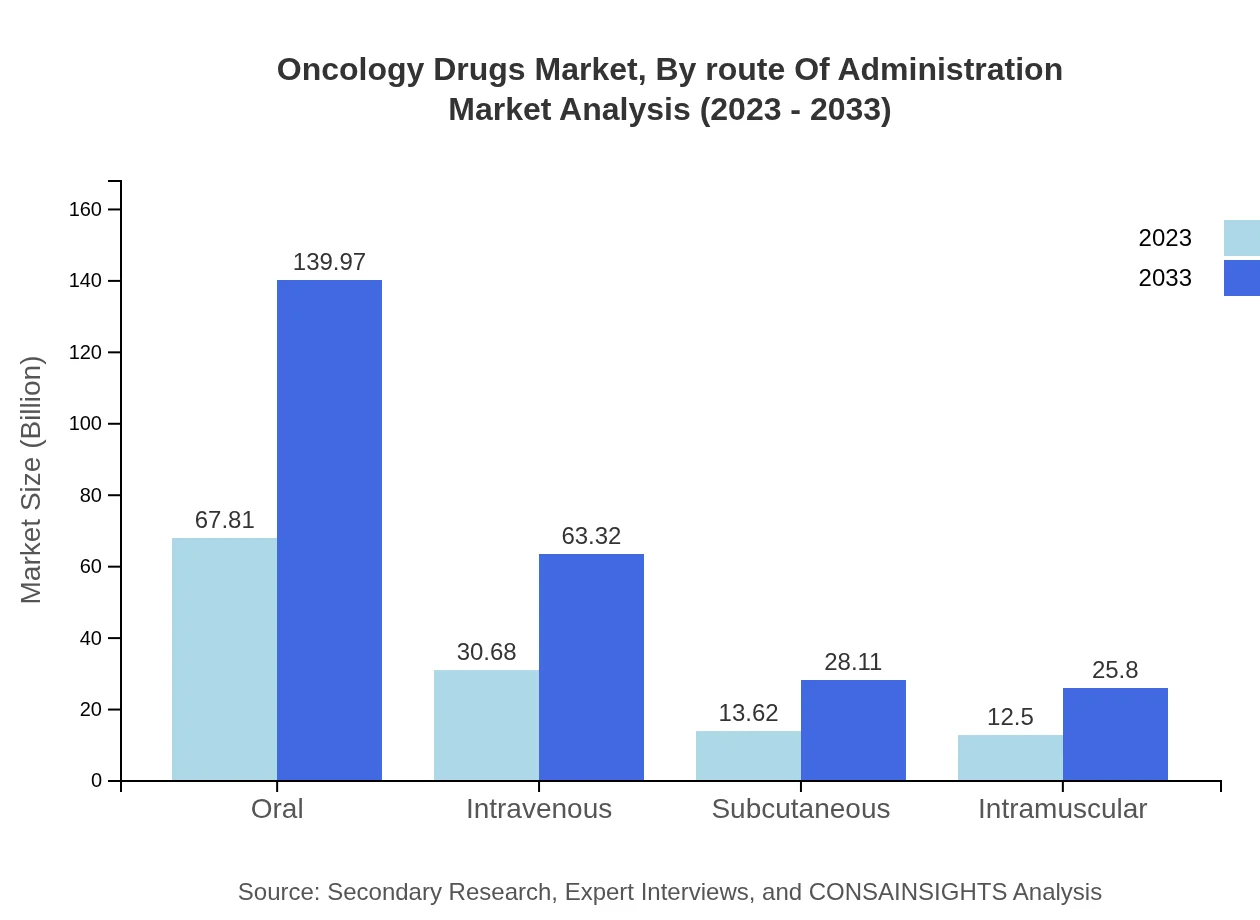

Oncology Drugs Market Analysis By Route Of Administration

Oral administration leads the market, valued at $67.81 billion in 2023 and expected to reach $139.97 billion by 2033. The ease of administration and convenience for patients contribute to this growth. Intravenous and subcutaneous routes also hold substantial shares, supported by advancements in drug formulations that enhance therapeutic effectiveness.

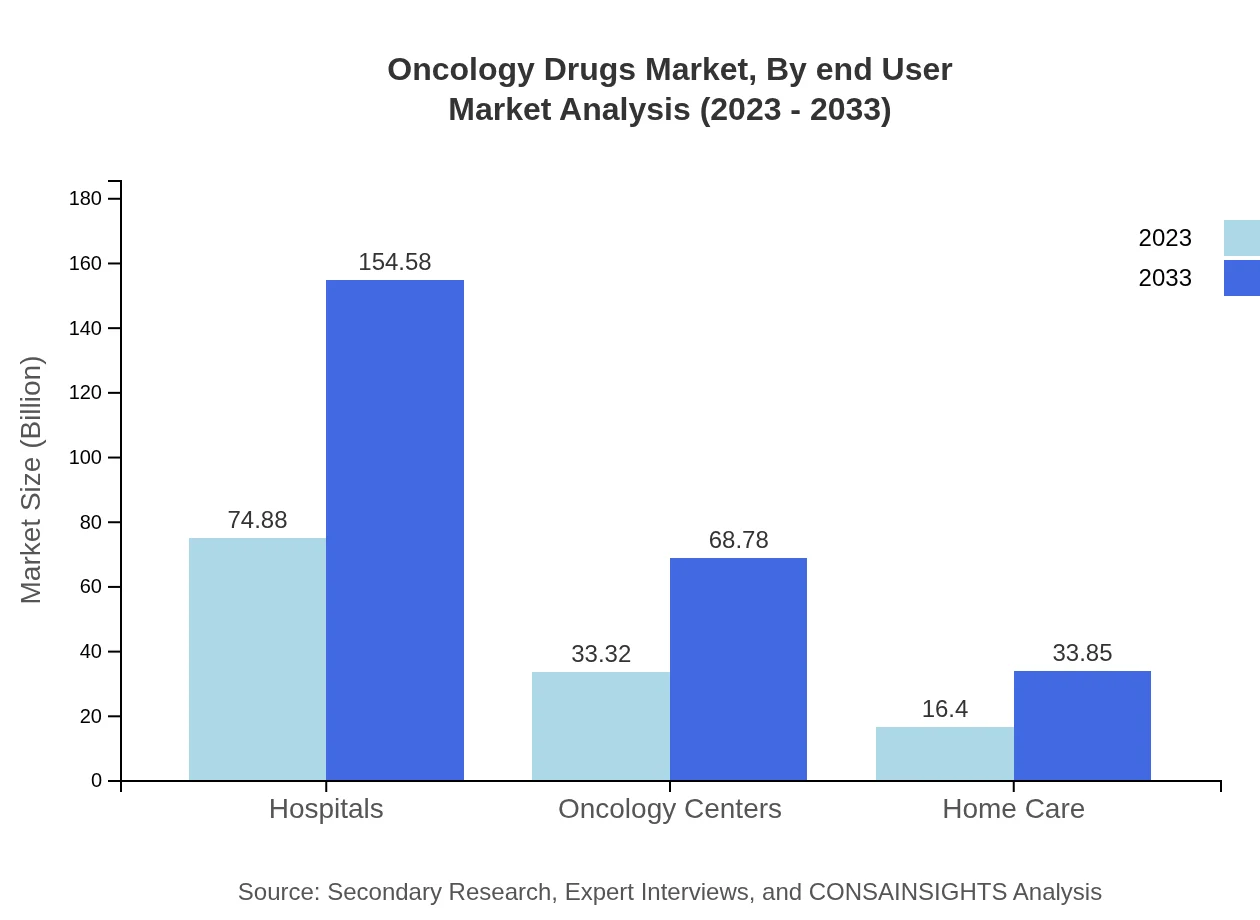

Oncology Drugs Market Analysis By End User

Hospitals play a critical role in the Oncology Drugs market, representing a significant portion of the overall demand. The market size for hospitals is anticipated to increase from $74.88 billion in 2023 to $154.58 billion in 2033. Oncology centers and home care services are also expanding, reflecting a trend towards accessible and comprehensive cancer management.

Oncology Drugs Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Oncology Drugs Industry

Roche:

Roche is a leading player in oncology therapies, known for its innovative anti-cancer drugs and commitment to advancing personalized medicine.Merck & Co.:

Merck is recognized for its groundbreaking immune-oncology treatments and a robust pipeline of oncology drug candidates aimed at improving patient outcomes.Pfizer :

Pfizer focuses on developing targeted therapies and immunotherapies within oncology, making significant contributions to cancer care advancements.Bristol-Myers Squibb:

Bristol-Myers Squibb is known for its innovative immunotherapy treatments and is a frontrunner in cancer treatment research.We're grateful to work with incredible clients.

FAQs

What is the market size of oncology Drugs?

The oncology drugs market is currently valued at approximately $124.6 billion with a projected CAGR of 7.3% from 2023 to 2033. This significant growth reflects increasing investments in cancer research and development.

What are the key market players or companies in this oncology Drugs industry?

Key players in the oncology drugs market include major pharmaceutical companies like Roche, Novartis, Merck, and Pfizer. These companies are pivotal in developing innovative therapies and expanding market footprints globally.

What are the primary factors driving the growth in the oncology Drugs industry?

Factors driving growth include increasing cancer prevalence, advancements in drug development technology, and rising investments in healthcare. Additionally, regulatory support and the rising demand for personalized medicine enhance market attractiveness.

Which region is the fastest Growing in the oncology Drugs?

The fastest-growing region in the oncology drugs market is Europe, with projected growth from $42.63 billion in 2023 to $87.99 billion by 2033. North America follows closely, with significant developments contributing to market expansion.

Does ConsaInsights provide customized market report data for the oncology Drugs industry?

Yes, ConsaInsights specializes in delivering customized market report data tailored to specific client needs within the oncology drugs industry. This allows for focused insights into niche segments and geographical areas.

What deliverables can I expect from this oncology Drugs market research project?

Expect comprehensive deliverables including market analysis, trend forecasts, competitive landscape assessments, and regional breakdowns. Reports also provide insights into market segmentation and potential growth opportunities.

What are the market trends of oncology Drugs?

Current trends in the oncology drugs market include a shift towards immunotherapy and targeted therapies, growing adoption of personalized medicine, and increased focus on early-stage drug development, all enhancing treatment options.