Operating Room Cameras Market Report

Published Date: 31 January 2026 | Report Code: operating-room-cameras

Operating Room Cameras Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Operating Room Cameras market, focusing on the current trends, market size, growth forecasts, and key players from 2023 to 2033. It offers insights into technology advancements, regional performance, and future challenges.

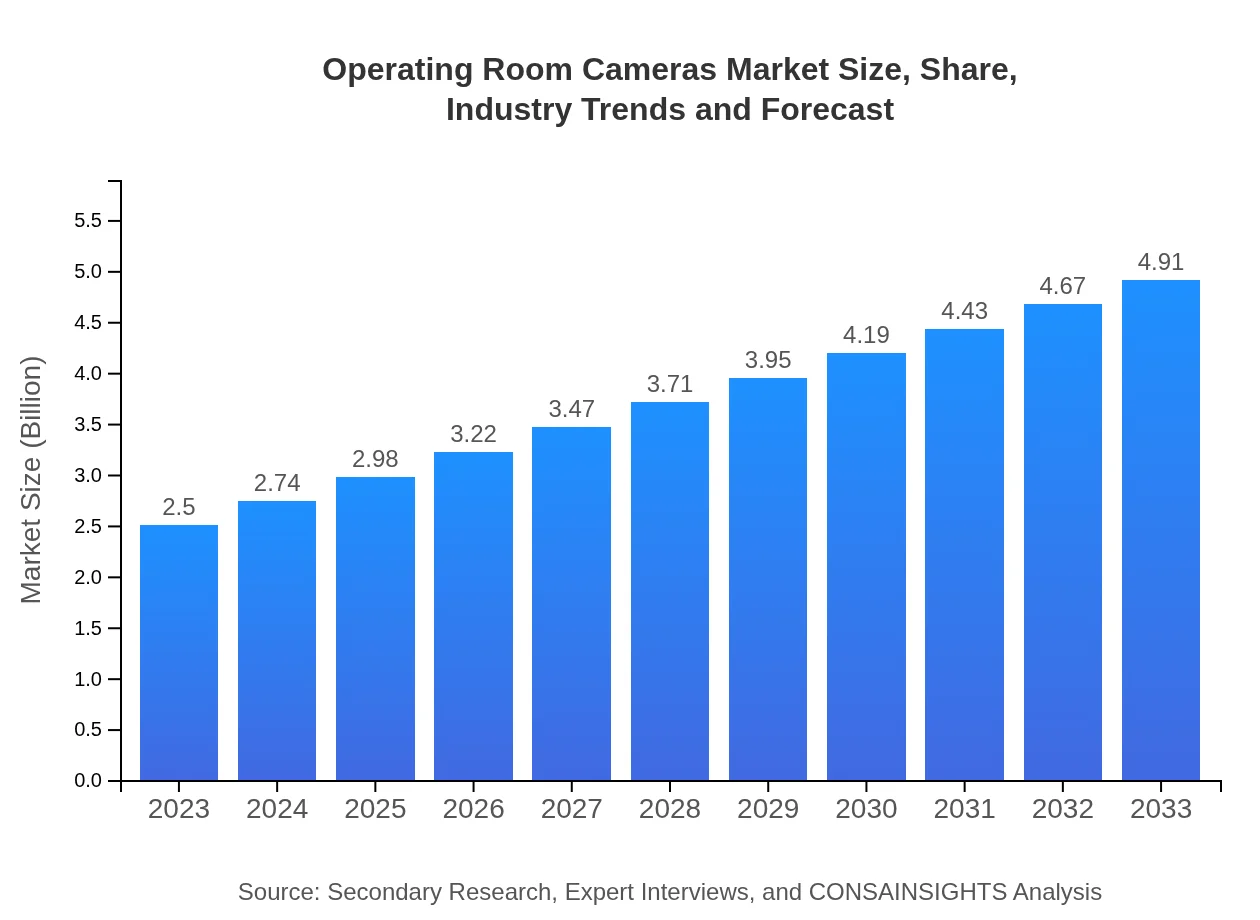

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | Olympus Corporation, Stryker Corporation, Karl Storz GmbH, Smith & Nephew, George M. Sharp, Inc. |

| Last Modified Date | 31 January 2026 |

Operating Room Cameras Market Overview

Customize Operating Room Cameras Market Report market research report

- ✔ Get in-depth analysis of Operating Room Cameras market size, growth, and forecasts.

- ✔ Understand Operating Room Cameras's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Operating Room Cameras

What is the Market Size & CAGR of Operating Room Cameras market in 2023?

Operating Room Cameras Industry Analysis

Operating Room Cameras Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Operating Room Cameras Market Analysis Report by Region

Europe Operating Room Cameras Market Report:

Europe's market is set to expand from $0.72 billion in 2023 to $1.41 billion by 2033. Country-wide initiatives for enhancing surgical outcomes, coupled with a growing elderly population and prevalence of chronic diseases, are central to market traction.Asia Pacific Operating Room Cameras Market Report:

In the Asia Pacific region, the Operating Room Cameras market is projected to grow from $0.52 billion in 2023 to $1.03 billion by 2033, driven by rising healthcare expenditure and increasing surgical procedures. Governments' initiatives to improve healthcare infrastructure are significant contributors to this growth, alongside a surge in private sector involvement.North America Operating Room Cameras Market Report:

In North America, the market is anticipated to grow from $0.85 billion in 2023 to $1.67 billion by 2033, attributed to technological innovations and robust healthcare systems. High adoption rates of minimally invasive techniques and advanced imaging solutions are primary growth factors in this region.South America Operating Room Cameras Market Report:

South America's market is expected to increase from $0.18 billion in 2023 to $0.34 billion in 2033. Limited healthcare resources and high demand for advanced imaging technologies due to rising healthcare awareness will drive market growth, although economic barriers may hinder rapid advancements.Middle East & Africa Operating Room Cameras Market Report:

The Middle East and Africa market is projected to rise from $0.23 billion in 2023 to $0.46 billion by 2033 due to increased healthcare investments and expansion of medical facilities. Ongoing reforms in healthcare infrastructure foster a conducive environment for the adoption of Operating Room Cameras.Tell us your focus area and get a customized research report.

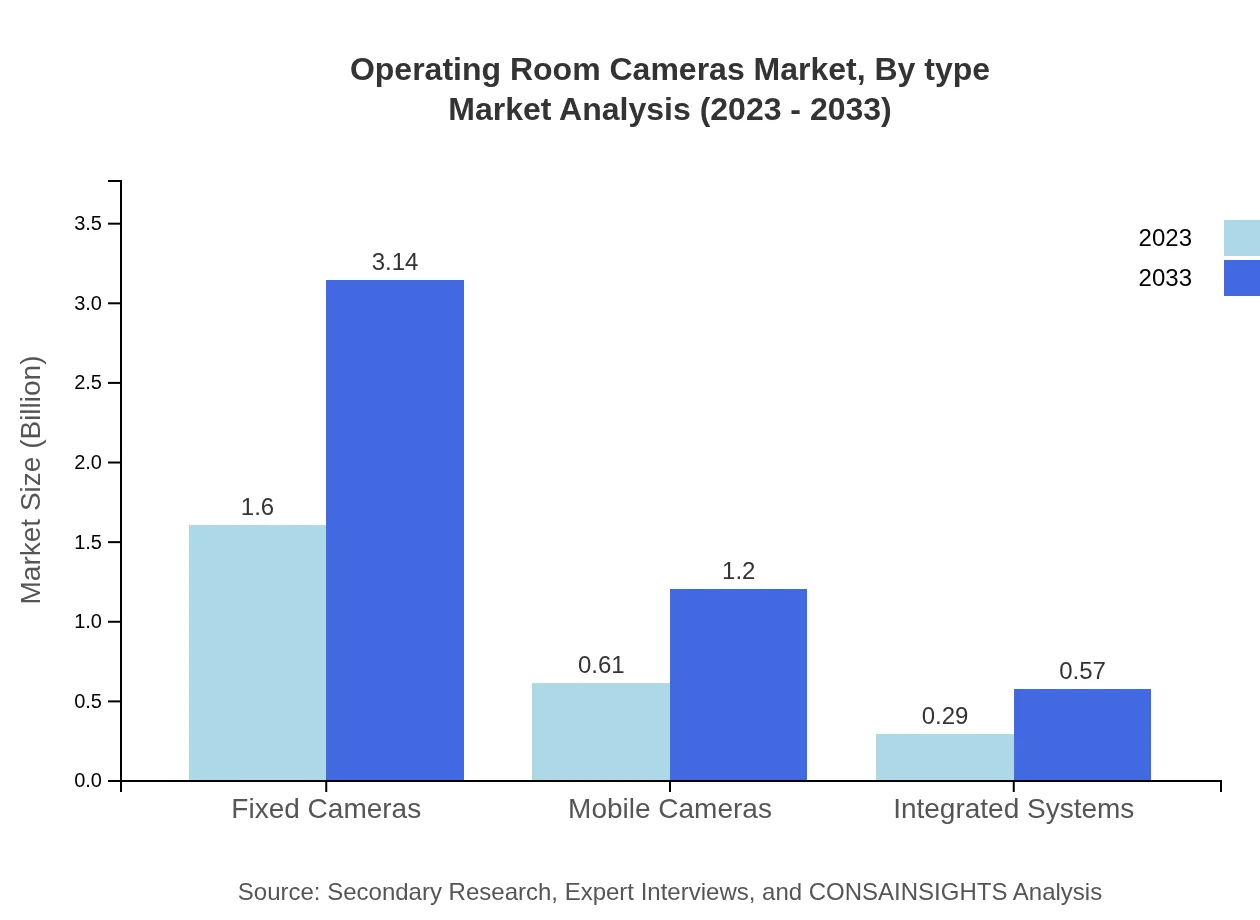

Operating Room Cameras Market Analysis By Type

By type, the Fixed Cameras segment dominates the market, valued at $1.60 billion in 2023, with a projected growth to $3.14 billion by 2033, holding a 64% market share. Mobile Cameras, valued at $0.61 billion in 2023, are set to double to $1.20 billion by 2033, maintaining a 24.42% share. Integrated Systems follow, with a valuation of $0.29 billion in 2023, expected to grow to $0.57 billion by 2033, holding 11.58% market share.

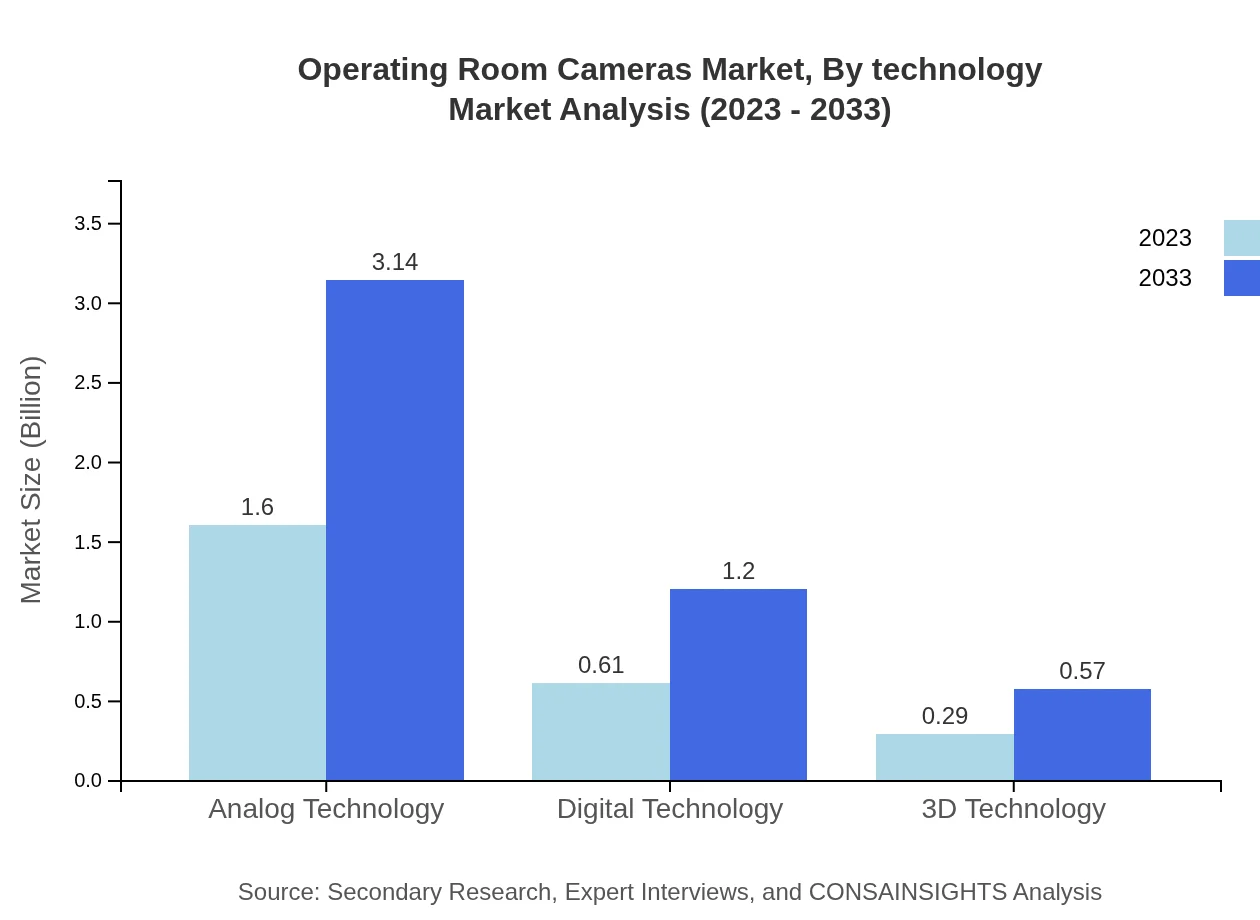

Operating Room Cameras Market Analysis By Technology

In terms of technology, Analog Technology continues to lead with a market size of $1.60 billion in 2023 and is expected to reach $3.14 billion by 2033, commanding a 64% market share. Digital Technology is growing robustly, projected from $0.61 billion to $1.20 billion, at a 24.42% share, followed by 3D Technology, forecasted to expand from $0.29 billion to $0.57 billion with an 11.58% share.

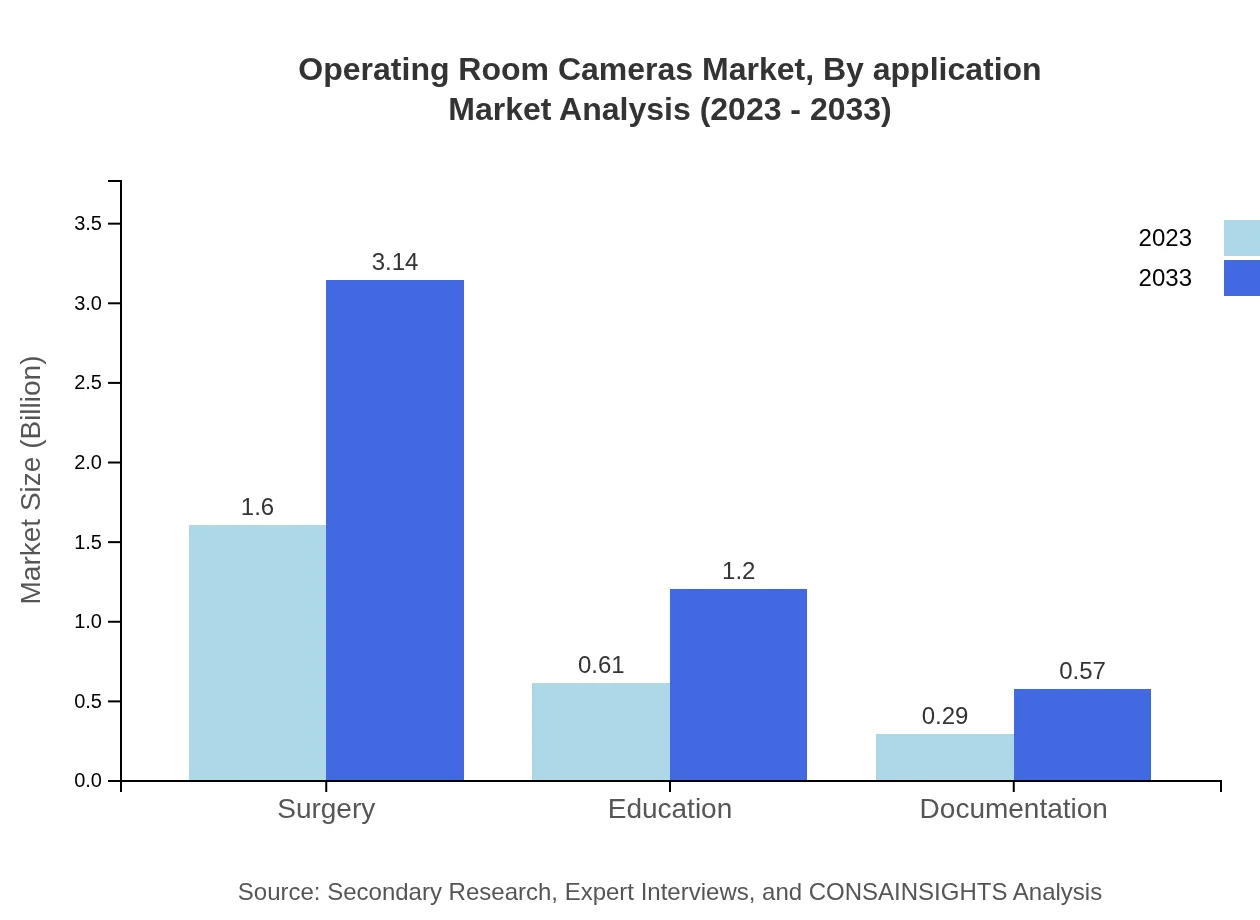

Operating Room Cameras Market Analysis By Application

The market by application shows Surgery as a dominant segment with a valuation of $1.60 billion in 2023, and it is projected to grow to $3.14 billion with a 64% share, followed by Education at $0.61 billion growing to $1.20 billion with a share of 24.42%. Documentation needs represent a smaller segment, moving from $0.29 billion to $0.57 billion, reflecting its 11.58% share.

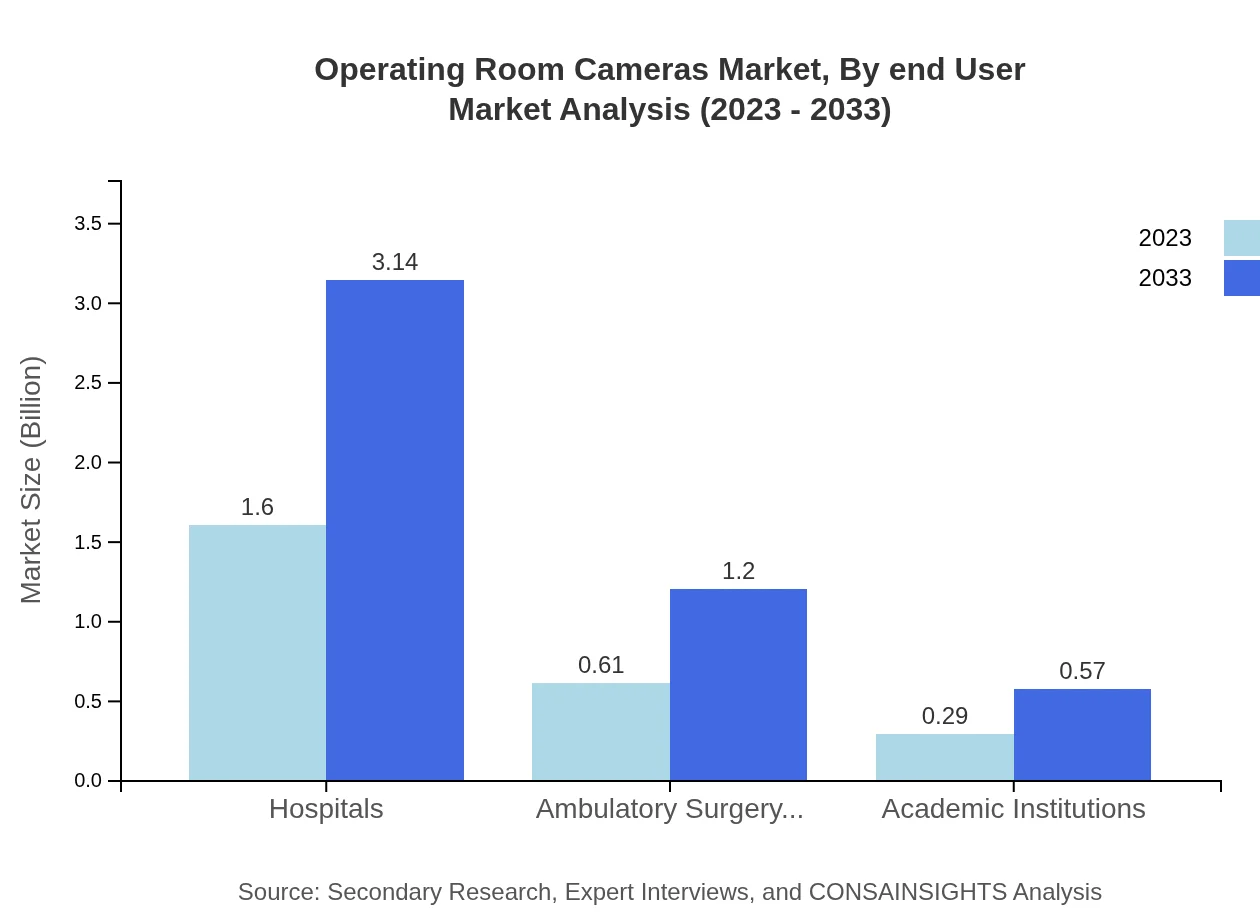

Operating Room Cameras Market Analysis By End User

Hospitals lead the end-user market, valued at $1.60 billion in 2023 and growing to $3.14 billion with a 64% share. Ambulatory Surgery Centers follow, expected to grow from $0.61 billion to $1.20 billion, holding a share of 24.42%. Academic Institutions hold a share of 11.58%, evolving from $0.29 billion to $0.57 billion during the same period.

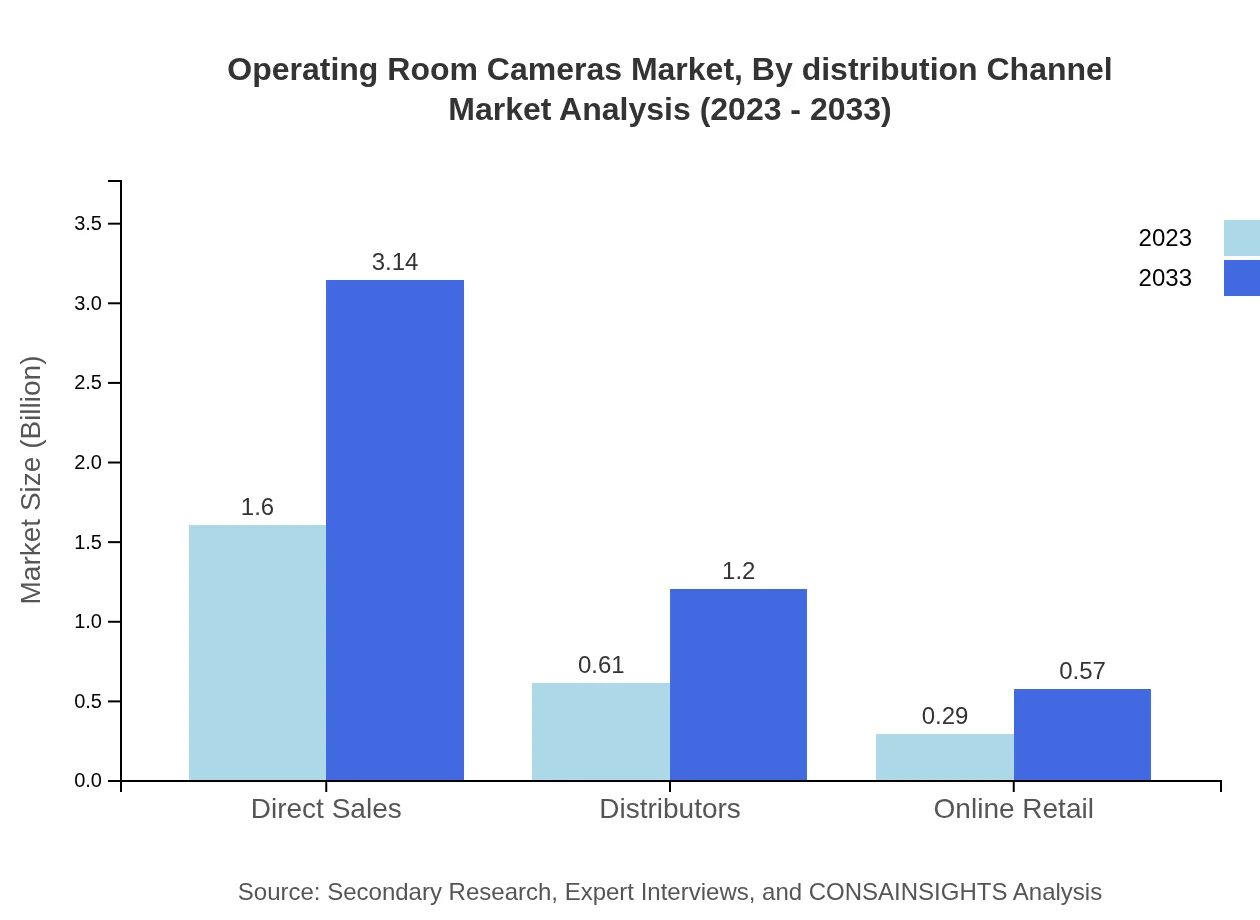

Operating Room Cameras Market Analysis By Distribution Channel

Direct Sales dominate distribution channels, with a size of $1.60 billion in 2023, projected at $3.14 billion with a consistent 64% share. Distributors are expected to grow from $0.61 billion to $1.20 billion, maintaining a 24.42% share, while Online Retail reflects a smaller segment, growing from $0.29 billion to $0.57 billion, holding 11.58% of the market.

Operating Room Cameras Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Operating Room Cameras Industry

Olympus Corporation:

Olympus is a leader in creating innovative imaging and optical technology, focusing on surgical equipment and operating room cameras that enhance visualization for better surgical outcomes.Stryker Corporation:

Known for its advanced medical devices, Stryker provides high-quality operating room cameras and solutions aimed at improving surgical prowess and patient safety.Karl Storz GmbH:

Karl Storz specializes in endoscopic instruments and equipment, offering sophisticated operating room camera systems that integrate seamlessly with surgical workflows.Smith & Nephew:

Smith & Nephew is a global medical technology company that provides innovative operating room cameras as part of its surgical portfolio, focusing on minimally invasive procedures.George M. Sharp, Inc.:

They are known for providing management and consultation services for surgical technologies including operating room cameras, enhancing surgical efficacy across facilities.We're grateful to work with incredible clients.

FAQs

What is the market size of operating Room Cameras?

The global operating room cameras market is currently valued at approximately $2.5 billion and is projected to grow at a compound annual growth rate (CAGR) of 6.8% through 2033. This growth is driven by advancements in medical technology and increasing surgical procedures.

What are the key market players or companies in this operating Room Cameras industry?

Key players in the operating room cameras market include renowned companies such as Stryker Corporation, Karl Storz SE & Co. KG, and Olympus Corporation. These firms lead the market with innovative technologies and strategic collaborations, significantly impacting industry dynamics.

What are the primary factors driving the growth in the operating Room Cameras industry?

The growth in the operating room cameras industry is primarily driven by the rising demand for minimally invasive surgeries, technological advancements in imaging systems, and the increasing focus on patient safety and surgical precision, which enhance the overall surgical experience.

Which region is the fastest Growing in the operating Room Cameras?

The fastest-growing region in the operating room cameras market is North America, expected to grow from $0.85 billion in 2023 to $1.67 billion by 2033. This growth is fueled by high healthcare spending and advanced medical infrastructure in the region.

Does ConsaInsights provide customized market report data for the operating Room Cameras industry?

Yes, ConsaInsights offers customized market report data tailored to specific industry needs and client requirements, providing detailed insights and analysis of trends, forecasts, and competitive landscapes in the operating room cameras market.

What deliverables can I expect from this operating Room Cameras market research project?

Expect comprehensive deliverables including detailed market analysis reports, segmentation data, trend forecasts, competitive landscape evaluations, and actionable insights to inform strategic decision-making within the operating room cameras industry.

What are the market trends of operating Room Cameras?

Current market trends in operating room cameras include a shift towards integrated imaging solutions, increasing adoption of 3D and digital technologies in surgical settings, and growing demand for educational tools in medical institutions to enhance surgical training and collaborative procedures.