Onpremise Enterprise Application Software Market Report

Published Date: 31 January 2026 | Report Code: onpremise-enterprise-application-software

Onpremise Enterprise Application Software Market Size, Share, Industry Trends and Forecast to 2033

This market report covers the Onpremise Enterprise Application Software industry from 2023 to 2033, providing insights on market size, trends, segmentation, regional analysis, and forecasts to support strategic decision-making.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

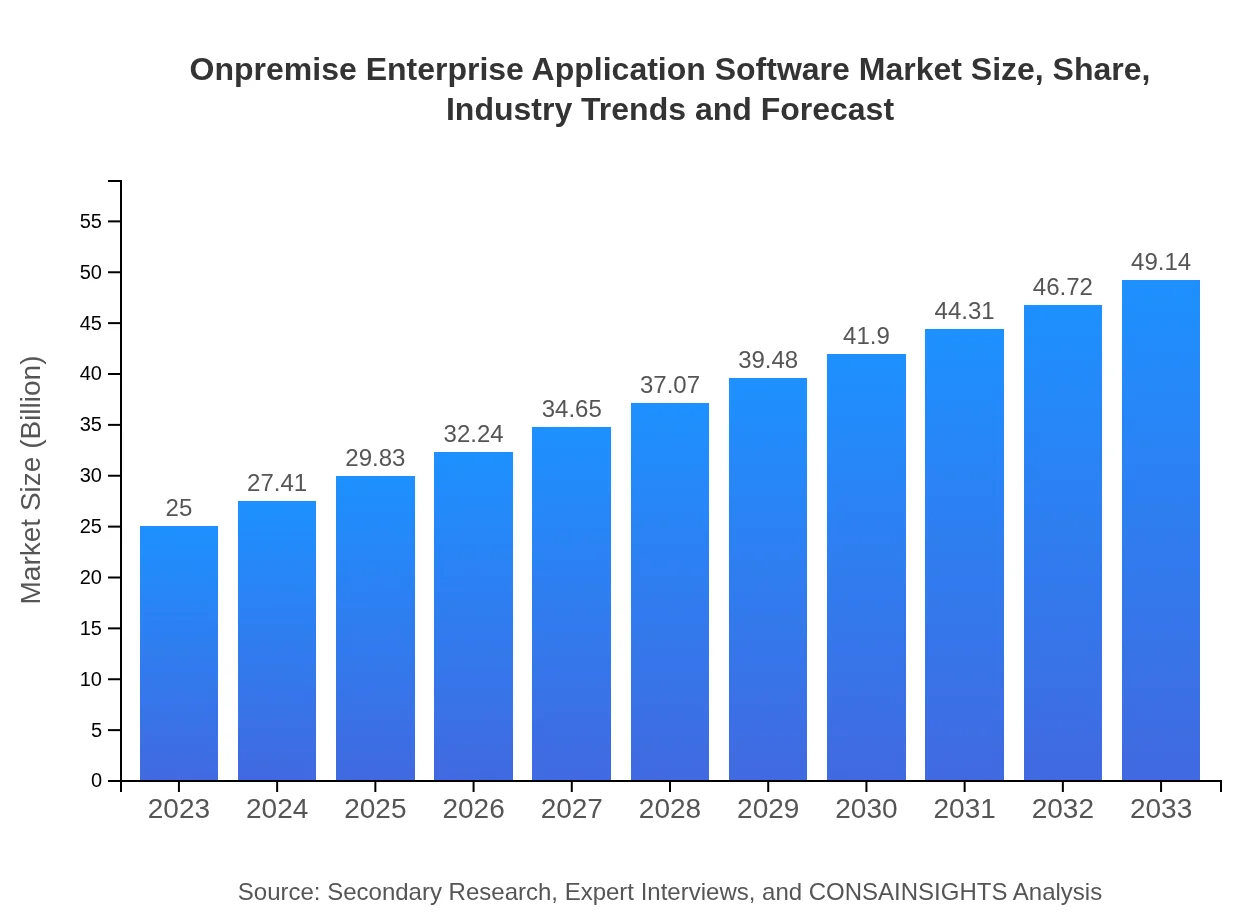

| 2023 Market Size | $25.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $49.14 Billion |

| Top Companies | SAP, Oracle, Microsoft, IBM, Infor |

| Last Modified Date | 31 January 2026 |

Onpremise Enterprise Application Software Market Overview

Customize Onpremise Enterprise Application Software Market Report market research report

- ✔ Get in-depth analysis of Onpremise Enterprise Application Software market size, growth, and forecasts.

- ✔ Understand Onpremise Enterprise Application Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Onpremise Enterprise Application Software

What is the Market Size & CAGR of Onpremise Enterprise Application Software market in 2033?

Onpremise Enterprise Application Software Industry Analysis

Onpremise Enterprise Application Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Onpremise Enterprise Application Software Market Analysis Report by Region

Europe Onpremise Enterprise Application Software Market Report:

Europe's market is expected to grow from $8.43 billion in 2023 to $16.57 billion by 2033. The growth is propelled by increasing regulatory requirements and the need for efficient enterprise management systems. Countries such as Germany and the UK are significant contributors, with industries rapidly adopting tailored solutions.Asia Pacific Onpremise Enterprise Application Software Market Report:

The Asia Pacific region is expected to grow from $4.60 billion in 2023 to $9.04 billion by 2033, with a strong demand for enterprise software driven by expanding economies and rapid digital transformation. Countries like India and China are leading the charge, as enterprises seek scalable technologies to enhance productivity and competitiveness.North America Onpremise Enterprise Application Software Market Report:

In North America, the Onpremise Enterprise Application Software market is anticipated to expand from $8.52 billion in 2023 to $16.75 billion by 2033. The region's dominance is attributed to the presence of leading software vendors and a robust demand from large enterprises seeking comprehensive and integrated solutions for enhanced operational efficiency.South America Onpremise Enterprise Application Software Market Report:

In South America, the market is projected to increase from $0.77 billion in 2023 to $1.52 billion by 2033. The growth is driven by investments in IT infrastructure among SMEs, fostering a strong environment for onpremise software implementation as organizations prioritize data security and localized support.Middle East & Africa Onpremise Enterprise Application Software Market Report:

The Middle East and Africa market is projected to rise from $2.68 billion in 2023 to $5.27 billion by 2033. This growth is fueled by the digital transformation initiatives in the region, where enterprises are increasingly adopting onpremise solutions to manage operations while ensuring data integrity and security.Tell us your focus area and get a customized research report.

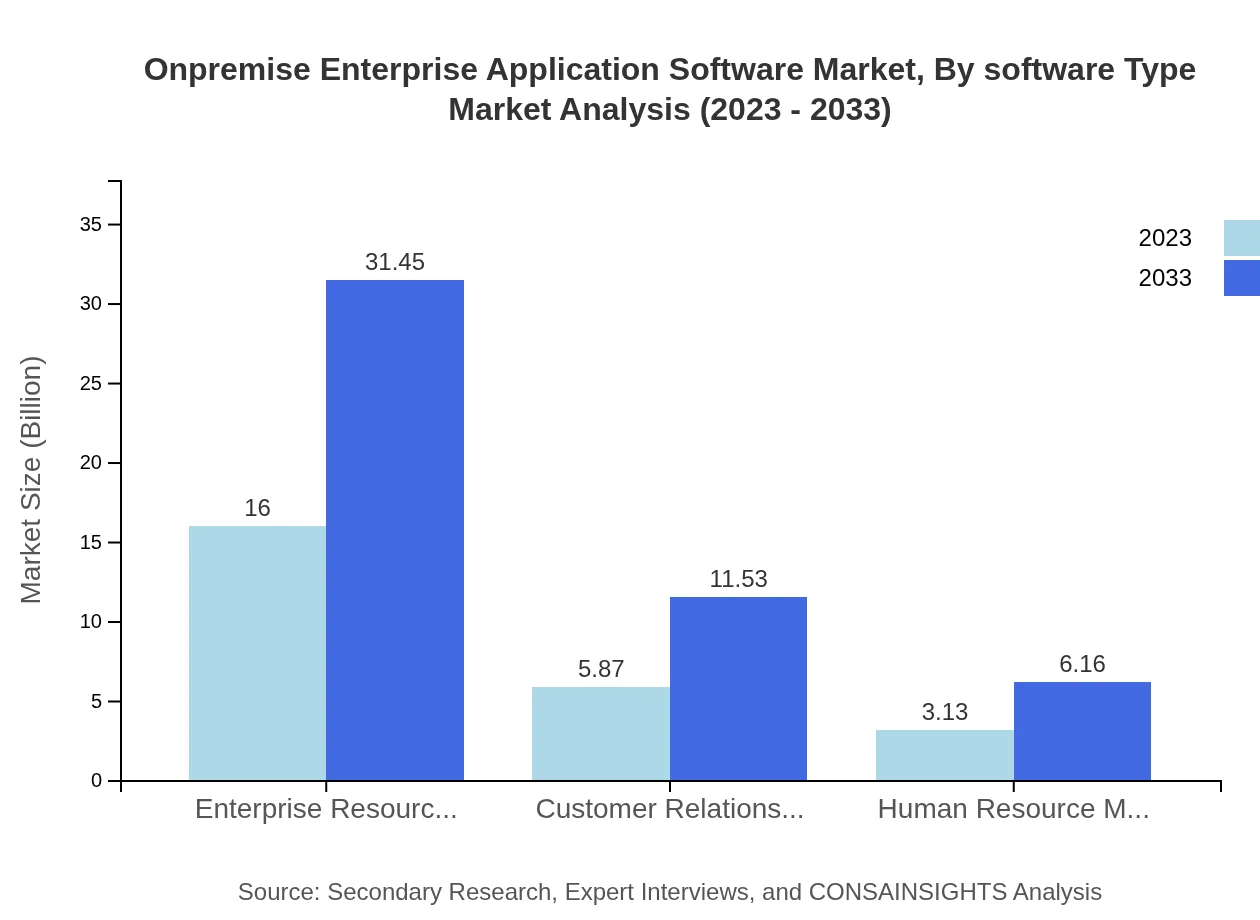

Onpremise Enterprise Application Software Market Analysis By Software Type

The market is dominated by Enterprise Resource Planning (ERP) solutions, which are expected to grow from $16.00 billion in 2023 to $31.45 billion by 2033, holding the largest market share of 64.01%. Other significant segments include Customer Relationship Management (CRM) with a market size growing from $5.87 billion to $11.53 billion, and Human Resource Management Systems (HRMS) from $3.13 billion to $6.16 billion. These software types address critical business requirements across various functions and sectors.

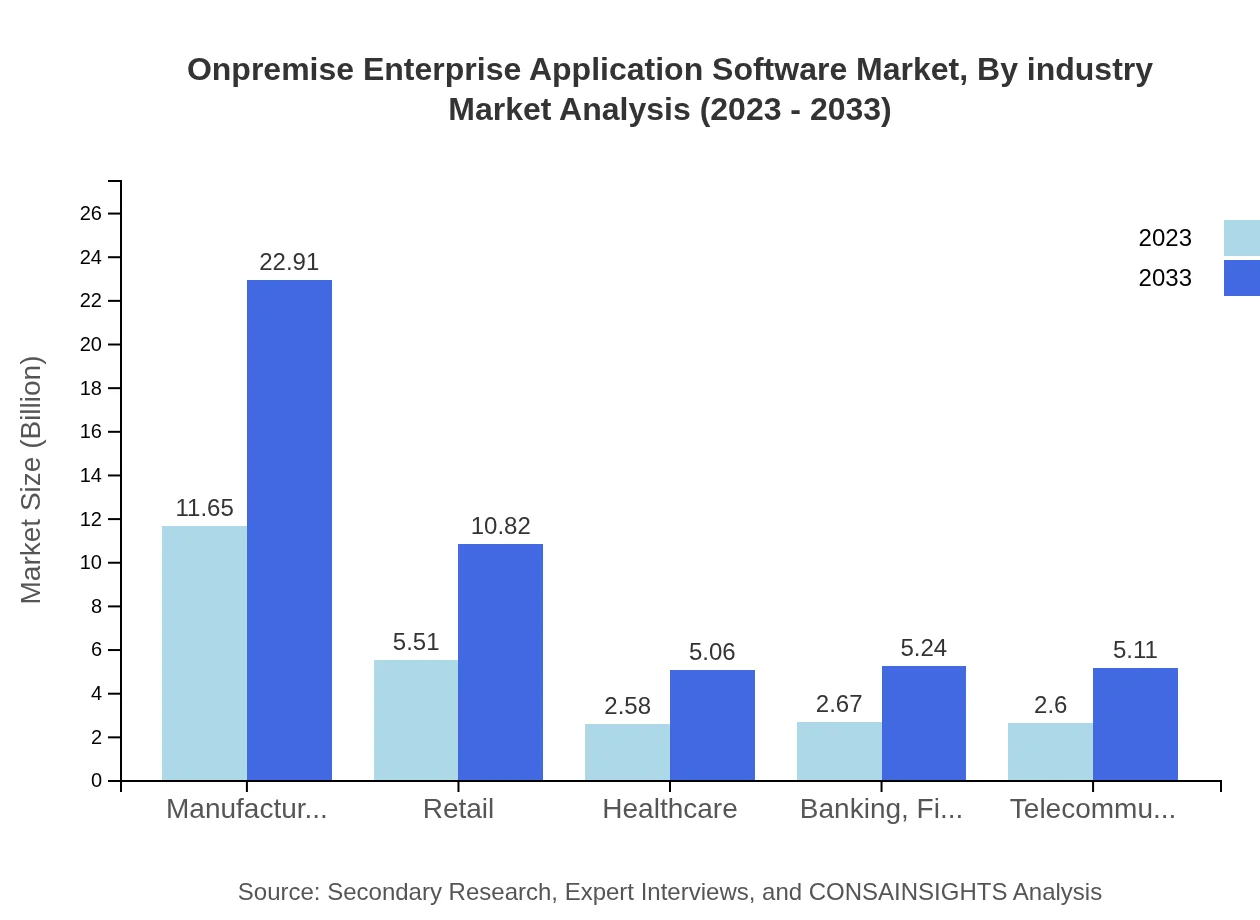

Onpremise Enterprise Application Software Market Analysis By Industry

The manufacturing sector is a key player in this market, anticipated to reach $22.91 billion by 2033, with a share of 46.62%. The retail sector is also prominent, growing to $10.82 billion by 2033. Healthcare, banking, telecommunications, and small and medium enterprises (SMEs) collectively contribute to substantial market growth, driven by increasing demands for operational efficiency and tailored enterprise solutions.

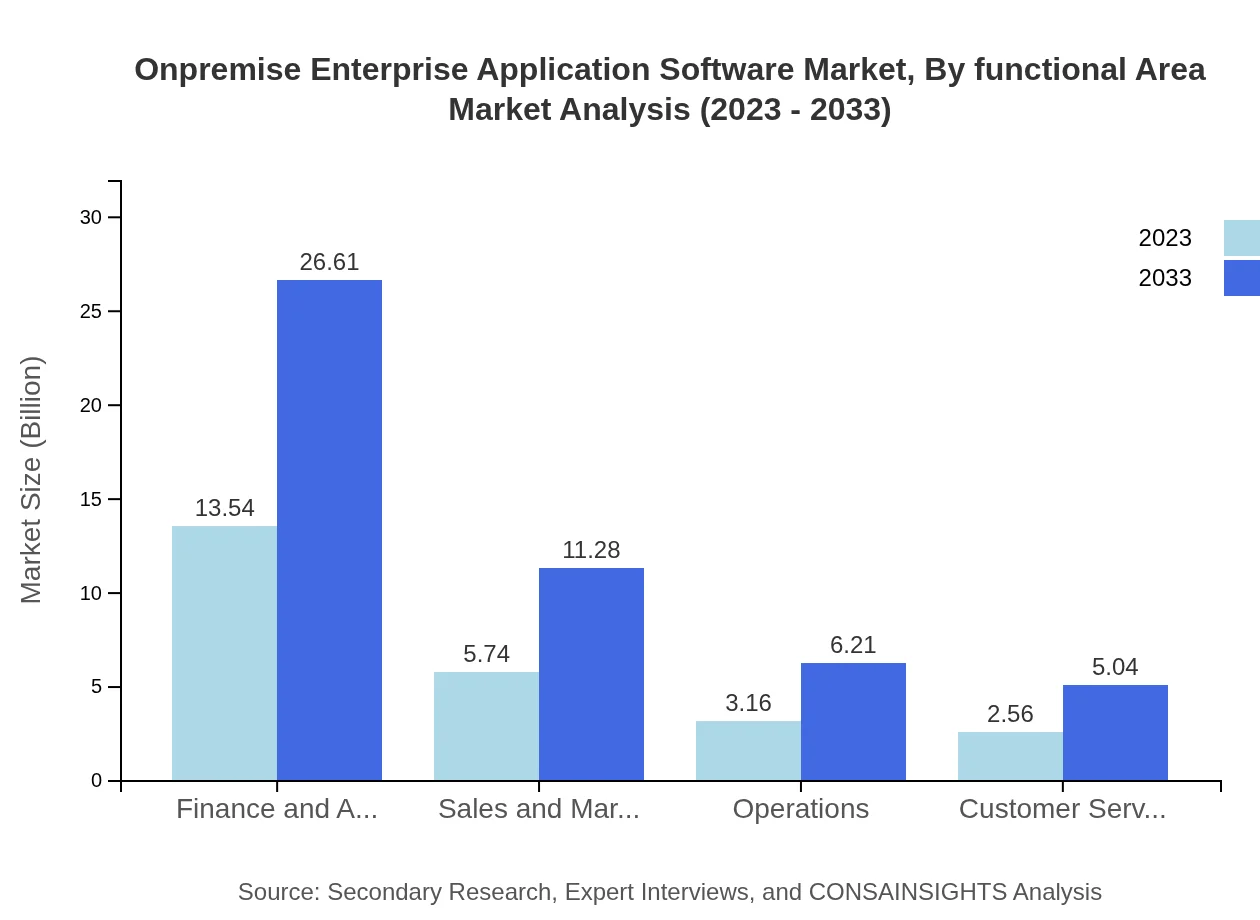

Onpremise Enterprise Application Software Market Analysis By Functional Area

Functional areas such as finance & accounting will see strong growth, from $13.54 billion in 2023 to $26.61 billion in 2033, followed by sales and marketing which grows to $11.28 billion. The operations area is also expected to flourish, highlighting the critical need for integrated applications that facilitate seamless management across various departments.

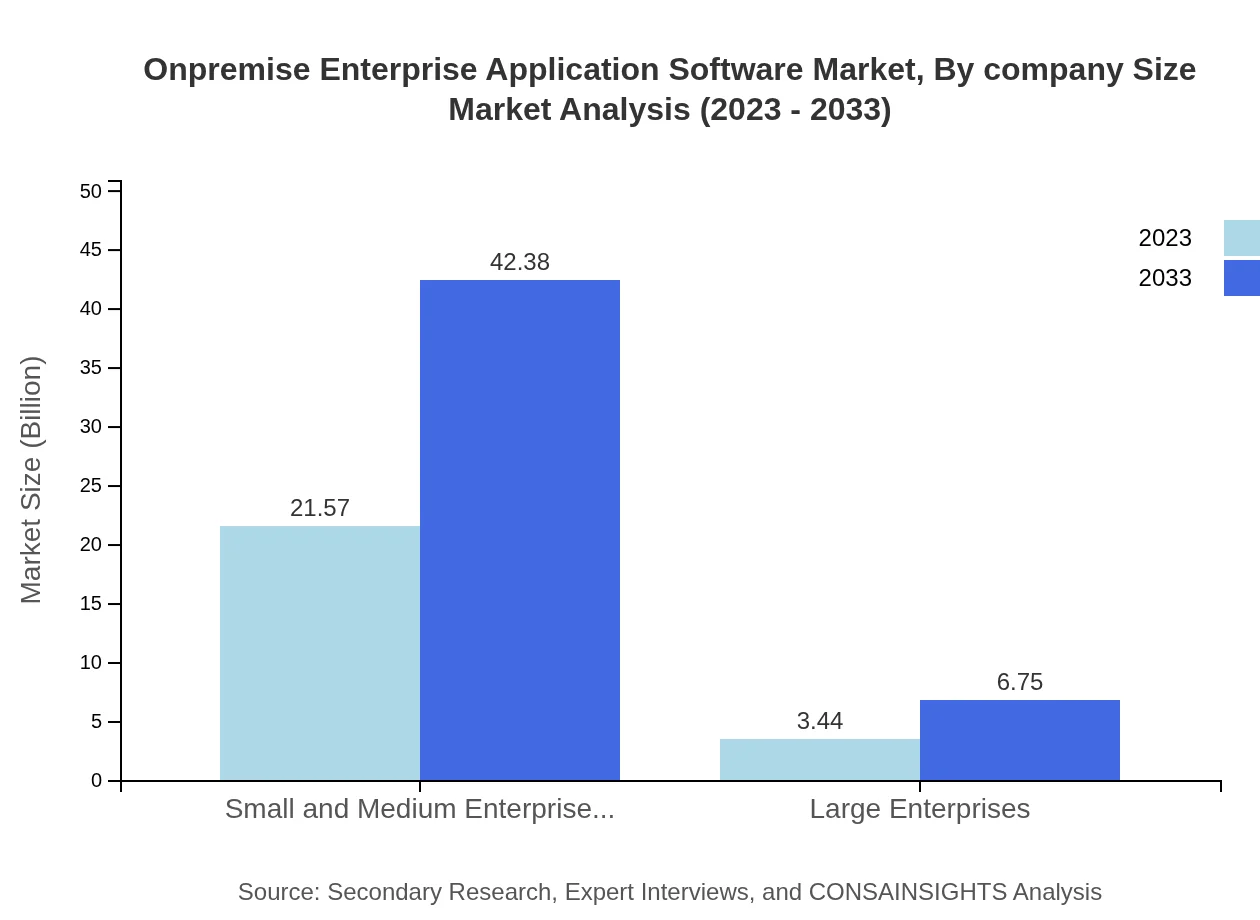

Onpremise Enterprise Application Software Market Analysis By Company Size

SMEs represent the largest segment, expected to grow from $21.57 billion in 2023 to $42.38 billion by 2033, maintaining a market share of 86.26%. Large enterprises are also significant contributors, though their share is lower, indicating a strong inclination toward adopting comprehensive onpremise solutions that provide enhanced control and customization.

Onpremise Enterprise Application Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Onpremise Enterprise Application Software Industry

SAP:

A leader in ERP solutions, SAP provides comprehensive software applications tailored for a variety of industries, enabling organizations to manage operations efficiently.Oracle:

Known for its robust databases and enterprise applications, Oracle offers strong onpremise solutions that cater to large enterprises' complex needs.Microsoft:

With Microsoft Dynamics, the company offers a range of ERP and CRM solutions aimed at enhancing productivity and operational efficiency for businesses.IBM:

IBM's solutions focus on AI-driven capabilities in enterprise applications, assisting organizations in data management and decision-making processes.Infor:

Infor specializes in industry-specific software solutions that empower organizations with tailored management tools to optimize their operations.We're grateful to work with incredible clients.

FAQs

What is the market size of onpremise Enterprise Application Software?

The on-premise enterprise application software market is valued at approximately $25 billion in 2023. This market is projected to grow at a CAGR of 6.8%, indicating a significant opportunity for key stakeholders over the next decade.

What are the key market players or companies in this onpremise Enterprise Application Software industry?

Key players in the on-premise enterprise application software sector include SAP, Oracle, Microsoft, IBM, and Salesforce. These companies dominate the market through innovative solutions, strong customer engagement, and continuous enhancement of service offerings.

What are the primary factors driving the growth in the onpremise Enterprise Application Software industry?

Growth in the on-premise enterprise application software market is primarily driven by increasing digital transformation initiatives, demand for integrated business operations, and the need for enhanced data security. Companies are investing heavily in on-premise solutions for compliance and customization.

Which region is the fastest Growing in the onpremise Enterprise Application Software?

The fastest-growing region in the on-premise enterprise application software market is Europe, where market value is projected to rise from $8.43 billion in 2023 to $16.57 billion by 2033, showcasing robust demand in this sector.

Does ConsaInsights provide customized market report data for the onpremise Enterprise Application Software industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the on-premise enterprise application software industry. Clients can obtain strategic insights, market trends, and detailed analyses that are customized to their requirements.

What deliverables can I expect from this onpremise Enterprise Application Software market research project?

From the on-premise enterprise application software market research project, clients can expect comprehensive reports including market size, growth forecasts, competitive analysis, segmentation data, regional insights, and trend identification to facilitate strategic decision-making.

What are the market trends of onpremise Enterprise Application Software?

Current market trends in the on-premise enterprise application software sector include increased adoption of cloud-enabled solutions, rising focus on automation, and integration of AI/ML technologies, pushing businesses towards more efficient operational models.