Operating Room Management Market Report

Published Date: 31 January 2026 | Report Code: operating-room-management

Operating Room Management Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Operating Room Management market, covering key trends, segment analyses, regional overviews, and future forecasts from 2023 to 2033.

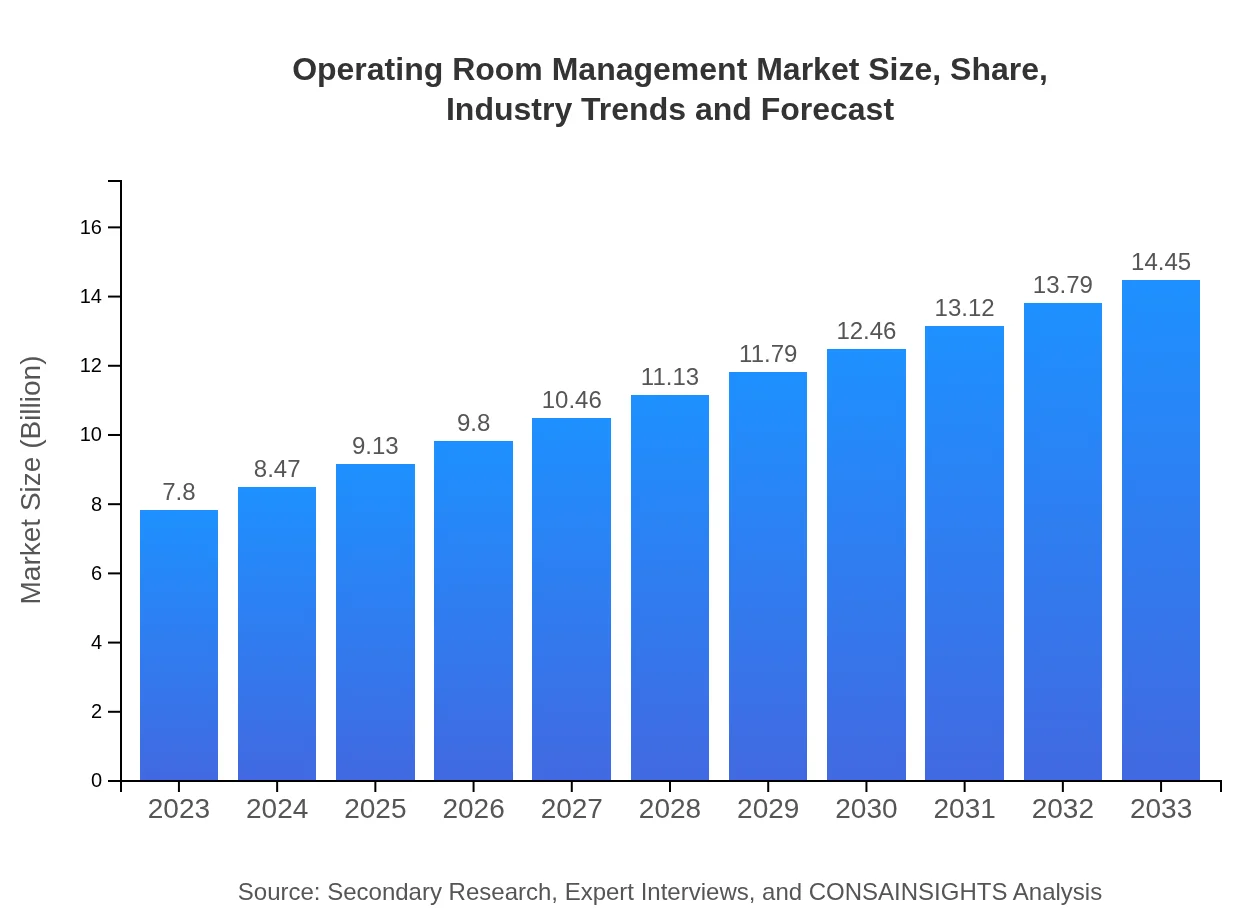

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $7.80 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $14.45 Billion |

| Top Companies | Siemens Healthineers, GE Healthcare, Medtronic , Philips Healthcare, Stryker Corporation |

| Last Modified Date | 31 January 2026 |

Operating Room Management Market Overview

Customize Operating Room Management Market Report market research report

- ✔ Get in-depth analysis of Operating Room Management market size, growth, and forecasts.

- ✔ Understand Operating Room Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Operating Room Management

What is the Market Size & CAGR of Operating Room Management market in 2023?

Operating Room Management Industry Analysis

Operating Room Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Operating Room Management Market Analysis Report by Region

Europe Operating Room Management Market Report:

In Europe, the market size is estimated at $2.43 billion for 2023, projected to increase to $4.50 billion by 2033. The European market benefits from stringent regulations that emphasize patient safety and surgical efficiency, driving demand for ORM solutions.Asia Pacific Operating Room Management Market Report:

In the Asia-Pacific region, the Operating Room Management market is valued at approximately $1.48 billion in 2023, projected to reach around $2.75 billion by 2033. Key growth drivers include increasing investments in healthcare infrastructure, adoption of advanced surgical technologies, and a rise in the number of surgical procedures.North America Operating Room Management Market Report:

North America remains a dominant region for the Operating Room Management market with a current valuation of $2.76 billion in 2023, expected to grow to $5.12 billion by 2033. This robust growth is fueled by high healthcare expenditure, advanced healthcare infrastructure, and a notable trend towards value-based care models.South America Operating Room Management Market Report:

The South American market is currently valued at around $0.71 billion in 2023, with expectations of growing to $1.31 billion by 2033. Challenges such as varying healthcare expenditure policies exist, but the rise in healthcare provision and technology adoption will foster market growth.Middle East & Africa Operating Room Management Market Report:

The Middle East and Africa segment, while smaller, is growing steadily from a market size of $0.42 billion in 2023 to projected $0.78 billion by 2033, with a focus on expanding healthcare access and technological advancements in surgical environments.Tell us your focus area and get a customized research report.

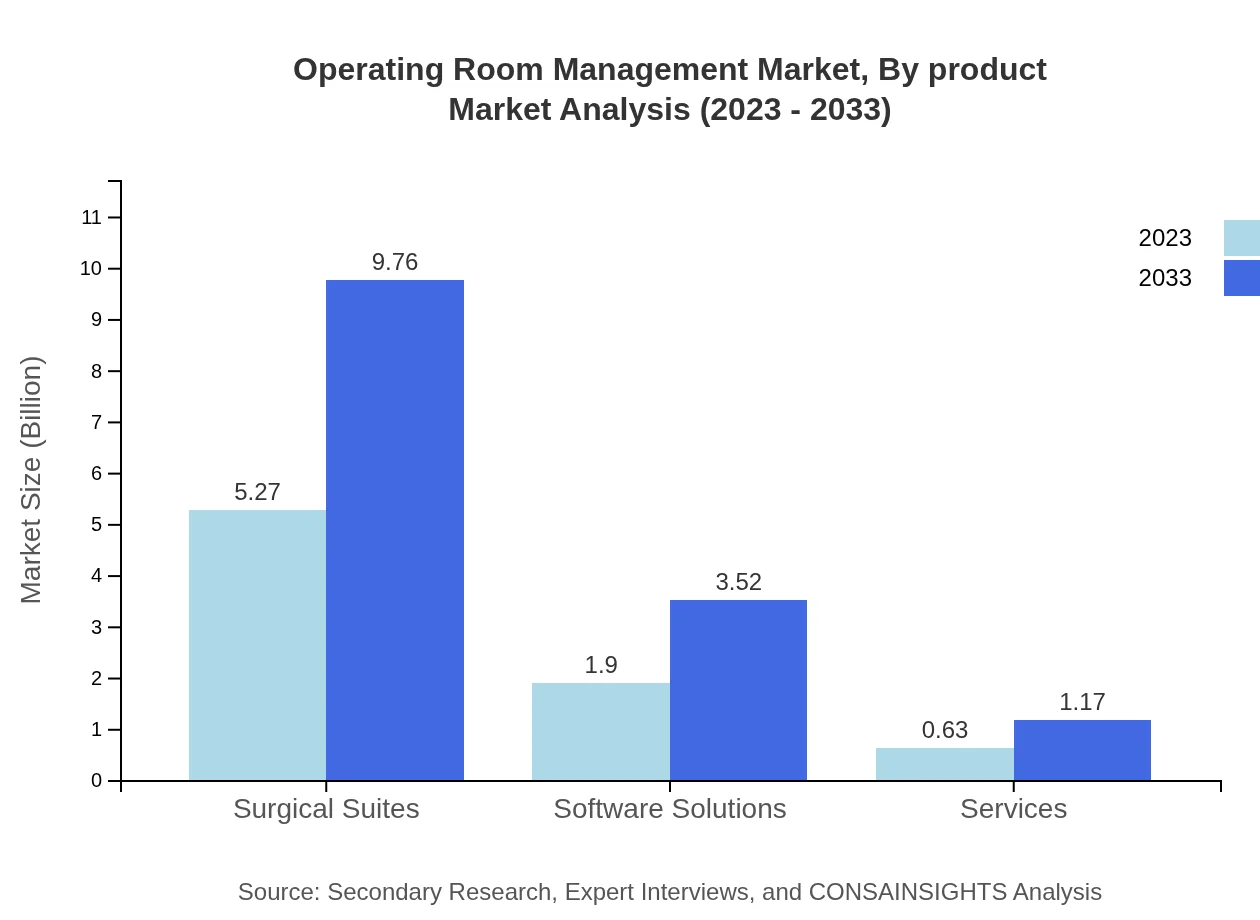

Operating Room Management Market Analysis By Product

The product segment of the Operating Room Management market is predominantly led by surgical suites, valued at $5.27 billion in 2023 and expected to reach approximately $9.76 billion by 2033, maintaining a dominant share of 67.51% throughout the period. Software solutions account for $1.90 billion in 2023, projected to grow to $3.52 billion with a stable share of 24.37%. Services, while smaller, are anticipated to grow from $0.63 billion to $1.17 billion, holding an 8.12% market share.

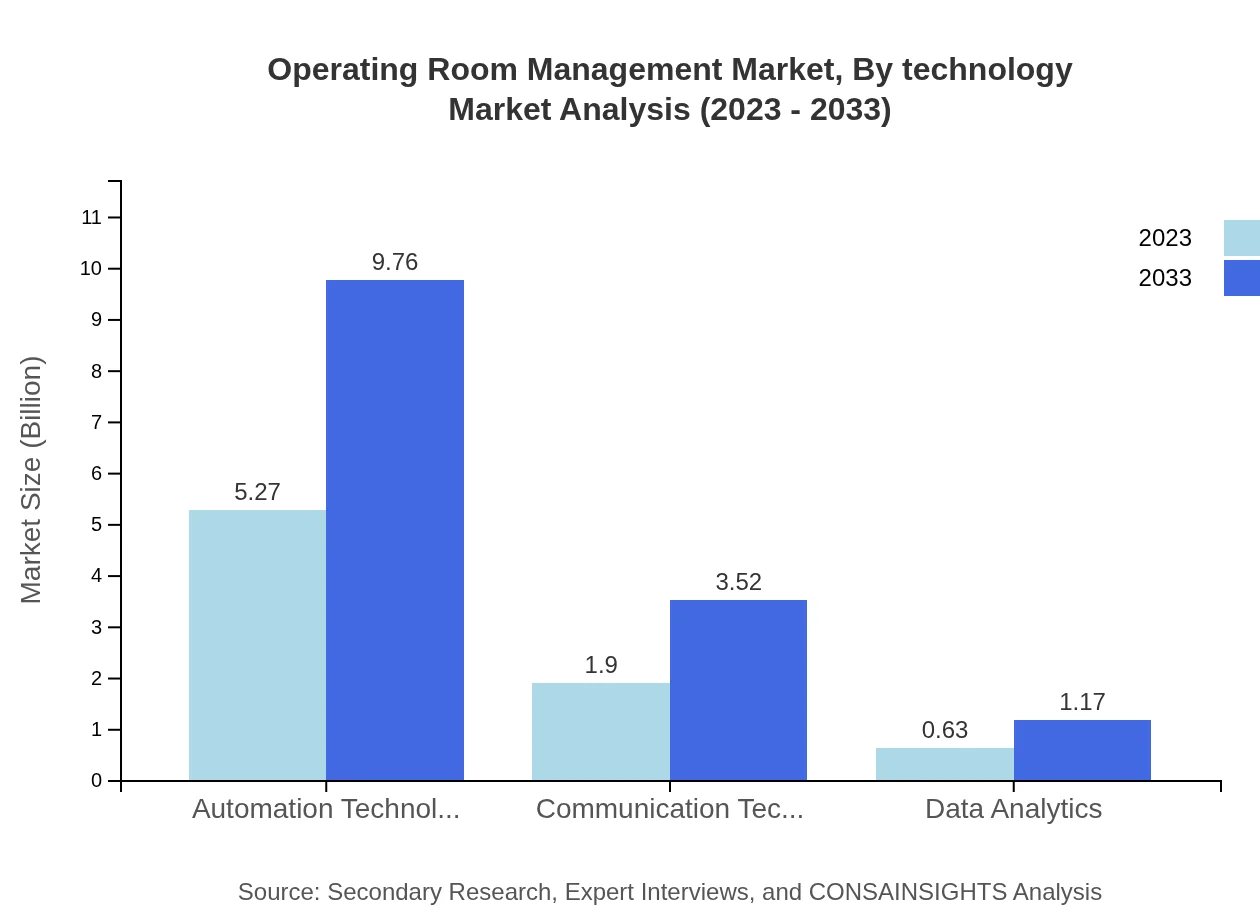

Operating Room Management Market Analysis By Technology

Technology plays a significant role in dictating the functionality of ORM. Automation technology represents the leading sector within this space, currently valued at $5.27 billion in 2023 and projected to soar to $9.76 billion by 2033, holding its steady dominance at 67.51%. Communication technology, valued at $1.90 billion now, is expected to grow to $3.52 billion by 2033, while data analytics, though less prominent, will expand from $0.63 billion to $1.17 billion, indicating the growing importance of analytics in enhancing operational efficiencies.

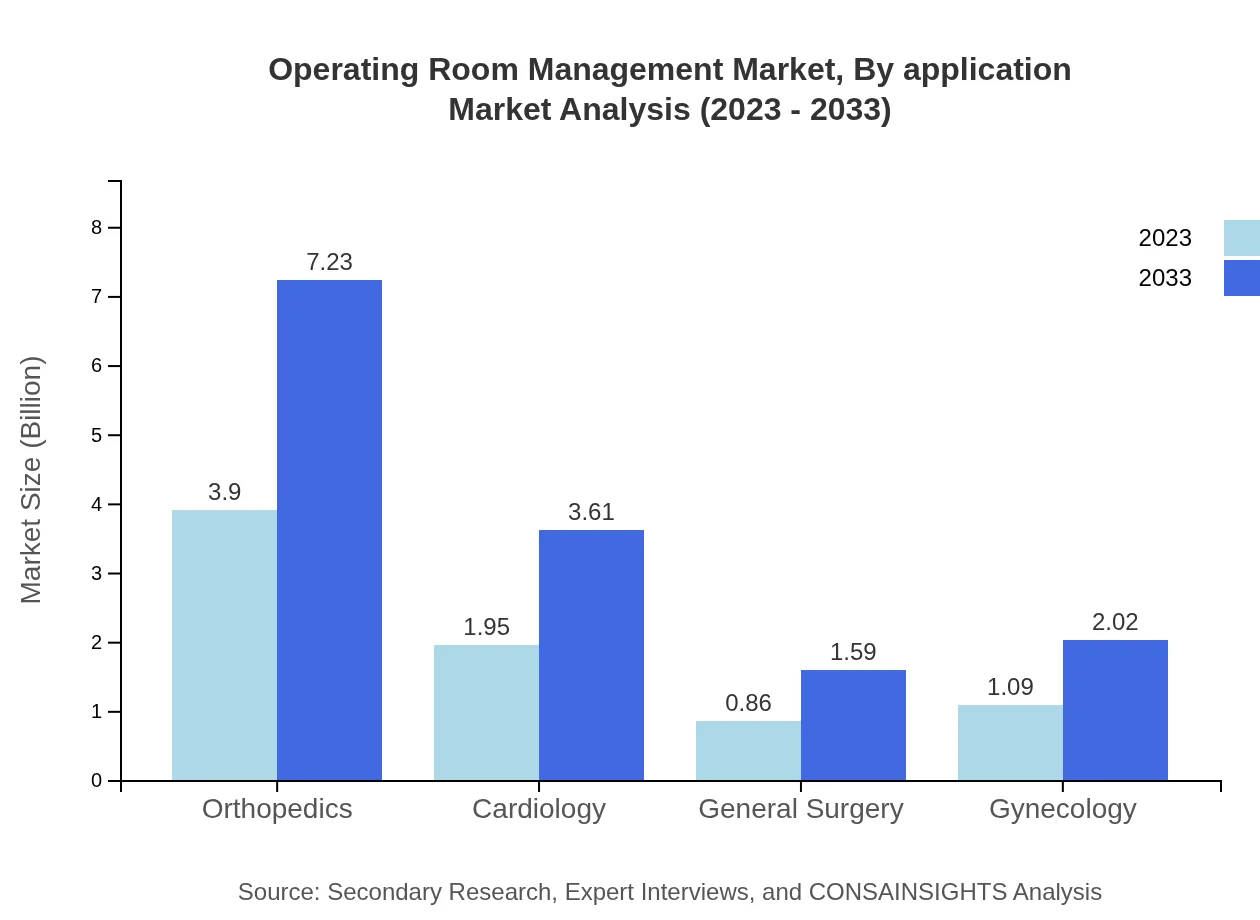

Operating Room Management Market Analysis By Application

Among the application segments, orthopedics commands the market with a size of $3.90 billion in 2023 expected to rise to $7.23 billion in 2033, maintaining a significant share of 50.03% throughout this duration. Cardiology and gynecology are also prominent, with current sizes of $1.95 billion and $1.09 billion respectively, projected to reach $3.61 billion and $2.02 billion by 2033, indicating robust demand across various surgical specialties.

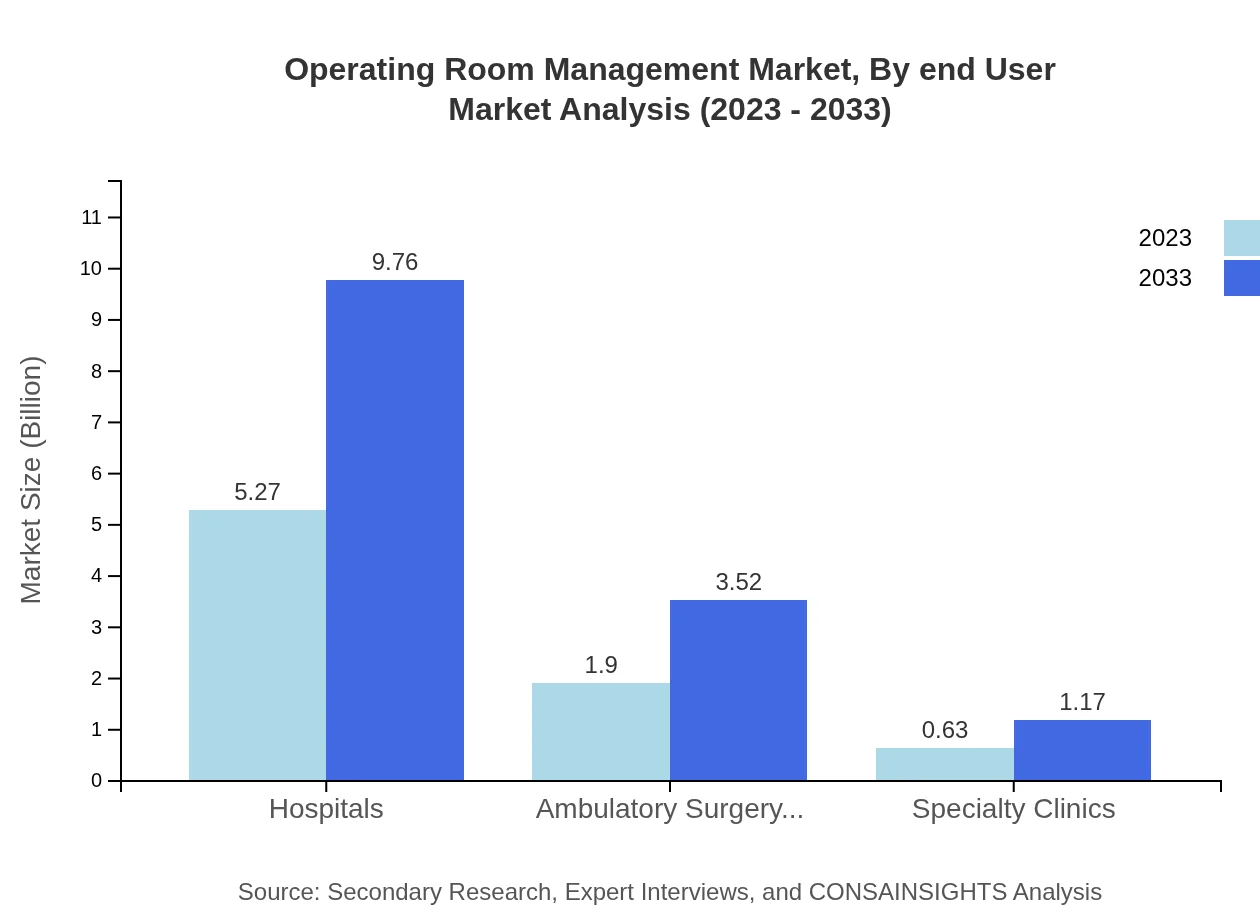

Operating Room Management Market Analysis By End User

Hospitals represent the largest market segment for ORM solutions, valued at $5.27 billion in 2023, anticipated to grow to $9.76 billion by 2033, while specialty clinics currently show a market size of $0.63 billion, forecasted to increase to $1.17 billion. Ambulatory surgery centers are also seeing growth, from $1.90 billion in 2023 to $3.52 billion in 2033, indicative of shifting healthcare dynamics towards outpatient surgical procedures.

Operating Room Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Operating Room Management Industry

Siemens Healthineers:

A market leader in medical technology, Siemens Healthineers excels in developing innovative imaging and diagnostic solutions enhancing surgical workflows and operational efficiency.GE Healthcare:

GE Healthcare is recognized for its advanced imaging and patient monitoring systems that facilitate better surgical management and operational excellence in hospitals.Medtronic :

A pioneer in medical technologies and services, Medtronic focuses on surgical innovations and solutions that streamline operating room management and enhance patient care.Philips Healthcare:

Philips is committed to healthcare advancements through its broad portfolio of operating room technologies, including integrated equipment and advanced imaging solutions.Stryker Corporation:

Stryker is known for its surgical equipment and software solutions that optimize operating room environments and improve surgical outcomes.We're grateful to work with incredible clients.

FAQs

What is the market size of operating Room Management?

The operating room management market is valued at approximately $7.8 billion in 2023, with a compound annual growth rate (CAGR) of 6.2% projected to continue to 2033.

What are the key market players or companies in this operating Room Management industry?

Key players in the operating room management market include Medtronic, GE Healthcare, Siemens Healthineers, and Philips Healthcare, who lead with innovative solutions and technologies catering to hospital and surgical center needs.

What are the primary factors driving the growth in the operating Room Management industry?

Growth is primarily driven by increasing surgical procedures, technological advancements in surgical equipment, demand for efficiency in hospital operations, and the need to reduce operational costs in healthcare.

Which region is the fastest Growing in the operating Room Management?

North America is the fastest-growing region in operating room management, with market size projected to rise from $2.76 billion in 2023 to $5.12 billion by 2033, reflecting robust healthcare expenditure.

Does ConsaInsights provide customized market report data for the operating Room Management industry?

Yes, ConsaInsights offers customized market reports tailored to clients' specific needs in the operating room management sector, ensuring relevant data and insights for strategic decision-making.

What deliverables can I expect from this operating Room Management market research project?

Deliverables include a detailed market analysis report, segmentation data, growth forecasts, competitive landscape insights, and trends affecting the operational and strategic decisions in the operating room management market.

What are the market trends of operating Room Management?

Current trends include increased adoption of advanced surgical technologies, automation in operating rooms, a shift towards outpatient surgeries, and growing emphasis on data analytics for surgical performance improvement.