Oncology Molecular Diagnostics Market Report

Published Date: 31 January 2026 | Report Code: oncology-molecular-diagnostics

Oncology Molecular Diagnostics Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Oncology Molecular Diagnostics market, providing insights into market dynamics, size forecasts, regional analyses, and trends from 2023 to 2033.

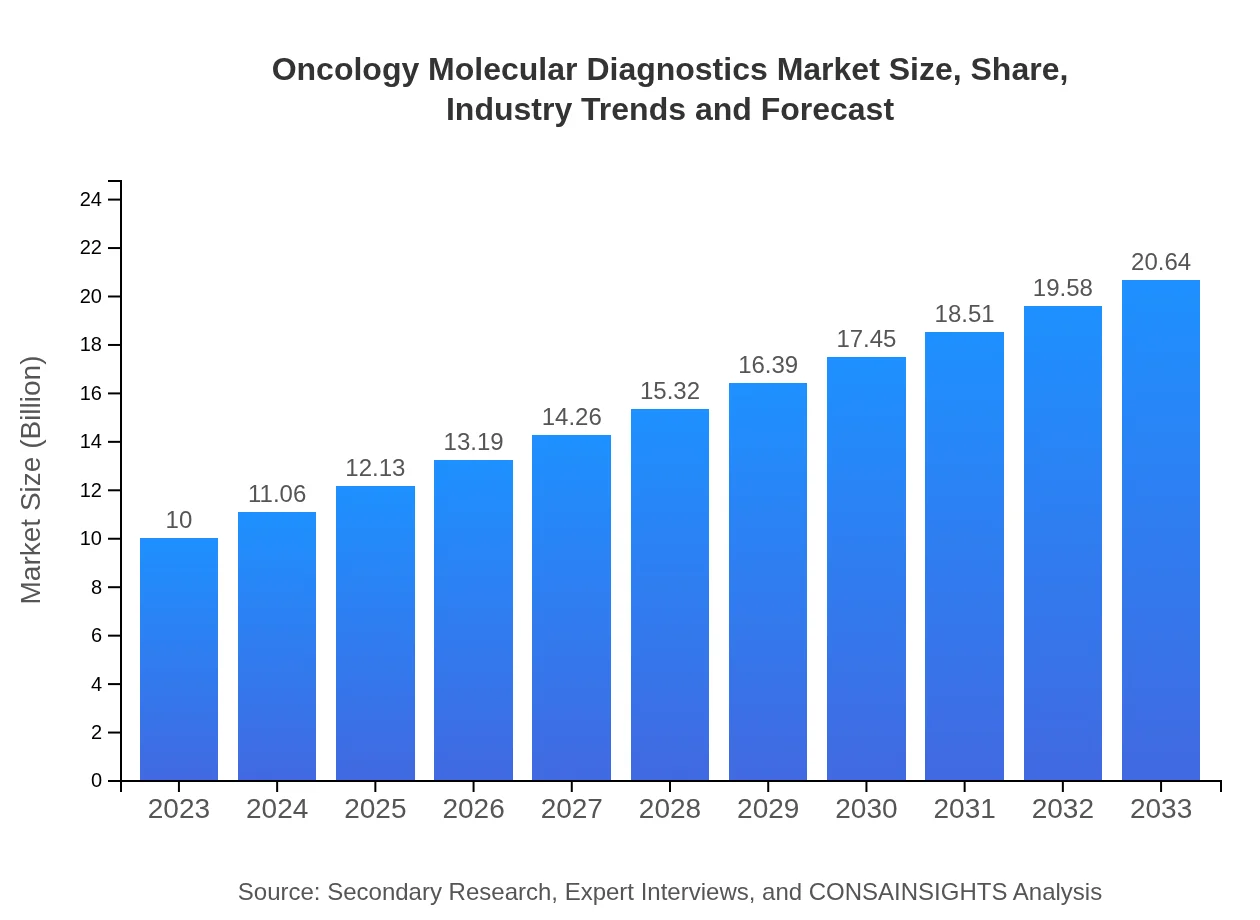

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 7.3% |

| 2033 Market Size | $20.64 Billion |

| Top Companies | Roche Diagnostics, Abbott Laboratories, Qiagen , Thermo Fisher Scientific, Illumina |

| Last Modified Date | 31 January 2026 |

Oncology Molecular Diagnostics Market Overview

Customize Oncology Molecular Diagnostics Market Report market research report

- ✔ Get in-depth analysis of Oncology Molecular Diagnostics market size, growth, and forecasts.

- ✔ Understand Oncology Molecular Diagnostics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Oncology Molecular Diagnostics

What is the Market Size & CAGR of Oncology Molecular Diagnostics market in 2023?

Oncology Molecular Diagnostics Industry Analysis

Oncology Molecular Diagnostics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Oncology Molecular Diagnostics Market Analysis Report by Region

Europe Oncology Molecular Diagnostics Market Report:

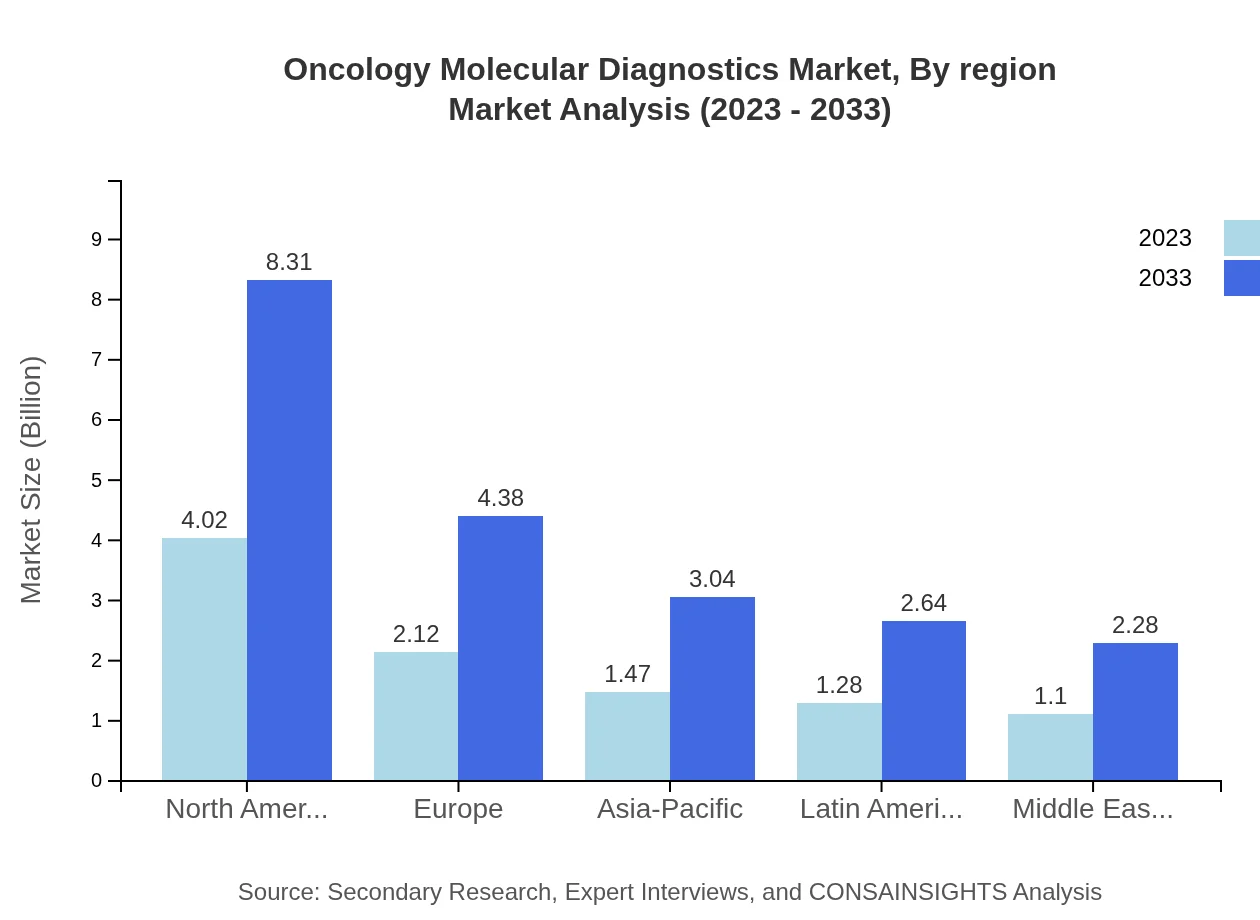

In Europe, the market is projected to grow from $2.80 billion in 2023 to $5.79 billion by 2033. Increasing collaborations among healthcare and biotech companies, along with the rising incidence of cancer, are significant growth factors in this region.Asia Pacific Oncology Molecular Diagnostics Market Report:

The Asia Pacific market was valued at $1.92 billion in 2023, expected to grow to $3.97 billion by 2033, driven by increasing investments in healthcare, rising cancer incidence rates, and expanding access to advanced molecular diagnostic technologies.North America Oncology Molecular Diagnostics Market Report:

North America, representing a dominant market with a value of $3.42 billion in 2023, is expected to reach $7.05 billion by 2033. This growth is attributed to high healthcare expenditure, ongoing innovative research, and a greater emphasis on personalized medicine.South America Oncology Molecular Diagnostics Market Report:

In South America, the market is projected to grow from $0.48 billion in 2023 to $0.99 billion by 2033. Growth drivers include improved healthcare infrastructure and increasing awareness about cancer screening and diagnosis.Middle East & Africa Oncology Molecular Diagnostics Market Report:

The Middle East and Africa saw a market size of $1.38 billion in 2023, which is expected to rise to $2.84 billion by 2033. There is a growing focus on enhancing healthcare services and increasing investment in diagnostics, particularly in urban regions.Tell us your focus area and get a customized research report.

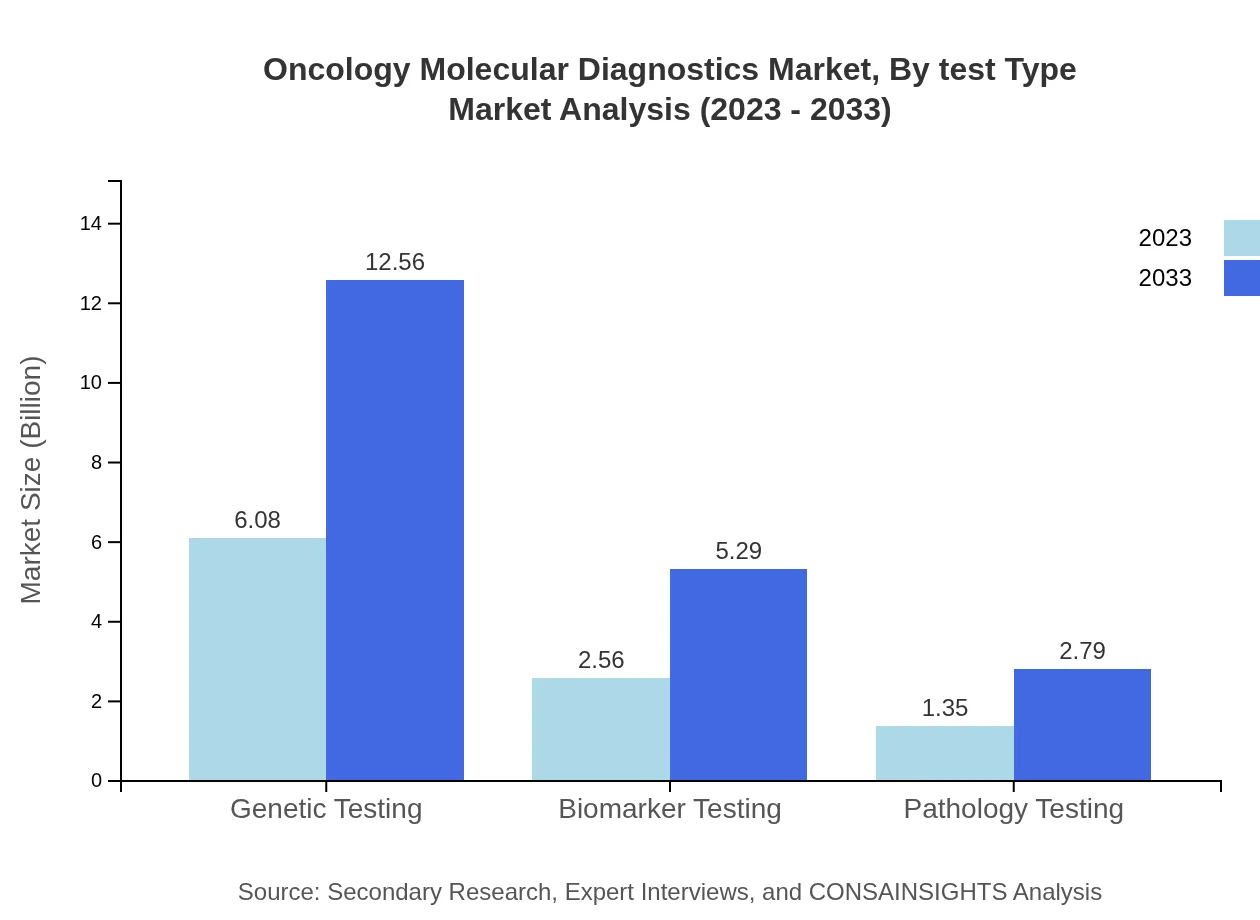

Oncology Molecular Diagnostics Market Analysis By Test Type

An in-depth analysis indicates that Genetic Testing comprises the majority of the market share at 60.83% in 2023, set to remain constant through 2033, valued at approximately $12.56 billion. Biomarker Testing follows, holding 25.64% of the market share with a projected growth to $5.29 billion. Pathology Testing, while smaller at 13.53% now, is expected to enhance its market presence with persistent advancements in diagnostic techniques.

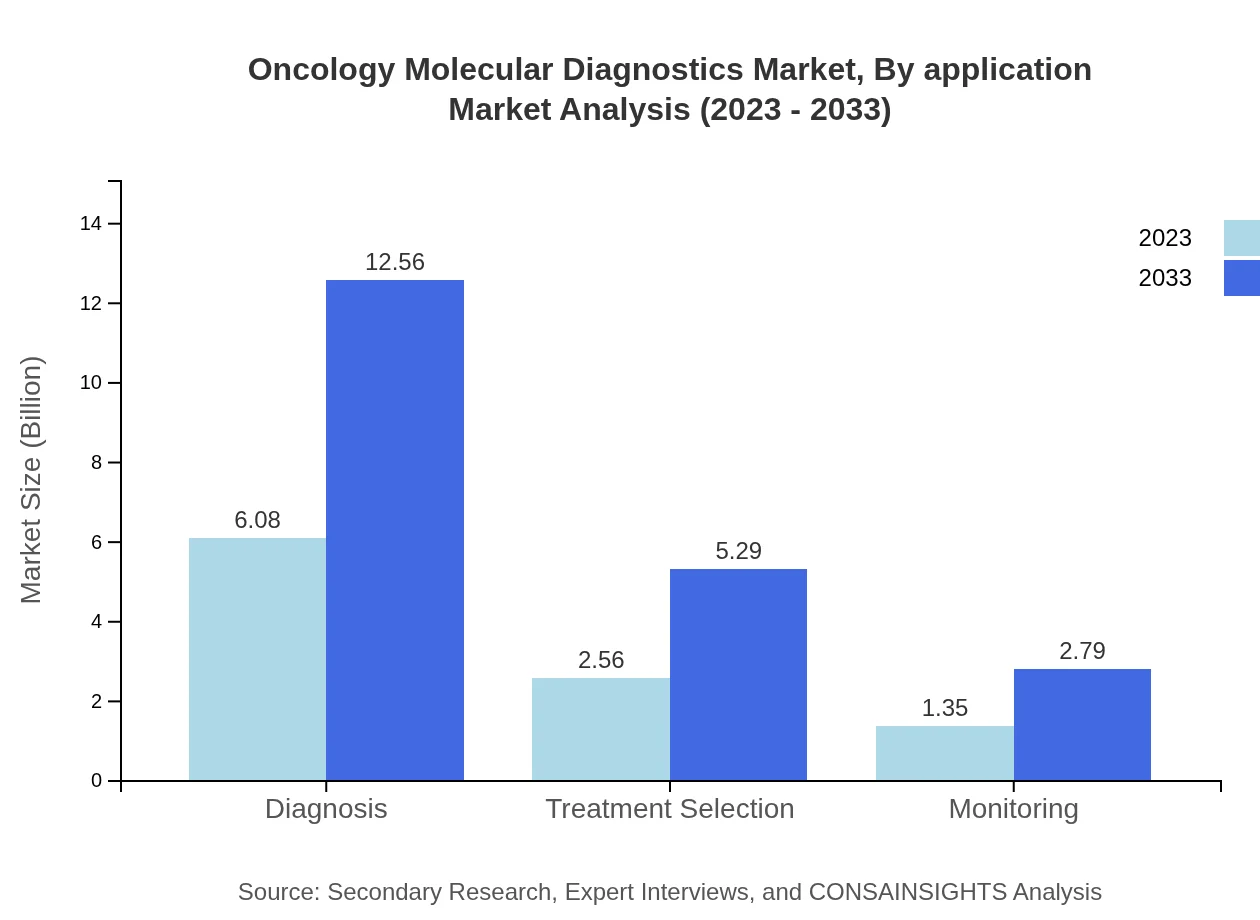

Oncology Molecular Diagnostics Market Analysis By Application

The prominent application areas include Diagnosis, Treatment Selection, and Monitoring, with Diagnosis taking the lead at 60.83% market share in 2023, forecasting similar levels through 2033. Treatment Selection comprises 25.64% and is gaining traction as personalized medicine becomes more prevalent, while Monitoring holds a steady 13.53% of the application segment.

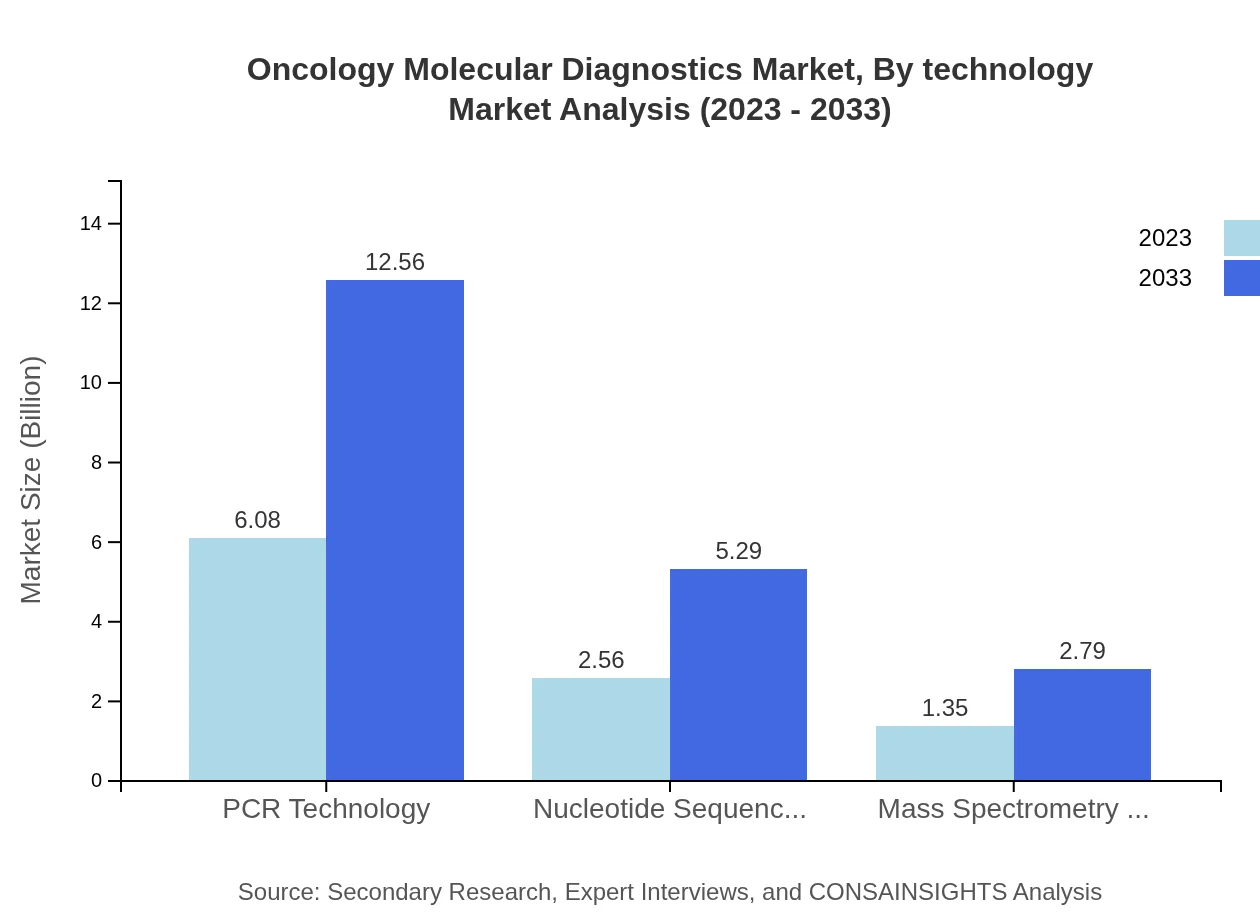

Oncology Molecular Diagnostics Market Analysis By Technology

PCR Technology leads the Oncology Molecular Diagnostics market at a share of 60.83% in 2023, expected to sustain this level through 2033. Nucleotide Sequencing Technology holds a promising 25.64%, showing strong growth potential, while Mass Spectrometry Technology retains a traditional but important role with 13.53% market share.

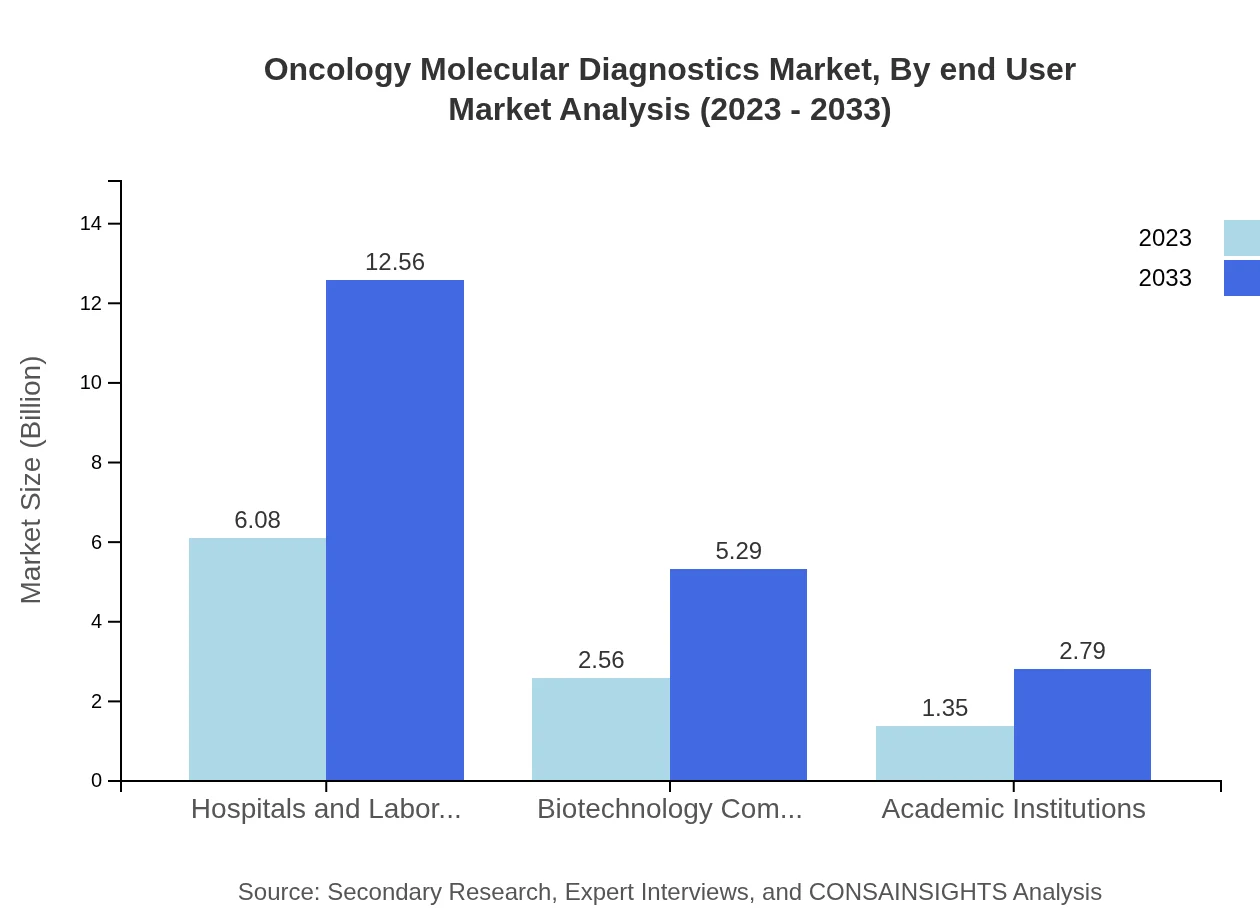

Oncology Molecular Diagnostics Market Analysis By End User

Hospitals and Laboratories capture a substantial market share at 60.83%, with forecasts suggesting continued leadership through 2033. Biotechnology Companies account for 25.64%, reflecting their crucial role in driving innovations, while Academic Institutions encompass 13.53% of the market, focusing on research and development in molecular diagnostics.

Oncology Molecular Diagnostics Market Analysis By Region

Regionally, North America leads with a significant market size of $4.02 billion in 2023, further expanding to $8.31 billion by 2033, and maintaining a consistent share of 40.24% across the forecast period. Europe and Asia-Pacific contribute to 21.22% and 14.72% share respectively, showcasing robust growth trajectories in the same period.

Oncology Molecular Diagnostics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Oncology Molecular Diagnostics Industry

Roche Diagnostics:

A leader in the field, Roche specializes in the development of molecular diagnostics and has a significant portfolio of innovative products that address various cancers.Abbott Laboratories:

Abbott is known for its advanced diagnostic solutions, providing high-quality molecular diagnostic tests for cancer detection and management.Qiagen :

Qiagen focuses on providing sample and assay technologies, enabling molecular diagnostics and personalized medicine approaches.Thermo Fisher Scientific:

Thermo Fisher offers a comprehensive range of molecular diagnostic solutions, playing a pivotal role in enhancing precision medicine and cancer management.Illumina:

Illumina is a leader in genomics, particularly known for its high-throughput sequencing technologies that significantly impact oncology diagnostics.We're grateful to work with incredible clients.

FAQs

What is the market size of oncology Molecular Diagnostics?

The global oncology molecular diagnostics market is projected to reach approximately $10 billion by 2033, with a compound annual growth rate (CAGR) of 7.3% from 2023 to 2033, indicating significant expansion in this sector.

What are the key market players or companies in the oncology Molecular Diagnostics industry?

Key players in the oncology molecular diagnostics industry include major biotechnology firms, specialized diagnostic companies, and laboratories. Their concentrated investments in research and development are crucial for technological advancements and competitive positioning.

What are the primary factors driving the growth in the oncology Molecular Diagnostics industry?

Growing incidence of cancer, increasing demand for personalized medicine, advancements in genetic testing technologies, and heightened awareness of early detection methods are significantly driving the growth of the oncology molecular diagnostics market.

Which region is the fastest Growing in the oncology Molecular Diagnostics?

The fastest-growing region in the oncology molecular diagnostics market is North America, projected to expand from $3.42 billion in 2023 to $7.05 billion by 2033, propelled by advanced healthcare infrastructure and significant investments in research.

Does ConsaInsights provide customized market report data for the oncology Molecular Diagnostics industry?

Yes, ConsaInsights offers customized market report data for the oncology molecular diagnostics industry, enabling clients to receive tailored insights based on specific requirements and focus areas relevant to their business goals.

What deliverables can I expect from this oncology Molecular Diagnostics market research project?

Deliverables from our oncology molecular diagnostics market research include comprehensive market analysis reports, trend forecasts, regional insights, competitor analysis, and strategic recommendations tailored to various stakeholders in the industry.

What are the market trends of oncology Molecular Diagnostics?

Market trends in oncology molecular diagnostics include a surge in the adoption of next-generation sequencing, increasing collaboration between biotechnology firms and healthcare providers, and a greater focus on biomarker-driven diagnostics for personalized cancer treatments.