Operating Room Equipment Market Report

Published Date: 31 January 2026 | Report Code: operating-room-equipment

Operating Room Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Operating Room Equipment market, examining its size, growth potential, regional insights, and technological advancements from 2023 to 2033.

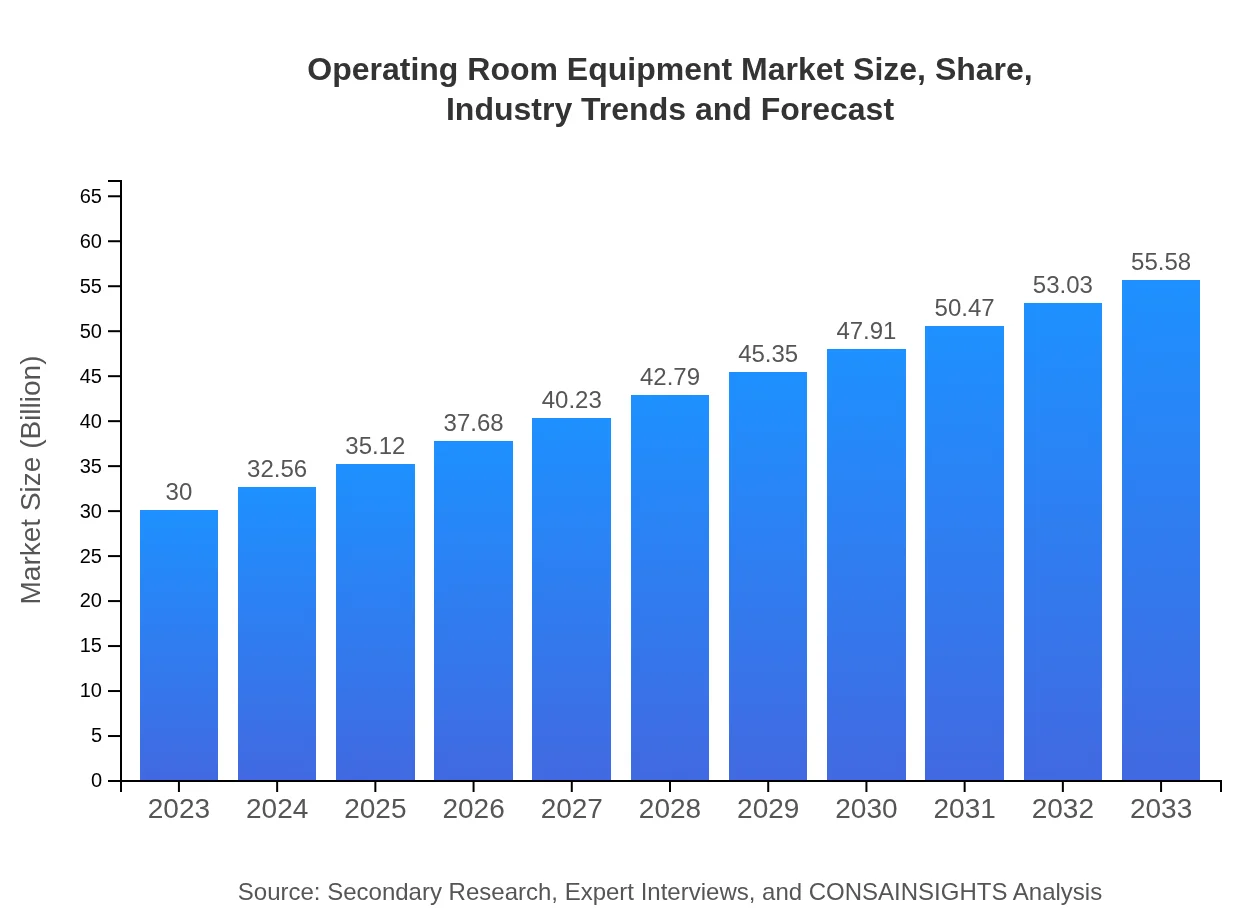

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $30.00 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $55.58 Billion |

| Top Companies | Medtronic , Siemens Healthineers, Johnson & Johnson, Stryker Corporation, GE Healthcare |

| Last Modified Date | 31 January 2026 |

Operating Room Equipment Market Overview

Customize Operating Room Equipment Market Report market research report

- ✔ Get in-depth analysis of Operating Room Equipment market size, growth, and forecasts.

- ✔ Understand Operating Room Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Operating Room Equipment

What is the Market Size & CAGR of Operating Room Equipment market in 2023?

Operating Room Equipment Industry Analysis

Operating Room Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Operating Room Equipment Market Analysis Report by Region

Europe Operating Room Equipment Market Report:

The European market for Operating Room Equipment is estimated to grow from $7.40 billion in 2023 to $13.72 billion by 2033. Key countries such as Germany, France, and the UK serve as significant markets, supported by well-established healthcare systems and a strong focus on technological advancements in surgery.Asia Pacific Operating Room Equipment Market Report:

In the Asia Pacific region, the Operating Room Equipment market is anticipated to grow from $6.08 billion in 2023 to $11.26 billion by 2033, fueled by an increasing number of surgical procedures and investments in healthcare infrastructure. Countries such as China and India are key growth drivers, owing to their large populations and rising awareness about advanced surgical technologies.North America Operating Room Equipment Market Report:

North America dominates the Operating Room Equipment market, with a projected increase from $10.37 billion in 2023 to $19.22 billion by 2033. The U.S. is the largest contributor to this growth, driven by advanced healthcare systems, high expenditure on healthcare, and continuous innovations in surgical technologies.South America Operating Room Equipment Market Report:

South America presents a steadily growing market for Operating Room Equipment, with an estimated market size expanding from $2.61 billion in 2023 to $4.83 billion in 2033. Growth factors include increasing healthcare spending, modernization of healthcare facilities, and the rising prevalence of chronic diseases requiring surgical intervention.Middle East & Africa Operating Room Equipment Market Report:

In the Middle East and Africa (MEA), the market for Operating Room Equipment is expected to rise from $3.54 billion in 2023 to $6.56 billion by 2033. Growth in this region is influenced by increasing healthcare investments, the emergence of private hospitals, and the need for modernized surgical solutions to recover from healthcare infrastructural challenges.Tell us your focus area and get a customized research report.

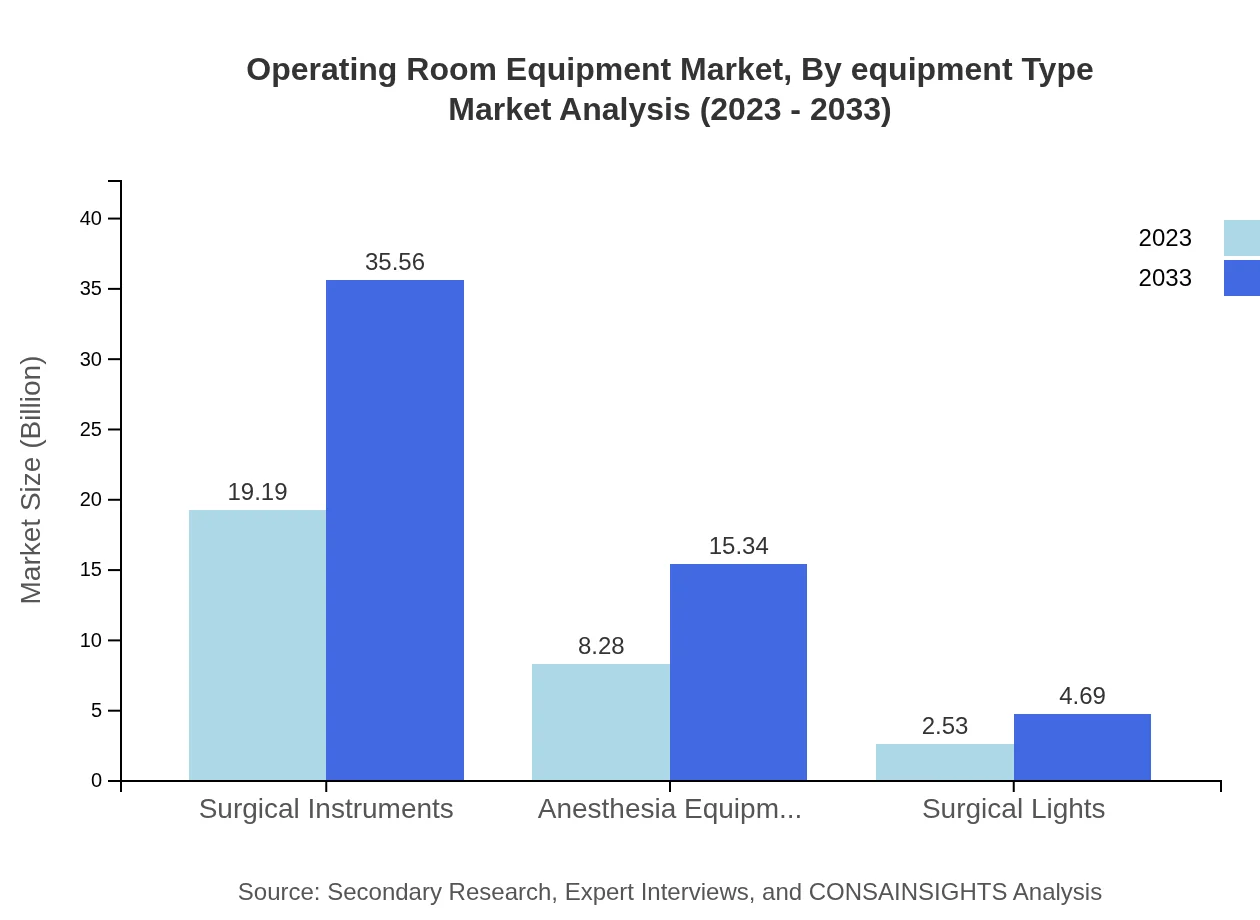

Operating Room Equipment Market Analysis By Equipment Type

The Operating Room Equipment market, segmented by equipment type, showcases surgical instruments leading the market, with a size expected to reach $19.19 billion in 2023, growing to $35.56 billion by 2033, holding a steady market share of 63.98% throughout the period. Anesthesia equipment and surgical lights also represent significant market players, with increasing contributions from ambulatory surgical center equipment, indicating a shift towards outpatient services.

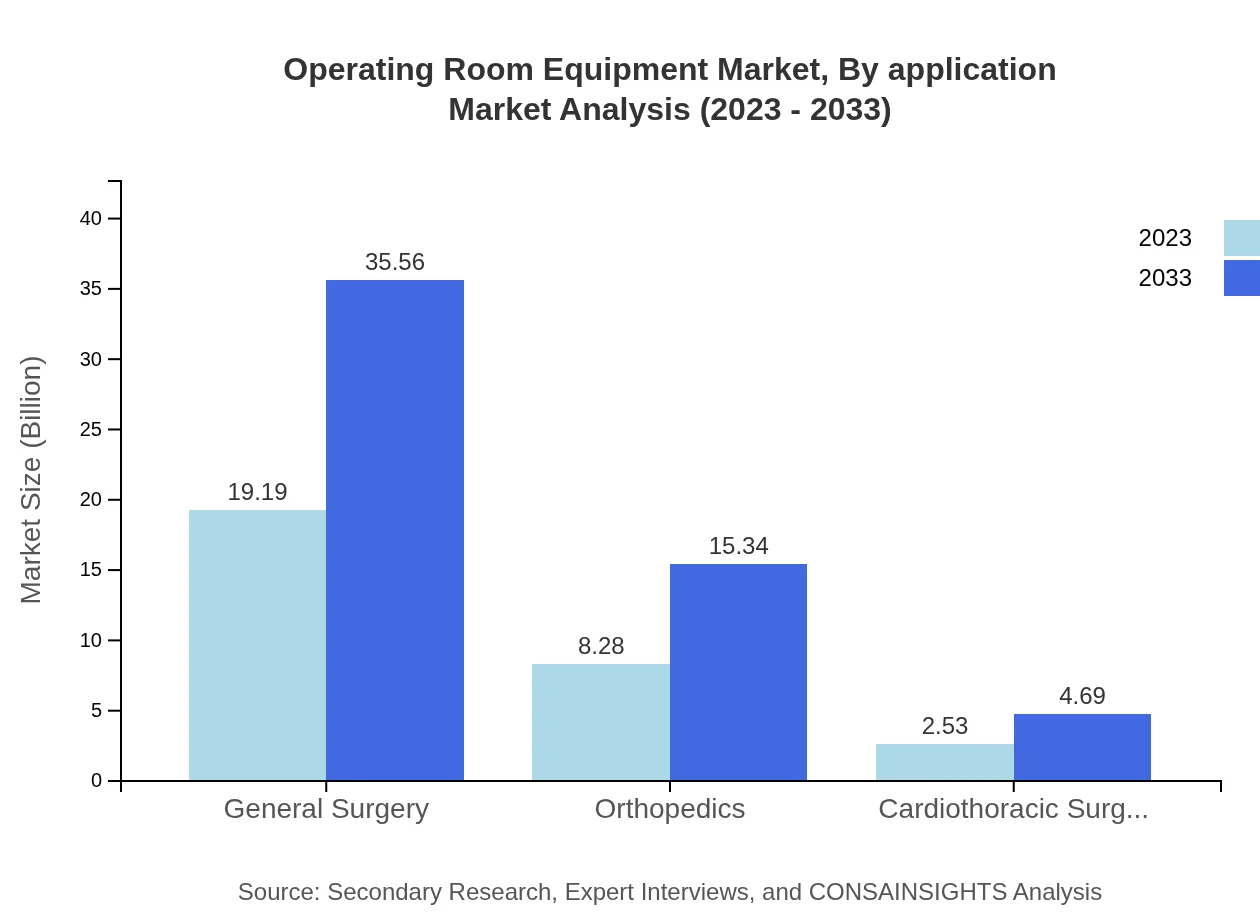

Operating Room Equipment Market Analysis By Application

By application, general surgery represents the largest segment, valued at $19.19 billion in 2023 with the same growing to $35.56 billion by 2033. The orthopedic and cardiothoracic surgery segments also play vital roles in the market. Each of these segments reflects the evolving needs of the surgical landscape as healthcare providers focus on improving patient outcomes.

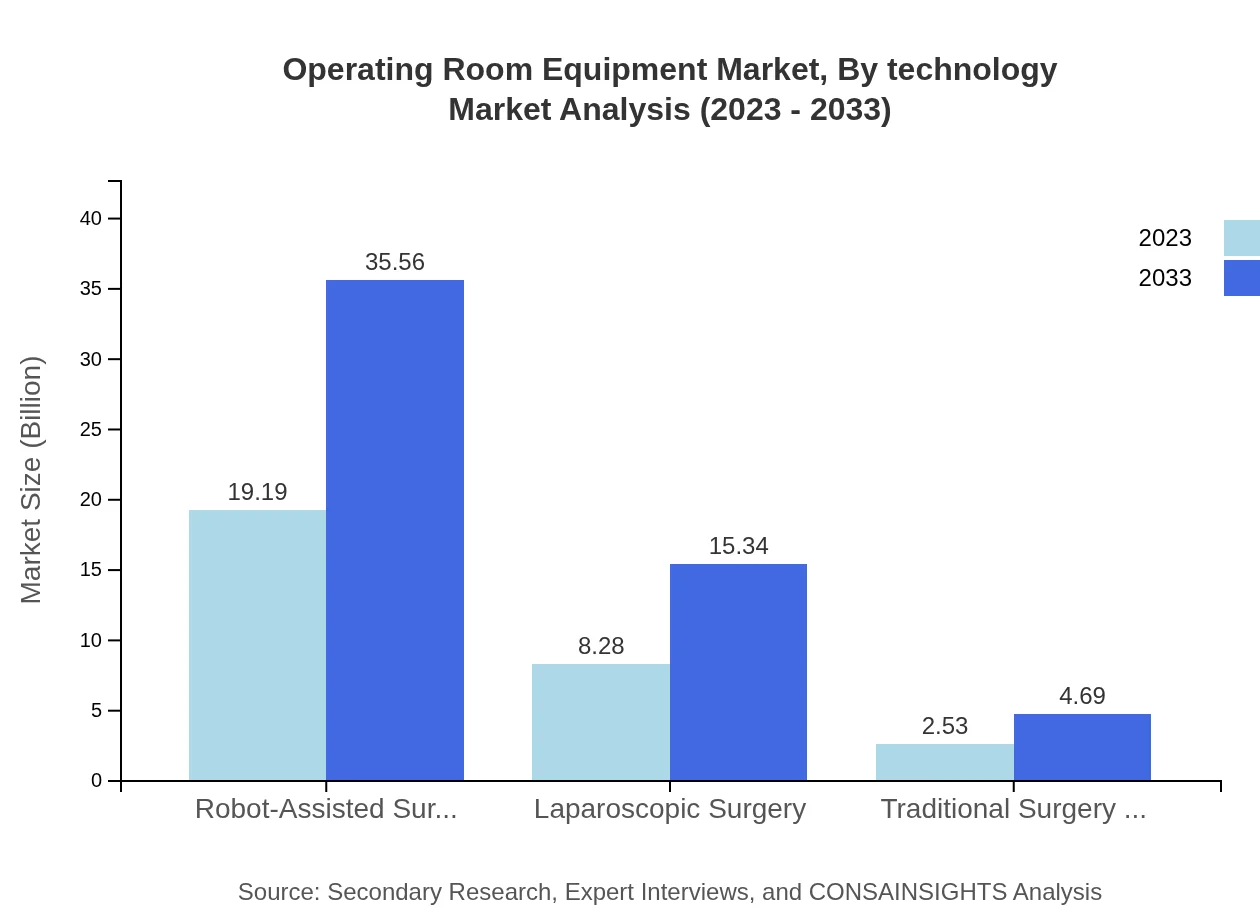

Operating Room Equipment Market Analysis By Technology

Technological advancements are pivotal in shaping the Operating Room Equipment market. Robotic-assisted surgeries, contributing a size of $19.19 billion in 2023, are set for growth to $35.56 billion by 2033, promising enhanced precision in surgical procedures. The implementation of augmented reality and AI capabilities is expected to revolutionize routine surgeries, making them safer and more efficient.

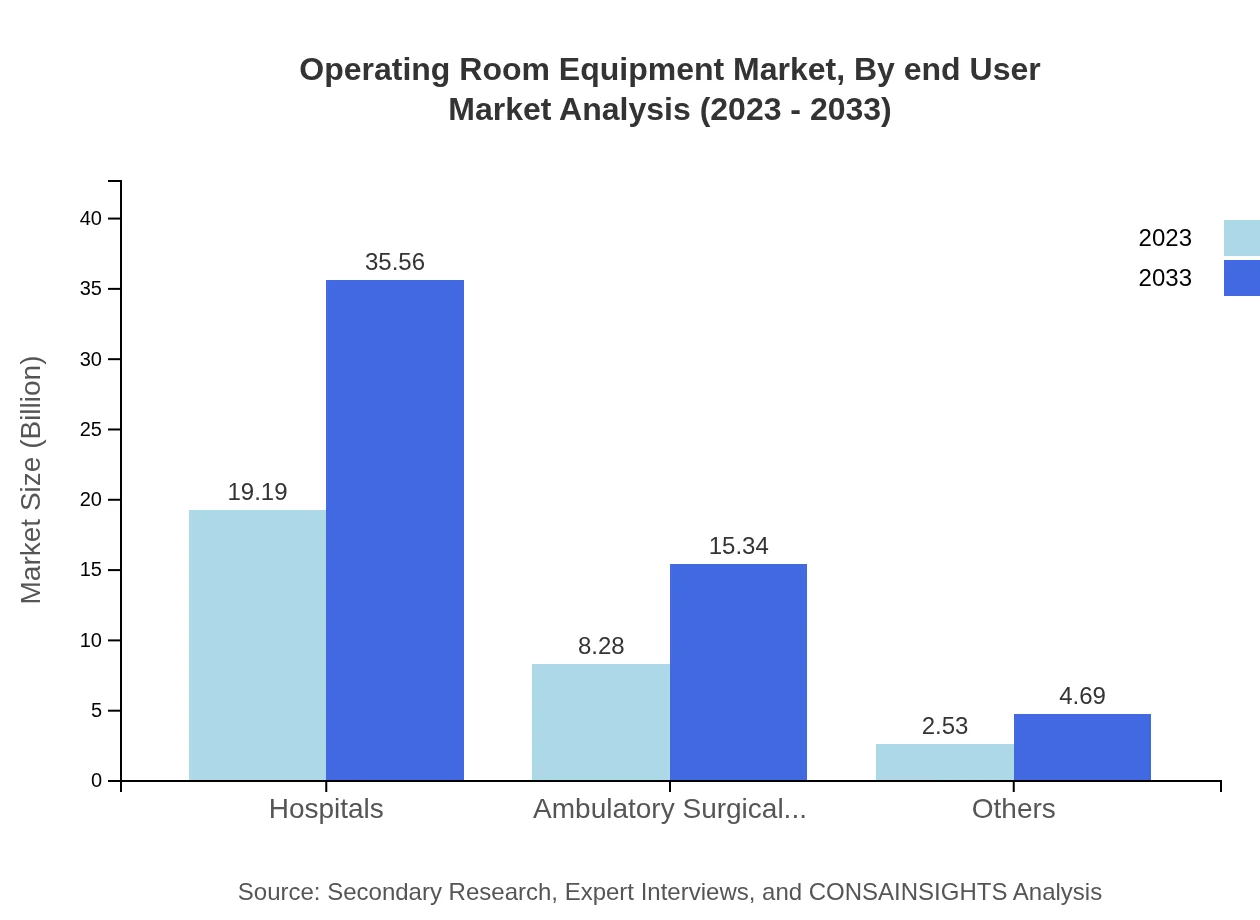

Operating Room Equipment Market Analysis By End User

Hospitals are the primary end-users of Operating Room Equipment, commanding a market size of $19.19 billion and maintaining a consistent share of 63.98% throughout the forecast period. Ambulatory surgical centers are emerging as critical players too, highlighting the growing popularity of outpatient surgeries and a move towards more cost-effective healthcare delivery.

Operating Room Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Operating Room Equipment Industry

Medtronic :

Medtronic is a global leader in medical technology, developing innovative solutions in surgical equipment and instruments, particularly known for their robotic-assisted surgery technologies.Siemens Healthineers:

With a focus on imaging and healthcare technology, Siemens Healthineers offers advanced solutions for operating rooms, enhancing surgical precision and efficiency.Johnson & Johnson:

Johnson & Johnson is a key player in medical devices, providing a wide range of surgical instruments and solutions catering to various surgical specialties.Stryker Corporation:

Stryker Corporation focuses on innovative surgical instruments and equipment, renowned for its orthopedic and robotic surgery technologies.GE Healthcare:

GE Healthcare provides advanced imaging and surgical technologies, facilitating better clinical outcomes in the operating room environment.We're grateful to work with incredible clients.

FAQs

What is the market size of operating Room Equipment?

The operating room equipment market is valued at approximately $30 billion in 2023, with a projected CAGR of 6.2%. This indicates a robust growth trajectory, reflecting the increasing demand for advanced surgical technologies and equipment.

What are the key market players or companies in this operating Room Equipment industry?

Key players in the operating room equipment market include leading healthcare companies specializing in surgical equipment and technology. These include prominent manufacturers and distributors known for innovation, quality, and market reach.

What are the primary factors driving the growth in the operating Room equipment industry?

Major factors driving growth include technological advancements, rising surgical procedures, increased healthcare expenditure, and demand for minimally invasive surgeries, which necessitate advanced operating room solutions.

Which region is the fastest Growing in the operating Room equipment?

North America is the fastest-growing region, with its market size projected to rise from $10.37 billion in 2023 to $19.22 billion by 2033. This growth is propelled by the high adoption of advanced surgical technologies.

Does ConsaInsights provide customized market report data for the operating Room equipment industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the operating room equipment industry, allowing clients to focus on particular segments or trends relevant to their business.

What deliverables can I expect from this operating Room equipment market research project?

Deliverables include comprehensive market reports, insights on market trends, competitive analysis, forecasts, and in-depth segment analysis, complete with data visualizations and actionable insights for strategic planning.

What are the market trends of operating Room equipment?

Current trends include the increasing reliance on robotic-assisted surgeries, advancements in surgical lighting, and growing use of anesthesia equipment, highlighting the shift towards automation and precision in surgeries.